20fffce7f122b517d30acdc4f6f5b944.ppt

- Количество слайдов: 24

INTEGRATED DISEASE SURVEILLANCE PROJECT (IDSP) An overview of Manual on Financial Management

INTEGRATED DISEASE SURVEILLANCE PROJECT (IDSP) An overview of Manual on Financial Management

FINANCIAL MANAGEMENT • PLANNING AND BUDGETING • FLOW OF FUNDS • FINANCIAL AND ACCOUNTING POLICIES • ACCOUNTING SYSYTEM & INTERNAL CONTROL • FINANCIAL REPORTING SYSYTEM • AUDITING ARRANGEMENTS

FINANCIAL MANAGEMENT • PLANNING AND BUDGETING • FLOW OF FUNDS • FINANCIAL AND ACCOUNTING POLICIES • ACCOUNTING SYSYTEM & INTERNAL CONTROL • FINANCIAL REPORTING SYSYTEM • AUDITING ARRANGEMENTS

BUDGETING • BUDGETS TO BE PREPARED BY CSU, SSU AND DSU. FORMATS GIVEN IN ANNEXURE–III /FIN. MANUAL. • BUDGET PERIOD: ANNUAL (APRIL TO MARCH) • ALL DSUs SHALL PREPARE THEIR ANNUAL BUDGETS BASED ON PIP AND SUBMIT THEM TO SSU. • SSU SHALL REVIEW AND CONSOLIDATE THEM ALONG WITH ITS OWN BUDGET FOR SUBMISSION. • BUDGET PROPOSALS FOR NEXT FINANCIAL YEAR BE RECEIVED AT CSU FROM SSU BY THE END OF AUGUST EVERY YEAR.

BUDGETING • BUDGETS TO BE PREPARED BY CSU, SSU AND DSU. FORMATS GIVEN IN ANNEXURE–III /FIN. MANUAL. • BUDGET PERIOD: ANNUAL (APRIL TO MARCH) • ALL DSUs SHALL PREPARE THEIR ANNUAL BUDGETS BASED ON PIP AND SUBMIT THEM TO SSU. • SSU SHALL REVIEW AND CONSOLIDATE THEM ALONG WITH ITS OWN BUDGET FOR SUBMISSION. • BUDGET PROPOSALS FOR NEXT FINANCIAL YEAR BE RECEIVED AT CSU FROM SSU BY THE END OF AUGUST EVERY YEAR.

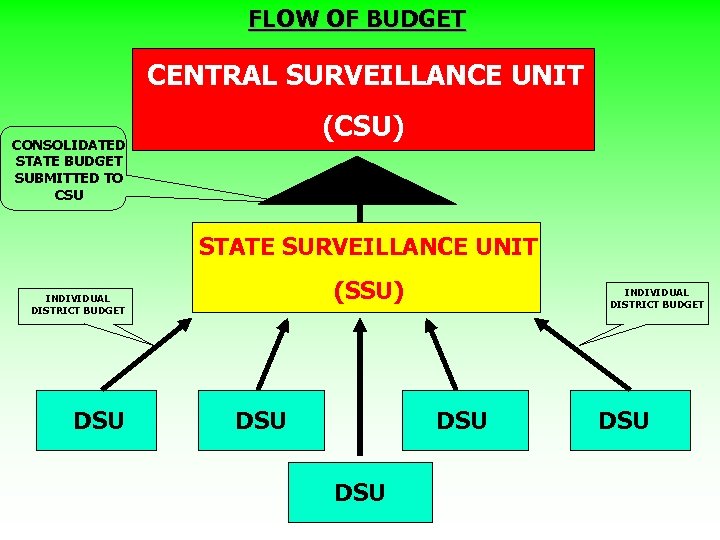

FLOW OF BUDGET CENTRAL SURVEILLANCE UNIT (CSU) CONSOLIDATED STATE BUDGET SUBMITTED TO CSU STATE SURVEILLANCE UNIT (SSU) INDIVIDUAL DISTRICT BUDGET DSU DSU DSU

FLOW OF BUDGET CENTRAL SURVEILLANCE UNIT (CSU) CONSOLIDATED STATE BUDGET SUBMITTED TO CSU STATE SURVEILLANCE UNIT (SSU) INDIVIDUAL DISTRICT BUDGET DSU DSU DSU

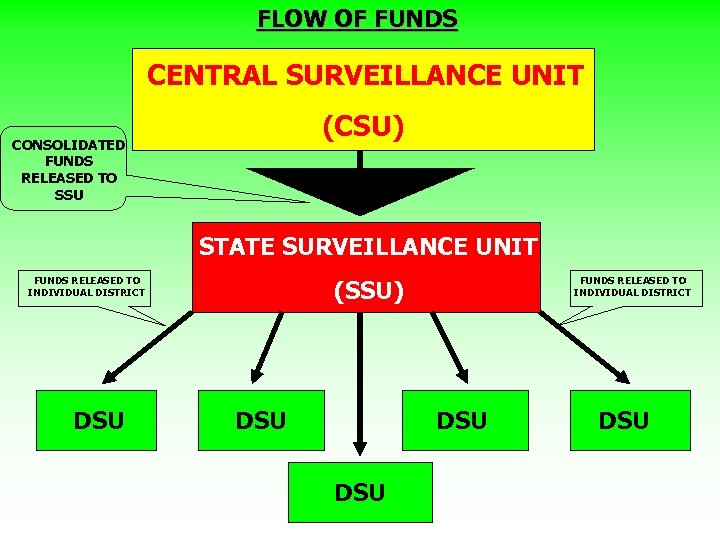

FLOW OF FUNDS CENTRAL SURVEILLANCE UNIT (CSU) CONSOLIDATED FUNDS RELEASED TO SSU STATE SURVEILLANCE UNIT FUNDS RELEASED TO INDIVIDUAL DISTRICT DSU FUNDS RELEASED TO INDIVIDUAL DISTRICT (SSU) DSU DSU

