9f0a761a09bcf23290dcdb38f3080c8e.ppt

- Количество слайдов: 50

Interest Rate Futures Chapter 6

Interest Rate Futures Chapter 6

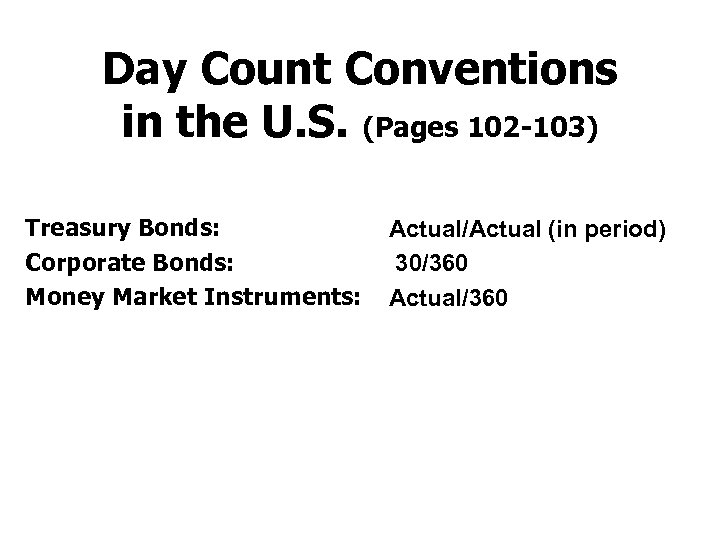

Day Count Conventions in the U. S. (Pages 102 -103) Treasury Bonds: Corporate Bonds: Money Market Instruments: Actual/Actual (in period) 30/360 Actual/360

Day Count Conventions in the U. S. (Pages 102 -103) Treasury Bonds: Corporate Bonds: Money Market Instruments: Actual/Actual (in period) 30/360 Actual/360

3

3

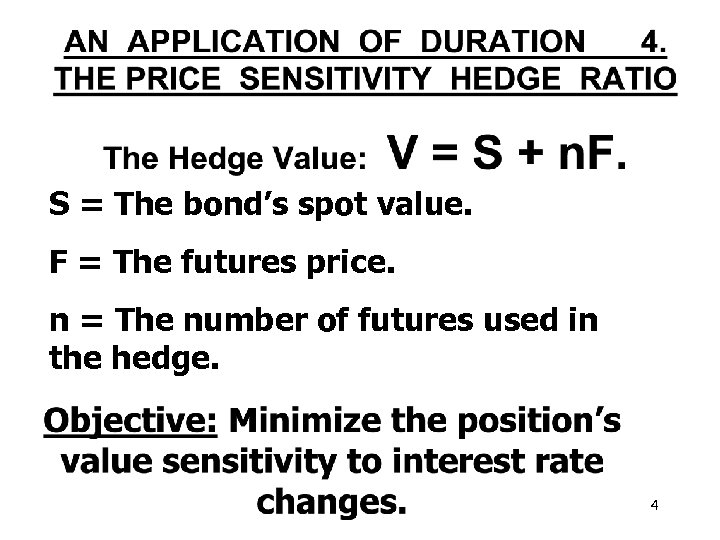

S = The bond’s spot value. F = The futures price. n = The number of futures used in the hedge. 4

S = The bond’s spot value. F = The futures price. n = The number of futures used in the hedge. 4

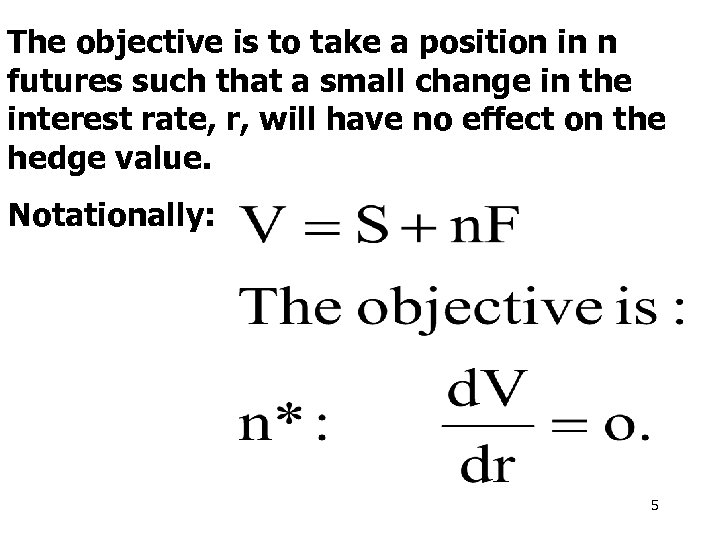

The objective is to take a position in n futures such that a small change in the interest rate, r, will have no effect on the hedge value. Notationally: 5

The objective is to take a position in n futures such that a small change in the interest rate, r, will have no effect on the hedge value. Notationally: 5

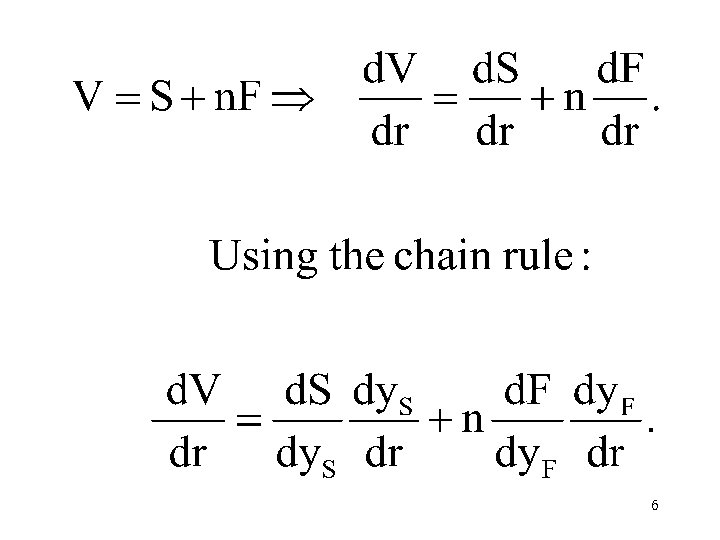

6

6

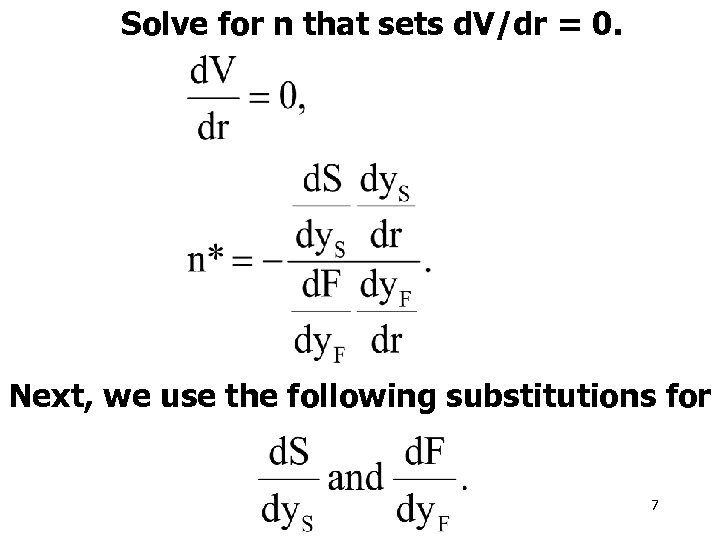

Solve for n that sets d. V/dr = 0. Next, we use the following substitutions for 7

Solve for n that sets d. V/dr = 0. Next, we use the following substitutions for 7

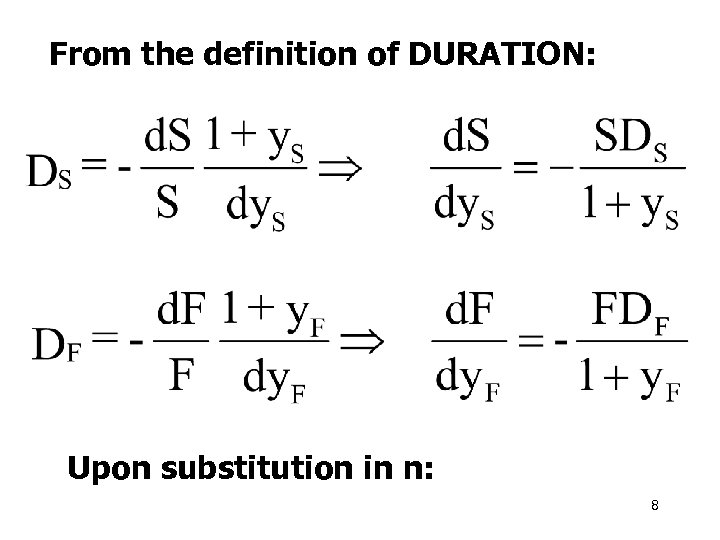

From the definition of DURATION: Upon substitution in n: 8

From the definition of DURATION: Upon substitution in n: 8

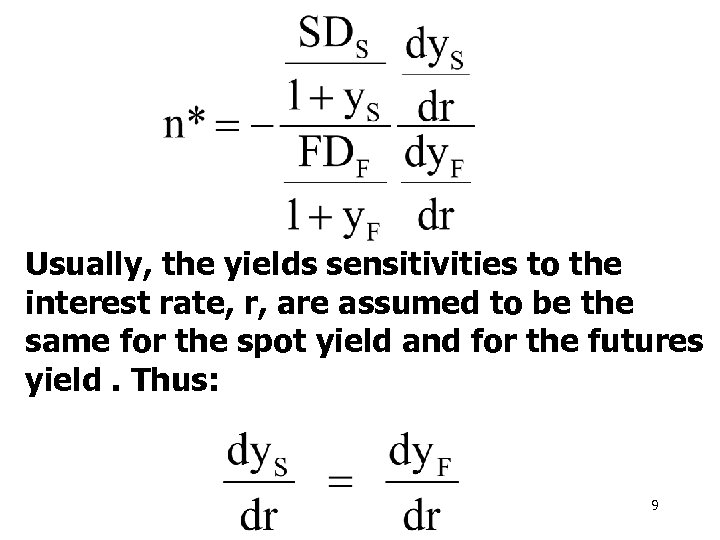

Usually, the yields sensitivities to the interest rate, r, are assumed to be the same for the spot yield and for the futures yield. Thus: 9

