eb361ebb0d9f2fedd163679d9c3f6514.ppt

- Количество слайдов: 50

• Purpose: This document provides an overview of features and enhancements included in Release 12. It is intended solely to help you assess the business benefits of upgrading to Release 12. • Disclaimer: This document in any form, software or printed matter, contains proprietary information that is the exclusive property of Oracle. Your access to and use of this confidential material is subject to the terms and conditions of your Oracle Software License and Service Agreement, which has been executed and with which you agree to comply. This document and information contained herein may not be disclosed, copied, reproduced or distributed to anyone outside Oracle without prior written consent of Oracle. This document is not part of your license agreement nor can it be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. This document is for informational purposes only and is intended solely to assist you in planning for the implementation and upgrade of the product features described. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described in this document remains at the sole discretion of Oracle.

• Purpose: This document provides an overview of features and enhancements included in Release 12. It is intended solely to help you assess the business benefits of upgrading to Release 12. • Disclaimer: This document in any form, software or printed matter, contains proprietary information that is the exclusive property of Oracle. Your access to and use of this confidential material is subject to the terms and conditions of your Oracle Software License and Service Agreement, which has been executed and with which you agree to comply. This document and information contained herein may not be disclosed, copied, reproduced or distributed to anyone outside Oracle without prior written consent of Oracle. This document is not part of your license agreement nor can it be incorporated into any contractual agreement with Oracle or its subsidiaries or affiliates. This document is for informational purposes only and is intended solely to assist you in planning for the implementation and upgrade of the product features described. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described in this document remains at the sole discretion of Oracle.

Agenda • What is Oracle Payments? • Disbursements • Key Disbursement Enhancements • The Integrated Disbursement Process • Oracle Payments Demo • Funds Capture • Key Funds Capture Enhancements • The Integrated Funds Capture Process • Q&A

Agenda • What is Oracle Payments? • Disbursements • Key Disbursement Enhancements • The Integrated Disbursement Process • Oracle Payments Demo • Funds Capture • Key Funds Capture Enhancements • The Integrated Funds Capture Process • Q&A

Question for Audience What release are you on? Release 12 • Thinking about it • Implementing it • Already there Of those not live on R 12 • Release 11. 5. 9 or earlier • Release 11. 5. 10 • Something else

Question for Audience What release are you on? Release 12 • Thinking about it • Implementing it • Already there Of those not live on R 12 • Release 11. 5. 9 or earlier • Release 11. 5. 10 • Something else

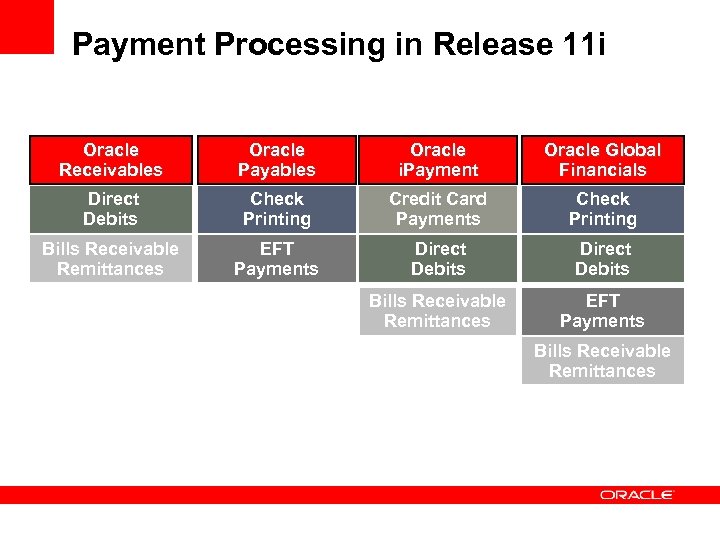

Payment Processing in Release 11 i Oracle Receivables Oracle Payables Oracle i. Payment Oracle Global Financials Direct Debits Check Printing Credit Card Payments Check Printing Bills Receivable Remittances EFT Payments Direct Debits Bills Receivable Remittances EFT Payments Bills Receivable Remittances

Payment Processing in Release 11 i Oracle Receivables Oracle Payables Oracle i. Payment Oracle Global Financials Direct Debits Check Printing Credit Card Payments Check Printing Bills Receivable Remittances EFT Payments Direct Debits Bills Receivable Remittances EFT Payments Bills Receivable Remittances

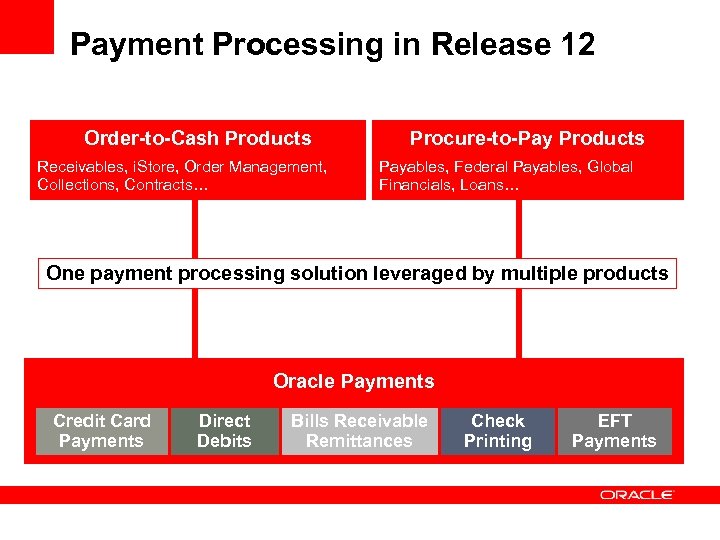

Payment Processing in Release 12 Order-to-Cash Products Receivables, i. Store, Order Management, Collections, Contracts… Procure-to-Pay Products Payables, Federal Payables, Global Financials, Loans… One payment processing solution leveraged by multiple products Oracle Payments Credit Card Payments Direct Debits Bills Receivable Remittances Check Printing EFT Payments

Payment Processing in Release 12 Order-to-Cash Products Receivables, i. Store, Order Management, Collections, Contracts… Procure-to-Pay Products Payables, Federal Payables, Global Financials, Loans… One payment processing solution leveraged by multiple products Oracle Payments Credit Card Payments Direct Debits Bills Receivable Remittances Check Printing EFT Payments

Release 12 Oracle Payments: Oracle Payments is a central engine to disburse and capture payments. For electronic payments, it connects Oracle EBS products like Receivables and Payables to financial institutions like banks and credit card processors.

Release 12 Oracle Payments: Oracle Payments is a central engine to disburse and capture payments. For electronic payments, it connects Oracle EBS products like Receivables and Payables to financial institutions like banks and credit card processors.

