061886067563176d58d9981fd0390946.ppt

- Количество слайдов: 17

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY ON-SITE INSPECTIONS OF INVESTMENT PORTFOLIO OF INSURERS A CASE STUDY OF IRDA S N JAYASIMHAN & ARUP CHATTERJEE 15 th NOV, 2005

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY ON-SITE INSPECTIONS OF INVESTMENT PORTFOLIO OF INSURERS A CASE STUDY OF IRDA S N JAYASIMHAN & ARUP CHATTERJEE 15 th NOV, 2005

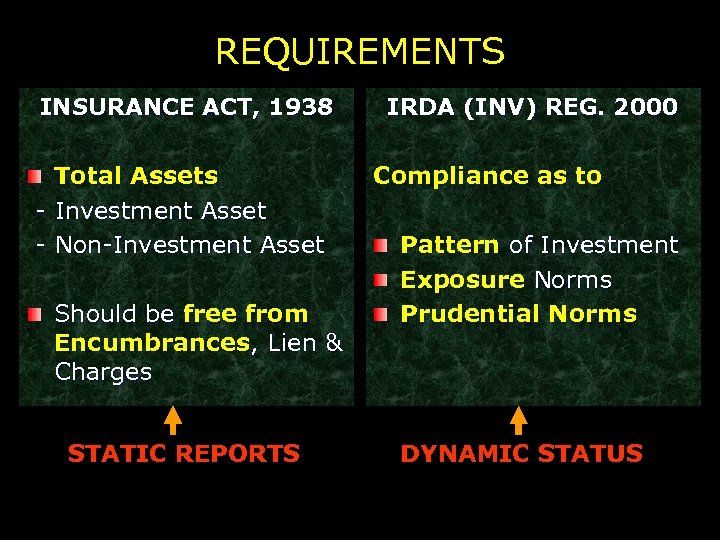

REQUIREMENTS INSURANCE ACT, 1938 Total Assets - Investment Asset - Non-Investment Asset Should be free from Encumbrances, Lien & Charges STATIC REPORTS IRDA (INV) REG. 2000 Compliance as to Pattern of Investment Exposure Norms Prudential Norms DYNAMIC STATUS

REQUIREMENTS INSURANCE ACT, 1938 Total Assets - Investment Asset - Non-Investment Asset Should be free from Encumbrances, Lien & Charges STATIC REPORTS IRDA (INV) REG. 2000 Compliance as to Pattern of Investment Exposure Norms Prudential Norms DYNAMIC STATUS

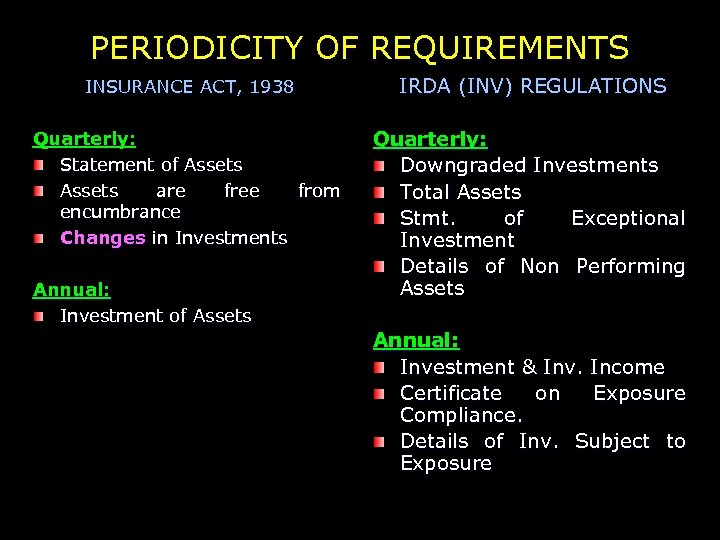

PERIODICITY OF REQUIREMENTS INSURANCE ACT, 1938 IRDA (INV) REGULATIONS Quarterly: Statement of Assets are free from encumbrance Changes in Investments Quarterly: Downgraded Investments Total Assets Stmt. of Exceptional Investment Details of Non Performing Assets Annual: Investment of Assets Annual: Investment & Inv. Income Certificate on Exposure Compliance. Details of Inv. Subject to Exposure