Usually, the yields sensitivities to the interest rate, r, are assumed to be the same for the spot yield and for the futures yield. Thus: 9

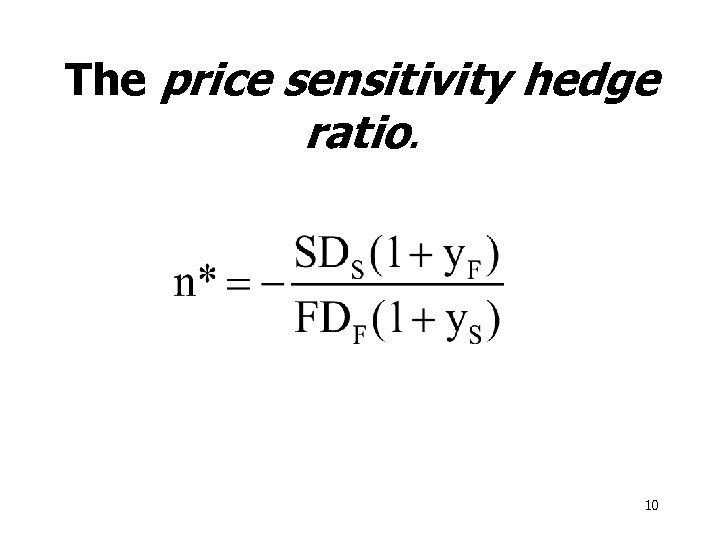

The price sensitivity hedge ratio. 10

The price sensitivity hedge ratio. 10

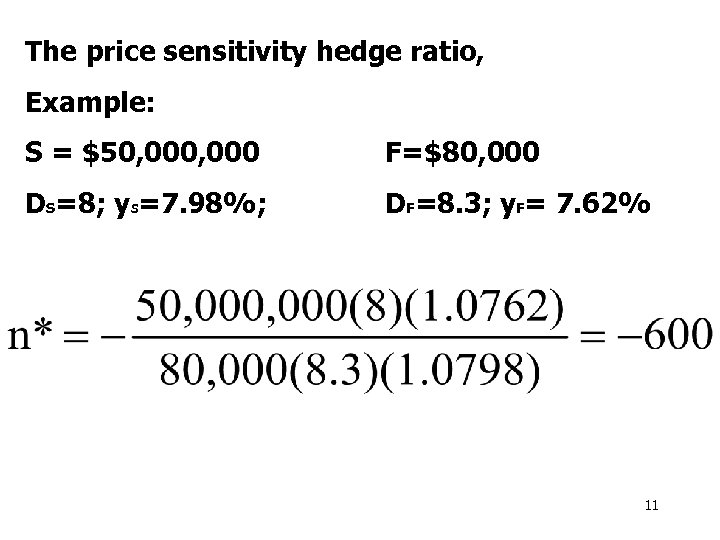

The price sensitivity hedge ratio, Example: S = $50, 000 F=$80, 000 DS=8; y. S=7. 98%; DF=8. 3; y. F= 7. 62% 11

The price sensitivity hedge ratio, Example: S = $50, 000 F=$80, 000 DS=8; y. S=7. 98%; DF=8. 3; y. F= 7. 62% 11

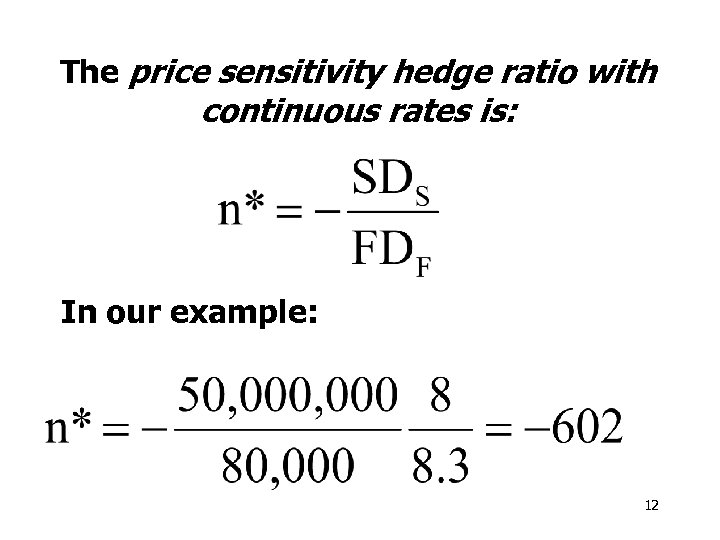

The price sensitivity hedge ratio with continuous rates is: In our example: 12

The price sensitivity hedge ratio with continuous rates is: In our example: 12

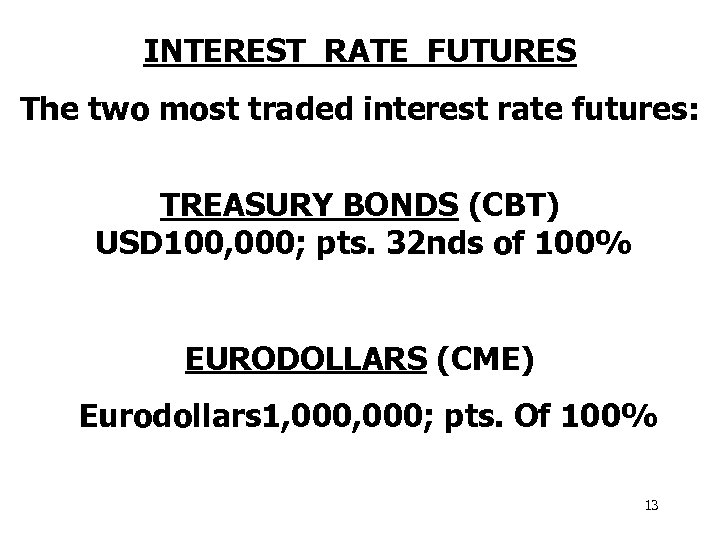

INTEREST RATE FUTURES The two most traded interest rate futures: TREASURY BONDS (CBT) USD 100, 000; pts. 32 nds of 100% EURODOLLARS (CME) Eurodollars 1, 000; pts. Of 100% 13

INTEREST RATE FUTURES The two most traded interest rate futures: TREASURY BONDS (CBT) USD 100, 000; pts. 32 nds of 100% EURODOLLARS (CME) Eurodollars 1, 000; pts. Of 100% 13

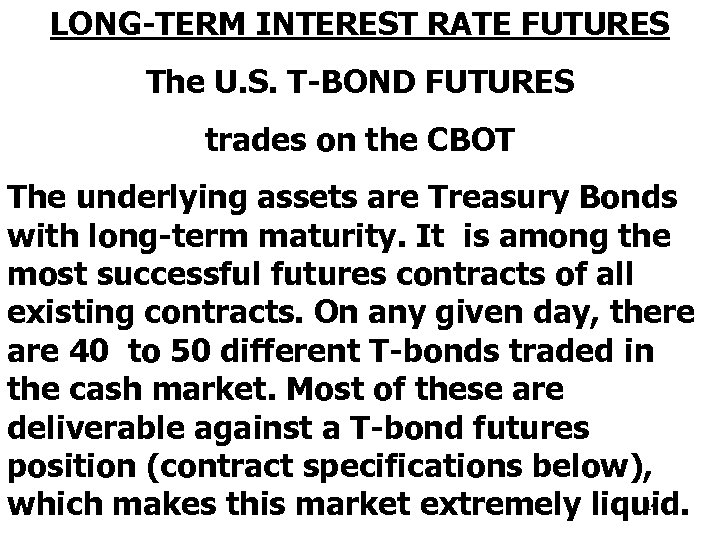

LONG-TERM INTEREST RATE FUTURES The U. S. T-BOND FUTURES trades on the CBOT The underlying assets are Treasury Bonds with long-term maturity. It is among the most successful futures contracts of all existing contracts. On any given day, there are 40 to 50 different T-bonds traded in the cash market. Most of these are deliverable against a T-bond futures position (contract specifications below), 14 which makes this market extremely liquid.

LONG-TERM INTEREST RATE FUTURES The U. S. T-BOND FUTURES trades on the CBOT The underlying assets are Treasury Bonds with long-term maturity. It is among the most successful futures contracts of all existing contracts. On any given day, there are 40 to 50 different T-bonds traded in the cash market. Most of these are deliverable against a T-bond futures position (contract specifications below), 14 which makes this market extremely liquid.

