Monetary Policy.pptx

- Количество слайдов: 33

Interest Rates and Monetary Policy The Fed’s primary influence in the economy is on the money supply and interest rates… So how is the interest rate determined? Let’s first consider the demand supply of money in the economy

Interest Rates and Monetary Policy The Fed’s primary influence in the economy is on the money supply and interest rates… So how is the interest rate determined? Let’s first consider the demand supply of money in the economy

Interest Rates and Monetary Policy People demand money for two primary reasons: 1. Transactions Demand This is the demand generated by people who want to use money as a medium of exchange

Interest Rates and Monetary Policy People demand money for two primary reasons: 1. Transactions Demand This is the demand generated by people who want to use money as a medium of exchange

Interest Rates and Monetary Policy People demand money for two primary reasons: 2. Asset Demand This is demand generated by people who want to hold money as an asset Why? Primarily because it is the most liquid of all assets and can be used for immediate exchange

Interest Rates and Monetary Policy People demand money for two primary reasons: 2. Asset Demand This is demand generated by people who want to hold money as an asset Why? Primarily because it is the most liquid of all assets and can be used for immediate exchange

Interest Rates and Monetary Policy People demand money for two primary reasons: 2. Asset Demand However this demand is balanced by the fact that money earns little to no interest…so it could be better placed elsewhere

Interest Rates and Monetary Policy People demand money for two primary reasons: 2. Asset Demand However this demand is balanced by the fact that money earns little to no interest…so it could be better placed elsewhere

Interest Rates and Monetary Policy So, in terms of interest rates, When interest rates rise, people demand less money for assets because they could be earning more by saving or investing the money But the transaction demand is not directly affected by interest rates…it is affected by the number of transactions (real GDP)

Interest Rates and Monetary Policy So, in terms of interest rates, When interest rates rise, people demand less money for assets because they could be earning more by saving or investing the money But the transaction demand is not directly affected by interest rates…it is affected by the number of transactions (real GDP)

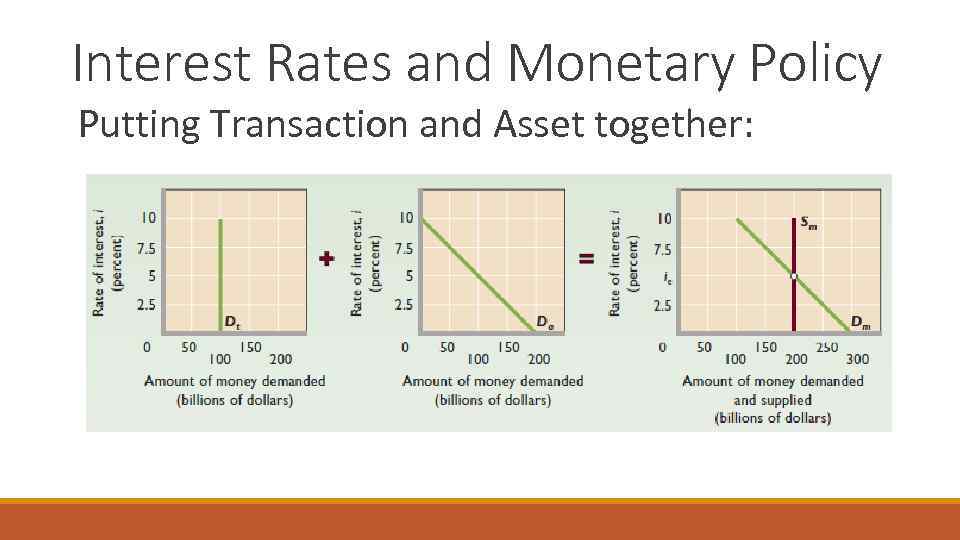

Interest Rates and Monetary Policy Putting Transaction and Asset together:

Interest Rates and Monetary Policy Putting Transaction and Asset together:

Interest Rates and Monetary Policy Putting Transaction and Asset together: This is how an general economy-wide level of interest rates is determined And as we learned…interest rates affect spending!

Interest Rates and Monetary Policy Putting Transaction and Asset together: This is how an general economy-wide level of interest rates is determined And as we learned…interest rates affect spending!