FLOW OF FUNDS CENTRAL SURVEILLANCE UNIT (CSU) CONSOLIDATED FUNDS RELEASED TO SSU STATE SURVEILLANCE UNIT FUNDS RELEASED TO INDIVIDUAL DISTRICT DSU FUNDS RELEASED TO INDIVIDUAL DISTRICT (SSU) DSU DSU

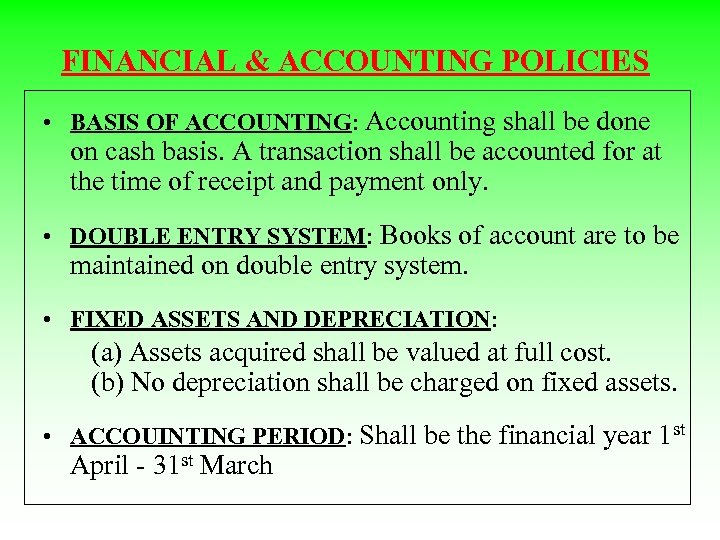

FINANCIAL & ACCOUNTING POLICIES • BASIS OF ACCOUNTING: Accounting shall be done on cash basis. A transaction shall be accounted for at the time of receipt and payment only. • DOUBLE ENTRY SYSTEM: Books of account are to be maintained on double entry system. • FIXED ASSETS AND DEPRECIATION: (a) Assets acquired shall be valued at full cost. (b) No depreciation shall be charged on fixed assets. • ACCOUINTING PERIOD: Shall be the financial year 1 st April - 31 st March

FINANCIAL & ACCOUNTING POLICIES • BASIS OF ACCOUNTING: Accounting shall be done on cash basis. A transaction shall be accounted for at the time of receipt and payment only. • DOUBLE ENTRY SYSTEM: Books of account are to be maintained on double entry system. • FIXED ASSETS AND DEPRECIATION: (a) Assets acquired shall be valued at full cost. (b) No depreciation shall be charged on fixed assets. • ACCOUINTING PERIOD: Shall be the financial year 1 st April - 31 st March

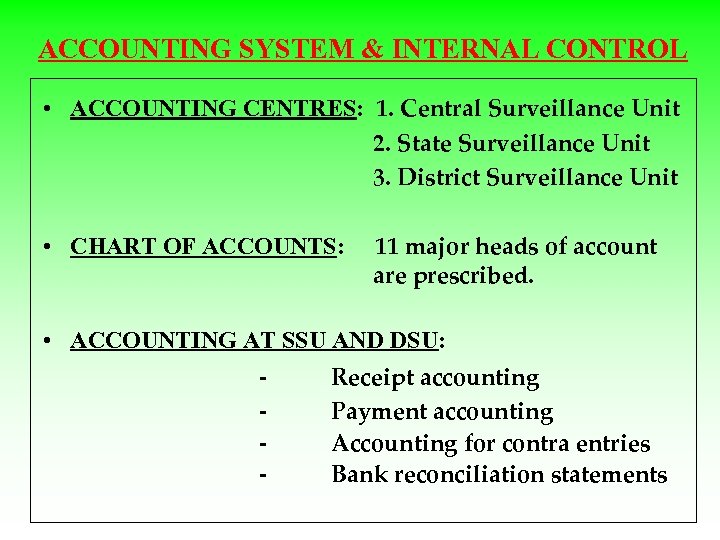

ACCOUNTING SYSTEM & INTERNAL CONTROL • ACCOUNTING CENTRES: 1. Central Surveillance Unit 2. State Surveillance Unit 3. District Surveillance Unit • CHART OF ACCOUNTS: 11 major heads of account are prescribed. • ACCOUNTING AT SSU AND DSU: - Receipt accounting Payment accounting Accounting for contra entries Bank reconciliation statements

ACCOUNTING SYSTEM & INTERNAL CONTROL • ACCOUNTING CENTRES: 1. Central Surveillance Unit 2. State Surveillance Unit 3. District Surveillance Unit • CHART OF ACCOUNTS: 11 major heads of account are prescribed. • ACCOUNTING AT SSU AND DSU: - Receipt accounting Payment accounting Accounting for contra entries Bank reconciliation statements

