96b046ce15aa9f4789832501a87eaa39.ppt

- Количество слайдов: 29

INSTITUTIONAL UNITS AND INSTITUTIONAL SECTORS NBS-OECD Workshop on National Accounts Guangzhou, December 2 – 5, 2014 Peter van de Ven Head of National Accounts, OECD

Introduction • Defining institutional units and institutional sectors • Delineation between market and non-market • Delineation between general government and Non-profit Institutions Serving Households (NPISHs) • Some specificities of general government • Some specificities of households • Some specificities of financial corporations • Overview of the institutional sector accounts • Concluding remarks 2

Definition of institutional unit • Institutional sector: grouping of institutional units • Definition of institutional unit: – – Entitled to own goods or assets in its own right Able to take economic decisions Able to incur liabilities on its own behalf Complete set of accounts, including balance sheets • Two main types of institutional units – Households – Units with independent legal status: legal or social entities – Note: quasi-corporations, notional resident units, subsidiaries of non-resident units 3

Main institutional sectors Groupings based on functions in the economy • S. 11: Non-financial corporations: Corporations principally engaged in the production of non-financial market goods and services • S. 12: Financial corporations: Corporations principally engaged in the production of financial market services • S. 13: Government: Institutional units engaged in the production of non-market goods and services, and redistribution of income • S. 14: Households: (Groups of) persons who share the same living accommodation, including unincorporated enterprises • S. 15: NPISHs: Non-profit institutions producing non-market goods and services, not controlled by government • S. 1: Total economy • S. 2: Rest of the World: Not a sectors, covers all transactions and positions with non-residents 4

Institutional unit clear cut? • Institutional units not always that clear cut: – Legal unit, enterprise group? – Holdings, head offices, SPEs? – Delineation of quasi-corporations? • Often based on practical considerations • May hamper international comparison 5

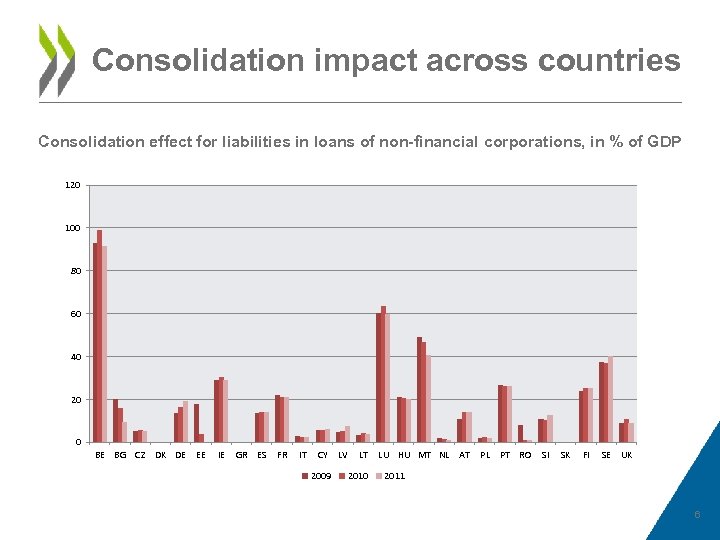

Consolidation impact across countries Consolidation effect for liabilities in loans of non-financial corporations, in % of GDP 120 100 80 60 40 20 0 BE BG CZ DK DE EE IE GR ES FR IT CY LV 2009 LT 2010 LU HU MT NL AT PL PT RO SI SK FI SE UK 2011 6

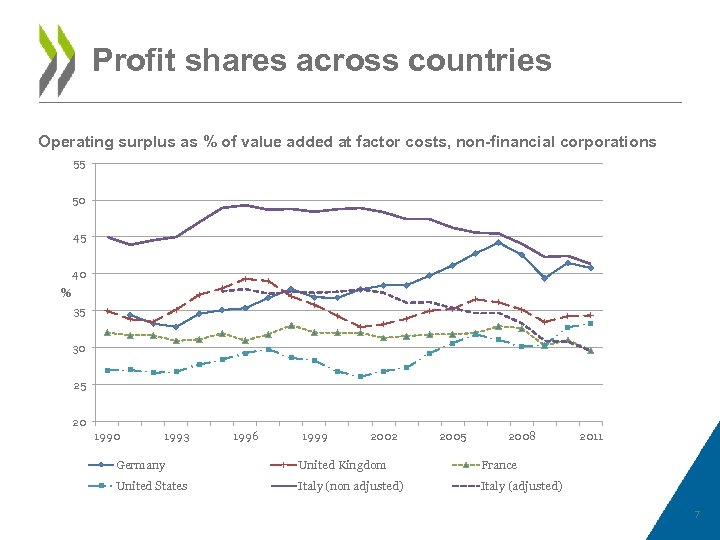

Profit shares across countries Operating surplus as % of value added at factor costs, non-financial corporations 55 50 45 40 % 35 30 25 20 1993 1996 1999 2002 2005 2008 Germany United Kingdom France United States Italy (non adjusted) 2011 Italy (adjusted) 7

