16d0e5da30800aa6a357764816e13874.ppt

- Количество слайдов: 22

Intel and Firm Analysis James Oldroyd Kellogg Graduate School of Management Northwestern University J-oldroyd@northwestern. edu 801 -422 -7888 650 TNRB

Intel and Firm Analysis James Oldroyd Kellogg Graduate School of Management Northwestern University J-oldroyd@northwestern. edu 801 -422 -7888 650 TNRB

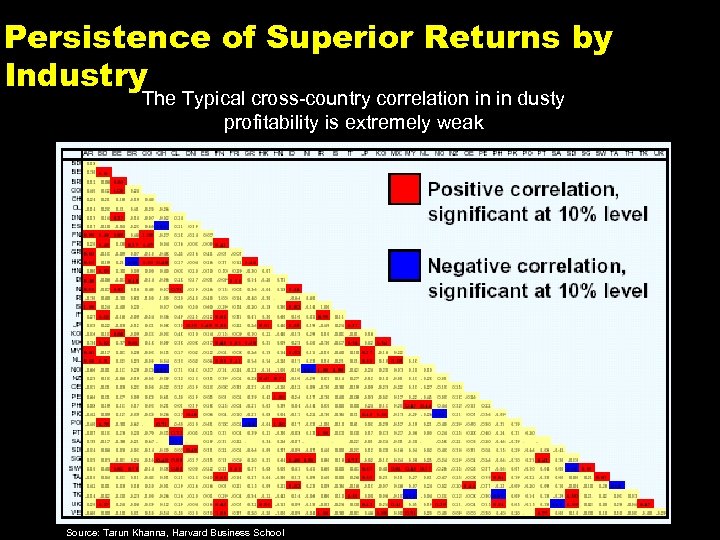

Persistence of Superior Returns by Industry The Typical cross-country correlation in in dusty profitability is extremely weak Source: Tarun Khanna, Harvard Business School 1

Persistence of Superior Returns by Industry The Typical cross-country correlation in in dusty profitability is extremely weak Source: Tarun Khanna, Harvard Business School 1

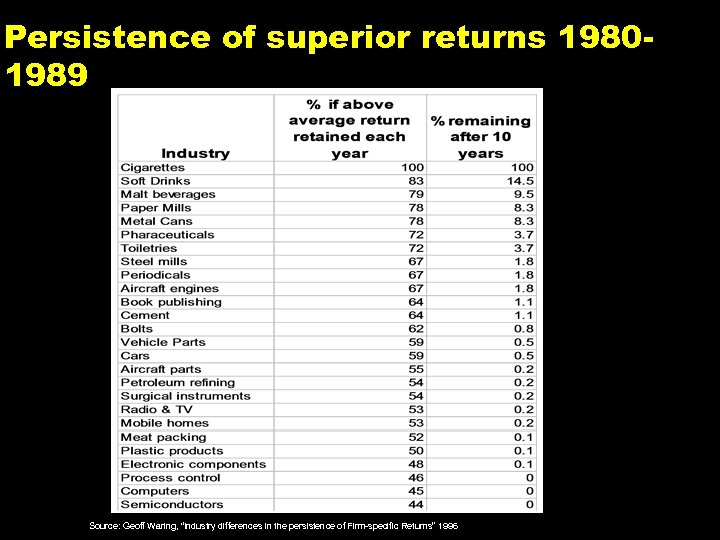

Persistence of superior returns 19801989 Source: Geoff Waring, “Industry differences in the persistence of Firm-specific Returns” 1996 2

Persistence of superior returns 19801989 Source: Geoff Waring, “Industry differences in the persistence of Firm-specific Returns” 1996 2

