Презентация на 26-28.04.16 2.pptx

- Количество слайдов: 37

Institutional developments worldwide and in the EU with regard to financial stability Peter Spicka, Senior Adviser for Banking Supervision and Financial Stability The views expressed in this presentation are those of the author and do not necessarily reflect the official views of the Deutsche Bundesbank

Institutional developments worldwide and in the EU with regard to financial stability Peter Spicka, Senior Adviser for Banking Supervision and Financial Stability The views expressed in this presentation are those of the author and do not necessarily reflect the official views of the Deutsche Bundesbank

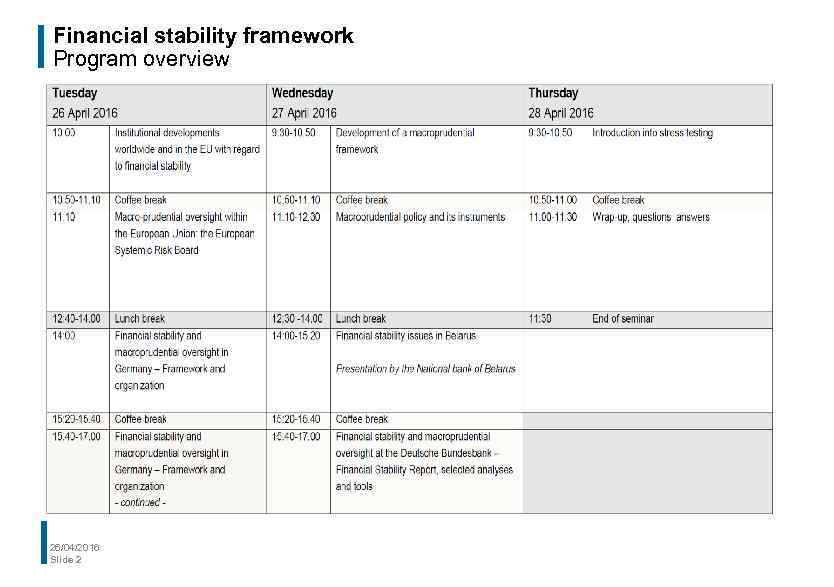

Financial stability framework Program overview 26/04/2016 Slide 2

Financial stability framework Program overview 26/04/2016 Slide 2

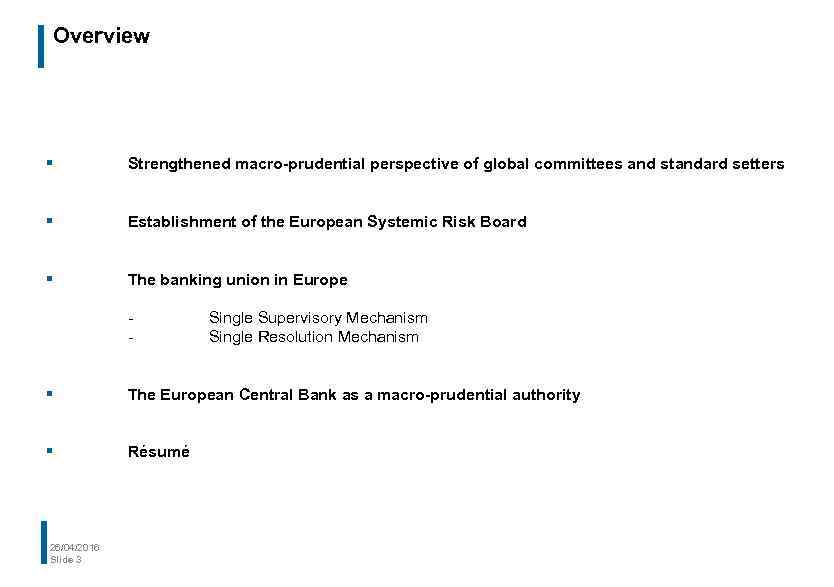

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 3

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 3

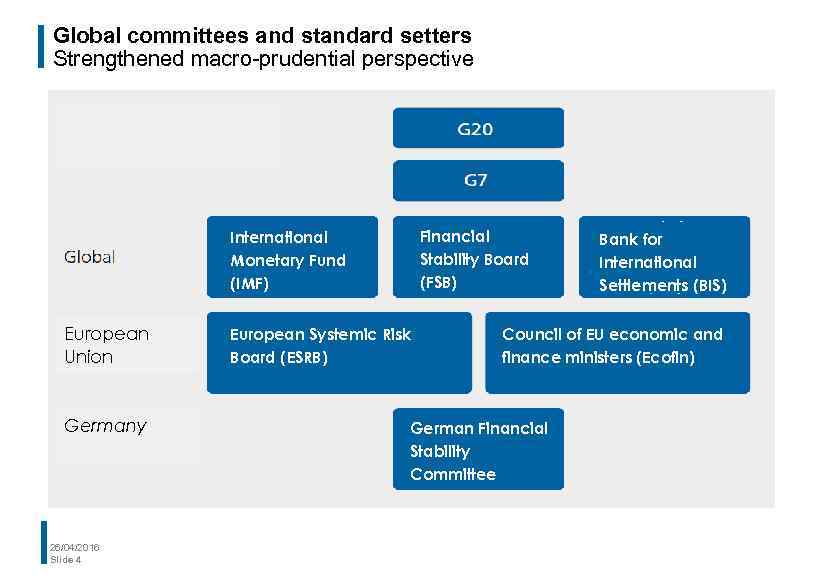

Global committees and standard setters Strengthened macro-prudential perspective Financial Stability Board (FSB) International Monetary Fund (IMF) European Union Germany 26/04/2016 Slide 4 European Systemic Risk Board (ESRB) Bank for International Settlements (BIS) Council of EU economic and finance ministers (Ecofin) German Financial Stability Committee

Global committees and standard setters Strengthened macro-prudential perspective Financial Stability Board (FSB) International Monetary Fund (IMF) European Union Germany 26/04/2016 Slide 4 European Systemic Risk Board (ESRB) Bank for International Settlements (BIS) Council of EU economic and finance ministers (Ecofin) German Financial Stability Committee

