440d7c22b03390e12e4389d9f5e41dbb.ppt

- Количество слайдов: 18

INTEGRATED TAX MANAGEMENT SYSTEM (i. Tax) ANNUAL TAX SEMINAR SYNOPSIS, COAST BRANCH 30 NOVEMBER 2016, BEST WESTERN CREEKSIDE HOTEL, MOMBASA By: MOSES WACHANA – i. Tax PROJECT OFFICE www. KRA. go. ke 16/03/2018

INTEGRATED TAX MANAGEMENT SYSTEM (i. Tax) ANNUAL TAX SEMINAR SYNOPSIS, COAST BRANCH 30 NOVEMBER 2016, BEST WESTERN CREEKSIDE HOTEL, MOMBASA By: MOSES WACHANA – i. Tax PROJECT OFFICE www. KRA. go. ke 16/03/2018

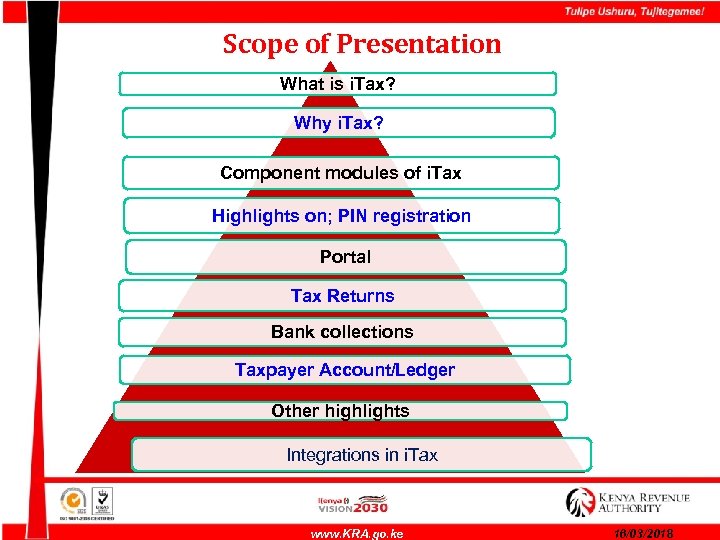

Scope of Presentation What is i. Tax? Why i. Tax? Component modules of i. Tax Highlights on; PIN registration Portal Tax Returns Bank collections Taxpayer Account/Ledger Other highlights Integrations in i. Tax www. KRA. go. ke 16/03/2018

Scope of Presentation What is i. Tax? Why i. Tax? Component modules of i. Tax Highlights on; PIN registration Portal Tax Returns Bank collections Taxpayer Account/Ledger Other highlights Integrations in i. Tax www. KRA. go. ke 16/03/2018

What is i. Tax? § It is a secure web-enabled application system that provides a fullyintegrated and automated solution for administration of Domestic Taxes. § Internet based registration for PIN, Tax Returns Filing and Payment to allow status inquiries with real-time monitoring of accounts. Status Inquiries Registration Payments Filing www. KRA. go. ke 16/03/2018

What is i. Tax? § It is a secure web-enabled application system that provides a fullyintegrated and automated solution for administration of Domestic Taxes. § Internet based registration for PIN, Tax Returns Filing and Payment to allow status inquiries with real-time monitoring of accounts. Status Inquiries Registration Payments Filing www. KRA. go. ke 16/03/2018

Why i. Tax? The key objectives for introducing i. Tax as a system was to: 1. Simplify tax processes and make it easy for Taxpayers to comply 2. Provide a reliable internet based platform for tax filing for taxpayers 3. Shorten time taken to extract data & information on revenue 4. Reduce time taken by Taxpayers when dealing with KRA 5. Re-engineer business processes for effectiveness & efficiency 6. Enhance the ability of KRA/Taxpayers to account for taxes 7. Reduce the queues at KRA offices www. KRA. go. ke 16/03/2018

Why i. Tax? The key objectives for introducing i. Tax as a system was to: 1. Simplify tax processes and make it easy for Taxpayers to comply 2. Provide a reliable internet based platform for tax filing for taxpayers 3. Shorten time taken to extract data & information on revenue 4. Reduce time taken by Taxpayers when dealing with KRA 5. Re-engineer business processes for effectiveness & efficiency 6. Enhance the ability of KRA/Taxpayers to account for taxes 7. Reduce the queues at KRA offices www. KRA. go. ke 16/03/2018

