600bafa8df07740f2f881f6ec7c15ca7.ppt

- Количество слайдов: 38

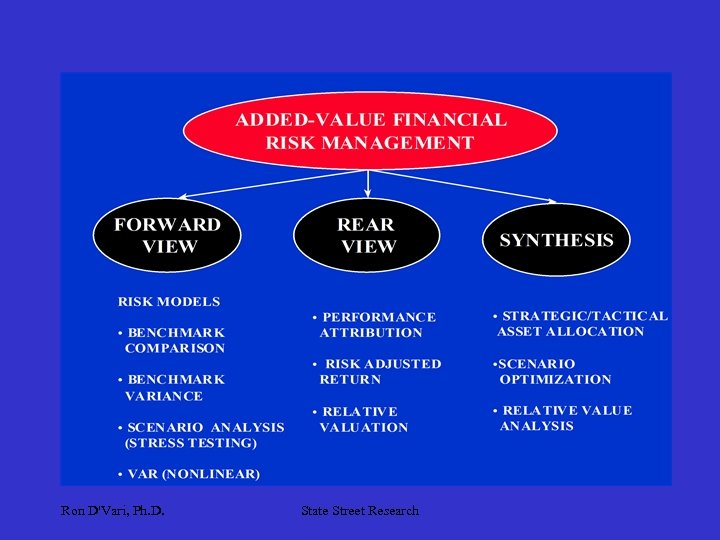

INTEGRATED MULTI-FACTOR RISK MANAGEMENT AND PERFORMANCE ATTRIBUTION Ron D’Vari, Ph. D. Vice President, Fixed Income State Street Research & Management Visiting Lecturer, Boston University Presented At Risk ‘ 97 Seminar June 4, 1997, Chicago, IL Ron D'Vari, Ph. D. State Street Research

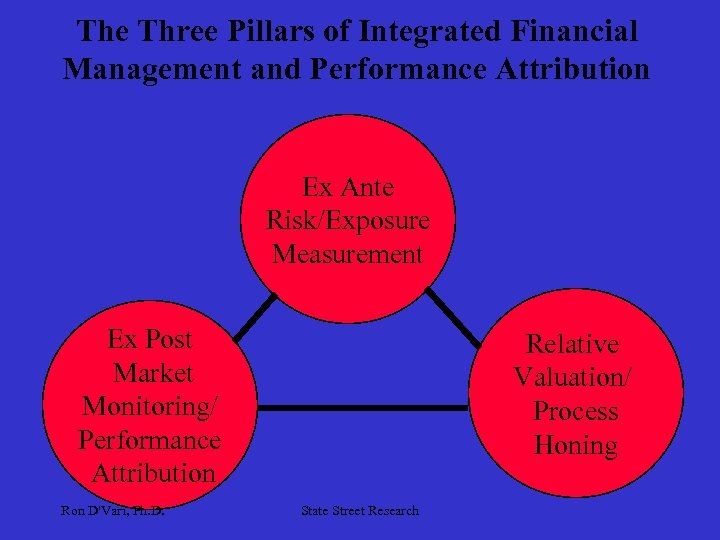

The Three Pillars of Integrated Financial Management and Performance Attribution Ex Ante Risk/Exposure Measurement Ex Post Market Monitoring/ Performance Attribution Ron D'Vari, Ph. D. Relative Valuation/ Process Honing State Street Research

Ron D'Vari, Ph. D. State Street Research

Ex-Post Market Move Monitoring and Decomposition u Factor Move Estimation and Monitoring Factor Return Attribution Consistent with Risk Measurement u Feedback Into The Investment Process u Relative Valuation u Investment Process Honing u Benchmark Setting/Improvement u Guideline/Mandate Improvements u Strategic Asset Allocation u Tactical Asset Allocation u Overlay Risk Hedges Ron D'Vari, Ph. D. State Street Research

Elementary Risk Models Ron D'Vari, Ph. D. State Street Research

Multi-Factor Risk Models Ron D'Vari, Ph. D. State Street Research

Traditional Approaches · Decoupled Macro (overall plan) vs. Micro (Portfolio) þ Macro: Highest risk-adjusted return via asset allocation þ Micro: Focus on highest return but often ignore incremental risk (stock picking) · No Integrated Risk Management · Static Approach Using Forecast Returns þ Relies on historical volatilities and correlations þ Neglects short horizon risk þ Ignores risk premium fluctuations · Ron D'Vari, Ph. D. Does not take advantage of short term mispricing State Street Research

