01ff0ec503909697a68ee827f34d38ec.ppt

- Количество слайдов: 53

Interim financial results for the six months to 30 June 2001 1

Interim financial results for the six months to 30 June 2001 1

Presentation structure u u u u u Financial highlights Alan van Biljon Retail Banking Peter Wharton-Hood SCMB Myles Ruck Commercial Banking Private Banking International Operations Jacko Maree Stanbic Africa Liberty Group Conclusion 2

Presentation structure u u u u u Financial highlights Alan van Biljon Retail Banking Peter Wharton-Hood SCMB Myles Ruck Commercial Banking Private Banking International Operations Jacko Maree Stanbic Africa Liberty Group Conclusion 2

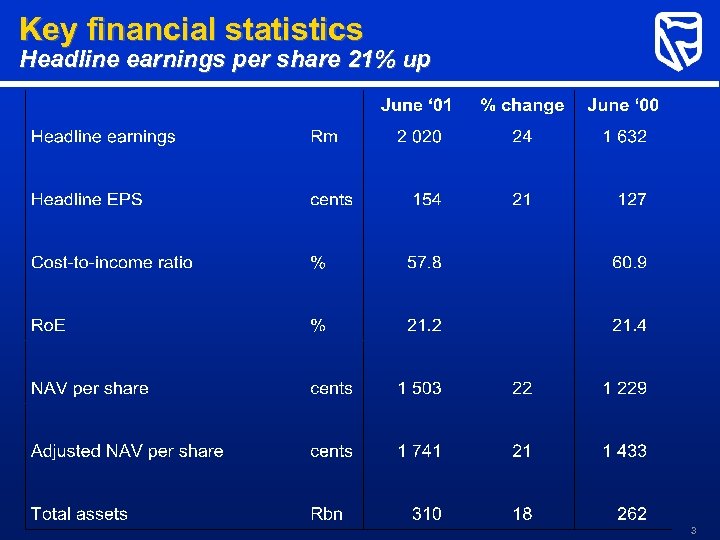

Key financial statistics Headline earnings per share 21% up 3

Key financial statistics Headline earnings per share 21% up 3

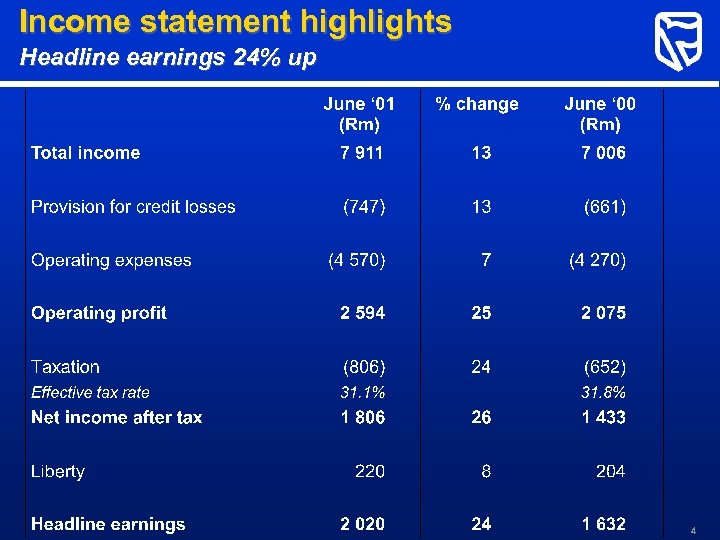

Income statement highlights Headline earnings 24% up 4

Income statement highlights Headline earnings 24% up 4

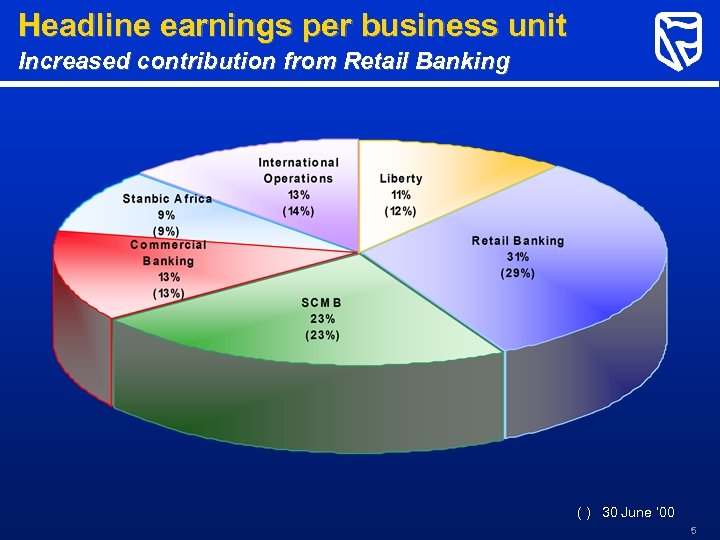

Headline earnings per business unit Increased contribution from Retail Banking ( ) 30 June ‘ 00 5

Headline earnings per business unit Increased contribution from Retail Banking ( ) 30 June ‘ 00 5

