a9ce68ce62033371a5f8cd35552cf187.ppt

- Количество слайдов: 30

<Insert Picture Here> Jill Hughes Oracle Business Intelligence

Demystifying “Oracle BI”

Some Terms Ÿ OBI EE: Oracle Business Intelligence Enterprise Edition • This is the “strategic” BI Platform for Oracle that was inherited from the Siebel acquisition. Ÿ OBI SE: Oracle Business Intelligence Standard Edition • This is the new packaging of Oracle Discoverer & other legacy Oracle BI technologies. Ÿ Pre-Packaged Oracle BI Applications • BI application solutions for EBS, PSFT, JDE, SEBL, and SAP, that generally include pre-built ETL, DW, Metrics, Reports & Dashboards. • These solutions are: • DBI: Daily Business Intelligence • EPM: Enterprise Performance Management BI Applications Packaged, subject-specific warehouses and data marts • OBI Applications: Business Intelligence Applications (from Siebel)

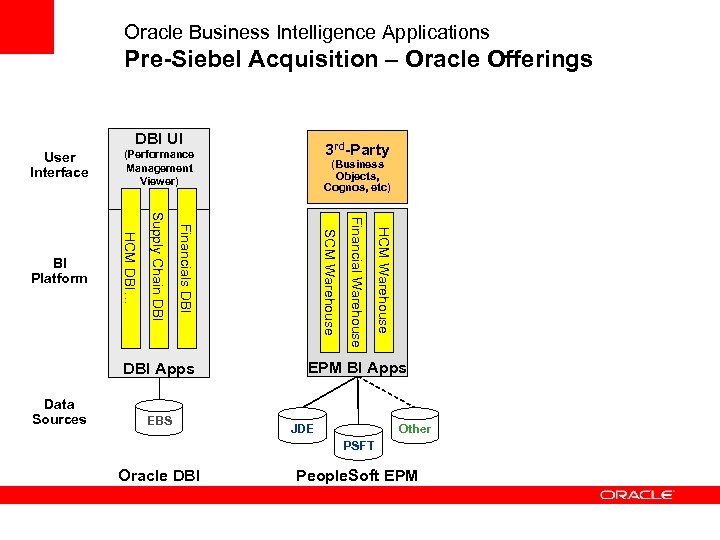

Oracle Business Intelligence Applications Pre-Siebel Acquisition – Oracle Offerings DBI UI HCM Warehouse EBS SCM Warehouse DBI Apps Data Sources (Business Objects, Cognos, etc) Financial Warehouse HCM DBI… 3 rd-Party Financials DBI BI Platform Supply Chain DBI User Interface (Performance Management Viewer) EPM BI Apps JDE Other PSFT Oracle DBI People. Soft EPM

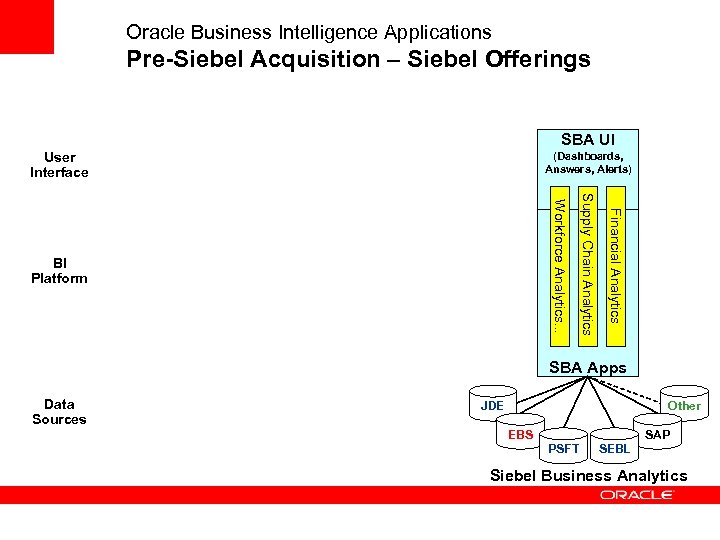

Oracle Business Intelligence Applications Pre-Siebel Acquisition – Siebel Offerings SBA UI User Interface (Dashboards, Answers, Alerts) Financial Analytics Supply Chain Analytics Workforce Analytics… BI Platform SBA Apps Data Sources JDE Other EBS SAP PSFT SEBL Siebel Business Analytics

