2d108e4bd14a3f7c0352aad79c0de948.ppt

- Количество слайдов: 27

Software Portfolio

Software Portfolio

Complete. Open. Integrated.

Complete. Open. Integrated.

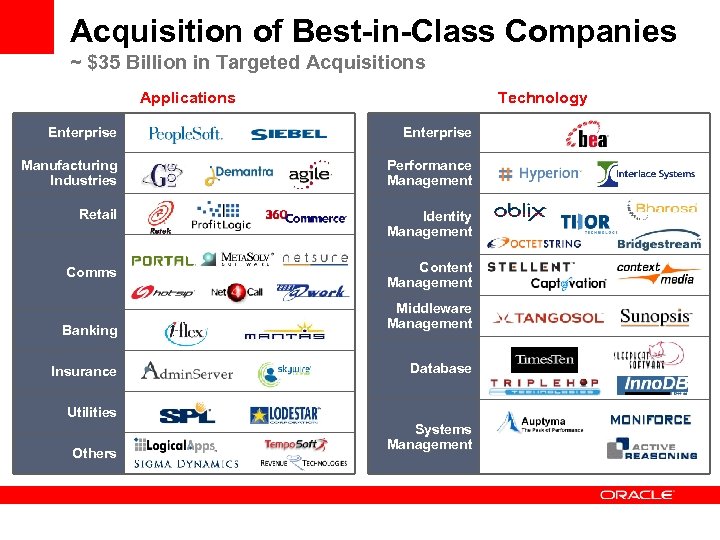

Acquisition of Best-in-Class Companies ~ $35 Billion in Targeted Acquisitions Applications Technology Enterprise Manufacturing Industries Performance Management Retail Identity Management Comms Content Management Banking Middleware Management Insurance Database Utilities Others Systems Management

Acquisition of Best-in-Class Companies ~ $35 Billion in Targeted Acquisitions Applications Technology Enterprise Manufacturing Industries Performance Management Retail Identity Management Comms Content Management Banking Middleware Management Insurance Database Utilities Others Systems Management

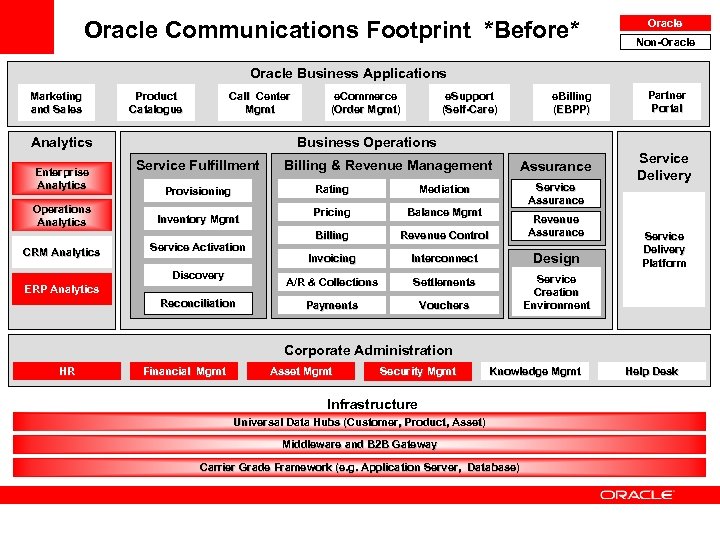

Oracle Communications Footprint *Before* Oracle Non-Oracle Business Applications Marketing and Sales Product Catalogue Call Center Mgmt Analytics Enterprise Analytics e. Commerce (Order Mgmt) e. Support (Self-Care) e. Billing (EBPP) Business Operations Service Fulfillment Billing & Revenue Management Assurance Service Assurance Rating Operations Analytics Inventory Mgmt CRM Analytics Service Activation Discovery ERP Analytics Reconciliation Mediation Pricing Balance Mgmt Billing Revenue Control Revenue Assurance Invoicing Interconnect Design A/R & Collections Provisioning Settlements Payments Vouchers Partner Portal Service Delivery Service Creation Environment Service Delivery Platform Corporate Administration HR Financial Mgmt Asset Mgmt Security Mgmt Knowledge Mgmt Infrastructure Universal Data Hubs (Customer, Product, Asset) Middleware and B 2 B Gateway Carrier Grade Framework (e. g. Application Server, Database) Help Desk