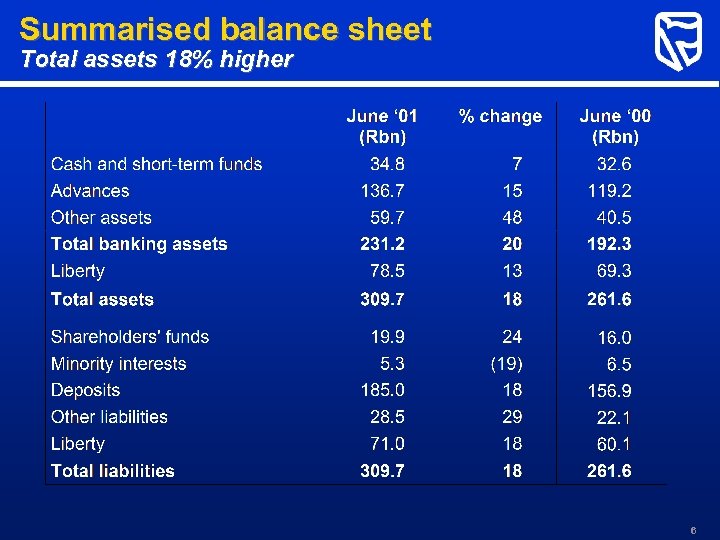

Summarised balance sheet Total assets 18% higher 6

Summarised balance sheet Total assets 18% higher 6

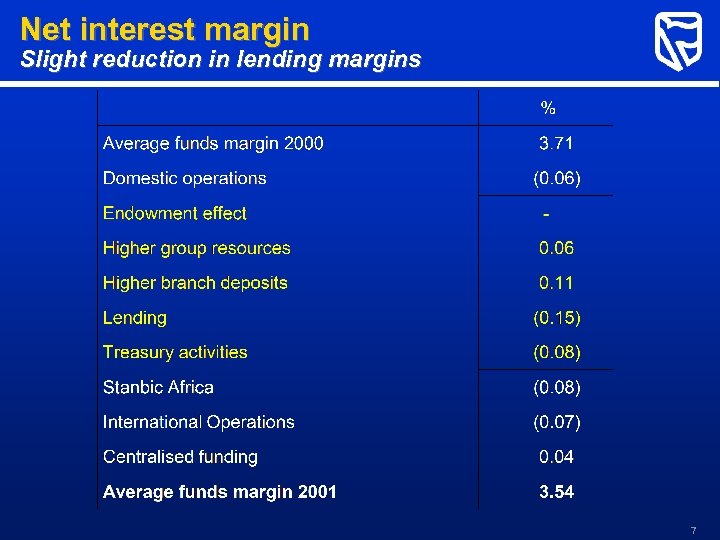

Net interest margin Slight reduction in lending margins 7

Net interest margin Slight reduction in lending margins 7

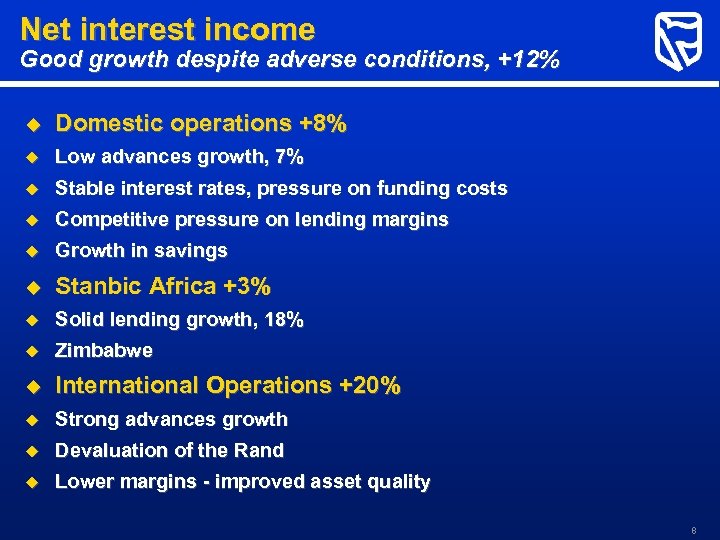

Net interest income Good growth despite adverse conditions, +12% u Domestic operations +8% u Low advances growth, 7% u Stable interest rates, pressure on funding costs u Competitive pressure on lending margins u Growth in savings u Stanbic Africa +3% u Solid lending growth, 18% u Zimbabwe u International Operations +20% u Strong advances growth u Devaluation of the Rand u Lower margins - improved asset quality 8

Net interest income Good growth despite adverse conditions, +12% u Domestic operations +8% u Low advances growth, 7% u Stable interest rates, pressure on funding costs u Competitive pressure on lending margins u Growth in savings u Stanbic Africa +3% u Solid lending growth, 18% u Zimbabwe u International Operations +20% u Strong advances growth u Devaluation of the Rand u Lower margins - improved asset quality 8

