Insurance and Risk Management for the House Corporation Officers Ned Kirklin Executive Vice President Mick Mc. Gill Vice President - Client Advocacy July 15, 2012

Insurance and Risk Management for the House Corporation Officers Ned Kirklin Executive Vice President Mick Mc. Gill Vice President - Client Advocacy July 15, 2012

Background of Willis § 100% dedicated to serving college student and alumni organizations § Founded in 1991 as Kirklin & Company, became a wholly owned subsidiary of Hilb Rogal & Hobbs (HRH) in 2002, merged with Willis Group Holdings in 2008 § Insurance and Risk Management programs provided to numerous college student and alumni organizations • • 57 North-American Interfraternity Conference (NIC) fraternities 5 National Panhellenic Conference (NPC) sororities 7 National Pan-Hellenic Council (NPHC) fraternities & sororities 10 National Association of Latino Fraternal Organizations (NALFO) fraternities & sororities • Professional and co-educational fraternities • Campus based programs and numerous local and smaller fraternal organizations § Over 1, 500 fraternity properties insured through the Fraternal Property Management Association (FPMA) § Insurance Brokerage Agency § We work for you, not the insurance company

Background of Willis § 100% dedicated to serving college student and alumni organizations § Founded in 1991 as Kirklin & Company, became a wholly owned subsidiary of Hilb Rogal & Hobbs (HRH) in 2002, merged with Willis Group Holdings in 2008 § Insurance and Risk Management programs provided to numerous college student and alumni organizations • • 57 North-American Interfraternity Conference (NIC) fraternities 5 National Panhellenic Conference (NPC) sororities 7 National Pan-Hellenic Council (NPHC) fraternities & sororities 10 National Association of Latino Fraternal Organizations (NALFO) fraternities & sororities • Professional and co-educational fraternities • Campus based programs and numerous local and smaller fraternal organizations § Over 1, 500 fraternity properties insured through the Fraternal Property Management Association (FPMA) § Insurance Brokerage Agency § We work for you, not the insurance company

Willis as your Broker/Advocate § Claim Advocacy/Assistance • We work for you, not the insurance company • Facilitate contact with claims adjusters and contractors • Site visits by Willis staff conducted within 72 hours of a large or serious incident • 41 + Years of insurance carrier claim handling experience on Willis staff

Willis as your Broker/Advocate § Claim Advocacy/Assistance • We work for you, not the insurance company • Facilitate contact with claims adjusters and contractors • Site visits by Willis staff conducted within 72 hours of a large or serious incident • 41 + Years of insurance carrier claim handling experience on Willis staff

Alpha Chi Omega’s National Insurance Program General Liability and Excess Liability Insurance (Liberty Surplus Insurance Corporation, Evanston, and Torus Specialty) Funding the loss prevention program of the fraternity and its retained risk Bodily injury, third party property damage and personal injury claims The BIG and EXPENSIVE challenge of every organization Each cchapter or colony and its affiliated HCB of Alpha Chi Omega receives: § $11, 000 per occurrence/$12, 000 general aggregate § $1, 000 Hired & Non Owned Auto Liability § $1, 000 Fire Legal Liability § $2, 500 deductible § Limits are provided per location/chapter

Alpha Chi Omega’s National Insurance Program General Liability and Excess Liability Insurance (Liberty Surplus Insurance Corporation, Evanston, and Torus Specialty) Funding the loss prevention program of the fraternity and its retained risk Bodily injury, third party property damage and personal injury claims The BIG and EXPENSIVE challenge of every organization Each cchapter or colony and its affiliated HCB of Alpha Chi Omega receives: § $11, 000 per occurrence/$12, 000 general aggregate § $1, 000 Hired & Non Owned Auto Liability § $1, 000 Fire Legal Liability § $2, 500 deductible § Limits are provided per location/chapter

Alpha Chi Omega’s National Insurance Program Director’s and Officer’s Liability Insurance (RSUI Indemnity) · · · $2, 000 per claim limit and policy year aggregate $5, 000 deductible Fiduciary negligence Includes Employment Practices Liability Defense cost are outside the per claim limit Crisis Management Limit: $100, 000 Coverage is afforded to all chapters and colonies and their affiliated HCB and educational foundations.

Alpha Chi Omega’s National Insurance Program Director’s and Officer’s Liability Insurance (RSUI Indemnity) · · · $2, 000 per claim limit and policy year aggregate $5, 000 deductible Fiduciary negligence Includes Employment Practices Liability Defense cost are outside the per claim limit Crisis Management Limit: $100, 000 Coverage is afforded to all chapters and colonies and their affiliated HCB and educational foundations.