Delineation market vs. non-market (1) • Principal function government: provision of goods and services to the community or to individual households and to finance their provision out of taxation or other incomes, to redistribute income and wealth by means of transfers, and to engage in non-market production (SNA 2008, para. 4. 117); controlled by government – Provision of collective services – Provision of individual services free or at price that are not economically significant – Transfers related to redistribution of income and wealth • Principal function NPISHs: provision of goods and services to households and to finance their provision out of subscription, transfers and/or donations, and to engage in non-market production; not controlled by government – Note: Not all non-profit institutions are NPISHs 8

Delineation market vs. non-market (2) • Primary government units (central administration) rather straightforward • Classification of extra budgetary units (and other NPIs): – Criterion 1: Separate institutional unit? • No => consolidation with primary unit • Yes => continue – Criterion 2: Market or non-market producer? • Market => classification as non-financial or financial corporation • Non-market => continue – Criterion 3: Controlled by government? • No => classification as NPISH • Yes => classification as general government unit 9

Delineation market vs. non-market (3) • Non-market output: goods and (individual or collective) services produced by non-profit institutions serving households (NPISHs) or government that are supplied free, or at prices that are not economically significant, to other institutional units or the community as a whole (SNA 2008, para. 6. 128) • Economically significant prices: prices that have a significant effect on the amounts that producers are willing to supply and on the amounts purchasers wish to buy (SNA 2008, para. 6. 95) • Privately owned corporations => market (few exceptions) • Public corporations (and NPIs): 50%-criterion (sales > 50% of production costs), but … • … suppliers of services to general government • Institutional set-up may have significant impact 10

Delineation general government vs. NPISHs – Criterion 3: Controlled by government? • No => classification as NPISH • Yes => classification as general government unit • Control: The ability to determine the general policy or programme (SNA 2008, para. 4. 92 – 4. 93) • Possible indicators: – – – Appointment of officers Other provisions of enabling instruments Contractual agreements Degree of financing Risk exposure 11

Further breakdown based on control • Breakdown of non-financial corporations and financial corporations by ownership/control: – Public corporations – National private corporations – Foreign controlled corporations 12

Some specificities of government • Further breakdown of government: – – Central government State government Local government Social security funds • Public sector: general government plus public corporations (corporations owned and/or controlled by government) 13

Some specificities of government (and NPISHs) Measurement of non-market output • No market price for services of government (and NPISHs) • Alternative: estimate value of output by applying a method to arrive at a market equivalent price • Sum of costs: – – – Intermediate consumption Compensation employees Consumption of fixed capital Other taxes less subsidies on production (Mark-up for profits = return on capital investments) 14

Measurement of non-market output • Government (and NPISHs) consumes its own services • Final consumption of government (and NPISHs) = Output of government (and NPISHs) minus Own-account production of investment goods minus Sales of goods and services plus Goods and services purchased from market producers for delivery to households free or at economically insignificant prices • Volume measurement? 15

Some specificities of households • Includes unincorporated enterprises (except quasicorporations) • Production of goods and services for own final use: – Production of goods included (e. g. subsistence farming in developing countries) – Owner-occupied housing included – Rationale: international comparability • However: production of (other) unpaid services within households not included • Value added broken down into compensation of employees, other taxes less subsidies on production, and mixed income 16

Some specificities of financial corporations • Further breakdown of financial corporations: – – S. 121: Central Bank S. 122: Deposit-taking corporation, excluding Central Bank S. 123: Money market funds (MMF) S. 124: Non-MMF investment funds – S. 125: Other financial intermediaries, excluding insurance corporations and pension funds – S. 126: Financial auxiliaries – S. 127: Captive financial institutions and money lenders – S. 128: Insurance corporations – S. 129: Pension funds 17

