b36880a26c902f667463d692af765f78.ppt

- Количество слайдов: 20

Innovative Ways to Improve the Funded Ratio: Dynamically Managing Beta and Alpha Dr. Arun S. Muralidhar Chairman Mcube Investment Technologies, LLC 27 September 2005

Innovative Ways to Improve the Funded Ratio: Dynamically Managing Beta and Alpha Dr. Arun S. Muralidhar Chairman Mcube Investment Technologies, LLC 27 September 2005

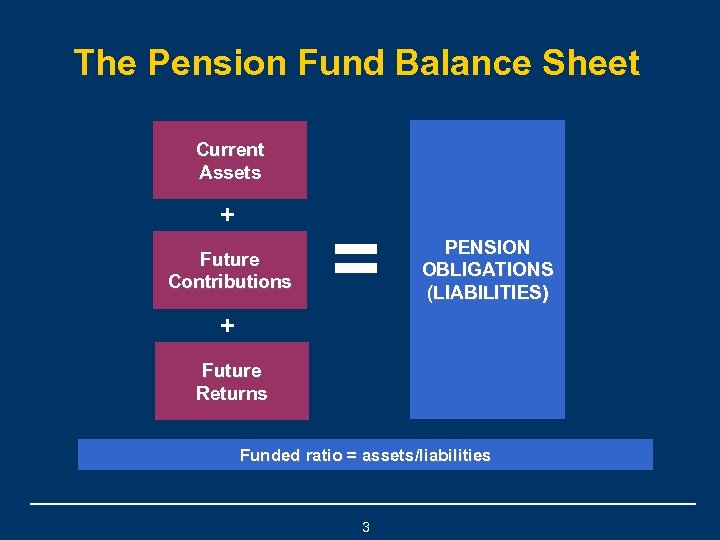

The Pension Fund Balance Sheet Current Assets + Future Contributions = PENSION OBLIGATIONS (LIABILITIES) + Future Returns Funded ratio = assets/liabilities 3

The Pension Fund Balance Sheet Current Assets + Future Contributions = PENSION OBLIGATIONS (LIABILITIES) + Future Returns Funded ratio = assets/liabilities 3

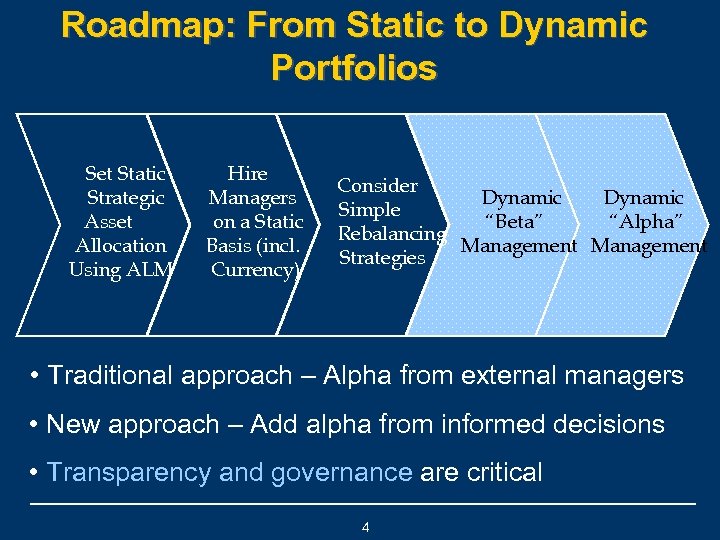

Roadmap: From Static to Dynamic Portfolios Set Static Strategic Asset Allocation Using ALM Hire Managers on a Static Basis (incl. Currency) Consider Dynamic Simple “Beta” “Alpha” Rebalancing Management Strategies • Traditional approach – Alpha from external managers • New approach – Add alpha from informed decisions • Transparency and governance are critical 4