Alpha Chi Omega’s National Insurance Program Crime coverage (Zurich NA) § Provided to all chartered chapters and colonies and their affiliated HCB § Employee theft/embezzlement: $500, 000 per occurrence limit with a $2, 500 deductible § Fund transfer fraud: $500, 000 per occurrence limit with a $2, 500 deductible § Computer fraud: $500, 000 per occurrence limit with a $2, 500 deductible § Forgery/alteration: $100, 000 per occurrence limit with a $1, 000 deductible § Theft must be reported to all appropriate authorities

Alpha Chi Omega’s National Insurance Program Crime coverage (Zurich NA) § Provided to all chartered chapters and colonies and their affiliated HCB § Employee theft/embezzlement: $500, 000 per occurrence limit with a $2, 500 deductible § Fund transfer fraud: $500, 000 per occurrence limit with a $2, 500 deductible § Computer fraud: $500, 000 per occurrence limit with a $2, 500 deductible § Forgery/alteration: $100, 000 per occurrence limit with a $1, 000 deductible § Theft must be reported to all appropriate authorities

MAPP Insurance Program Member Accident Protection Program Markel Insurance Company § Supplemental accident coverage of all associate and initiated undergraduate members § Coverage applies 365 days of the year for all members and associate and initiated undergraduate members in good standing and enrolled at the institution of higher education where their chapter is located § Limit of Coverage • $100, 000 Medical or Dental Injury Maximum Limit • $5, 000 Accidental Death or Dismemberment Limit • No deductible

MAPP Insurance Program Member Accident Protection Program Markel Insurance Company § Supplemental accident coverage of all associate and initiated undergraduate members § Coverage applies 365 days of the year for all members and associate and initiated undergraduate members in good standing and enrolled at the institution of higher education where their chapter is located § Limit of Coverage • $100, 000 Medical or Dental Injury Maximum Limit • $5, 000 Accidental Death or Dismemberment Limit • No deductible

Workers’ Compensation Insurance Who is doing the work in your facility? Injury to chapter employee caused by: § Unsafe act of employee § Condition of physical plant Issues all Housing Advisors/HCBs should consider: § Employee vs. Independent Contractor § Appropriate Hiring Decisions § Exclusive remedy for injured employee § Possible penalties and fines when not purchased § General Liability policy excludes employment related claims § Provided through the National Insurance Program by request If your chapter has employees and we do not place the workers’ compensation coverage for chapter employees, please let us know.

Workers’ Compensation Insurance Who is doing the work in your facility? Injury to chapter employee caused by: § Unsafe act of employee § Condition of physical plant Issues all Housing Advisors/HCBs should consider: § Employee vs. Independent Contractor § Appropriate Hiring Decisions § Exclusive remedy for injured employee § Possible penalties and fines when not purchased § General Liability policy excludes employment related claims § Provided through the National Insurance Program by request If your chapter has employees and we do not place the workers’ compensation coverage for chapter employees, please let us know.

Risk Management - Contracts § Contract Review should be done by Headquarters § Minimum Required Limits of Liability § Additional Insured Requirements § Identify Inequitable Contract Terms § Assuming Liability of Landlord/University § Mutual Indemnification Clauses § Waiver of Subrogation Clauses

Risk Management - Contracts § Contract Review should be done by Headquarters § Minimum Required Limits of Liability § Additional Insured Requirements § Identify Inequitable Contract Terms § Assuming Liability of Landlord/University § Mutual Indemnification Clauses § Waiver of Subrogation Clauses

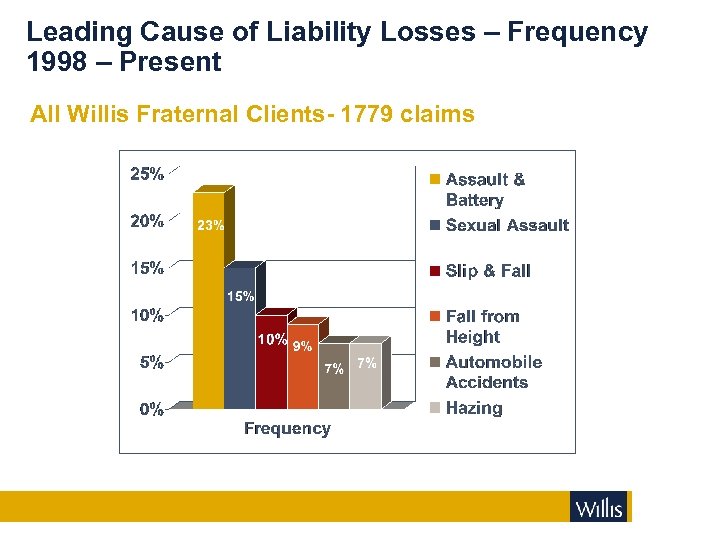

Leading Cause of Liability Losses – Frequency 1998 – Present All Willis Fraternal Clients- 1779 claims