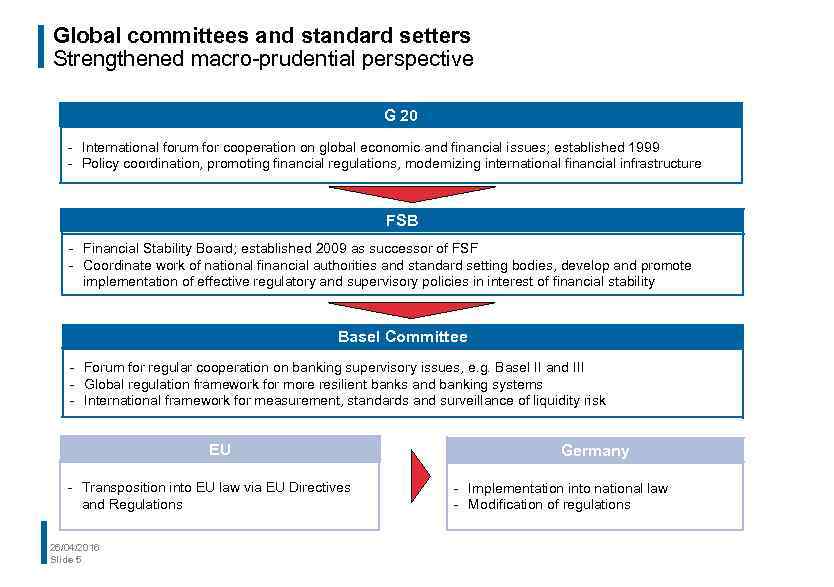

Global committees and standard setters Strengthened macro-prudential perspective G 20 - International forum for cooperation on global economic and financial issues; established 1999 - Policy coordination, promoting financial regulations, modernizing international financial infrastructure FSB - Financial Stability Board; established 2009 as successor of FSF - Coordinate work of national financial authorities and standard setting bodies, develop and promote implementation of effective regulatory and supervisory policies in interest of financial stability Basel Committee - Forum for regular cooperation on banking supervisory issues, e. g. Basel II and III - Global regulation framework for more resilient banks and banking systems - International framework for measurement, standards and surveillance of liquidity risk EU - Transposition into EU law via EU Directives and Regulations 26/04/2016 Slide 5 Germany - Implementation into national law - Modification of regulations

Global committees and standard setters Strengthened macro-prudential perspective G 20 - International forum for cooperation on global economic and financial issues; established 1999 - Policy coordination, promoting financial regulations, modernizing international financial infrastructure FSB - Financial Stability Board; established 2009 as successor of FSF - Coordinate work of national financial authorities and standard setting bodies, develop and promote implementation of effective regulatory and supervisory policies in interest of financial stability Basel Committee - Forum for regular cooperation on banking supervisory issues, e. g. Basel II and III - Global regulation framework for more resilient banks and banking systems - International framework for measurement, standards and surveillance of liquidity risk EU - Transposition into EU law via EU Directives and Regulations 26/04/2016 Slide 5 Germany - Implementation into national law - Modification of regulations

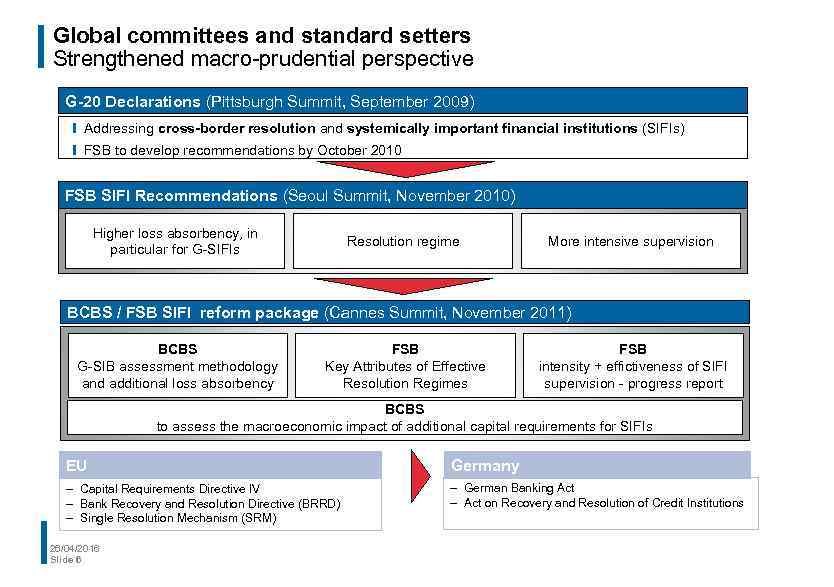

Global committees and standard setters Strengthened macro-prudential perspective G-20 Declarations (Pittsburgh Summit, September 2009) ❙ Addressing cross-border resolution and systemically important financial institutions (SIFIs) ❙ FSB to develop recommendations by October 2010 FSB SIFI Recommendations (Seoul Summit, November 2010) Higher loss absorbency, in particular for G-SIFIs Resolution regime More intensive supervision BCBS / FSB SIFI reform package (Cannes Summit, November 2011) BCBS G-SIB assessment methodology and additional loss absorbency FSB Key Attributes of Effective Resolution Regimes FSB intensity + effictiveness of SIFI supervision - progress report BCBS to assess the macroeconomic impact of additional capital requirements for SIFIs EU Germany - Capital Requirements Directive IV - Bank Recovery and Resolution Directive (BRRD) - Single Resolution Mechanism (SRM) - German Banking Act - Act on Recovery and Resolution of Credit Institutions 26/04/2016 Slide 6

Global committees and standard setters Strengthened macro-prudential perspective G-20 Declarations (Pittsburgh Summit, September 2009) ❙ Addressing cross-border resolution and systemically important financial institutions (SIFIs) ❙ FSB to develop recommendations by October 2010 FSB SIFI Recommendations (Seoul Summit, November 2010) Higher loss absorbency, in particular for G-SIFIs Resolution regime More intensive supervision BCBS / FSB SIFI reform package (Cannes Summit, November 2011) BCBS G-SIB assessment methodology and additional loss absorbency FSB Key Attributes of Effective Resolution Regimes FSB intensity + effictiveness of SIFI supervision - progress report BCBS to assess the macroeconomic impact of additional capital requirements for SIFIs EU Germany - Capital Requirements Directive IV - Bank Recovery and Resolution Directive (BRRD) - Single Resolution Mechanism (SRM) - German Banking Act - Act on Recovery and Resolution of Credit Institutions 26/04/2016 Slide 6

