487515472a741dcda1bece92ac657d3a.ppt

- Количество слайдов: 47

Innovative Thinking in Retail Banking Investor Pre - Roadshow Presentation April 2008

Our Focus Individuals in need of basic low cost banking 2

We deliver on four core needs: • Accessibility • Affordability • Simplicity • Personal Service 3 3

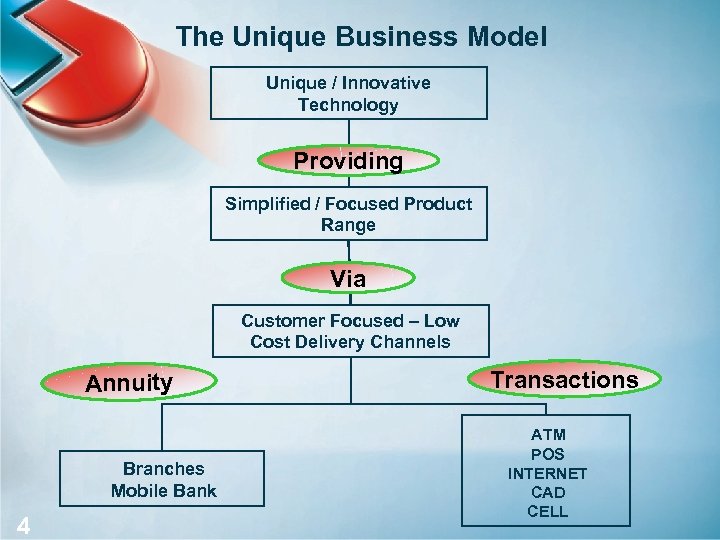

The Unique Business Model Unique / Innovative Technology Providing Simplified / Focused Product Range Via Customer Focused – Low Cost Delivery Channels Annuity Branches Mobile Bank 4 4 Transactions ATM POS INTERNET CAD CELL

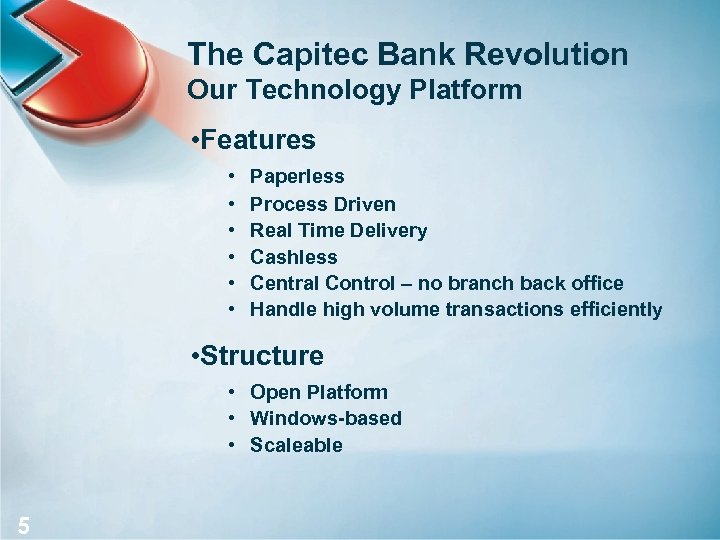

The Capitec Bank Revolution Our Technology Platform • Features • • • Paperless Process Driven Real Time Delivery Cashless Central Control – no branch back office Handle high volume transactions efficiently • Structure • Open Platform • Windows-based • Scaleable 5 5