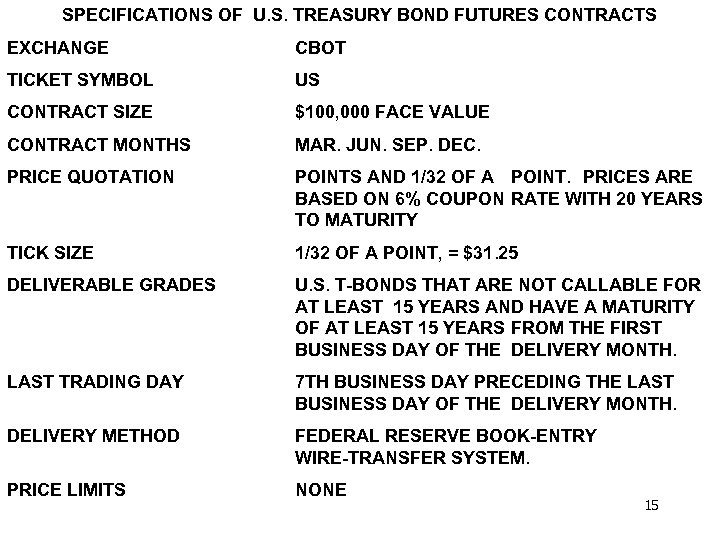

SPECIFICATIONS OF U. S. TREASURY BOND FUTURES CONTRACTS EXCHANGE CBOT TICKET SYMBOL US CONTRACT SIZE $100, 000 FACE VALUE CONTRACT MONTHS MAR. JUN. SEP. DEC. PRICE QUOTATION POINTS AND 1/32 OF A POINT. PRICES ARE BASED ON 6% COUPON RATE WITH 20 YEARS TO MATURITY TICK SIZE 1/32 OF A POINT, = $31. 25 DELIVERABLE GRADES U. S. T-BONDS THAT ARE NOT CALLABLE FOR AT LEAST 15 YEARS AND HAVE A MATURITY OF AT LEAST 15 YEARS FROM THE FIRST BUSINESS DAY OF THE DELIVERY MONTH. LAST TRADING DAY 7 TH BUSINESS DAY PRECEDING THE LAST BUSINESS DAY OF THE DELIVERY MONTH. DELIVERY METHOD FEDERAL RESERVE BOOK-ENTRY WIRE-TRANSFER SYSTEM. PRICE LIMITS NONE 15

SPECIFICATIONS OF U. S. TREASURY BOND FUTURES CONTRACTS EXCHANGE CBOT TICKET SYMBOL US CONTRACT SIZE $100, 000 FACE VALUE CONTRACT MONTHS MAR. JUN. SEP. DEC. PRICE QUOTATION POINTS AND 1/32 OF A POINT. PRICES ARE BASED ON 6% COUPON RATE WITH 20 YEARS TO MATURITY TICK SIZE 1/32 OF A POINT, = $31. 25 DELIVERABLE GRADES U. S. T-BONDS THAT ARE NOT CALLABLE FOR AT LEAST 15 YEARS AND HAVE A MATURITY OF AT LEAST 15 YEARS FROM THE FIRST BUSINESS DAY OF THE DELIVERY MONTH. LAST TRADING DAY 7 TH BUSINESS DAY PRECEDING THE LAST BUSINESS DAY OF THE DELIVERY MONTH. DELIVERY METHOD FEDERAL RESERVE BOOK-ENTRY WIRE-TRANSFER SYSTEM. PRICE LIMITS NONE 15

Delivery The SHORT position prerogatives: 1. On which day to deliver? 2. The timing option 16

Delivery The SHORT position prerogatives: 1. On which day to deliver? 2. The timing option 16

Delivery 2. Which T-bond to deliver? 3. The bond option Many deliverable T-bonds are available With (call) Maturity > 15 years The short will deliver the most profitable (deliverable) T-bond available. This bond is called: The Cheapest –To-Delivery bond. 17

Delivery 2. Which T-bond to deliver? 3. The bond option Many deliverable T-bonds are available With (call) Maturity > 15 years The short will deliver the most profitable (deliverable) T-bond available. This bond is called: The Cheapest –To-Delivery bond. 17

The Cheapest –To-Delivery bond SHORT: On date t: Opened a short position for Ft, T. On date T: Buys T-bond for its Cash Price and deliver it for an adjusted futures price. The original futures price, Ft, T was Calculated Based on CR = 6% and time to Maturity 20 yrs, without accrued Interest. 18

The Cheapest –To-Delivery bond SHORT: On date t: Opened a short position for Ft, T. On date T: Buys T-bond for its Cash Price and deliver it for an adjusted futures price. The original futures price, Ft, T was Calculated Based on CR = 6% and time to Maturity 20 yrs, without accrued Interest. 18

The Cheapest –To-Delivery bond The delivered T-bond CR is most likely different than 6% and its Maturity may be any number greater than 15. Finally, because of the Daily Marking-to Market process, the original Ft, T does not apply any more. Instead, the last Settlement price applies. 19

The Cheapest –To-Delivery bond The delivered T-bond CR is most likely different than 6% and its Maturity may be any number greater than 15. Finally, because of the Daily Marking-to Market process, the original Ft, T does not apply any more. Instead, the last Settlement price applies. 19

![The Cheapest –To-Delivery bond The SHORT’s payment is calculated as follows: [Last settlement price][Conversion The Cheapest –To-Delivery bond The SHORT’s payment is calculated as follows: [Last settlement price][Conversion](https://present5.com/presentation/9f0a761a09bcf23290dcdb38f3080c8e/image-20.jpg) The Cheapest –To-Delivery bond The SHORT’s payment is calculated as follows: [Last settlement price][Conversion Factor] + Accrued Interest. The SHORT’s cost of delivery is: The Quoted T-bond price + Accrued Interest. 20

The Cheapest –To-Delivery bond The SHORT’s payment is calculated as follows: [Last settlement price][Conversion Factor] + Accrued Interest. The SHORT’s cost of delivery is: The Quoted T-bond price + Accrued Interest. 20

![The Cheapest –To-Delivery bond The SHORT’s profit is: [Last settlement price][Conversion Factor] - [The The Cheapest –To-Delivery bond The SHORT’s profit is: [Last settlement price][Conversion Factor] - [The](https://present5.com/presentation/9f0a761a09bcf23290dcdb38f3080c8e/image-21.jpg) The Cheapest –To-Delivery bond The SHORT’s profit is: [Last settlement price][Conversion Factor] - [The Quoted T-bond price] 21

The Cheapest –To-Delivery bond The SHORT’s profit is: [Last settlement price][Conversion Factor] - [The Quoted T-bond price] 21

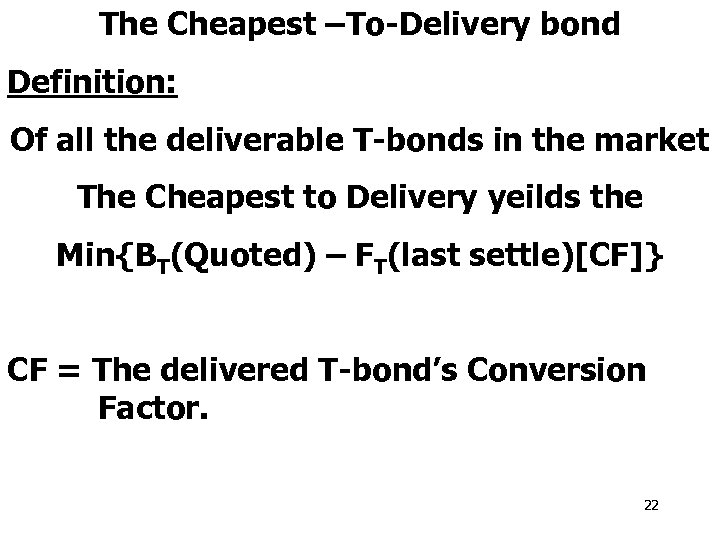

The Cheapest –To-Delivery bond Definition: Of all the deliverable T-bonds in the market The Cheapest to Delivery yeilds the Min{BT(Quoted) – FT(last settle)[CF]} CF = The delivered T-bond’s Conversion Factor. 22

The Cheapest –To-Delivery bond Definition: Of all the deliverable T-bonds in the market The Cheapest to Delivery yeilds the Min{BT(Quoted) – FT(last settle)[CF]} CF = The delivered T-bond’s Conversion Factor. 22

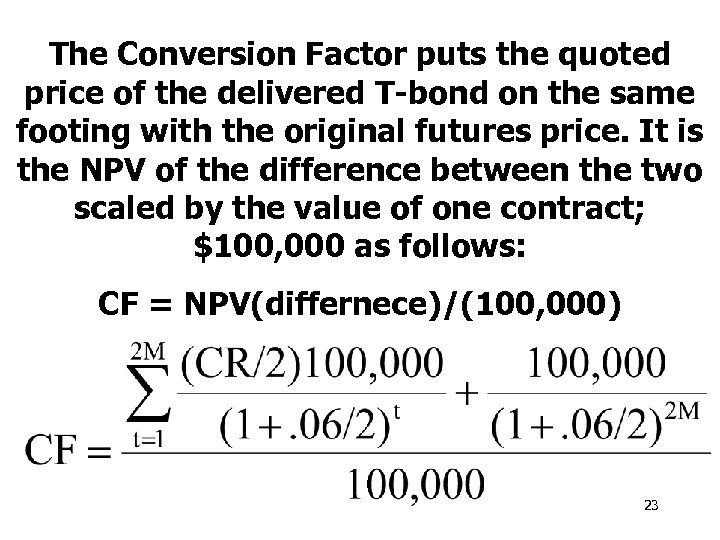

The Conversion Factor puts the quoted price of the delivered T-bond on the same footing with the original futures price. It is the NPV of the difference between the two scaled by the value of one contract; $100, 000 as follows: CF = NPV(differnece)/(100, 000) 23

The Conversion Factor puts the quoted price of the delivered T-bond on the same footing with the original futures price. It is the NPV of the difference between the two scaled by the value of one contract; $100, 000 as follows: CF = NPV(differnece)/(100, 000) 23