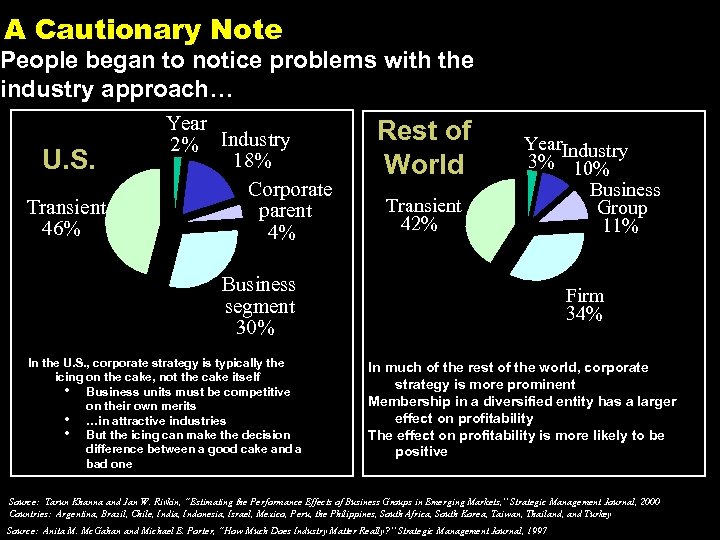

A Cautionary Note People began to notice problems with the industry approach… U. S. Transient 46% Year 2% Industry 18% Corporate parent 4% Rest of World Transient 42% Year. Industry 3% 10% Business Group 11% Business segment 30% In the U. S. , corporate strategy is typically the icing on the cake, not the cake itself • Business units must be competitive on their own merits • …in attractive industries • But the icing can make the decision difference between a good cake and a bad one Firm 34% In much of the rest of the world, corporate strategy is more prominent Membership in a diversified entity has a larger effect on profitability The effect on profitability is more likely to be positive Source: Tarun Khanna and Jan W. Rivkin, “Estimating the Performance Effects of Business Groups in Emerging Markets, ” Strategic Management Journal, 2000 Countries: Argentina, Brazil, Chile, India, Indonesia, Israel, Mexico, Peru, the Philippines, South Africa, South Korea, Taiwan, Thailand, and Turkey Source: Anita M. Mc. Gahan and Michael E. Porter, “How Much Does Industry Matter Really? ” Strategic Management Journal, 1997 3

A Cautionary Note People began to notice problems with the industry approach… U. S. Transient 46% Year 2% Industry 18% Corporate parent 4% Rest of World Transient 42% Year. Industry 3% 10% Business Group 11% Business segment 30% In the U. S. , corporate strategy is typically the icing on the cake, not the cake itself • Business units must be competitive on their own merits • …in attractive industries • But the icing can make the decision difference between a good cake and a bad one Firm 34% In much of the rest of the world, corporate strategy is more prominent Membership in a diversified entity has a larger effect on profitability The effect on profitability is more likely to be positive Source: Tarun Khanna and Jan W. Rivkin, “Estimating the Performance Effects of Business Groups in Emerging Markets, ” Strategic Management Journal, 2000 Countries: Argentina, Brazil, Chile, India, Indonesia, Israel, Mexico, Peru, the Philippines, South Africa, South Korea, Taiwan, Thailand, and Turkey Source: Anita M. Mc. Gahan and Michael E. Porter, “How Much Does Industry Matter Really? ” Strategic Management Journal, 1997 3