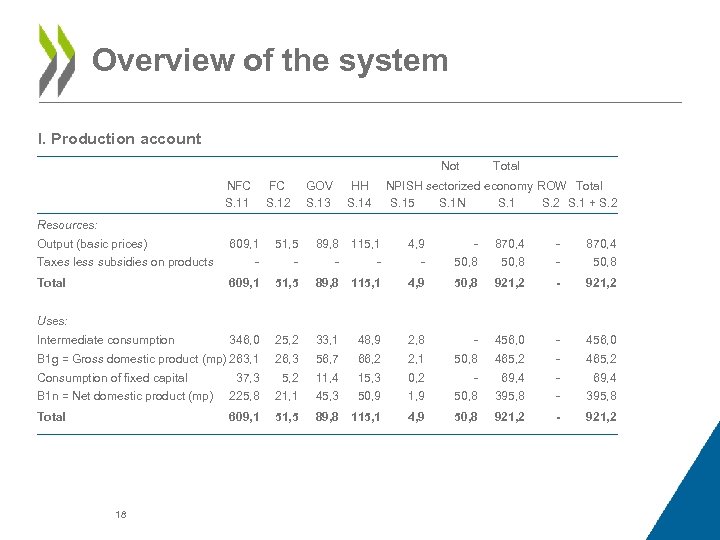

Overview of the system I. Production account Not NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 Total NPISH sectorized economy ROW Total S. 15 S. 1 N S. 1 S. 2 S. 1 + S. 2 Resources: Output (basic prices) 4, 9 - 870, 4 - - 50, 8 51, 5 89, 8 115, 1 4, 9 50, 8 921, 2 - 921, 2 346, 0 25, 2 33, 1 48, 9 2, 8 - 456, 0 B 1 g = Gross domestic product (mp) 263, 1 26, 3 56, 7 66, 2 2, 1 50, 8 465, 2 - 465, 2 37, 3 5, 2 11, 4 15, 3 0, 2 - 69, 4 B 1 n = Net domestic product (mp) 225, 8 21, 1 45, 3 50, 9 1, 9 50, 8 395, 8 - 395, 8 Total 609, 1 51, 5 89, 8 115, 1 4, 9 50, 8 921, 2 - 921, 2 Total 51, 5 - - 609, 1 Taxes less subsidies on products 609, 1 89, 8 115, 1 - Uses: Intermediate consumption Consumption of fixed capital 18

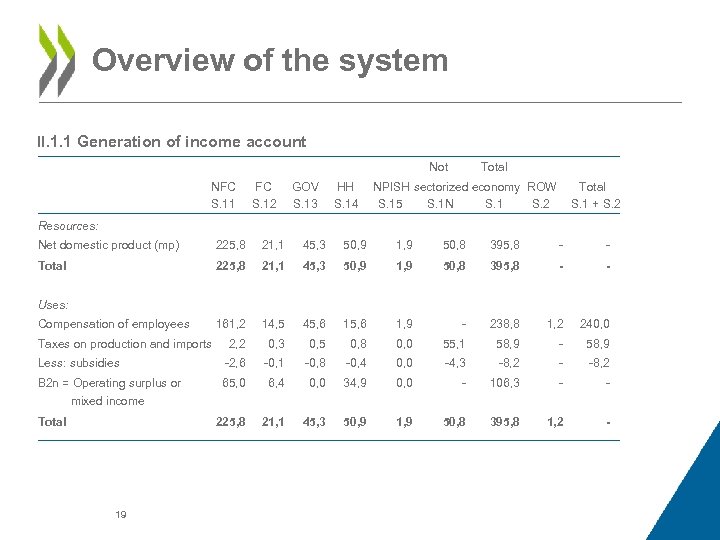

Overview of the system II. 1. 1 Generation of income account Not NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 Total NPISH sectorized economy ROW S. 15 S. 1 N S. 1 S. 2 Total S. 1 + S. 2 Resources: Net domestic product (mp) 225, 8 21, 1 45, 3 50, 9 1, 9 50, 8 395, 8 - - Total 225, 8 21, 1 45, 3 50, 9 1, 9 50, 8 395, 8 - - 161, 2 14, 5 45, 6 1, 9 - 238, 8 1, 2 240, 0 2, 2 0, 3 0, 5 0, 8 0, 0 55, 1 58, 9 - 58, 9 Less: subsidies -2, 6 -0, 1 -0, 8 -0, 4 0, 0 -4, 3 -8, 2 - -8, 2 B 2 n = Operating surplus or 65, 0 6, 4 0, 0 34, 9 0, 0 - 106, 3 - - 225, 8 21, 1 45, 3 50, 9 1, 9 50, 8 395, 8 1, 2 - Uses: Compensation of employees Taxes on production and imports mixed income Total 19