State-of-the-Art Approach · Breaks up risk to its lowest common denominator · Integrates risk management into active management strategies · Use forward-looking view of volatility and correlations · Dynamic Approach þForecast both expected returns and volatility þFocus on forecast risk-adjusted returns þConsiders environment where expected returns are constant but volatility might have risen · Portfolio risk/return characteristics vs. Benchmark Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

FIXED-INCOME INTEGRATED MULTI-FACTOR RISK MANAGEMENT Ron D'Vari, Ph. D. State Street Research

MARKET Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

VOLATILITY • Volatility Risk þ Volatility Sensitivity • Prepayment and Call Risk Function of Interest Rates and Volatility þ Can be measured and managed by Prepayment Elasticities and Convexity þ Ron D'Vari, Ph. D. State Street Research 17

CREDIT • Default Spread þ Measured and Managed by Effective Spread Duration (Sprdur) þ OTHERS • Currency, Liquidity, Model, Operational, Counterparty, etc. Ron D'Vari, Ph. D. State Street Research 18

FACTORS Ron D'Vari, Ph. D. State Street Research

Ron D'Vari, Ph. D. State Street Research

FIXED-INCOME ANALYTIC Ron D'Vari, Ph. D. State Street Research

FIXED-INCOME ANALYTIC, cont. Ron D'Vari, Ph. D. State Street Research

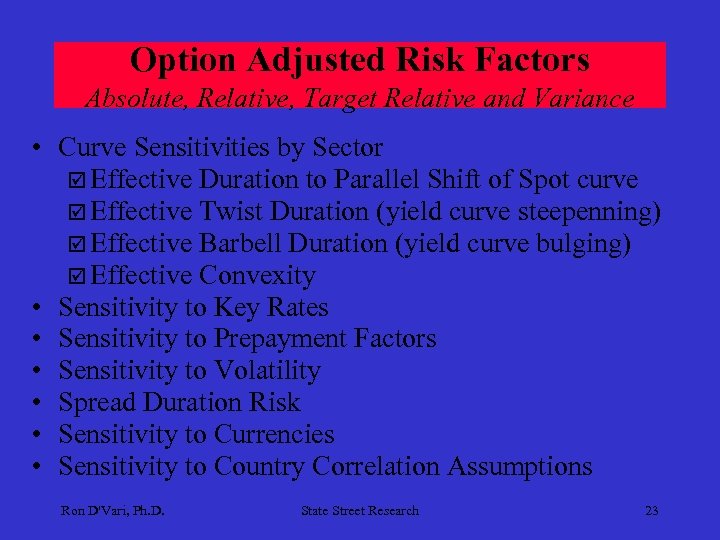

Option Adjusted Risk Factors Absolute, Relative, Target Relative and Variance • Curve Sensitivities by Sector þ Effective Duration to Parallel Shift of Spot curve þ Effective Twist Duration (yield curve steepenning) þ Effective Barbell Duration (yield curve bulging) þ Effective Convexity • Sensitivity to Key Rates • Sensitivity to Prepayment Factors • Sensitivity to Volatility • Spread Duration Risk • Sensitivity to Currencies • Sensitivity to Country Correlation Assumptions Ron D'Vari, Ph. D. State Street Research 23

Ron D'Vari, Ph. D. State Street Research

RECOMMENDED DAILY REPORTS • Relative Curve Exposures, Yield, OAS, Convexity • Absolute Curve Exposures • Absolute and Relative Sector Exposures þ % Invested and Duration Contribution • Duration Bucket Exposure • Full-Valuation Scenario Returns by Sector þ Absolute and Relative þ Factor Returns Ron D'Vari, Ph. D. State Street Research 25

Ron D'Vari, Ph. D. State Street Research

FIXED-INCOME PERFORMANCE ATTRIBUTIONS Two Approaches: • Periodic Performance Attribution þ þ For selected accounts with special benchmarks Division to sub-periods (portfolio & benchmark) • Portfolio action • Market moves • Cash Flows • Daily Performance Attribution þ For all portfolios and composites Ron D'Vari, Ph. D. State Street Research 27

