4e0ec96e1aae880182b085649f68e98f.ppt

- Количество слайдов: 14

Intensive Savings Delivery Programmes 1 © supply chainge management ltd. 2008

Intensive Savings Delivery Programmes 1 © supply chainge management ltd. 2008

Intensive Savings Programmes (as an interim manager) § Petro-chemicals § Pan-European Post Acquisition Purchasing Synergies § NOVA acquired four large chemical plants from Shell - giving £ 500 m turnover § Replaced Mc. Kinsey’s role in previous acquisitions § Led first pan-European supplier conference & intensive negotiation programme § 1 year assignment § Delivered synergy target in 12 weeks. § Exceeded annual savings target too § Substantially exceeded client’s expectations § Awarded 2 “applause!” awards & offered the permanent role § Polymer compounding industry § Client wanted a review of a selection of spend categories § Identified global suppliers using supplier industry research tools incl. India § Launched global RFQs and engaged with suppliers § Re-negotiated categories based upon global quotations § Delivered annual savings target 7% (> £ 400 k) in 8 weeks (brand new industry entirely unsupported) § Substantially exceeded client’s expectations § Contract extended § Invited to examine supply chain improvement opportunities. 2 © supply chainge management ltd. 2008

Intensive Savings Programmes (as an interim manager) § Petro-chemicals § Pan-European Post Acquisition Purchasing Synergies § NOVA acquired four large chemical plants from Shell - giving £ 500 m turnover § Replaced Mc. Kinsey’s role in previous acquisitions § Led first pan-European supplier conference & intensive negotiation programme § 1 year assignment § Delivered synergy target in 12 weeks. § Exceeded annual savings target too § Substantially exceeded client’s expectations § Awarded 2 “applause!” awards & offered the permanent role § Polymer compounding industry § Client wanted a review of a selection of spend categories § Identified global suppliers using supplier industry research tools incl. India § Launched global RFQs and engaged with suppliers § Re-negotiated categories based upon global quotations § Delivered annual savings target 7% (> £ 400 k) in 8 weeks (brand new industry entirely unsupported) § Substantially exceeded client’s expectations § Contract extended § Invited to examine supply chain improvement opportunities. 2 © supply chainge management ltd. 2008

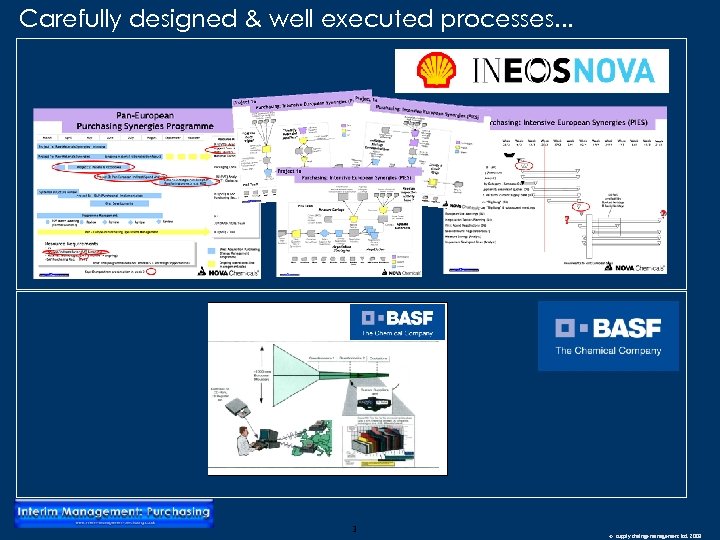

Carefully designed & well executed processes. . . 3 © supply chainge management ltd. 2008

Carefully designed & well executed processes. . . 3 © supply chainge management ltd. 2008

Prioritising Negotiation Programmes Focus by Supplier Hi Hi Strategic Bottleneck / Collaborative Start Here Proportion of Project Spend Supply Market Risk / Challenge ow ow Routine / Transactional Leverage / Opportunist Start Here Lo Lo Chance of Success Lo Hi Lo Value / Expenditure Hi Kraljic Output: Added focus on highest priority suppliers e. g. some suppliers may supply several lower value systems not picked up in key sub-systems Also need to understand risk (quality, lead time/liquidated damages etc. ) Opportunities for e-auction ? 4 © supply chainge management ltd. 2008