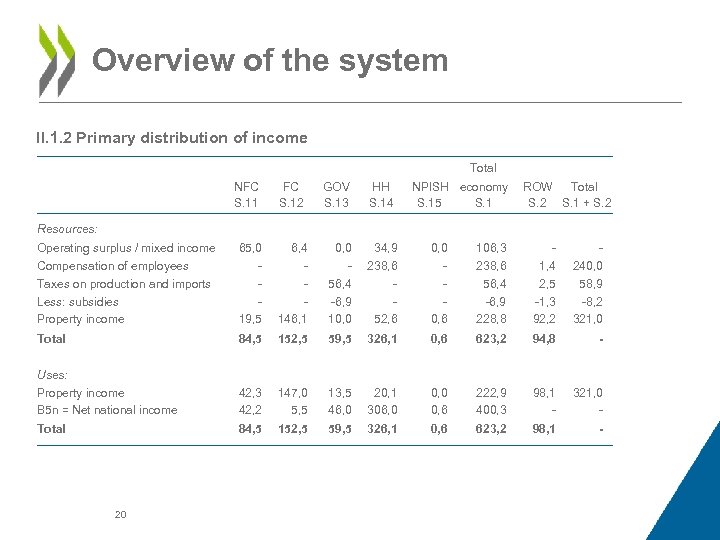

Overview of the system II. 1. 2 Primary distribution of income Total NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 NPISH economy S. 15 S. 1 ROW Total S. 2 S. 1 + S. 2 Resources: Operating surplus / mixed income 65, 0 6, 4 0, 0 34, 9 0, 0 106, 3 - - Compensation of employees Taxes on production and imports Less: subsidies Property income 19, 5 146, 1 56, 4 -6, 9 10, 0 238, 6 52, 6 0, 6 238, 6 56, 4 -6, 9 228, 8 1, 4 2, 5 -1, 3 92, 2 240, 0 58, 9 -8, 2 321, 0 Total 84, 5 152, 5 59, 5 326, 1 0, 6 623, 2 94, 8 - Uses: Property income B 5 n = Net national income 42, 3 42, 2 147, 0 5, 5 13, 5 46, 0 20, 1 306, 0 0, 6 222, 9 400, 3 98, 1 - 321, 0 - Total 84, 5 152, 5 59, 5 326, 1 0, 6 623, 2 98, 1 - 20

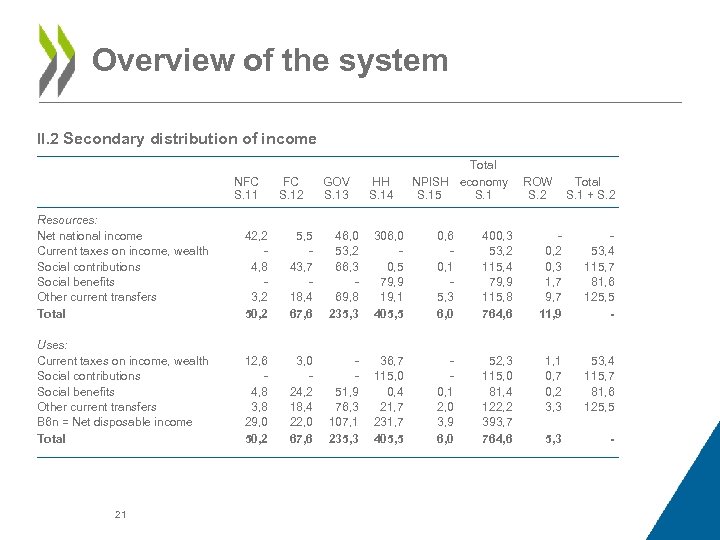

Overview of the system II. 2 Secondary distribution of income NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 Total NPISH economy S. 15 S. 1 ROW S. 2 Total S. 1 + S. 2 Resources: Net national income Current taxes on income, wealth Social contributions Social benefits Other current transfers Total 42, 2 4, 8 3, 2 50, 2 5, 5 43, 7 18, 4 67, 6 46, 0 53, 2 66, 3 69, 8 235, 3 306, 0 0, 5 79, 9 19, 1 405, 5 0, 6 0, 1 5, 3 6, 0 400, 3 53, 2 115, 4 79, 9 115, 8 764, 6 0, 2 0, 3 1, 7 9, 7 11, 9 53, 4 115, 7 81, 6 125, 5 - Uses: Current taxes on income, wealth Social contributions Social benefits Other current transfers B 6 n = Net disposable income Total 12, 6 4, 8 3, 8 29, 0 50, 2 3, 0 24, 2 18, 4 22, 0 67, 6 51, 9 76, 3 107, 1 235, 3 36, 7 115, 0 0, 4 21, 7 231, 7 405, 5 0, 1 2, 0 3, 9 6, 0 52, 3 115, 0 81, 4 122, 2 393, 7 764, 6 1, 1 0, 7 0, 2 3, 3 53, 4 115, 7 81, 6 125, 5 5, 3 - 21