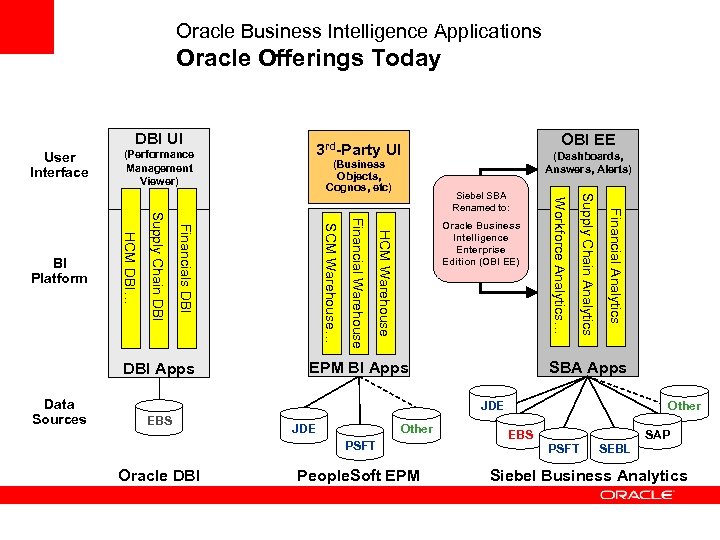

Oracle Business Intelligence Applications Oracle Offerings Today DBI UI User Interface (Dashboards, Answers, Alerts) Financial Analytics EPM BI Apps Supply Chain Analytics Oracle Business Intelligence Enterprise Edition (OBI EE) Workforce Analytics… Siebel SBA Renamed to: HCM Warehouse Financial Warehouse SCM Warehouse… DBI Apps Data Sources (Business Objects, Cognos, etc) Financials DBI Supply Chain DBI HCM DBI… BI Platform OBI EE 3 rd-Party UI (Performance Management Viewer) SBA Apps JDE EBS JDE Other PSFT Oracle DBI People. Soft EPM Other EBS SAP PSFT SEBL Siebel Business Analytics

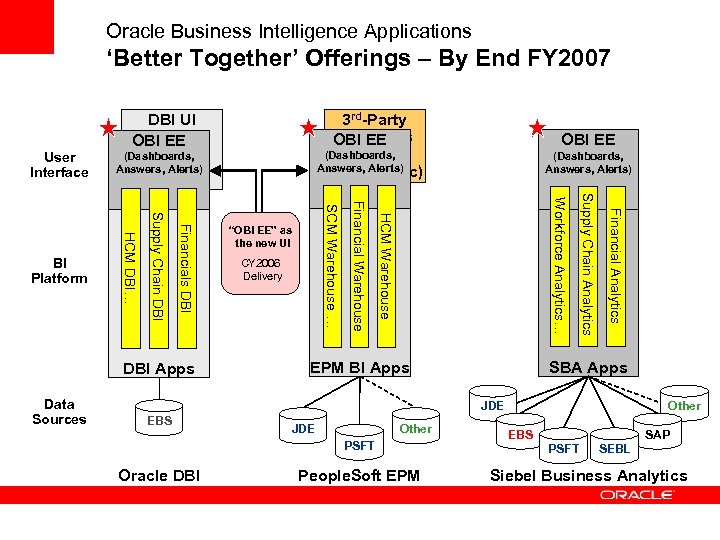

Oracle Business Intelligence Applications ‘Better Together’ Offerings – By End FY 2007 Financial Analytics EPM BI Apps Supply Chain Analytics Workforce Analytics… CY 2006 Delivery OBI EE (Dashboards, Answers, Alerts) HCM Warehouse Data Sources “OBI EE” as the new UI Financial Warehouse DBI Apps SCM Warehouse … Financials DBI BI Platform 3 rd-Party (Business OBI EE (Dashboards, Objects, Answers, Alerts) Cognos, etc) (Dashboards, Viewer) Answers, Alerts) HCM DBI… User Interface Supply Chain DBI UI (Performance OBI EE Management SBA Apps JDE EBS JDE Other PSFT Oracle DBI People. Soft EPM Other EBS SAP PSFT SEBL Siebel Business Analytics

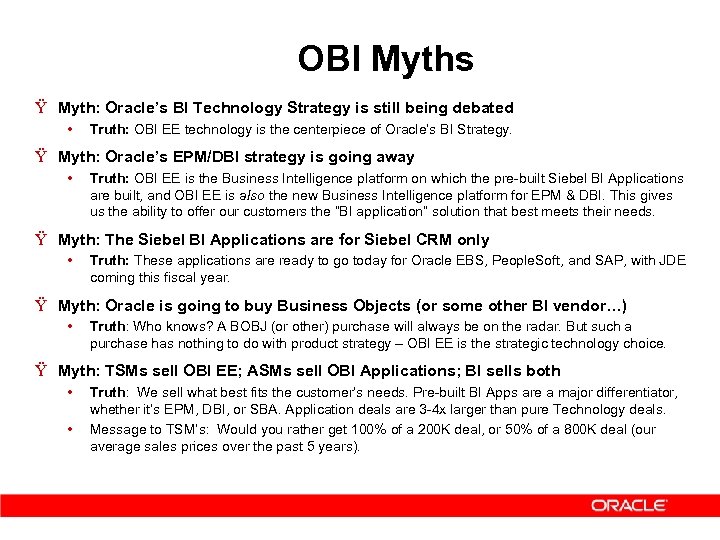

OBI Myths Ÿ Myth: Oracle’s BI Technology Strategy is still being debated • Truth: OBI EE technology is the centerpiece of Oracle’s BI Strategy. Ÿ Myth: Oracle’s EPM/DBI strategy is going away • Truth: OBI EE is the Business Intelligence platform on which the pre-built Siebel BI Applications are built, and OBI EE is also the new Business Intelligence platform for EPM & DBI. This gives us the ability to offer our customers the “BI application” solution that best meets their needs. Ÿ Myth: The Siebel BI Applications are for Siebel CRM only • Truth: These applications are ready to go today for Oracle EBS, People. Soft, and SAP, with JDE coming this fiscal year. Ÿ Myth: Oracle is going to buy Business Objects (or some other BI vendor…) • Truth: Who knows? A BOBJ (or other) purchase will always be on the radar. But such a purchase has nothing to do with product strategy – OBI EE is the strategic technology choice. Ÿ Myth: TSMs sell OBI EE; ASMs sell OBI Applications; BI sells both • • Truth: We sell what best fits the customer’s needs. Pre-built BI Apps are a major differentiator, whether it’s EPM, DBI, or SBA. Application deals are 3 -4 x larger than pure Technology deals. Message to TSM’s: Would you rather get 100% of a 200 K deal, or 50% of a 800 K deal (our average sales prices over the past 5 years).

