7f0bd1ec204a59e8355fc56f5ed2a86a.ppt

- Количество слайдов: 35

Intellectual Property and Competitiveness of MSMEs G S Jaiya, Director, SMEs Division World Intellectual Property Organization

Intellectual Property and Competitiveness of MSMEs G S Jaiya, Director, SMEs Division World Intellectual Property Organization

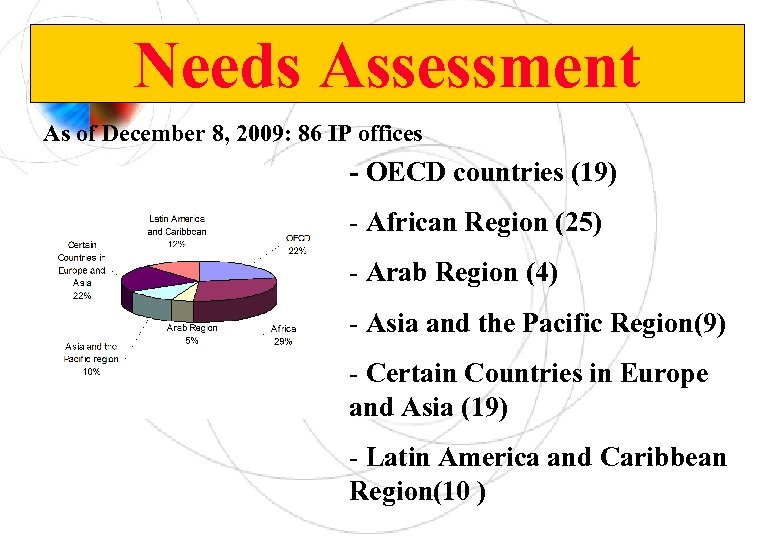

Needs Assessment As of December 8, 2009: 86 IP offices - OECD countries (19) - African Region (25) - Arab Region (4) - Asia and the Pacific Region(9) - Certain Countries in Europe and Asia (19) - Latin America and Caribbean Region(10 )

Needs Assessment As of December 8, 2009: 86 IP offices - OECD countries (19) - African Region (25) - Arab Region (4) - Asia and the Pacific Region(9) - Certain Countries in Europe and Asia (19) - Latin America and Caribbean Region(10 )

IP awareness and capacity building activities for SMEs are done in an ad hoc and reactive mode, instead of being driven by a proactive overall strategy • 6% of the IP Offices which have replied have done a study of the impact of the IP awareness and capacity building services for SMEs. • 22% of the respondents have a formally approved marketing policy, plan and strategy for their IP awareness and capacity building activities. • 24% of the respondents have done a survey of the IP needs of their users • 30% of the respondents maintain a database of contacts of SMEs support institutions. • Most IP offices have not allocated a specific budget or full-time human resources for their SME support (outreach and capacity building) activities:

IP awareness and capacity building activities for SMEs are done in an ad hoc and reactive mode, instead of being driven by a proactive overall strategy • 6% of the IP Offices which have replied have done a study of the impact of the IP awareness and capacity building services for SMEs. • 22% of the respondents have a formally approved marketing policy, plan and strategy for their IP awareness and capacity building activities. • 24% of the respondents have done a survey of the IP needs of their users • 30% of the respondents maintain a database of contacts of SMEs support institutions. • Most IP offices have not allocated a specific budget or full-time human resources for their SME support (outreach and capacity building) activities:

MSME Competitiveness (I) • In a knowledge-based economy, competitiveness of enterprises, including MSMEs, is increasingly based on ability to provide high-value-added products at a competitive price • Globalization and trade liberalization has made it crucial for most enterprises, including MSMEs, to become internationally competitive even when operating wholly in the domestic market

MSME Competitiveness (I) • In a knowledge-based economy, competitiveness of enterprises, including MSMEs, is increasingly based on ability to provide high-value-added products at a competitive price • Globalization and trade liberalization has made it crucial for most enterprises, including MSMEs, to become internationally competitive even when operating wholly in the domestic market

MSMEs Competitiveness (II) • To become and remain competitive, MSMEs need a coherent business strategy to constantly improve their efficiency, reduce production costs and enhance the reputation of their products by: – Investing in research and development – Acquiring new technology – Improving management practices – Developing creative and appealing designs – Effectively marketing their products

MSMEs Competitiveness (II) • To become and remain competitive, MSMEs need a coherent business strategy to constantly improve their efficiency, reduce production costs and enhance the reputation of their products by: – Investing in research and development – Acquiring new technology – Improving management practices – Developing creative and appealing designs – Effectively marketing their products

MSMEs Competitiveness (III) • For this, MSMEs must make significant investments of time and resources • Without intellectual property protection there is a strong risk that investments in R&D, product differentiation and marketing may be stolen/copied • Intellectual property rights enable MSMEs to have exclusivity over the exploitation of their innovative new or original products, their creative designs and their brands. The exclusivity creates an appropriate incentive for investing in improving their competitiveness

MSMEs Competitiveness (III) • For this, MSMEs must make significant investments of time and resources • Without intellectual property protection there is a strong risk that investments in R&D, product differentiation and marketing may be stolen/copied • Intellectual property rights enable MSMEs to have exclusivity over the exploitation of their innovative new or original products, their creative designs and their brands. The exclusivity creates an appropriate incentive for investing in improving their competitiveness

Everything Depends on 5 Key Choices: • Choosing the right business to be in • Creating the right strategy • Building the right systems • Designing the right organization • Getting the right people

Everything Depends on 5 Key Choices: • Choosing the right business to be in • Creating the right strategy • Building the right systems • Designing the right organization • Getting the right people

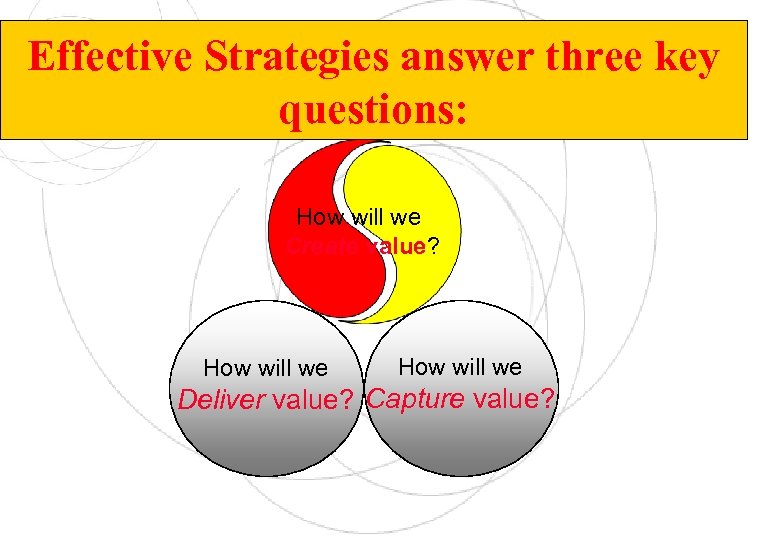

Effective Strategies answer three key questions: How will we Create value? How will we Deliver value? Capture value?