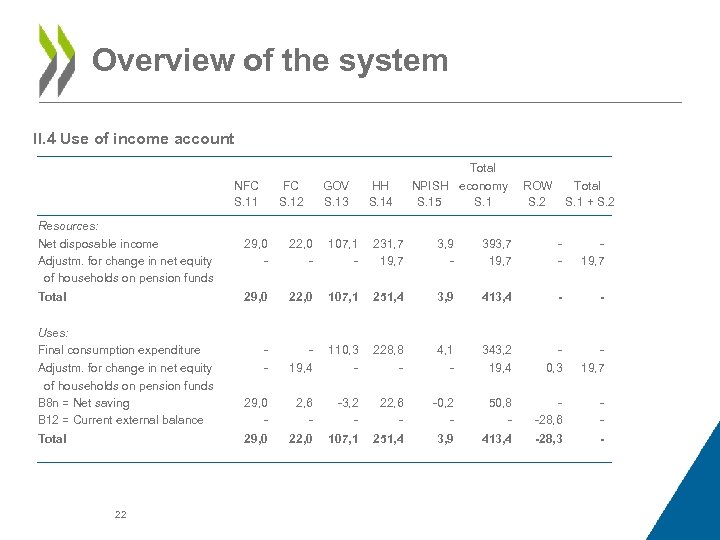

Overview of the system II. 4 Use of income account Total NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 NPISH economy S. 15 S. 1 ROW S. 2 Total S. 1 + S. 2 Resources: Net disposable income Adjustm. for change in net equity of households on pension funds 29, 0 - 22, 0 - 107, 1 - 231, 7 19, 7 3, 9 - 393, 7 19, 7 - 19, 7 Total 29, 0 22, 0 107, 1 251, 4 3, 9 413, 4 - - Uses: Final consumption expenditure Adjustm. for change in net equity of households on pension funds B 8 n = Net saving B 12 = Current external balance - 19, 4 110, 3 - 228, 8 - 4, 1 - 343, 2 19, 4 0, 3 19, 7 29, 0 - 2, 6 - -3, 2 - 22, 6 - -0, 2 - 50, 8 - -28, 6 - Total 29, 0 22, 0 107, 1 251, 4 3, 9 413, 4 -28, 3 - 22