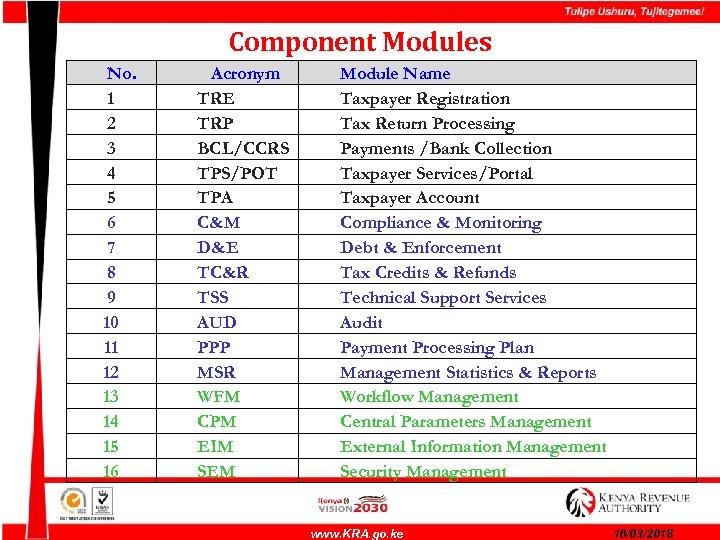

Component Modules No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Acronym TRE TRP BCL/CCRS TPS/POT TPA C&M D&E TC&R TSS AUD PPP MSR WFM CPM EIM SEM Module Name Taxpayer Registration Tax Return Processing Payments /Bank Collection Taxpayer Services/Portal Taxpayer Account Compliance & Monitoring Debt & Enforcement Tax Credits & Refunds Technical Support Services Audit Payment Processing Plan Management Statistics & Reports Workflow Management Central Parameters Management External Information Management Security Management www. KRA. go. ke 16/03/2018

Component Modules No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Acronym TRE TRP BCL/CCRS TPS/POT TPA C&M D&E TC&R TSS AUD PPP MSR WFM CPM EIM SEM Module Name Taxpayer Registration Tax Return Processing Payments /Bank Collection Taxpayer Services/Portal Taxpayer Account Compliance & Monitoring Debt & Enforcement Tax Credits & Refunds Technical Support Services Audit Payment Processing Plan Management Statistics & Reports Workflow Management Central Parameters Management External Information Management Security Management www. KRA. go. ke 16/03/2018

