7996d2e352fa03ad69390a438bf581d1.ppt

- Количество слайдов: 32

Insuring the young generation

Insuring the young generation

What do consumers spend on their children ? • • • Summer camp Child Care • Family Food vacations Clothing Books • Toys/games Sports and extracurricular activities What about investing money in their future?

What do consumers spend on their children ? • • • Summer camp Child Care • Family Food vacations Clothing Books • Toys/games Sports and extracurricular activities What about investing money in their future?

Why life insurance ? • Life Insurance is not getting any cheaper • We cannot predict the future…. • There are no guarantees on a child’s health or lifestyle choices • Will life insurance be guaranteed in the future ? Why not reallocate spending to provide for the future ?

Why life insurance ? • Life Insurance is not getting any cheaper • We cannot predict the future…. • There are no guarantees on a child’s health or lifestyle choices • Will life insurance be guaranteed in the future ? Why not reallocate spending to provide for the future ?

Our children are our future Are we protecting them ? • Diabetes is one of the most common chronic diseases among children and youth. • In 2008/09, more than 3, 000 new cases of diabetes (type 1 and type 2) were reported among Canadian children and youth aged one to 19 years, bringing the number of prevalent cases to just under 26, 000. • For both types, the early onset of the disease increases the risk of related complications and lifelong consequences. • Children and youth with type 1 diabetes are at a greater risk of life-threatening complications because they rely on daily doses of insulin. Reference: Public Health Agency of Canada

Our children are our future Are we protecting them ? • Diabetes is one of the most common chronic diseases among children and youth. • In 2008/09, more than 3, 000 new cases of diabetes (type 1 and type 2) were reported among Canadian children and youth aged one to 19 years, bringing the number of prevalent cases to just under 26, 000. • For both types, the early onset of the disease increases the risk of related complications and lifelong consequences. • Children and youth with type 1 diabetes are at a greater risk of life-threatening complications because they rely on daily doses of insulin. Reference: Public Health Agency of Canada

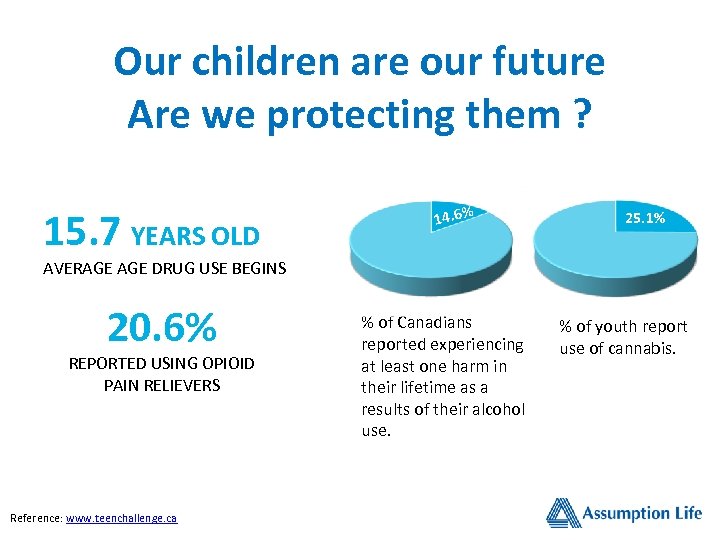

Our children are our future Are we protecting them ? 15. 7 YEARS OLD 14. 6% 25. 1% AVERAGE DRUG USE BEGINS 20. 6% REPORTED USING OPIOID PAIN RELIEVERS Reference: www. teenchallenge. ca % of Canadians reported experiencing at least one harm in their lifetime as a results of their alcohol use. % of youth report use of cannabis.

Our children are our future Are we protecting them ? 15. 7 YEARS OLD 14. 6% 25. 1% AVERAGE DRUG USE BEGINS 20. 6% REPORTED USING OPIOID PAIN RELIEVERS Reference: www. teenchallenge. ca % of Canadians reported experiencing at least one harm in their lifetime as a results of their alcohol use. % of youth report use of cannabis.