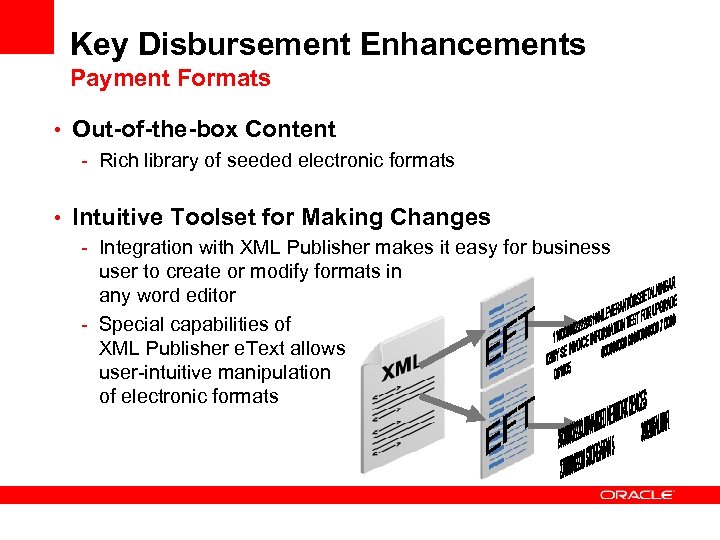

Key Disbursement Enhancements Payment Formats • Out-of-the-box Content - Rich library of seeded electronic formats • Intuitive Toolset for Making Changes - Integration with XML Publisher makes it easy for business user to create or modify formats in any word editor - Special capabilities of XML Publisher e. Text allows user-intuitive manipulation of electronic formats

Key Disbursement Enhancements Payment Formats • Out-of-the-box Content - Rich library of seeded electronic formats • Intuitive Toolset for Making Changes - Integration with XML Publisher makes it easy for business user to create or modify formats in any word editor - Special capabilities of XML Publisher e. Text allows user-intuitive manipulation of electronic formats

Key Disbursement Enhancements Payment Formats Key formats supported out of the box include: • SWIFT MT 103 • ANSI X 12 820 • EDIFACT PAYMUL • NACHA • • NACHA CTX NACHA CCDP NACHA PPD

Key Disbursement Enhancements Payment Formats Key formats supported out of the box include: • SWIFT MT 103 • ANSI X 12 820 • EDIFACT PAYMUL • NACHA • • NACHA CTX NACHA CCDP NACHA PPD

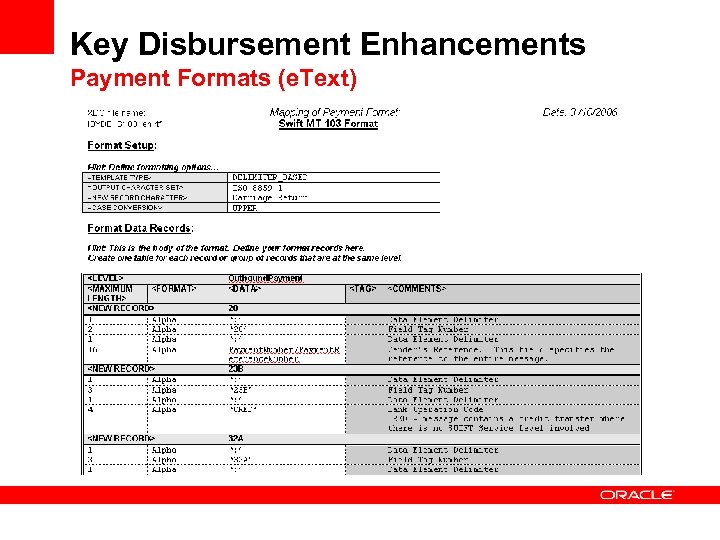

Key Disbursement Enhancements Payment Formats (e. Text)

Key Disbursement Enhancements Payment Formats (e. Text)

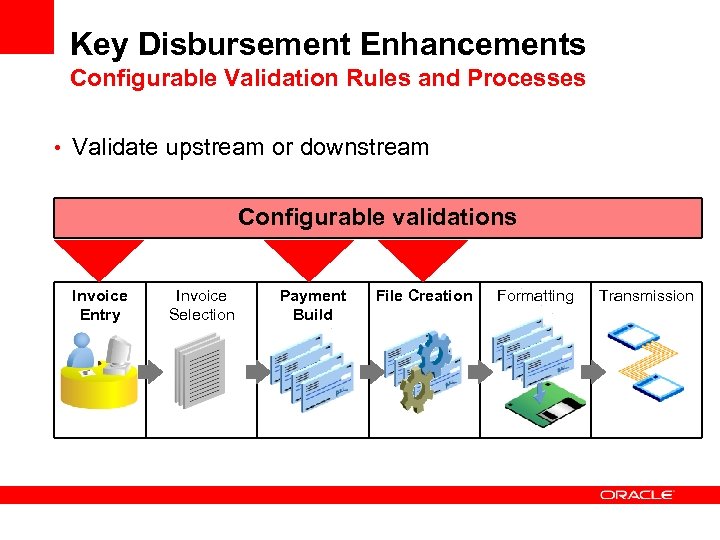

Key Disbursement Enhancements Configurable Validation Rules and Processes • Rich library of country- and format-specific validations usable out of the box • Highly configurable framework • WHAT: Define new validations rules • WHEN: Set timing of validations • HOW: Set how errors should be handled

Key Disbursement Enhancements Configurable Validation Rules and Processes • Rich library of country- and format-specific validations usable out of the box • Highly configurable framework • WHAT: Define new validations rules • WHEN: Set timing of validations • HOW: Set how errors should be handled

Key Disbursement Enhancements Configurable Validation Rules and Processes • Validate upstream or downstream Configurable validations Invoice Entry Invoice Selection Payment Build File Creation Formatting Transmission

Key Disbursement Enhancements Configurable Validation Rules and Processes • Validate upstream or downstream Configurable validations Invoice Entry Invoice Selection Payment Build File Creation Formatting Transmission

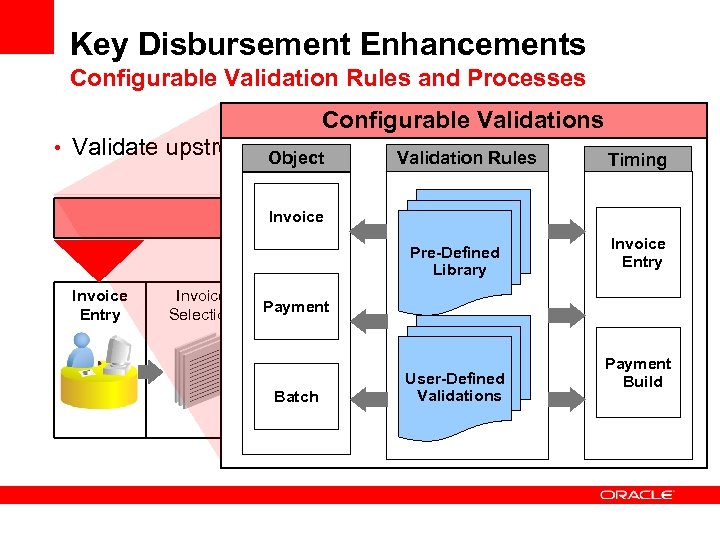

Key Disbursement Enhancements Configurable Validation Rules and Processes Configurable Validations • Validate upstream Object or downstream Validation Rules Timing Invoice Configurable validations Pre-Defined Library Invoice Entry Invoice Selection Payment Build Batch File Creation Formatting User-Defined Validations Invoice Entry Transmission Payment Build

Key Disbursement Enhancements Configurable Validation Rules and Processes Configurable Validations • Validate upstream Object or downstream Validation Rules Timing Invoice Configurable validations Pre-Defined Library Invoice Entry Invoice Selection Payment Build Batch File Creation Formatting User-Defined Validations Invoice Entry Transmission Payment Build