Effective Strategies answer three key questions: How will we Create value? How will we Deliver value? Capture value?

From Three to Seven Critical Questions • How will we create value? – How will the technology evolve? – How will the market change? • How will we capture value? – How should we design the business model? – Where should we compete in the value chain? – How should we compete if standards are important? • How will we deliver value? – How do we manage the core business and growth simultaneously? – How do we use our strategy to drive real resource allocation?

From Three to Seven Critical Questions • How will we create value? – How will the technology evolve? – How will the market change? • How will we capture value? – How should we design the business model? – Where should we compete in the value chain? – How should we compete if standards are important? • How will we deliver value? – How do we manage the core business and growth simultaneously? – How do we use our strategy to drive real resource allocation?

Three key ideas: • Uniqueness – Controlling the knowledge generated by an innovation • Complementary assets – Controlling the assets that maximize the profits from innovating • Understanding the dynamics of the value chain – Should we buy our suppliers? Distributors? – Should we outsource our manufacturing… distribution… sales… capability?

Three key ideas: • Uniqueness – Controlling the knowledge generated by an innovation • Complementary assets – Controlling the assets that maximize the profits from innovating • Understanding the dynamics of the value chain – Should we buy our suppliers? Distributors? – Should we outsource our manufacturing… distribution… sales… capability?

Ideas, Creativity and Innovation • Creativity The ability to make or otherwise bring into existence something new, whether a new solution to a problem, a new method or device, or a new artistic object or form. • Innovation 1 : The introduction of something new 2 : A new idea, method, or device • Creativity = Idea + Action • Innovation = Creativity + Productivity • Innovation = Idea + Action + Productivity

Ideas, Creativity and Innovation • Creativity The ability to make or otherwise bring into existence something new, whether a new solution to a problem, a new method or device, or a new artistic object or form. • Innovation 1 : The introduction of something new 2 : A new idea, method, or device • Creativity = Idea + Action • Innovation = Creativity + Productivity • Innovation = Idea + Action + Productivity

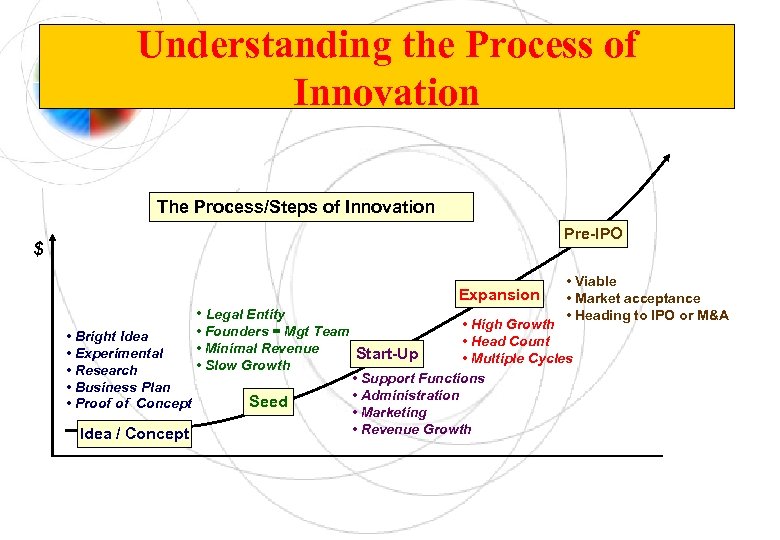

Understanding the Process of Innovation The Process/Steps of Innovation Pre-IPO $ Expansion • Legal Entity • Viable • Market acceptance • Heading to IPO or M&A • High Growth • Founders = Mgt Team • Bright Idea • Head Count • Minimal Revenue • Experimental Start-Up • Multiple Cycles • Slow Growth • Research • Support Functions • Business Plan • Administration Seed • Proof of Concept • Marketing • Revenue Growth Idea / Concept Time

Understanding the Process of Innovation The Process/Steps of Innovation Pre-IPO $ Expansion • Legal Entity • Viable • Market acceptance • Heading to IPO or M&A • High Growth • Founders = Mgt Team • Bright Idea • Head Count • Minimal Revenue • Experimental Start-Up • Multiple Cycles • Slow Growth • Research • Support Functions • Business Plan • Administration Seed • Proof of Concept • Marketing • Revenue Growth Idea / Concept Time

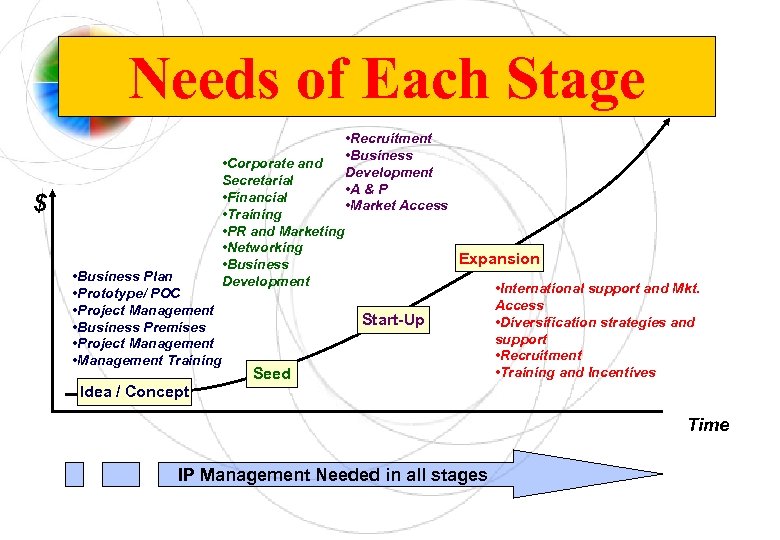

Needs of Each Stage • Corporate and Secretarial • Financial • Training • PR and Marketing • Networking • Business Development $ • Business Plan • Prototype/ POC • Project Management • Business Premises • Project Management • Management Training • Recruitment • Business Development • A & P • Market Access Expansion Start-Up Seed • International support and Mkt. Access • Diversification strategies and support • Recruitment • Training and Incentives Idea / Concept Time IP Management Needed in all stages

Needs of Each Stage • Corporate and Secretarial • Financial • Training • PR and Marketing • Networking • Business Development $ • Business Plan • Prototype/ POC • Project Management • Business Premises • Project Management • Management Training • Recruitment • Business Development • A & P • Market Access Expansion Start-Up Seed • International support and Mkt. Access • Diversification strategies and support • Recruitment • Training and Incentives Idea / Concept Time IP Management Needed in all stages