Oracle Communications Footprint *Before* Oracle Non-Oracle Business Applications Marketing and Sales Product Catalogue Call Center Mgmt Analytics Enterprise Analytics e. Commerce (Order Mgmt) e. Support (Self-Care) e. Billing (EBPP) Business Operations Service Fulfillment Billing & Revenue Management Assurance Service Assurance Rating Operations Analytics Inventory Mgmt CRM Analytics Service Activation Discovery ERP Analytics Reconciliation Mediation Pricing Balance Mgmt Billing Revenue Control Revenue Assurance Invoicing Interconnect Design A/R & Collections Provisioning Settlements Payments Vouchers Partner Portal Service Delivery Service Creation Environment Service Delivery Platform Corporate Administration HR Financial Mgmt Asset Mgmt Security Mgmt Knowledge Mgmt Infrastructure Universal Data Hubs (Customer, Product, Asset) Middleware and B 2 B Gateway Carrier Grade Framework (e. g. Application Server, Database) Help Desk

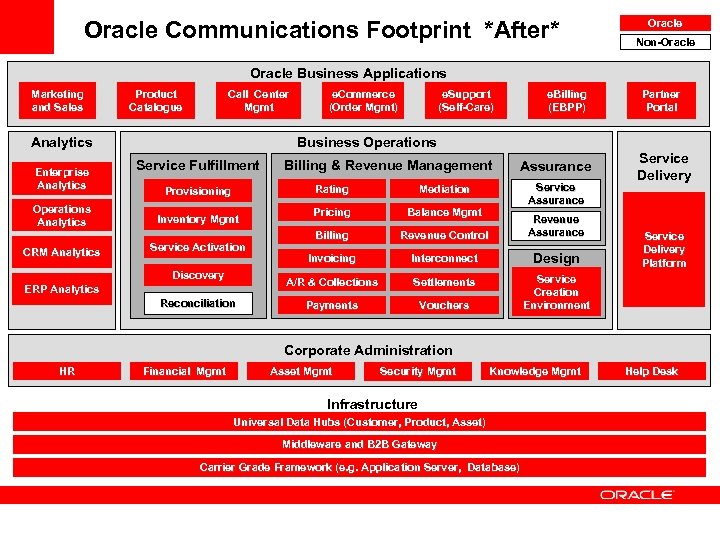

Oracle Communications Footprint *After* Oracle Non-Oracle Business Applications Marketing and Sales Product Catalogue Call Center Mgmt Analytics Enterprise Analytics e. Commerce (Order Mgmt) e. Support (Self-Care) e. Billing (EBPP) Business Operations Service Fulfillment Billing & Revenue Management Assurance Service Assurance Rating Operations Analytics Inventory Mgmt CRM Analytics Service Activation Discovery ERP Analytics Reconciliation Mediation Pricing Balance Mgmt Billing Revenue Control Revenue Assurance Invoicing Interconnect Design A/R & Collections Provisioning Settlements Payments Vouchers Partner Portal Service Delivery Service Creation Environment Service Delivery Platform Corporate Administration HR Financial Mgmt Asset Mgmt Security Mgmt Knowledge Mgmt Infrastructure Universal Data Hubs (Customer, Product, Asset) Middleware and B 2 B Gateway Carrier Grade Framework (e. g. Application Server, Database) Help Desk

Oracle Communications Footprint *After* Oracle Non-Oracle Business Applications Marketing and Sales Product Catalogue Call Center Mgmt Analytics Enterprise Analytics e. Commerce (Order Mgmt) e. Support (Self-Care) e. Billing (EBPP) Business Operations Service Fulfillment Billing & Revenue Management Assurance Service Assurance Rating Operations Analytics Inventory Mgmt CRM Analytics Service Activation Discovery ERP Analytics Reconciliation Mediation Pricing Balance Mgmt Billing Revenue Control Revenue Assurance Invoicing Interconnect Design A/R & Collections Provisioning Settlements Payments Vouchers Partner Portal Service Delivery Service Creation Environment Service Delivery Platform Corporate Administration HR Financial Mgmt Asset Mgmt Security Mgmt Knowledge Mgmt Infrastructure Universal Data Hubs (Customer, Product, Asset) Middleware and B 2 B Gateway Carrier Grade Framework (e. g. Application Server, Database) Help Desk