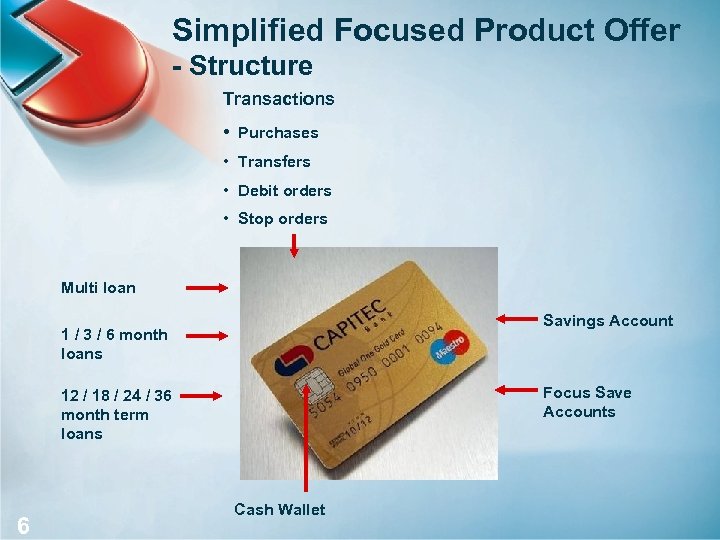

Simplified Focused Product Offer - Structure Transactions • Purchases • Transfers • Debit orders • Stop orders Multi loan Savings Account 1 / 3 / 6 month loans Focus Save Accounts 12 / 18 / 24 / 36 month term loans 6 Cash Wallet

Simplified Focused Product Offer - Price Savings and Transactions • Aggressive Loans • Competitive 7

Our People • Cultural alignment • Service driven • Recruit for potential, train for skill • Team approach • Zero to hero in 7 weeks Firm Foundations • Ongoing investment in competency E Learning 8 8

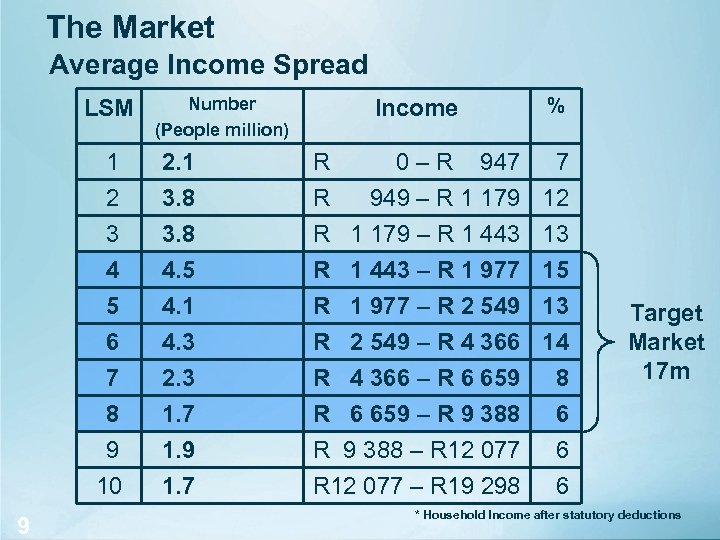

The Market Average Income Spread LSM Number (People million) Income 1 2 R R 3 4 5 6 7 8 9 10 9 9 2. 1 3. 8 4. 5 4. 1 4. 3 2. 3 1. 7 1. 9 1. 7 R 1 179 – R 1 443 – R 1 977 – R 2 549 – R 4 366 – R 6 659 – R 9 388 – R 12 077 – R 19 298 % 0 – R 947 7 949 – R 1 179 12 13 15 13 14 8 6 6 6 Target Market 17 m * Household Income after statutory deductions