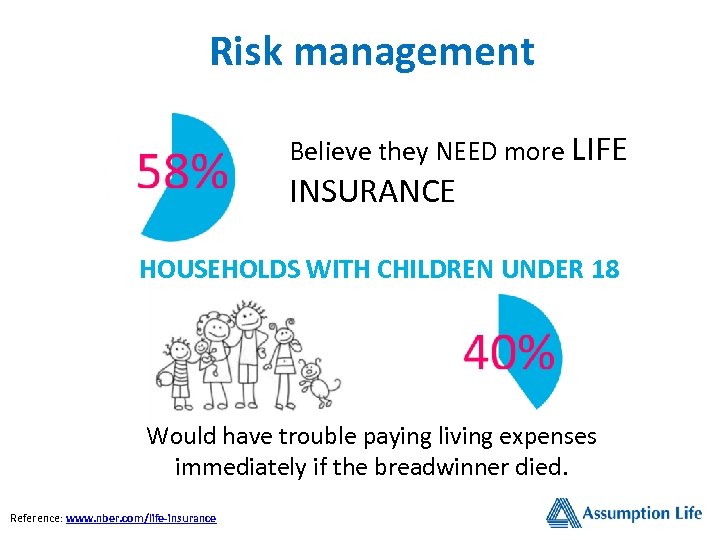

Risk management Believe they NEED more LIFE INSURANCE HOUSEHOLDS WITH CHILDREN UNDER 18 Would have trouble paying living expenses immediately if the breadwinner died. Reference: www. nber. com/life-insurance

Risk management Believe they NEED more LIFE INSURANCE HOUSEHOLDS WITH CHILDREN UNDER 18 Would have trouble paying living expenses immediately if the breadwinner died. Reference: www. nber. com/life-insurance

Life insurance A key element of financial security Why not put this piece of the puzzle in place now for your kids’ future? • • Simple underwriting process Low premiums Temporary payment period for many policies – 20 pay Ensures life insurance will be available when children become adults.

Life insurance A key element of financial security Why not put this piece of the puzzle in place now for your kids’ future? • • Simple underwriting process Low premiums Temporary payment period for many policies – 20 pay Ensures life insurance will be available when children become adults.

Who buys insurance for kids Parents Grandparents Insurable interest

Who buys insurance for kids Parents Grandparents Insurable interest

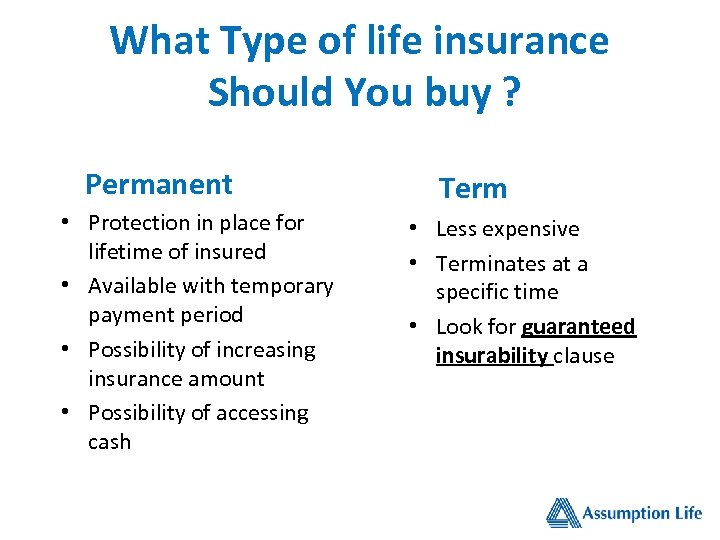

What Type of life insurance Should You buy ? Permanent • Protection in place for lifetime of insured • Available with temporary payment period • Possibility of increasing insurance amount • Possibility of accessing cash Term • Less expensive • Terminates at a specific time • Look for guaranteed insurability clause

What Type of life insurance Should You buy ? Permanent • Protection in place for lifetime of insured • Available with temporary payment period • Possibility of increasing insurance amount • Possibility of accessing cash Term • Less expensive • Terminates at a specific time • Look for guaranteed insurability clause

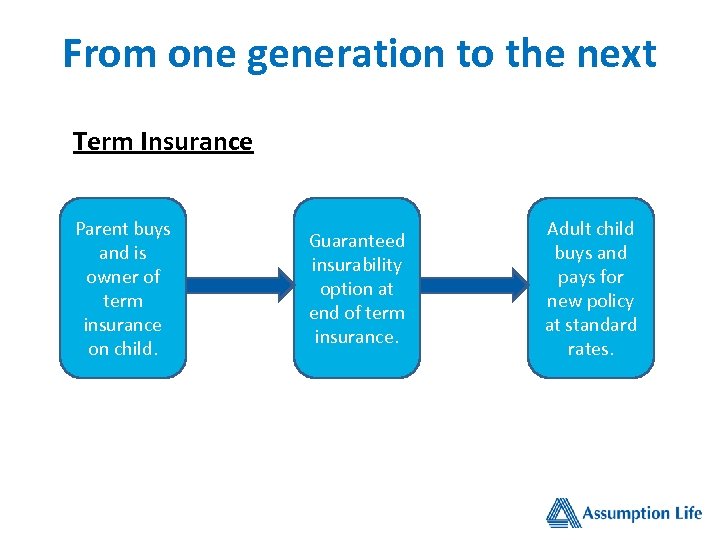

From one generation to the next Term Insurance Parent buys and is owner of term insurance on child. Guaranteed insurability option at end of term insurance. Adult child buys and pays for new policy at standard rates.