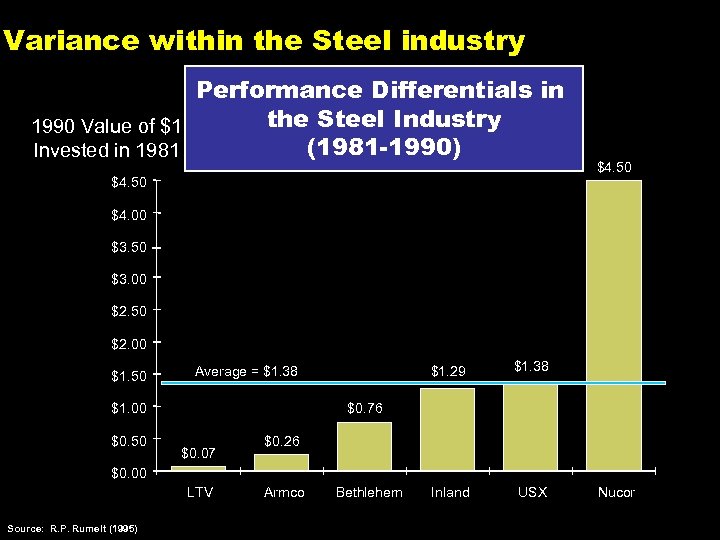

Variance within the Steel industry Performance Differentials in the Steel Industry 1990 Value of $1 (1981 -1990) Invested in 1981 $4. 50 $4. 00 $3. 50 $3. 00 $2. 50 $2. 00 $1. 50 $1. 00 $0. 50 $1. 29 Average = $1. 38 Inland USX $0. 76 $0. 07 $0. 26 $0. 00 LTV Source: R. P. Rumelt (1995) Armco Bethlehem Nucor 4

Variance within the Steel industry Performance Differentials in the Steel Industry 1990 Value of $1 (1981 -1990) Invested in 1981 $4. 50 $4. 00 $3. 50 $3. 00 $2. 50 $2. 00 $1. 50 $1. 00 $0. 50 $1. 29 Average = $1. 38 Inland USX $0. 76 $0. 07 $0. 26 $0. 00 LTV Source: R. P. Rumelt (1995) Armco Bethlehem Nucor 4

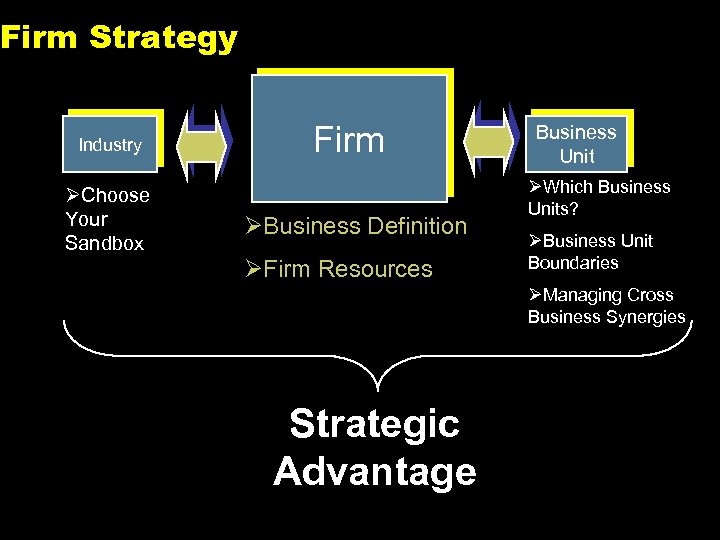

Firm Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 5

Firm Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 5

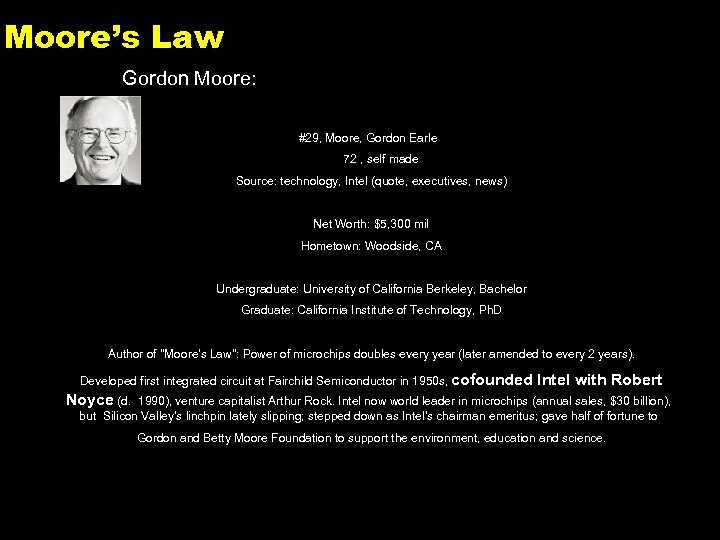

Moore’s Law Gordon Moore: #29, Moore, Gordon Earle 72 , self made Source: technology, Intel (quote, executives, news) Net Worth: $5, 300 mil Hometown: Woodside, CA Undergraduate: University of California Berkeley, Bachelor Graduate: California Institute of Technology, Ph. D Author of "Moore's Law": Power of microchips doubles every year (later amended to every 2 years). Developed first integrated circuit at Fairchild Semiconductor in 1950 s, cofounded Intel with Robert Noyce (d. 1990), venture capitalist Arthur Rock. Intel now world leader in microchips (annual sales, $30 billion), but Silicon Valley's linchpin lately slipping; stepped down as Intel's chairman emeritus; gave half of fortune to Gordon and Betty Moore Foundation to support the environment, education and science. 6