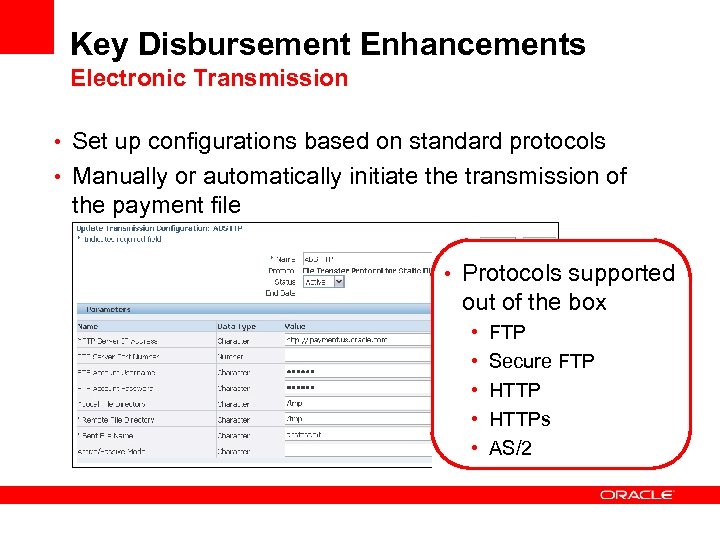

Key Disbursement Enhancements Electronic Transmission • Set up configurations based on standard protocols • Manually or automatically initiate the transmission of the payment file • Protocols supported out of the box • • • FTP Secure FTP HTTPs AS/2

Key Disbursement Enhancements Electronic Transmission • Set up configurations based on standard protocols • Manually or automatically initiate the transmission of the payment file • Protocols supported out of the box • • • FTP Secure FTP HTTPs AS/2

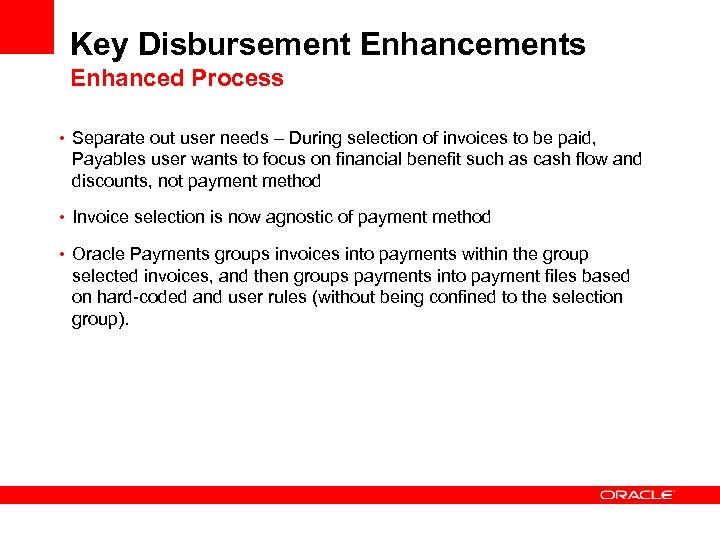

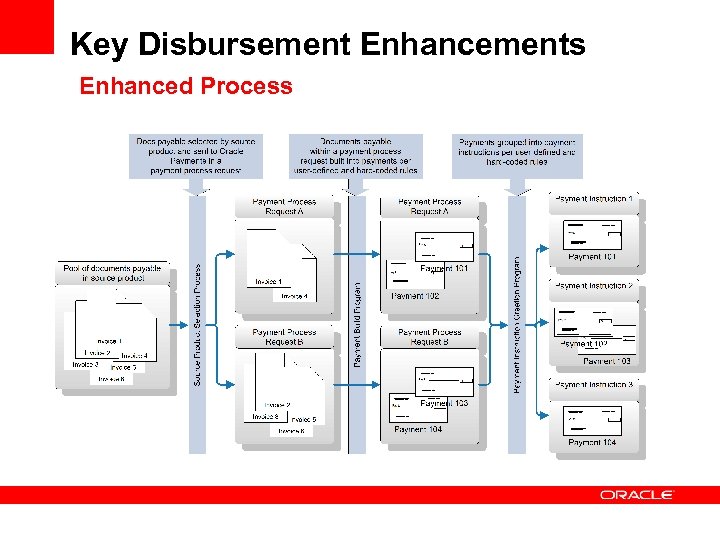

Key Disbursement Enhancements Enhanced Process • Separate out user needs – During selection of invoices to be paid, Payables user wants to focus on financial benefit such as cash flow and discounts, not payment method • Invoice selection is now agnostic of payment method • Oracle Payments groups invoices into payments within the group selected invoices, and then groups payments into payment files based on hard-coded and user rules (without being confined to the selection group).

Key Disbursement Enhancements Enhanced Process • Separate out user needs – During selection of invoices to be paid, Payables user wants to focus on financial benefit such as cash flow and discounts, not payment method • Invoice selection is now agnostic of payment method • Oracle Payments groups invoices into payments within the group selected invoices, and then groups payments into payment files based on hard-coded and user rules (without being confined to the selection group).

Key Disbursement Enhancements Enhanced Process

Key Disbursement Enhancements Enhanced Process

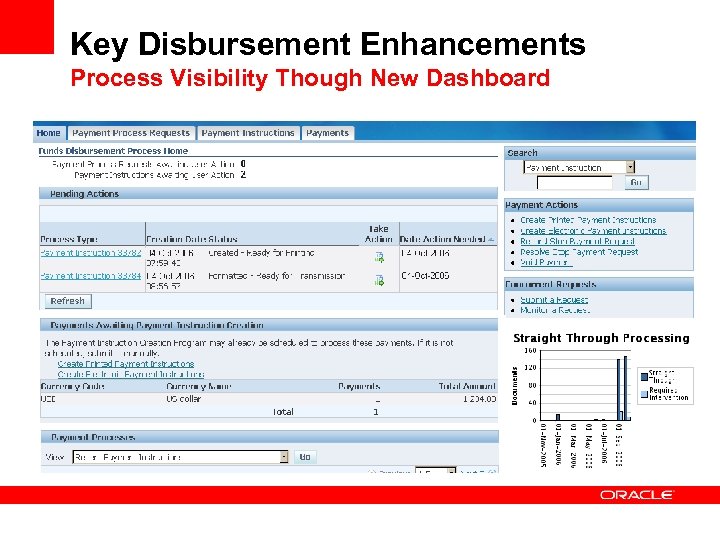

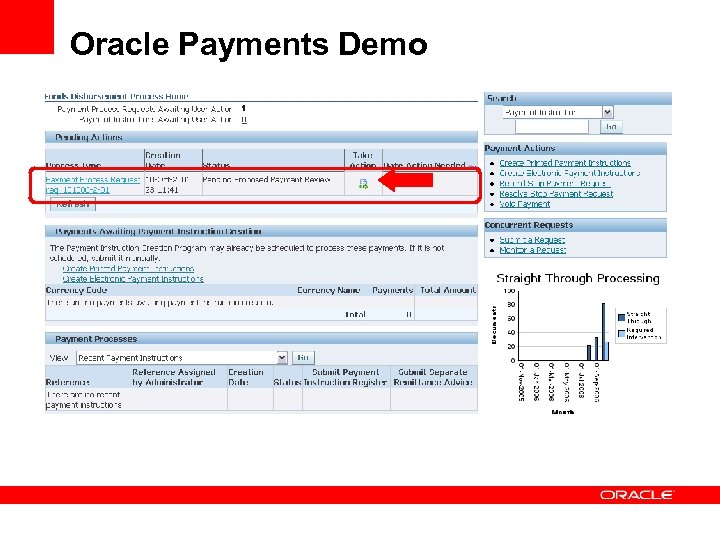

Key Disbursement Enhancements Process Visibility Though New Dashboard Supports different business models : • Centralized AP and Payments • Decentralized AP and centralized Payments • Decentralized AP and decentralized Payments Guides the user with smart Take Action icon