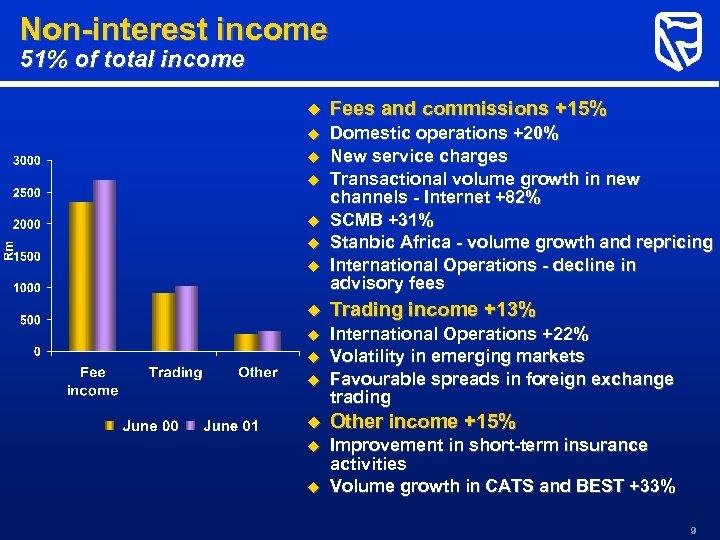

Non-interest income 51% of total income u Fees and commissions +15% u Domestic operations +20% New service charges Transactional volume growth in new channels - Internet +82% SCMB +31% Stanbic Africa - volume growth and repricing International Operations - decline in advisory fees u u u Trading income +13% u International Operations +22% Volatility in emerging markets Favourable spreads in foreign exchange trading u u u Other income +15% u Improvement in short-term insurance activities Volume growth in CATS and BEST +33% u 9

Non-interest income 51% of total income u Fees and commissions +15% u Domestic operations +20% New service charges Transactional volume growth in new channels - Internet +82% SCMB +31% Stanbic Africa - volume growth and repricing International Operations - decline in advisory fees u u u Trading income +13% u International Operations +22% Volatility in emerging markets Favourable spreads in foreign exchange trading u u u Other income +15% u Improvement in short-term insurance activities Volume growth in CATS and BEST +33% u 9

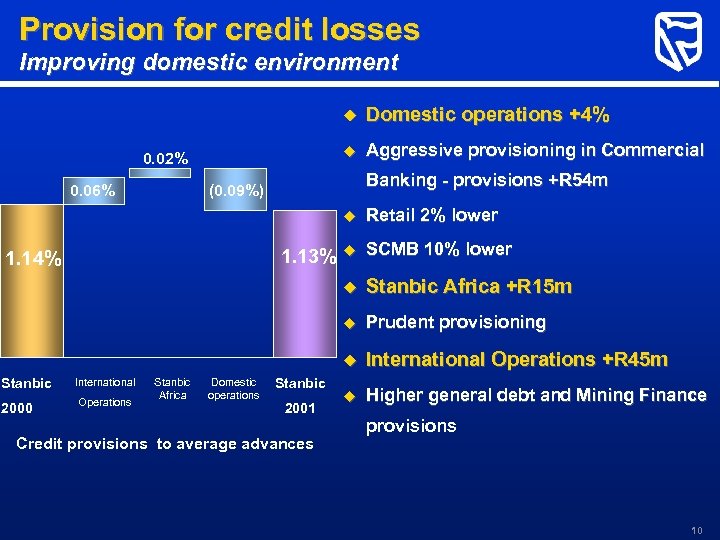

Provision for credit losses Improving domestic environment u u 0. 02% 0. 06% Domestic operations +4% Aggressive provisioning in Commercial Banking - provisions +R 54 m (0. 09%) u Retail 2% lower 1. 13% u SCMB 10% lower u Stanbic Africa +R 15 m 1. 14% u u Stanbic 2000 International Operations Stanbic Africa Domestic operations Stanbic 2001 Credit provisions to average advances Prudent provisioning International Operations +R 45 m u Higher general debt and Mining Finance provisions 10

Provision for credit losses Improving domestic environment u u 0. 02% 0. 06% Domestic operations +4% Aggressive provisioning in Commercial Banking - provisions +R 54 m (0. 09%) u Retail 2% lower 1. 13% u SCMB 10% lower u Stanbic Africa +R 15 m 1. 14% u u Stanbic 2000 International Operations Stanbic Africa Domestic operations Stanbic 2001 Credit provisions to average advances Prudent provisioning International Operations +R 45 m u Higher general debt and Mining Finance provisions 10

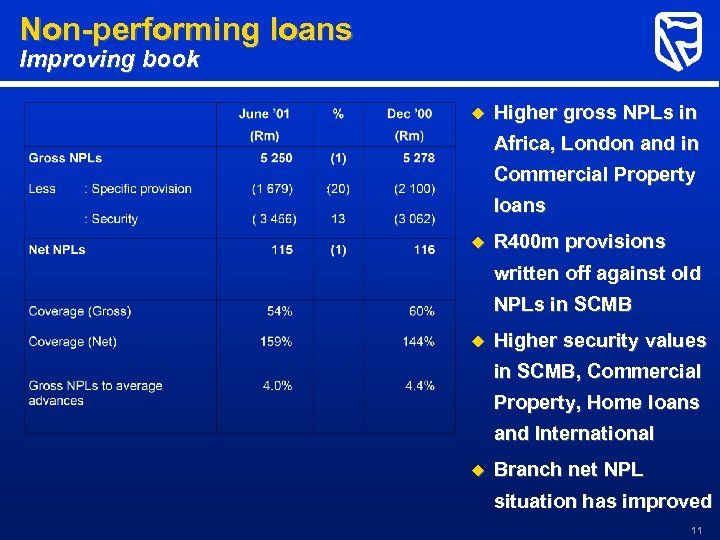

Non-performing loans Improving book u Higher gross NPLs in Africa, London and in Commercial Property loans u R 400 m provisions written off against old NPLs in SCMB u Higher security values in SCMB, Commercial Property, Home loans and International u Branch net NPL situation has improved 11