Moore’s Law Gordon Moore: #29, Moore, Gordon Earle 72 , self made Source: technology, Intel (quote, executives, news) Net Worth: $5, 300 mil Hometown: Woodside, CA Undergraduate: University of California Berkeley, Bachelor Graduate: California Institute of Technology, Ph. D Author of "Moore's Law": Power of microchips doubles every year (later amended to every 2 years). Developed first integrated circuit at Fairchild Semiconductor in 1950 s, cofounded Intel with Robert Noyce (d. 1990), venture capitalist Arthur Rock. Intel now world leader in microchips (annual sales, $30 billion), but Silicon Valley's linchpin lately slipping; stepped down as Intel's chairman emeritus; gave half of fortune to Gordon and Betty Moore Foundation to support the environment, education and science. 6

Would you have invested? 7

Would you have invested? 7

The Top 25 8

The Top 25 8

Why are Microsoft and Intel Friends? 9

Why are Microsoft and Intel Friends? 9

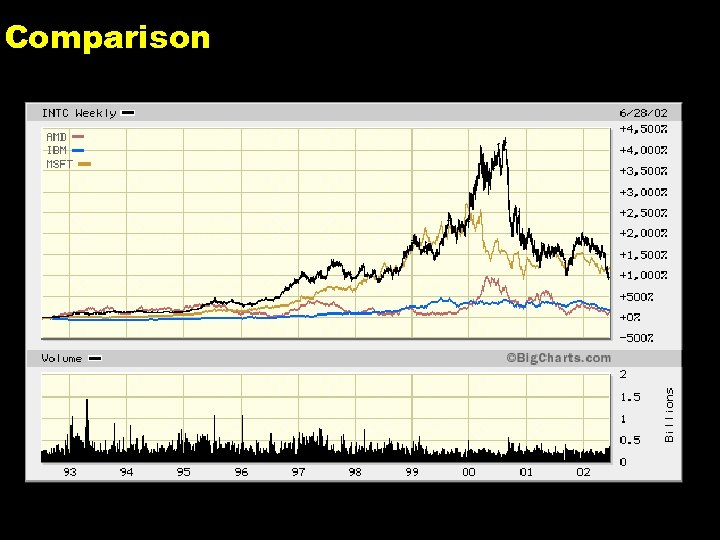

Comparison 10

Comparison 10

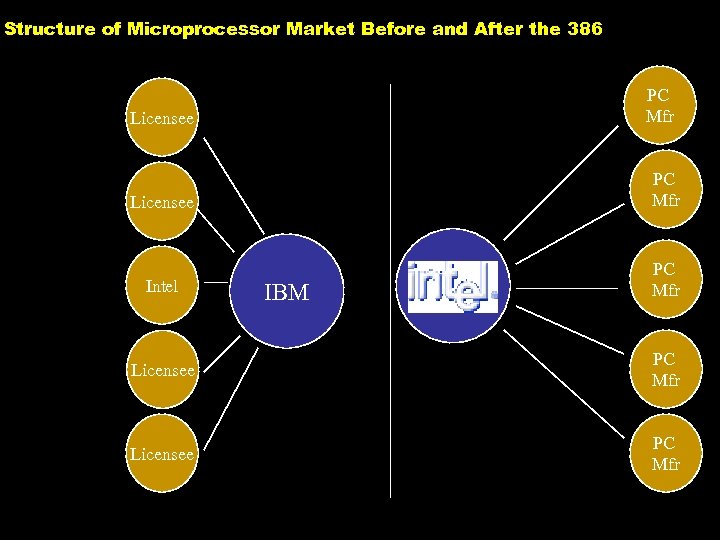

Creating Advantages Become the Standard • • License the technology at low cost to many suppliers to become the standard Low bargaining power (e. g. , IBM) Intel does not reap high profits from the standard Become a Proprietary Standard • • • Intel eliminates licensing on the 386 once it has capacity to supply the industry; IBM is only competitor IBM does not choose to incorporate 386 as the PC standard right away, opening the door for Intel to negotiate with Compaq Speed to market capabilities allow Intel to be first to market with next generation microprocessors

