af49d452892e8e1d5a63810357b817f1.ppt

- Количество слайдов: 24

Institutional Structured Products – Fact or Fiction? Bristol – 29 th January 2015 1

Agenda • Background • Facts – Complexity • Facts – Liquidity • Facts – Costs • How We Work With Brewin Dolphin • Appendix 2

Institutional Structured Products - Background 3

Fiction The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he knows already, without a shadow of a doubt, what is laid before him. Leo Tolstoy, 1897 “Spread bets on steroids” Martin Wheatley, Chief Executive and FCA Board Member 4

Bad Press 5

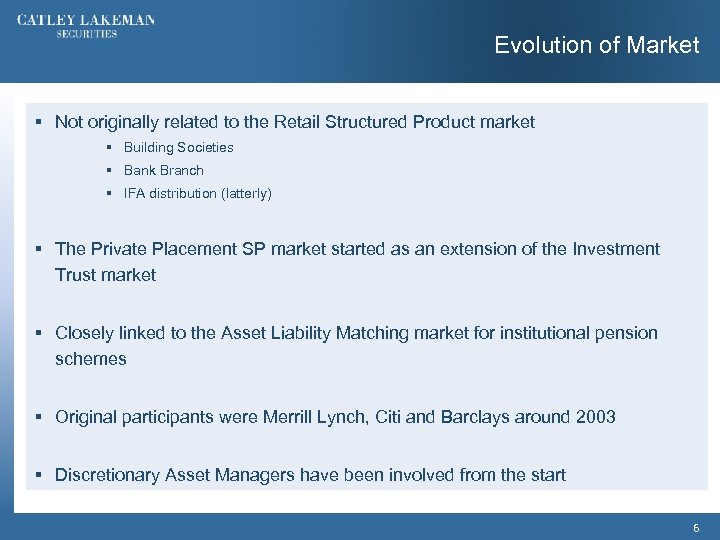

Evolution of Market § Not originally related to the Retail Structured Product market § Building Societies § Bank Branch § IFA distribution (latterly) § The Private Placement SP market started as an extension of the Investment Trust market § Closely linked to the Asset Liability Matching market for institutional pension schemes § Original participants were Merrill Lynch, Citi and Barclays around 2003 § Discretionary Asset Managers have been involved from the start 6

Facts - Complexity 7

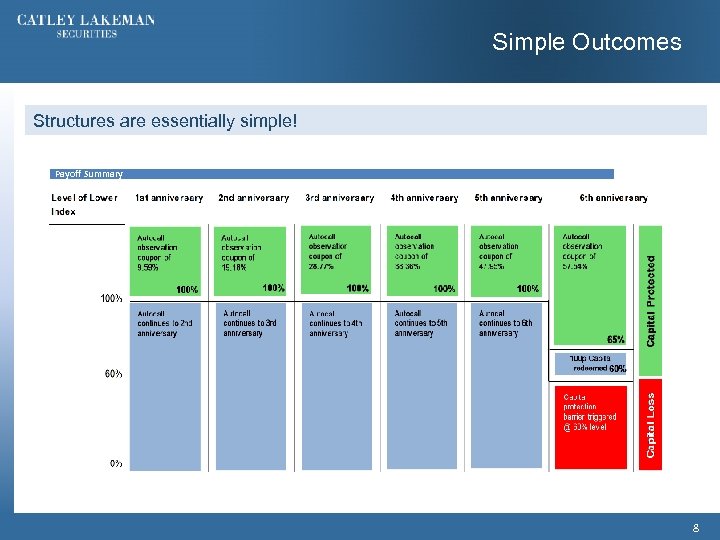

Simple Outcomes Structures are essentially simple! Payoff Summary 8

Unlike Shares Companies’ Balance Sheets are complex – most of these were on most Wealth Managers’ Stock buy lists / in most large cap funds when they suffer large losses or effective bankruptcy 9