Roadmap: From Static to Dynamic Portfolios Set Static Strategic Asset Allocation Using ALM Hire Managers on a Static Basis (incl. Currency) Consider Dynamic Simple “Beta” “Alpha” Rebalancing Management Strategies • Traditional approach – Alpha from external managers • New approach – Add alpha from informed decisions • Transparency and governance are critical 4

Key Conclusions • Separating “alpha” from “beta” - Too much focus on alpha, not on beta • Little focus on impact versus liabilities • Simple improvements to managing fund may be cheapest way to improve funded ratio • All portfolio decisions (incl. rebalancing) impact returns and risks; Must make decisions in an informed manner 5

Key Conclusions • Separating “alpha” from “beta” - Too much focus on alpha, not on beta • Little focus on impact versus liabilities • Simple improvements to managing fund may be cheapest way to improve funded ratio • All portfolio decisions (incl. rebalancing) impact returns and risks; Must make decisions in an informed manner 5

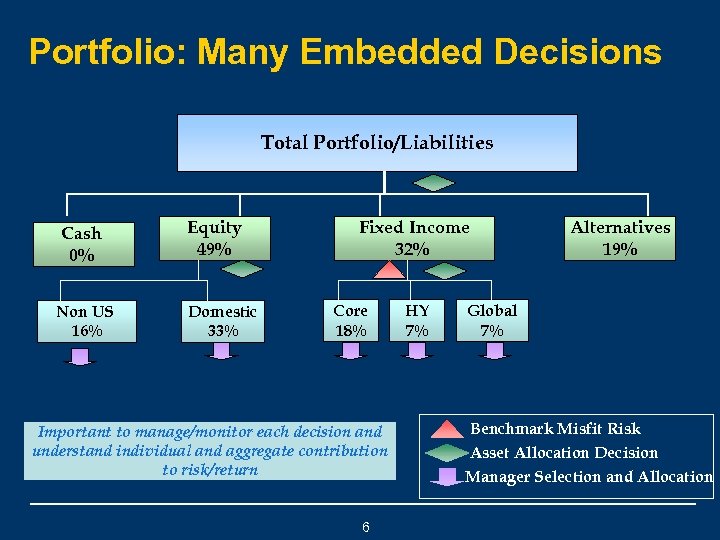

Portfolio: Many Embedded Decisions Total Portfolio/Liabilities Cash 0% Non US 16% Equity 49% Domestic 33% Fixed Income 32% Core 18% Important to manage/monitor each decision and understand individual and aggregate contribution to risk/return 6 HY 7% Alternatives 19% Global 7% Benchmark Misfit Risk Asset Allocation Decision Manager Selection and Allocation

Portfolio: Many Embedded Decisions Total Portfolio/Liabilities Cash 0% Non US 16% Equity 49% Domestic 33% Fixed Income 32% Core 18% Important to manage/monitor each decision and understand individual and aggregate contribution to risk/return 6 HY 7% Alternatives 19% Global 7% Benchmark Misfit Risk Asset Allocation Decision Manager Selection and Allocation

The “Old” Static Framework for Beta • Passive: Calendar or range-based rebalancing • When range hit, go either to range or target or in-between • Range: +/- 3% around target for most assets • What happens within range? ? ? • Client policy gives discretion = Tracking Error!! 7

The “Old” Static Framework for Beta • Passive: Calendar or range-based rebalancing • When range hit, go either to range or target or in-between • Range: +/- 3% around target for most assets • What happens within range? ? ? • Client policy gives discretion = Tracking Error!! 7

Client’s Goals and Objectives • Rebalance fund assets using state-of-the-art investment practice thereby improving governance, transparency and alpha • Make implicit decisions explicit and manage fund risk effectively. The current rebalancing policy takes an implicit view within the target ranges. It is a buy and hold strategy within the asset ranges. Source: Tim Barrett and Don Pierce, SBCERA 8

Client’s Goals and Objectives • Rebalance fund assets using state-of-the-art investment practice thereby improving governance, transparency and alpha • Make implicit decisions explicit and manage fund risk effectively. The current rebalancing policy takes an implicit view within the target ranges. It is a buy and hold strategy within the asset ranges. Source: Tim Barrett and Don Pierce, SBCERA 8