Leading Cause of Liability Losses – Frequency 1998 – Present All Willis Fraternal Clients- 1779 claims

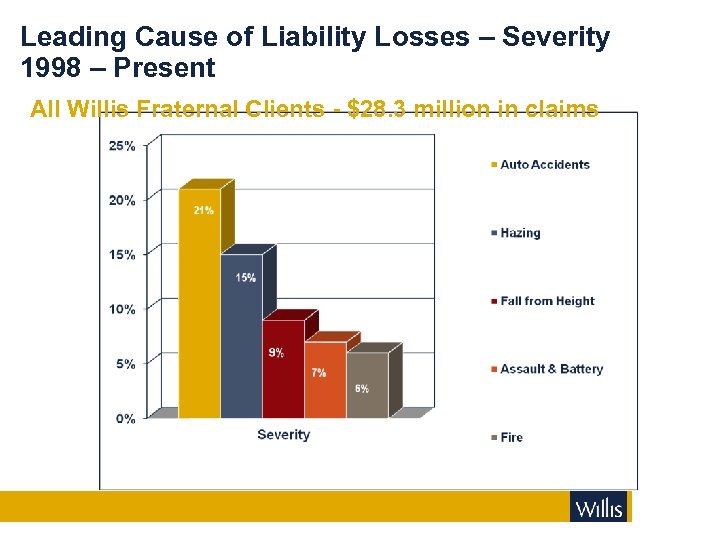

Leading Cause of Liability Losses – Severity 1998 – Present All Willis Fraternal Clients - $28. 3 million in claims

Leading Cause of Liability Losses – Severity 1998 – Present All Willis Fraternal Clients - $28. 3 million in claims

What do you do at the Chapter Level when there is an incident? Who is in charge? Immediate and timely contact to: §Emergency Personnel §Chapter Advisor/house mother/father §Greek Advisor §Alpha Chi Omega Headquarters §Insurance Company/Adjuster Be prepared to provide the facts. §Who, what, where, when and how? §Witnesses §Save all documentation Inform Members Designate Spokesperson §Written statement §Agreed upon with Alpha Chi Omega Headquarters Staff

What do you do at the Chapter Level when there is an incident? Who is in charge? Immediate and timely contact to: §Emergency Personnel §Chapter Advisor/house mother/father §Greek Advisor §Alpha Chi Omega Headquarters §Insurance Company/Adjuster Be prepared to provide the facts. §Who, what, where, when and how? §Witnesses §Save all documentation Inform Members Designate Spokesperson §Written statement §Agreed upon with Alpha Chi Omega Headquarters Staff

Commercial Property Insurance RSUI Indemnity Insurance Co. § 3 program options - ACV/Stated Value/GRC § Replacement Cost (GRC & Stated Value) § Business Personal Property § Business Interruption / Extra Expense § Law & Ordinance Coverage (GRC and Stated Value) § $2, 500 deductible for majority of losses § Developed to meet the unique needs of sororities

Commercial Property Insurance RSUI Indemnity Insurance Co. § 3 program options - ACV/Stated Value/GRC § Replacement Cost (GRC & Stated Value) § Business Personal Property § Business Interruption / Extra Expense § Law & Ordinance Coverage (GRC and Stated Value) § $2, 500 deductible for majority of losses § Developed to meet the unique needs of sororities

Premium Saving Opportunities Property Discounts Offered § Fire Sprinkler System • 50% discount for the first two policy years • 40% discount for each year thereafter § Professional Property Management – 10% § Modern, Safe Facility – 10% § Strategic Assessment/Feasibility Study – 5% § Multiple Locations – 5% § $10, 000 deductible – 10%

Premium Saving Opportunities Property Discounts Offered § Fire Sprinkler System • 50% discount for the first two policy years • 40% discount for each year thereafter § Professional Property Management – 10% § Modern, Safe Facility – 10% § Strategic Assessment/Feasibility Study – 5% § Multiple Locations – 5% § $10, 000 deductible – 10%