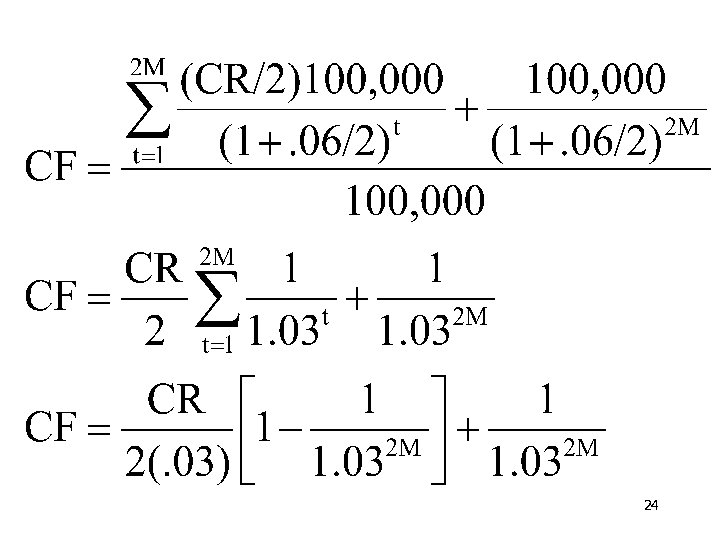

24

24

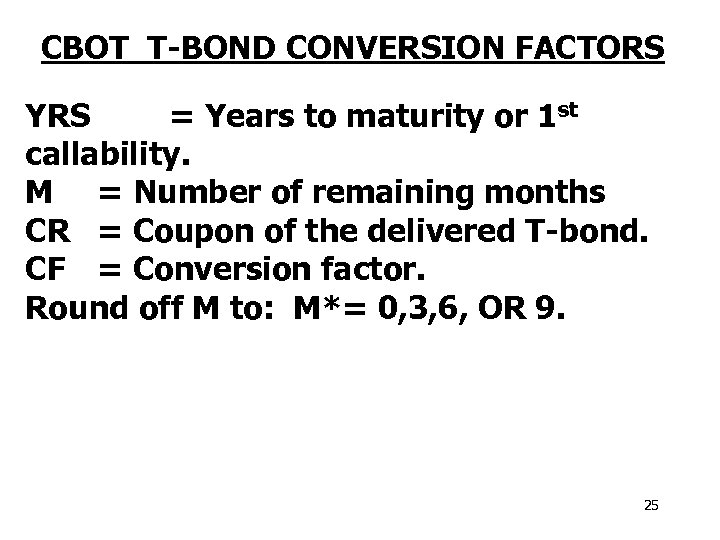

CBOT T-BOND CONVERSION FACTORS YRS = Years to maturity or 1 st callability. M = Number of remaining months CR = Coupon of the delivered T-bond. CF = Conversion factor. Round off M to: M*= 0, 3, 6, OR 9. 25

CBOT T-BOND CONVERSION FACTORS YRS = Years to maturity or 1 st callability. M = Number of remaining months CR = Coupon of the delivered T-bond. CF = Conversion factor. Round off M to: M*= 0, 3, 6, OR 9. 25

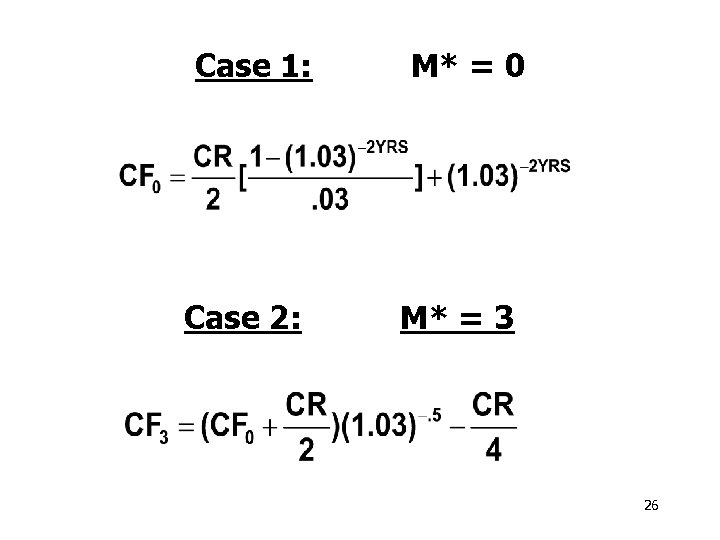

Case 1: Case 2: M* = 0 M* = 3 26

Case 1: Case 2: M* = 0 M* = 3 26

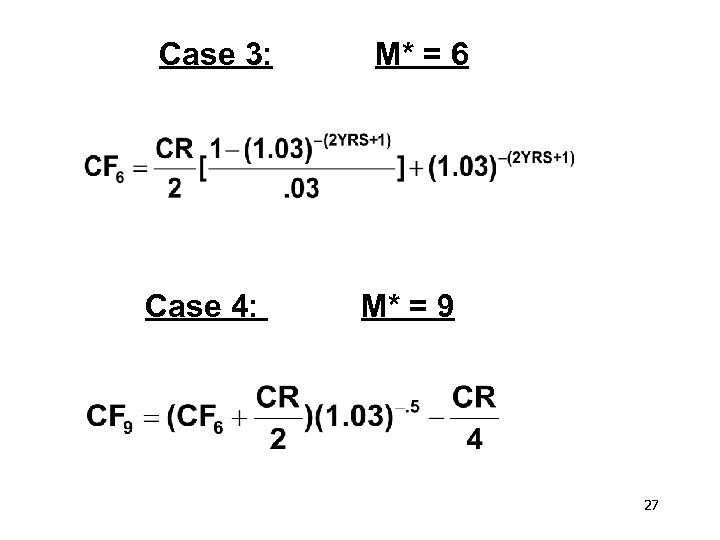

Case 3: Case 4: M* = 6 M* = 9 27

Case 3: Case 4: M* = 6 M* = 9 27

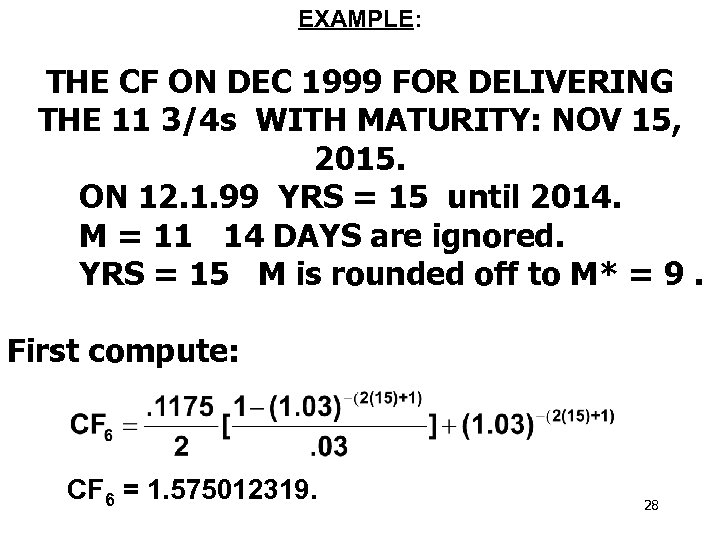

EXAMPLE: THE CF ON DEC 1999 FOR DELIVERING THE 11 3/4 s WITH MATURITY: NOV 15, 2015. ON 12. 1. 99 YRS = 15 until 2014. M = 11 14 DAYS are ignored. YRS = 15 M is rounded off to M* = 9. First compute: CF 6 = 1. 575012319. 28

EXAMPLE: THE CF ON DEC 1999 FOR DELIVERING THE 11 3/4 s WITH MATURITY: NOV 15, 2015. ON 12. 1. 99 YRS = 15 until 2014. M = 11 14 DAYS are ignored. YRS = 15 M is rounded off to M* = 9. First compute: CF 6 = 1. 575012319. 28

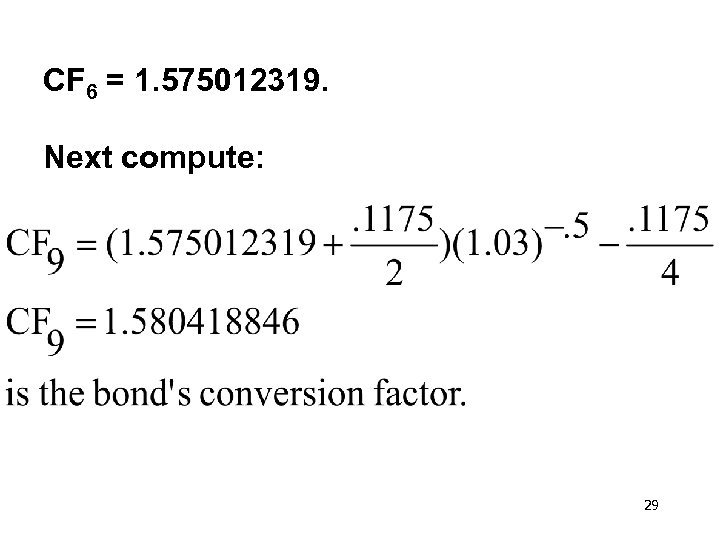

CF 6 = 1. 575012319. Next compute: 29

CF 6 = 1. 575012319. Next compute: 29

HEDGING WITH T-BOND FUTURES 30

HEDGING WITH T-BOND FUTURES 30

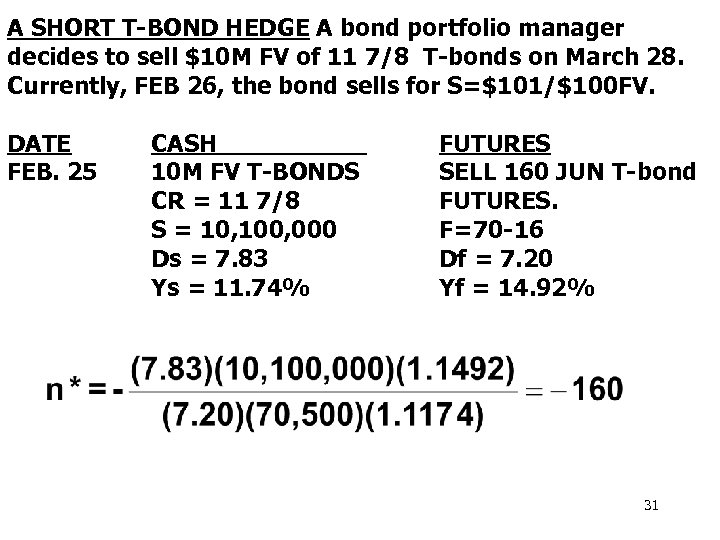

A SHORT T-BOND HEDGE A bond portfolio manager decides to sell $10 M FV of 11 7/8 T-bonds on March 28. Currently, FEB 26, the bond sells for S=$101/$100 FV. DATE FEB. 25 CASH 10 M FV T-BONDS CR = 11 7/8 S = 10, 100, 000 Ds = 7. 83 Ys = 11. 74% FUTURES SELL 160 JUN T-bond FUTURES. F=70 -16 Df = 7. 20 Yf = 14. 92% 31