The Market Situation

Let’s start with a simple proposition Everyone in your company can do their jobs better if they made decisions and took actions based on actual information rather than “best guess” or “how we did it last year” Sounds simple, but….

BI Challenges Today …not easy to achieve! • Fragmented • In-consistent • Report-centric • Restricted • Non-Intuitive Hasn’t the promise of BI been there for the past decade?

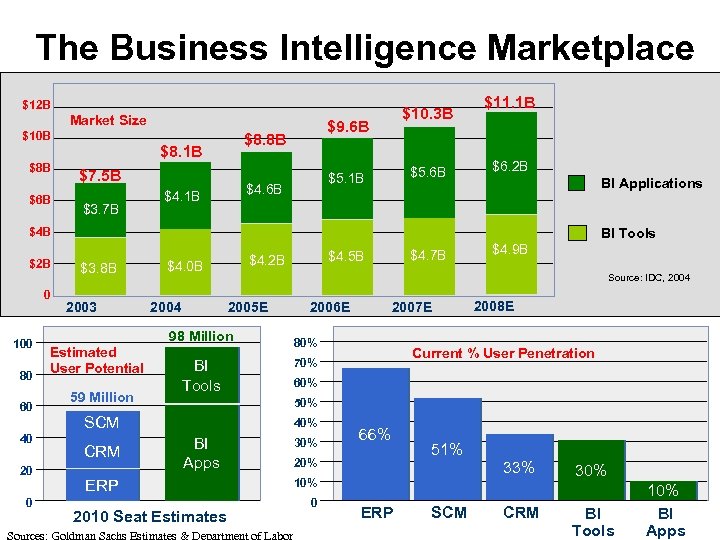

The Business Intelligence Marketplace $12 B Market Size $10 B $8 B $6 B $7. 5 B $3. 7 B $9. 6 B $8. 8 B $8. 1 B $5. 6 B $5. 1 B $4. 6 B $4. 1 B $10. 3 B $11. 1 B $6. 2 B BI Applications $4 B $2 B 0 100 80 60 40 20 0 BI Tools $3. 8 B 2003 $4. 0 B 2004 59 Million 2005 E BI Tools 2006 E 2007 E 80% 2008 E Current % User Penetration 70% 60% 50% SCM CRM $4. 9 B Source: IDC, 2004 98 Million Estimated User Potential $4. 7 B $4. 5 B $4. 2 B 40% BI Apps ERP 2010 Seat Estimates Sources: Goldman Sachs Estimates & Department of Labor 30% 66% 20% 51% 33% 10% 0 ERP SCM CRM 30% BI Tools 10% BI Apps

Insight-Driven Business Processes “Business intelligence (BI) is moving into the context of the business process, not just to make users’ information experience more effective, but also to allow for business process optimization. ” Software Macro-Trends: Reshaping Enterprise Software - Sep 2005

Oracle History in the Market Ÿ 80 -85% of COGN, BOBJ & HYSL’s revenue come from selling their “Tools” on top of an Oracle DW. Ÿ SAP sells SAP/BW with every deal – it looks and feels like a clean, integrated story (even if it’s not true). Ÿ At Oracle, in Commercial for FY 06: • ~18 M in total revenue for CPM/EPM • Avg deal size ~$64 K • 3 rd Largest EPM Deal in Q 4: 700 K for EPM/Scorecard • And yet $1. 4 M went to BOBJ for the BI piece Ÿ Oracle dominates in the DW market share, but is largely not visible in the BI tools market…not yet at least.

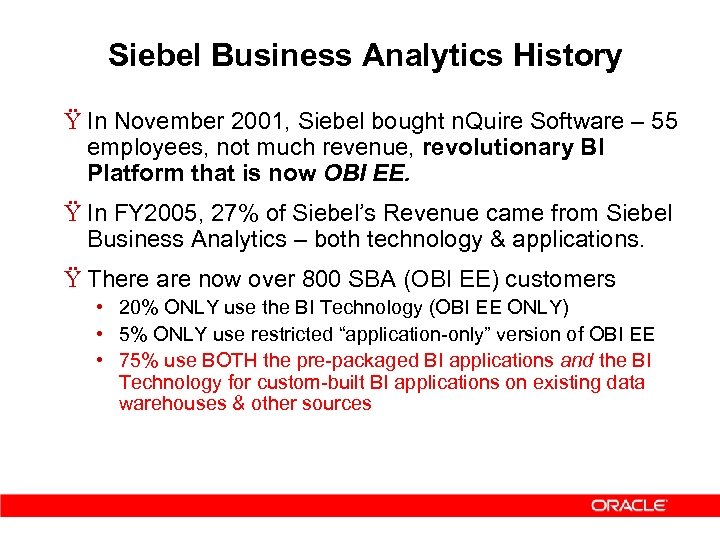

Siebel Business Analytics History Ÿ In November 2001, Siebel bought n. Quire Software – 55 employees, not much revenue, revolutionary BI Platform that is now OBI EE. Ÿ In FY 2005, 27% of Siebel’s Revenue came from Siebel Business Analytics – both technology & applications. Ÿ There are now over 800 SBA (OBI EE) customers • 20% ONLY use the BI Technology (OBI EE ONLY) • 5% ONLY use restricted “application-only” version of OBI EE • 75% use BOTH the pre-packaged BI applications and the BI Technology for custom-built BI applications on existing data warehouses & other sources