Creating Advantages Become the Standard • • License the technology at low cost to many suppliers to become the standard Low bargaining power (e. g. , IBM) Intel does not reap high profits from the standard Become a Proprietary Standard • • • Intel eliminates licensing on the 386 once it has capacity to supply the industry; IBM is only competitor IBM does not choose to incorporate 386 as the PC standard right away, opening the door for Intel to negotiate with Compaq Speed to market capabilities allow Intel to be first to market with next generation microprocessors

Sustaining Advantage “Intel Inside” campaign (Differentiators) • • creates brand awareness with end customers (costly to imitate) creates bargaining power over computer manufacturers Speed to market capabilities (Sequencing) • reputation and ability for developing the next generation of processes faster than other players Cost and complexity of market entry • cost of development and fab is approximately $1 billion Intel’s financial resources allow it to: • • buy options on a wide variety of new technologies vigorously defend its patents

Sustaining Advantage “Intel Inside” campaign (Differentiators) • • creates brand awareness with end customers (costly to imitate) creates bargaining power over computer manufacturers Speed to market capabilities (Sequencing) • reputation and ability for developing the next generation of processes faster than other players Cost and complexity of market entry • cost of development and fab is approximately $1 billion Intel’s financial resources allow it to: • • buy options on a wide variety of new technologies vigorously defend its patents

The Transitory Nature of Advantages “Every competitive advantage is predicated upon a particular set of conditions that exist at a particular point in time for particular reasons. Many of history’s seemingly unassailable advantages have proved transitory because the underlying factors changed. The very existence of competitive advantage sets in motion creative innovations that, as competitors strive to level the playing field, cause the advantage to dissipate. ” Clayton Christensen Source: Clayton Christensen, Past and Future of Competitive Advantage, 2001 13

The Transitory Nature of Advantages “Every competitive advantage is predicated upon a particular set of conditions that exist at a particular point in time for particular reasons. Many of history’s seemingly unassailable advantages have proved transitory because the underlying factors changed. The very existence of competitive advantage sets in motion creative innovations that, as competitors strive to level the playing field, cause the advantage to dissipate. ” Clayton Christensen Source: Clayton Christensen, Past and Future of Competitive Advantage, 2001 13

Structure of Microprocessor Market Before and After the 386 PC Mfr Licensee PC Mfr Intel PC Mfr IBM Licensee PC Mfr 14

Structure of Microprocessor Market Before and After the 386 PC Mfr Licensee PC Mfr Intel PC Mfr IBM Licensee PC Mfr 14

What is the Resourced Based View? The RBV assumes that firms are endowed with different bundles of resources. These may include: locations, brand names, distributions channels, patents, cultures etc. The RBV seeks to understand what resources are important and what a firm needs to do to protected and renew their important resources. 15

What is the Resourced Based View? The RBV assumes that firms are endowed with different bundles of resources. These may include: locations, brand names, distributions channels, patents, cultures etc. The RBV seeks to understand what resources are important and what a firm needs to do to protected and renew their important resources. 15