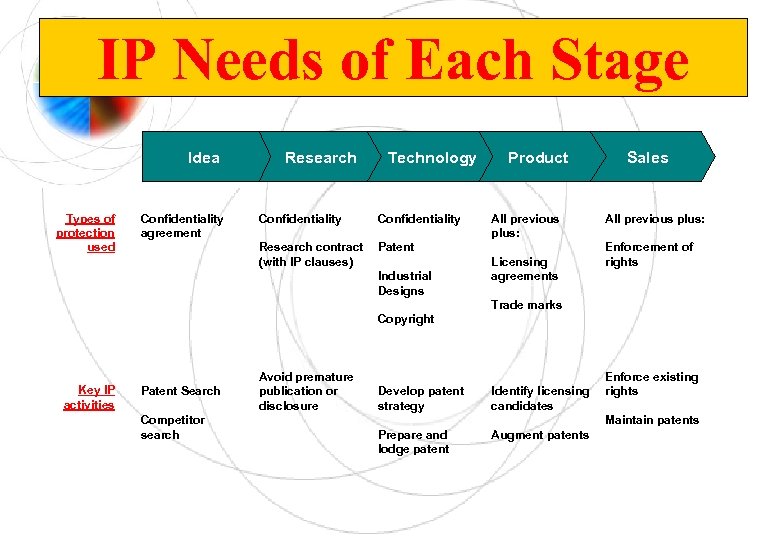

IP Needs of Each Stage Idea Types of protection used Confidentiality agreement Research Technology Confidentiality Research contract (with IP clauses) Product Patent Industrial Designs All previous plus: Licensing agreements Sales All previous plus: Enforcement of rights Trade marks Copyright Key IP activities Patent Search Competitor search Avoid premature publication or disclosure Develop patent strategy Identify licensing candidates Prepare and lodge patent Augment patents Enforce existing rights Maintain patents

IP Needs of Each Stage Idea Types of protection used Confidentiality agreement Research Technology Confidentiality Research contract (with IP clauses) Product Patent Industrial Designs All previous plus: Licensing agreements Sales All previous plus: Enforcement of rights Trade marks Copyright Key IP activities Patent Search Competitor search Avoid premature publication or disclosure Develop patent strategy Identify licensing candidates Prepare and lodge patent Augment patents Enforce existing rights Maintain patents

A Network View of Innovation Depending on a firm’s strengths, different firms play different roles in open innovation value chain • Some firms generate innovations • Some integrate the innovations of others • Some have a fully integrated model An open innovation system is a networked system

A Network View of Innovation Depending on a firm’s strengths, different firms play different roles in open innovation value chain • Some firms generate innovations • Some integrate the innovations of others • Some have a fully integrated model An open innovation system is a networked system

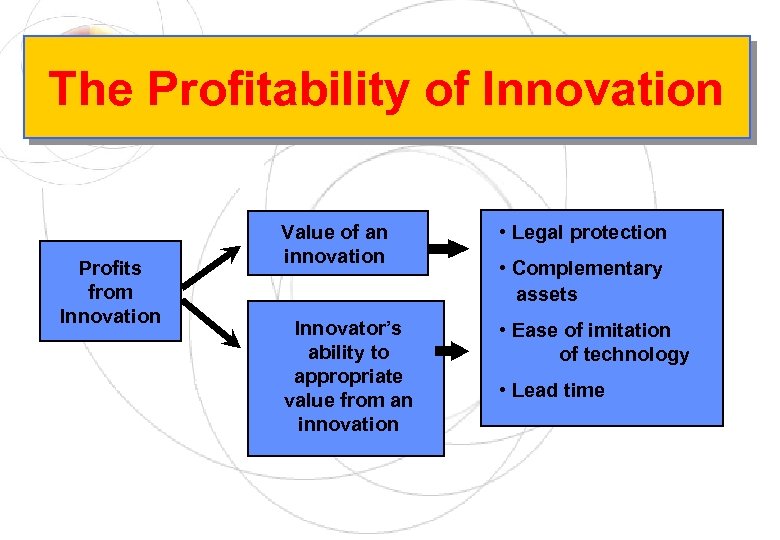

The Profitability of Innovation Profits from Innovation Value of an innovation • Legal protection Innovator’s ability to appropriate value from an innovation • Ease of imitation of technology • Complementary assets • Lead time

The Profitability of Innovation Profits from Innovation Value of an innovation • Legal protection Innovator’s ability to appropriate value from an innovation • Ease of imitation of technology • Complementary assets • Lead time

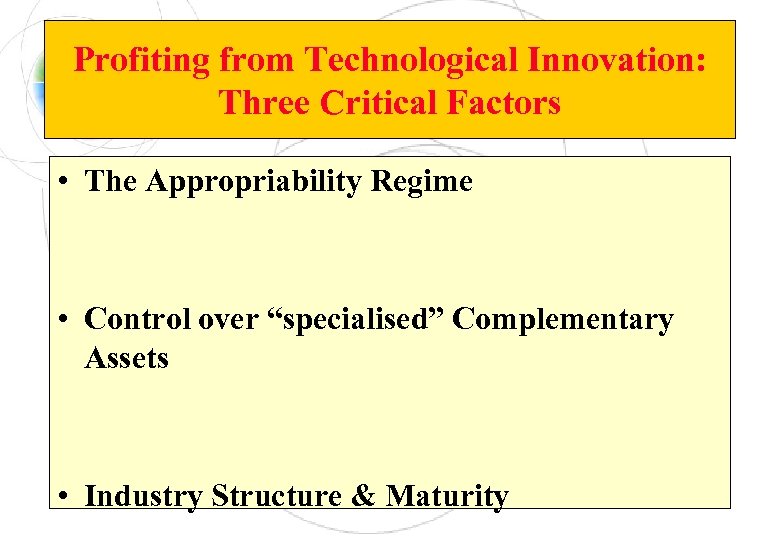

Profiting from Technological Innovation: Three Critical Factors • The Appropriability Regime • Control over “specialised” Complementary Assets • Industry Structure & Maturity

Profiting from Technological Innovation: Three Critical Factors • The Appropriability Regime • Control over “specialised” Complementary Assets • Industry Structure & Maturity