A SHORT T-BOND HEDGE A bond portfolio manager decides to sell $10 M FV of 11 7/8 T-bonds on March 28. Currently, FEB 26, the bond sells for S=$101/$100 FV. DATE FEB. 25 CASH 10 M FV T-BONDS CR = 11 7/8 S = 10, 100, 000 Ds = 7. 83 Ys = 11. 74% FUTURES SELL 160 JUN T-bond FUTURES. F=70 -16 Df = 7. 20 Yf = 14. 92% 31

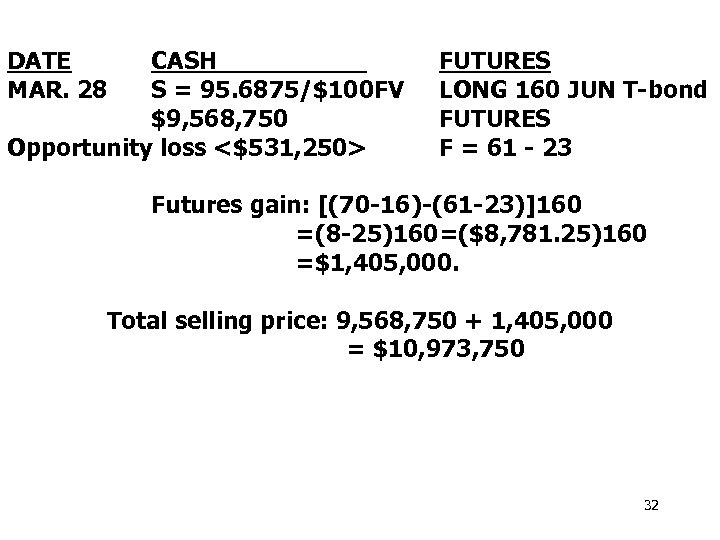

DATE MAR. 28 CASH S = 95. 6875/$100 FV $9, 568, 750 Opportunity loss <$531, 250> FUTURES LONG 160 JUN T-bond FUTURES F = 61 - 23 Futures gain: [(70 -16)-(61 -23)]160 =(8 -25)160=($8, 781. 25)160 =$1, 405, 000. Total selling price: 9, 568, 750 + 1, 405, 000 = $10, 973, 750 32

DATE MAR. 28 CASH S = 95. 6875/$100 FV $9, 568, 750 Opportunity loss <$531, 250> FUTURES LONG 160 JUN T-bond FUTURES F = 61 - 23 Futures gain: [(70 -16)-(61 -23)]160 =(8 -25)160=($8, 781. 25)160 =$1, 405, 000. Total selling price: 9, 568, 750 + 1, 405, 000 = $10, 973, 750 32

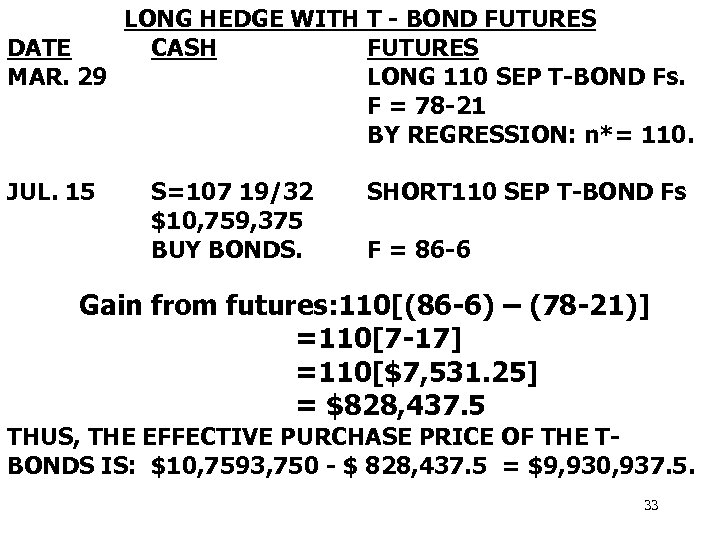

LONG HEDGE WITH T - BOND FUTURES DATE CASH FUTURES MAR. 29 LONG 110 SEP T-BOND Fs. F = 78 -21 BY REGRESSION: n*= 110. JUL. 15 S=107 19/32 $10, 759, 375 BUY BONDS. SHORT 110 SEP T-BOND Fs F = 86 -6 Gain from futures: 110[(86 -6) – (78 -21)] =110[7 -17] =110[$7, 531. 25] = $828, 437. 5 THUS, THE EFFECTIVE PURCHASE PRICE OF THE TBONDS IS: $10, 7593, 750 - $ 828, 437. 5 = $9, 930, 937. 5. 33

LONG HEDGE WITH T - BOND FUTURES DATE CASH FUTURES MAR. 29 LONG 110 SEP T-BOND Fs. F = 78 -21 BY REGRESSION: n*= 110. JUL. 15 S=107 19/32 $10, 759, 375 BUY BONDS. SHORT 110 SEP T-BOND Fs F = 86 -6 Gain from futures: 110[(86 -6) – (78 -21)] =110[7 -17] =110[$7, 531. 25] = $828, 437. 5 THUS, THE EFFECTIVE PURCHASE PRICE OF THE TBONDS IS: $10, 7593, 750 - $ 828, 437. 5 = $9, 930, 937. 5. 33

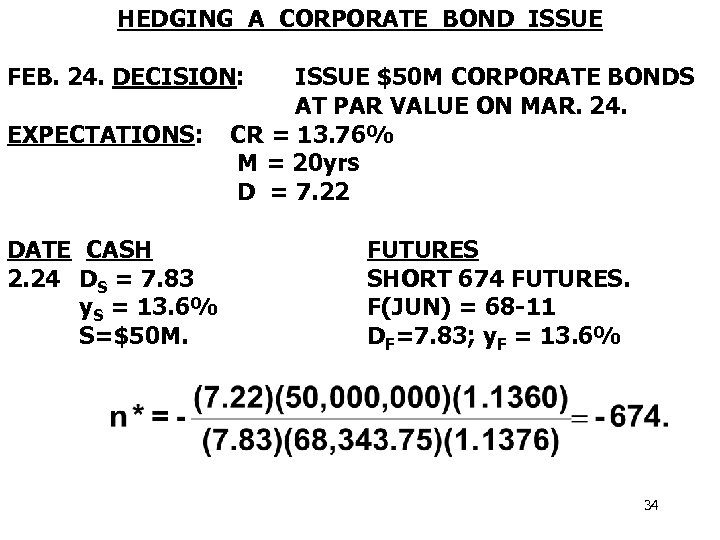

HEDGING A CORPORATE BOND ISSUE FEB. 24. DECISION: EXPECTATIONS: DATE CASH 2. 24 DS = 7. 83 y. S = 13. 6% S=$50 M. ISSUE $50 M CORPORATE BONDS AT PAR VALUE ON MAR. 24. CR = 13. 76% M = 20 yrs D = 7. 22 FUTURES SHORT 674 FUTURES. F(JUN) = 68 -11 DF=7. 83; y. F = 13. 6% 34

HEDGING A CORPORATE BOND ISSUE FEB. 24. DECISION: EXPECTATIONS: DATE CASH 2. 24 DS = 7. 83 y. S = 13. 6% S=$50 M. ISSUE $50 M CORPORATE BONDS AT PAR VALUE ON MAR. 24. CR = 13. 76% M = 20 yrs D = 7. 22 FUTURES SHORT 674 FUTURES. F(JUN) = 68 -11 DF=7. 83; y. F = 13. 6% 34

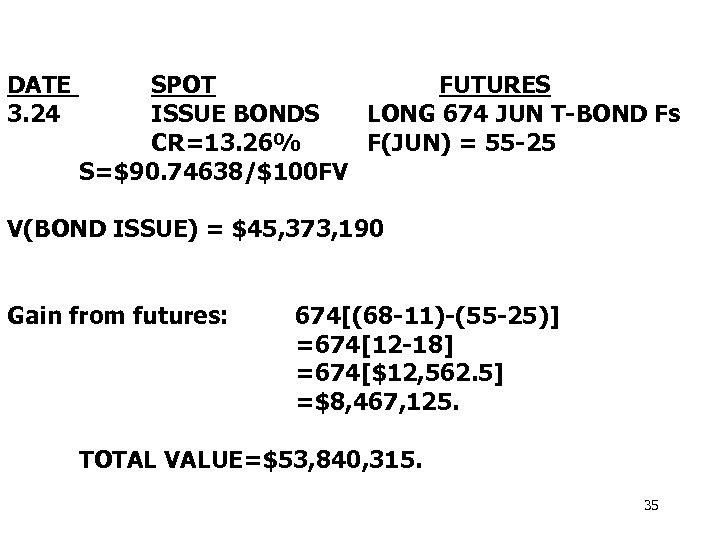

DATE 3. 24 SPOT FUTURES ISSUE BONDS LONG 674 JUN T-BOND Fs CR=13. 26% F(JUN) = 55 -25 S=$90. 74638/$100 FV V(BOND ISSUE) = $45, 373, 190 Gain from futures: 674[(68 -11)-(55 -25)] =674[12 -18] =674[$12, 562. 5] =$8, 467, 125. TOTAL VALUE=$53, 840, 315. 35

DATE 3. 24 SPOT FUTURES ISSUE BONDS LONG 674 JUN T-BOND Fs CR=13. 26% F(JUN) = 55 -25 S=$90. 74638/$100 FV V(BOND ISSUE) = $45, 373, 190 Gain from futures: 674[(68 -11)-(55 -25)] =674[12 -18] =674[$12, 562. 5] =$8, 467, 125. TOTAL VALUE=$53, 840, 315. 35

SHORT-TERM INTEREST RATE FUTURES EURODOLLAR FUTURES The U. S. T-BILLS FUTURES The underlying assets For the Eurodollars futures are 3 -months Eurodollars time deposit. It is the most successful futures contracts of all existing contracts. Clearly, the underlying asset for the U. S. Gov. T-bills are T-bills. 36