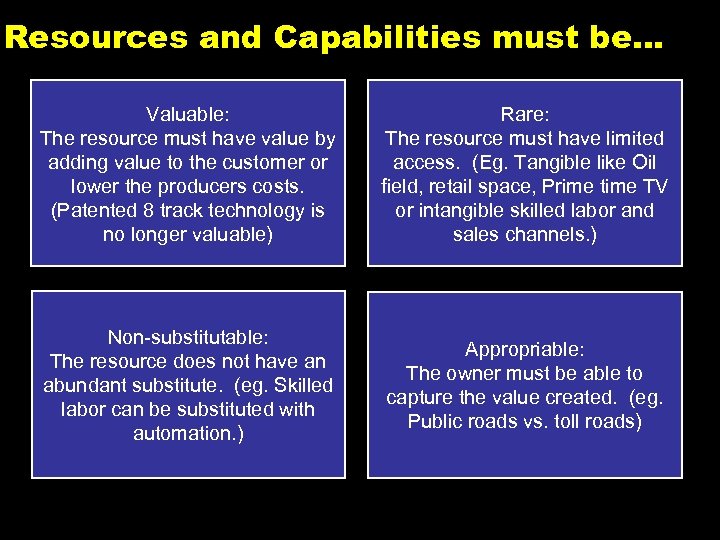

Resources and Capabilities must be… Valuable: The resource must have value by adding value to the customer or lower the producers costs. (Patented 8 track technology is no longer valuable) Rare: The resource must have limited access. (Eg. Tangible like Oil field, retail space, Prime time TV or intangible skilled labor and sales channels. ) Non-substitutable: The resource does not have an abundant substitute. (eg. Skilled labor can be substituted with automation. ) Appropriable: The owner must be able to capture the value created. (eg. Public roads vs. toll roads) 16

Resources and Capabilities must be… Valuable: The resource must have value by adding value to the customer or lower the producers costs. (Patented 8 track technology is no longer valuable) Rare: The resource must have limited access. (Eg. Tangible like Oil field, retail space, Prime time TV or intangible skilled labor and sales channels. ) Non-substitutable: The resource does not have an abundant substitute. (eg. Skilled labor can be substituted with automation. ) Appropriable: The owner must be able to capture the value created. (eg. Public roads vs. toll roads) 16

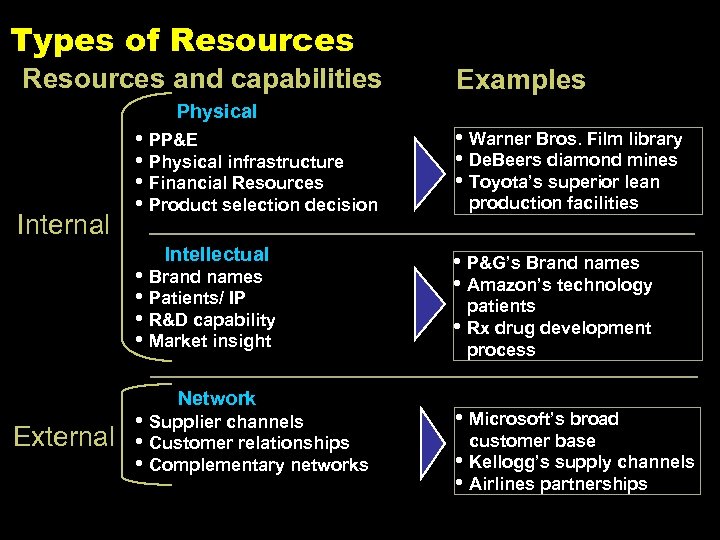

Types of Resources and capabilities Examples Physical Internal • PP&E • Physical infrastructure • Financial Resources • Product selection decision Intellectual • Brand names • Patients/ IP • R&D capability • Market insight Network • Supplier channels External • Customer relationships • Complementary networks • Warner Bros. Film library • De. Beers diamond mines • Toyota’s superior lean production facilities • P&G’s Brand names • Amazon’s technology patients • Rx drug development process • Microsoft’s broad customer base • Kellogg’s supply channels • Airlines partnerships 17

Types of Resources and capabilities Examples Physical Internal • PP&E • Physical infrastructure • Financial Resources • Product selection decision Intellectual • Brand names • Patients/ IP • R&D capability • Market insight Network • Supplier channels External • Customer relationships • Complementary networks • Warner Bros. Film library • De. Beers diamond mines • Toyota’s superior lean production facilities • P&G’s Brand names • Amazon’s technology patients • Rx drug development process • Microsoft’s broad customer base • Kellogg’s supply channels • Airlines partnerships 17