PERIODICITY OF REQUIREMENTS INSURANCE ACT, 1938 IRDA (INV) REGULATIONS Quarterly: Statement of Assets are free from encumbrance Changes in Investments Quarterly: Downgraded Investments Total Assets Stmt. of Exceptional Investment Details of Non Performing Assets Annual: Investment of Assets Annual: Investment & Inv. Income Certificate on Exposure Compliance. Details of Inv. Subject to Exposure

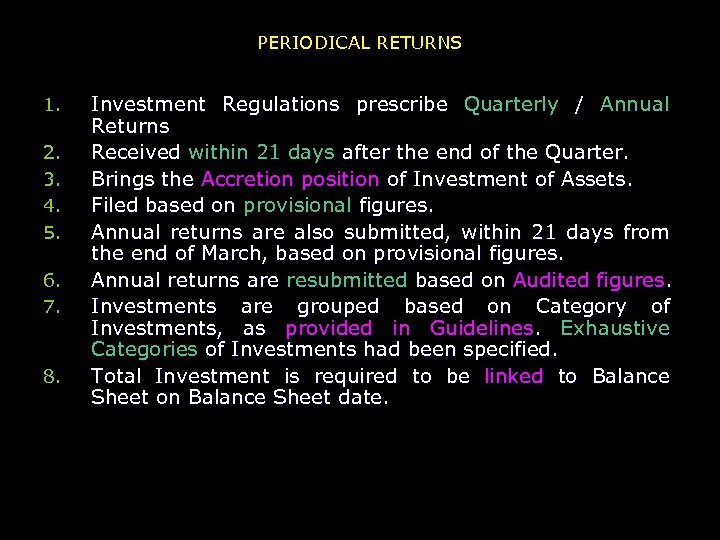

PERIODICAL RETURNS 1. 2. 3. 4. 5. 6. 7. 8. Investment Regulations prescribe Quarterly / Annual Returns Received within 21 days after the end of the Quarter. Brings the Accretion position of Investment of Assets. Filed based on provisional figures. Annual returns are also submitted, within 21 days from the end of March, based on provisional figures. Annual returns are resubmitted based on Audited figures. Investments are grouped based on Category of Investments, as provided in Guidelines. Exhaustive Categories of Investments had been specified. Total Investment is required to be linked to Balance Sheet on Balance Sheet date.

PERIODICAL RETURNS 1. 2. 3. 4. 5. 6. 7. 8. Investment Regulations prescribe Quarterly / Annual Returns Received within 21 days after the end of the Quarter. Brings the Accretion position of Investment of Assets. Filed based on provisional figures. Annual returns are also submitted, within 21 days from the end of March, based on provisional figures. Annual returns are resubmitted based on Audited figures. Investments are grouped based on Category of Investments, as provided in Guidelines. Exhaustive Categories of Investments had been specified. Total Investment is required to be linked to Balance Sheet on Balance Sheet date.