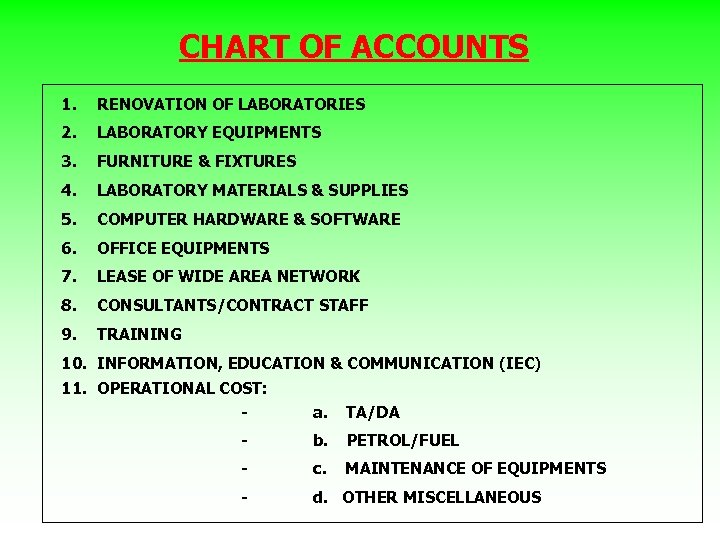

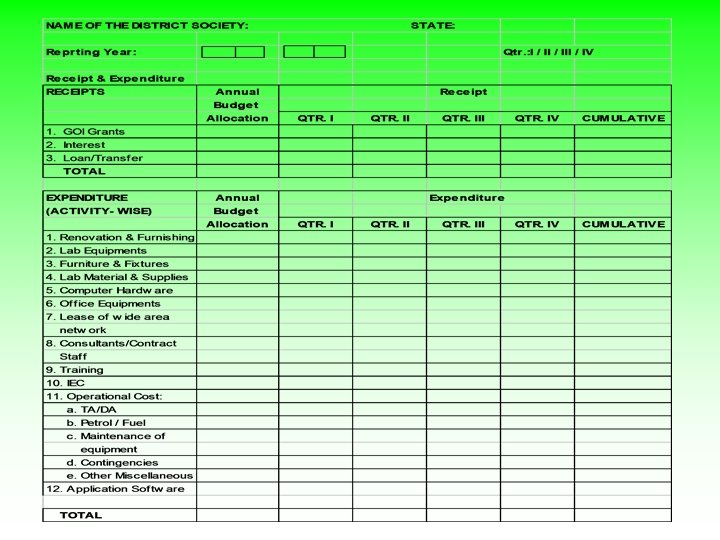

CHART OF ACCOUNTS 1. RENOVATION OF LABORATORIES 2. LABORATORY EQUIPMENTS 3. FURNITURE & FIXTURES 4. LABORATORY MATERIALS & SUPPLIES 5. COMPUTER HARDWARE & SOFTWARE 6. OFFICE EQUIPMENTS 7. LEASE OF WIDE AREA NETWORK 8. CONSULTANTS/CONTRACT STAFF 9. TRAINING 10. INFORMATION, EDUCATION & COMMUNICATION (IEC) 11. OPERATIONAL COST: - a. TA/DA - b. PETROL/FUEL - c. MAINTENANCE OF EQUIPMENTS - d. OTHER MISCELLANEOUS

CHART OF ACCOUNTS 1. RENOVATION OF LABORATORIES 2. LABORATORY EQUIPMENTS 3. FURNITURE & FIXTURES 4. LABORATORY MATERIALS & SUPPLIES 5. COMPUTER HARDWARE & SOFTWARE 6. OFFICE EQUIPMENTS 7. LEASE OF WIDE AREA NETWORK 8. CONSULTANTS/CONTRACT STAFF 9. TRAINING 10. INFORMATION, EDUCATION & COMMUNICATION (IEC) 11. OPERATIONAL COST: - a. TA/DA - b. PETROL/FUEL - c. MAINTENANCE OF EQUIPMENTS - d. OTHER MISCELLANEOUS

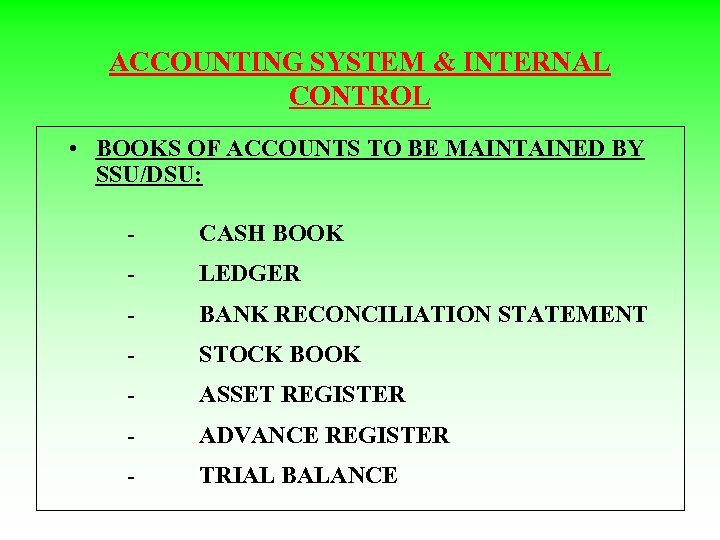

ACCOUNTING SYSTEM & INTERNAL CONTROL • BOOKS OF ACCOUNTS TO BE MAINTAINED BY SSU/DSU: - CASH BOOK - LEDGER - BANK RECONCILIATION STATEMENT - STOCK BOOK - ASSET REGISTER - ADVANCE REGISTER - TRIAL BALANCE