Key Disbursement Enhancements Process Visibility Though New Dashboard Supports different business models : • Centralized AP and Payments • Decentralized AP and centralized Payments • Decentralized AP and decentralized Payments Guides the user with smart Take Action icon

Key Disbursement Enhancements Process Visibility Though New Dashboard

Key Disbursement Enhancements Process Visibility Though New Dashboard

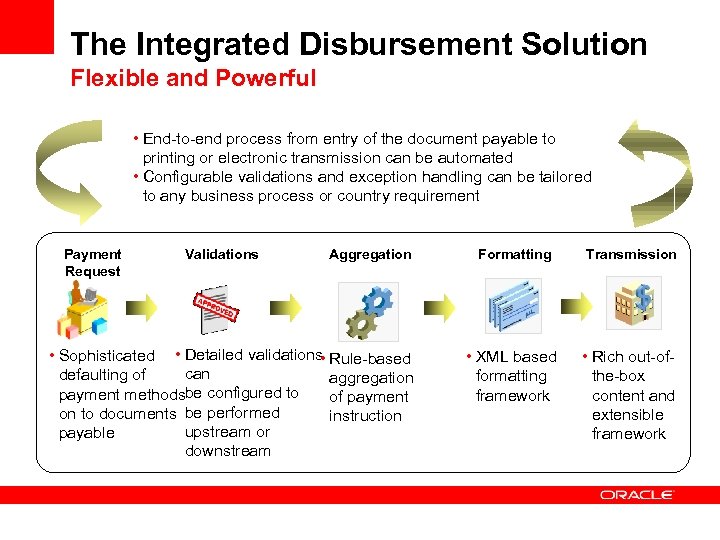

The Integrated Disbursement Solution Flexible and Powerful • End-to-end process from entry of the document payable to printing or electronic transmission can be automated • Configurable validations and exception handling can be tailored to any business process or country requirement Payment Request Validations Aggregation • Sophisticated • Detailed validations • Rule-based can defaulting of aggregation payment methodsbe configured to of payment on to documents be performed instruction upstream or payable downstream Formatting Transmission • XML based formatting framework • Rich out-ofthe-box content and extensible framework

The Integrated Disbursement Solution Flexible and Powerful • End-to-end process from entry of the document payable to printing or electronic transmission can be automated • Configurable validations and exception handling can be tailored to any business process or country requirement Payment Request Validations Aggregation • Sophisticated • Detailed validations • Rule-based can defaulting of aggregation payment methodsbe configured to of payment on to documents be performed instruction upstream or payable downstream Formatting Transmission • XML based formatting framework • Rich out-ofthe-box content and extensible framework

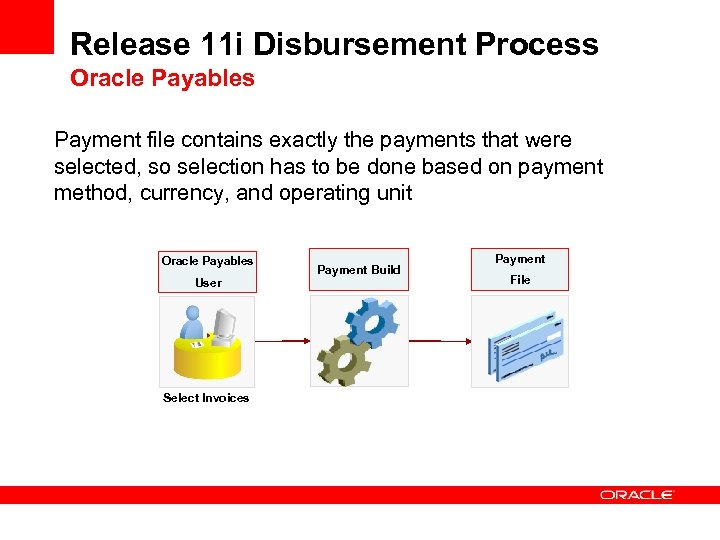

Release 11 i Disbursement Process Oracle Payables Payment file contains exactly the payments that were selected, so selection has to be done based on payment method, currency, and operating unit Oracle Payables User Select Invoices Payment Build Payment File

Release 11 i Disbursement Process Oracle Payables Payment file contains exactly the payments that were selected, so selection has to be done based on payment method, currency, and operating unit Oracle Payables User Select Invoices Payment Build Payment File

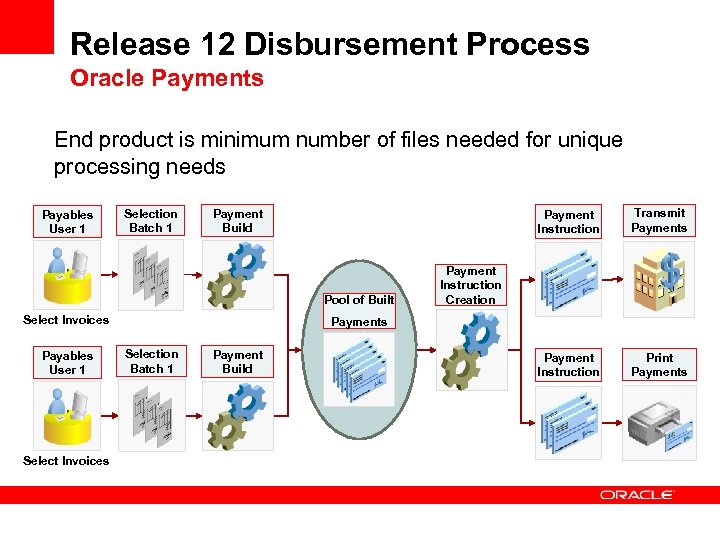

Release 12 Disbursement Process Oracle Payments End product is minimum number of files needed for unique processing needs Payables User 1 Selection Batch 1 Payment Instruction Payment Build Pool of Built Select Invoices Payables User 1 Select Invoices Transmit Payments Payment Instruction Print Payments Payment Instruction Creation Payments Selection Batch 1 Payment Build

Release 12 Disbursement Process Oracle Payments End product is minimum number of files needed for unique processing needs Payables User 1 Selection Batch 1 Payment Instruction Payment Build Pool of Built Select Invoices Payables User 1 Select Invoices Transmit Payments Payment Instruction Print Payments Payment Instruction Creation Payments Selection Batch 1 Payment Build