Non-performing loans Improving book u Higher gross NPLs in Africa, London and in Commercial Property loans u R 400 m provisions written off against old NPLs in SCMB u Higher security values in SCMB, Commercial Property, Home loans and International u Branch net NPL situation has improved 11

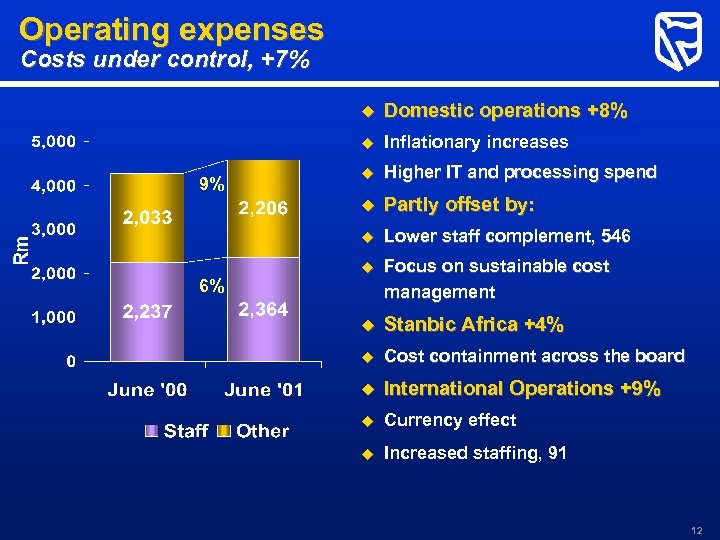

Operating expenses Costs under control, +7% u u Inflationary increases u Higher IT and processing spend u Partly offset by: u Lower staff complement, 546 u 9% Domestic operations +8% Focus on sustainable cost management u Stanbic Africa +4% u Cost containment across the board u International Operations +9% u Currency effect u Increased staffing, 91 6% 12

Operating expenses Costs under control, +7% u u Inflationary increases u Higher IT and processing spend u Partly offset by: u Lower staff complement, 546 u 9% Domestic operations +8% Focus on sustainable cost management u Stanbic Africa +4% u Cost containment across the board u International Operations +9% u Currency effect u Increased staffing, 91 6% 12

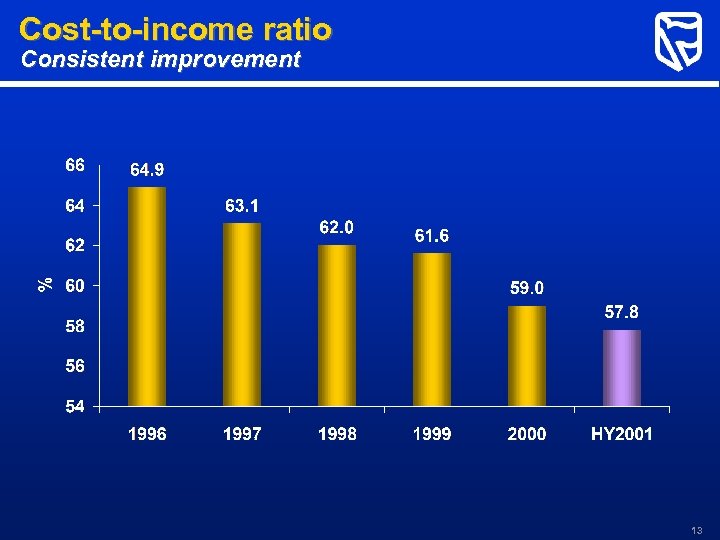

Cost-to-income ratio Consistent improvement 13

Cost-to-income ratio Consistent improvement 13

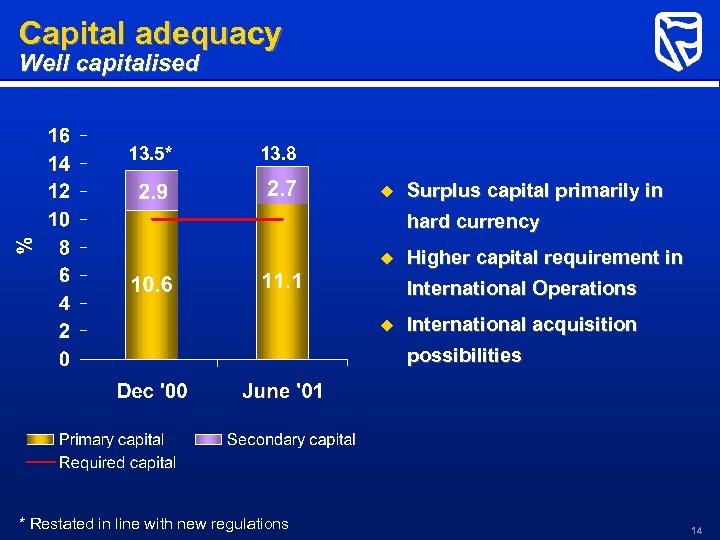

Capital adequacy Well capitalised 13. 5* 13. 8 u Surplus capital primarily in hard currency u Higher capital requirement in International Operations u International acquisition possibilities * Restated in line with new regulations 14