METHODOLOGY OF INFORMATION CONSOLIDATION AT IRDA

METHODOLOGY OF INFORMATION CONSOLIDATION AT IRDA

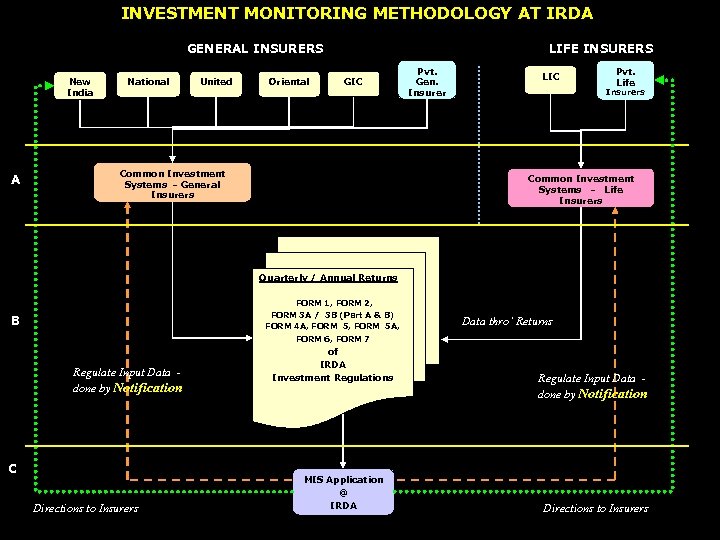

INVESTMENT MONITORING METHODOLOGY AT IRDA GENERAL INSURERS New India A National United Oriental LIFE INSURERS GIC Common Investment Systems - General Insurers Pvt. Gen. Insurer LIC Pvt. Life Insurers Common Investment Systems - Life Insurers Quarterly / Annual Returns FORM 1, FORM 2, FORM 3 A / 3 B (Part A & B) FORM 4 A, FORM 5 A, B Data thro’ Returns FORM 6, FORM 7 Regulate Input Data done by Notification C Directions to Insurers of IRDA Investment Regulations MIS Application @ IRDA Regulate Input Data done by Notification Directions to Insurers

INVESTMENT MONITORING METHODOLOGY AT IRDA GENERAL INSURERS New India A National United Oriental LIFE INSURERS GIC Common Investment Systems - General Insurers Pvt. Gen. Insurer LIC Pvt. Life Insurers Common Investment Systems - Life Insurers Quarterly / Annual Returns FORM 1, FORM 2, FORM 3 A / 3 B (Part A & B) FORM 4 A, FORM 5 A, B Data thro’ Returns FORM 6, FORM 7 Regulate Input Data done by Notification C Directions to Insurers of IRDA Investment Regulations MIS Application @ IRDA Regulate Input Data done by Notification Directions to Insurers

OLD INSURERS EXISTING / REQUIRED SYSTEMS

OLD INSURERS EXISTING / REQUIRED SYSTEMS

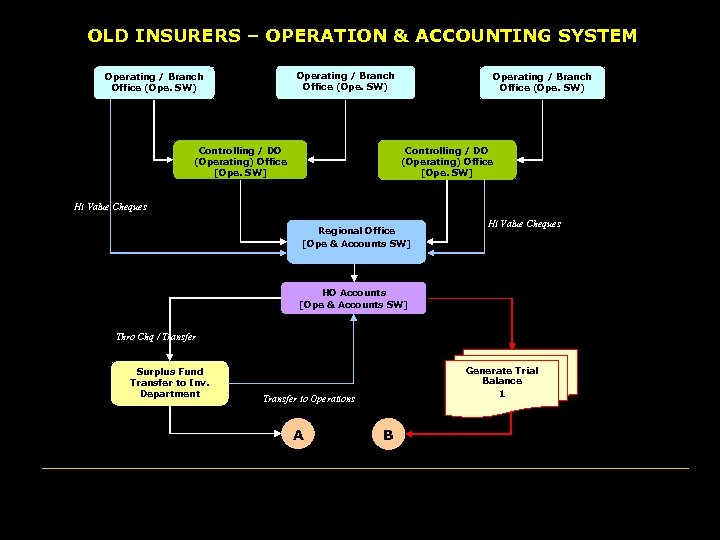

OLD INSURERS – OPERATION & ACCOUNTING SYSTEM Operating / Branch Office (Ope. SW) Controlling / DO (Operating) Office [Ope. SW] Hi Value Cheques Regional Office [Ope & Accounts SW] Hi Value Cheques HO Accounts [Ope & Accounts SW] Thro Chq / Transfer Surplus Fund Transfer to Inv. Department Generate Trial Balance 1 Transfer to Operations A B

OLD INSURERS – OPERATION & ACCOUNTING SYSTEM Operating / Branch Office (Ope. SW) Controlling / DO (Operating) Office [Ope. SW] Hi Value Cheques Regional Office [Ope & Accounts SW] Hi Value Cheques HO Accounts [Ope & Accounts SW] Thro Chq / Transfer Surplus Fund Transfer to Inv. Department Generate Trial Balance 1 Transfer to Operations A B