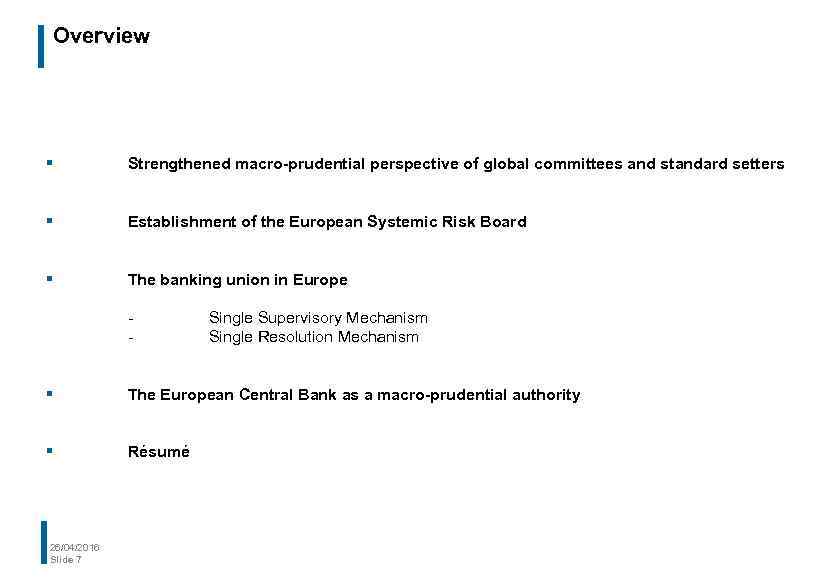

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 7

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 7

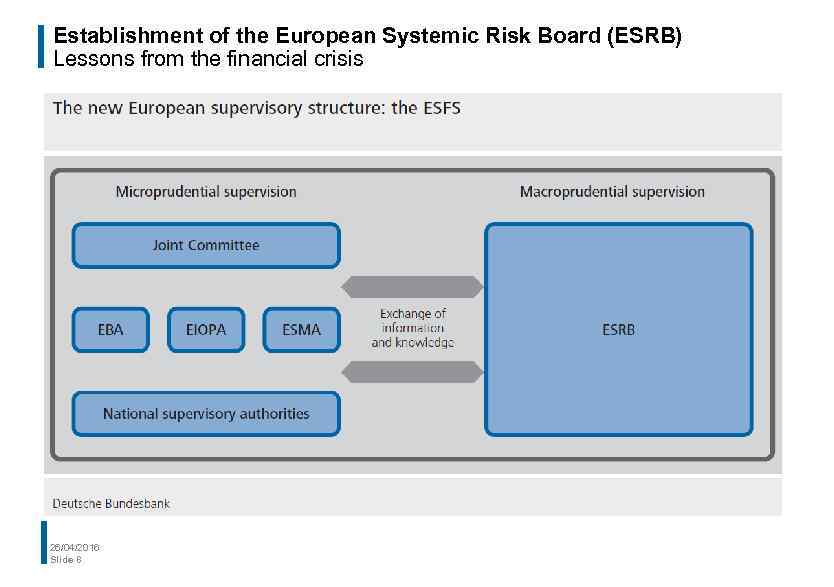

Establishment of the European Systemic Risk Board (ESRB) Lessons from the financial crisis 26/04/2016 Slide 8

Establishment of the European Systemic Risk Board (ESRB) Lessons from the financial crisis 26/04/2016 Slide 8

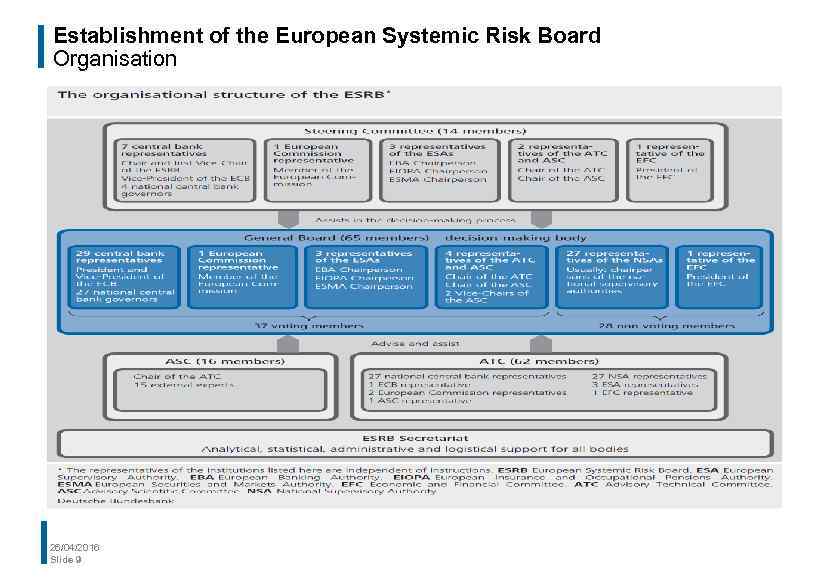

Establishment of the European Systemic Risk Board Organisation 26/04/2016 Slide 9

Establishment of the European Systemic Risk Board Organisation 26/04/2016 Slide 9

European Systemic Risk Board Tasks § Responsible for macro-prudential oversight of the financial system within the EU in order to contribute to the prevention or mitigation of systemic risks to financial stability in the EU that arise from developments within the financial system and taking into account macro-economic developments § Establishes link between micro-prudential supervision and macro economy § Brings the systemic component into financial supervision 26/04/2016 Slide 10

European Systemic Risk Board Tasks § Responsible for macro-prudential oversight of the financial system within the EU in order to contribute to the prevention or mitigation of systemic risks to financial stability in the EU that arise from developments within the financial system and taking into account macro-economic developments § Establishes link between micro-prudential supervision and macro economy § Brings the systemic component into financial supervision 26/04/2016 Slide 10

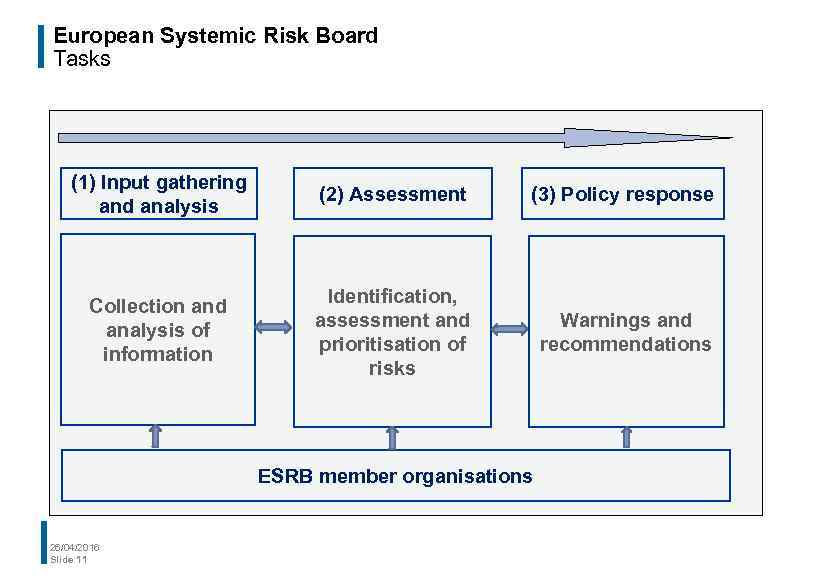

European Systemic Risk Board Tasks (1) Input gathering and analysis (2) Assessment (3) Policy response Collection and analysis of information Identification, assessment and prioritisation of risks Warnings and recommendations ESRB member organisations 26/04/2016 Slide 11

European Systemic Risk Board Tasks (1) Input gathering and analysis (2) Assessment (3) Policy response Collection and analysis of information Identification, assessment and prioritisation of risks Warnings and recommendations ESRB member organisations 26/04/2016 Slide 11