From one generation to the next Term Insurance Parent buys and is owner of term insurance on child. Guaranteed insurability option at end of term insurance. Adult child buys and pays for new policy at standard rates.

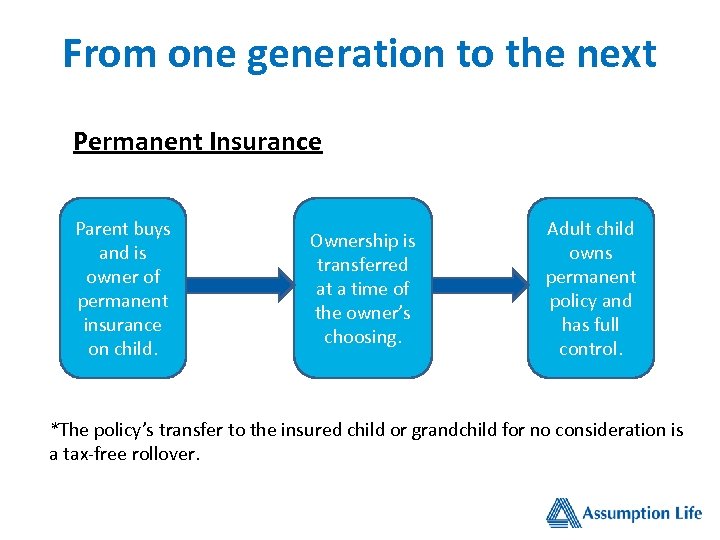

From one generation to the next Permanent Insurance Parent buys and is owner of permanent insurance on child. Ownership is transferred at a time of the owner’s choosing. Adult child owns permanent policy and has full control. *The policy’s transfer to the insured child or grandchild for no consideration is a tax-free rollover.

From one generation to the next Permanent Insurance Parent buys and is owner of permanent insurance on child. Ownership is transferred at a time of the owner’s choosing. Adult child owns permanent policy and has full control. *The policy’s transfer to the insured child or grandchild for no consideration is a tax-free rollover.

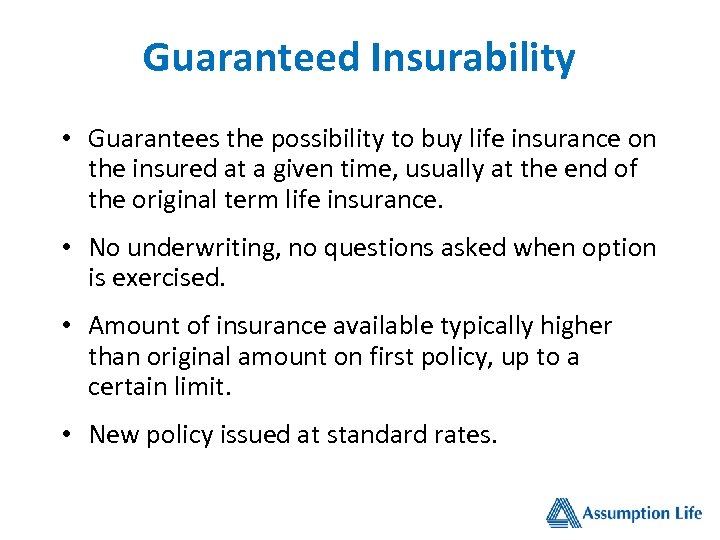

Guaranteed Insurability • Guarantees the possibility to buy life insurance on the insured at a given time, usually at the end of the original term life insurance. • No underwriting, no questions asked when option is exercised. • Amount of insurance available typically higher than original amount on first policy, up to a certain limit. • New policy issued at standard rates.

Guaranteed Insurability • Guarantees the possibility to buy life insurance on the insured at a given time, usually at the end of the original term life insurance. • No underwriting, no questions asked when option is exercised. • Amount of insurance available typically higher than original amount on first policy, up to a certain limit. • New policy issued at standard rates.