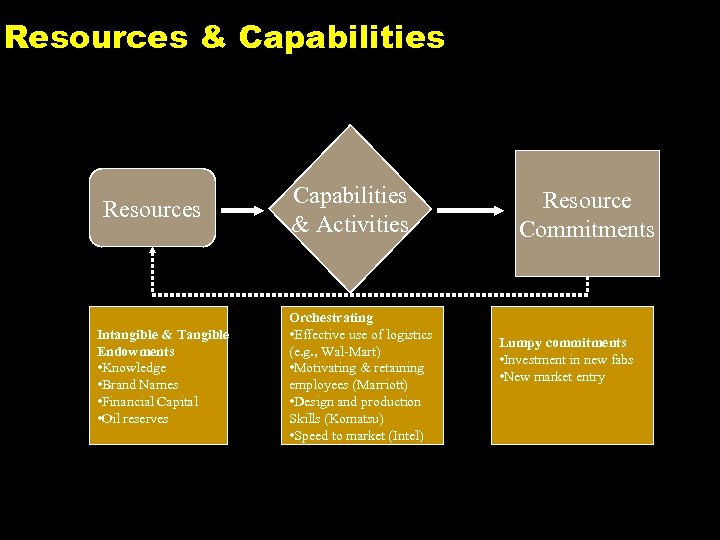

Resources & Capabilities Resources Intangible & Tangible Endowments • Knowledge • Brand Names • Financial Capital • Oil reserves Capabilities & Activities Orchestrating • Effective use of logistics (e. g. , Wal-Mart) • Motivating & retaining employees (Marriott) • Design and production Skills (Komatsu) • Speed to market (Intel) Resource Commitments Lumpy commitments • Investment in new fabs • New market entry 18

Resources & Capabilities Resources Intangible & Tangible Endowments • Knowledge • Brand Names • Financial Capital • Oil reserves Capabilities & Activities Orchestrating • Effective use of logistics (e. g. , Wal-Mart) • Motivating & retaining employees (Marriott) • Design and production Skills (Komatsu) • Speed to market (Intel) Resource Commitments Lumpy commitments • Investment in new fabs • New market entry 18

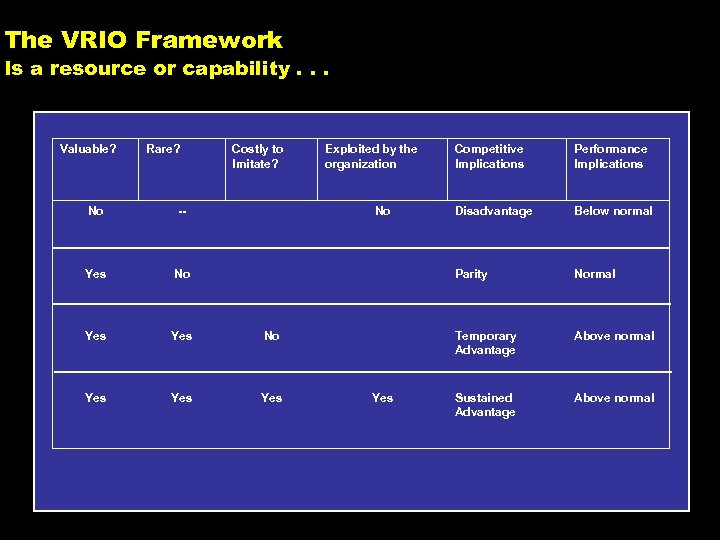

The VRIO Framework Is a resource or capability. . . Valuable? Rare? Costly to Imitate? -- Yes No Yes Yes Yes Performance Implications Disadvantage Below normal Normal Temporary Advantage No Competitive Implications Parity No Exploited by the organization Above normal Sustained Advantage Above normal 19

The VRIO Framework Is a resource or capability. . . Valuable? Rare? Costly to Imitate? -- Yes No Yes Yes Yes Performance Implications Disadvantage Below normal Normal Temporary Advantage No Competitive Implications Parity No Exploited by the organization Above normal Sustained Advantage Above normal 19