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 12

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 12

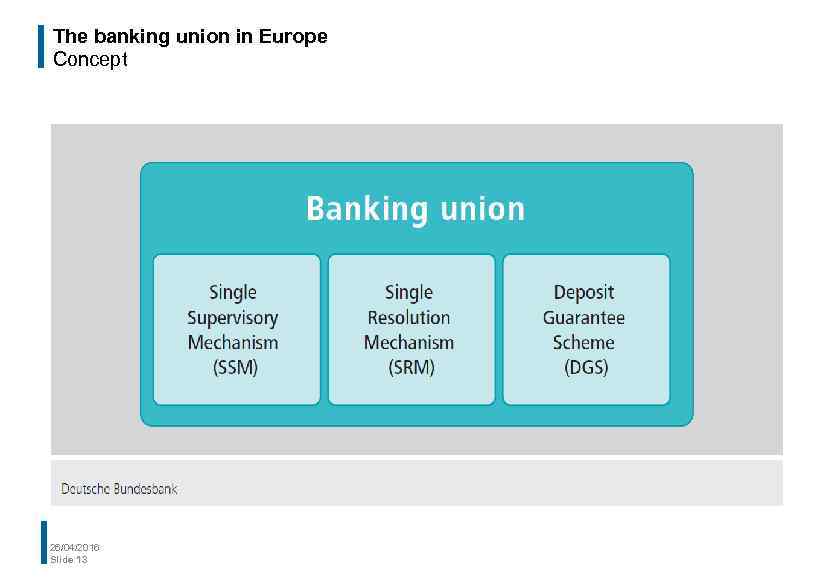

The banking union in Europe Concept 26/04/2016 Slide 13

The banking union in Europe Concept 26/04/2016 Slide 13

Conceptual background of the banking union Lessons from the financial crisis § Lessons from the financial crisis kick-started work on the European banking union § Supervisory structures previously in place were no longer adequate to deal with highly interconnected European financial markets § Banking supervision primarily carried out at national levels makes it difficult to identify all risks of cross-border banking groups § One of the overarching goals is to loosen the close ties between bank and sovereign risks 26/04/2016 Slide 14

Conceptual background of the banking union Lessons from the financial crisis § Lessons from the financial crisis kick-started work on the European banking union § Supervisory structures previously in place were no longer adequate to deal with highly interconnected European financial markets § Banking supervision primarily carried out at national levels makes it difficult to identify all risks of cross-border banking groups § One of the overarching goals is to loosen the close ties between bank and sovereign risks 26/04/2016 Slide 14

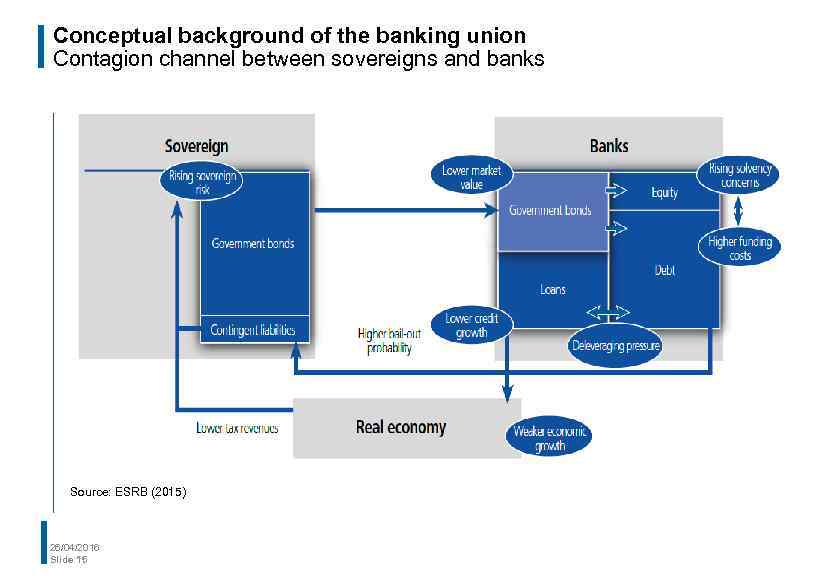

Conceptual background of the banking union Contagion channel between sovereigns and banks Source: ESRB (2015) 26/04/2016 Slide 15

Conceptual background of the banking union Contagion channel between sovereigns and banks Source: ESRB (2015) 26/04/2016 Slide 15

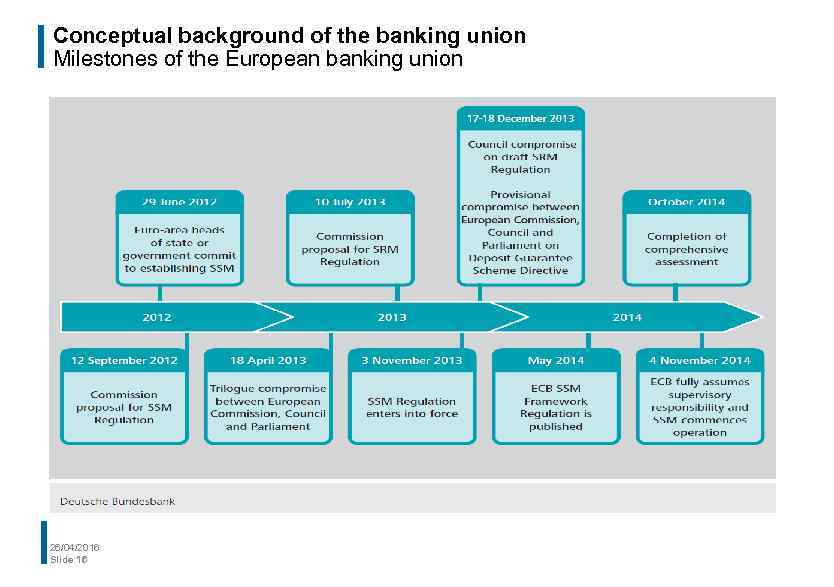

Conceptual background of the banking union Milestones of the European banking union 26/04/2016 Slide 16

Conceptual background of the banking union Milestones of the European banking union 26/04/2016 Slide 16

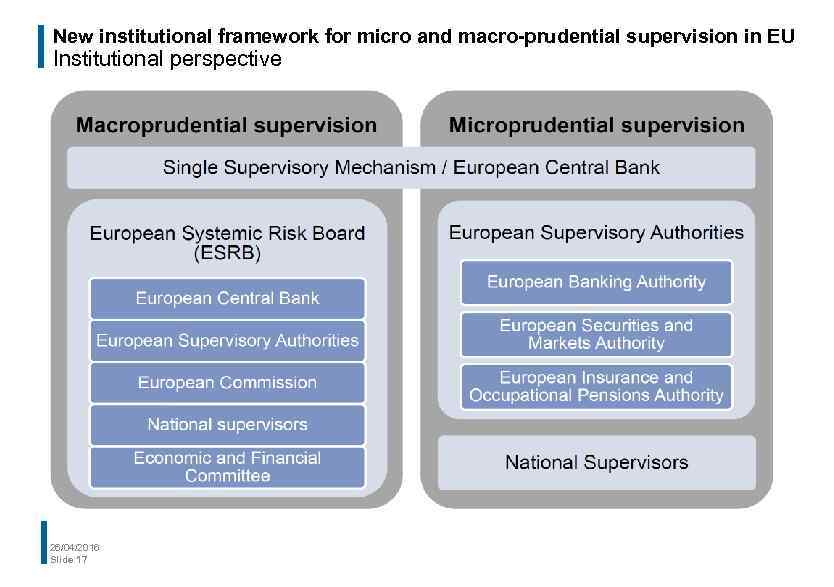

New institutional framework for micro and macro-prudential supervision in EU Institutional perspective 26/04/2016 Slide 17