ACCOUNTING SYSTEM & INTERNAL CONTROL • BOOKS OF ACCOUNTS TO BE MAINTAINED BY SSU/DSU: - CASH BOOK - LEDGER - BANK RECONCILIATION STATEMENT - STOCK BOOK - ASSET REGISTER - ADVANCE REGISTER - TRIAL BALANCE

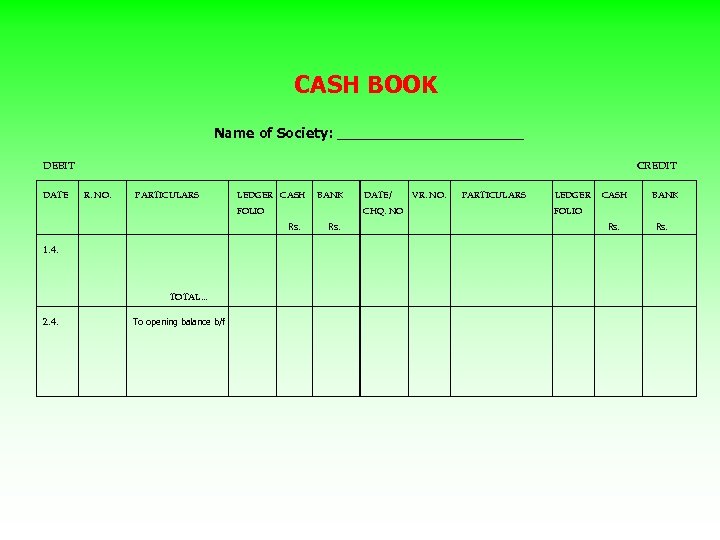

CASH BOOK Name of Society: ___________ DEBIT DATE CREDIT R. NO. PARTICULARS LEDGER CASH BANK FOLIO CHQ. NO Rs. 1. 4. TOTAL. . . 2. 4. To opening balance b/f DATE/ Rs. VR. NO. PARTICULARS LEDGER CASH BANK FOLIO Rs.

CASH BOOK Name of Society: ___________ DEBIT DATE CREDIT R. NO. PARTICULARS LEDGER CASH BANK FOLIO CHQ. NO Rs. 1. 4. TOTAL. . . 2. 4. To opening balance b/f DATE/ Rs. VR. NO. PARTICULARS LEDGER CASH BANK FOLIO Rs.

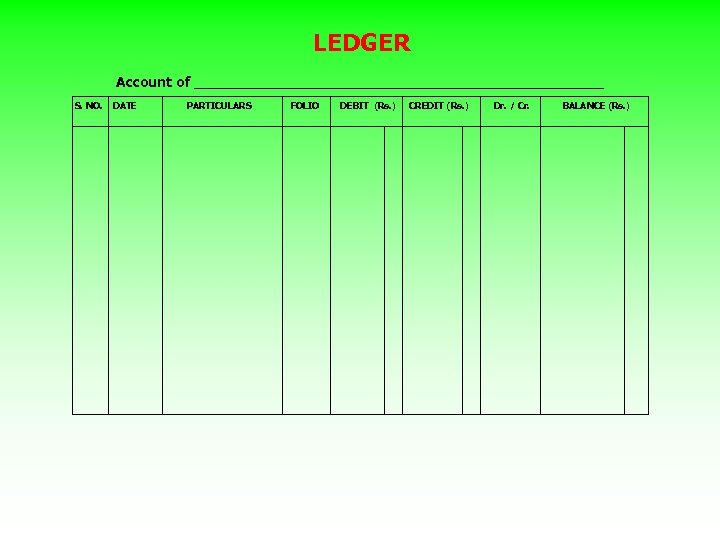

LEDGER Account of _______________________ S. NO. DATE PARTICULARS FOLIO DEBIT (Rs. ) CREDIT (Rs. ) Dr. / Cr. BALANCE (Rs. )

LEDGER Account of _______________________ S. NO. DATE PARTICULARS FOLIO DEBIT (Rs. ) CREDIT (Rs. ) Dr. / Cr. BALANCE (Rs. )