Prioritising Negotiation Programmes Focus by Supplier Hi Hi Strategic Bottleneck / Collaborative Start Here Proportion of Project Spend Supply Market Risk / Challenge ow ow Routine / Transactional Leverage / Opportunist Start Here Lo Lo Chance of Success Lo Hi Lo Value / Expenditure Hi Kraljic Output: Added focus on highest priority suppliers e. g. some suppliers may supply several lower value systems not picked up in key sub-systems Also need to understand risk (quality, lead time/liquidated damages etc. ) Opportunities for e-auction ? 4 © supply chainge management ltd. 2008

Prioritising Negotiation Programmes Hi Low Spend Low Levels of Competition Supply Market Risk / Challenge Bottleneck / Collaborative High Spend Strategic Risk of Not Achieving Savings Monopolistic suppliers Easier for the supplier to say “No” Risk of Not Achieving Savings Easier for the supplier to say “No” PROJECT APPROACH Prepare a “bespoke” approach that acknowledges the complications of the relationship. E. g. Threaten giving development projects to new emerging suppliers. Consider working on the lower risk suppliers in this segment first. PROJECT APPROACH Ignore (Should be few suppliers here (e. g. BA < 10) ow Routine / Transactional Leverage / Opportunist Low Spend Good Chance of Achieving Savings High Levels of Competition Lo High Spend Good Chance of Achieving Savings PROJECT APPROACH Move into here once finished in Leverage PROJECT APPROACH Start here and move progressively left Lo Value / Expenditure Impact on end product / service attractiveness 5 Hi © supply chainge management ltd. 2008

Prioritising Negotiation Programmes Hi Low Spend Low Levels of Competition Supply Market Risk / Challenge Bottleneck / Collaborative High Spend Strategic Risk of Not Achieving Savings Monopolistic suppliers Easier for the supplier to say “No” Risk of Not Achieving Savings Easier for the supplier to say “No” PROJECT APPROACH Prepare a “bespoke” approach that acknowledges the complications of the relationship. E. g. Threaten giving development projects to new emerging suppliers. Consider working on the lower risk suppliers in this segment first. PROJECT APPROACH Ignore (Should be few suppliers here (e. g. BA < 10) ow Routine / Transactional Leverage / Opportunist Low Spend Good Chance of Achieving Savings High Levels of Competition Lo High Spend Good Chance of Achieving Savings PROJECT APPROACH Move into here once finished in Leverage PROJECT APPROACH Start here and move progressively left Lo Value / Expenditure Impact on end product / service attractiveness 5 Hi © supply chainge management ltd. 2008

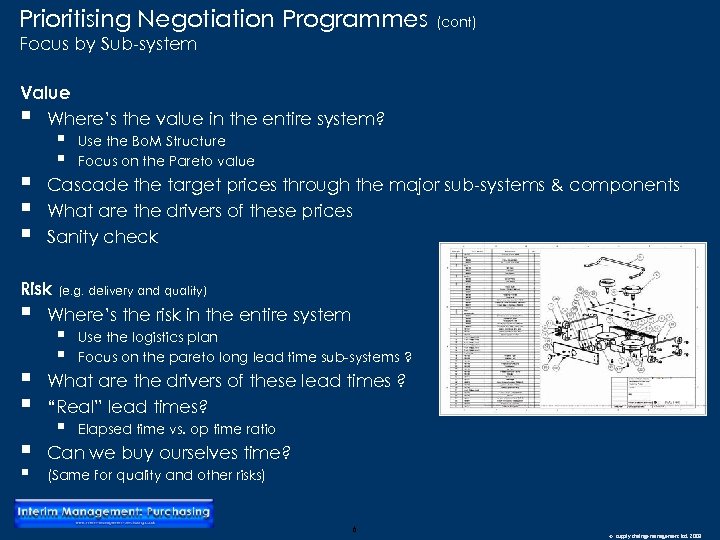

Prioritising Negotiation Programmes (cont) Focus by Sub-system Value § Where’s the value in the entire system? § § § Use the Bo. M Structure Focus on the Pareto value Cascade the target prices through the major sub-systems & components What are the drivers of these prices Sanity check Risk (e. g. delivery and quality) § Where’s the risk in the entire system § § § Use the logistics plan Focus on the pareto long lead time sub-systems ? What are the drivers of these lead times ? “Real” lead times? § Elapsed time vs. op time ratio Can we buy ourselves time? (Same for quality and other risks) 6 © supply chainge management ltd. 2008