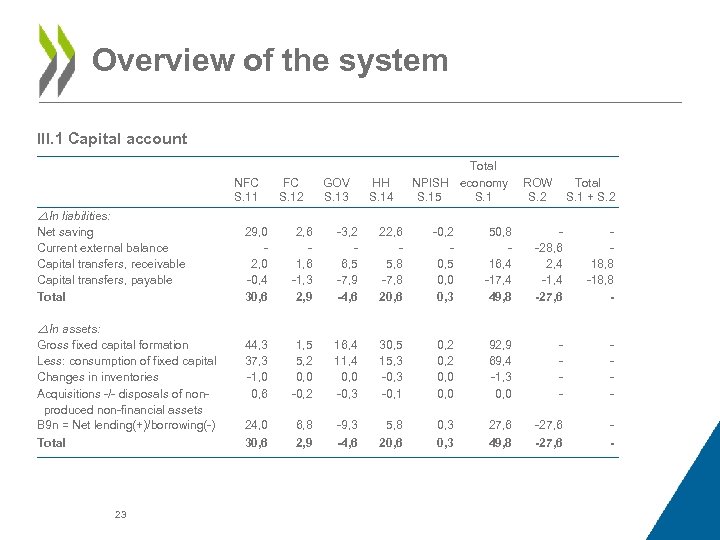

Overview of the system III. 1 Capital account NFC S. 11 FC S. 12 GOV S. 13 HH S. 14 Total NPISH economy S. 15 S. 1 ROW S. 2 Total S. 1 + S. 2 In liabilities: Net saving Current external balance Capital transfers, receivable Capital transfers, payable Total 29, 0 2, 0 -0, 4 30, 6 2, 6 1, 6 -1, 3 2, 9 -3, 2 6, 5 -7, 9 -4, 6 22, 6 5, 8 -7, 8 20, 6 -0, 2 0, 5 0, 0 0, 3 50, 8 16, 4 -17, 4 49, 8 -28, 6 2, 4 -1, 4 -27, 6 18, 8 - 44, 3 37, 3 -1, 0 0, 6 1, 5 5, 2 0, 0 -0, 2 16, 4 11, 4 0, 0 -0, 3 30, 5 15, 3 -0, 1 0, 2 0, 0 92, 9 69, 4 -1, 3 0, 0 - - 24, 0 30, 6 6, 8 2, 9 -9, 3 -4, 6 5, 8 20, 6 0, 3 27, 6 49, 8 -27, 6 - In assets: Gross fixed capital formation Less: consumption of fixed capital Changes in inventories Acquisitions -/- disposals of nonproduced non-financial assets B 9 n = Net lending(+)/borrowing(-) Total 23

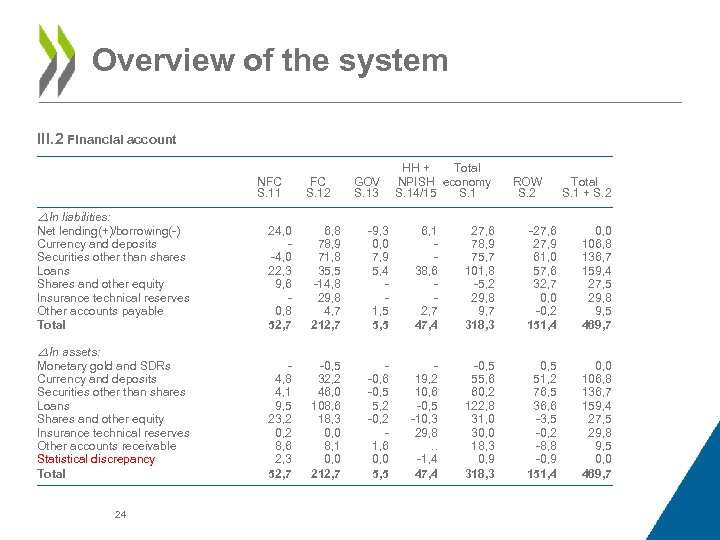

Overview of the system III. 2 Financial account NFC S. 11 In liabilities: Net lending(+)/borrowing(-) Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts payable Total In assets: Monetary gold and SDRs Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts receivable Statistical discrepancy Total 24 FC S. 12 GOV S. 13 HH + Total NPISH economy S. 14/15 S. 1 ROW S. 2 Total S. 1 + S. 2 24, 0 -4, 0 22, 3 9, 6 0, 8 52, 7 6, 8 78, 9 71, 8 35, 5 -14, 8 29, 8 4, 7 212, 7 -9, 3 0, 0 7, 9 5, 4 1, 5 5, 5 6, 1 38, 6 2, 7 47, 4 27, 6 78, 9 75, 7 101, 8 -5, 2 29, 8 9, 7 318, 3 -27, 6 27, 9 61, 0 57, 6 32, 7 0, 0 -0, 2 151, 4 0, 0 106, 8 136, 7 159, 4 27, 5 29, 8 9, 5 469, 7 4, 8 4, 1 9, 5 23, 2 0, 2 8, 6 2, 3 52, 7 -0, 5 32, 2 46, 0 108, 6 18, 3 0, 0 8, 1 0, 0 212, 7 -0, 6 -0, 5 5, 2 -0, 2 1, 6 0, 0 5, 5 19, 2 10, 6 -0, 5 -10, 3 29, 8. . -1, 4 47, 4 -0, 5 55, 6 60, 2 122, 8 31, 0 30, 0 18, 3 0, 9 318, 3 0, 5 51, 2 76, 5 36, 6 -3, 5 -0, 2 -8, 8 -0, 9 151, 4 0, 0 106, 8 136, 7 159, 4 27, 5 29, 8 9, 5 0, 0 469, 7