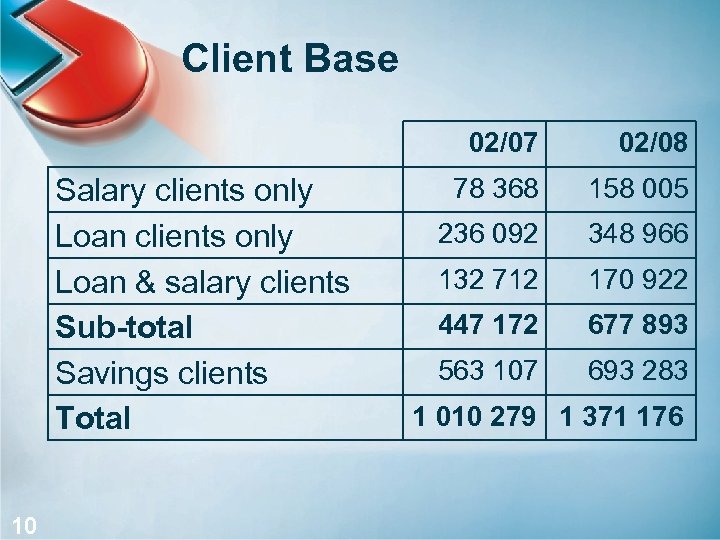

Client Base 02/07 Salary clients only Loan & salary clients Sub-total Savings clients Total 10 10 02/08 78 368 158 005 236 092 348 966 132 712 170 922 447 172 677 893 563 107 693 283 1 010 279 1 371 176

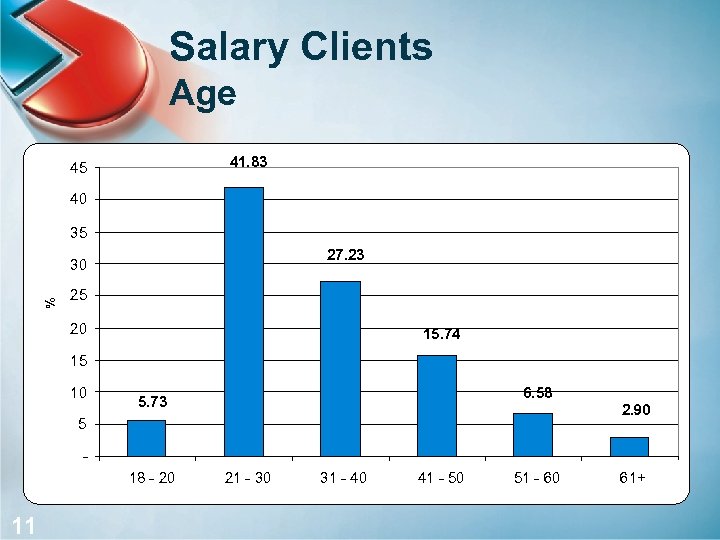

Salary Clients Age 41. 83 45 40 35 27. 23 % 30 25 20 15. 74 15 10 6. 58 5. 73 2. 90 5 18 - 20 11 11 21 - 30 31 - 40 41 - 50 51 - 60 61+

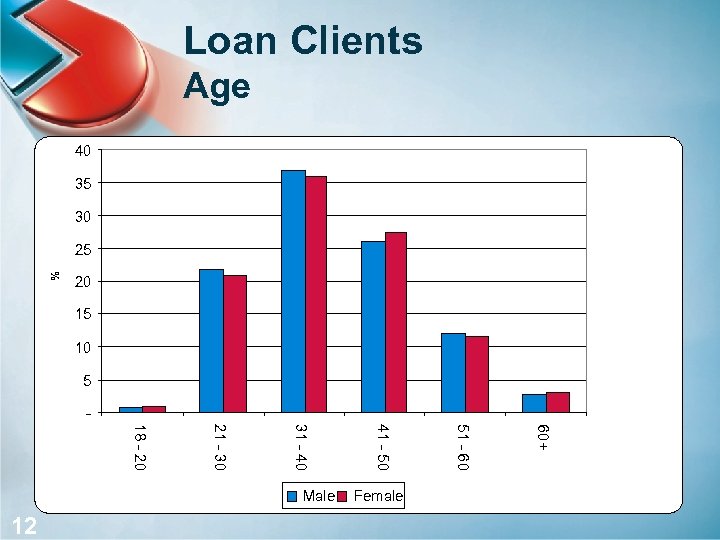

Loan Clients Age 40 35 30 % 25 20 15 10 5 60+ Female 51 - 60 41 - 50 31 - 40 21 - 30 18 - 20 12 12 Male