New institutional framework for micro and macro-prudential supervision in EU Institutional perspective 26/04/2016 Slide 17

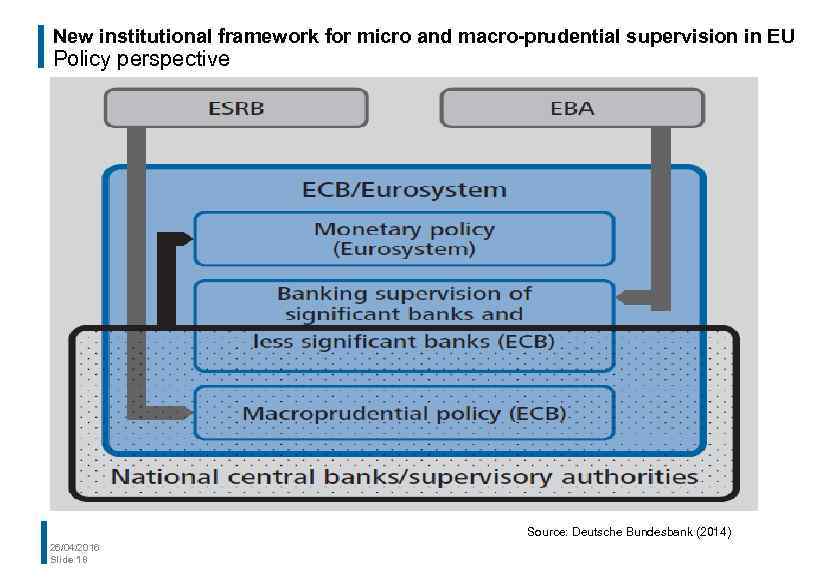

New institutional framework for micro and macro-prudential supervision in EU Policy perspective Source: Deutsche Bundesbank (2014) 26/04/2016 Slide 18

New institutional framework for micro and macro-prudential supervision in EU Policy perspective Source: Deutsche Bundesbank (2014) 26/04/2016 Slide 18

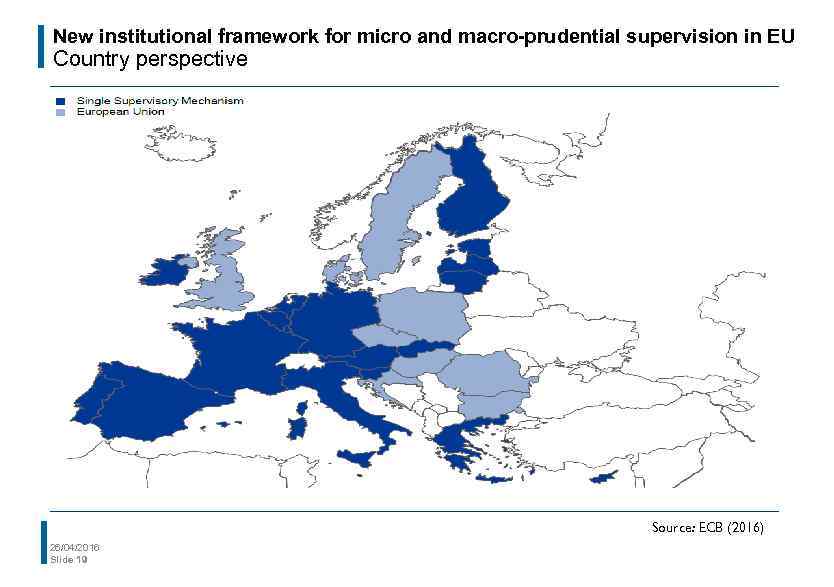

New institutional framework for micro and macro-prudential supervision in EU Country perspective Source: ECB (2016) 26/04/2016 Slide 19

New institutional framework for micro and macro-prudential supervision in EU Country perspective Source: ECB (2016) 26/04/2016 Slide 19

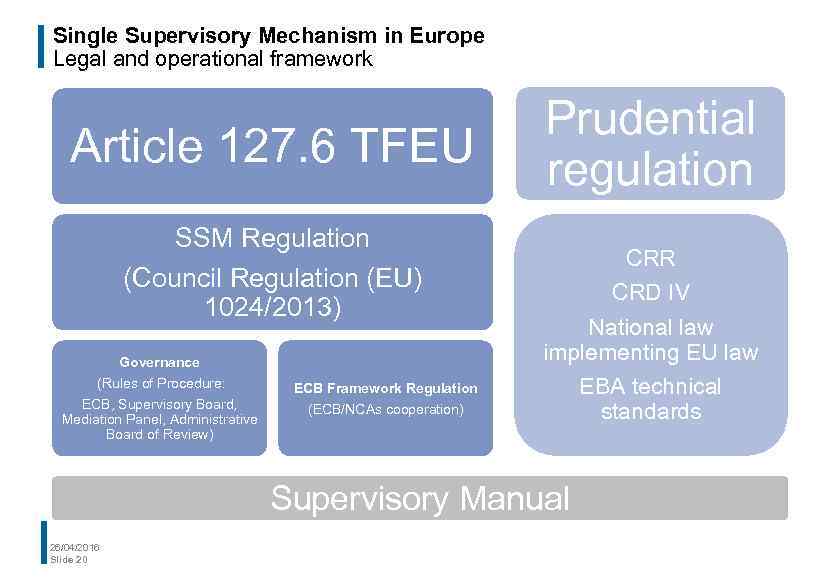

Single Supervisory Mechanism in Europe Legal and operational framework Article 127. 6 TFEU Prudential regulation SSM Regulation (Council Regulation (EU) 1024/2013) CRR CRD IV Governance (Rules of Procedure: ECB, Supervisory Board, Mediation Panel, Administrative Board of Review) ECB Framework Regulation (ECB/NCAs cooperation) National law implementing EU law EBA technical standards Supervisory Manual 26/04/2016 Slide 20

Single Supervisory Mechanism in Europe Legal and operational framework Article 127. 6 TFEU Prudential regulation SSM Regulation (Council Regulation (EU) 1024/2013) CRR CRD IV Governance (Rules of Procedure: ECB, Supervisory Board, Mediation Panel, Administrative Board of Review) ECB Framework Regulation (ECB/NCAs cooperation) National law implementing EU law EBA technical standards Supervisory Manual 26/04/2016 Slide 20