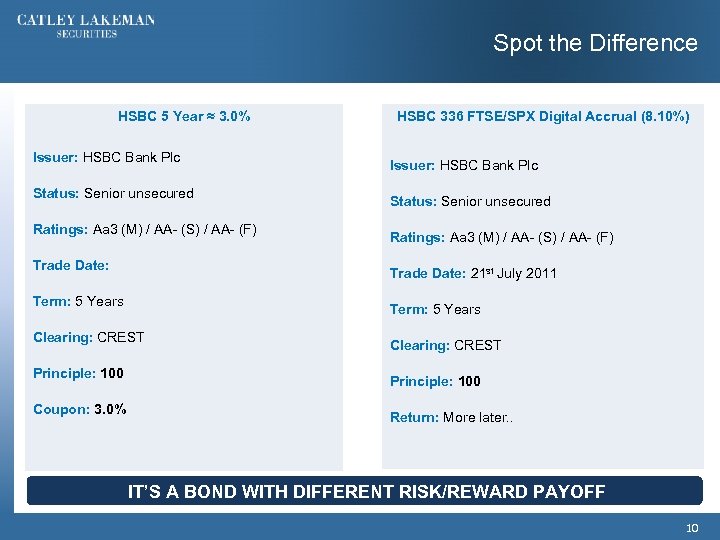

Spot the Difference HSBC 5 Year ≈ 3. 0% Issuer: HSBC Bank Plc Status: Senior unsecured Ratings: Aa 3 (M) / AA- (S) / AA- (F) Trade Date: Status: Senior unsecured Ratings: Aa 3 (M) / AA- (S) / AA- (F) Term: 5 Years Clearing: CREST Coupon: 3. 0% Issuer: HSBC Bank Plc Trade Date: 21 st July 2011 Term: 5 Years Principle: 100 HSBC 336 FTSE/SPX Digital Accrual (8. 10%) Clearing: CREST Principle: 100 Return: More later. . IT’S A BOND WITH DIFFERENT RISK/REWARD PAYOFF 10

Facts - Liquidity 11

Other Defensive Assets? Real property is by nature illiquid Property Equity (REITs/IPD) is liquid but correlated to equity ultimately Funds of Hedge Funds Absolute Return Funds Bond Funds. . ? 12

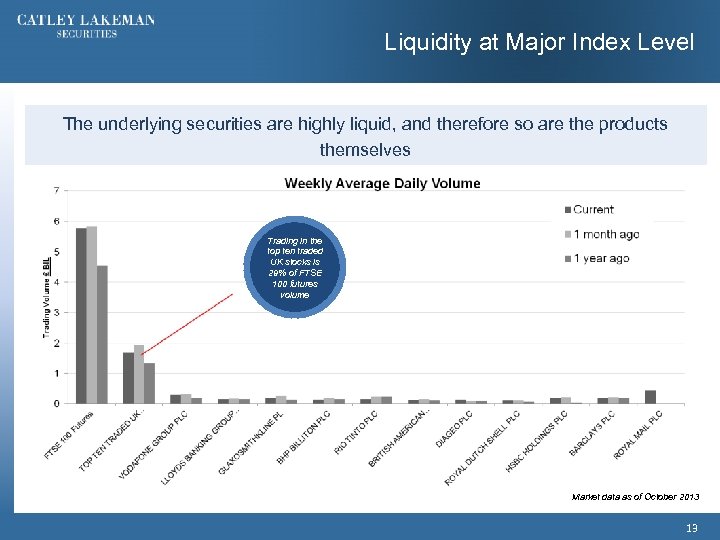

Liquidity at Major Index Level The underlying securities are highly liquid, and therefore so are the products themselves Trading in the top ten traded UK stocks is 29% of FTSE 100 futures volume Market data as of October 2013 13

