effd74ec831c3d783db94a86ee7a0c45.ppt

- Количество слайдов: 13

Insuring the balance sheet DACT Treasury Beurs Noordwijk November 5 th, 2009

Contents • Setting the scene • Options • Receivables solution • Q&A • Lessons learned 2

Setting the scene • Take over of Vedior • EUR 2. 7 bn 5 year syndicated facility • 1 covenant: leverage below 3. 5 • 31 banks • Sharp decline in EBITDA due to downturn, future uncertain • LTM EBITDA 2008 Q 3: EUR 1, 000 mio • LTM EBITDA 2009 Q 3: EUR 500 mio • Conservative leverage policy • Internal policy: Leverage below 2 • Zero risks on breach syndicated facility 3

What were we looking for? • Secure solution • No umbrella for sunny days • At least 12 moths, preferably up to 18 -24 months • Cost effective solution • Should be significantly less expensive than a covenant breach • Standby solution / option on solution • Possibility of ever needing it was and is very small • For receivables: avoiding operational hassle and transfer of credit risk 4

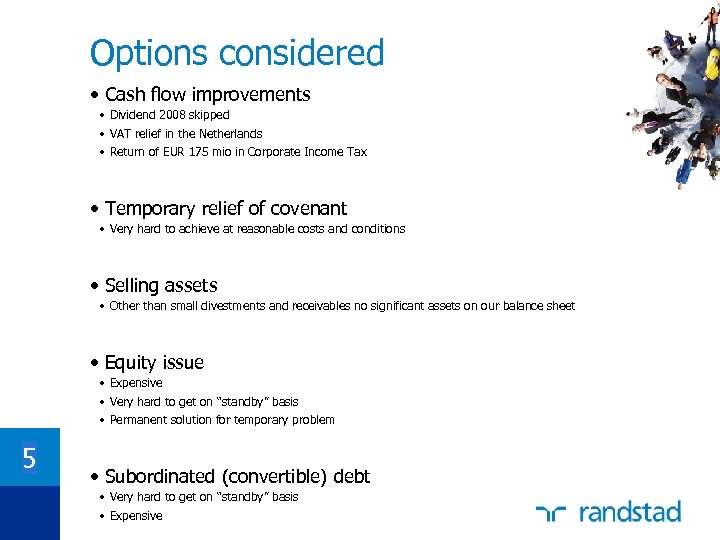

Options considered • Cash flow improvements • Dividend 2008 skipped • VAT relief in the Netherlands • Return of EUR 175 mio in Corporate Income Tax • Temporary relief of covenant • Very hard to achieve at reasonable costs and conditions • Selling assets • Other than small divestments and receivables no significant assets on our balance sheet • Equity issue • Expensive • Very hard to get on “standby” basis • Permanent solution for temporary problem 5 • Subordinated (convertible) debt • Very hard to get on “standby” basis • Expensive

Receivables solution • Things to consider • What made it easier and harder for Randstad? • Off balance under IFRS 6

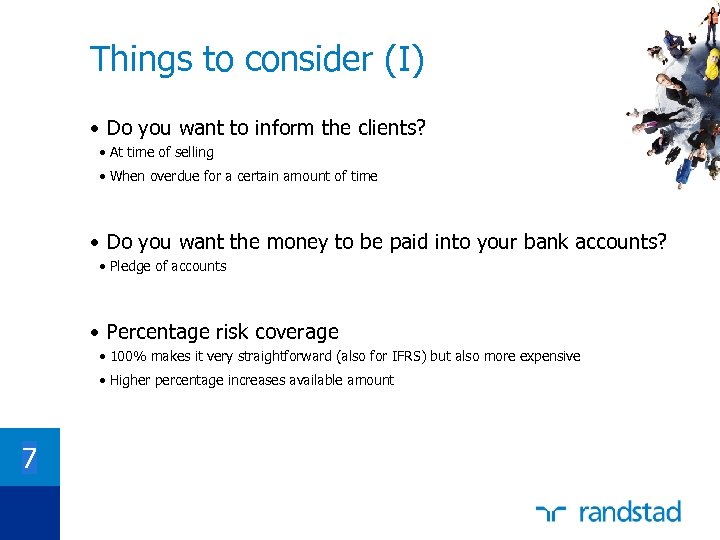

Things to consider (I) • Do you want to inform the clients? • At time of selling • When overdue for a certain amount of time • Do you want the money to be paid into your bank accounts? • Pledge of accounts • Percentage risk coverage • 100% makes it very straightforward (also for IFRS) but also more expensive • Higher percentage increases available amount 7

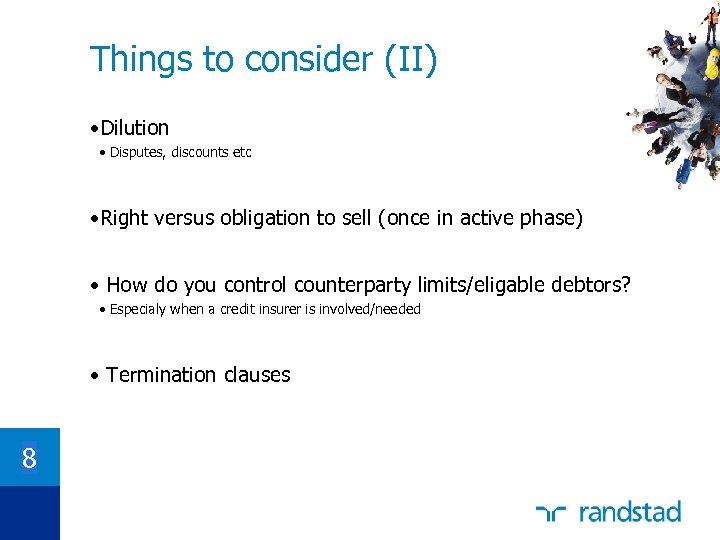

Things to consider (II) • Dilution • Disputes, discounts etc • Right versus obligation to sell (once in active phase) • How do you control counterparty limits/eligable debtors? • Especialy when a credit insurer is involved/needed • Termination clauses 8

What made it easier for Randstad? • Single country and single currency strategy • Belgium has friendly legislation on this subject • NL, GE, and UK also • Diversified portfolio with very limited concentration risk • Standardized procedure • Use of shared service center • Selling entity has very strong balance sheet • Commingling risk • Dilution risk 9 • Solid banking partners with long relations • Trust factor

What made it harder for Randstad? • Commitment for longer period • Right to sell / obligation to buy • Standby mode • Pricing for extremely unsure situation • Preference for dealing with only one counterparty • Selling including VAT • Especially with credit-insurers 10

Off balance under IFRS • Transfer of significantly all risks and rewards • Credit risk • Late payment risk • Claw backs • Objective formulas • Company has right to terminate • Dilution • Changes in IFRS are expected • Control based vs risk/rewards based? 11

Questions • Please feel free to ask BUT • Please respect that have agreed with our banks that we will not discuss pricing levels • Please respect that we are not at liberty to disclose all elements of the agreement 12

Lessons learned • Allow sufficient time • Especially when off balance is desired • Involve internal and external parties early in the process • Accounting, legal, tax, (local) operations, credit mgt dept, auditors, legal advisors • Selling receivables (off balance) is not just a variation of borrowing with collateral • Make sure that when a word or definition is used everybody understands the same thing 13 • Be aware that it is very hard to cater for all situations and exceptions in the contract

effd74ec831c3d783db94a86ee7a0c45.ppt