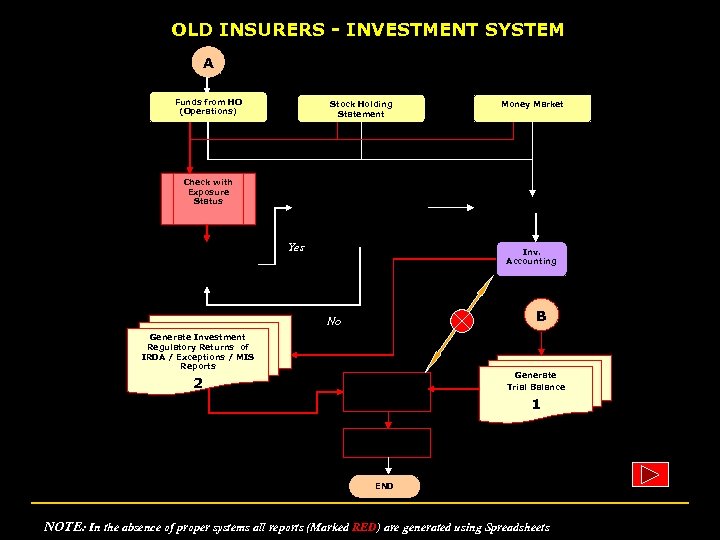

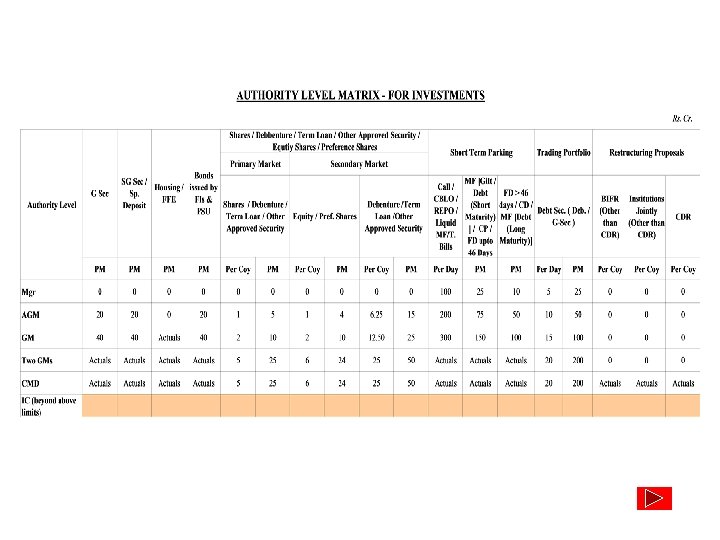

OLD INSURERS - INVESTMENT SYSTEM A Funds from HO (Operations) Stock Holding Statement Check with Exposure Status Prepare Inv. Placement Note Approved as per Matrix ? [Ref. Anx. 1] Yes Bank / RBI Inv. Accounting B No Generate Investment Regulatory Returns of IRDA / Exceptions / MIS Reports 2 Money Market Returns checked for Compliance Generate Trial Balance 1 Returns Filed with IRDA END NOTE: In the absence of proper systems all reports (Marked RED) are generated using Spreadsheets

OLD INSURERS - INVESTMENT SYSTEM A Funds from HO (Operations) Stock Holding Statement Check with Exposure Status Prepare Inv. Placement Note Approved as per Matrix ? [Ref. Anx. 1] Yes Bank / RBI Inv. Accounting B No Generate Investment Regulatory Returns of IRDA / Exceptions / MIS Reports 2 Money Market Returns checked for Compliance Generate Trial Balance 1 Returns Filed with IRDA END NOTE: In the absence of proper systems all reports (Marked RED) are generated using Spreadsheets