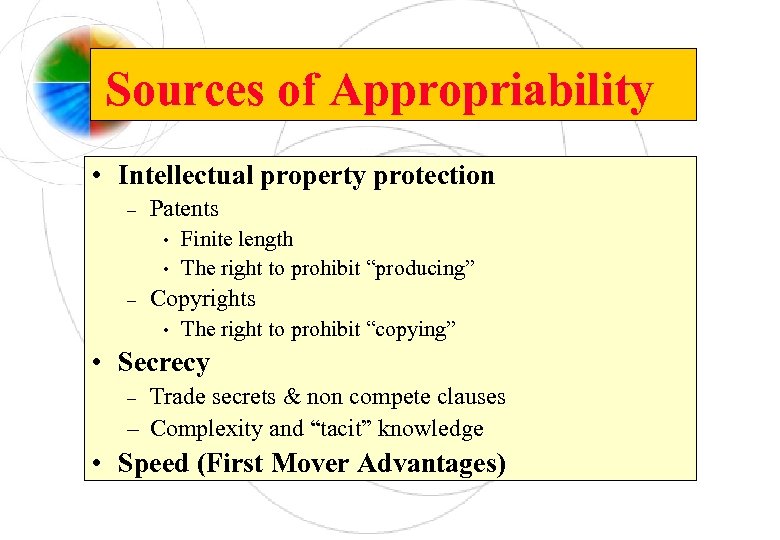

Sources of Appropriability • Intellectual property protection – Patents • • – Finite length The right to prohibit “producing” Copyrights • The right to prohibit “copying” • Secrecy Trade secrets & non compete clauses – Complexity and “tacit” knowledge – • Speed (First Mover Advantages)

Sources of Appropriability • Intellectual property protection – Patents • • – Finite length The right to prohibit “producing” Copyrights • The right to prohibit “copying” • Secrecy Trade secrets & non compete clauses – Complexity and “tacit” knowledge – • Speed (First Mover Advantages)

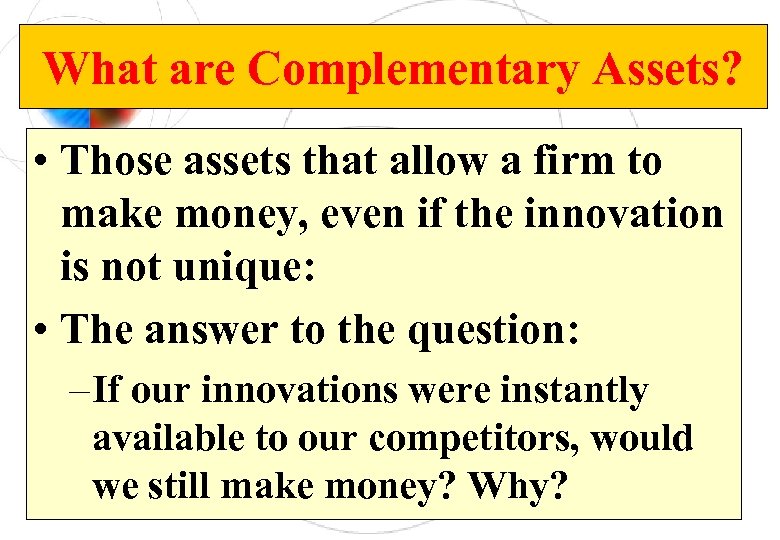

What are Complementary Assets? • Those assets that allow a firm to make money, even if the innovation is not unique: • The answer to the question: – If our innovations were instantly available to our competitors, would we still make money? Why?

What are Complementary Assets? • Those assets that allow a firm to make money, even if the innovation is not unique: • The answer to the question: – If our innovations were instantly available to our competitors, would we still make money? Why?

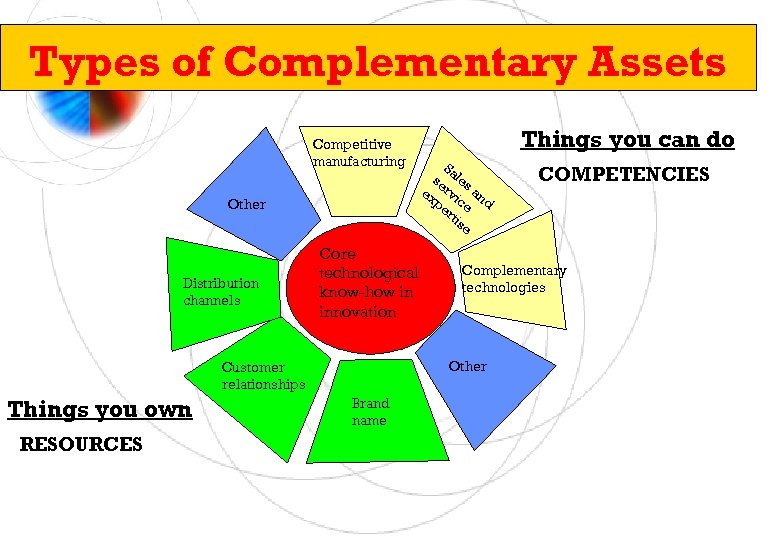

Types of Complementary Assets Competitive manufacturing Other Distribution channels Core technological know-how in innovation RESOURCES Sa se les ex rvi an pe ce d rti se Brand name COMPETENCIES Complementary technologies Other Customer relationships Things you own Things you can do

Types of Complementary Assets Competitive manufacturing Other Distribution channels Core technological know-how in innovation RESOURCES Sa se les ex rvi an pe ce d rti se Brand name COMPETENCIES Complementary technologies Other Customer relationships Things you own Things you can do

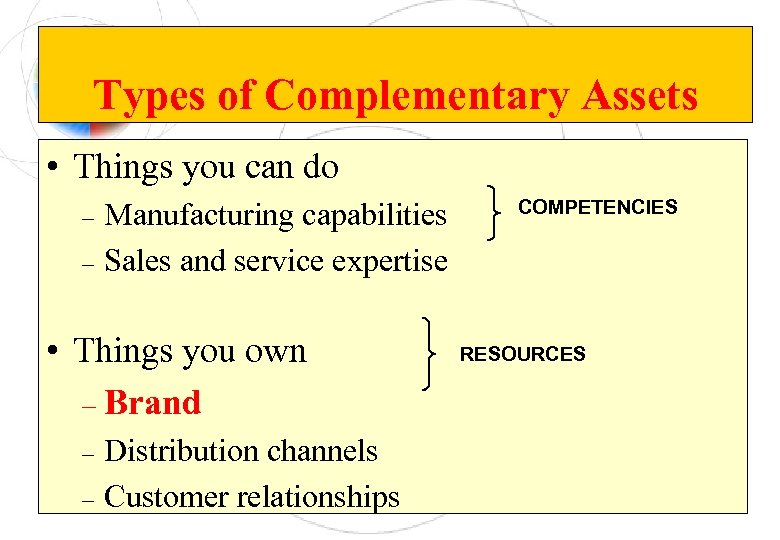

Types of Complementary Assets • Things you can do – – Manufacturing capabilities Sales and service expertise • Things you own – Brand – – Distribution channels Customer relationships COMPETENCIES RESOURCES

Types of Complementary Assets • Things you can do – – Manufacturing capabilities Sales and service expertise • Things you own – Brand – – Distribution channels Customer relationships COMPETENCIES RESOURCES