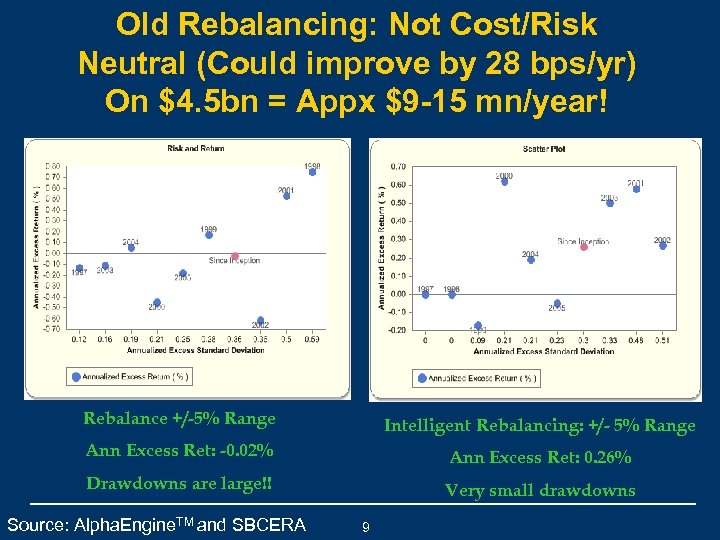

Old Rebalancing: Not Cost/Risk Neutral (Could improve by 28 bps/yr) On $4. 5 bn = Appx $9 -15 mn/year! Rebalance +/-5% Range Intelligent Rebalancing: +/- 5% Range Ann Excess Ret: -0. 02% Ann Excess Ret: 0. 26% Drawdowns are large!! Very small drawdowns Source: Alpha. Engine. TM and SBCERA 9

Old Rebalancing: Not Cost/Risk Neutral (Could improve by 28 bps/yr) On $4. 5 bn = Appx $9 -15 mn/year! Rebalance +/-5% Range Intelligent Rebalancing: +/- 5% Range Ann Excess Ret: -0. 02% Ann Excess Ret: 0. 26% Drawdowns are large!! Very small drawdowns Source: Alpha. Engine. TM and SBCERA 9

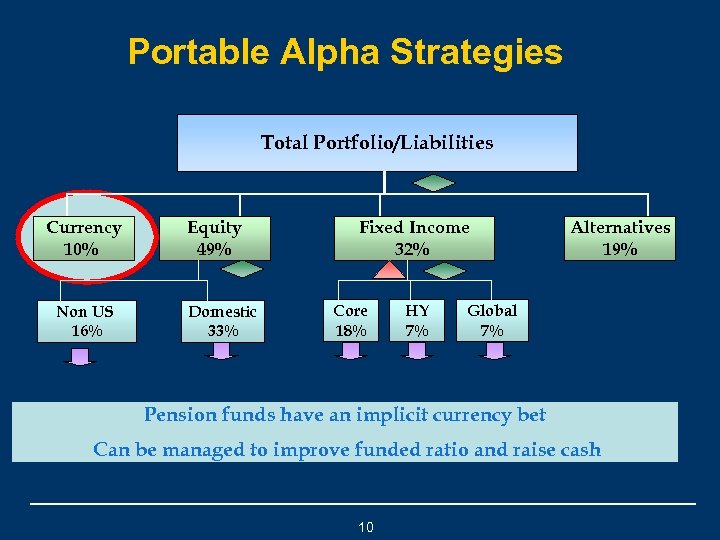

Portable Alpha Strategies Total Portfolio/Liabilities Currency 10% Non US 16% Equity 49% Domestic 33% Fixed Income 32% Core 18% HY 7% Alternatives 19% Global 7% Pension funds have an implicit currency bet Can be managed to improve funded ratio and raise cash 10