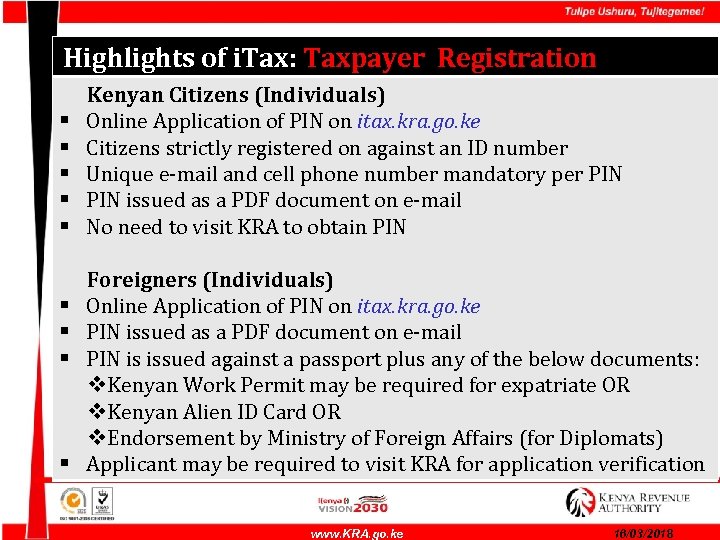

Highlights of i. Tax: Taxpayer Registration § § § § § Kenyan Citizens (Individuals) Online Application of PIN on itax. kra. go. ke Citizens strictly registered on against an ID number Unique e-mail and cell phone number mandatory per PIN issued as a PDF document on e-mail No need to visit KRA to obtain PIN Foreigners (Individuals) Online Application of PIN on itax. kra. go. ke PIN issued as a PDF document on e-mail PIN is issued against a passport plus any of the below documents: v. Kenyan Work Permit may be required for expatriate OR v. Kenyan Alien ID Card OR v. Endorsement by Ministry of Foreign Affairs (for Diplomats) Applicant may be required to visit KRA for application verification www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Taxpayer Registration § § § § § Kenyan Citizens (Individuals) Online Application of PIN on itax. kra. go. ke Citizens strictly registered on against an ID number Unique e-mail and cell phone number mandatory per PIN issued as a PDF document on e-mail No need to visit KRA to obtain PIN Foreigners (Individuals) Online Application of PIN on itax. kra. go. ke PIN issued as a PDF document on e-mail PIN is issued against a passport plus any of the below documents: v. Kenyan Work Permit may be required for expatriate OR v. Kenyan Alien ID Card OR v. Endorsement by Ministry of Foreign Affairs (for Diplomats) Applicant may be required to visit KRA for application verification www. KRA. go. ke 16/03/2018

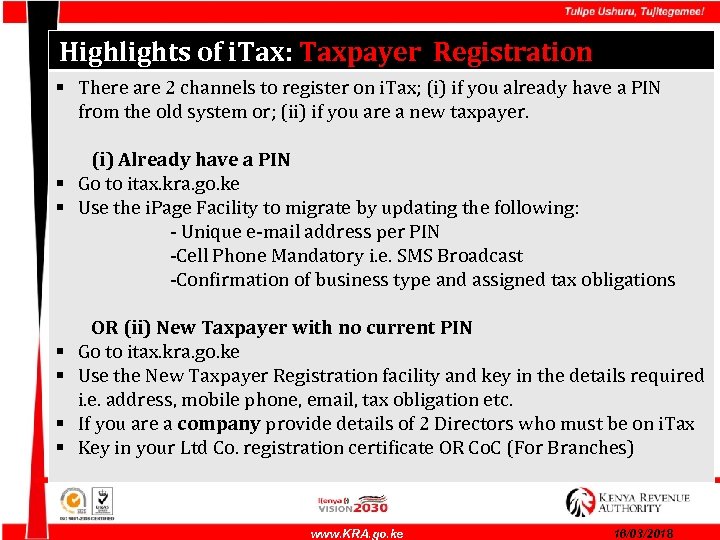

Highlights of i. Tax: Taxpayer Registration § There are 2 channels to register on i. Tax; (i) if you already have a PIN from the old system or; (ii) if you are a new taxpayer. (i) Already have a PIN § Go to itax. kra. go. ke § Use the i. Page Facility to migrate by updating the following: - Unique e-mail address per PIN -Cell Phone Mandatory i. e. SMS Broadcast -Confirmation of business type and assigned tax obligations § § OR (ii) New Taxpayer with no current PIN Go to itax. kra. go. ke Use the New Taxpayer Registration facility and key in the details required i. e. address, mobile phone, email, tax obligation etc. If you are a company provide details of 2 Directors who must be on i. Tax Key in your Ltd Co. registration certificate OR Co. C (For Branches) www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Taxpayer Registration § There are 2 channels to register on i. Tax; (i) if you already have a PIN from the old system or; (ii) if you are a new taxpayer. (i) Already have a PIN § Go to itax. kra. go. ke § Use the i. Page Facility to migrate by updating the following: - Unique e-mail address per PIN -Cell Phone Mandatory i. e. SMS Broadcast -Confirmation of business type and assigned tax obligations § § OR (ii) New Taxpayer with no current PIN Go to itax. kra. go. ke Use the New Taxpayer Registration facility and key in the details required i. e. address, mobile phone, email, tax obligation etc. If you are a company provide details of 2 Directors who must be on i. Tax Key in your Ltd Co. registration certificate OR Co. C (For Branches) www. KRA. go. ke 16/03/2018