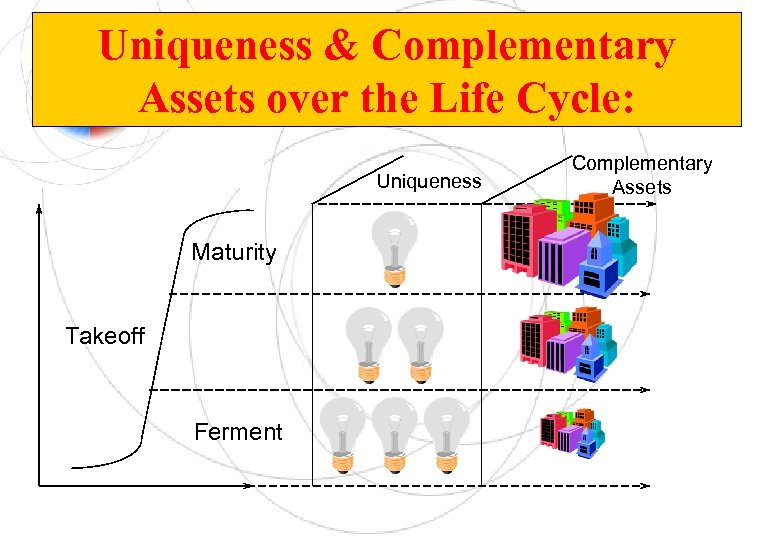

Uniqueness & Complementary Assets over the Life Cycle: Uniqueness Maturity Takeoff Ferment Complementary Assets

Uniqueness & Complementary Assets over the Life Cycle: Uniqueness Maturity Takeoff Ferment Complementary Assets

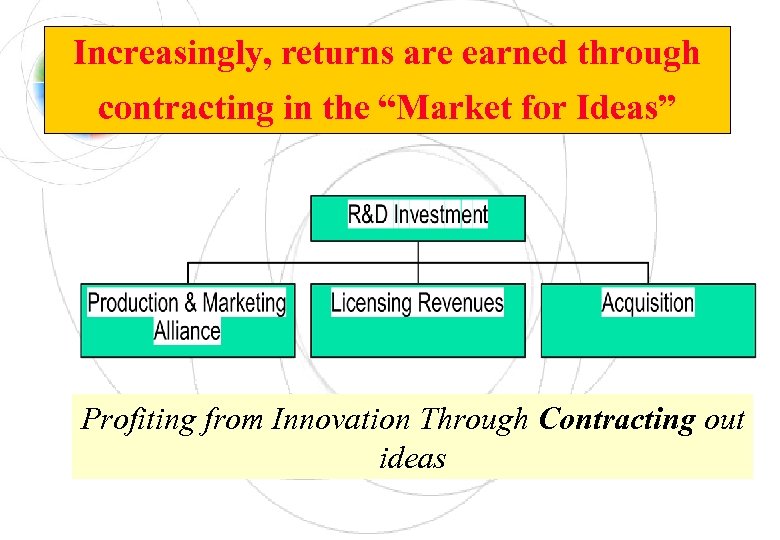

Increasingly, returns are earned through contracting in the “Market for Ideas” Profiting from Innovation Through Contracting out ideas

Increasingly, returns are earned through contracting in the “Market for Ideas” Profiting from Innovation Through Contracting out ideas

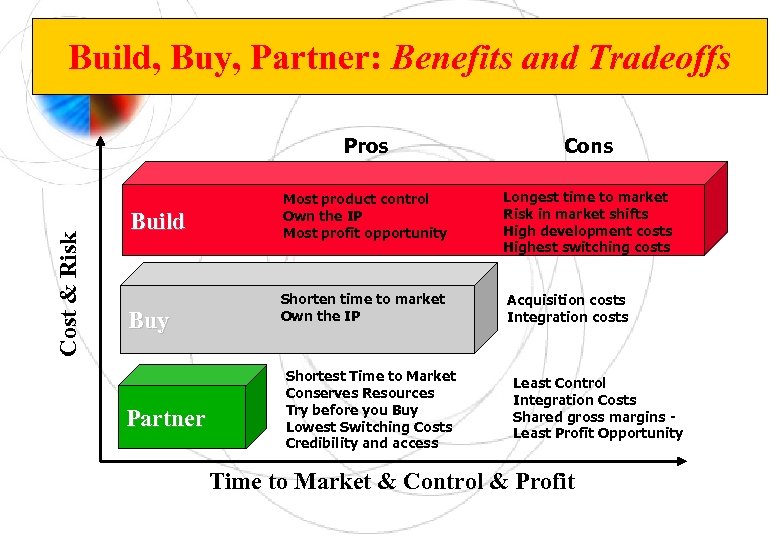

Build, Buy, Partner: Benefits and Tradeoffs Cost & Risk Pros Build Buy Partner Cons Most product control Own the IP Most profit opportunity Longest time to market Risk in market shifts High development costs Highest switching costs Shorten time to market Own the IP Acquisition costs Integration costs Shortest Time to Market Conserves Resources Try before you Buy Lowest Switching Costs Credibility and access Least Control Integration Costs Shared gross margins Least Profit Opportunity Time to Market & Control & Profit

Build, Buy, Partner: Benefits and Tradeoffs Cost & Risk Pros Build Buy Partner Cons Most product control Own the IP Most profit opportunity Longest time to market Risk in market shifts High development costs Highest switching costs Shorten time to market Own the IP Acquisition costs Integration costs Shortest Time to Market Conserves Resources Try before you Buy Lowest Switching Costs Credibility and access Least Control Integration Costs Shared gross margins Least Profit Opportunity Time to Market & Control & Profit

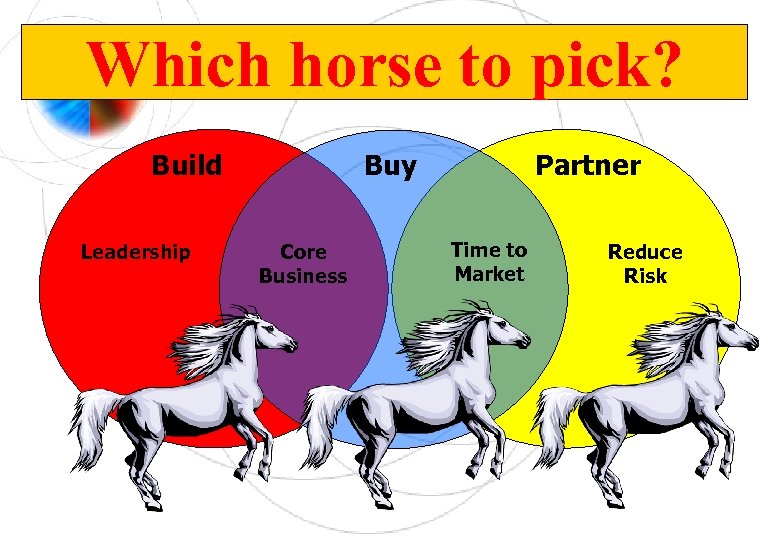

Which horse to pick? Build Leadership Buy Core Business Partner Time to Market Reduce Risk