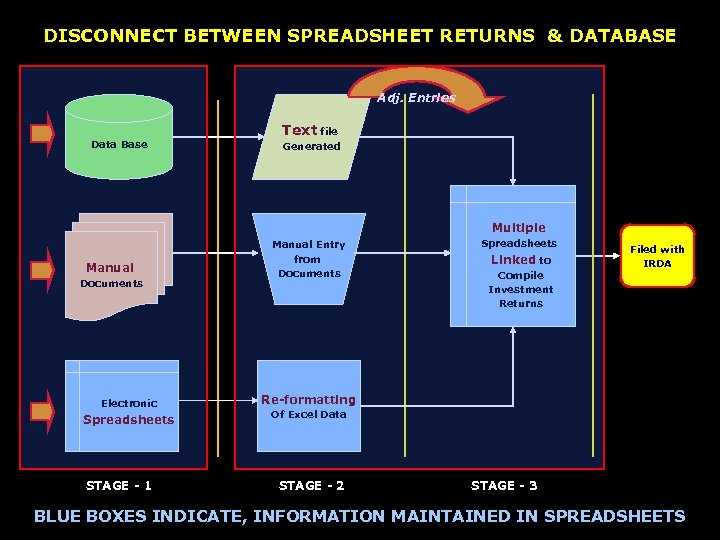

DISCONNECT BETWEEN SPREADSHEET RETURNS & DATABASE Adj. Entries Data Base Text file Generated Multiple Manual Documents Electronic Spreadsheets STAGE - 1 Manual Entry from Documents Spreadsheets Linked to Compile Investment Returns Filed with IRDA Re-formatting Of Excel Data STAGE - 2 STAGE - 3 BLUE BOXES INDICATE, INFORMATION MAINTAINED IN SPREADSHEETS

DISCONNECT BETWEEN SPREADSHEET RETURNS & DATABASE Adj. Entries Data Base Text file Generated Multiple Manual Documents Electronic Spreadsheets STAGE - 1 Manual Entry from Documents Spreadsheets Linked to Compile Investment Returns Filed with IRDA Re-formatting Of Excel Data STAGE - 2 STAGE - 3 BLUE BOXES INDICATE, INFORMATION MAINTAINED IN SPREADSHEETS

OLD INSURERS CURRENT METHOD OF COMPILING INFORMATION FOR INVESTMENT RETURNS

OLD INSURERS CURRENT METHOD OF COMPILING INFORMATION FOR INVESTMENT RETURNS

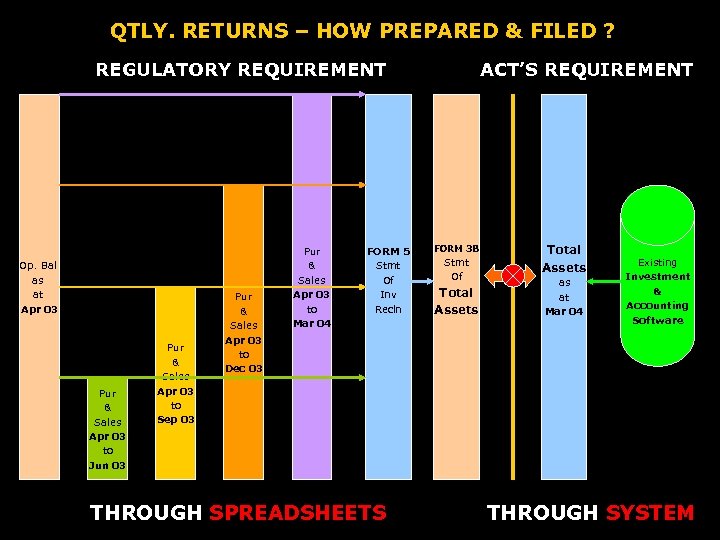

QTLY. RETURNS – HOW PREPARED & FILED ? REGULATORY REQUIREMENT Op. Bal as at Apr 03 Pur & Sales Apr 03 to Jun 03 Pur & Sales Apr 03 to Sep 03 Pur & Sales Apr 03 to Dec 03 Pur & Sales Apr 03 to Mar 04 FORM 5 Stmt Of Inv Recln THROUGH SPREADSHEETS ACT’S REQUIREMENT FORM 3 B Stmt Of Total Assets as at Mar 04 Existing Investment & Accounting Software THROUGH SYSTEM