Guaranteed Insurability • Most likely kids will need life insurance as adults, as it is a key element in an adult’s financial security. • Constant improvements in diagnosis methods + rising statistics in obesity = increased chances of premium ratings or refusals to insure. • Guaranteed insurability addresses these points.

Guaranteed Insurability • Most likely kids will need life insurance as adults, as it is a key element in an adult’s financial security. • Constant improvements in diagnosis methods + rising statistics in obesity = increased chances of premium ratings or refusals to insure. • Guaranteed insurability addresses these points.

Insurance for life… and more • Permanent insurance lasts for lifetime of insured. • In addition to basic life insurance coverage: – access to cash in future to help cover certain expenses; – increase insurance coverage over time without increasing premiums.

Insurance for life… and more • Permanent insurance lasts for lifetime of insured. • In addition to basic life insurance coverage: – access to cash in future to help cover certain expenses; – increase insurance coverage over time without increasing premiums.

Insurance for Life… and more Accessing cash to help cover certain expenses • Withdrawal from the accumulation fund in a UL • Accumulated policy dividends from a participating whole life policy • Receipt of policy dividends from a participating policy • Policy or collateral loans guaranteed by cash values

Insurance for Life… and more Accessing cash to help cover certain expenses • Withdrawal from the accumulation fund in a UL • Accumulated policy dividends from a participating whole life policy • Receipt of policy dividends from a participating policy • Policy or collateral loans guaranteed by cash values

Insurance for Life… and more Increase insurance coverage over time • Start with amount sufficient to cover final expenses. • Insurance coverage grows and will help cover greater needs when child is an adult. • In most cases, premiums do not increase and sometimes, payment duration is temporary. • Participating whole life (paid-up additions) or UL (face amount + accumulation fund)

Insurance for Life… and more Increase insurance coverage over time • Start with amount sufficient to cover final expenses. • Insurance coverage grows and will help cover greater needs when child is an adult. • In most cases, premiums do not increase and sometimes, payment duration is temporary. • Participating whole life (paid-up additions) or UL (face amount + accumulation fund)

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) Faye is a 9 year old girl who lives in a urban centre. The cost of living and lifestyle are very expensive. • Participating whole life with paid-up additions • Initial face amount: $25, 000 • Monthly premium $39. 31 • Policy paid up in 20 years

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) Faye is a 9 year old girl who lives in a urban centre. The cost of living and lifestyle are very expensive. • Participating whole life with paid-up additions • Initial face amount: $25, 000 • Monthly premium $39. 31 • Policy paid up in 20 years

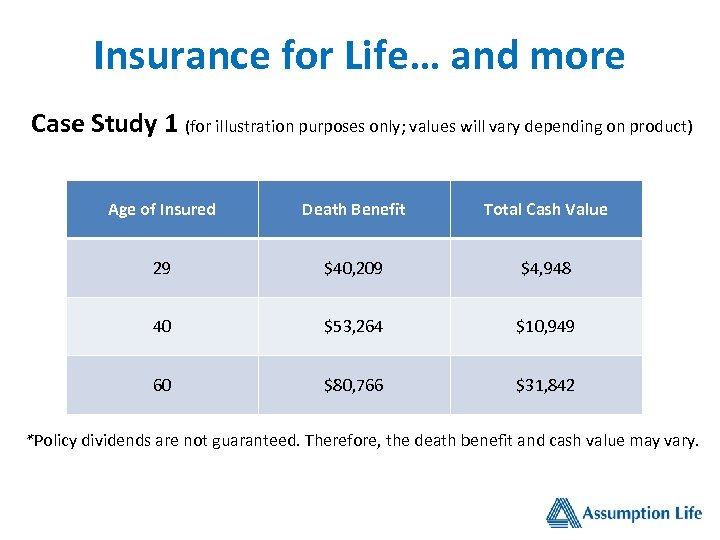

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) Age of Insured Death Benefit Total Cash Value 29 $40, 209 $4, 948 40 $53, 264 $10, 949 60 $80, 766 $31, 842 *Policy dividends are not guaranteed. Therefore, the death benefit and cash value may vary.

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) Age of Insured Death Benefit Total Cash Value 29 $40, 209 $4, 948 40 $53, 264 $10, 949 60 $80, 766 $31, 842 *Policy dividends are not guaranteed. Therefore, the death benefit and cash value may vary.