Interest Rates and Monetary Policy Recall the indirect crowding out effect of interest rates…higher rates means less borrowing which means less demand in the economy…thus lowered levels of real GDP

Interest Rates and Monetary Policy Recall the indirect crowding out effect of interest rates…higher rates means less borrowing which means less demand in the economy…thus lowered levels of real GDP

Interest Rates and Monetary Policy Tools of Monetary Policy 1. Open-market Operations 2. The reserve ratio 3. The discount rate 4. The term auction facility

Interest Rates and Monetary Policy Tools of Monetary Policy 1. Open-market Operations 2. The reserve ratio 3. The discount rate 4. The term auction facility

Interest Rates and Monetary Policy Tools of Monetary Policy Open Market Operations Bond markets are “open” to all buyers and sellers of corporate and government bonds The open market operations consist of the government buying and selling bonds to commercial banks and the general public

Interest Rates and Monetary Policy Tools of Monetary Policy Open Market Operations Bond markets are “open” to all buyers and sellers of corporate and government bonds The open market operations consist of the government buying and selling bonds to commercial banks and the general public

Interest Rates and Monetary Policy Tools of Monetary Policy When the government buys bonds from the public, it puts money into circulation When the government sells bonds to the public, it takes money out of circulation

Interest Rates and Monetary Policy Tools of Monetary Policy When the government buys bonds from the public, it puts money into circulation When the government sells bonds to the public, it takes money out of circulation

Interest Rates and Monetary Policy Tools of Monetary Policy Thus, by increasing or decreasing the money supply, the FED is able to maintain some control over the price level… Recall that when money is scarce, prices are low…when money is abundant, prices are high

Interest Rates and Monetary Policy Tools of Monetary Policy Thus, by increasing or decreasing the money supply, the FED is able to maintain some control over the price level… Recall that when money is scarce, prices are low…when money is abundant, prices are high

Interest Rates and Monetary Policy Tools of Monetary Policy The Reserve Ratio By allowing banks to have a lower reserve ratio, the FED is allowing banks to lend more of its cash assets…thereby increasing the amount of money that is “created” by banks.

Interest Rates and Monetary Policy Tools of Monetary Policy The Reserve Ratio By allowing banks to have a lower reserve ratio, the FED is allowing banks to lend more of its cash assets…thereby increasing the amount of money that is “created” by banks.

Interest Rates and Monetary Policy Tools of Monetary Policy The Reserve Ratio Again, the effect here is to increase or decrease the money supply and thus affect price levels

Interest Rates and Monetary Policy Tools of Monetary Policy The Reserve Ratio Again, the effect here is to increase or decrease the money supply and thus affect price levels

Interest Rates and Monetary Policy Tools of Monetary Policy The Discount Rate This is the rate at which commercial banks borrow money from the FED Lower discount rates make borrowing from the FED more appealing…which ultimately could increase lending from commercial banks

Interest Rates and Monetary Policy Tools of Monetary Policy The Discount Rate This is the rate at which commercial banks borrow money from the FED Lower discount rates make borrowing from the FED more appealing…which ultimately could increase lending from commercial banks

Interest Rates and Monetary Policy Tools of Monetary Policy When commercial banks borrow from the FED they are not required to keep reserves on that loan…so this borrowing simply increases the level of reserves that commercial banks have available for lending.

Interest Rates and Monetary Policy Tools of Monetary Policy When commercial banks borrow from the FED they are not required to keep reserves on that loan…so this borrowing simply increases the level of reserves that commercial banks have available for lending.

Interest Rates and Monetary Policy Tools of Monetary Policy Term Auction Facility Introduced in December 2007 in response to the mortgage debt crisis Every month, two auctions are held where commercial banks bid for the right to borrow reserves from the FED for 28 -day periods

Interest Rates and Monetary Policy Tools of Monetary Policy Term Auction Facility Introduced in December 2007 in response to the mortgage debt crisis Every month, two auctions are held where commercial banks bid for the right to borrow reserves from the FED for 28 -day periods

Interest Rates and Monetary Policy Tools of Monetary Policy Bids are submitted to the FED in secret, and the bank that offered the highest interest rate wins the privilege of borrowing from the FED