Portable Alpha Strategies Total Portfolio/Liabilities Currency 10% Non US 16% Equity 49% Domestic 33% Fixed Income 32% Core 18% HY 7% Alternatives 19% Global 7% Pension funds have an implicit currency bet Can be managed to improve funded ratio and raise cash 10

Explaining Currency Management • With investment in international assets = inherit currency risk • Portfolio performance is impacted by currency movements • Clients may consider ─ Monitoring potential USD strength or weakness ─ Implementing a currency portable alpha product • These strategies are typically uncorrelated to other strategies, do not need funding and generate cash! Therefore, improve funded ratio 11

Explaining Currency Management • With investment in international assets = inherit currency risk • Portfolio performance is impacted by currency movements • Clients may consider ─ Monitoring potential USD strength or weakness ─ Implementing a currency portable alpha product • These strategies are typically uncorrelated to other strategies, do not need funding and generate cash! Therefore, improve funded ratio 11

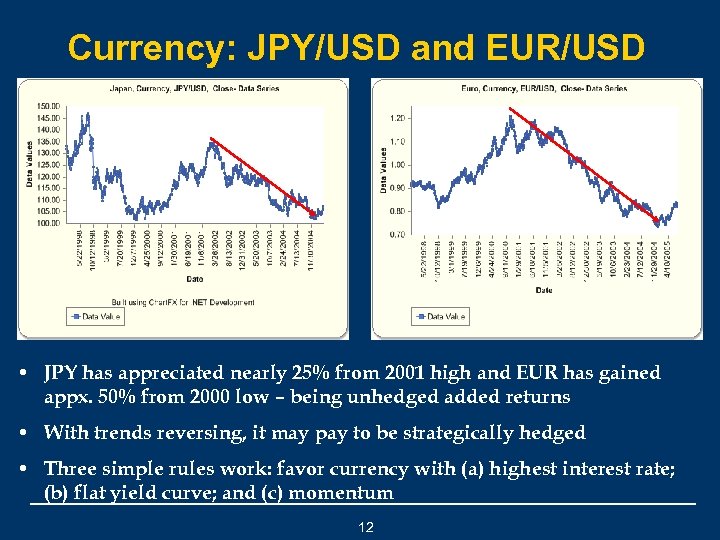

Currency: JPY/USD and EUR/USD • JPY has appreciated nearly 25% from 2001 high and EUR has gained appx. 50% from 2000 low – being unhedged added returns • With trends reversing, it may pay to be strategically hedged • Three simple rules work: favor currency with (a) highest interest rate; (b) flat yield curve; and (c) momentum 12

Currency: JPY/USD and EUR/USD • JPY has appreciated nearly 25% from 2001 high and EUR has gained appx. 50% from 2000 low – being unhedged added returns • With trends reversing, it may pay to be strategically hedged • Three simple rules work: favor currency with (a) highest interest rate; (b) flat yield curve; and (c) momentum 12

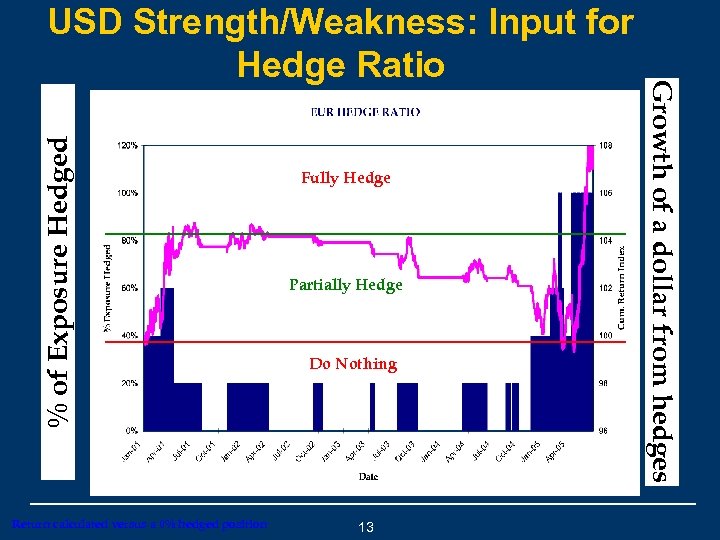

% of Exposure Hedged Return calculated versus a 0% hedged position Fully Hedge Partially Hedge Do Nothing 13 Growth of a dollar from hedges USD Strength/Weakness: Input for Hedge Ratio