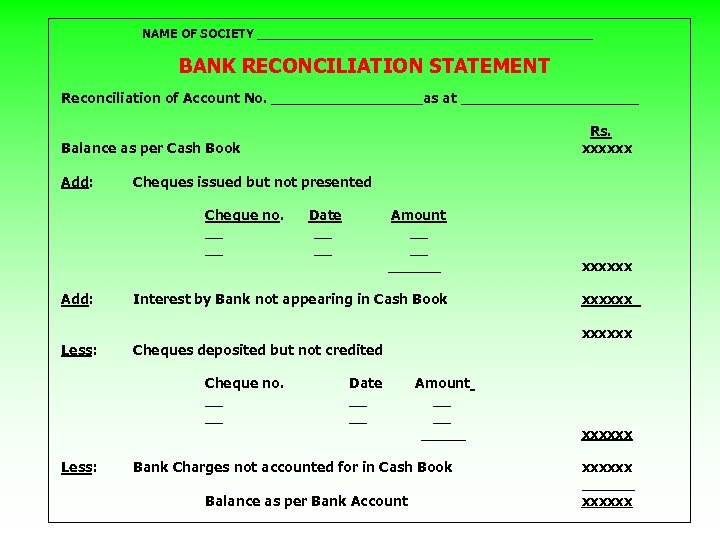

NAME OF SOCIETY ______________________ BANK RECONCILIATION STATEMENT Reconciliation of Account No. _________as at __________ Rs. xxxxxx Balance as per Cash Book Add: Cheques issued but not presented Cheque no. __ __ Add: Less: Amount __ __ ______ xxxxxx Interest by Bank not appearing in Cash Book xxxxxx Cheques deposited but not credited Cheque no. __ __ Less: Date __ __ Amount __ __ _____ Bank Charges not accounted for in Cash Book Balance as per Bank Account xxxxxx ______ xxxxxx

NAME OF SOCIETY ______________________ BANK RECONCILIATION STATEMENT Reconciliation of Account No. _________as at __________ Rs. xxxxxx Balance as per Cash Book Add: Cheques issued but not presented Cheque no. __ __ Add: Less: Amount __ __ ______ xxxxxx Interest by Bank not appearing in Cash Book xxxxxx Cheques deposited but not credited Cheque no. __ __ Less: Date __ __ Amount __ __ _____ Bank Charges not accounted for in Cash Book Balance as per Bank Account xxxxxx ______ xxxxxx

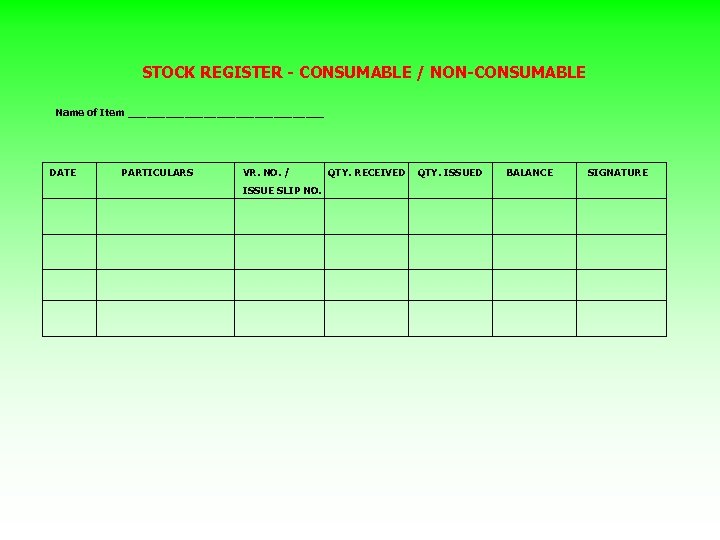

STOCK REGISTER - CONSUMABLE / NON-CONSUMABLE Name of Item ________________ DATE PARTICULARS VR. NO. / ISSUE SLIP NO. QTY. RECEIVED QTY. ISSUED BALANCE SIGNATURE

STOCK REGISTER - CONSUMABLE / NON-CONSUMABLE Name of Item ________________ DATE PARTICULARS VR. NO. / ISSUE SLIP NO. QTY. RECEIVED QTY. ISSUED BALANCE SIGNATURE

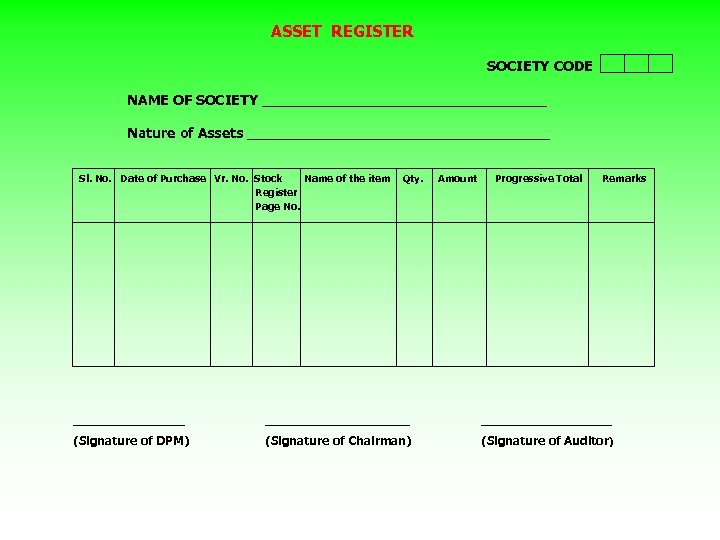

ASSET REGISTER SOCIETY CODE NAME OF SOCIETY ________________ Nature of Assets _________________ Sl. No. Date of Purchase Vr. No. Stock Name of the item Register Page No. Qty. Amount Progressive Total Remarks ______________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

ASSET REGISTER SOCIETY CODE NAME OF SOCIETY ________________ Nature of Assets _________________ Sl. No. Date of Purchase Vr. No. Stock Name of the item Register Page No. Qty. Amount Progressive Total Remarks ______________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