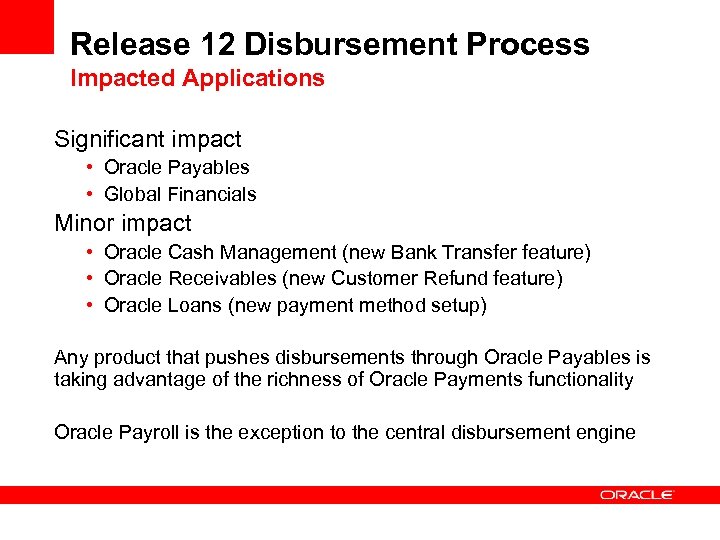

Release 12 Disbursement Process Impacted Applications Significant impact • Oracle Payables • Global Financials Minor impact • Oracle Cash Management (new Bank Transfer feature) • Oracle Receivables (new Customer Refund feature) • Oracle Loans (new payment method setup) Any product that pushes disbursements through Oracle Payables is taking advantage of the richness of Oracle Payments functionality Oracle Payroll is the exception to the central disbursement engine

Release 12 Disbursement Process Impacted Applications Significant impact • Oracle Payables • Global Financials Minor impact • Oracle Cash Management (new Bank Transfer feature) • Oracle Receivables (new Customer Refund feature) • Oracle Loans (new payment method setup) Any product that pushes disbursements through Oracle Payables is taking advantage of the richness of Oracle Payments functionality Oracle Payroll is the exception to the central disbursement engine

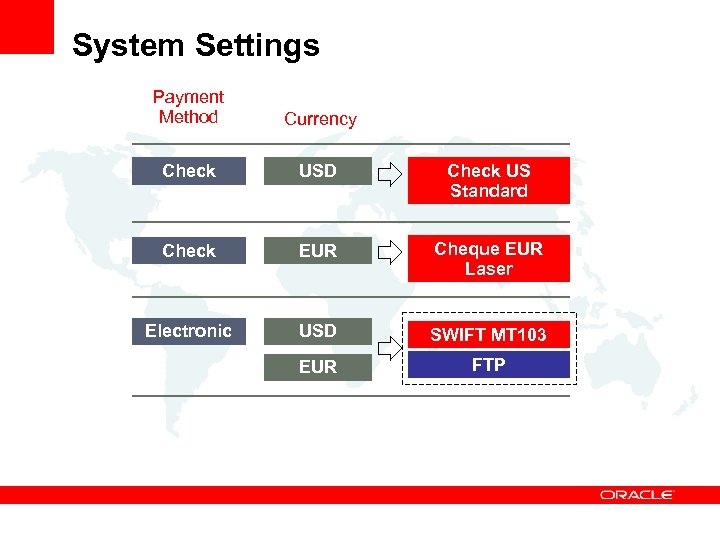

System Settings Payment Method Currency Check USD Check US Standard Check EUR Cheque EUR Laser Electronic USD SWIFT MT 103 EUR FTP

System Settings Payment Method Currency Check USD Check US Standard Check EUR Cheque EUR Laser Electronic USD SWIFT MT 103 EUR FTP