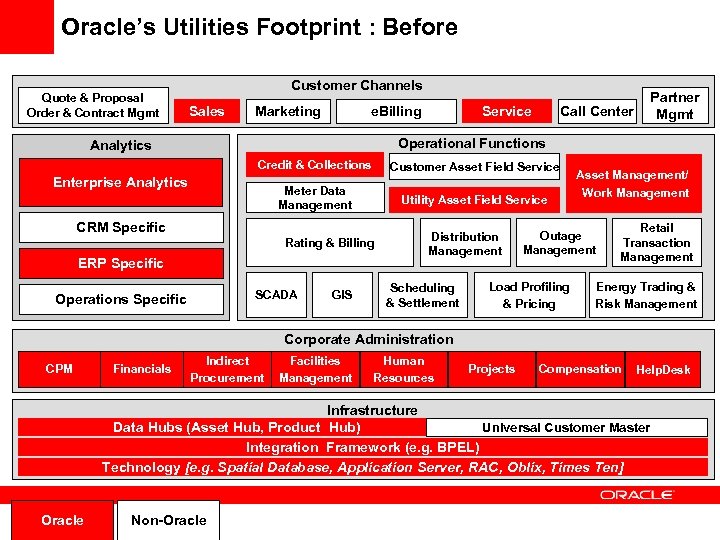

Solutions Map – Footprint : Before Oracle’s Utilities Overall View Quote & Proposal Order & Contract Mgmt Customer Channels Sales Marketing e. Billing Service Call Center Partner Mgmt Operational Functions Analytics Credit & Collections Customer Asset Field Service Meter Data Management Utility Asset Field Service Enterprise Analytics CRM Specific Rating & Billing ERP Specific SCADA Operations Specific GIS Distribution Management Scheduling & Settlement Asset Management/ Work Management Outage Management Load Profiling & Pricing Retail Transaction Management Energy Trading & Risk Management Corporate Administration CPM Financials Indirect Procurement Facilities Management Human Resources Projects Compensation Help. Desk Infrastructure Universal Customer Master Data Hubs (Asset Hub, Product Hub) Integration Framework (e. g. BPEL) Technology [e. g. Spatial Database, Application Server, RAC, Oblix, Times Ten] Oracle Non-Oracle

Solutions Map – Footprint : Before Oracle’s Utilities Overall View Quote & Proposal Order & Contract Mgmt Customer Channels Sales Marketing e. Billing Service Call Center Partner Mgmt Operational Functions Analytics Credit & Collections Customer Asset Field Service Meter Data Management Utility Asset Field Service Enterprise Analytics CRM Specific Rating & Billing ERP Specific SCADA Operations Specific GIS Distribution Management Scheduling & Settlement Asset Management/ Work Management Outage Management Load Profiling & Pricing Retail Transaction Management Energy Trading & Risk Management Corporate Administration CPM Financials Indirect Procurement Facilities Management Human Resources Projects Compensation Help. Desk Infrastructure Universal Customer Master Data Hubs (Asset Hub, Product Hub) Integration Framework (e. g. BPEL) Technology [e. g. Spatial Database, Application Server, RAC, Oblix, Times Ten] Oracle Non-Oracle