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) The policy owner has the flexibility to: • Let the insurance coverage grow – With a growing paid-up coverage, he won’t have to buy as much life insurance to cover his other needs. • Change the dividend option to receive cash annually – At a point when he finds the insurance coverage is sufficient, he can use the dividends for other purposes such as annual expenses or investments. • Access cash with a policy or collateral loan guaranteed by the CSV – To help with a specific project or to address an emergency. – Consideration of possible tax consequences of a policy loan should be given before going forward with the transaction.

Insurance for Life… and more Case Study 1 (for illustration purposes only; values will vary depending on product) The policy owner has the flexibility to: • Let the insurance coverage grow – With a growing paid-up coverage, he won’t have to buy as much life insurance to cover his other needs. • Change the dividend option to receive cash annually – At a point when he finds the insurance coverage is sufficient, he can use the dividends for other purposes such as annual expenses or investments. • Access cash with a policy or collateral loan guaranteed by the CSV – To help with a specific project or to address an emergency. – Consideration of possible tax consequences of a policy loan should be given before going forward with the transaction.

Which insurance is better ? Depends on your clients: • Budget – Term insurance is less expensive • Preferences – – – Level insurance amount at lower cost Increasing insurance amount Paid-up options Tax-sheltered savings options Level of control on investments within the policy

Which insurance is better ? Depends on your clients: • Budget – Term insurance is less expensive • Preferences – – – Level insurance amount at lower cost Increasing insurance amount Paid-up options Tax-sheltered savings options Level of control on investments within the policy

Immediate benefit when needed • Should the unthinkable happen… • Tax-free benefit – Final expenses – Time off work for parents to heal and recover – Some policies offer living benefits in case of illness

Immediate benefit when needed • Should the unthinkable happen… • Tax-free benefit – Final expenses – Time off work for parents to heal and recover – Some policies offer living benefits in case of illness

Looking after the entire family • When taking care of your clients’ insurance needs, take the opportunity to look after the entire family by discussing life insurance for their kids. • Options for every budget, easy process. • The young generation of today are your future clients. Why not create that client-advisor relationship now.

Looking after the entire family • When taking care of your clients’ insurance needs, take the opportunity to look after the entire family by discussing life insurance for their kids. • Options for every budget, easy process. • The young generation of today are your future clients. Why not create that client-advisor relationship now.

Insuring the young generation Putting a financial safety net in place for their future while being ready for today's unforeseen events.

Insuring the young generation Putting a financial safety net in place for their future while being ready for today's unforeseen events.

Who are we? Assumption Life is a thriving Canadian Mutual Insurance Company with more than a century of experience! We provide a broad range of insurance and investments products such as: • • • Life Insurance Group Insurance Investment products through well-know fund manager (AGF, Fidelity Investments, CI investments and Louisbourg Investments) Group Savings and retirement plans Mortgage Loans

Who are we? Assumption Life is a thriving Canadian Mutual Insurance Company with more than a century of experience! We provide a broad range of insurance and investments products such as: • • • Life Insurance Group Insurance Investment products through well-know fund manager (AGF, Fidelity Investments, CI investments and Louisbourg Investments) Group Savings and retirement plans Mortgage Loans

Assumption Life’s Corporate Overview • Excellent rating, Am Best (15 years running) • Solvency ratio: 232% (2014) • Assets under Management: 1. 5 billion

Assumption Life’s Corporate Overview • Excellent rating, Am Best (15 years running) • Solvency ratio: 232% (2014) • Assets under Management: 1. 5 billion

LIA – Electronic sales tool • Multiplatform (PC, Mac, Android, i. Pad, Cloud Technology) • Save to any device • Your device directly to our underwriter • Online or offline

LIA – Electronic sales tool • Multiplatform (PC, Mac, Android, i. Pad, Cloud Technology) • Save to any device • Your device directly to our underwriter • Online or offline

Non Face-to-Face Sales • Referrals • Replacement • Up sell/ Cross sell • Business where you want, when you want, how you want!

Non Face-to-Face Sales • Referrals • Replacement • Up sell/ Cross sell • Business where you want, when you want, how you want!

Delivery Receipt Remember no delivery receipt required!

Delivery Receipt Remember no delivery receipt required!

Service - Second to none! • Quick to respond • Direct access to underwriters • Free marketing materials • Online training presentations • Video sales tool

Service - Second to none! • Quick to respond • Direct access to underwriters • Free marketing materials • Online training presentations • Video sales tool

Producer’s Corner Visit our www. producerscorner. ca

Producer’s Corner Visit our www. producerscorner. ca

Doing Business With Us is Easy… and Smart!

Doing Business With Us is Easy… and Smart!