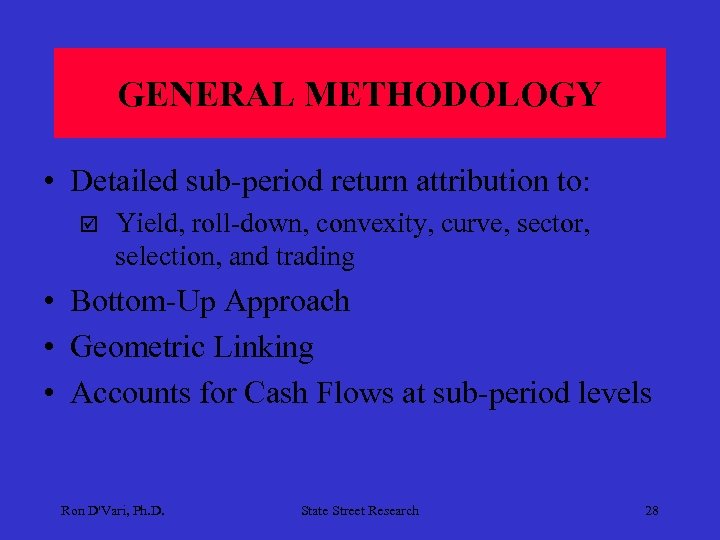

GENERAL METHODOLOGY • Detailed sub-period return attribution to: þ Yield, roll-down, convexity, curve, sector, selection, and trading • Bottom-Up Approach • Geometric Linking • Accounts for Cash Flows at sub-period levels Ron D'Vari, Ph. D. State Street Research 28

Ron D'Vari, Ph. D. State Street Research

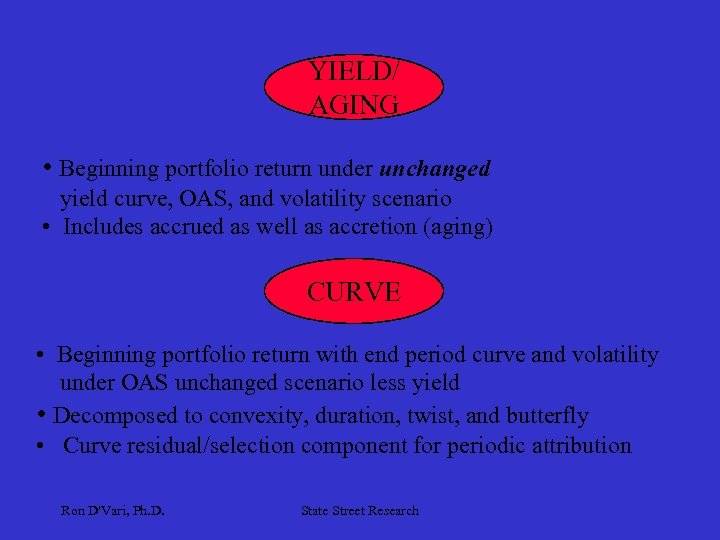

YIELD/ AGING • Beginning portfolio return under unchanged yield curve, OAS, and volatility scenario • Includes accrued as well as accretion (aging) CURVE • Beginning portfolio return with end period curve and volatility under OAS unchanged scenario less yield • Decomposed to convexity, duration, twist, and butterfly • Curve residual/selection component for periodic attribution Ron D'Vari, Ph. D. State Street Research

![NONCURVE (OAS+VOL) • Beginning Portfolio’s Buy-and-hold Total Return Minus [(Yield+Aging)+Curve Returns] • Attributed to NONCURVE (OAS+VOL) • Beginning Portfolio’s Buy-and-hold Total Return Minus [(Yield+Aging)+Curve Returns] • Attributed to](https://present5.com/presentation/600bafa8df07740f2f881f6ec7c15ca7/image-31.jpg)

NONCURVE (OAS+VOL) • Beginning Portfolio’s Buy-and-hold Total Return Minus [(Yield+Aging)+Curve Returns] • Attributed to • Credit • Sector factor move (OAS) • Security specific OAS move • Selection/Residual Ron D'Vari, Ph. D. State Street Research