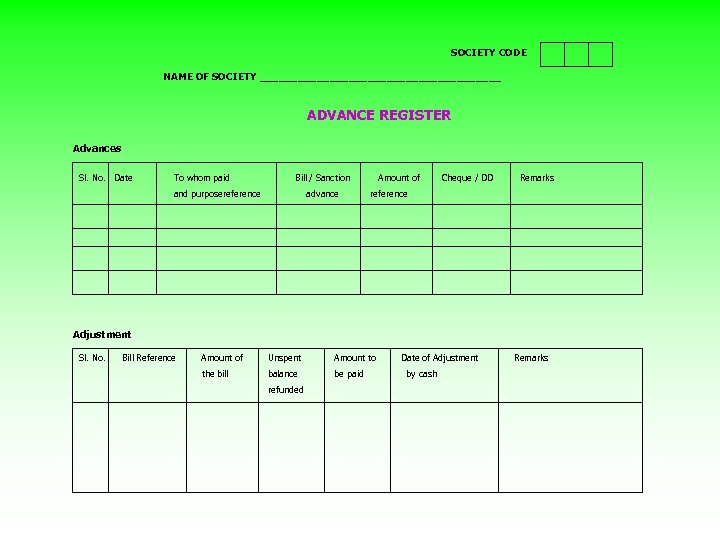

SOCIETY CODE NAME OF SOCIETY ___________________ ADVANCE REGISTER Advances Sl. No. Date To whom paid Bill / Sanction and purposereference advance Amount of Cheque / DD Remarks reference Adjustment Sl. No. Bill Reference Amount of Unspent Amount to the bill balance be paid refunded Date of Adjustment by cash Remarks

SOCIETY CODE NAME OF SOCIETY ___________________ ADVANCE REGISTER Advances Sl. No. Date To whom paid Bill / Sanction and purposereference advance Amount of Cheque / DD Remarks reference Adjustment Sl. No. Bill Reference Amount of Unspent Amount to the bill balance be paid refunded Date of Adjustment by cash Remarks