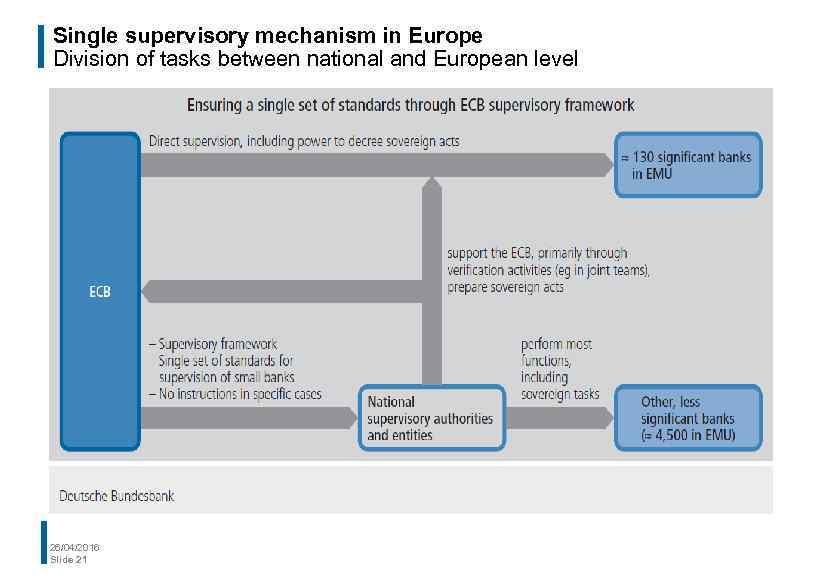

Single supervisory mechanism in Europe Division of tasks between national and European level 26/04/2016 Slide 21

Single supervisory mechanism in Europe Division of tasks between national and European level 26/04/2016 Slide 21

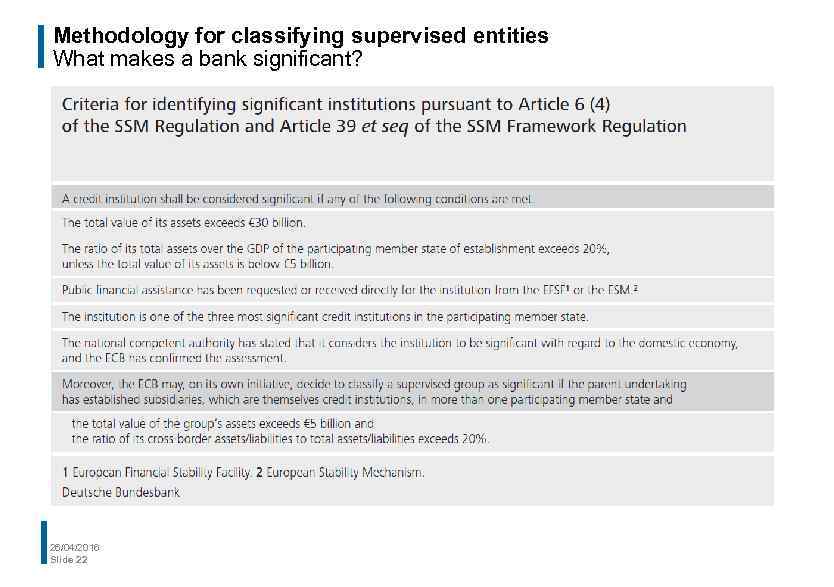

Methodology for classifying supervised entities What makes a bank significant? 26/04/2016 Slide 22

Methodology for classifying supervised entities What makes a bank significant? 26/04/2016 Slide 22

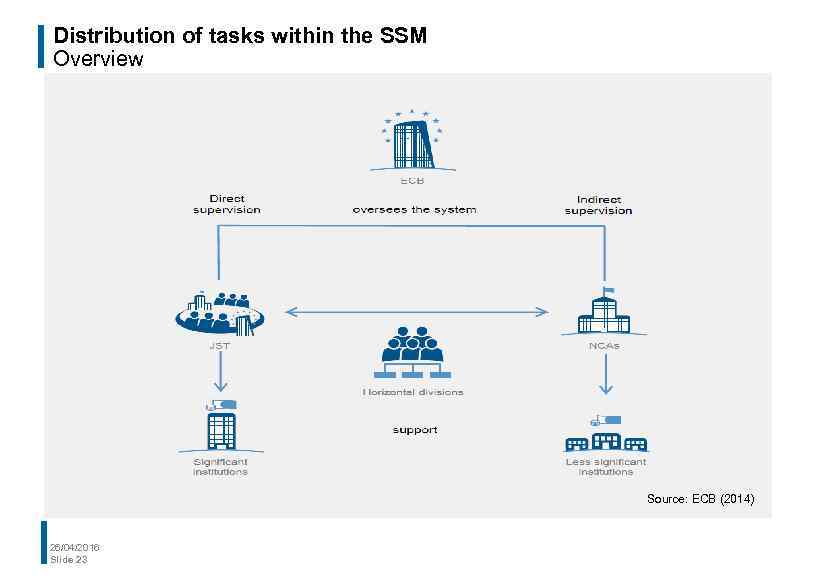

Distribution of tasks within the SSM Overview Source: ECB (2014) 26/04/2016 Slide 23

Distribution of tasks within the SSM Overview Source: ECB (2014) 26/04/2016 Slide 23

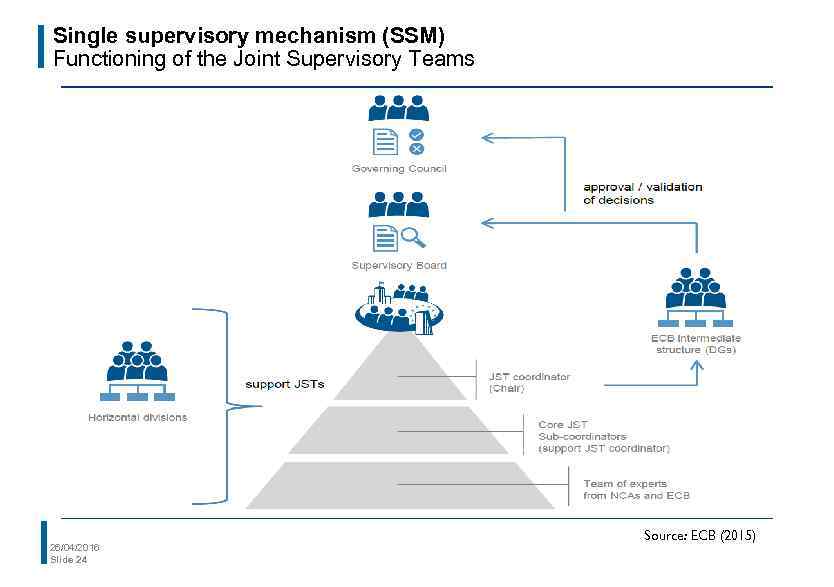

Single supervisory mechanism (SSM) Functioning of the Joint Supervisory Teams 26/04/2016 Slide 24 Source: ECB (2015)

Single supervisory mechanism (SSM) Functioning of the Joint Supervisory Teams 26/04/2016 Slide 24 Source: ECB (2015)