SHORT-TERM INTEREST RATE FUTURES EURODOLLAR FUTURES The U. S. T-BILLS FUTURES The underlying assets For the Eurodollars futures are 3 -months Eurodollars time deposit. It is the most successful futures contracts of all existing contracts. Clearly, the underlying asset for the U. S. Gov. T-bills are T-bills. 36

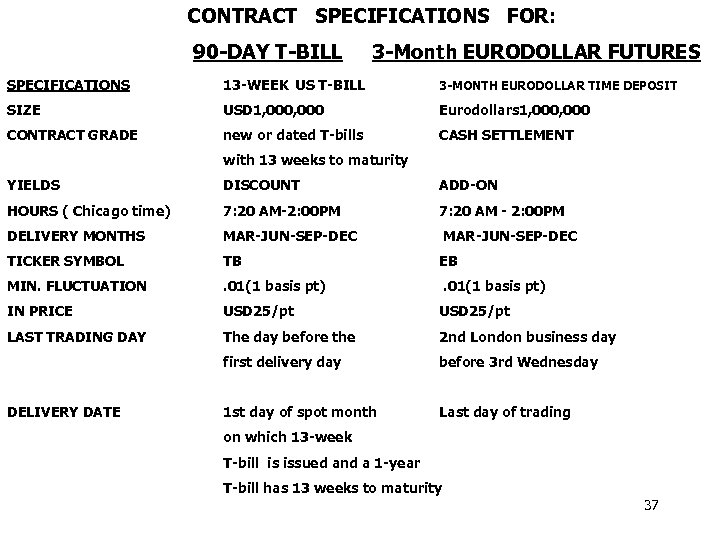

CONTRACT SPECIFICATIONS FOR: 90 -DAY T-BILL 3 -Month EURODOLLAR FUTURES SPECIFICATIONS 13 -WEEK US T-BILL 3 -MONTH EURODOLLAR TIME DEPOSIT SIZE USD 1, 000 Eurodollars 1, 000 CONTRACT GRADE new or dated T-bills CASH SETTLEMENT with 13 weeks to maturity YIELDS DISCOUNT ADD-ON HOURS ( Chicago time) 7: 20 AM-2: 00 PM 7: 20 AM - 2: 00 PM DELIVERY MONTHS MAR-JUN-SEP-DEC TICKER SYMBOL TB EB MIN. FLUCTUATION . 01(1 basis pt) IN PRICE USD 25/pt LAST TRADING DAY The day before the 2 nd London business day first delivery day before 3 rd Wednesday 1 st day of spot month Last day of trading DELIVERY DATE on which 13 -week T-bill is issued and a 1 -year T-bill has 13 weeks to maturity 37

CONTRACT SPECIFICATIONS FOR: 90 -DAY T-BILL 3 -Month EURODOLLAR FUTURES SPECIFICATIONS 13 -WEEK US T-BILL 3 -MONTH EURODOLLAR TIME DEPOSIT SIZE USD 1, 000 Eurodollars 1, 000 CONTRACT GRADE new or dated T-bills CASH SETTLEMENT with 13 weeks to maturity YIELDS DISCOUNT ADD-ON HOURS ( Chicago time) 7: 20 AM-2: 00 PM 7: 20 AM - 2: 00 PM DELIVERY MONTHS MAR-JUN-SEP-DEC TICKER SYMBOL TB EB MIN. FLUCTUATION . 01(1 basis pt) IN PRICE USD 25/pt LAST TRADING DAY The day before the 2 nd London business day first delivery day before 3 rd Wednesday 1 st day of spot month Last day of trading DELIVERY DATE on which 13 -week T-bill is issued and a 1 -year T-bill has 13 weeks to maturity 37

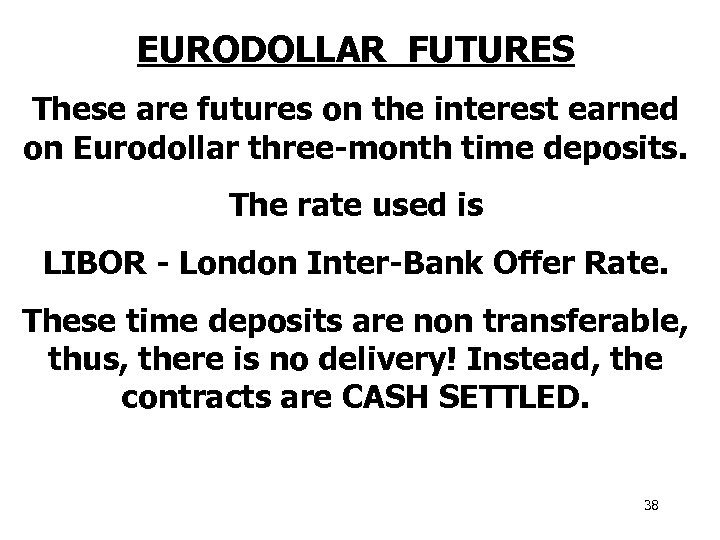

EURODOLLAR FUTURES These are futures on the interest earned on Eurodollar three-month time deposits. The rate used is LIBOR - London Inter-Bank Offer Rate. These time deposits are non transferable, thus, there is no delivery! Instead, the contracts are CASH SETTLED. 38

EURODOLLAR FUTURES These are futures on the interest earned on Eurodollar three-month time deposits. The rate used is LIBOR - London Inter-Bank Offer Rate. These time deposits are non transferable, thus, there is no delivery! Instead, the contracts are CASH SETTLED. 38

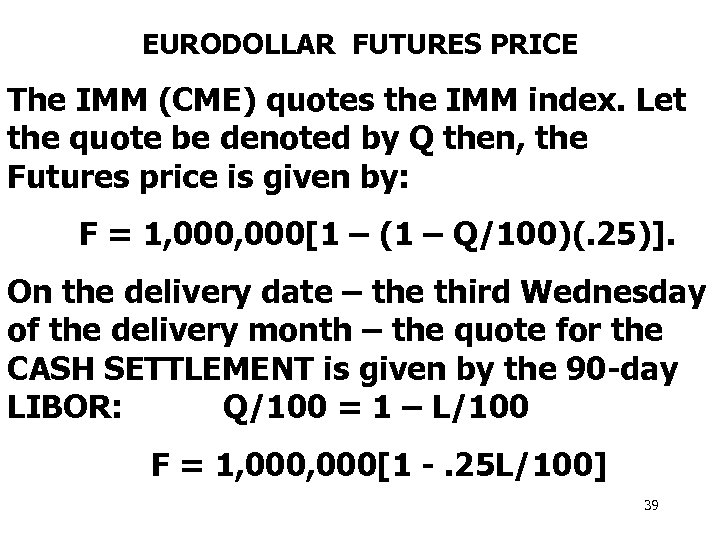

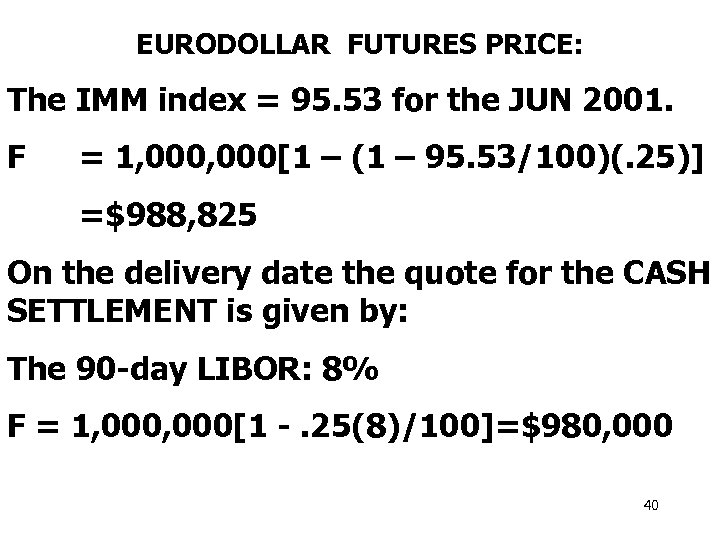

EURODOLLAR FUTURES PRICE The IMM (CME) quotes the IMM index. Let the quote be denoted by Q then, the Futures price is given by: F = 1, 000[1 – (1 – Q/100)(. 25)]. On the delivery date – the third Wednesday of the delivery month – the quote for the CASH SETTLEMENT is given by the 90 -day LIBOR: Q/100 = 1 – L/100 F = 1, 000[1 -. 25 L/100] 39

EURODOLLAR FUTURES PRICE The IMM (CME) quotes the IMM index. Let the quote be denoted by Q then, the Futures price is given by: F = 1, 000[1 – (1 – Q/100)(. 25)]. On the delivery date – the third Wednesday of the delivery month – the quote for the CASH SETTLEMENT is given by the 90 -day LIBOR: Q/100 = 1 – L/100 F = 1, 000[1 -. 25 L/100] 39

EURODOLLAR FUTURES PRICE: The IMM index = 95. 53 for the JUN 2001. F = 1, 000[1 – (1 – 95. 53/100)(. 25)] =$988, 825 On the delivery date the quote for the CASH SETTLEMENT is given by: The 90 -day LIBOR: 8% F = 1, 000[1 -. 25(8)/100]=$980, 000 40

EURODOLLAR FUTURES PRICE: The IMM index = 95. 53 for the JUN 2001. F = 1, 000[1 – (1 – 95. 53/100)(. 25)] =$988, 825 On the delivery date the quote for the CASH SETTLEMENT is given by: The 90 -day LIBOR: 8% F = 1, 000[1 -. 25(8)/100]=$980, 000 40