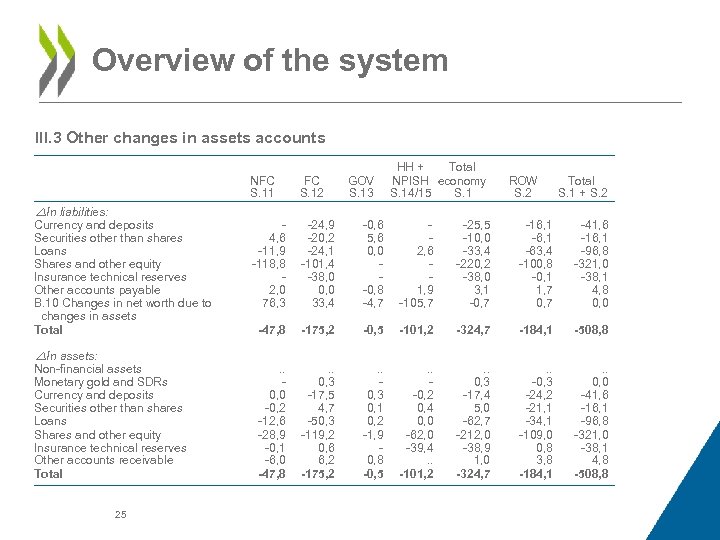

Overview of the system III. 3 Other changes in assets accounts NFC S. 11 In liabilities: Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts payable B. 10 Changes in net worth due to changes in assets Total In assets: Non-financial assets Monetary gold and SDRs Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts receivable Total 25 GOV S. 13 HH + Total NPISH economy S. 14/15 S. 1 FC S. 12 ROW S. 2 Total S. 1 + S. 2 4, 6 -11, 9 -118, 8 2, 0 76, 3 -24, 9 -20, 2 -24, 1 -101, 4 -38, 0 0, 0 33, 4 -0, 6 5, 6 0, 0 -0, 8 -4, 7 2, 6 1, 9 -105, 7 -25, 5 -10, 0 -33, 4 -220, 2 -38, 0 3, 1 -0, 7 -16, 1 -63, 4 -100, 8 -0, 1 1, 7 0, 7 -41, 6 -16, 1 -96, 8 -321, 0 -38, 1 4, 8 0, 0 -47, 8 -175, 2 -0, 5 -101, 2 -324, 7 -184, 1 -508, 8 . . 0, 0 -0, 2 -12, 6 -28, 9 -0, 1 -6, 0 -47, 8 . . 0, 3 -17, 5 4, 7 -50, 3 -119, 2 0, 6 6, 2 -175, 2 . . 0, 3 0, 1 0, 2 -1, 9 0, 8 -0, 5 . . -0, 2 0, 4 0, 0 -62, 0 -39, 4. . -101, 2 . . 0, 3 -17, 4 5, 0 -62, 7 -212, 0 -38, 9 1, 0 -324, 7 . . -0, 3 -24, 2 -21, 1 -34, 1 -109, 0 0, 8 3, 8 -184, 1 . . 0, 0 -41, 6 -16, 1 -96, 8 -321, 0 -38, 1 4, 8 -508, 8