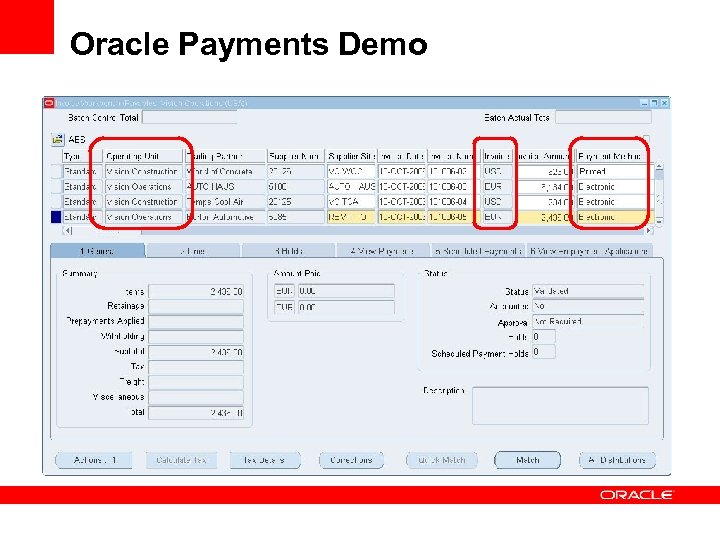

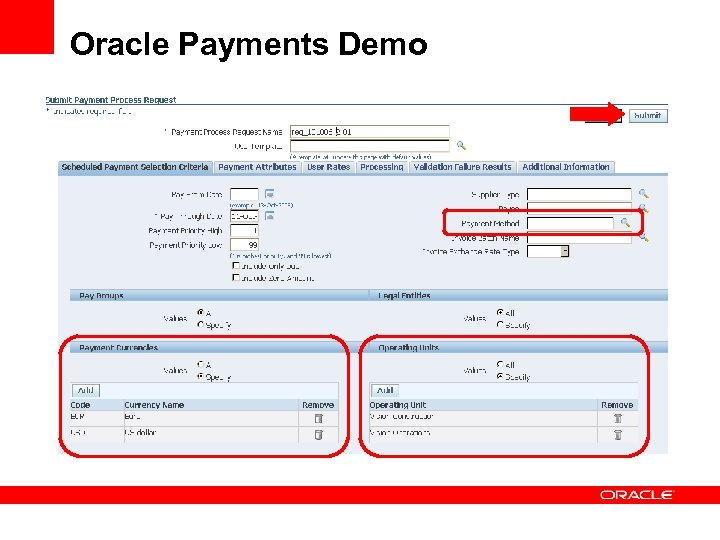

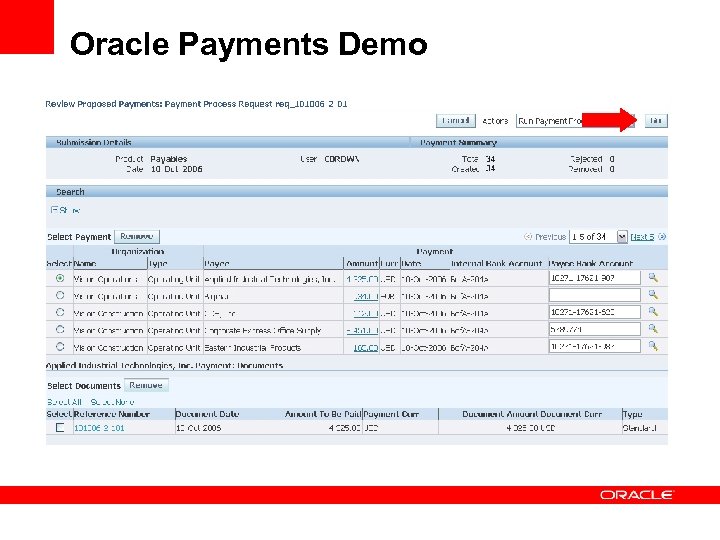

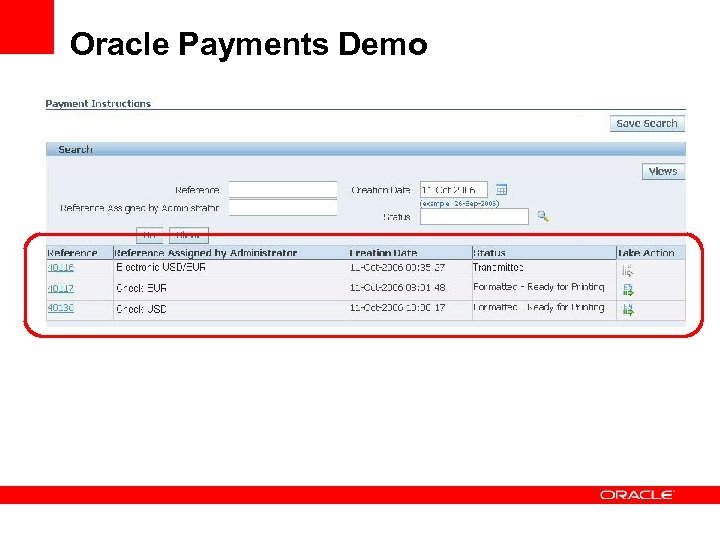

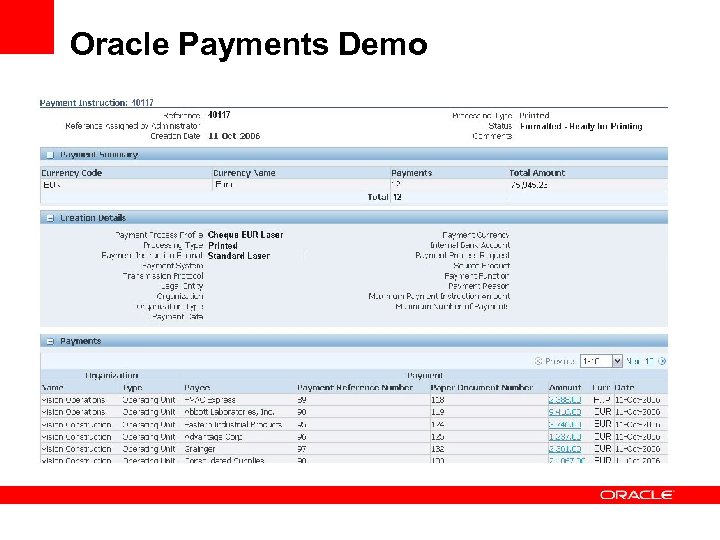

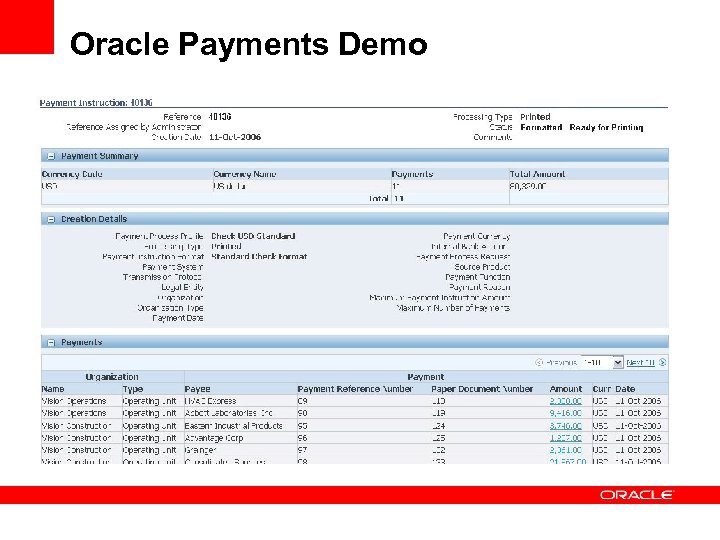

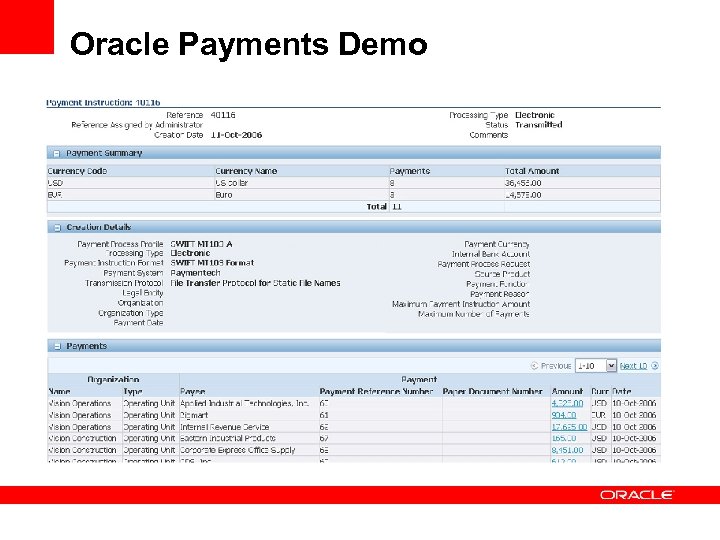

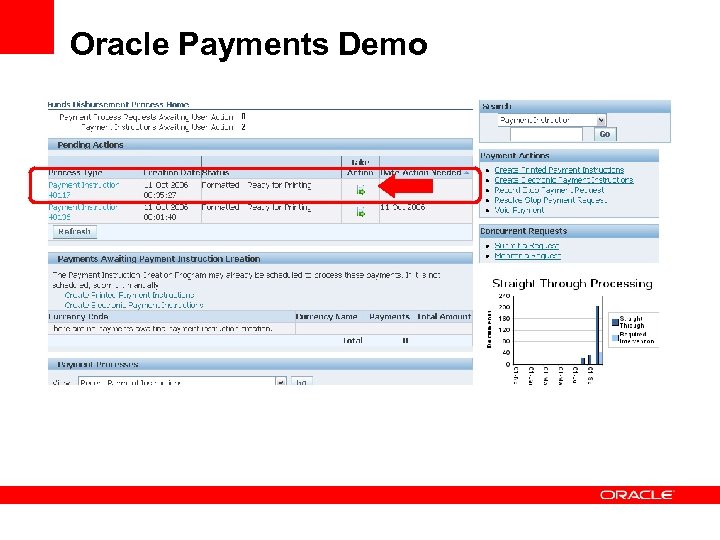

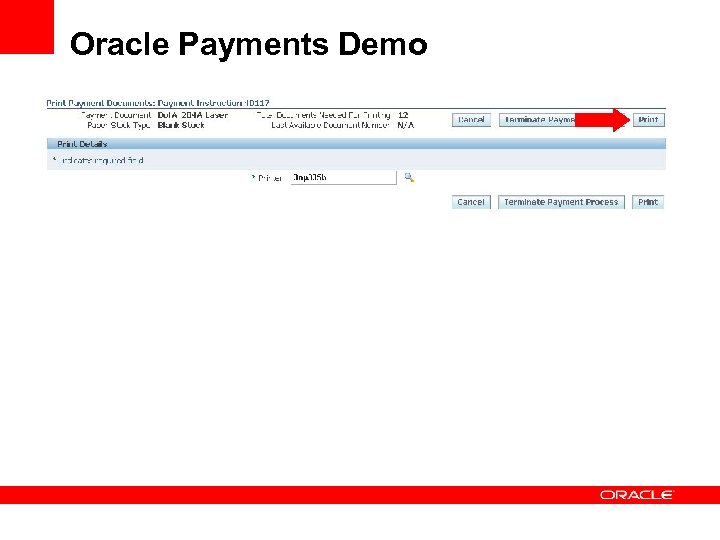

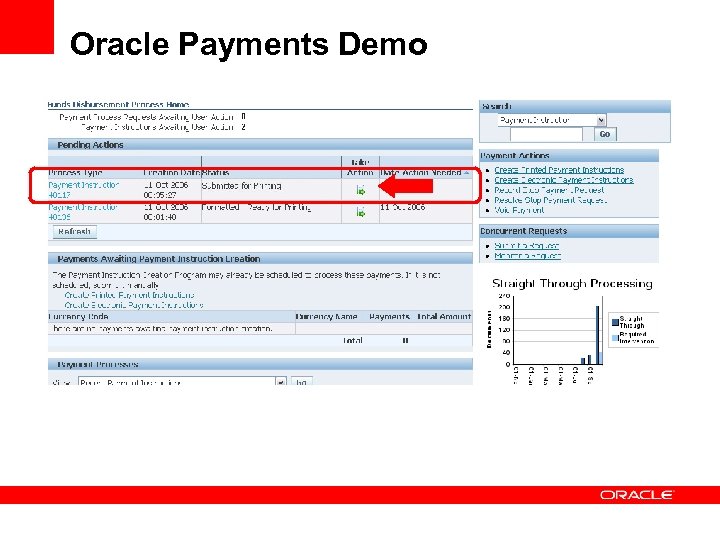

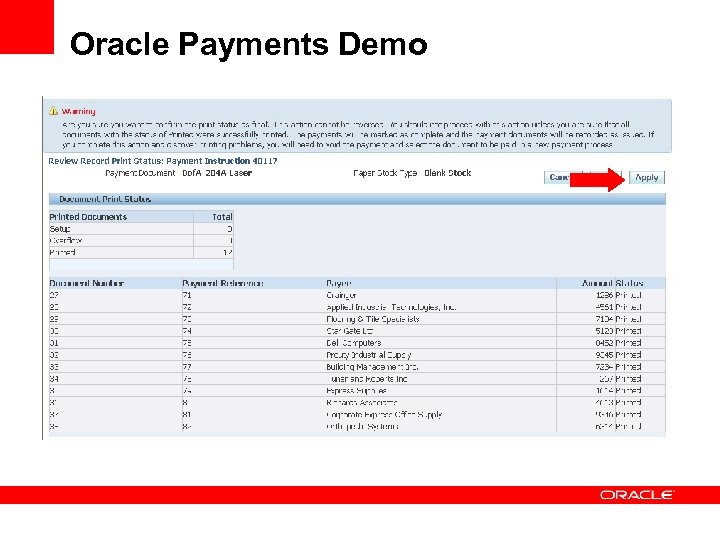

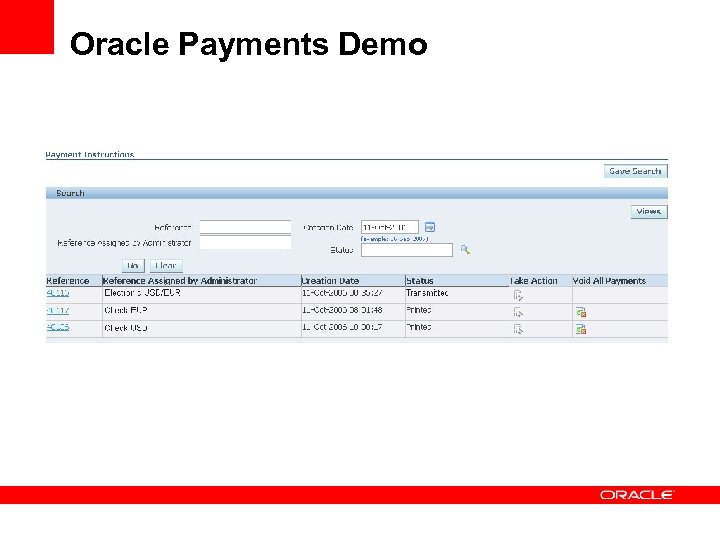

Oracle Payments Demo

Oracle Payments Demo

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo • First Level Bullet

Oracle Payments Demo

Oracle Payments Demo

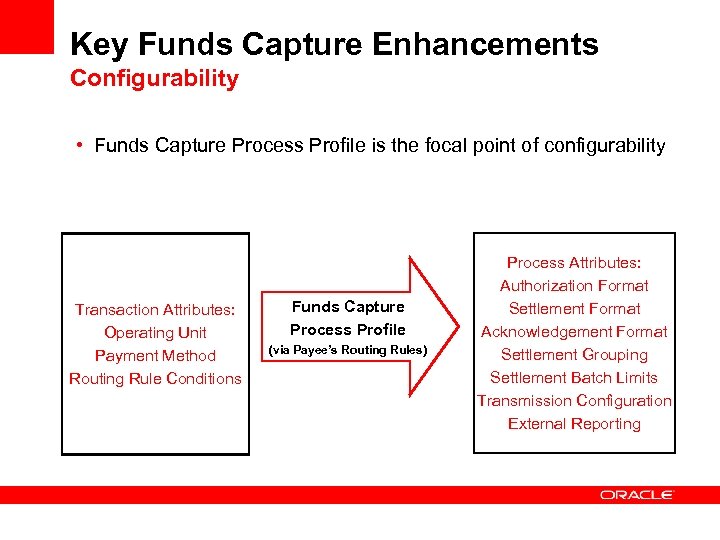

Key Funds Capture Enhancements Configurability • Funds Capture Process Profile is the focal point of configurability Transaction Attributes: Operating Unit Payment Method Routing Rule Conditions Funds Capture Process Profile (via Payee’s Routing Rules) Process Attributes: Authorization Format Settlement Format Acknowledgement Format Settlement Grouping Settlement Batch Limits Transmission Configuration External Reporting

Key Funds Capture Enhancements Configurability • Funds Capture Process Profile is the focal point of configurability Transaction Attributes: Operating Unit Payment Method Routing Rule Conditions Funds Capture Process Profile (via Payee’s Routing Rules) Process Attributes: Authorization Format Settlement Format Acknowledgement Format Settlement Grouping Settlement Batch Limits Transmission Configuration External Reporting

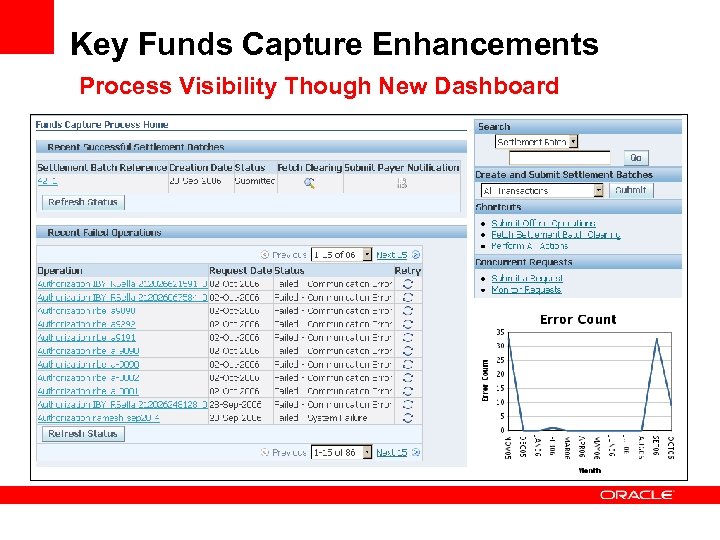

Key Funds Capture Enhancements Process Visibility Though New Dashboard Significant impact • Oracle Payables

