f532ae86b51c367727195223c81f41af.ppt

- Количество слайдов: 24

Interest Rates (Chapter 15 BH)

Why Don’t They Buy… • Energy efficient appliances, insulation, windows and so on when they redo their homes? • additional cost $4 K upfront • utility bill decrease $744 • CO 2 e saved about 11, 800 per year.

Interest Rate • principle • interest payment • interest rate = payment/principle – (these days often daily, but expressed as a yearly equivalent) • Future Value: The future value of 100 at r% for t years is the amnt of money you will have in t years if invested at r%: principle*(1+r)^t

• Present Value (PV). Value today of payments in the future. • PV = (1+r) -t * FV • PV of annual payment of AV starting in one year is AV/r.

Back to energy saving If interest is 5% and savings last forever PV of savings is 14, 880 Cost is 4047 Present Net Value is 10, 833. On the other hand if the savings only last 5 years the PV of savings is 3221 (look at book for calc) and PNV = -826. • Could also try 10% interest rate. • • •

Invest and interest • Obviously high interest and quick depreciation militate against investments. – Even socially nice ones.

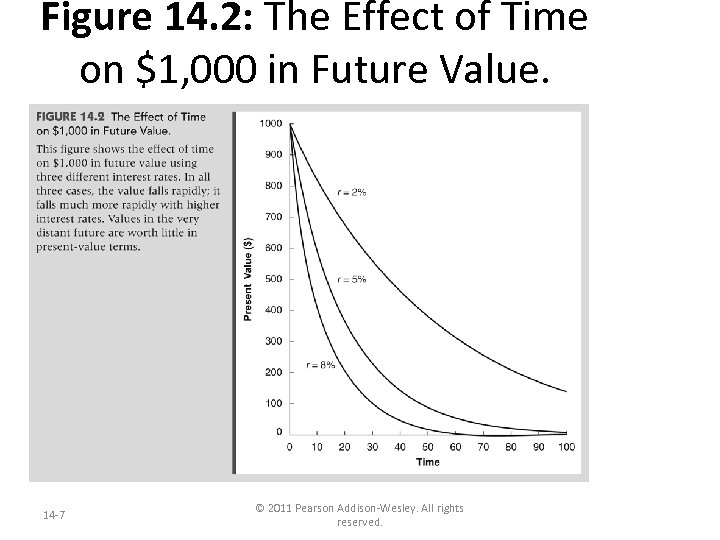

Figure 14. 2: The Effect of Time on $1, 000 in Future Value. 14 -7 © 2011 Pearson Addison-Wesley. All rights reserved.

Market interest rates • Nominal vs. Real – inflation – CPI • If you use real interest rates make sure you are using real prices for the benefits – e. g. nominal electric prices rose by 5%/year, but so did the price of other goods (CPI). – Use nominal prices and nominal interest rate – Use real prices (price/CPI) and real interest = r minus the inflation rate. – Get same answer either way.

Borrowing and Saving • Financial system gets paid to round up your savings and lend them to someone. • Difference in rates compensates them for their work and also the risk of the loan, which they bare and you do not.

Risk • Treasury bonds are really as guaranteed as you can get. You will get your $ back. Hence no risk. • Corporate bonds—more risk so you get a higher rate of return to pay you for taking the risk. • Stocks—S&P 500 is a good index (Russel 2000 is a little better). Higher rate of return yet, but you can gain or lose 4% of your money in one day!

Risk Reality • 1. If you look only at the post war period then stocks look great relative to bonds. But if you include pre-war bonds and stocks look more similar in their returns. • 2. Your greatest risk is your human capital risk. Disability is not so uncommon and has a far greater effect on your lifetime income than the stock market.

Price of Risk • (Advanced Topic) • Investor can hold the S&P itself. Eliminates idiosyncratic risk. Intel goes up and AMD down. Together less risk than alone. • Stocks are priced based on their tendency to rise and fall with the market (S&P). • Ones that go up and down in market cycle faster than the market have the most risk.