QTLY. RETURNS – HOW PREPARED & FILED ? REGULATORY REQUIREMENT Op. Bal as at Apr 03 Pur & Sales Apr 03 to Jun 03 Pur & Sales Apr 03 to Sep 03 Pur & Sales Apr 03 to Dec 03 Pur & Sales Apr 03 to Mar 04 FORM 5 Stmt Of Inv Recln THROUGH SPREADSHEETS ACT’S REQUIREMENT FORM 3 B Stmt Of Total Assets as at Mar 04 Existing Investment & Accounting Software THROUGH SYSTEM

DRAWBACKS Group & Industry Sector Exposure not tracked as required by Regulations. No system to ‘monitor’ the Investments Market Value of Investments not tracked. Clear segregation of Front and Back Office Operations not possible in Spreadsheet environment. Regulatory requirement, handled by Spreadsheets Inv. Reconciliation, done after closing the Accounts, at the end of the year. Purchase & Sale, reported Cumulatively, in Quarterly reporting on provisional basis, without linking to Balance Sheet. Static Reports (Non-Inv. Assets) generated only at the end of the year. Independent Trial Balance not available for Investment Operations.

DRAWBACKS Group & Industry Sector Exposure not tracked as required by Regulations. No system to ‘monitor’ the Investments Market Value of Investments not tracked. Clear segregation of Front and Back Office Operations not possible in Spreadsheet environment. Regulatory requirement, handled by Spreadsheets Inv. Reconciliation, done after closing the Accounts, at the end of the year. Purchase & Sale, reported Cumulatively, in Quarterly reporting on provisional basis, without linking to Balance Sheet. Static Reports (Non-Inv. Assets) generated only at the end of the year. Independent Trial Balance not available for Investment Operations.

TO MOVE FORWARD - WHAT IS REQUIRED Long Range Planning for IT issues. Creation of Investment IT Department to Maintain the System / Documentation of Changes. Clear Work Scope of Internal / Concurrent Audit to cover the entire Investment Operations. Standard Security Classification Procedure (To cover all Investments which are subject to Exposure Norms) Risk Management Department to be created. Segregation of Front / Mid / Back Office Operations. A common ‘Time Target’ to all Insurers to migrate from Spreadsheets to a an Integrated Information System. Independent Trial Balance for Investment Operations. Qtly. consolidation of Non-Investment Assets.

TO MOVE FORWARD - WHAT IS REQUIRED Long Range Planning for IT issues. Creation of Investment IT Department to Maintain the System / Documentation of Changes. Clear Work Scope of Internal / Concurrent Audit to cover the entire Investment Operations. Standard Security Classification Procedure (To cover all Investments which are subject to Exposure Norms) Risk Management Department to be created. Segregation of Front / Mid / Back Office Operations. A common ‘Time Target’ to all Insurers to migrate from Spreadsheets to a an Integrated Information System. Independent Trial Balance for Investment Operations. Qtly. consolidation of Non-Investment Assets.

TO MOVE FORWARD - WHAT IS REQUIRED Direct insurers to follow clearly documented Systems & Procedures to cover ALL Investment Operations till filing of periodical Investment Returns with the Authority. Conduct ANNUAL Systems Audit to confirm the existence of proper procedures in drawing up the periodical returns in ensuring Compliance. IDENTIFY Insurers based on adherence to Systems, in Complying with Act and Regulations. Based on the above, decide PERIODICITY of Compliance Audit to confirm that the Information submitted, corroborates with Books / Records maintained by the Insurer.

TO MOVE FORWARD - WHAT IS REQUIRED Direct insurers to follow clearly documented Systems & Procedures to cover ALL Investment Operations till filing of periodical Investment Returns with the Authority. Conduct ANNUAL Systems Audit to confirm the existence of proper procedures in drawing up the periodical returns in ensuring Compliance. IDENTIFY Insurers based on adherence to Systems, in Complying with Act and Regulations. Based on the above, decide PERIODICITY of Compliance Audit to confirm that the Information submitted, corroborates with Books / Records maintained by the Insurer.

THANK YOU

THANK YOU