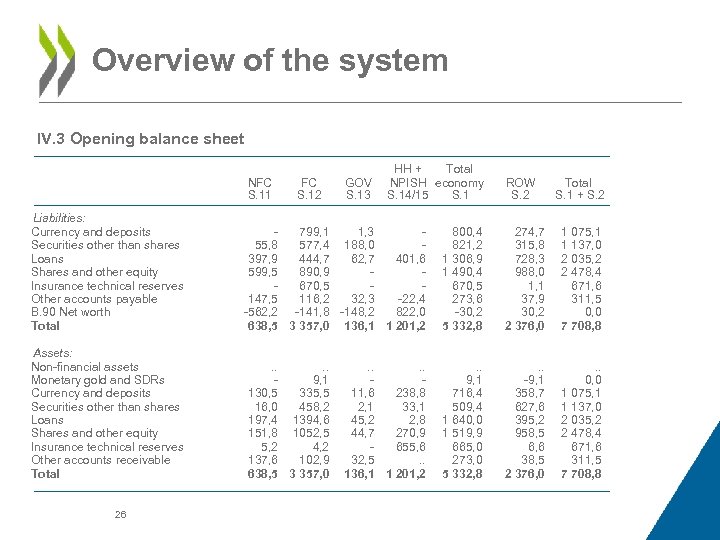

Overview of the system IV. 3 Opening balance sheet NFC S. 11 Liabilities: Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts payable B. 90 Net worth Total Assets: Non-financial assets Monetary gold and SDRs Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts receivable Total 26 FC S. 12 GOV S. 13 HH + Total NPISH economy S. 14/15 S. 1 799, 1 1, 3 55, 8 577, 4 188, 0 397, 9 444, 7 62, 7 401, 6 599, 5 890, 9 670, 5 147, 5 116, 2 32, 3 -22, 4 -562, 2 -141, 8 -148, 2 822, 0 638, 5 3 357, 0 136, 1 1 201, 2. . 9, 1 130, 5 335, 5 16, 0 458, 2 197, 4 1394, 6 151, 8 1052, 5 5, 2 4, 2 137, 6 102, 9 638, 5 3 357, 0 . . 11, 6 238, 8 2, 1 33, 1 45, 2 2, 8 44, 7 270, 9 655, 6 32, 5. . 136, 1 1 201, 2 ROW S. 2 Total S. 1 + S. 2 800, 4 821, 2 1 306, 9 1 490, 4 670, 5 273, 6 -30, 2 5 332, 8 274, 7 315, 8 728, 3 988, 0 1, 1 37, 9 30, 2 2 376, 0 1 075, 1 1 137, 0 2 035, 2 2 478, 4 671, 6 311, 5 0, 0 7 708, 8 . . 9, 1 716, 4 509, 4 1 640, 0 1 519, 9 665, 0 273, 0 5 332, 8 . . -9, 1 358, 7 627, 6 395, 2 958, 5 6, 6 38, 5 2 376, 0 . . 0, 0 1 075, 1 1 137, 0 2 035, 2 2 478, 4 671, 6 311, 5 7 708, 8

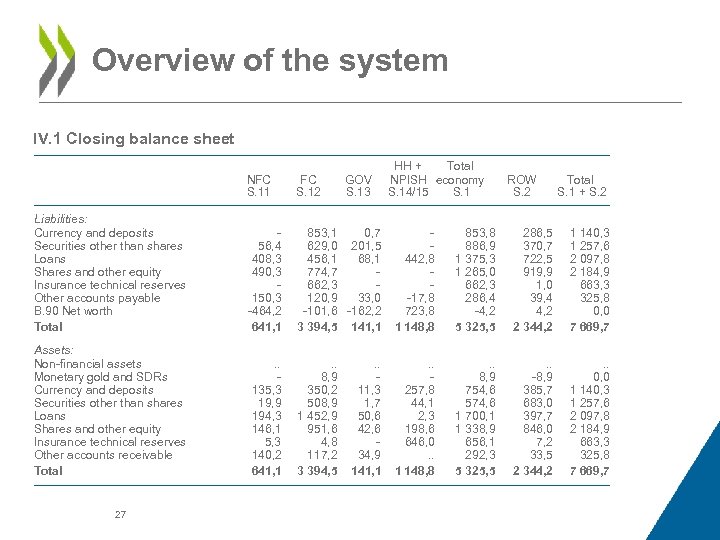

Overview of the system IV. 1 Closing balance sheet FC S. 12 Liabilities: Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts payable B. 90 Net worth Total 56, 4 408, 3 490, 3 150, 3 -464, 2 641, 1 853, 1 0, 7 629, 0 201, 5 456, 1 68, 1 774, 7 662, 3 120, 9 33, 0 -101, 6 -162, 2 3 394, 5 141, 1 442, 8 -17, 8 723, 8 1 148, 8 853, 8 886, 9 1 375, 3 1 265, 0 662, 3 286, 4 -4, 2 5 325, 5 286, 5 370, 7 722, 5 919, 9 1, 0 39, 4 4, 2 2 344, 2 1 140, 3 1 257, 6 2 097, 8 2 184, 9 663, 3 325, 8 0, 0 7 669, 7 Assets: Non-financial assets Monetary gold and SDRs Currency and deposits Securities other than shares Loans Shares and other equity Insurance technical reserves Other accounts receivable Total . . 135, 3 19, 9 194, 3 146, 1 5, 3 140, 2 641, 1 . . 8, 9 350, 2 508, 9 1 452, 9 951, 6 4, 8 117, 2 3 394, 5 . . 257, 8 44, 1 2, 3 198, 6 646, 0. . 1 148, 8 . . 8, 9 754, 6 574, 6 1 700, 1 1 338, 9 656, 1 292, 3 5 325, 5 . . -8, 9 385, 7 683, 0 397, 7 846, 0 7, 2 33, 5 2 344, 2 . . 0, 0 1 140, 3 1 257, 6 2 097, 8 2 184, 9 663, 3 325, 8 7 669, 7 27 GOV S. 13 HH + Total NPISH economy S. 14/15 S. 1 NFC S. 11 . . 11, 3 1, 7 50, 6 42, 6 34, 9 141, 1 ROW S. 2 Total S. 1 + S. 2

Some concluding remarks • Attention has changed from production to income and finance – Interrelationship between “real” economy and financial economy – Analysis of risks and vulnerabilities, among which price bubbles and interconnectedness – More attention for households, including distributional aspects – Etc. • Considerable pressure to compile quarterly institutional sector accounts, including financial accounts and balance sheets • Caveat: International comparison of data generally needs more careful analysis 28

Thank you for your attention! 29

96b046ce15aa9f4789832501a87eaa39.ppt