Capital adequacy Well capitalised 13. 5* 13. 8 u Surplus capital primarily in hard currency u Higher capital requirement in International Operations u International acquisition possibilities * Restated in line with new regulations 14

Headline earnings Strong domestic performance 15

Headline earnings Strong domestic performance 15

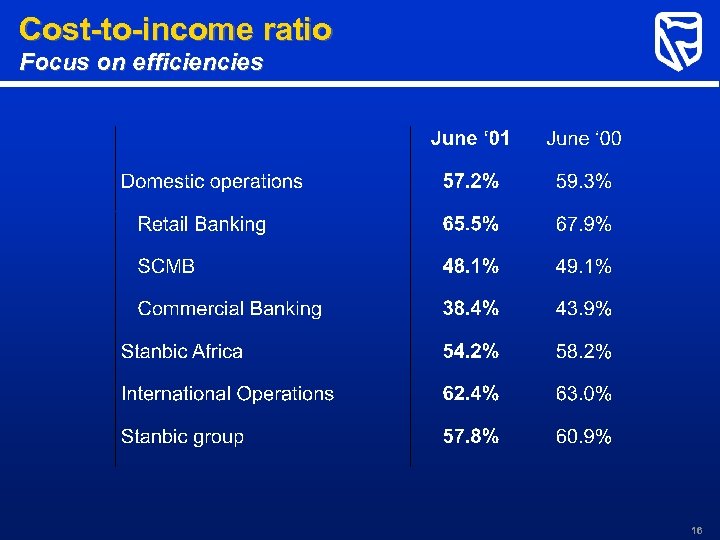

Cost-to-income ratio Focus on efficiencies 16

Cost-to-income ratio Focus on efficiencies 16

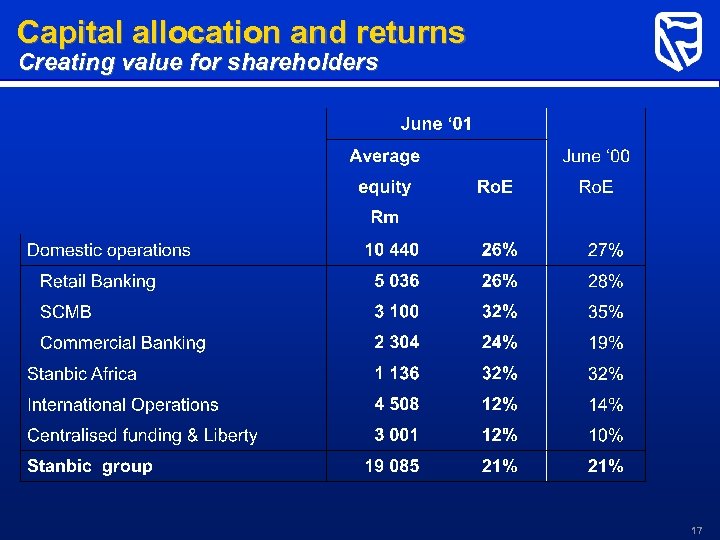

Capital allocation and returns Creating value for shareholders 17

Capital allocation and returns Creating value for shareholders 17

Retail Banking 18

Retail Banking 18

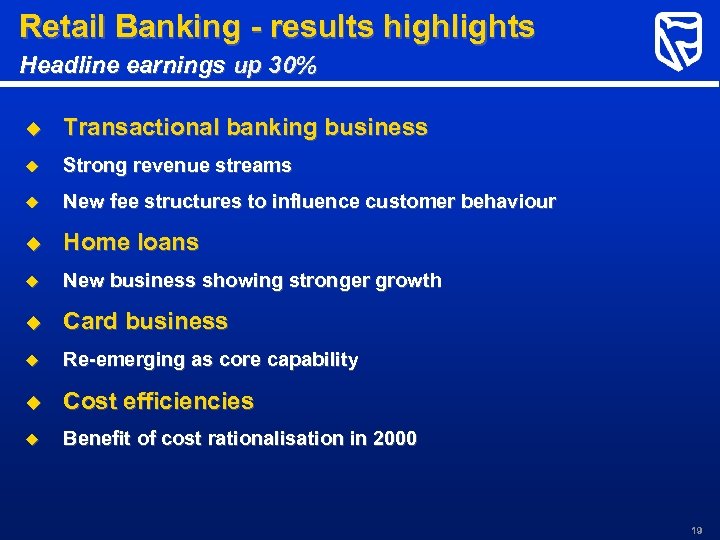

Retail Banking - results highlights Headline earnings up 30% u Transactional banking business u Strong revenue streams u New fee structures to influence customer behaviour u Home loans u New business showing stronger growth u Card business u Re-emerging as core capability u Cost efficiencies u Benefit of cost rationalisation in 2000 19

Retail Banking - results highlights Headline earnings up 30% u Transactional banking business u Strong revenue streams u New fee structures to influence customer behaviour u Home loans u New business showing stronger growth u Card business u Re-emerging as core capability u Cost efficiencies u Benefit of cost rationalisation in 2000 19