Key Funds Capture Enhancements Process Visibility Though New Dashboard Significant impact • Oracle Payables

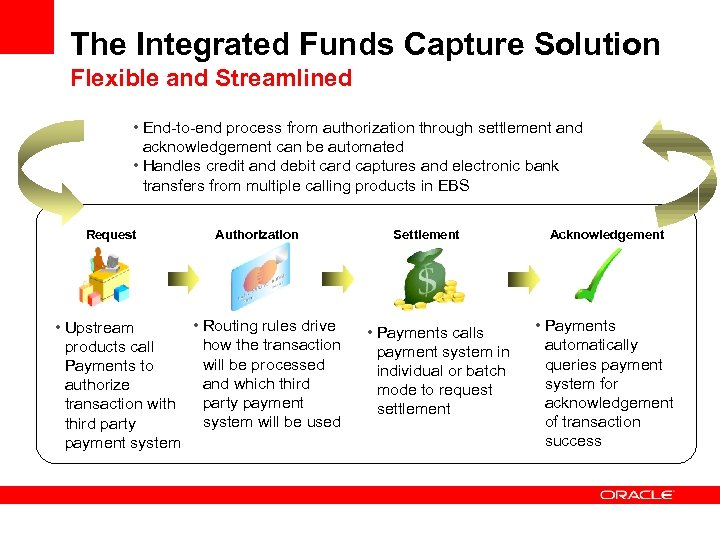

The Integrated Funds Capture Solution Flexible and Streamlined • End-to-end process from authorization through settlement and acknowledgement can be automated • Handles credit and debit card captures and electronic bank transfers from multiple calling products in EBS Request Authorization • Routing rules drive • Upstream how the transaction products call will be processed Payments to and which third authorize party payment transaction with system will be used third party payment system Settlement • Payments calls payment system in individual or batch mode to request settlement Acknowledgement • Payments automatically queries payment system for acknowledgement of transaction success

The Integrated Funds Capture Solution Flexible and Streamlined • End-to-end process from authorization through settlement and acknowledgement can be automated • Handles credit and debit card captures and electronic bank transfers from multiple calling products in EBS Request Authorization • Routing rules drive • Upstream how the transaction products call will be processed Payments to and which third authorize party payment transaction with system will be used third party payment system Settlement • Payments calls payment system in individual or batch mode to request settlement Acknowledgement • Payments automatically queries payment system for acknowledgement of transaction success

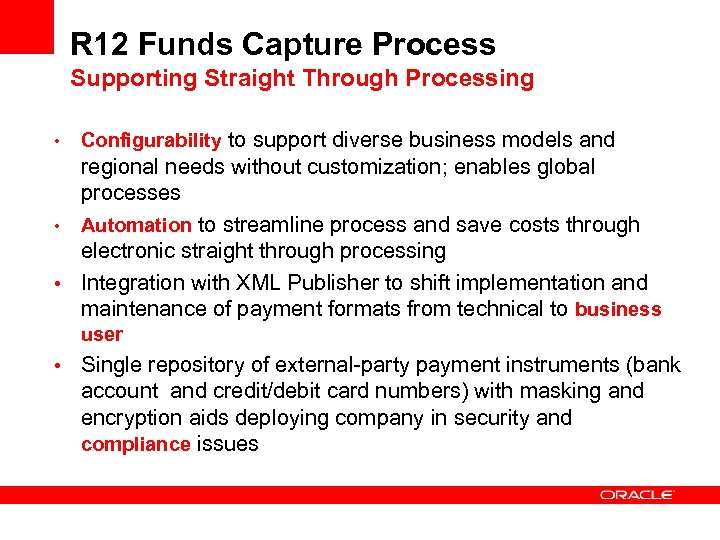

R 12 Funds Capture Process Supporting Straight Through Processing • Configurability to support diverse business models and regional needs without customization; enables global processes • Automation to streamline process and save costs through electronic straight through processing • Integration with XML Publisher to shift implementation and maintenance of payment formats from technical to business user • Single repository of external-party payment instruments (bank account and credit/debit card numbers) with masking and encryption aids deploying company in security and compliance issues

R 12 Funds Capture Process Supporting Straight Through Processing • Configurability to support diverse business models and regional needs without customization; enables global processes • Automation to streamline process and save costs through electronic straight through processing • Integration with XML Publisher to shift implementation and maintenance of payment formats from technical to business user • Single repository of external-party payment instruments (bank account and credit/debit card numbers) with masking and encryption aids deploying company in security and compliance issues

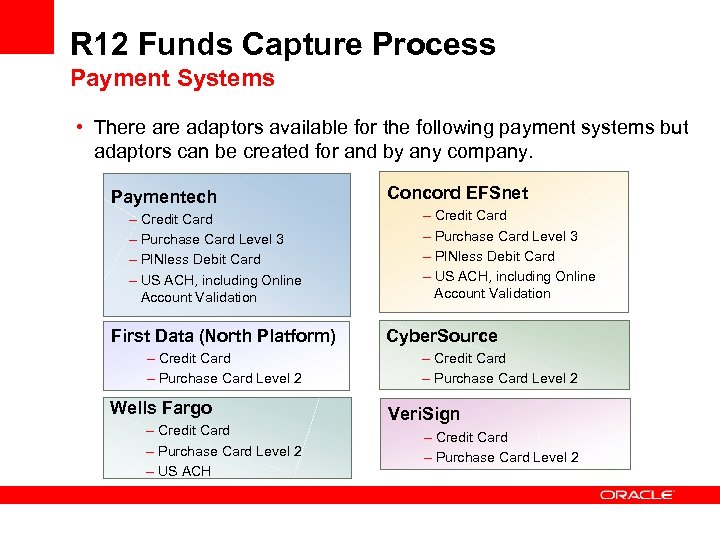

R 12 Funds Capture Process Payment Systems • There adaptors available for the following payment systems but adaptors can be created for and by any company. Paymentech – Credit Card – Purchase Card Level 3 – PINless Debit Card – US ACH, including Online Account Validation First Data (North Platform) – Credit Card – Purchase Card Level 2 Wells Fargo – Credit Card – Purchase Card Level 2 – US ACH Concord EFSnet – Credit Card – Purchase Card Level 3 – PINless Debit Card – US ACH, including Online Account Validation Cyber. Source – Credit Card – Purchase Card Level 2 Veri. Sign – Credit Card – Purchase Card Level 2

R 12 Funds Capture Process Payment Systems • There adaptors available for the following payment systems but adaptors can be created for and by any company. Paymentech – Credit Card – Purchase Card Level 3 – PINless Debit Card – US ACH, including Online Account Validation First Data (North Platform) – Credit Card – Purchase Card Level 2 Wells Fargo – Credit Card – Purchase Card Level 2 – US ACH Concord EFSnet – Credit Card – Purchase Card Level 3 – PINless Debit Card – US ACH, including Online Account Validation Cyber. Source – Credit Card – Purchase Card Level 2 Veri. Sign – Credit Card – Purchase Card Level 2

Q & A

Q & A

For More Information http: //search. oracle. com Financials or http: //www. oracle. com/

For More Information http: //search. oracle. com Financials or http: //www. oracle. com/

The preceding is intended to outline our general product direction. It is intended for information purposes only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described for Oracle’s products remains at the sole discretion of Oracle.

The preceding is intended to outline our general product direction. It is intended for information purposes only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described for Oracle’s products remains at the sole discretion of Oracle.