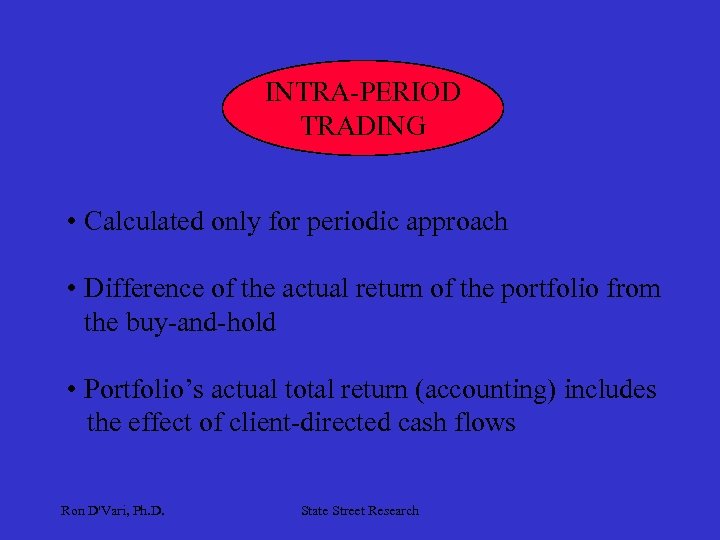

INTRA-PERIOD TRADING • Calculated only for periodic approach • Difference of the actual return of the portfolio from the buy-and-hold • Portfolio’s actual total return (accounting) includes the effect of client-directed cash flows Ron D'Vari, Ph. D. State Street Research

SECURITY RETURN DECOMPOSITION Where: Ron D'Vari, Ph. D. State Street Research 33

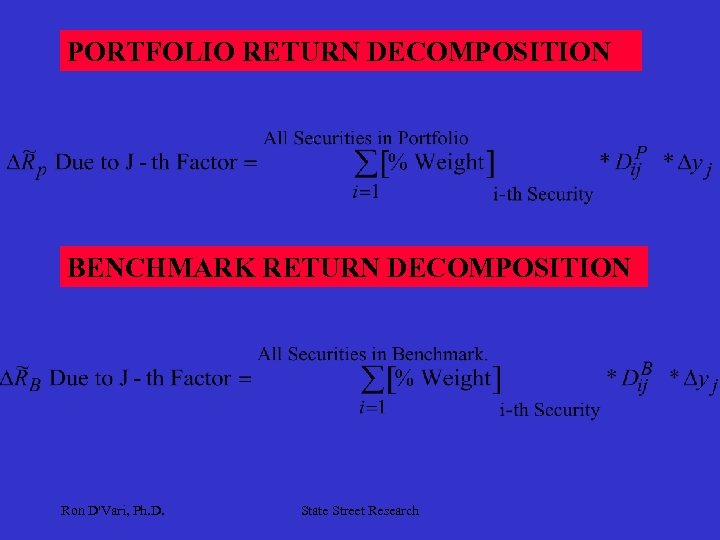

PORTFOLIO RETURN DECOMPOSITION BENCHMARK RETURN DECOMPOSITION Ron D'Vari, Ph. D. State Street Research

PERFORMANCE ATTRIBUTION PITFALLS · Plain bad pricing · Non-contemporaneous pricing þ Benchmark and Portfolio þ Sectors þ Curve calculation · Coarse generic pricing þ Insensitive to sector specific factors, e. g. þ WAM, WAC, seasoning, age, volatility Ron D'Vari, Ph. D. State Street Research 35

PERFORMANCE ATTRIBUTION PITFALLS, cont. · · Inaccurate Analytic Tools þMortgages and Asset-Backed Securities Client-directed actions & cash flows that affect performance Over Linking and Cross Factor Returns Benchmark Changes and Inaccuracies þSponsor initiated changes þBenchmark pricing þForward benchmark vs. Backward benchmark þExclusion/Inclusion of new asset classes Ron D'Vari, Ph. D. State Street Research 36

CONCLUSIONS • Comprehensive Multi-Factor Model þIntuitive Factors þHigh Fidelity Yield Curve Sensitivity Model þDetailed Sector/Benchmark Comparison Analysis (BCA) þScenario Analysis (SA) and Optimization (SO) • Uniform Measurement of Risk and Implementation of Market Views þAcross Hundreds of Portfolios with Different Benchmarks and Investment Objectives þConsistent Reporting Ron D'Vari, Ph. D. State Street Research 37

CONCLUSIONS (Cont’D) • Other Benefits þPerformance Attribution • Multi-factor • Accurate • Consistent with Risk Model þQuantitative Security and Sector Valuation Framework • Multi-factor valuation • Accurate • Consistent with risk and performance attribution models Ron D'Vari, Ph. D. State Street Research

600bafa8df07740f2f881f6ec7c15ca7.ppt