Retail Banking Bancassurance portfolio showed mixed results u Simple products u Number of policies in force up 53% - Credit life policies 290 000 (+19%) - Funeral policies 260 000 (+125%) u Funeral penetration now 10. 8% (from 4. 5%) u Complex products u Business 7% up but below budget u Focus on sales force management u Investment in IT based selling tools 20

Retail Banking Bancassurance portfolio showed mixed results u Simple products u Number of policies in force up 53% - Credit life policies 290 000 (+19%) - Funeral policies 260 000 (+125%) u Funeral penetration now 10. 8% (from 4. 5%) u Complex products u Business 7% up but below budget u Focus on sales force management u Investment in IT based selling tools 20

Retail Banking E-plan and ABIL JV well positioned u Mass market number of transactions and average balances increase u Annual E-plan transactions per account up from 35 to 38 u Average balance up from R 717 to R 872 u African Bank JV u 20 000 accounts opened during first 6 months u Gross advances book R 88 m u Working closely together 21

Retail Banking E-plan and ABIL JV well positioned u Mass market number of transactions and average balances increase u Annual E-plan transactions per account up from 35 to 38 u Average balance up from R 717 to R 872 u African Bank JV u 20 000 accounts opened during first 6 months u Gross advances book R 88 m u Working closely together 21

Retail Banking Sustained demand for virtual banking u Virtual banking development u Majority of home loans originated outside of branch infrastructure u Auto-E transactions increased by 19% u Internet banking customers up 43% to 186 000 u Internet transaction volumes up 82% u Internet fee based transactions up 74% u Call centre volumes up 24% u Virtual transactions account for 65% of total volumes u bluebean. com being repositioned 22

Retail Banking Sustained demand for virtual banking u Virtual banking development u Majority of home loans originated outside of branch infrastructure u Auto-E transactions increased by 19% u Internet banking customers up 43% to 186 000 u Internet transaction volumes up 82% u Internet fee based transactions up 74% u Call centre volumes up 24% u Virtual transactions account for 65% of total volumes u bluebean. com being repositioned 22

Retail Banking - priorities u Revenue growth u Establish optimal balance between near and long term portfolio u Improve under-performing businesses u Leverage revenues from partnerships - ABIL JV - FIHRST payroll intermediary with Alexander Forbes - SA Homeloans - Edgars initiative - E-plan expansion with Orlando Pirates and Kaizer Chiefs u Comprehensive payment product strategy 23

Retail Banking - priorities u Revenue growth u Establish optimal balance between near and long term portfolio u Improve under-performing businesses u Leverage revenues from partnerships - ABIL JV - FIHRST payroll intermediary with Alexander Forbes - SA Homeloans - Edgars initiative - E-plan expansion with Orlando Pirates and Kaizer Chiefs u Comprehensive payment product strategy 23

Retail Banking - priorities continued u Cost management u Best Bank Enhancement Programme u Roll out of Bank at Any Centre u Optimisation of channel, product and customer mix u Project execution disciplines extended to non-IT projects u End-to-end process management rules to extract efficiencies u Customer focus u Investment 24

Retail Banking - priorities continued u Cost management u Best Bank Enhancement Programme u Roll out of Bank at Any Centre u Optimisation of channel, product and customer mix u Project execution disciplines extended to non-IT projects u End-to-end process management rules to extract efficiencies u Customer focus u Investment 24

Retail Banking Rated by external groups u Pricewaterhouse. Coopers banking survey u Ranked first by peers in: - Retail Lending and Deposits - Internet Banking u Euromoney awards u Standard Bank rated Best Bank in South Africa u “…, the bank is a match foreign entrants in retail banking technology as well as wholesale payments, clearing and custody. . . ” 25

Retail Banking Rated by external groups u Pricewaterhouse. Coopers banking survey u Ranked first by peers in: - Retail Lending and Deposits - Internet Banking u Euromoney awards u Standard Bank rated Best Bank in South Africa u “…, the bank is a match foreign entrants in retail banking technology as well as wholesale payments, clearing and custody. . . ” 25

SCMB 26

SCMB 26

SCMB - results highlights All-round contribution u Headline earnings 25% higher u Costs well contained, +4% u Retained strong position in chosen markets u Attracted a number of high calibre people 27

SCMB - results highlights All-round contribution u Headline earnings 25% higher u Costs well contained, +4% u Retained strong position in chosen markets u Attracted a number of high calibre people 27

SCMB Rated by external groups u Pricewaterhouse. Coopers banking survey u SCMB ranked first by its peers in: - Corporate Banking - Foreign Exchange Trading - Capital Markets, Bonds and Derivatives - Money Markets 28

SCMB Rated by external groups u Pricewaterhouse. Coopers banking survey u SCMB ranked first by its peers in: - Corporate Banking - Foreign Exchange Trading - Capital Markets, Bonds and Derivatives - Money Markets 28