Single supervisory mechanism (SSM) Significant supervised entities in Germany 26/04/2016 Slide 25

Single supervisory mechanism (SSM) Significant supervised entities in Germany 26/04/2016 Slide 25

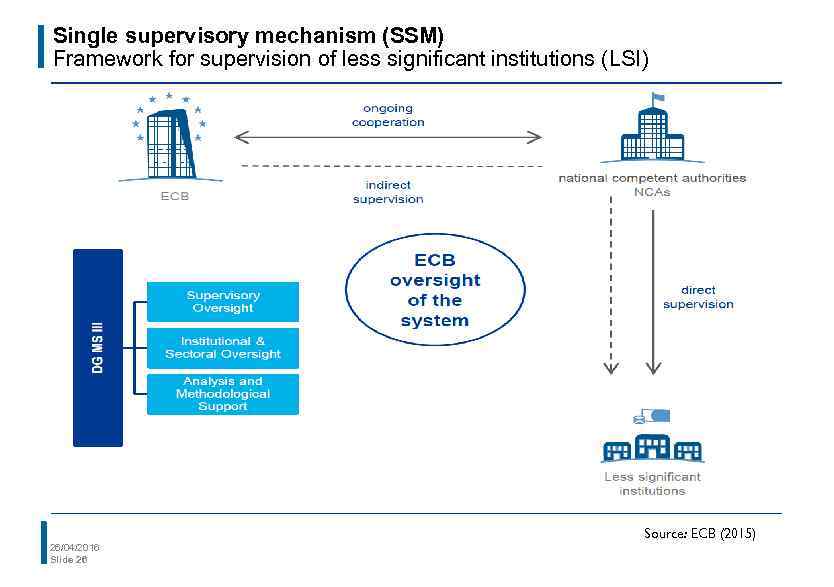

Single supervisory mechanism (SSM) Framework for supervision of less significant institutions (LSI) Source: ECB (2015) 26/04/2016 Slide 26

Single supervisory mechanism (SSM) Framework for supervision of less significant institutions (LSI) Source: ECB (2015) 26/04/2016 Slide 26

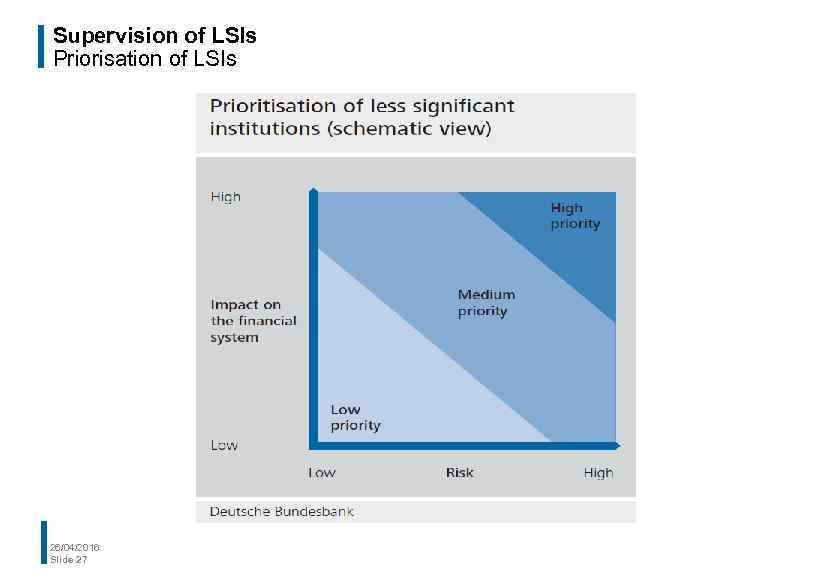

Supervision of LSIs Priorisation of LSIs 26/04/2016 Slide 27

Supervision of LSIs Priorisation of LSIs 26/04/2016 Slide 27

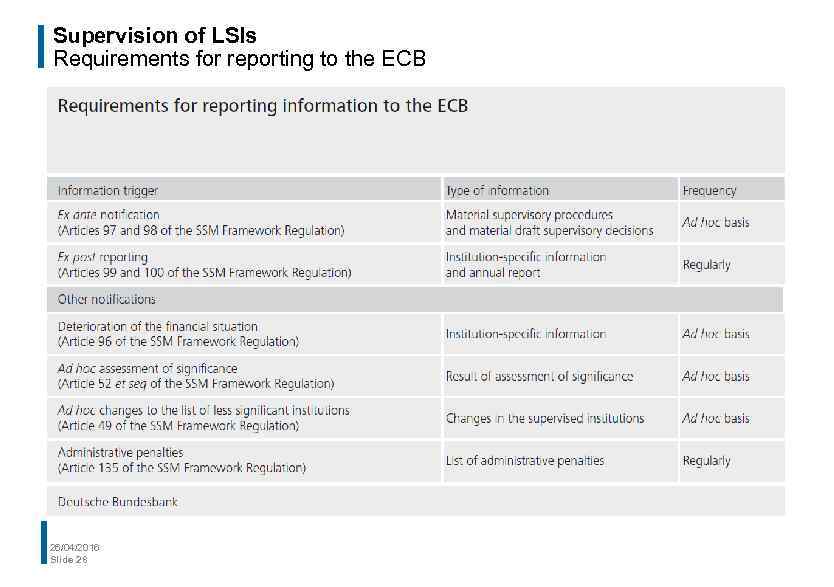

Supervision of LSIs Requirements for reporting to the ECB 26/04/2016 Slide 28

Supervision of LSIs Requirements for reporting to the ECB 26/04/2016 Slide 28

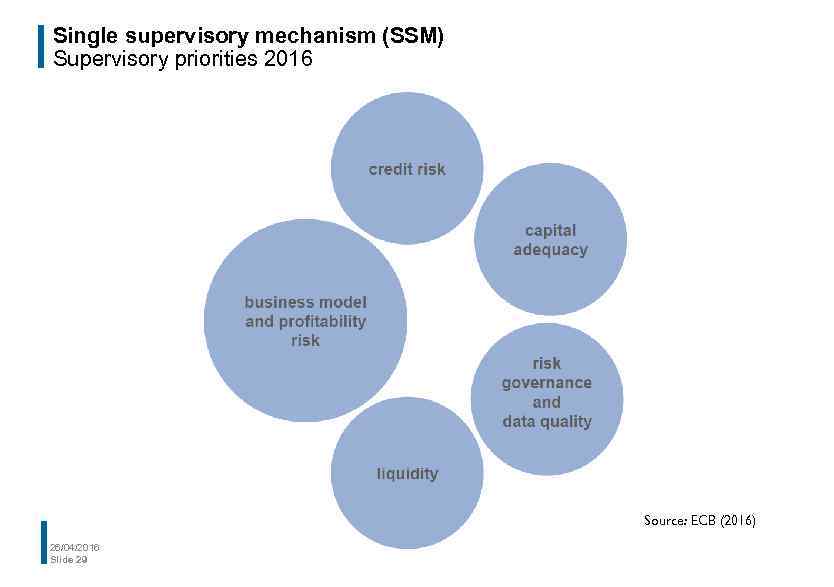

Single supervisory mechanism (SSM) Supervisory priorities 2016 Source: ECB (2016) 26/04/2016 Slide 29