% of Exposure Hedged Return calculated versus a 0% hedged position Fully Hedge Partially Hedge Do Nothing 13 Growth of a dollar from hedges USD Strength/Weakness: Input for Hedge Ratio

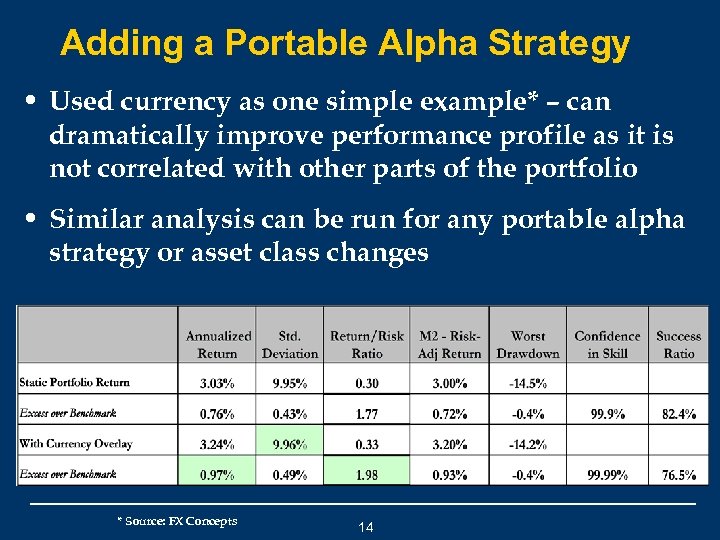

Adding a Portable Alpha Strategy • Used currency as one simple example* – can dramatically improve performance profile as it is not correlated with other parts of the portfolio • Similar analysis can be run for any portable alpha strategy or asset class changes * Source: FX Concepts 14

Adding a Portable Alpha Strategy • Used currency as one simple example* – can dramatically improve performance profile as it is not correlated with other parts of the portfolio • Similar analysis can be run for any portable alpha strategy or asset class changes * Source: FX Concepts 14

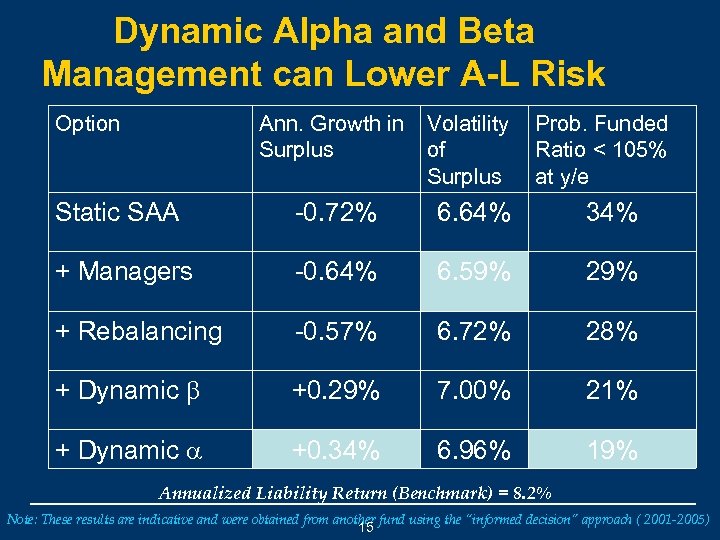

Dynamic Alpha and Beta Management can Lower A-L Risk Option Ann. Growth in Surplus Volatility of Surplus Prob. Funded Ratio < 105% at y/e Static SAA -0. 72% 6. 64% 34% + Managers -0. 64% 6. 59% 29% + Rebalancing -0. 57% 6. 72% 28% + Dynamic b +0. 29% 7. 00% 21% + Dynamic a +0. 34% 6. 96% 19% Annualized Liability Return (Benchmark) = 8. 2% Note: These results are indicative and were obtained from another fund using the “informed decision” approach ( 2001 -2005) 15