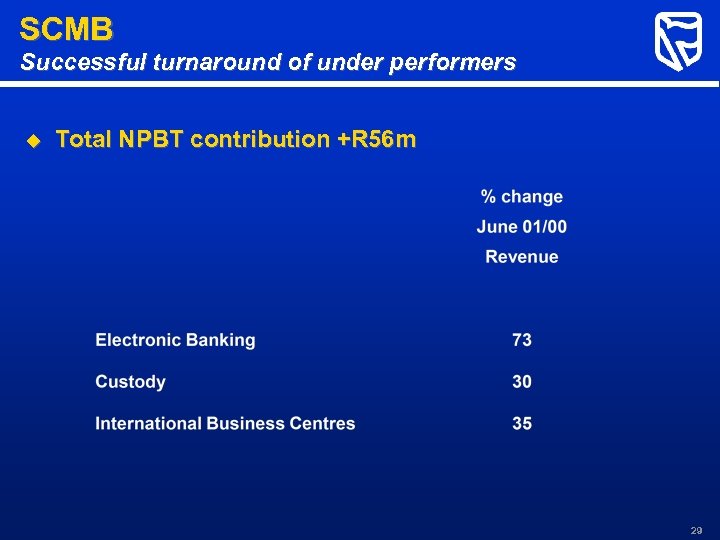

SCMB Successful turnaround of under performers u Total NPBT contribution +R 56 m 29

SCMB Successful turnaround of under performers u Total NPBT contribution +R 56 m 29

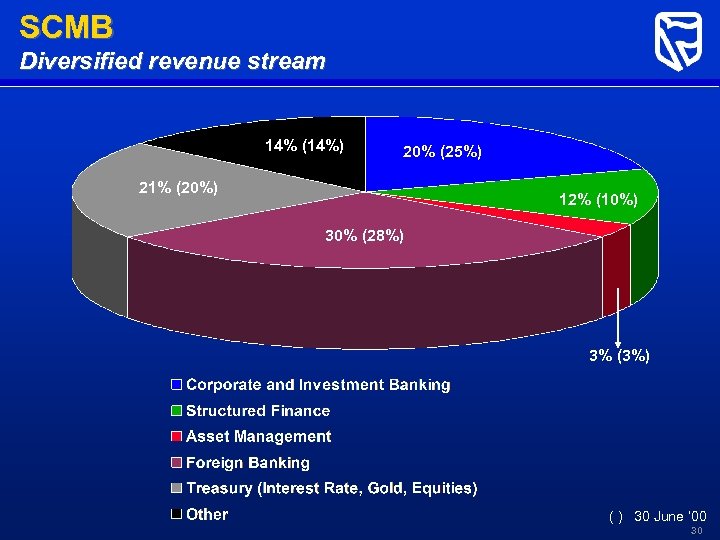

SCMB Diversified revenue stream 14% (14%) 20% (25%) 21% (20%) 12% (10%) 30% (28%) 3% (3%) ( ) 30 June ‘ 00 30

SCMB Diversified revenue stream 14% (14%) 20% (25%) 21% (20%) 12% (10%) 30% (28%) 3% (3%) ( ) 30 June ‘ 00 30

SCMB - priorities u Developing global product focus with Standard Bank London u Cost containment u Focus on e-Commerce u Private equity / Leveraged buy outs u Sustained improvement of equities broking business 31

SCMB - priorities u Developing global product focus with Standard Bank London u Cost containment u Focus on e-Commerce u Private equity / Leveraged buy outs u Sustained improvement of equities broking business 31

Commercial Banking 32

Commercial Banking 32

Commercial Banking - results highlights Headline earnings 25% up u Commercial Suites u More conservative provisioning u Lending flat, but improved asset quality u Deposit base growing u Stannic u Turnover growth in line with market growth u Declining bad debts u Costs u Restricted to 2% increase 33

Commercial Banking - results highlights Headline earnings 25% up u Commercial Suites u More conservative provisioning u Lending flat, but improved asset quality u Deposit base growing u Stannic u Turnover growth in line with market growth u Declining bad debts u Costs u Restricted to 2% increase 33

Commercial Banking - priorities u Commercial Suites u Forecasting lower bad debts in the second half u Improvement in lending book boosted by lower interest rates u Continued focus on cross sell opportunities u Leverage off market leadership in electronic banking u Continued improvement in customer service u Stannic u Selective market share gains 34

Commercial Banking - priorities u Commercial Suites u Forecasting lower bad debts in the second half u Improvement in lending book boosted by lower interest rates u Continued focus on cross sell opportunities u Leverage off market leadership in electronic banking u Continued improvement in customer service u Stannic u Selective market share gains 34

Private Banking 35

Private Banking 35

Private Banking - introduction New business opportunity u Five cornerstones u International u Wealth management u Melville Douglas u Consolidated lending u Transactional banking 36

Private Banking - introduction New business opportunity u Five cornerstones u International u Wealth management u Melville Douglas u Consolidated lending u Transactional banking 36

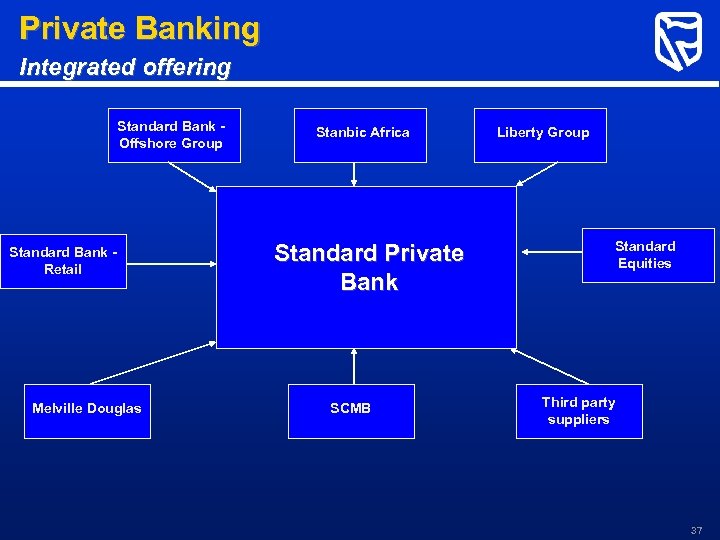

Private Banking Integrated offering Standard Bank Offshore Group Standard Bank Retail Melville Douglas Stanbic Africa Standard Private Bank SCMB Liberty Group Standard Equities Third party suppliers 37