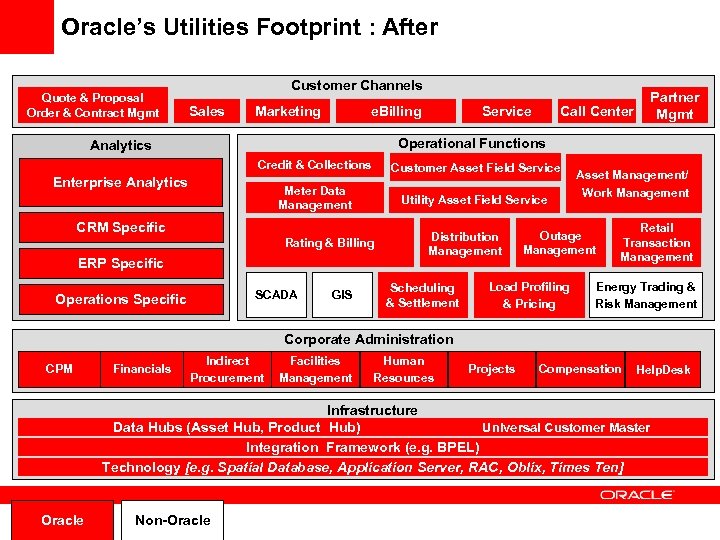

Solutions Map – Footprint : After Oracle’s Utilities Overall View Quote & Proposal Order & Contract Mgmt Customer Channels Sales Marketing e. Billing Service Call Center Partner Mgmt Operational Functions Analytics Credit & Collections Customer Asset Field Service Meter Data Management Utility Asset Field Service Enterprise Analytics CRM Specific Rating & Billing ERP Specific SCADA Operations Specific GIS Distribution Management Scheduling & Settlement Asset Management/ Work Management Outage Management Load Profiling & Pricing Retail Transaction Management Energy Trading & Risk Management Corporate Administration CPM Financials Indirect Procurement Facilities Management Human Resources Projects Compensation Help. Desk Infrastructure Universal Customer Master Data Hubs (Asset Hub, Product Hub) Integration Framework (e. g. BPEL) Technology [e. g. Spatial Database, Application Server, RAC, Oblix, Times Ten] Oracle Non-Oracle

Solutions Map – Footprint : After Oracle’s Utilities Overall View Quote & Proposal Order & Contract Mgmt Customer Channels Sales Marketing e. Billing Service Call Center Partner Mgmt Operational Functions Analytics Credit & Collections Customer Asset Field Service Meter Data Management Utility Asset Field Service Enterprise Analytics CRM Specific Rating & Billing ERP Specific SCADA Operations Specific GIS Distribution Management Scheduling & Settlement Asset Management/ Work Management Outage Management Load Profiling & Pricing Retail Transaction Management Energy Trading & Risk Management Corporate Administration CPM Financials Indirect Procurement Facilities Management Human Resources Projects Compensation Help. Desk Infrastructure Universal Customer Master Data Hubs (Asset Hub, Product Hub) Integration Framework (e. g. BPEL) Technology [e. g. Spatial Database, Application Server, RAC, Oblix, Times Ten] Oracle Non-Oracle

Leadership Communications Healthcare Education Consumer Products Engr & Construction 65 of Top 100 4 of Top 5 Fortune 500 20 of Top 20 Service Providers Over 300 Leading Providers 9 of Top 10 Academic Universities Industrial Mfg Professional Svcs Natural Resources Travel & Transport Utilities 9 of Top 10 Global IT Services Firms 16 of 21 Fortune 500 3 of Top 5 Airlines in Fortune 500 13 of Top 20 Fortune 500

Leadership Communications Healthcare Education Consumer Products Engr & Construction 65 of Top 100 4 of Top 5 Fortune 500 20 of Top 20 Service Providers Over 300 Leading Providers 9 of Top 10 Academic Universities Industrial Mfg Professional Svcs Natural Resources Travel & Transport Utilities 9 of Top 10 Global IT Services Firms 16 of 21 Fortune 500 3 of Top 5 Airlines in Fortune 500 13 of Top 20 Fortune 500

The Last 4 Years • 1, 000 to 9, 500 Products • $10. 1 B to $22. 4 B Revenue • 42, 000 to 81, 000 Employees • 8, 000 to 22, 000 Developers • 8, 700 to 16, 900 Sales Reps • 200, 000 to 300, 000 Customers • 12, 000 to 19, 500 Partners • 2 M to 6 M OTN Members • 90 to 425 User Groups • 0 to 32 Advisory Boards