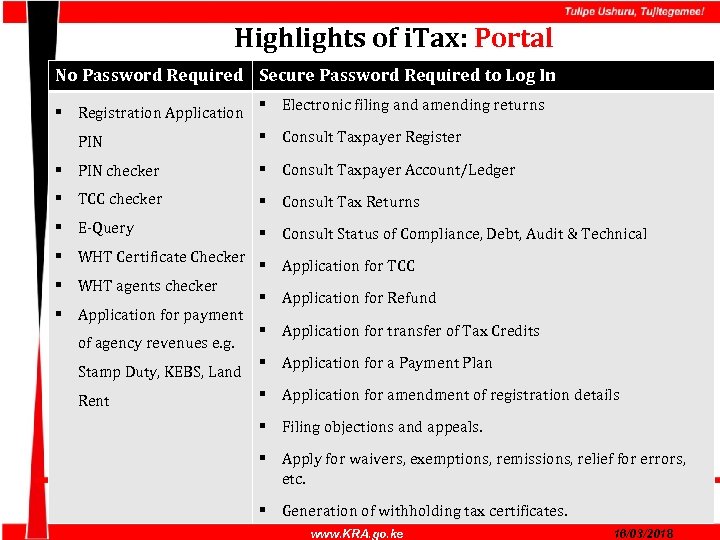

Highlights of i. Tax: Portal No Password Required Secure Password Required to Log In § Registration Application § Electronic filing and amending returns § Consult Taxpayer Register PIN § PIN checker § Consult Taxpayer Account/Ledger § TCC checker § Consult Tax Returns § E-Query § Consult Status of Compliance, Debt, Audit & Technical § WHT Certificate Checker § WHT agents checker § Application for payment of agency revenues e. g. Stamp Duty, KEBS, Land Rent § Application for TCC § Application for Refund § Application for transfer of Tax Credits § Application for a Payment Plan § Application for amendment of registration details § Filing objections and appeals. § Apply for waivers, exemptions, remissions, relief for errors, etc. § Generation of withholding tax certificates. www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Portal No Password Required Secure Password Required to Log In § Registration Application § Electronic filing and amending returns § Consult Taxpayer Register PIN § PIN checker § Consult Taxpayer Account/Ledger § TCC checker § Consult Tax Returns § E-Query § Consult Status of Compliance, Debt, Audit & Technical § WHT Certificate Checker § WHT agents checker § Application for payment of agency revenues e. g. Stamp Duty, KEBS, Land Rent § Application for TCC § Application for Refund § Application for transfer of Tax Credits § Application for a Payment Plan § Application for amendment of registration details § Filing objections and appeals. § Apply for waivers, exemptions, remissions, relief for errors, etc. § Generation of withholding tax certificates. www. KRA. go. ke 16/03/2018