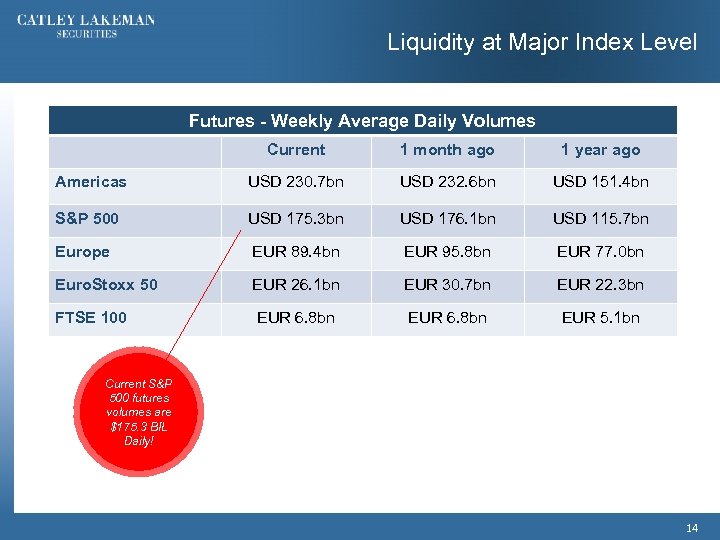

Liquidity at Major Index Level Futures - Weekly Average Daily Volumes Current 1 month ago 1 year ago Americas USD 230. 7 bn USD 232. 6 bn USD 151. 4 bn S&P 500 USD 175. 3 bn USD 176. 1 bn USD 115. 7 bn Europe EUR 89. 4 bn EUR 95. 8 bn EUR 77. 0 bn Euro. Stoxx 50 EUR 26. 1 bn EUR 30. 7 bn EUR 22. 3 bn FTSE 100 EUR 6. 8 bn EUR 5. 1 bn Current S&P 500 futures volumes are $175. 3 BIL Daily! 14

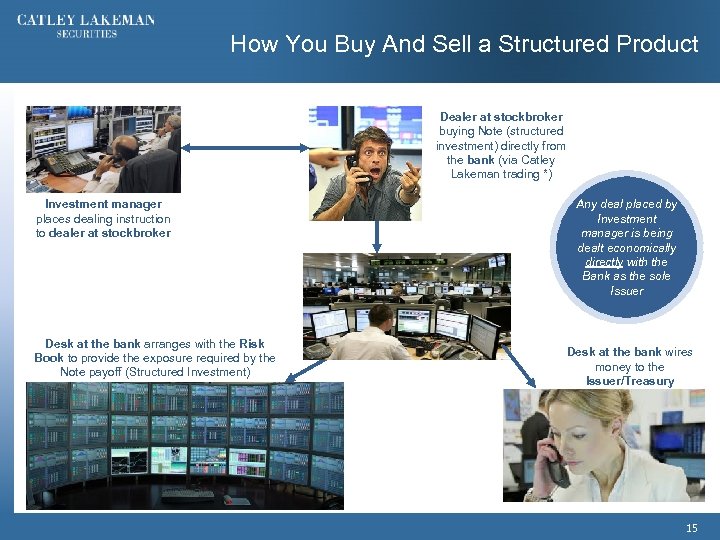

How You Buy And Sell a Structured Product Dealer at stockbroker buying Note (structured investment) directly from the bank (via Catley Lakeman trading *) Investment manager places dealing instruction to dealer at stockbroker Desk at the bank arranges with the Risk Book to provide the exposure required by the Note payoff (Structured Investment) Any deal placed by Investment manager is being dealt economically directly with the Bank as the sole Issuer Desk at the bank wires money to the Issuer/Treasury 15

Past Exceptions § Close Brothers & ELDer. S - collateralised with British, Irish and some Icelandic banks and building societies. Different to modern structures. § Retail Structured Product market 16