Dynamic Alpha and Beta Management can Lower A-L Risk Option Ann. Growth in Surplus Volatility of Surplus Prob. Funded Ratio < 105% at y/e Static SAA -0. 72% 6. 64% 34% + Managers -0. 64% 6. 59% 29% + Rebalancing -0. 57% 6. 72% 28% + Dynamic b +0. 29% 7. 00% 21% + Dynamic a +0. 34% 6. 96% 19% Annualized Liability Return (Benchmark) = 8. 2% Note: These results are indicative and were obtained from another fund using the “informed decision” approach ( 2001 -2005) 15

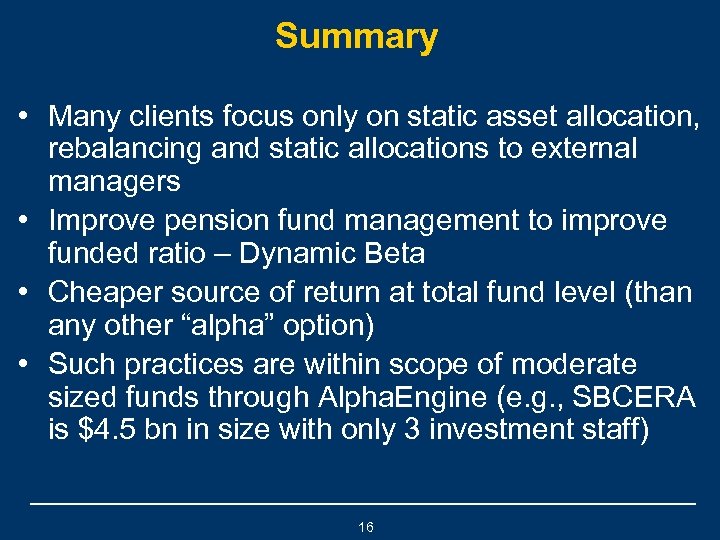

Summary • Many clients focus only on static asset allocation, rebalancing and static allocations to external managers • Improve pension fund management to improve funded ratio – Dynamic Beta • Cheaper source of return at total fund level (than any other “alpha” option) • Such practices are within scope of moderate sized funds through Alpha. Engine (e. g. , SBCERA is $4. 5 bn in size with only 3 investment staff) 16

Summary • Many clients focus only on static asset allocation, rebalancing and static allocations to external managers • Improve pension fund management to improve funded ratio – Dynamic Beta • Cheaper source of return at total fund level (than any other “alpha” option) • Such practices are within scope of moderate sized funds through Alpha. Engine (e. g. , SBCERA is $4. 5 bn in size with only 3 investment staff) 16