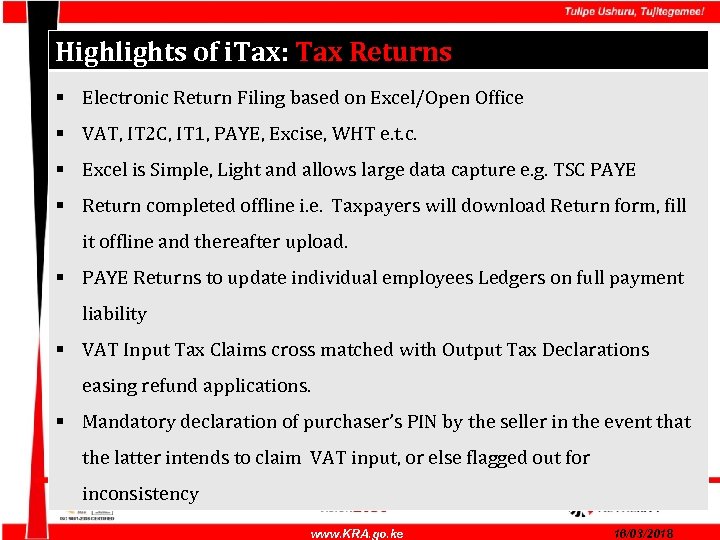

Highlights of i. Tax: Tax Returns § Electronic Return Filing based on Excel/Open Office § VAT, IT 2 C, IT 1, PAYE, Excise, WHT e. t. c. § Excel is Simple, Light and allows large data capture e. g. TSC PAYE § Return completed offline i. e. Taxpayers will download Return form, fill it offline and thereafter upload. § PAYE Returns to update individual employees Ledgers on full payment liability § VAT Input Tax Claims cross matched with Output Tax Declarations easing refund applications. § Mandatory declaration of purchaser’s PIN by the seller in the event that the latter intends to claim VAT input, or else flagged out for inconsistency www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Tax Returns § Electronic Return Filing based on Excel/Open Office § VAT, IT 2 C, IT 1, PAYE, Excise, WHT e. t. c. § Excel is Simple, Light and allows large data capture e. g. TSC PAYE § Return completed offline i. e. Taxpayers will download Return form, fill it offline and thereafter upload. § PAYE Returns to update individual employees Ledgers on full payment liability § VAT Input Tax Claims cross matched with Output Tax Declarations easing refund applications. § Mandatory declaration of purchaser’s PIN by the seller in the event that the latter intends to claim VAT input, or else flagged out for inconsistency www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Tax Returns…cont’d § Uploading of returns can be done by taxpayer, agent, and an officer § Ability to file returns by branches apart from IT 1 and IT 2 C § Liability of one branch can be settled by the other branch § Amendment of returns available on portal § Automatic approval of an amended return where liability increases or reduction in credit. § Upon filing a return on i. Tax, stoppage only on dormancy or deregistration § Non-filing of a return results to an estimated assessment by our compliance officers at stations § Objection to our decision or assessment must be done online and leads to creation of a task to our policy officers § Acceptance of your objection , original return submission www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Tax Returns…cont’d § Uploading of returns can be done by taxpayer, agent, and an officer § Ability to file returns by branches apart from IT 1 and IT 2 C § Liability of one branch can be settled by the other branch § Amendment of returns available on portal § Automatic approval of an amended return where liability increases or reduction in credit. § Upon filing a return on i. Tax, stoppage only on dormancy or deregistration § Non-filing of a return results to an estimated assessment by our compliance officers at stations § Objection to our decision or assessment must be done online and leads to creation of a task to our policy officers § Acceptance of your objection , original return submission www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Bank Collections § 42 Commercial Banks already collecting taxes in i. Tax § Payments made only on presentation of an e-slip (PRN) at these Banks § Payments can be paid through mobile money transfer i. e. Mpesa or Airtel money § Pre Payments of Tax provided for in the system through advance payments § Payments not linked to return filing § Real time update of Ledgers on Payments § Excess payments moved to advance payment account § WHT Certificates issued electronically from i. Tax hence serialised § WHT Certificates issued after making a payment to KRA § WHT Checker Facility available on the Portal www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Bank Collections § 42 Commercial Banks already collecting taxes in i. Tax § Payments made only on presentation of an e-slip (PRN) at these Banks § Payments can be paid through mobile money transfer i. e. Mpesa or Airtel money § Pre Payments of Tax provided for in the system through advance payments § Payments not linked to return filing § Real time update of Ledgers on Payments § Excess payments moved to advance payment account § WHT Certificates issued electronically from i. Tax hence serialised § WHT Certificates issued after making a payment to KRA § WHT Checker Facility available on the Portal www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Taxpayer Account/Ledger § Online Ledger to show your tax records available on i. Tax Ledger updated immediately after every transaction Ledger to be visible to ALL Taxpayers on i. Tax Portal PAYE deductions posted to Employee Ledger entries based on double entry accounting Refund application transfers ones credit from the ledger to a refund payable account hence not utilized till approval § Excess payments automatically offset against outstanding liability (PIPF) § § § www. KRA. go. ke 16/03/2018