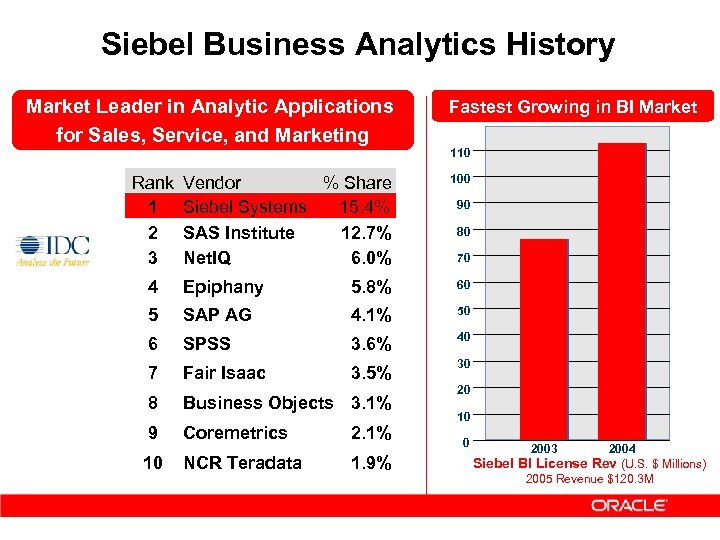

Siebel Business Analytics History Market Leader in Analytic Applications for Sales, Service, and Marketing Rank 1 2 3 Vendor % Share 15. 4% Siebel Systems SAS Institute 12. 7% Net. IQ 6. 0% Fastest Growing in BI Market 110 100 90 80 70 4 Epiphany 5. 8% 60 5 SAP AG 4. 1% 50 6 SPSS 3. 6% 40 7 Fair Isaac 3. 5% 30 8 Business Objects 3. 1% 9 Coremetrics 2. 1% 10 NCR Teradata 1. 9% Sources: IDC Vendor Rankings, Worldwide Customer Analytics Applications (2003), July 2004 20 10 0 2003 2004 Siebel BI License Rev (U. S. $ Millions) 2005 Revenue $120. 3 M

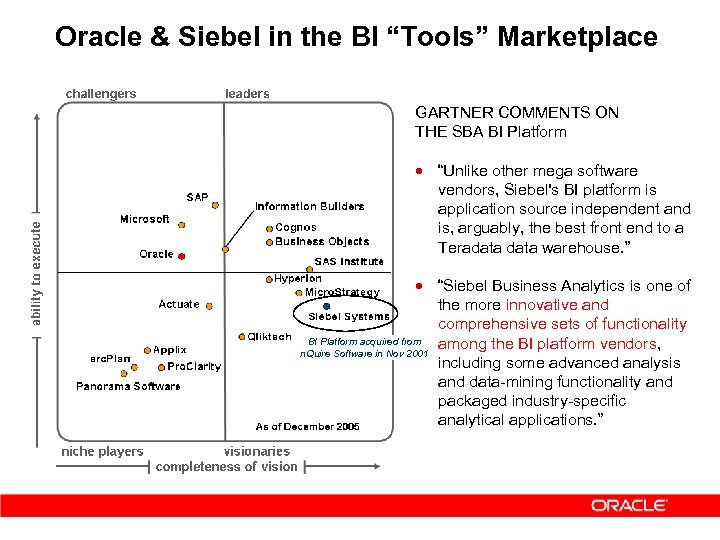

Oracle & Siebel in the BI “Tools” Marketplace GARTNER COMMENTS ON THE SBA BI Platform · “Unlike other mega software vendors, Siebel's BI platform is application source independent and is, arguably, the best front end to a Teradata warehouse. ” · “Siebel Business Analytics is one of the more innovative and comprehensive sets of functionality BI Platform acquired from among the BI platform vendors, n. Quire Software in Nov 2001 including some advanced analysis and data-mining functionality and packaged industry-specific analytical applications. ”

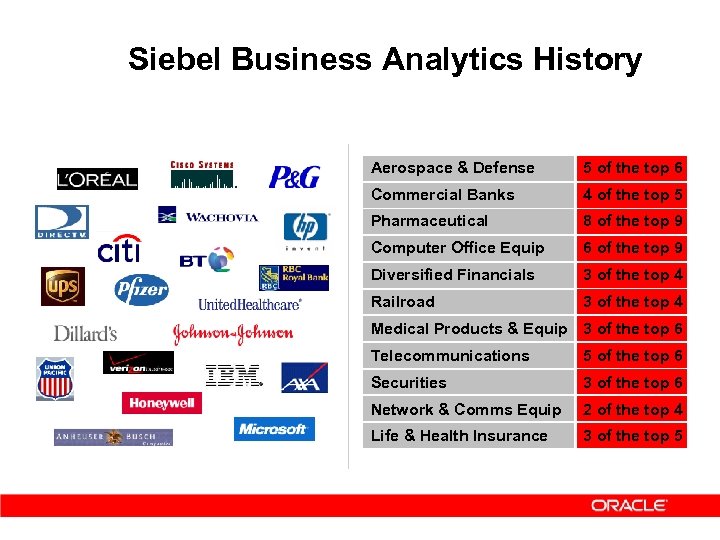

Siebel Business Analytics History Aerospace & Defense 5 of the top 6 Commercial Banks 4 of the top 5 Pharmaceutical 8 of the top 9 Computer Office Equip 6 of the top 9 Diversified Financials 3 of the top 4 Railroad 3 of the top 4 Medical Products & Equip 3 of the top 6 Telecommunications 5 of the top 6 Securities 3 of the top 6 Network & Comms Equip 2 of the top 4 Life & Health Insurance 3 of the top 5

So, the Opportunity for Us Ÿ Get in front of Cognos, Business Objects & Hyperion opportunities Ÿ Become #1 in the Business Intelligence marketplace in the next 18 months. Ÿ Expose SAP’s “black box” BI Applications story Ÿ The way we do it is by selling packaged BI Applications, built on the new Oracle BI Platform (SBA), for People. Soft, EBS, Siebel, & JDE customers.