Facts – Costs 17

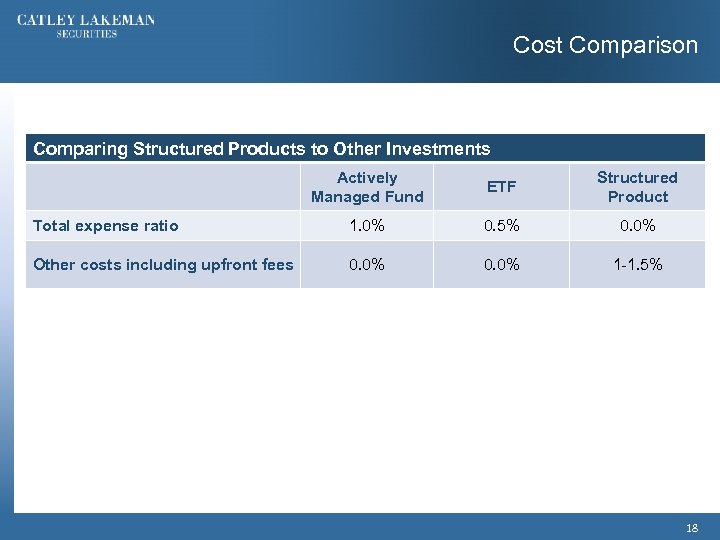

Cost Comparison Comparing Structured Products to Other Investments Actively Managed Fund ETF Structured Product Total expense ratio 1. 0% 0. 5% 0. 0% Other costs including upfront fees 0. 0% 1 -1. 5% 18