Strategic Assessment/10 year plan Looking to the Future § Evaluation of major systems (HVAC, electrical, etc. ) § Roof and Windows § Financing Plan

Strategic Assessment/10 year plan Looking to the Future § Evaluation of major systems (HVAC, electrical, etc. ) § Roof and Windows § Financing Plan

What you need to know about mold and moisture §Prevention §Coverage §Remediation

What you need to know about mold and moisture §Prevention §Coverage §Remediation

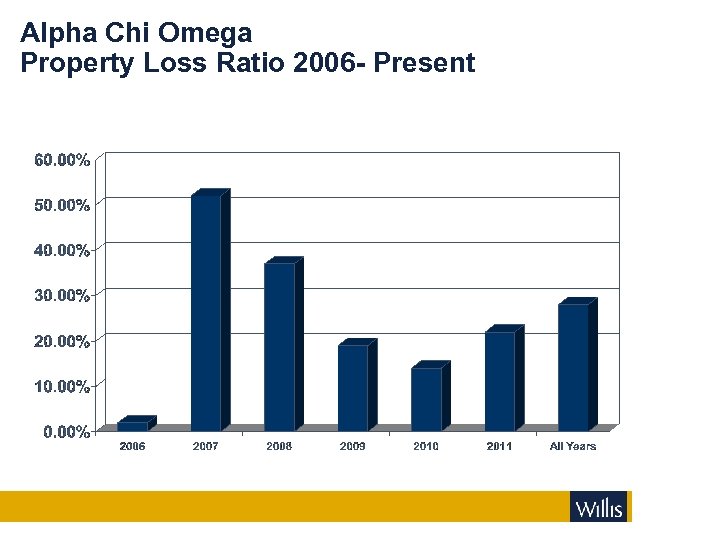

Alpha Chi Omega Property Loss Ratio 2006 - Present

Alpha Chi Omega Property Loss Ratio 2006 - Present

Alpha Chi Omega Property Claim Statistics -2006 - Present Most Frequently Occurring

Alpha Chi Omega Property Claim Statistics -2006 - Present Most Frequently Occurring

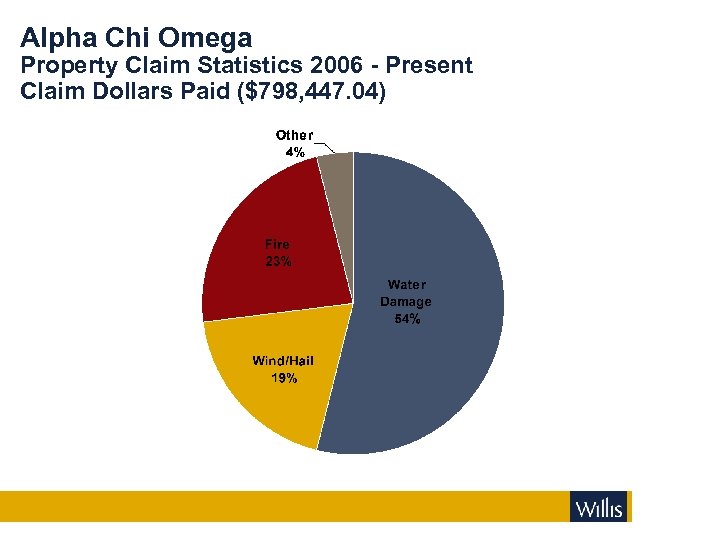

Alpha Chi Omega Property Claim Statistics 2006 - Present Claim Dollars Paid ($798, 447. 04)

Alpha Chi Omega Property Claim Statistics 2006 - Present Claim Dollars Paid ($798, 447. 04)