Public Projects • I want to build a dam. Benefits from electricity, irrigation and flood control all come in the future. Costs all come now. • High interest rate = little PV benefits • Low interest rate = big PV benefits • Which interest rate is “right? ”

Social Discount Rate • Pure: I believe that all people are too present oriented and want my government to compensate for that. That is, I wouldn’t invest in the dam, but I think they should. • Confused: Global warming is an externality. I want it stopped. I want government to stop it. Here I don’t see why they should use a lower interest rate—they should just price the externality.

Risk in Public Projects • There is a way of stopping global climate change. (a hypothetical) • It’s expected costs are a little larger than its expected benefits at the market rate of interest (around 10%, the return, nominal, on the s&p 500) • Would you do it anyway? – Do you insure your house against fire? – Would you buy planet fire insurance?

Vexed Question • I hold with the conservatives: • for the same type of project, the gov’t and the private sector should be using the same rates

Socially Responsible Investing • A bet against dirty companies. – Tobacco; nuclear; alcohol; defense; – Good record of compliance • Loses diversification • Costs money to do the “screens” • Gives investors a “warm glow”; might work for workers too—but nuclear employees might think that nuclear is cool.

Benefit Cost Analysis • “if the benefits to whomsoever they may accrue are in excess of the estimated costs. ” • Criteria for public projects

Tellico Dam Outline of story: (Chapt 17) Dam was mostly built Snail darter discovered ESA invoked G_d squad—interagency group to determine whether to allow extinction. • Found defect in BCA • Dam built and darter survived • Development benefits never happened. • • •

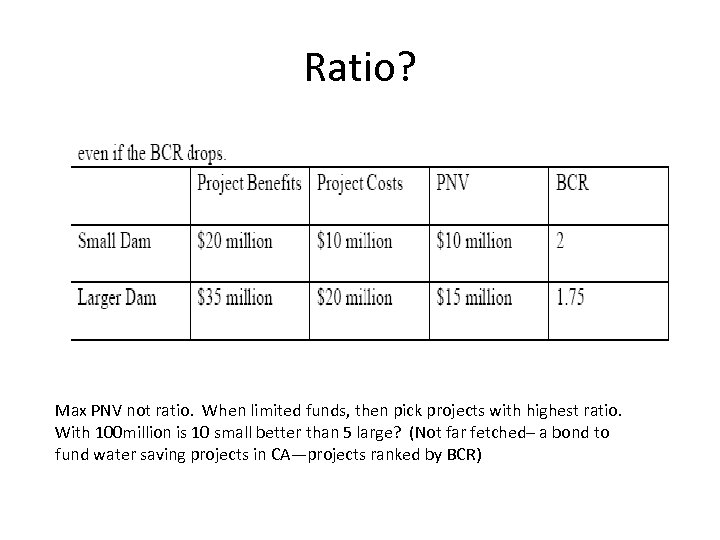

Ratio? Max PNV not ratio. When limited funds, then pick projects with highest ratio. With 100 million is 10 small better than 5 large? (Not far fetched– a bond to fund water saving projects in CA—projects ranked by BCR)

Benefits • Area under demand – could be market good, like corn – could be non-market good like whales

costs • usually engineering estimates for structures • got to get all costs – drowned land – drowned Indian villages and historic sites – endangered species – and so on.

Alternatives • Big or little dam? – Max concrete s. t. BCA > 0 – Max BCA • When? – Now – Later – Is there an uncertainty that will be resolved if you wait? Is the project marginal with 10 years ago energy prices? Would it be a go now?

To BCA or Not to BCA It is a screen to get rid of truly awful projects. Like an EIS/EIR it can be manipulated. If permitted it could be litigated. Requiring a BCA for environmental regulations is controversial. In practice we do that here in CA and still have the toughest environmental laws. • Perhaps it is an important part of being able to have tough environmental laws—efficient ones are cheaper. • •

f532ae86b51c367727195223c81f41af.ppt