Appendix

Appendix

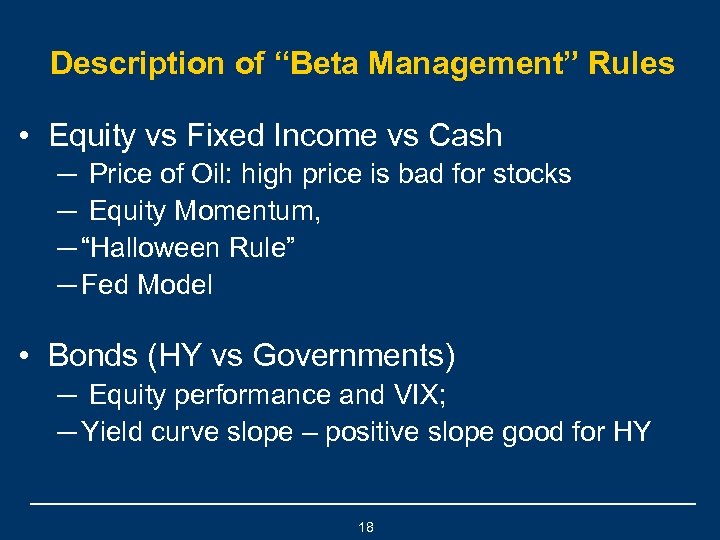

Description of “Beta Management” Rules • Equity vs Fixed Income vs Cash ─ Price of Oil: high price is bad for stocks ─ Equity Momentum, ─ “Halloween Rule” ─ Fed Model • Bonds (HY vs Governments) ─ Equity performance and VIX; ─ Yield curve slope – positive slope good for HY 18

Description of “Beta Management” Rules • Equity vs Fixed Income vs Cash ─ Price of Oil: high price is bad for stocks ─ Equity Momentum, ─ “Halloween Rule” ─ Fed Model • Bonds (HY vs Governments) ─ Equity performance and VIX; ─ Yield curve slope – positive slope good for HY 18

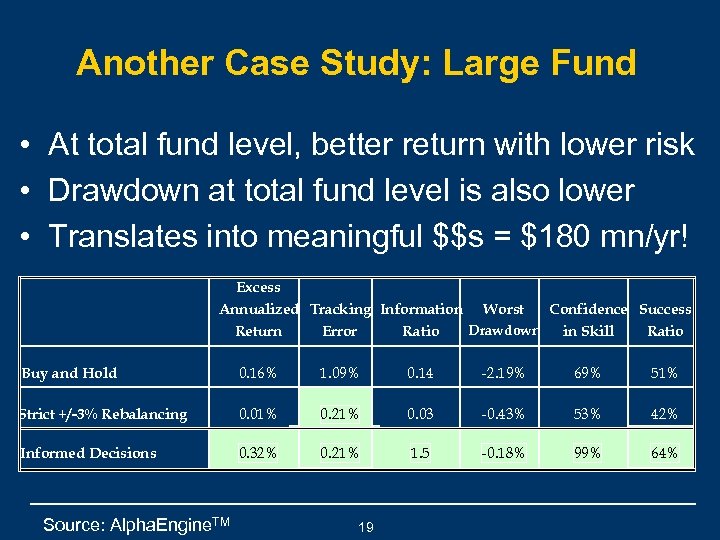

Another Case Study: Large Fund • At total fund level, better return with lower risk • Drawdown at total fund level is also lower • Translates into meaningful $$s = $180 mn/yr! Excess Annualized Tracking Information Worst Confidence Success Drawdown Return Error Ratio in Skill Ratio Buy and Hold 0. 16% 1. 09% 0. 14 -2. 19% 69% 51% Strict +/-3% Rebalancing 0. 01% 0. 21% 0. 03 -0. 43% 53% 42% Informed Decisions 0. 32% 0. 21% 1. 5 -0. 18% 99% 64% Source: Alpha. Engine. TM 19

Another Case Study: Large Fund • At total fund level, better return with lower risk • Drawdown at total fund level is also lower • Translates into meaningful $$s = $180 mn/yr! Excess Annualized Tracking Information Worst Confidence Success Drawdown Return Error Ratio in Skill Ratio Buy and Hold 0. 16% 1. 09% 0. 14 -2. 19% 69% 51% Strict +/-3% Rebalancing 0. 01% 0. 21% 0. 03 -0. 43% 53% 42% Informed Decisions 0. 32% 0. 21% 1. 5 -0. 18% 99% 64% Source: Alpha. Engine. TM 19

Contact Information Name: Dr. Arun S. Muralidhar Title: Chairman Company: Mcube Investment Technologies, LLC Phone: 1 -646 -591 -6991 E-mail: asmuralidhar@mcubeit. com Website address: www. mcubeit. com

Contact Information Name: Dr. Arun S. Muralidhar Title: Chairman Company: Mcube Investment Technologies, LLC Phone: 1 -646 -591 -6991 E-mail: asmuralidhar@mcubeit. com Website address: www. mcubeit. com