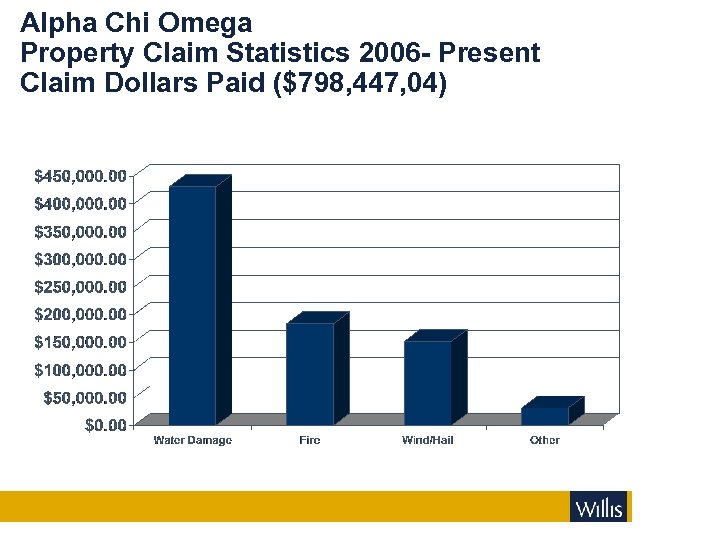

Alpha Chi Omega Property Claim Statistics 2006 - Present Claim Dollars Paid ($798, 447, 04)

Alpha Chi Omega Property Claim Statistics 2006 - Present Claim Dollars Paid ($798, 447, 04)

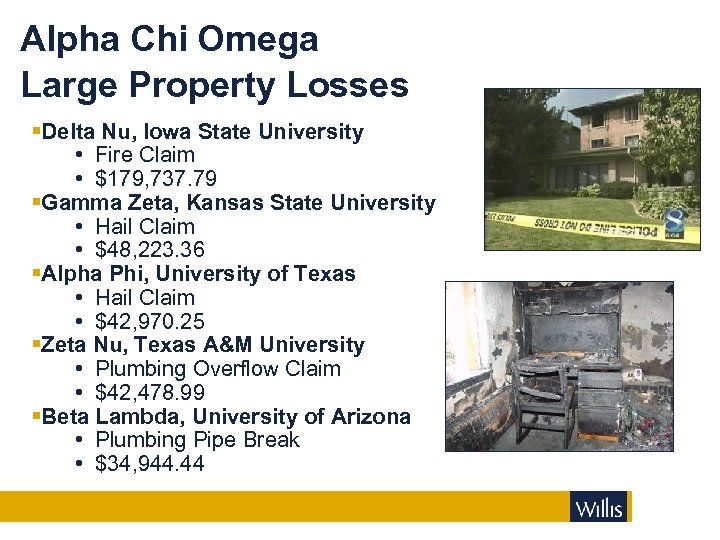

Alpha Chi Omega Large Property Losses §Delta Nu, Iowa State University • Fire Claim • $179, 737. 79 §Gamma Zeta, Kansas State University • Hail Claim • $48, 223. 36 §Alpha Phi, University of Texas • Hail Claim • $42, 970. 25 §Zeta Nu, Texas A&M University • Plumbing Overflow Claim • $42, 478. 99 §Beta Lambda, University of Arizona • Plumbing Pipe Break • $34, 944. 44

Alpha Chi Omega Large Property Losses §Delta Nu, Iowa State University • Fire Claim • $179, 737. 79 §Gamma Zeta, Kansas State University • Hail Claim • $48, 223. 36 §Alpha Phi, University of Texas • Hail Claim • $42, 970. 25 §Zeta Nu, Texas A&M University • Plumbing Overflow Claim • $42, 478. 99 §Beta Lambda, University of Arizona • Plumbing Pipe Break • $34, 944. 44

Simple Property Risk Management Identify the Board Member who will handle facility calls Understand manage high risk times §Winter Break §Summer Break §Vacancy Take Fire Safety Seriously §No smoking and candle burning policies §Extinguishers mounted and charged §Smoke Detectors/Fire Sprinklers/Alarms §Proper Storage of Flammables Willis Inspection biennially Preventative Maintenance §Establishing a Facility Inspection Plan § 10 -Year-Out Plan

Simple Property Risk Management Identify the Board Member who will handle facility calls Understand manage high risk times §Winter Break §Summer Break §Vacancy Take Fire Safety Seriously §No smoking and candle burning policies §Extinguishers mounted and charged §Smoke Detectors/Fire Sprinklers/Alarms §Proper Storage of Flammables Willis Inspection biennially Preventative Maintenance §Establishing a Facility Inspection Plan § 10 -Year-Out Plan

What are an Insured’s duties after a claim? Notify the police if a law has been broken and Report all claims immediately Willis Contacts: Steve Wilson, Manager Claim Advocacy & Loss Control 1 -800 -736 -4327 ext. 4189 swilson@willis. com After Hours: 1 -800 -818 -5619 Make temporary repairs to prevent further damage (mitigate damage) Allow the adjuster to inspect damages prior to making permanent repairs Appoint HCB Representative to meet with Adjuster Select a competent contractor Be prepared to provide records, estimates of repair, receipts and personal property inventories