Highlights of i. Tax: Taxpayer Account/Ledger § Online Ledger to show your tax records available on i. Tax Ledger updated immediately after every transaction Ledger to be visible to ALL Taxpayers on i. Tax Portal PAYE deductions posted to Employee Ledger entries based on double entry accounting Refund application transfers ones credit from the ledger to a refund payable account hence not utilized till approval § Excess payments automatically offset against outstanding liability (PIPF) § § § www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax § Electronic Application, Approval and Monitoring of Payment plans § Electronic waiver & Write-off applications , processing and Approval § Electronic Application and Issuance of Exemption Certificates § Court and Tribunal’s records maintained in i. Tax. § Investment Deduction Allowances are being monitored and tracked in i. Tax. § Employees to view what employer has deducted as PAYE on their ledger. expected to enhance revenue. www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax § Electronic Application, Approval and Monitoring of Payment plans § Electronic waiver & Write-off applications , processing and Approval § Electronic Application and Issuance of Exemption Certificates § Court and Tribunal’s records maintained in i. Tax. § Investment Deduction Allowances are being monitored and tracked in i. Tax. § Employees to view what employer has deducted as PAYE on their ledger. expected to enhance revenue. www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax…cont’d. 1 § Electronic notices for interview/inspection by our compliance, debt and audit staff viz-a-vis assessment notices § Electronic application and approval/rejection of a Tax Compliance Certificate § MOL officials are able to verify transactions in i. Tax § Expected twinning of SD and CGT § Unified payroll return - Taxpayers can now file a joint PAYE and NSSF return on i. Tax platform. NHIF still under development § County Government revenue collections at pilot stages www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax…cont’d. 1 § Electronic notices for interview/inspection by our compliance, debt and audit staff viz-a-vis assessment notices § Electronic application and approval/rejection of a Tax Compliance Certificate § MOL officials are able to verify transactions in i. Tax § Expected twinning of SD and CGT § Unified payroll return - Taxpayers can now file a joint PAYE and NSSF return on i. Tax platform. NHIF still under development § County Government revenue collections at pilot stages www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax…cont’d. 2 § L. N. No. 60 of 2012 introduced Tax Agent Committee to vet and regulate tax gents § Very independent consisting of various stakeholders ; ICPAK with KRA providing secretarial duties only. § ICPAK, LSK, Former KRA officers and any other qualification prescribed by the Commissioner § Application through either ones professional body or to TAC with the later exempted from interview § TAC must ratify before registration to i. Tax is done § Tax Agent certificate to be issued through i. Tax system. www. KRA. go. ke 16/03/2018

Other Highlights of i. Tax…cont’d. 2 § L. N. No. 60 of 2012 introduced Tax Agent Committee to vet and regulate tax gents § Very independent consisting of various stakeholders ; ICPAK with KRA providing secretarial duties only. § ICPAK, LSK, Former KRA officers and any other qualification prescribed by the Commissioner § Application through either ones professional body or to TAC with the later exempted from interview § TAC must ratify before registration to i. Tax is done § Tax Agent certificate to be issued through i. Tax system. www. KRA. go. ke 16/03/2018

Integrations to i. Tax § IFMIS – Integrated Financial Management Information System Suppliers transacting with National & County Governments and their agents § TIMS – Tax Invoice Management System Relaying of tax invoices to KRA servers on real time basis Intended benefit: to simplify return filing via auto population of VAT return ICMS – Integrated Customs Management System Validation of exports and imports Speeding up of refund processing www. KRA. go. ke 16/03/2018

Integrations to i. Tax § IFMIS – Integrated Financial Management Information System Suppliers transacting with National & County Governments and their agents § TIMS – Tax Invoice Management System Relaying of tax invoices to KRA servers on real time basis Intended benefit: to simplify return filing via auto population of VAT return ICMS – Integrated Customs Management System Validation of exports and imports Speeding up of refund processing www. KRA. go. ke 16/03/2018

Integrations to i. Tax…cont’d § EPROMIS – Enterprise Project Management Information System Donor Aid Funded and all Government projects that qualify for remissions and exemptions IPMIS – Integrated Protocol Management Information System Foreign/diplomats on blanket VAT remissions § TIMS (NTSA) – Transport Information Management System Advance tax payments and motor vehicle inspection § EGMS –Excisable Goods Management System - Licensed manufactures and registered importers of excisable goods - Production accounting, track and trace of excisable goods. - Soma label available on Google play store www. KRA. go. ke 16/03/2018

Integrations to i. Tax…cont’d § EPROMIS – Enterprise Project Management Information System Donor Aid Funded and all Government projects that qualify for remissions and exemptions IPMIS – Integrated Protocol Management Information System Foreign/diplomats on blanket VAT remissions § TIMS (NTSA) – Transport Information Management System Advance tax payments and motor vehicle inspection § EGMS –Excisable Goods Management System - Licensed manufactures and registered importers of excisable goods - Production accounting, track and trace of excisable goods. - Soma label available on Google play store www. KRA. go. ke 16/03/2018

THANK YOU THE END COMMENTS AND QUESTIONS S: BCL (Payments/Bank Collections) www. KRA. go. ke 16/03/2018

THANK YOU THE END COMMENTS AND QUESTIONS S: BCL (Payments/Bank Collections) www. KRA. go. ke 16/03/2018