Oracle BI Solutions

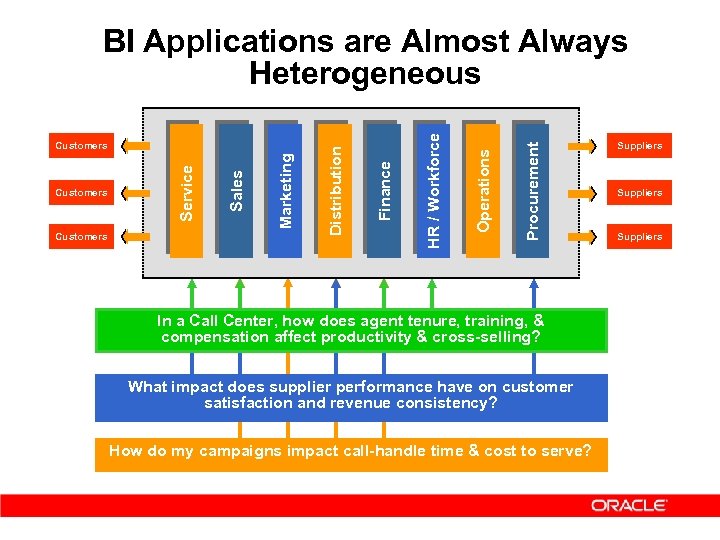

Procurement Operations Finance Marketing HR / Workforce Customers Sales Customers Service Customers Distribution BI Applications are Almost Always Heterogeneous In a Call Center, how does agent tenure, training, & compensation affect productivity & cross-selling? What impact does supplier performance have on customer satisfaction and revenue consistency? How do my campaigns impact call-handle time & cost to serve? Suppliers

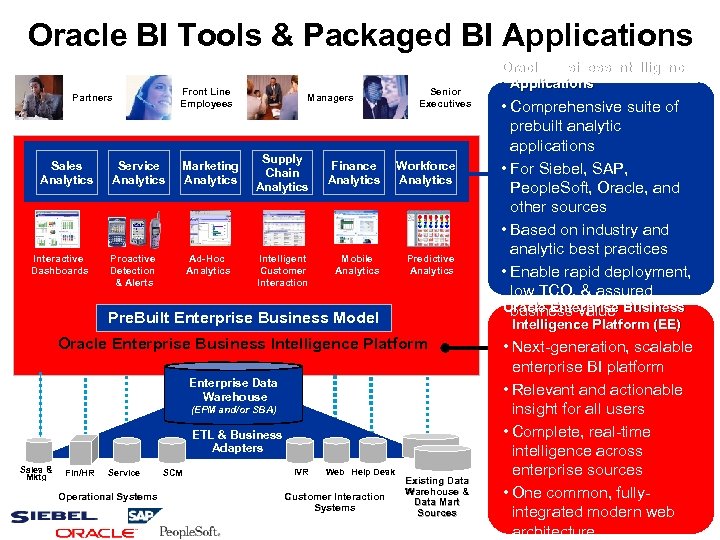

Oracle BI Tools & Packaged BI Applications Front Line Employees Partners Sales Analytics Interactive Dashboards Service Analytics Marketing Analytics Proactive Detection & Alerts Ad-Hoc Analytics Managers Supply Chain Analytics Intelligent Customer Interaction Senior Executives Finance Analytics Workforce Analytics Mobile Analytics Predictive Analytics Pre. Built Enterprise Business Model Enterprise Data Warehouse (EPM and/or SBA) ETL & Business Adapters Fin/HR Service Operational Systems SCM IVR Web Help Desk Customer Interaction Systems • Comprehensive suite of prebuilt analytic applications • For Siebel, SAP, People. Soft, Oracle, and other sources • Based on industry and analytic best practices • Enable rapid deployment, low TCO, & assured Oracle Enterprise Business business value Intelligence Platform (EE) Oracle Enterprise Business Intelligence Platform Sales & Mktg Oracle Business Intelligence Applications Existing Data Warehouse & Data Mart Sources • Next-generation, scalable enterprise BI platform • Relevant and actionable insight for all users • Complete, real-time intelligence across enterprise sources • One common, fullyintegrated modern web architecture