What are an Insured’s duties after a claim? Notify the police if a law has been broken and Report all claims immediately Willis Contacts: Steve Wilson, Manager Claim Advocacy & Loss Control 1 -800 -736 -4327 ext. 4189 swilson@willis. com After Hours: 1 -800 -818 -5619 Make temporary repairs to prevent further damage (mitigate damage) Allow the adjuster to inspect damages prior to making permanent repairs Appoint HCB Representative to meet with Adjuster Select a competent contractor Be prepared to provide records, estimates of repair, receipts and personal property inventories

What Happens after the Adjuster Arrives? Designate a person on site to meet with adjuster to initiate claim adjustment process Identify/select a contractor to make applicable repairs Adjuster will want to agree on the scope of damage with the Insured and their contractor Adjuster will advise if additional outputs are needed at inspection (i. e. cause and origin, engineer, etc. ) If the loss is large enough, the adjuster can make a request for an advance payment to help defray initial expenses Upon agreement with the Insured or Insured’s contractor on scope and pricing, the adjuster will make a recommendation to the carrier for an Actual Cash Value payment A portion of the repair cost will be deferred (depreciation) until the adjuster confirms that all repairs are complete Upon the completion of repairs the adjuster will review and make a recommendation for the hold back to be released Upon completion of repairs, you are entitled to the full amount deferred or the amount you spent to complete repairs, whichever is less Costs incurred which exceed agreed repair/replacement costs may not be covered

What Happens after the Adjuster Arrives? Designate a person on site to meet with adjuster to initiate claim adjustment process Identify/select a contractor to make applicable repairs Adjuster will want to agree on the scope of damage with the Insured and their contractor Adjuster will advise if additional outputs are needed at inspection (i. e. cause and origin, engineer, etc. ) If the loss is large enough, the adjuster can make a request for an advance payment to help defray initial expenses Upon agreement with the Insured or Insured’s contractor on scope and pricing, the adjuster will make a recommendation to the carrier for an Actual Cash Value payment A portion of the repair cost will be deferred (depreciation) until the adjuster confirms that all repairs are complete Upon the completion of repairs the adjuster will review and make a recommendation for the hold back to be released Upon completion of repairs, you are entitled to the full amount deferred or the amount you spent to complete repairs, whichever is less Costs incurred which exceed agreed repair/replacement costs may not be covered

Be prepared! Important FPMA dates: April 1 - Renewal Premium Due Limits sufficient? Contacts correct? All buildings scheduled? Are you getting all the discounts you are eligible to receive? Risk Management Sorority newsletter – Fall & Spring Winter Break warning Summer Break warning Biennial Inspection Prepare your tenants Appoint appropriate contact Coordinate with local fire inspection Address recommendations timely

Be prepared! Important FPMA dates: April 1 - Renewal Premium Due Limits sufficient? Contacts correct? All buildings scheduled? Are you getting all the discounts you are eligible to receive? Risk Management Sorority newsletter – Fall & Spring Winter Break warning Summer Break warning Biennial Inspection Prepare your tenants Appoint appropriate contact Coordinate with local fire inspection Address recommendations timely

Contacts at Willis Ned Kirklin Executive Vice President nkirklin@willis. com 1 -800 -736 -4327 (ext. 4195) Steve Wilson Manager – Claims Advocacy swilson@willis. com 1 -800 -736 -4327 (ext. 4189) Mick Mc. Gill Vice President-Client Advocacy mmcgill@willis. com 1 -800 -736 -4327 (ext. 4199) Mandy Craig Client Manager mcraig@willis. com 1 -800 -736 -4327 (ext. 4187) Bobbi Larsen Education Consultant blarsen@willis. com 1 -800 -736 -4327 (ext. 4178)

Contacts at Willis Ned Kirklin Executive Vice President nkirklin@willis. com 1 -800 -736 -4327 (ext. 4195) Steve Wilson Manager – Claims Advocacy swilson@willis. com 1 -800 -736 -4327 (ext. 4189) Mick Mc. Gill Vice President-Client Advocacy mmcgill@willis. com 1 -800 -736 -4327 (ext. 4199) Mandy Craig Client Manager mcraig@willis. com 1 -800 -736 -4327 (ext. 4187) Bobbi Larsen Education Consultant blarsen@willis. com 1 -800 -736 -4327 (ext. 4178)