How We Work With Brewin Dolphin 19

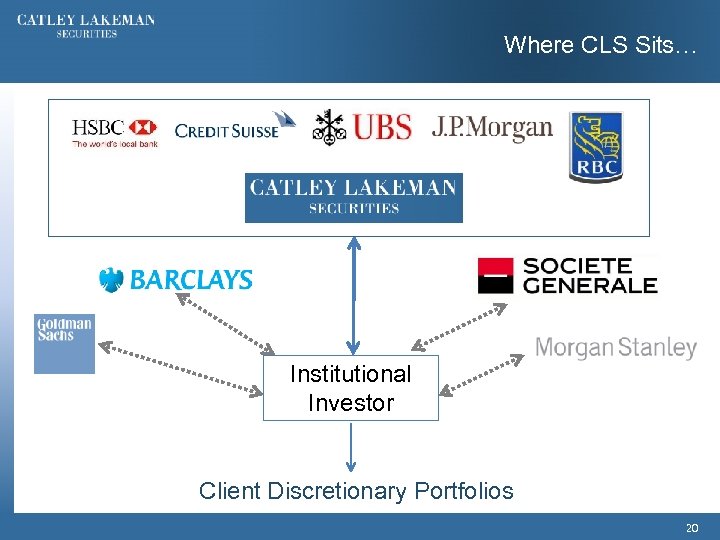

Where CLS Sits… Institutional Investor Client Discretionary Portfolios 20

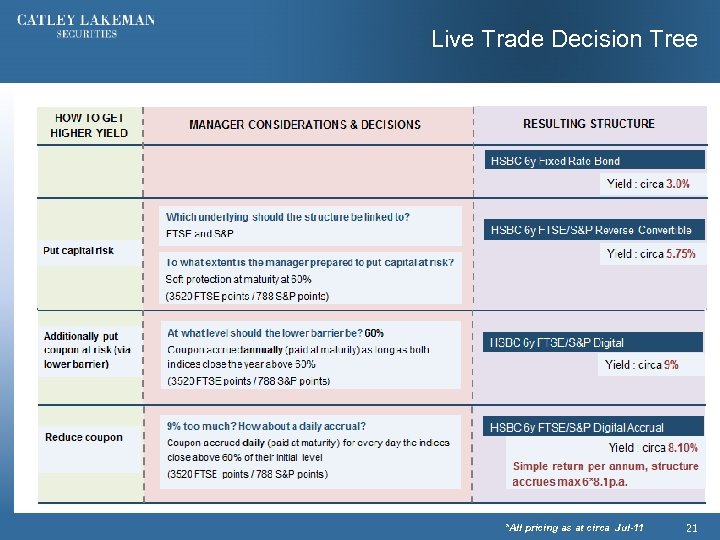

Live Trade Decision Tree *All pricing as at circa Jul-11 21

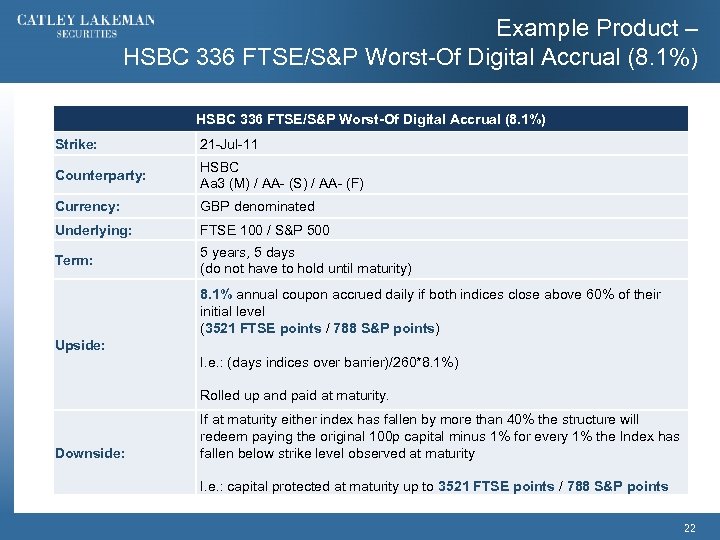

Example Product – HSBC 336 FTSE/S&P Worst-Of Digital Accrual (8. 1%) Strike: 21 -Jul-11 Counterparty: HSBC Aa 3 (M) / AA- (S) / AA- (F) Currency: GBP denominated Underlying: FTSE 100 / S&P 500 Term: 5 years, 5 days (do not have to hold until maturity) 8. 1% annual coupon accrued daily if both indices close above 60% of their initial level (3521 FTSE points / 788 S&P points) Upside: I. e. : (days indices over barrier)/260*8. 1%) Rolled up and paid at maturity. Downside: If at maturity either index has fallen by more than 40% the structure will redeem paying the original 100 p capital minus 1% for every 1% the Index has fallen below strike level observed at maturity I. e. : capital protected at maturity up to 3521 FTSE points / 788 S&P points 22

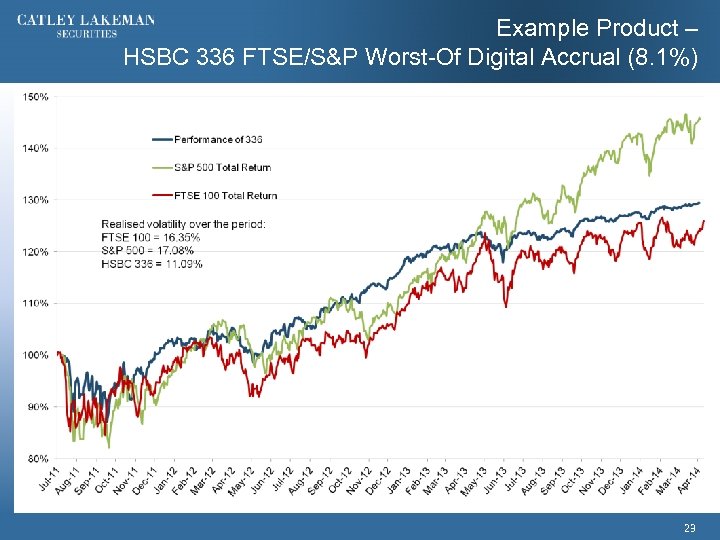

Example Product – HSBC 336 FTSE/S&P Worst-Of Digital Accrual (8. 1%) 23

DISCLAIMER The information in this document is derived from sources believed to be reliable but which have not been independently verified. Catley Lakeman Securities makes no guarantee of its accuracy and completeness and is not responsible for errors of transmission of factual or analytical data, nor is it liable for damages arising out of any person’s reliance upon this information. All charts and graphs are from publicly available sources or proprietary data. The opinions in this document constitute the present judgment of Catley Lakeman Securities, which is subject to change without notice. This document is neither an offer to sell, purchase or subscribe for any investment nor a solicitation of such an offer. This document is intended for the use of institutional and professional customers and is not intended for the use of private customers. This document is not intended for distribution in the United States of America or to US persons. This document is intended to be distributed in its entirety. No consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. Catley Lakeman Securities is a LLP registered in England Wales, Registered Office : One Eleven Edmund Street, Birmingham, B 3 2 HJ. Registration Number: OC 336585, FSA Reference: 484826 24

af49d452892e8e1d5a63810357b817f1.ppt