Prioritising Negotiation Programmes (cont) Focus by Sub-system Value § Where’s the value in the entire system? § § § Use the Bo. M Structure Focus on the Pareto value Cascade the target prices through the major sub-systems & components What are the drivers of these prices Sanity check Risk (e. g. delivery and quality) § Where’s the risk in the entire system § § § Use the logistics plan Focus on the pareto long lead time sub-systems ? What are the drivers of these lead times ? “Real” lead times? § Elapsed time vs. op time ratio Can we buy ourselves time? (Same for quality and other risks) 6 © supply chainge management ltd. 2008

e-Sourcing § Facilitates easy like for like comparisons for multiple suppliers & large nos of SKUs § Requires preparation…. but really worth it § Conditions suppliers that customer has high expectations § Barriers to adoption no longer significant, even for SMEs (e. g. £ 5 k per seat/annum) § Auctions (when used) typically deliver an additional ~10% § 33% saving on leaflets § Remarkable result for “Fleet Management” 7 © supply chainge management ltd. 2008

e-Sourcing § Facilitates easy like for like comparisons for multiple suppliers & large nos of SKUs § Requires preparation…. but really worth it § Conditions suppliers that customer has high expectations § Barriers to adoption no longer significant, even for SMEs (e. g. £ 5 k per seat/annum) § Auctions (when used) typically deliver an additional ~10% § 33% saving on leaflets § Remarkable result for “Fleet Management” 7 © supply chainge management ltd. 2008

Managing Supplier Conditioning Co-ordinated multi-media campaign XX% savings needed… (PR/Comms support? ) Standard Presentation Packs / Supplier Conferences “Introduction of auctions” Website / Webinars Letters from CPO / CFO / CEO etc. Emails “Supplier Rationalisation” Phone calls • Purchasing • Logistics • Supplier Quality Meetings “Lean Supplier Interventions” “Global Sourcing Initiative” 8 © supply chainge management ltd. 2008

Managing Supplier Conditioning Co-ordinated multi-media campaign XX% savings needed… (PR/Comms support? ) Standard Presentation Packs / Supplier Conferences “Introduction of auctions” Website / Webinars Letters from CPO / CFO / CEO etc. Emails “Supplier Rationalisation” Phone calls • Purchasing • Logistics • Supplier Quality Meetings “Lean Supplier Interventions” “Global Sourcing Initiative” 8 © supply chainge management ltd. 2008

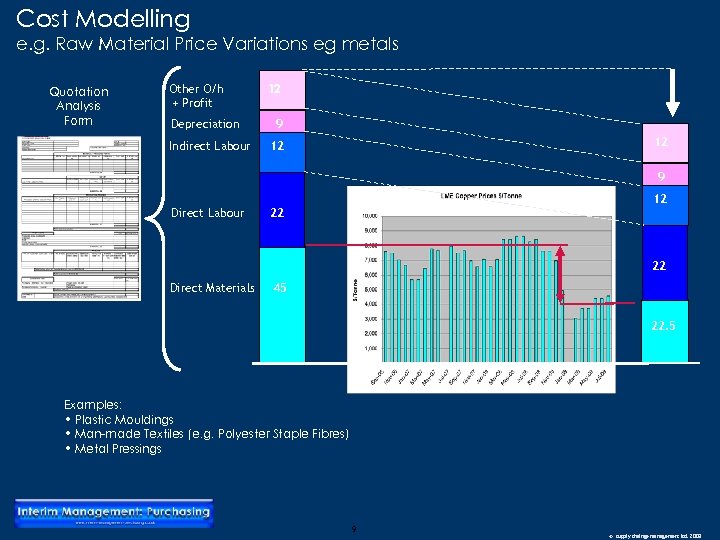

Cost Modelling e. g. Raw Material Price Variations eg metals Quotation Analysis Form Other O/h + Profit Depreciation Indirect Labour 12 9 12 Direct Labour 22 22 Direct Materials 45 22. 5 Examples: • Plastic Mouldings • Man-made Textiles (e. g. Polyester Staple Fibres) • Metal Pressings 9 © supply chainge management ltd. 2008