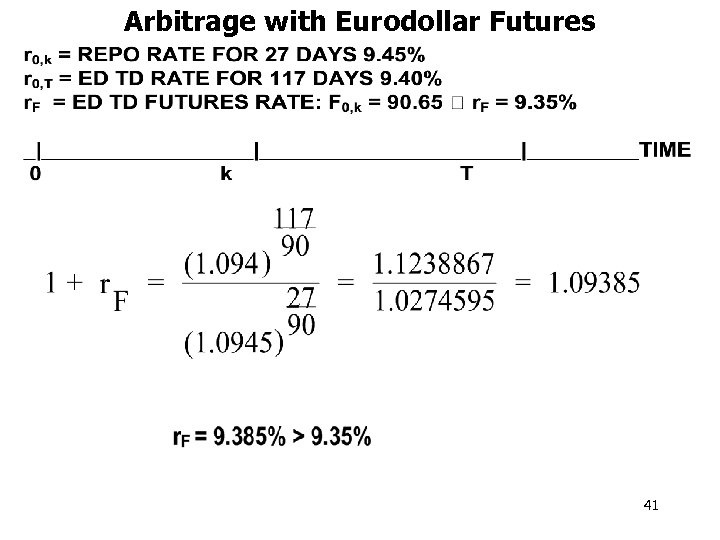

Arbitrage with Eurodollar Futures 41

Arbitrage with Eurodollar Futures 41

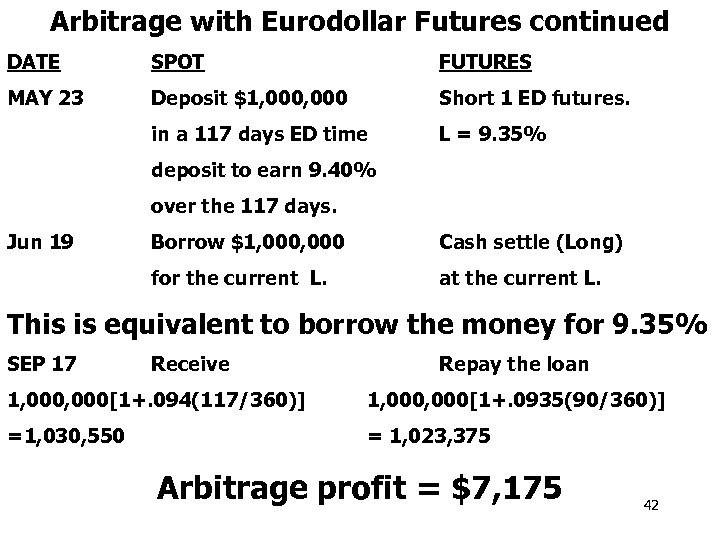

Arbitrage with Eurodollar Futures continued DATE SPOT FUTURES MAY 23 Deposit $1, 000 Short 1 ED futures. in a 117 days ED time L = 9. 35% deposit to earn 9. 40% over the 117 days. Jun 19 Borrow $1, 000 Cash settle (Long) for the current L. at the current L. This is equivalent to borrow the money for 9. 35% SEP 17 Receive Repay the loan 1, 000[1+. 094(117/360)] 1, 000[1+. 0935(90/360)] =1, 030, 550 = 1, 023, 375 Arbitrage profit = $7, 175 42

Arbitrage with Eurodollar Futures continued DATE SPOT FUTURES MAY 23 Deposit $1, 000 Short 1 ED futures. in a 117 days ED time L = 9. 35% deposit to earn 9. 40% over the 117 days. Jun 19 Borrow $1, 000 Cash settle (Long) for the current L. at the current L. This is equivalent to borrow the money for 9. 35% SEP 17 Receive Repay the loan 1, 000[1+. 094(117/360)] 1, 000[1+. 0935(90/360)] =1, 030, 550 = 1, 023, 375 Arbitrage profit = $7, 175 42

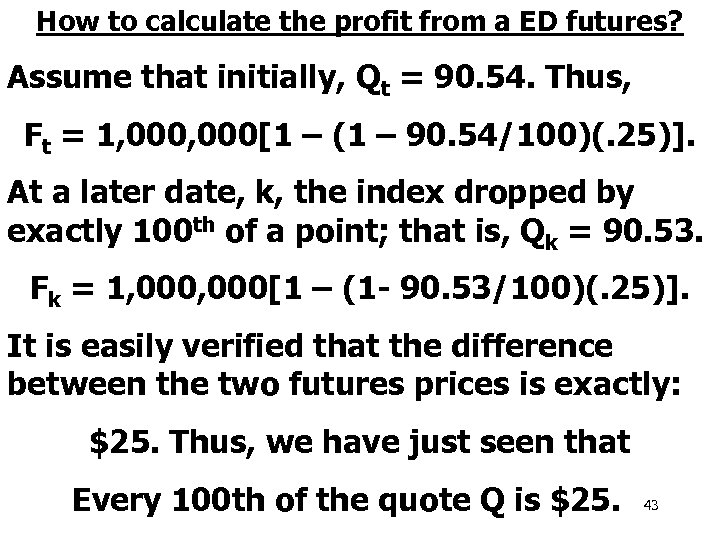

How to calculate the profit from a ED futures? Assume that initially, Qt = 90. 54. Thus, Ft = 1, 000[1 – (1 – 90. 54/100)(. 25)]. At a later date, k, the index dropped by exactly 100 th of a point; that is, Qk = 90. 53. Fk = 1, 000[1 – (1 - 90. 53/100)(. 25)]. It is easily verified that the difference between the two futures prices is exactly: $25. Thus, we have just seen that Every 100 th of the quote Q is $25. 43

How to calculate the profit from a ED futures? Assume that initially, Qt = 90. 54. Thus, Ft = 1, 000[1 – (1 – 90. 54/100)(. 25)]. At a later date, k, the index dropped by exactly 100 th of a point; that is, Qk = 90. 53. Fk = 1, 000[1 – (1 - 90. 53/100)(. 25)]. It is easily verified that the difference between the two futures prices is exactly: $25. Thus, we have just seen that Every 100 th of the quote Q is $25. 43

Hedging with Eurodollars futures. Eurodollar futures became the most successful contract in the world. Its enormous success is attributed to its ability to fill in the need for hedging that still remained open even with a successful market for T-bond and T-bill futures. The main attribute of the 90 -day Eurodollars futures is that, unlike the T-bills futures, it is risky. This risk makes it a better hedging tool than the risk-free T-bill futures. 44

Hedging with Eurodollars futures. Eurodollar futures became the most successful contract in the world. Its enormous success is attributed to its ability to fill in the need for hedging that still remained open even with a successful market for T-bond and T-bill futures. The main attribute of the 90 -day Eurodollars futures is that, unlike the T-bills futures, it is risky. This risk makes it a better hedging tool than the risk-free T-bill futures. 44

The examples below demonstrate how to hedge with ED futures using a STRIP, or a STACK. In most of the loans involved in these hedging strategies, the interest today determines the payment by the end of the period. Only interest payments are paid during the loan term and the last payment include the interest and the principal payment. 45

The examples below demonstrate how to hedge with ED futures using a STRIP, or a STACK. In most of the loans involved in these hedging strategies, the interest today determines the payment by the end of the period. Only interest payments are paid during the loan term and the last payment include the interest and the principal payment. 45

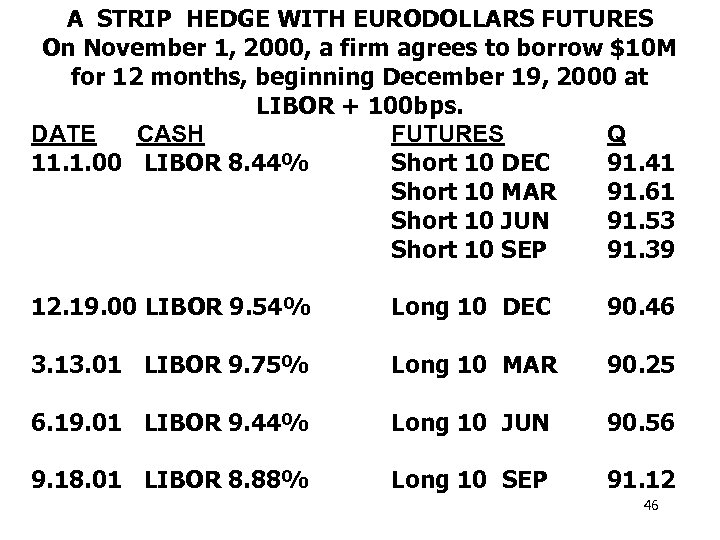

A STRIP HEDGE WITH EURODOLLARS FUTURES On November 1, 2000, a firm agrees to borrow $10 M for 12 months, beginning December 19, 2000 at LIBOR + 100 bps. DATE CASH FUTURES Q 11. 1. 00 LIBOR 8. 44% Short 10 DEC 91. 41 Short 10 MAR 91. 61 Short 10 JUN 91. 53 Short 10 SEP 91. 39 12. 19. 00 LIBOR 9. 54% Long 10 DEC 90. 46 3. 13. 01 LIBOR 9. 75% Long 10 MAR 90. 25 6. 19. 01 LIBOR 9. 44% Long 10 JUN 90. 56 9. 18. 01 LIBOR 8. 88% Long 10 SEP 91. 12 46

A STRIP HEDGE WITH EURODOLLARS FUTURES On November 1, 2000, a firm agrees to borrow $10 M for 12 months, beginning December 19, 2000 at LIBOR + 100 bps. DATE CASH FUTURES Q 11. 1. 00 LIBOR 8. 44% Short 10 DEC 91. 41 Short 10 MAR 91. 61 Short 10 JUN 91. 53 Short 10 SEP 91. 39 12. 19. 00 LIBOR 9. 54% Long 10 DEC 90. 46 3. 13. 01 LIBOR 9. 75% Long 10 MAR 90. 25 6. 19. 01 LIBOR 9. 44% Long 10 JUN 90. 56 9. 18. 01 LIBOR 8. 88% Long 10 SEP 91. 12 46