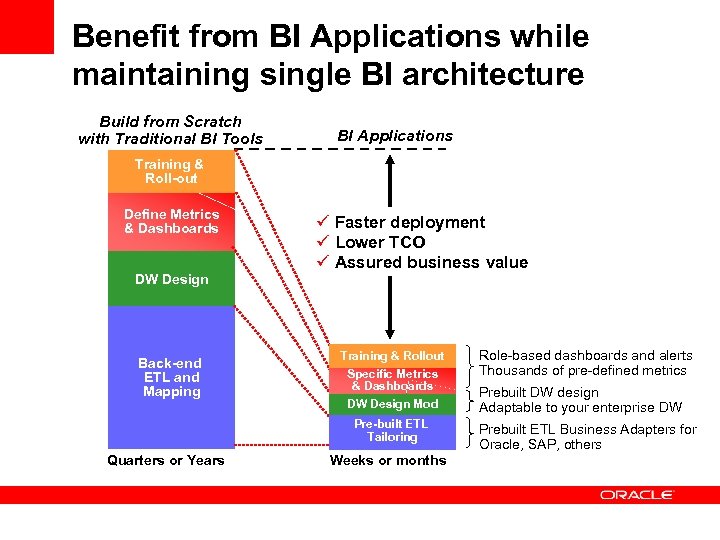

Benefit from BI Applications while maintaining single BI architecture Build from Scratch with Traditional BI Tools BI Applications Training & Roll-out Define Metrics & Dashboards DW Design Back-end ETL and Mapping ü Faster deployment ü Lower TCO ü Assured business value Training & Rollout Specific Metrics & Dashboards DW Design Mod Pre-built ETL Tailoring Quarters or Years Weeks or months Role-based dashboards and alerts Thousands of pre-defined metrics Prebuilt DW design Adaptable to your enterprise DW Prebuilt ETL Business Adapters for Oracle, SAP, others

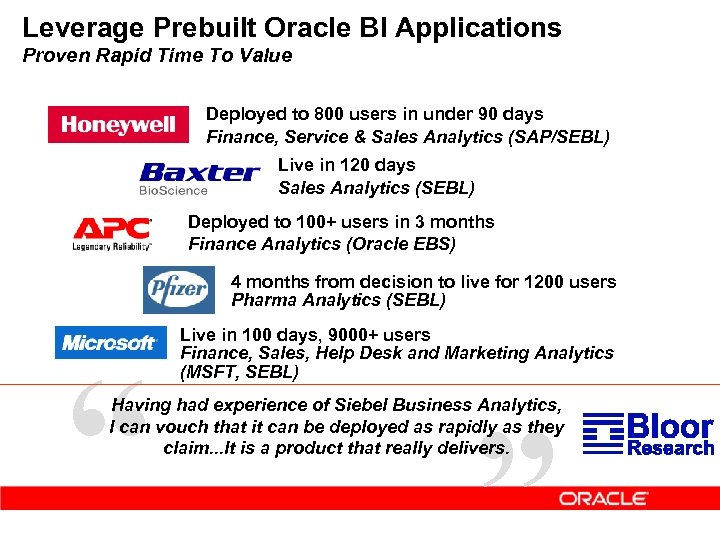

Leverage Prebuilt Oracle BI Applications Proven Rapid Time To Value Deployed to 800 users in under 90 days Finance, Service & Sales Analytics (SAP/SEBL) Live in 120 days Sales Analytics (SEBL) Deployed to 100+ users in 3 months Finance Analytics (Oracle EBS) 4 months from decision to live for 1200 users Pharma Analytics (SEBL) “ Live in 100 days, 9000+ users Finance, Sales, Help Desk and Marketing Analytics (MSFT, SEBL) Having had experience of Siebel Business Analytics, I can vouch that it can be deployed as rapidly as they claim. . . It is a product that really delivers.

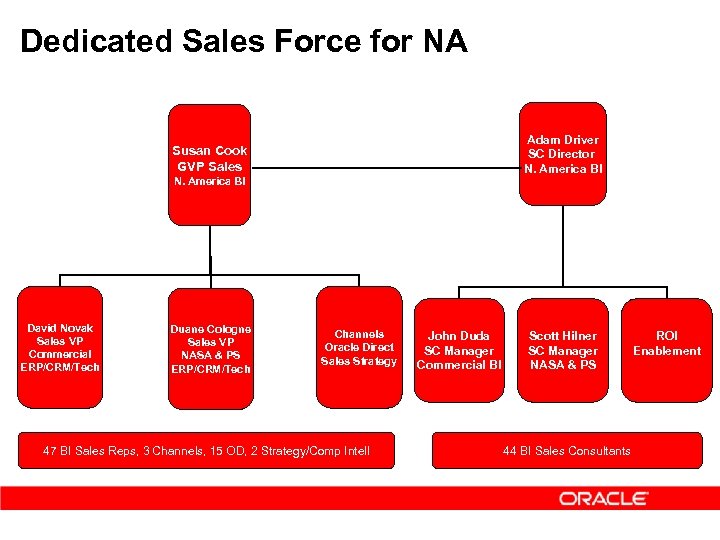

Dedicated Sales Force for NA Adam Driver SC Director N. America BI Susan Cook GVP Sales N. America BI David Novak Sales VP Commercial ERP/CRM/Tech Duane Cologne Sales VP NASA & PS ERP/CRM/Tech Channels Oracle Direct Sales Strategy 47 BI Sales Reps, 3 Channels, 15 OD, 2 Strategy/Comp Intell John Duda SC Manager Commercial BI Scott Hilner SC Manager NASA & PS 44 BI Sales Consultants ROI Enablement