Interest Rates and Monetary Policy Tools of Monetary Policy Bids are submitted to the FED in secret, and the bank that offered the highest interest rate wins the privilege of borrowing from the FED

Interest Rates and Monetary Policy Tools of Monetary Policy This type of auction helps to ensure that extra reserves offered by the FED are actually acquired by banks and helps maintain lending stability

Interest Rates and Monetary Policy Tools of Monetary Policy This type of auction helps to ensure that extra reserves offered by the FED are actually acquired by banks and helps maintain lending stability

Interest Rates and Monetary Policy The Federal Funds Rate This is the rate of interest that banks charge one another for overnight loans made from temporary excess reserves This rate is manipulated by the FED through varying levels of FED reserves offered for borrowing

Interest Rates and Monetary Policy The Federal Funds Rate This is the rate of interest that banks charge one another for overnight loans made from temporary excess reserves This rate is manipulated by the FED through varying levels of FED reserves offered for borrowing

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy Suppose the economy is going through a recession and there is high unemployment… What will be the goal of the FED?

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy Suppose the economy is going through a recession and there is high unemployment… What will be the goal of the FED?

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy Probably to stimulate spending and increase the demand for workers (or in other words increase the supply of jobs, thus decreasing unemployment)

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy Probably to stimulate spending and increase the demand for workers (or in other words increase the supply of jobs, thus decreasing unemployment)

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy So in other words…EXPAND the economy… Hence, expansionary monetary policy. So how is this done?

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Expansionary Monetary Policy So in other words…EXPAND the economy… Hence, expansionary monetary policy. So how is this done?

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: First the FED will attempt to lower interest rates by announcing a lower target Federal funds rate…suppose 3. 5% instead of 4% To do this, the FED will buy bonds from banks and the public…

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: First the FED will attempt to lower interest rates by announcing a lower target Federal funds rate…suppose 3. 5% instead of 4% To do this, the FED will buy bonds from banks and the public…

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: As mentioned earlier, buying bonds increases the money supply (or the reserves available in the banking system) So two critical results are produced by stimulating greater bank reserves:

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: As mentioned earlier, buying bonds increases the money supply (or the reserves available in the banking system) So two critical results are produced by stimulating greater bank reserves:

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: 1. The supply of Federal funds increases, lowering the FED funds rate to the new targeted rate 2. A multiple expansion of the nation’s money supply occurs, also putting downward pressure on interest rates

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: 1. The supply of Federal funds increases, lowering the FED funds rate to the new targeted rate 2. A multiple expansion of the nation’s money supply occurs, also putting downward pressure on interest rates

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy This is used to combat periods of rising inflation (or rising prices)

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy This is used to combat periods of rising inflation (or rising prices)

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy The basic idea here is to increase the interest rate in order to reduce borrowing and spending which will curtail the expansion of aggregate demand hold down price levels

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy The basic idea here is to increase the interest rate in order to reduce borrowing and spending which will curtail the expansion of aggregate demand hold down price levels

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy The first step is to announce a higher target for the FED funds rate… Then to achieve that higher rate the FED will sell bonds through open market transactions by offering higher interest rates on loans

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy The first step is to announce a higher target for the FED funds rate… Then to achieve that higher rate the FED will sell bonds through open market transactions by offering higher interest rates on loans

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy This means the FED is scooping up excess reserves from banks and the public and holding them to keep them from being loaned out

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy This means the FED is scooping up excess reserves from banks and the public and holding them to keep them from being loaned out

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy Hence, the decreased money supply results in higher interest rates and less borrowing

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Restrictive Monetary Policy Hence, the decreased money supply results in higher interest rates and less borrowing

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Often times in practice a combination of several tools will be employed simultaneously…for example if the goal is expansionary monetary policy the FED might:

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: Often times in practice a combination of several tools will be employed simultaneously…for example if the goal is expansionary monetary policy the FED might:

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: 1. Buy gov’t securities from banks and the public in the open market 2. lower the legal reserve ratio 3. lower the discount rate 4. increase reserve auctions

Interest Rates and Monetary Policy Reaching Monetary Policy Goals: 1. Buy gov’t securities from banks and the public in the open market 2. lower the legal reserve ratio 3. lower the discount rate 4. increase reserve auctions