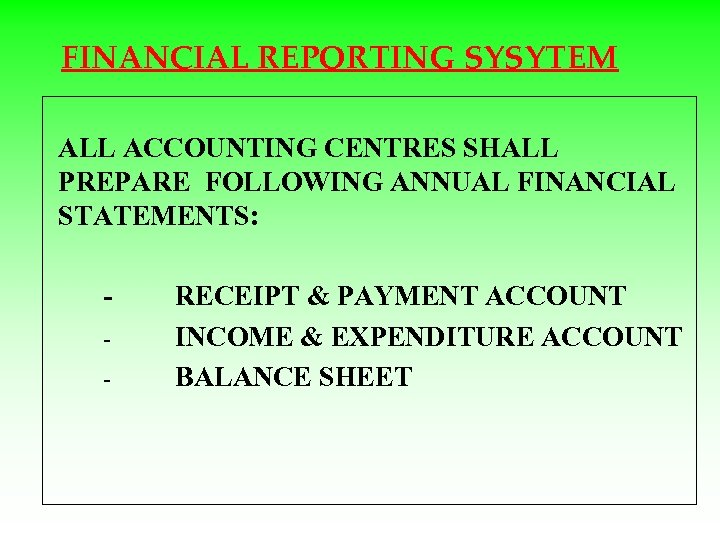

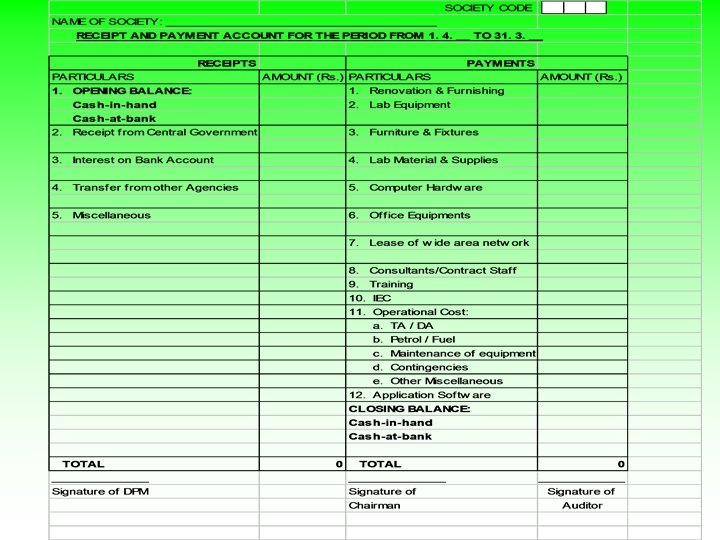

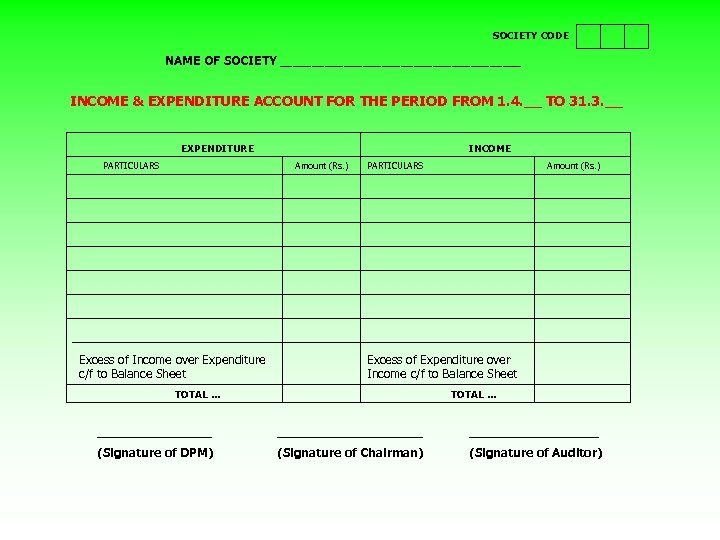

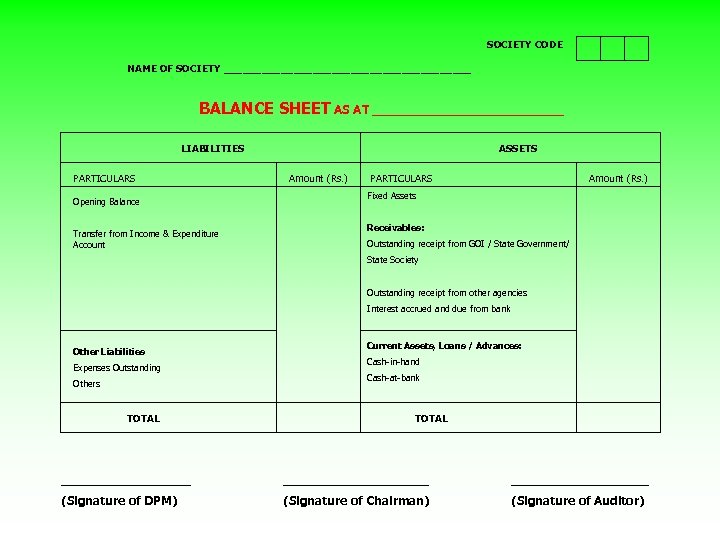

FINANCIAL REPORTING SYSYTEM ALL ACCOUNTING CENTRES SHALL PREPARE FOLLOWING ANNUAL FINANCIAL STATEMENTS: - RECEIPT & PAYMENT ACCOUNT INCOME & EXPENDITURE ACCOUNT BALANCE SHEET

FINANCIAL REPORTING SYSYTEM ALL ACCOUNTING CENTRES SHALL PREPARE FOLLOWING ANNUAL FINANCIAL STATEMENTS: - RECEIPT & PAYMENT ACCOUNT INCOME & EXPENDITURE ACCOUNT BALANCE SHEET

SOCIETY CODE NAME OF SOCIETY ___________________ INCOME & EXPENDITURE ACCOUNT FOR THE PERIOD FROM 1. 4. __ TO 31. 3. __ EXPENDITURE PARTICULARS INCOME Amount (Rs. ) Excess of Income over Expenditure c/f to Balance Sheet PARTICULARS Amount (Rs. ) Excess of Expenditure over Income c/f to Balance Sheet TOTAL. . . ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

SOCIETY CODE NAME OF SOCIETY ___________________ INCOME & EXPENDITURE ACCOUNT FOR THE PERIOD FROM 1. 4. __ TO 31. 3. __ EXPENDITURE PARTICULARS INCOME Amount (Rs. ) Excess of Income over Expenditure c/f to Balance Sheet PARTICULARS Amount (Rs. ) Excess of Expenditure over Income c/f to Balance Sheet TOTAL. . . ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

SOCIETY CODE NAME OF SOCIETY ____________________ BALANCE SHEET AS AT _____________ LIABILITIES PARTICULARS Opening Balance Transfer from Income & Expenditure Account ASSETS Amount (Rs. ) PARTICULARS Amount (Rs. ) Fixed Assets Receivables: Outstanding receipt from GOI / State Government/ State Society Outstanding receipt from other agencies Interest accrued and due from bank Other Liabilities Expenses Outstanding Others TOTAL Current Assets, Loans / Advances: Cash-in-hand Cash-at-bank TOTAL ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

SOCIETY CODE NAME OF SOCIETY ____________________ BALANCE SHEET AS AT _____________ LIABILITIES PARTICULARS Opening Balance Transfer from Income & Expenditure Account ASSETS Amount (Rs. ) PARTICULARS Amount (Rs. ) Fixed Assets Receivables: Outstanding receipt from GOI / State Government/ State Society Outstanding receipt from other agencies Interest accrued and due from bank Other Liabilities Expenses Outstanding Others TOTAL Current Assets, Loans / Advances: Cash-in-hand Cash-at-bank TOTAL ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

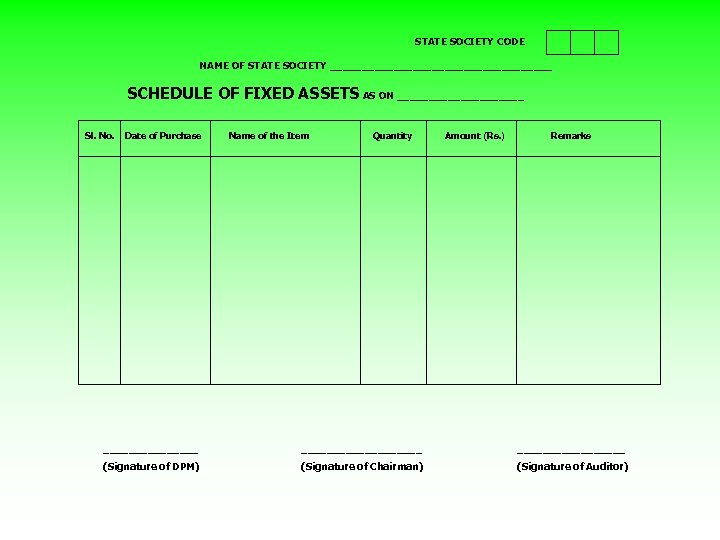

STATE SOCIETY CODE NAME OF STATE SOCIETY __________________ SCHEDULE OF FIXED ASSETS AS ON __________ Sl. No. Date of Purchase Name of the Item Quantity Amount (Rs. ) Remarks ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