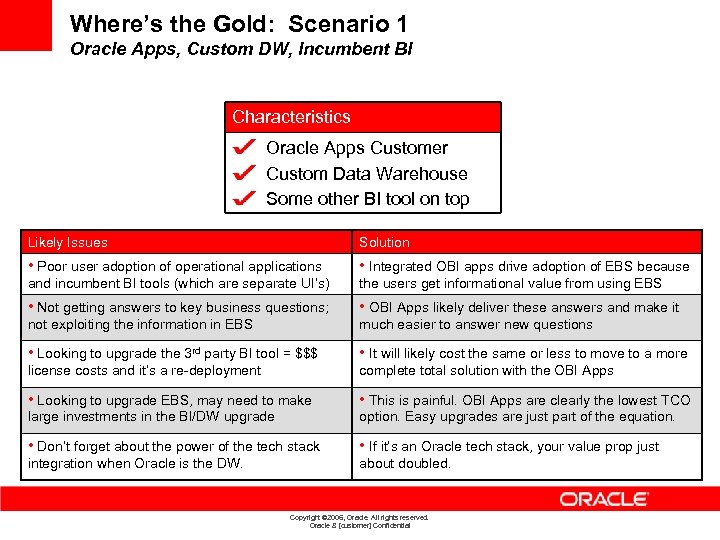

Where’s the Gold: Scenario 1 Oracle Apps, Custom DW, Incumbent BI Characteristics Oracle Apps Customer Custom Data Warehouse Some other BI tool on top Likely Issues Solution • Poor user adoption of operational applications • Integrated OBI apps drive adoption of EBS because and incumbent BI tools (which are separate UI’s) the users get informational value from using EBS • Not getting answers to key business questions; • OBI Apps likely deliver these answers and make it not exploiting the information in EBS much easier to answer new questions • Looking to upgrade the 3 rd party BI tool = $$$ • It will likely cost the same or less to move to a more license costs and it’s a re-deployment complete total solution with the OBI Apps • Looking to upgrade EBS, may need to make • This is painful. OBI Apps are clearly the lowest TCO large investments in the BI/DW upgrade option. Easy upgrades are just part of the equation. • Don’t forget about the power of the tech stack • If it’s an Oracle tech stack, your value prop just integration when Oracle is the DW. about doubled. Copyright © 2006, Oracle. All rights reserved. Oracle & [customer] Confidential

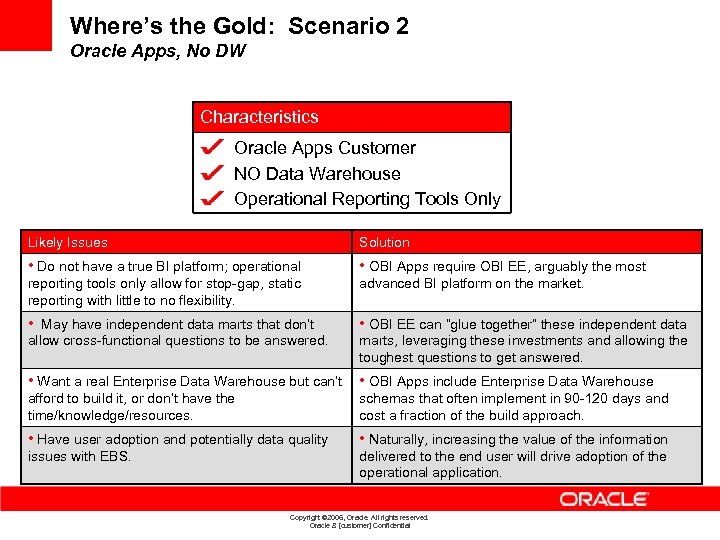

Where’s the Gold: Scenario 2 Oracle Apps, No DW Characteristics Oracle Apps Customer NO Data Warehouse Operational Reporting Tools Only Likely Issues Solution • Do not have a true BI platform; operational • OBI Apps require OBI EE, arguably the most reporting tools only allow for stop-gap, static reporting with little to no flexibility. advanced BI platform on the market. • May have independent data marts that don’t • OBI EE can “glue together” these independent data allow cross-functional questions to be answered. marts, leveraging these investments and allowing the toughest questions to get answered. • Want a real Enterprise Data Warehouse but can’t • OBI Apps include Enterprise Data Warehouse afford to build it, or don’t have the time/knowledge/resources. schemas that often implement in 90 -120 days and cost a fraction of the build approach. • Have user adoption and potentially data quality • Naturally, increasing the value of the information issues with EBS. delivered to the end user will drive adoption of the operational application. Copyright © 2006, Oracle. All rights reserved. Oracle & [customer] Confidential