The Last 4 Years • 1, 000 to 9, 500 Products • $10. 1 B to $22. 4 B Revenue • 42, 000 to 81, 000 Employees • 8, 000 to 22, 000 Developers • 8, 700 to 16, 900 Sales Reps • 200, 000 to 300, 000 Customers • 12, 000 to 19, 500 Partners • 2 M to 6 M OTN Members • 90 to 425 User Groups • 0 to 32 Advisory Boards

Oracle Database • Database on Linux • Embedded Database • Data Warehousing

Oracle Database • Database on Linux • Embedded Database • Data Warehousing

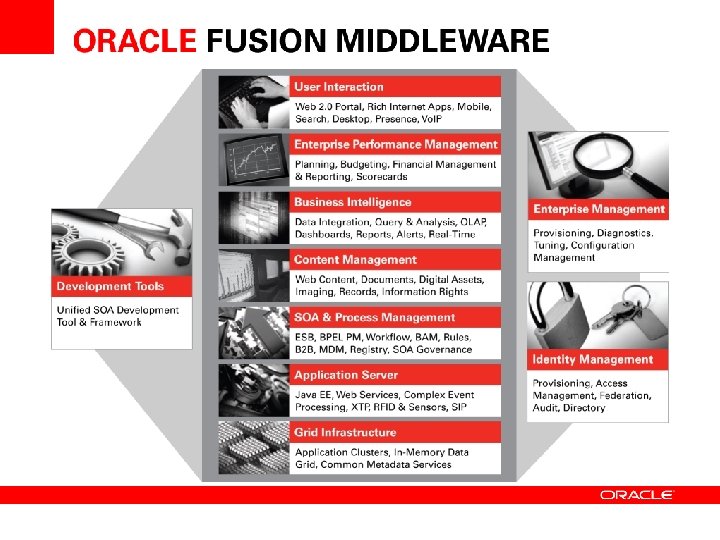

Oracle Fusion Middleware Leader in 18 Magic Quadrants Leader in 12 Forrester Waves More than 200 Product Awards

Oracle Fusion Middleware Leader in 18 Magic Quadrants Leader in 12 Forrester Waves More than 200 Product Awards

Oracle Applications • Customer Relationship Management • Human Capital Management • Enterprise Performance Management • Supply Chain Management • Retail • Communications • Financial Services • Public Sector • Professional Services • North America • United Kingdom

Oracle Applications • Customer Relationship Management • Human Capital Management • Enterprise Performance Management • Supply Chain Management • Retail • Communications • Financial Services • Public Sector • Professional Services • North America • United Kingdom

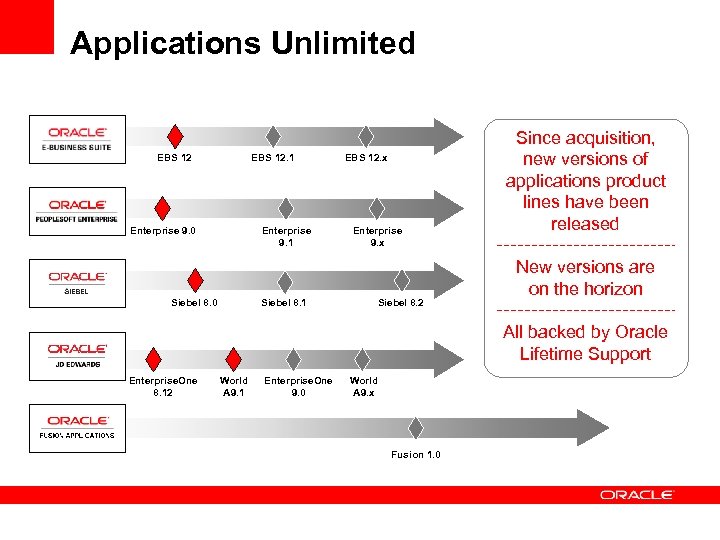

Applications Unlimited EBS 12. 1 Enterprise 9. 0 Enterprise 9. 1 Siebel 8. 0 Siebel 8. 1 EBS 12. x Enterprise 9. x Siebel 8. 2 Since acquisition, new versions of applications product lines have been released New versions are on the horizon All backed by Oracle Lifetime Support Enterprise. One 8. 12 World A 9. 1 Enterprise. One 9. 0 World A 9. x Fusion 1. 0