Which horse to pick? Build Leadership Buy Core Business Partner Time to Market Reduce Risk

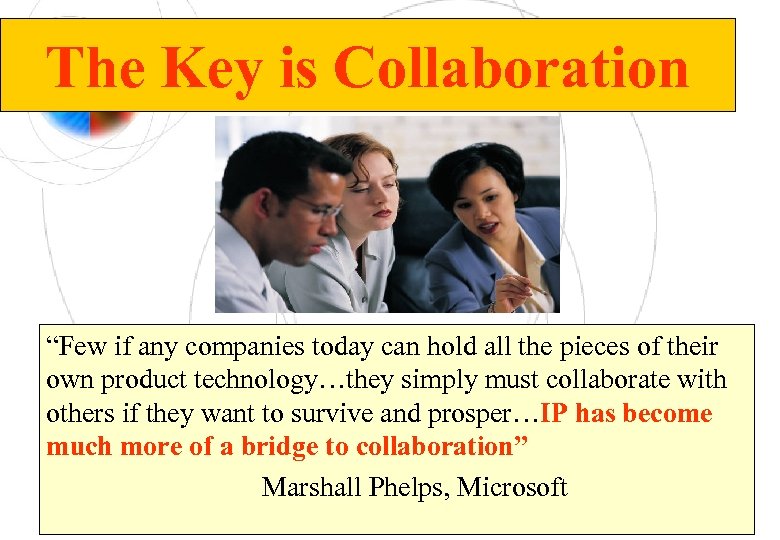

The Key is Collaboration “Few if any companies today can hold all the pieces of their own product technology…they simply must collaborate with others if they want to survive and prosper…IP has become much more of a bridge to collaboration” Marshall Phelps, Microsoft

The Key is Collaboration “Few if any companies today can hold all the pieces of their own product technology…they simply must collaborate with others if they want to survive and prosper…IP has become much more of a bridge to collaboration” Marshall Phelps, Microsoft

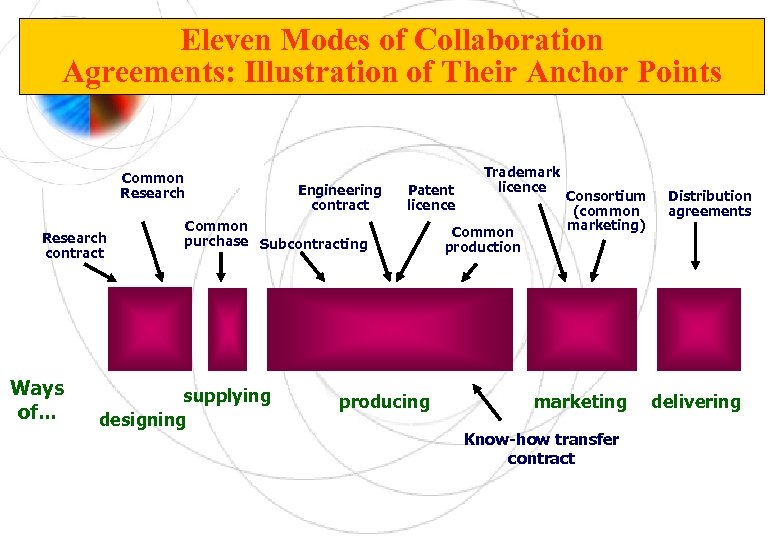

Eleven Modes of Collaboration Agreements: Illustration of Their Anchor Points Common Research contract Ways of. . . Engineering contract Patent licence Common purchase Subcontracting supplying designing producing Trademark licence Common production Consortium (common marketing) marketing Know-how transfer contract Distribution agreements delivering

Eleven Modes of Collaboration Agreements: Illustration of Their Anchor Points Common Research contract Ways of. . . Engineering contract Patent licence Common purchase Subcontracting supplying designing producing Trademark licence Common production Consortium (common marketing) marketing Know-how transfer contract Distribution agreements delivering

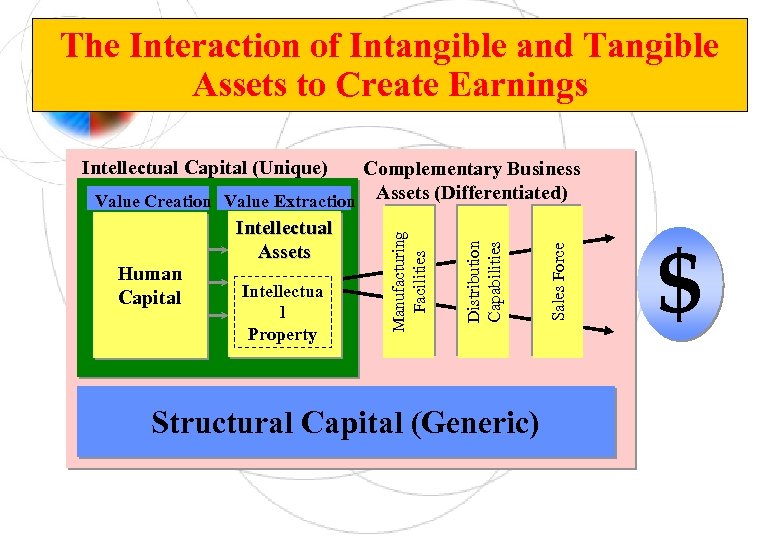

The Interaction of Intangible and Tangible Assets to Create Earnings Intellectual Capital (Unique) Structural Capital (Generic) Sales Force Distribution Capabilities l Property Manufacturing Facilities Complementary Business Value Creation Value Extraction Assets (Differentiated) Intellectual Assets Human Intellectua Capital $

The Interaction of Intangible and Tangible Assets to Create Earnings Intellectual Capital (Unique) Structural Capital (Generic) Sales Force Distribution Capabilities l Property Manufacturing Facilities Complementary Business Value Creation Value Extraction Assets (Differentiated) Intellectual Assets Human Intellectua Capital $