Single supervisory mechanism (SSM) Supervisory priorities 2016 Source: ECB (2016) 26/04/2016 Slide 29

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 30

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 30

European Central Bank as a macro-prudential authority Macroprudential policy and oversight in Europe: EU, ECB and ESRB § General responsibility for EU-wide policy measures lies with European Commission § General responsibility for country-specific policy measures lies with national authorities § ECB can tighten macroprudential requirements - Notification of Member State 10 working days prior to decision - Member state has 5 working days to object § ESRB: macroprudential surveillance on EU level 26/04/2016 Slide 31

European Central Bank as a macro-prudential authority Macroprudential policy and oversight in Europe: EU, ECB and ESRB § General responsibility for EU-wide policy measures lies with European Commission § General responsibility for country-specific policy measures lies with national authorities § ECB can tighten macroprudential requirements - Notification of Member State 10 working days prior to decision - Member state has 5 working days to object § ESRB: macroprudential surveillance on EU level 26/04/2016 Slide 31

European Central Bank as a macro-prudential authority Macroprudential policy in Europe: the role of the ECB European Central Bank (ECB) § Additional tasks within its new responsibility for banking supervision in Europe § Macroprudential tasks according to Article 5 SSM regulation - Regional responsibility: euro area and opt-in countries - Sectoral responsibilities: banks § Intensification of national macroprudential measures - Direct approach - Counteracting 'inaction bias' 26/04/2016 Slide 32

European Central Bank as a macro-prudential authority Macroprudential policy in Europe: the role of the ECB European Central Bank (ECB) § Additional tasks within its new responsibility for banking supervision in Europe § Macroprudential tasks according to Article 5 SSM regulation - Regional responsibility: euro area and opt-in countries - Sectoral responsibilities: banks § Intensification of national macroprudential measures - Direct approach - Counteracting 'inaction bias' 26/04/2016 Slide 32

European Central Bank as a macro-prudential authority Macroprudential oversight in Europe: the role of the ESRB European Systemic Risk Board (ESRB) § Central EU body for macroprudential oversight and policy - Regional competence: 29 EU Member States Sectoral competence: all financial intermediaries § Objectives and tasks - § Addressees: Identification, surveillance and limitation of systemic risk Instrument: warnings and recommendations --> comply or explain, indirect approach EU institutions or EU member states § Comply or explain: Addressee of a recommendation is obliged to inform within a limited time period how he wants to implement the recommendation or why he does not intend to implement it 26/04/2016 Slide 33

European Central Bank as a macro-prudential authority Macroprudential oversight in Europe: the role of the ESRB European Systemic Risk Board (ESRB) § Central EU body for macroprudential oversight and policy - Regional competence: 29 EU Member States Sectoral competence: all financial intermediaries § Objectives and tasks - § Addressees: Identification, surveillance and limitation of systemic risk Instrument: warnings and recommendations --> comply or explain, indirect approach EU institutions or EU member states § Comply or explain: Addressee of a recommendation is obliged to inform within a limited time period how he wants to implement the recommendation or why he does not intend to implement it 26/04/2016 Slide 33

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 34

Overview § Strengthened macro-prudential perspective of global committees and standard setters § Establishment of the European Systemic Risk Board § The banking union in Europe - Single Supervisory Mechanism Single Resolution Mechanism § The European Central Bank as a macro-prudential authority § Résumé 26/04/2016 Slide 34

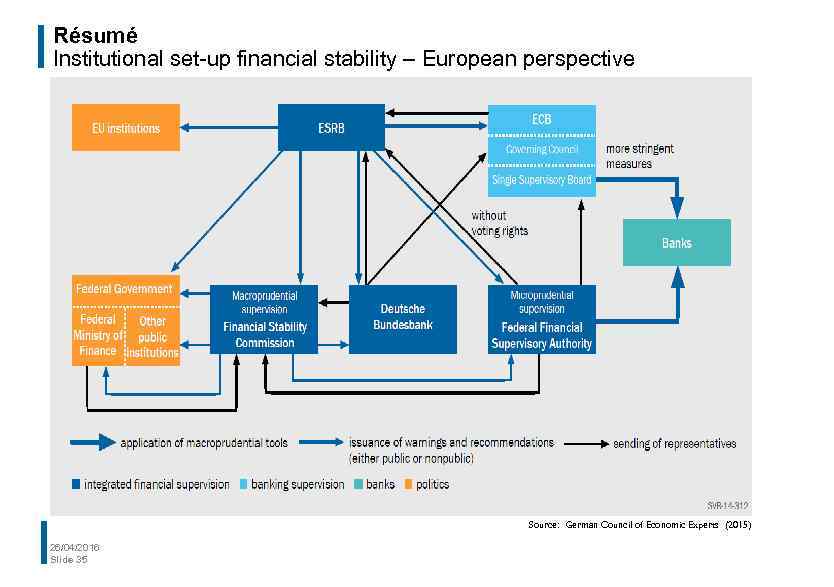

Résumé Institutional set-up financial stability – European perspective Source: German Council of Economic Experts (2015) 26/04/2016 Slide 35

Résumé Institutional set-up financial stability – European perspective Source: German Council of Economic Experts (2015) 26/04/2016 Slide 35

References § Council Regulation (EU) No 1024/2013 of 15 October 2013, L 287/63 § Deutsche Bundesbank, Monthly Report, various issues § European Banking Authority, Annual Report, various issues § European Central Bank, Annual Report on Supervisory Activities, March 2015 § European Central Bank, Banking Supervision, SSM Priorities 2016, 2016 § European Central Bank, Guide to Banking Supervision, November 2014 § European Systemic Risk Board, ESRB report on the regulatory treatment of sovereign exposures, March 2015 § German Council of Economic Experts, Annual Report, various issues § Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014, L 141/1 26/04/2016 Slide 36

References § Council Regulation (EU) No 1024/2013 of 15 October 2013, L 287/63 § Deutsche Bundesbank, Monthly Report, various issues § European Banking Authority, Annual Report, various issues § European Central Bank, Annual Report on Supervisory Activities, March 2015 § European Central Bank, Banking Supervision, SSM Priorities 2016, 2016 § European Central Bank, Guide to Banking Supervision, November 2014 § European Systemic Risk Board, ESRB report on the regulatory treatment of sovereign exposures, March 2015 § German Council of Economic Experts, Annual Report, various issues § Regulation (EU) No 468/2014 of the European Central Bank of 16 April 2014, L 141/1 26/04/2016 Slide 36

Thank you very much for your attention! Contact: Peter. Spicka@bundesbank. de

Thank you very much for your attention! Contact: Peter. Spicka@bundesbank. de