Cost Modelling e. g. Raw Material Price Variations eg metals Quotation Analysis Form Other O/h + Profit Depreciation Indirect Labour 12 9 12 Direct Labour 22 22 Direct Materials 45 22. 5 Examples: • Plastic Mouldings • Man-made Textiles (e. g. Polyester Staple Fibres) • Metal Pressings 9 © supply chainge management ltd. 2008

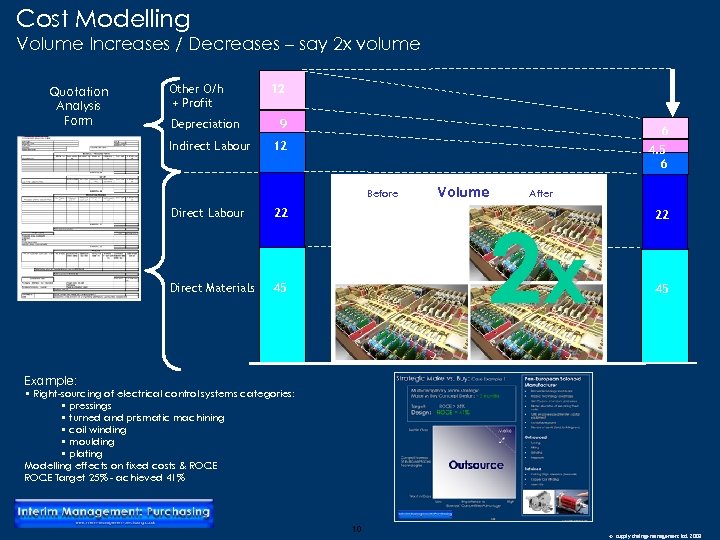

Cost Modelling Volume Increases / Decreases – say 2 x volume Quotation Analysis Form Other O/h + Profit Depreciation Indirect Labour 12 9 6 12 4. 5 6 Before Direct Labour 22 Direct Materials 45 Volume After 2 x 22 45 Example: • Right-sourcing of electrical control systems categories: • pressings • turned and prismatic machining • coil winding • moulding • plating Modelling effects on fixed costs & ROCE Target 25% - achieved 41% 10 © supply chainge management ltd. 2008

Cost Modelling Volume Increases / Decreases – say 2 x volume Quotation Analysis Form Other O/h + Profit Depreciation Indirect Labour 12 9 6 12 4. 5 6 Before Direct Labour 22 Direct Materials 45 Volume After 2 x 22 45 Example: • Right-sourcing of electrical control systems categories: • pressings • turned and prismatic machining • coil winding • moulding • plating Modelling effects on fixed costs & ROCE Target 25% - achieved 41% 10 © supply chainge management ltd. 2008

What Information is Available for Cost Modelling? § E. g. If volume effects are key opportunity: § What’s known about the split between direct and indirect costs? What’s known about volume changes? § Our volume changes by line § Total volume changes by line § § Possible sources of information: § QUAFs § Database Hosts (e. g. volume increases) § Published accounts § Category Manager’s knowledge § Questionnaires (RFIs / e. RFIs) § Org charts § SQA Audits § Other touch points: § Supplier Management Team § Logistics § Factory gate monitoring § Lean re-engineering diagnostics 11 © supply chainge management ltd. 2008

What Information is Available for Cost Modelling? § E. g. If volume effects are key opportunity: § What’s known about the split between direct and indirect costs? What’s known about volume changes? § Our volume changes by line § Total volume changes by line § § Possible sources of information: § QUAFs § Database Hosts (e. g. volume increases) § Published accounts § Category Manager’s knowledge § Questionnaires (RFIs / e. RFIs) § Org charts § SQA Audits § Other touch points: § Supplier Management Team § Logistics § Factory gate monitoring § Lean re-engineering diagnostics 11 © supply chainge management ltd. 2008