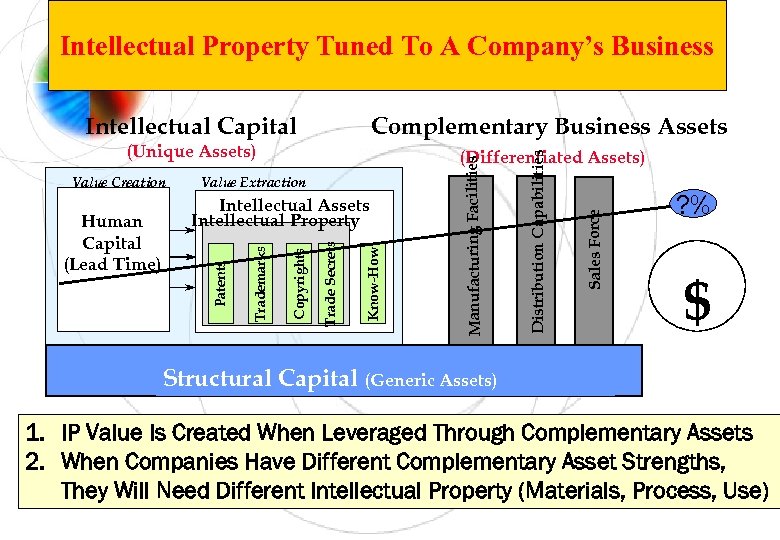

Intellectual Property Tuned To A Company’s Business (Differentiated Assets) Value Creation Know-How Trade Secrets Copyrights Trademarks Intellectual Assets Intellectual Property Patents Human Capital (Lead Time) Value Extraction Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital ? % $ Structural Capital (Generic Assets) 1. IP Value Is Created When Leveraged Through Complementary Assets 2. When Companies Have Different Complementary Asset Strengths, They Will Need Different Intellectual Property (Materials, Process, Use)

Intellectual Property Tuned To A Company’s Business (Differentiated Assets) Value Creation Know-How Trade Secrets Copyrights Trademarks Intellectual Assets Intellectual Property Patents Human Capital (Lead Time) Value Extraction Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital ? % $ Structural Capital (Generic Assets) 1. IP Value Is Created When Leveraged Through Complementary Assets 2. When Companies Have Different Complementary Asset Strengths, They Will Need Different Intellectual Property (Materials, Process, Use)

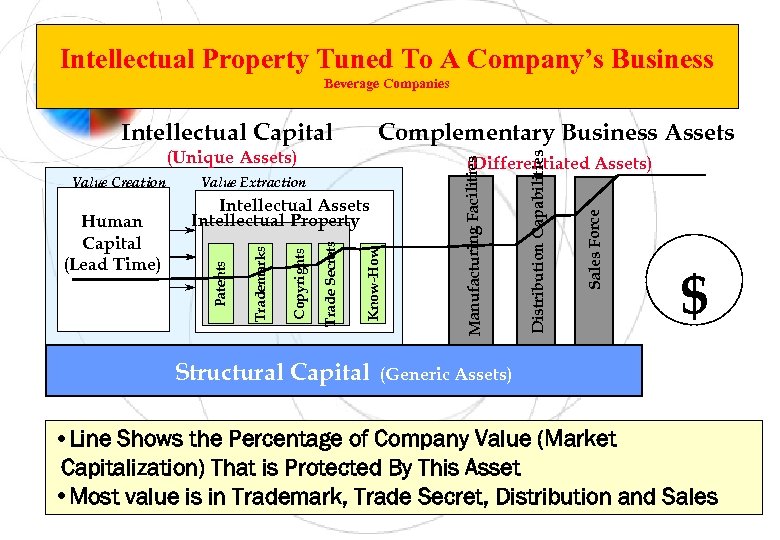

Intellectual Property Tuned To A Company’s Business Beverage Companies (Differentiated Assets) Know-How Trade Secrets Copyrights Intellectual Assets Intellectual Property Trademarks Human Capital (Lead Time) Value Extraction Patents Value Creation Structural Capital Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital $ (Generic Assets) • Line Shows the Percentage of Company Value (Market Capitalization) That is Protected By This Asset • Most value is in Trademark, Trade Secret, Distribution and Sales

Intellectual Property Tuned To A Company’s Business Beverage Companies (Differentiated Assets) Know-How Trade Secrets Copyrights Intellectual Assets Intellectual Property Trademarks Human Capital (Lead Time) Value Extraction Patents Value Creation Structural Capital Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital $ (Generic Assets) • Line Shows the Percentage of Company Value (Market Capitalization) That is Protected By This Asset • Most value is in Trademark, Trade Secret, Distribution and Sales

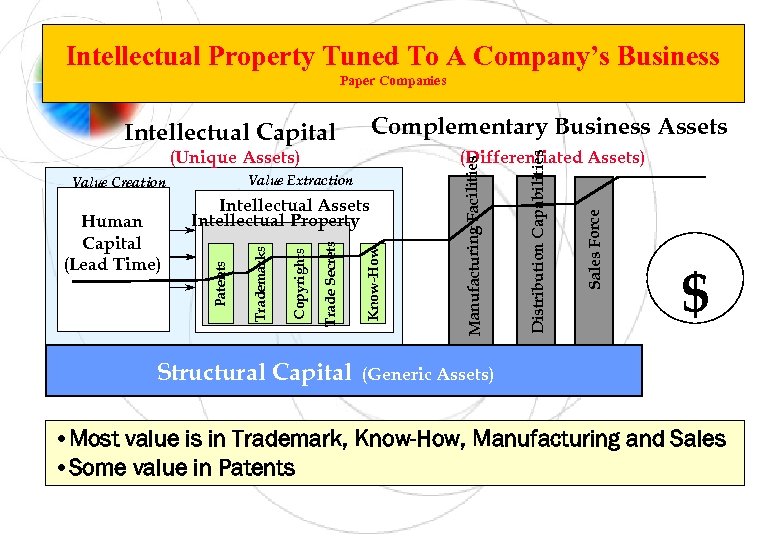

Intellectual Property Tuned To A Company’s Business Paper Companies Complementary Business Assets Intellectual Capital Structural Capital Sales Force Know-How Trade Secrets Copyrights Trademarks Patents Human Capital (Lead Time) Intellectual Assets Intellectual Property Distribution Capabilities Value Extraction Value Creation Manufacturing Facilities (Differentiated Assets) (Unique Assets) $ (Generic Assets) • Most value is in Trademark, Know-How, Manufacturing and Sales • Some value in Patents

Intellectual Property Tuned To A Company’s Business Paper Companies Complementary Business Assets Intellectual Capital Structural Capital Sales Force Know-How Trade Secrets Copyrights Trademarks Patents Human Capital (Lead Time) Intellectual Assets Intellectual Property Distribution Capabilities Value Extraction Value Creation Manufacturing Facilities (Differentiated Assets) (Unique Assets) $ (Generic Assets) • Most value is in Trademark, Know-How, Manufacturing and Sales • Some value in Patents