Applications Unlimited EBS 12. 1 Enterprise 9. 0 Enterprise 9. 1 Siebel 8. 0 Siebel 8. 1 EBS 12. x Enterprise 9. x Siebel 8. 2 Since acquisition, new versions of applications product lines have been released New versions are on the horizon All backed by Oracle Lifetime Support Enterprise. One 8. 12 World A 9. 1 Enterprise. One 9. 0 World A 9. x Fusion 1. 0

New Zealand Leadership Team

New Zealand Leadership Team

New Zealand Marketplace • Customer Growth • Product Growth • People Growth • Ecosystem Growth

New Zealand Marketplace • Customer Growth • Product Growth • People Growth • Ecosystem Growth

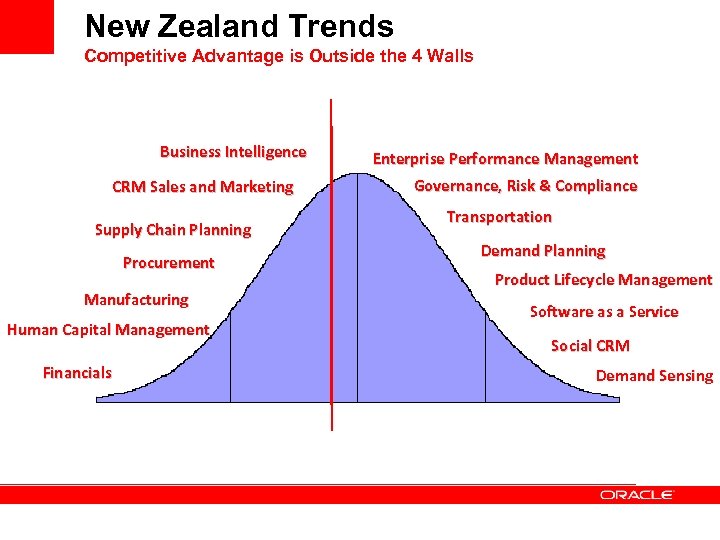

New Zealand Trends Competitive Advantage is Outside the 4 Walls Business Intelligence CRM Sales and Marketing Supply Chain Planning Procurement Manufacturing Human Capital Management Financials Enterprise Performance Management Governance, Risk & Compliance Transportation Demand Planning Product Lifecycle Management Software as a Service Social CRM Demand Sensing

New Zealand Trends Competitive Advantage is Outside the 4 Walls Business Intelligence CRM Sales and Marketing Supply Chain Planning Procurement Manufacturing Human Capital Management Financials Enterprise Performance Management Governance, Risk & Compliance Transportation Demand Planning Product Lifecycle Management Software as a Service Social CRM Demand Sensing

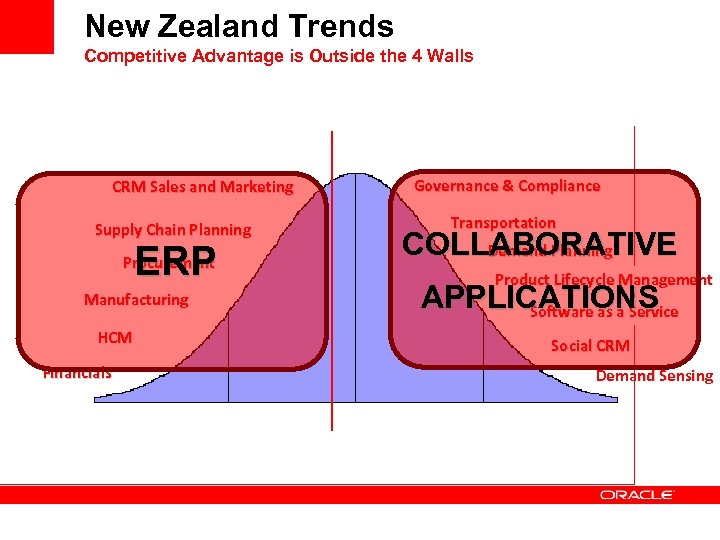

New Zealand Trends Competitive Advantage is Outside the 4 Walls CRM Sales and Marketing Supply Chain Planning ERP Procurement Manufacturing HCM Financials Governance & Compliance Transportation COLLABORATIVE Demand Planning Product Lifecycle Management APPLICATIONS Software as a Service Social CRM Demand Sensing