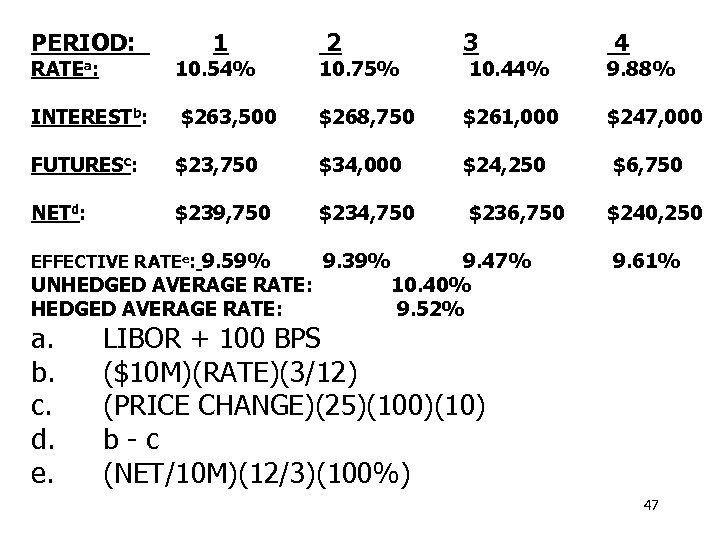

PERIOD: 1 2 RATEa: 10. 54% 10. 75% INTERESTb: $263, 500 FUTURESc: NETd: 3 10. 44% 9. 88% $268, 750 $261, 000 $247, 000 $23, 750 $34, 000 $24, 250 $6, 750 $239, 750 $234, 750 $236, 750 $240, 250 EFFECTIVE RATEe: 9. 59% 9. 39% 9. 47% UNHEDGED AVERAGE RATE: 10. 40% HEDGED AVERAGE RATE: 9. 52% a. b. c. d. e. 4 9. 61% LIBOR + 100 BPS ($10 M)(RATE)(3/12) (PRICE CHANGE)(25)(100)(10) b-c (NET/10 M)(12/3)(100%) 47

PERIOD: 1 2 RATEa: 10. 54% 10. 75% INTERESTb: $263, 500 FUTURESc: NETd: 3 10. 44% 9. 88% $268, 750 $261, 000 $247, 000 $23, 750 $34, 000 $24, 250 $6, 750 $239, 750 $234, 750 $236, 750 $240, 250 EFFECTIVE RATEe: 9. 59% 9. 39% 9. 47% UNHEDGED AVERAGE RATE: 10. 40% HEDGED AVERAGE RATE: 9. 52% a. b. c. d. e. 4 9. 61% LIBOR + 100 BPS ($10 M)(RATE)(3/12) (PRICE CHANGE)(25)(100)(10) b-c (NET/10 M)(12/3)(100%) 47

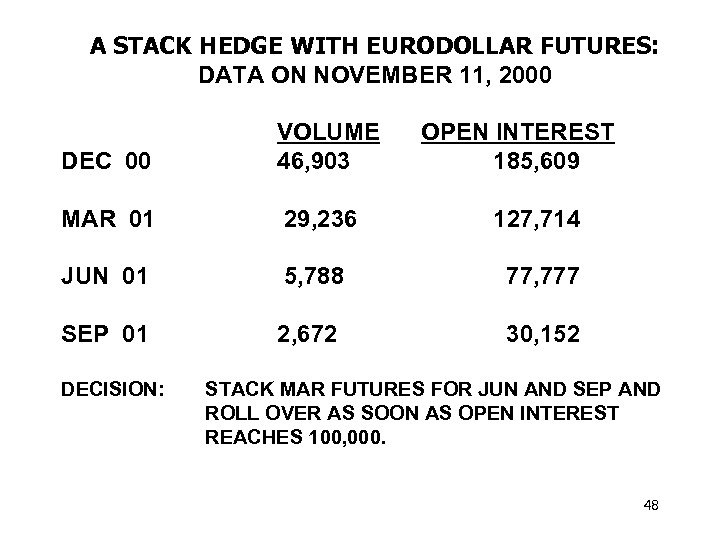

A STACK HEDGE WITH EURODOLLAR FUTURES: DATA ON NOVEMBER 11, 2000 DEC 00 VOLUME 46, 903 MAR 01 29, 236 127, 714 JUN 01 5, 788 77, 777 SEP 01 2, 672 30, 152 DECISION: OPEN INTEREST 185, 609 STACK MAR FUTURES FOR JUN AND SEP AND ROLL OVER AS SOON AS OPEN INTEREST REACHES 100, 000. 48

A STACK HEDGE WITH EURODOLLAR FUTURES: DATA ON NOVEMBER 11, 2000 DEC 00 VOLUME 46, 903 MAR 01 29, 236 127, 714 JUN 01 5, 788 77, 777 SEP 01 2, 672 30, 152 DECISION: OPEN INTEREST 185, 609 STACK MAR FUTURES FOR JUN AND SEP AND ROLL OVER AS SOON AS OPEN INTEREST REACHES 100, 000. 48

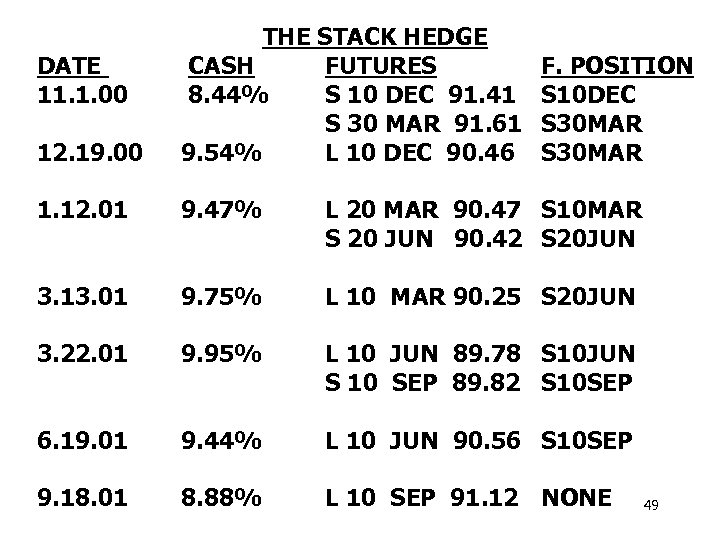

12. 19. 00 THE STACK HEDGE CASH FUTURES 8. 44% S 10 DEC 91. 41 S 30 MAR 91. 61 9. 54% L 10 DEC 90. 46 1. 12. 01 9. 47% L 20 MAR 90. 47 S 10 MAR S 20 JUN 90. 42 S 20 JUN 3. 13. 01 9. 75% L 10 MAR 90. 25 S 20 JUN 3. 22. 01 9. 95% L 10 JUN 89. 78 S 10 JUN S 10 SEP 89. 82 S 10 SEP 6. 19. 01 9. 44% L 10 JUN 90. 56 S 10 SEP 9. 18. 01 8. 88% L 10 SEP 91. 12 NONE DATE 11. 1. 00 F. POSITION S 10 DEC S 30 MAR 49

12. 19. 00 THE STACK HEDGE CASH FUTURES 8. 44% S 10 DEC 91. 41 S 30 MAR 91. 61 9. 54% L 10 DEC 90. 46 1. 12. 01 9. 47% L 20 MAR 90. 47 S 10 MAR S 20 JUN 90. 42 S 20 JUN 3. 13. 01 9. 75% L 10 MAR 90. 25 S 20 JUN 3. 22. 01 9. 95% L 10 JUN 89. 78 S 10 JUN S 10 SEP 89. 82 S 10 SEP 6. 19. 01 9. 44% L 10 JUN 90. 56 S 10 SEP 9. 18. 01 8. 88% L 10 SEP 91. 12 NONE DATE 11. 1. 00 F. POSITION S 10 DEC S 30 MAR 49

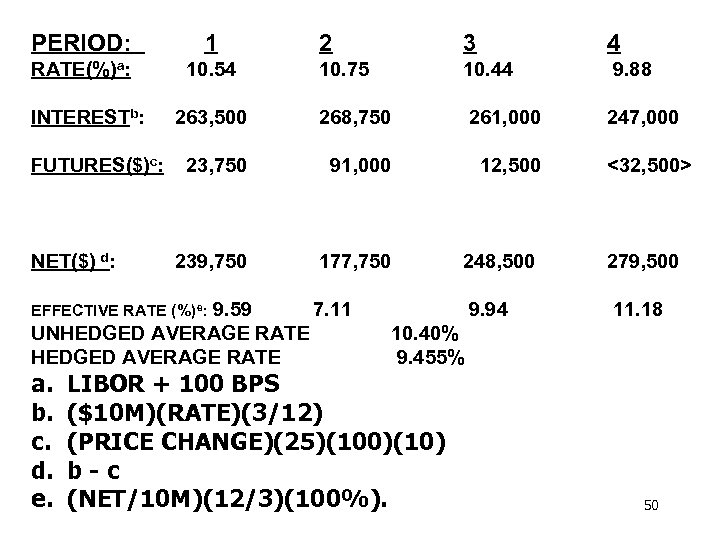

PERIOD: 1 RATE(%)a: 10. 54 INTERESTb: FUTURES($)c: NET($) d: 2 3 4 10. 75 10. 44 9. 88 263, 500 268, 750 261, 000 247, 000 23, 750 91, 000 12, 500 239, 750 177, 750 248, 500 279, 500 9. 94 11. 18 9. 59 7. 11 UNHEDGED AVERAGE RATE EFFECTIVE RATE (%)e: a. b. c. d. e. <32, 500> 10. 40% 9. 455% LIBOR + 100 BPS ($10 M)(RATE)(3/12) (PRICE CHANGE)(25)(100)(10) b-c (NET/10 M)(12/3)(100%). 50

PERIOD: 1 RATE(%)a: 10. 54 INTERESTb: FUTURES($)c: NET($) d: 2 3 4 10. 75 10. 44 9. 88 263, 500 268, 750 261, 000 247, 000 23, 750 91, 000 12, 500 239, 750 177, 750 248, 500 279, 500 9. 94 11. 18 9. 59 7. 11 UNHEDGED AVERAGE RATE EFFECTIVE RATE (%)e: a. b. c. d. e. <32, 500> 10. 40% 9. 455% LIBOR + 100 BPS ($10 M)(RATE)(3/12) (PRICE CHANGE)(25)(100)(10) b-c (NET/10 M)(12/3)(100%). 50