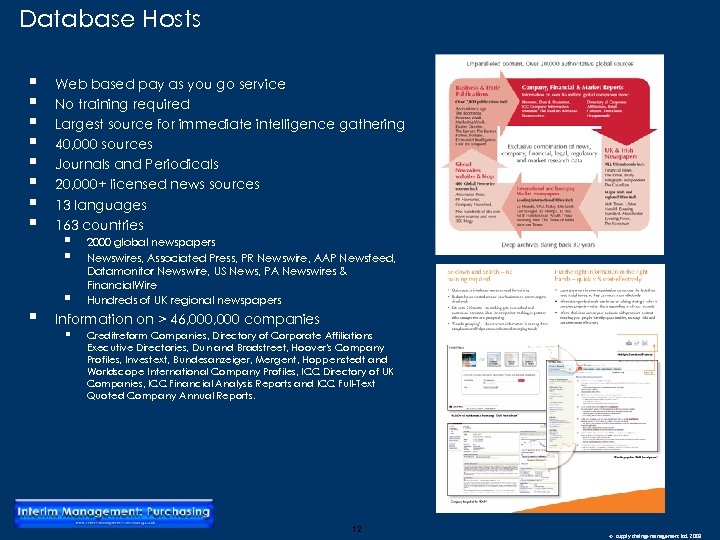

Database Hosts § § § § § Web based pay as you go service No training required Largest source for immediate intelligence gathering 40, 000 sources Journals and Periodicals 20, 000+ licensed news sources 13 languages 163 countries § § § 2000 global newspapers Newswires, Associated Press, PR Newswire, AAP Newsfeed, Datamonitor Newswire, US News, PA Newswires & Financial. Wire Hundreds of UK regional newspapers Information on > 46, 000 companies § Creditreform Companies, Directory of Corporate Affiliations Executive Directories, Dun and Bradstreet, Hoover's Company Profiles, Investext, Bundesanzeiger, Mergent, Hoppenstedt and Worldscope International Company Profiles, ICC Directory of UK Companies, ICC Financial Analysis Reports and ICC Full-Text Quoted Company Annual Reports. 12 © supply chainge management ltd. 2008

Database Hosts § § § § § Web based pay as you go service No training required Largest source for immediate intelligence gathering 40, 000 sources Journals and Periodicals 20, 000+ licensed news sources 13 languages 163 countries § § § 2000 global newspapers Newswires, Associated Press, PR Newswire, AAP Newsfeed, Datamonitor Newswire, US News, PA Newswires & Financial. Wire Hundreds of UK regional newspapers Information on > 46, 000 companies § Creditreform Companies, Directory of Corporate Affiliations Executive Directories, Dun and Bradstreet, Hoover's Company Profiles, Investext, Bundesanzeiger, Mergent, Hoppenstedt and Worldscope International Company Profiles, ICC Directory of UK Companies, ICC Financial Analysis Reports and ICC Full-Text Quoted Company Annual Reports. 12 © supply chainge management ltd. 2008

Mc. Kinsey Negotiation Process § § Team based negotiation § § § Synergistic: “X heads are better than one” Tag-team approach to questions Variety of styles / role playing Rules of engagement - maverick s can derail progress Value of consensus in identifying & validating SWOTs Rigorous planning § § § Objectives SWOTs Role playing Formal debriefs to close the loop Back to planning the next negotiation 13 © supply chainge management ltd. 2008

Mc. Kinsey Negotiation Process § § Team based negotiation § § § Synergistic: “X heads are better than one” Tag-team approach to questions Variety of styles / role playing Rules of engagement - maverick s can derail progress Value of consensus in identifying & validating SWOTs Rigorous planning § § § Objectives SWOTs Role playing Formal debriefs to close the loop Back to planning the next negotiation 13 © supply chainge management ltd. 2008

Contract Models § § § Have contract models been established? Have they been set up as “non negotiable” ? Risks ? 14 © supply chainge management ltd. 2008

Contract Models § § § Have contract models been established? Have they been set up as “non negotiable” ? Risks ? 14 © supply chainge management ltd. 2008