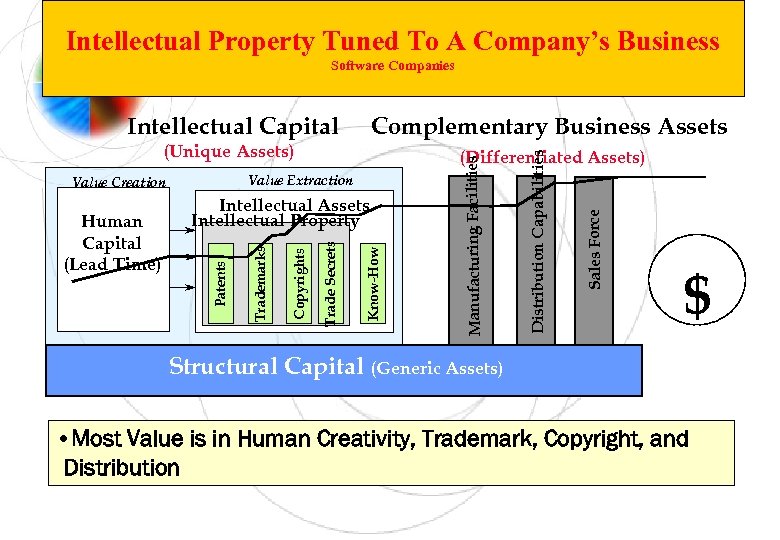

Intellectual Property Tuned To A Company’s Business Software Companies (Differentiated Assets) Value Extraction Value Creation Know-How Trade Secrets Copyrights Trademarks Patents Human Capital (Lead Time) Intellectual Assets Intellectual Property Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital $ Structural Capital (Generic Assets) • Most Value is in Human Creativity, Trademark, Copyright, and Distribution

Intellectual Property Tuned To A Company’s Business Software Companies (Differentiated Assets) Value Extraction Value Creation Know-How Trade Secrets Copyrights Trademarks Patents Human Capital (Lead Time) Intellectual Assets Intellectual Property Sales Force (Unique Assets) Distribution Capabilities Complementary Business Assets Manufacturing Facilities Intellectual Capital $ Structural Capital (Generic Assets) • Most Value is in Human Creativity, Trademark, Copyright, and Distribution

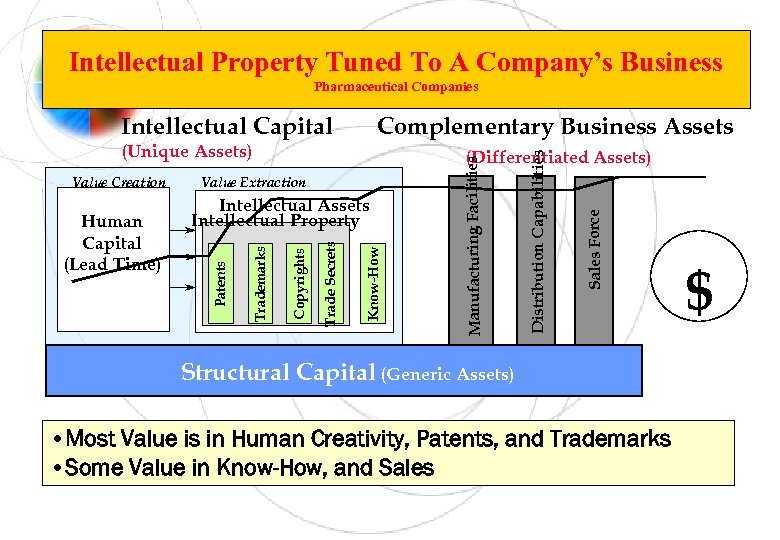

Intellectual Property Tuned To A Company’s Business Pharmaceutical Companies Intellectual Capital Complementary Business Assets (Unique Assets) Sales Force Distribution Capabilities Manufacturing Facilities Know-How Trade Secrets Copyrights Intellectual Assets Intellectual Property Trademarks Human Capital (Lead Time) Value Extraction Patents Value Creation (Differentiated Assets) Structural Capital (Generic Assets) • Most Value is in Human Creativity, Patents, and Trademarks • Some Value in Know-How, and Sales $

Intellectual Property Tuned To A Company’s Business Pharmaceutical Companies Intellectual Capital Complementary Business Assets (Unique Assets) Sales Force Distribution Capabilities Manufacturing Facilities Know-How Trade Secrets Copyrights Intellectual Assets Intellectual Property Trademarks Human Capital (Lead Time) Value Extraction Patents Value Creation (Differentiated Assets) Structural Capital (Generic Assets) • Most Value is in Human Creativity, Patents, and Trademarks • Some Value in Know-How, and Sales $

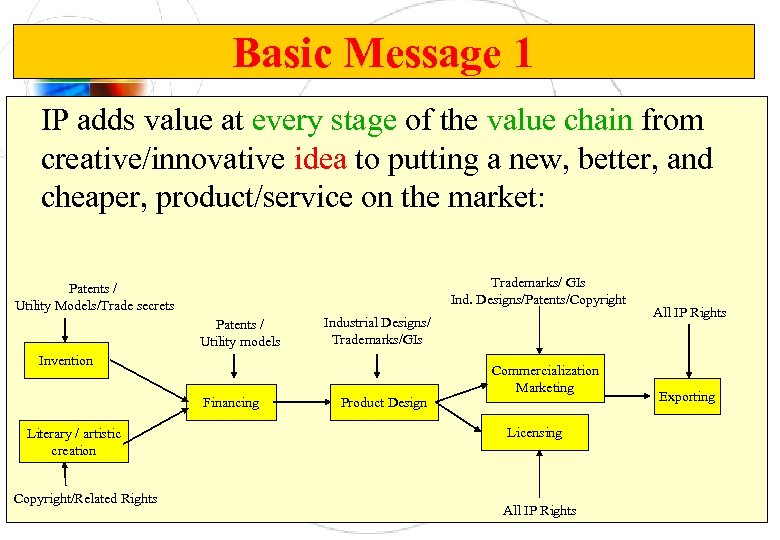

Basic Message 1 IP adds value at every stage of the value chain from creative/innovative idea to putting a new, better, and cheaper, product/service on the market: Trademarks/ GIs Ind. Designs/Patents/Copyright Patents / Utility Models/Trade secrets Patents / Utility models Industrial Designs/ Trademarks/GIs Invention Commercialization Marketing Financing Literary / artistic creation Copyright/Related Rights Product Design Licensing All IP Rights Exporting

Basic Message 1 IP adds value at every stage of the value chain from creative/innovative idea to putting a new, better, and cheaper, product/service on the market: Trademarks/ GIs Ind. Designs/Patents/Copyright Patents / Utility Models/Trade secrets Patents / Utility models Industrial Designs/ Trademarks/GIs Invention Commercialization Marketing Financing Literary / artistic creation Copyright/Related Rights Product Design Licensing All IP Rights Exporting

Basic Message 2 • IP Strategy should be an integral part of the overall business strategy of an Enterprise • The IP strategy of an Enterprise is influenced by its creative/innovative capacity, financial resources, field of technology, competitive environment, etc. • BUT: Ignoring the IP system altogether is in itself an IP strategy, which may eventually prove very costly or even fatal

Basic Message 2 • IP Strategy should be an integral part of the overall business strategy of an Enterprise • The IP strategy of an Enterprise is influenced by its creative/innovative capacity, financial resources, field of technology, competitive environment, etc. • BUT: Ignoring the IP system altogether is in itself an IP strategy, which may eventually prove very costly or even fatal