New Zealand Trends Competitive Advantage is Outside the 4 Walls CRM Sales and Marketing Supply Chain Planning ERP Procurement Manufacturing HCM Financials Governance & Compliance Transportation COLLABORATIVE Demand Planning Product Lifecycle Management APPLICATIONS Software as a Service Social CRM Demand Sensing

New Zealand Trends • Simplification • Software as a Service

New Zealand Trends • Simplification • Software as a Service

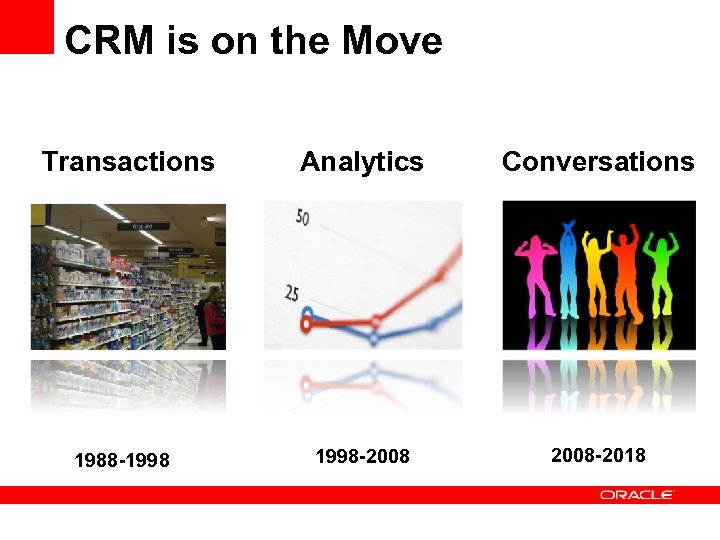

CRM is on the Move Transactions 1988 -1998 Analytics Conversations 1998 -2008 -2018

CRM is on the Move Transactions 1988 -1998 Analytics Conversations 1998 -2008 -2018

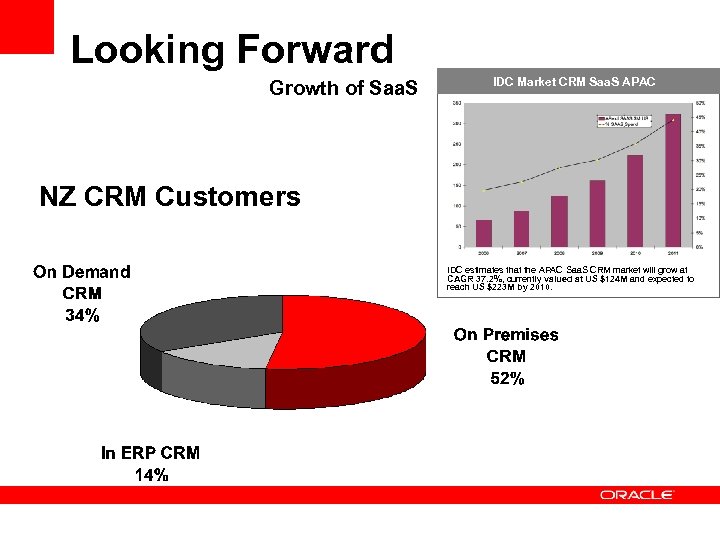

Looking Forward Growth of Saa. S IDC Market CRM Saa. S APAC NZ CRM Customers IDC estimates that the APAC Saa. S CRM market will grow at CAGR 37. 2%, currently valued at US $124 M and expected to reach US $223 M by 2010.

Looking Forward Growth of Saa. S IDC Market CRM Saa. S APAC NZ CRM Customers IDC estimates that the APAC Saa. S CRM market will grow at CAGR 37. 2%, currently valued at US $124 M and expected to reach US $223 M by 2010.

Complete Open Integrated • Insight • Solution Value Assessment • Software Consolidation

Complete Open Integrated • Insight • Solution Value Assessment • Software Consolidation