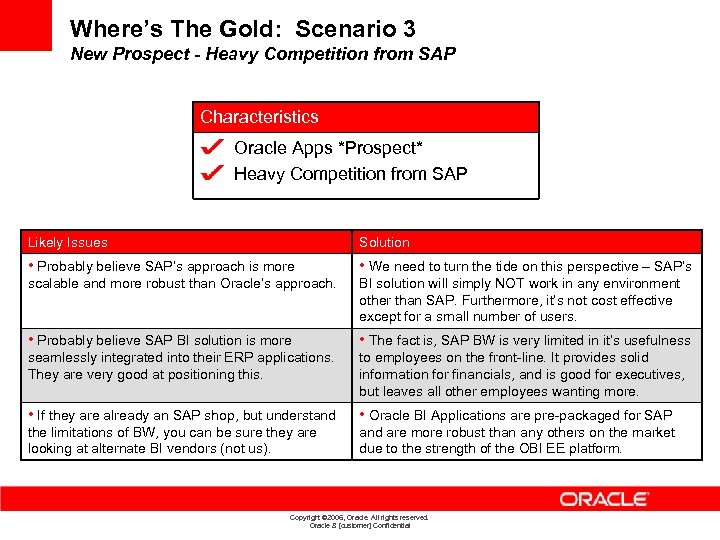

Where’s The Gold: Scenario 3 New Prospect - Heavy Competition from SAP Characteristics Oracle Apps *Prospect* Heavy Competition from SAP Likely Issues Solution • Probably believe SAP’s approach is more • We need to turn the tide on this perspective – SAP’s scalable and more robust than Oracle’s approach. BI solution will simply NOT work in any environment other than SAP. Furthermore, it’s not cost effective except for a small number of users. • Probably believe SAP BI solution is more • The fact is, SAP BW is very limited in it’s usefulness seamlessly integrated into their ERP applications. They are very good at positioning this. to employees on the front-line. It provides solid information for financials, and is good for executives, but leaves all other employees wanting more. • If they are already an SAP shop, but understand • Oracle BI Applications are pre-packaged for SAP the limitations of BW, you can be sure they are looking at alternate BI vendors (not us). and are more robust than any others on the market due to the strength of the OBI EE platform. Copyright © 2006, Oracle. All rights reserved. Oracle & [customer] Confidential

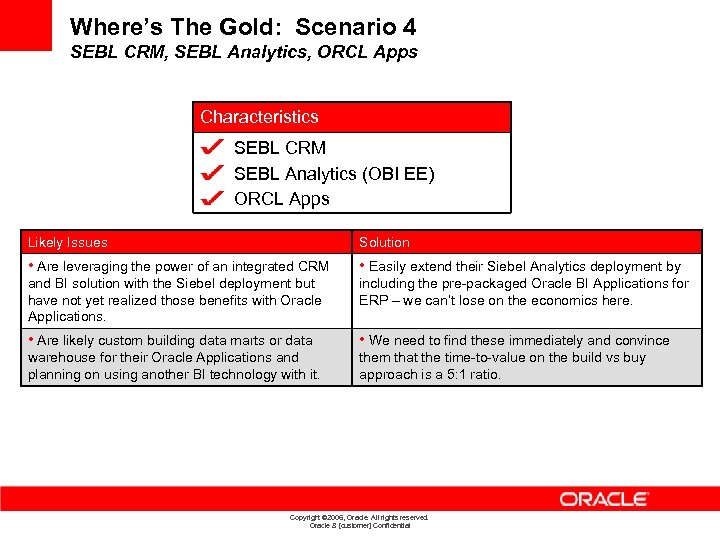

Where’s The Gold: Scenario 4 SEBL CRM, SEBL Analytics, ORCL Apps Characteristics SEBL CRM SEBL Analytics (OBI EE) ORCL Apps Likely Issues Solution • Are leveraging the power of an integrated CRM • Easily extend their Siebel Analytics deployment by and BI solution with the Siebel deployment but have not yet realized those benefits with Oracle Applications. including the pre-packaged Oracle BI Applications for ERP – we can’t lose on the economics here. • Are likely custom building data marts or data • We need to find these immediately and convince warehouse for their Oracle Applications and planning on using another BI technology with it. them that the time-to-value on the build vs buy approach is a 5: 1 ratio. Copyright © 2006, Oracle. All rights reserved. Oracle & [customer] Confidential

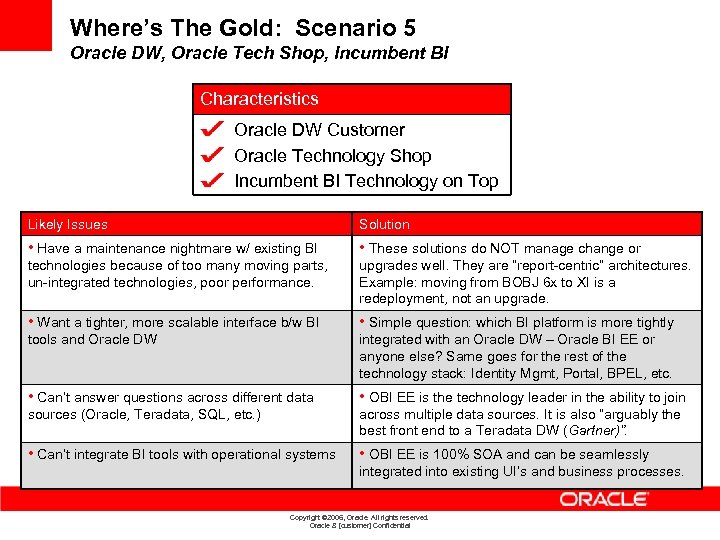

Where’s The Gold: Scenario 5 Oracle DW, Oracle Tech Shop, Incumbent BI Characteristics Oracle DW Customer Oracle Technology Shop Incumbent BI Technology on Top Likely Issues Solution • Have a maintenance nightmare w/ existing BI • These solutions do NOT manage change or technologies because of too many moving parts, un-integrated technologies, poor performance. upgrades well. They are “report-centric” architectures. Example: moving from BOBJ 6 x to XI is a redeployment, not an upgrade. • Want a tighter, more scalable interface b/w BI • Simple question: which BI platform is more tightly tools and Oracle DW integrated with an Oracle DW – Oracle BI EE or anyone else? Same goes for the rest of the technology stack: Identity Mgmt, Portal, BPEL, etc. • Can’t answer questions across different data • OBI EE is the technology leader in the ability to join sources (Oracle, Teradata, SQL, etc. ) across multiple data sources. It is also “arguably the best front end to a Teradata DW (Gartner)”. • Can’t integrate BI tools with operational systems • OBI EE is 100% SOA and can be seamlessly integrated into existing UI’s and business processes. Copyright © 2006, Oracle. All rights reserved. Oracle & [customer] Confidential

a9ce68ce62033371a5f8cd35552cf187.ppt