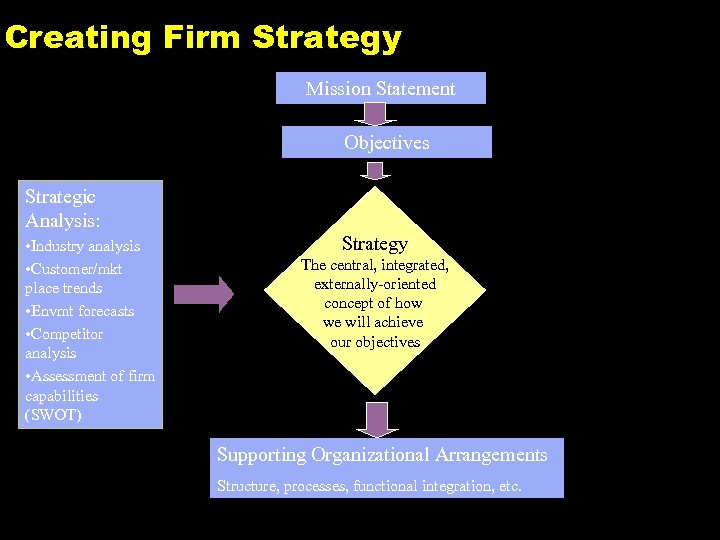

Creating Firm Strategy Mission Statement Objectives Strategic Analysis: • Industry analysis • Customer/mkt place trends • Envmt forecasts • Competitor analysis • Assessment of firm capabilities (SWOT) Strategy The central, integrated, externally-oriented concept of how we will achieve our objectives Supporting Organizational Arrangements Structure, processes, functional integration, etc. 20

Creating Firm Strategy Mission Statement Objectives Strategic Analysis: • Industry analysis • Customer/mkt place trends • Envmt forecasts • Competitor analysis • Assessment of firm capabilities (SWOT) Strategy The central, integrated, externally-oriented concept of how we will achieve our objectives Supporting Organizational Arrangements Structure, processes, functional integration, etc. 20

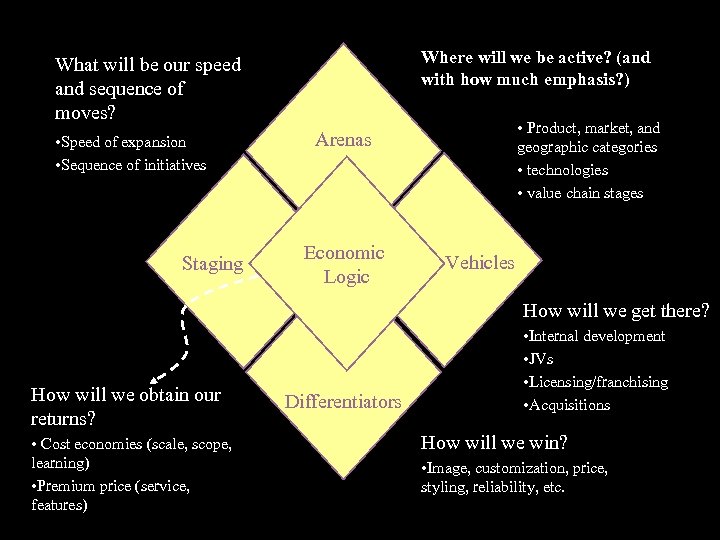

Where will we be active? (and with how much emphasis? ) What will be our speed and sequence of moves? • Speed of expansion • Sequence of initiatives Staging • Product, market, and geographic categories • technologies • value chain stages Arenas Economic Logic Vehicles How will we get there? How will we obtain our returns? • Cost economies (scale, scope, learning) • Premium price (service, features) Differentiators • Internal development • JVs • Licensing/franchising • Acquisitions How will we win? • Image, customization, price, styling, reliability, etc. 21

Where will we be active? (and with how much emphasis? ) What will be our speed and sequence of moves? • Speed of expansion • Sequence of initiatives Staging • Product, market, and geographic categories • technologies • value chain stages Arenas Economic Logic Vehicles How will we get there? How will we obtain our returns? • Cost economies (scale, scope, learning) • Premium price (service, features) Differentiators • Internal development • JVs • Licensing/franchising • Acquisitions How will we win? • Image, customization, price, styling, reliability, etc. 21