Private Banking Integrated offering Standard Bank Offshore Group Standard Bank Retail Melville Douglas Stanbic Africa Standard Private Bank SCMB Liberty Group Standard Equities Third party suppliers 37

Private Banking - priorities u Integrated product offering u Pace of product roll-out and client acquisition u Systems roll-out u Achieving first class service levels u Co-ordinating offshore offering u Contain start-up losses 38

Private Banking - priorities u Integrated product offering u Pace of product roll-out and client acquisition u Systems roll-out u Achieving first class service levels u Co-ordinating offshore offering u Contain start-up losses 38

International Operations 39

International Operations 39

International Operations - results highlights Difficult market conditions u Headline earnings 13% up u Excellent client driven performance u Disappointing performance in fixed income activities u Strong unsettled dealing balance growth u Increased ability to hold margin assets on balance sheet 40

International Operations - results highlights Difficult market conditions u Headline earnings 13% up u Excellent client driven performance u Disappointing performance in fixed income activities u Strong unsettled dealing balance growth u Increased ability to hold margin assets on balance sheet 40

International Operations Debt capital markets u Client business u Contribution up 74% u Key driver - sales u Strengthened management u Trading u Profits down u Continued uncertainty in emerging markets u Sell-off in US high yield market 41

International Operations Debt capital markets u Client business u Contribution up 74% u Key driver - sales u Strengthened management u Trading u Profits down u Continued uncertainty in emerging markets u Sell-off in US high yield market 41

International Operations Resource banking u Earnings stable u Strong growth in precious metals (up 15%) offset by low activity in base metals and project finance u Core energy team, including electricity, now in place u Commodity trade finance contribution up 64% 42

International Operations Resource banking u Earnings stable u Strong growth in precious metals (up 15%) offset by low activity in base metals and project finance u Core energy team, including electricity, now in place u Commodity trade finance contribution up 64% 42

International Operations Private Banking u Strong growth in deposit business u Banking earnings increased 8% u Weaker stock broking/investment management/trust and advisory activity in line with the market 43

International Operations Private Banking u Strong growth in deposit business u Banking earnings increased 8% u Weaker stock broking/investment management/trust and advisory activity in line with the market 43

International Operations - priorities u Weather the slowdown in major economies and uncertainty in emerging economies u Take advantage of widening spreads u Complete the integration of JF Bank u Selective acquisitions u Expand regional focus by adding to current teams and expanding business mix 44

International Operations - priorities u Weather the slowdown in major economies and uncertainty in emerging economies u Take advantage of widening spreads u Complete the integration of JF Bank u Selective acquisitions u Expand regional focus by adding to current teams and expanding business mix 44

Stanbic Africa 45

Stanbic Africa 45

Stanbic Africa - results highlights Challenging environment u Headline earnings up 20% u Modest asset growth u Higher provisions u Good non-funds income growth u Costs well managed, +4% u Zimbabwe, Kenya performing poorly 46

Stanbic Africa - results highlights Challenging environment u Headline earnings up 20% u Modest asset growth u Higher provisions u Good non-funds income growth u Costs well managed, +4% u Zimbabwe, Kenya performing poorly 46

Stanbic Africa - priorities u Selective acquisitions u Strategic relationships u New products 47

Stanbic Africa - priorities u Selective acquisitions u Strategic relationships u New products 47

Liberty Group 48

Liberty Group 48

Liberty Group - results highlights Performed well over the period u Headline return on equity increased to 24%* u Headline earnings up 15%* u Embedded value up 13% since December u Total new business increased by 18% *On continuing operations 49

Liberty Group - results highlights Performed well over the period u Headline return on equity increased to 24%* u Headline earnings up 15%* u Embedded value up 13% since December u Total new business increased by 18% *On continuing operations 49

Stanbic 50

Stanbic 50

Stanbic - strategic imperatives u No change since last presentation u Move Retail Banking to a higher level u New head u Strong results u Develop Standard/Liberty axis further u Private Bank u Re-engineering Stanfin 51

Stanbic - strategic imperatives u No change since last presentation u Move Retail Banking to a higher level u New head u Strong results u Develop Standard/Liberty axis further u Private Bank u Re-engineering Stanfin 51

Stanbic u International Ro. E u Tough conditions - solid performance u Selective acquisitions will help u Capitalise on complementary capabilities of SCMB, International, Africa u Good progress u Global business lines u Attract, retain and deploy the right people 52

Stanbic u International Ro. E u Tough conditions - solid performance u Selective acquisitions will help u Capitalise on complementary capabilities of SCMB, International, Africa u Good progress u Global business lines u Attract, retain and deploy the right people 52