STATE SOCIETY CODE NAME OF STATE SOCIETY __________________ SCHEDULE OF FIXED ASSETS AS ON __________ Sl. No. Date of Purchase Name of the Item Quantity Amount (Rs. ) Remarks ___________________ (Signature of DPM) (Signature of Chairman) (Signature of Auditor)

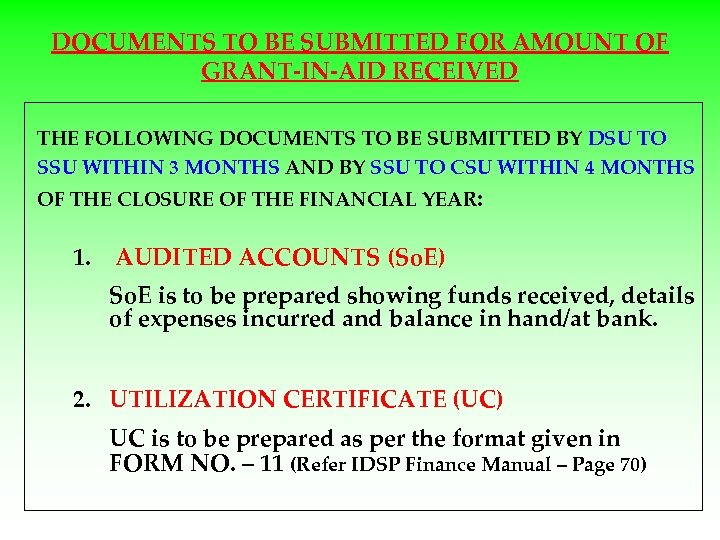

DOCUMENTS TO BE SUBMITTED FOR AMOUNT OF GRANT-IN-AID RECEIVED THE FOLLOWING DOCUMENTS TO BE SUBMITTED BY DSU TO SSU WITHIN 3 MONTHS AND BY SSU TO CSU WITHIN 4 MONTHS OF THE CLOSURE OF THE FINANCIAL YEAR: 1. AUDITED ACCOUNTS (So. E) So. E is to be prepared showing funds received, details of expenses incurred and balance in hand/at bank. 2. UTILIZATION CERTIFICATE (UC) UC is to be prepared as per the format given in FORM NO. – 11 (Refer IDSP Finance Manual – Page 70)

DOCUMENTS TO BE SUBMITTED FOR AMOUNT OF GRANT-IN-AID RECEIVED THE FOLLOWING DOCUMENTS TO BE SUBMITTED BY DSU TO SSU WITHIN 3 MONTHS AND BY SSU TO CSU WITHIN 4 MONTHS OF THE CLOSURE OF THE FINANCIAL YEAR: 1. AUDITED ACCOUNTS (So. E) So. E is to be prepared showing funds received, details of expenses incurred and balance in hand/at bank. 2. UTILIZATION CERTIFICATE (UC) UC is to be prepared as per the format given in FORM NO. – 11 (Refer IDSP Finance Manual – Page 70)

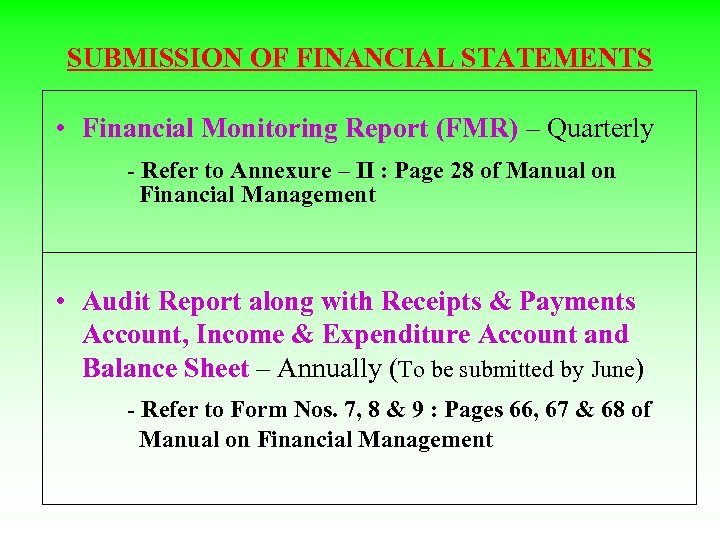

SUBMISSION OF FINANCIAL STATEMENTS • Financial Monitoring Report (FMR) – Quarterly - Refer to Annexure – II : Page 28 of Manual on Financial Management • Audit Report along with Receipts & Payments Account, Income & Expenditure Account and Balance Sheet – Annually (To be submitted by June) - Refer to Form Nos. 7, 8 & 9 : Pages 66, 67 & 68 of Manual on Financial Management

SUBMISSION OF FINANCIAL STATEMENTS • Financial Monitoring Report (FMR) – Quarterly - Refer to Annexure – II : Page 28 of Manual on Financial Management • Audit Report along with Receipts & Payments Account, Income & Expenditure Account and Balance Sheet – Annually (To be submitted by June) - Refer to Form Nos. 7, 8 & 9 : Pages 66, 67 & 68 of Manual on Financial Management