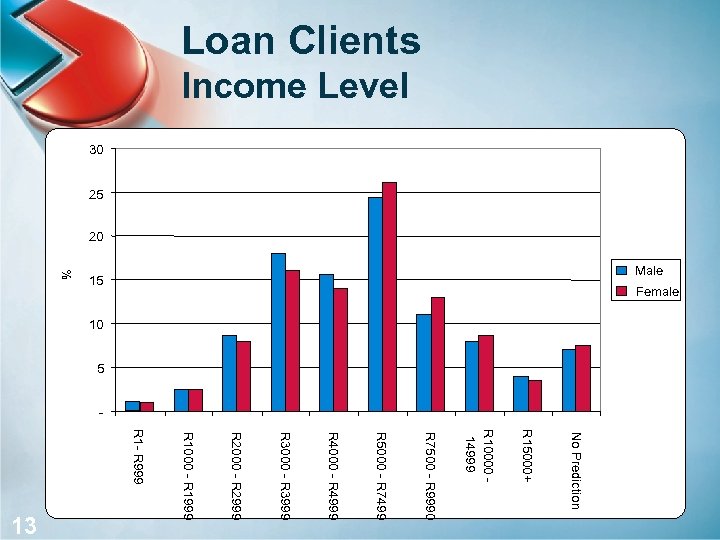

No Prediction R 15000+ R 10000 14999 R 7500 - R 9990 R 5000 - R 7499 R 4000 - R 4999 R 3000 - R 3999 R 2000 - R 2999 R 1000 - R 1999 R 1 - R 999 13 13 Male Female 15 % Loan Clients Income Level 30 25 20 10 5 -

History 1. Microlending 2. Bank (2000/1) 3. Management team 4. 5. 6. 7. - Determining strategy Bank licence PASA membership IT platform 3. Conversion - Microlending to bank - 14 14 Deposit taking Client conversion to bank with Capitec 4. Growth Strategy

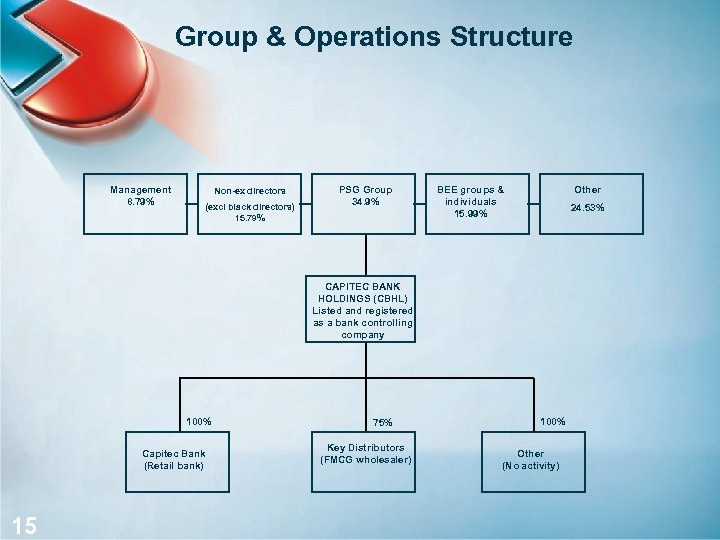

Group & Operations Structure Management 8. 79% Non-ex directors (excl black directors) 15. 79% PSG Group 34. 9% BEE groups & individuals 15. 99% Other 24. 53% CAPITEC BANK HOLDINGS (CBHL) Listed and registered as a bank controlling company 100% Capitec Bank (Retail bank) 15 15 75% Key Distributors (FMCG wholesaler) 100% Other (No activity)

Management • CEO Riaan Stassen (54) • CFO Andre du Plessis (46) • Other Executives: - 16 16 IT Risk Human Resources Operations/Sales Marketing & Corporate Affairs Credit Risk Card Services & Business Support Chris Oosthuizen (53) Christian van Schalkwyk (52) Leon Venter (46) Gerrie Fourie (44) Carl Fischer (51) Jaco Carstens (39) Ian Abrahams (39) Andre Olivier (40) Faick Davids (31)

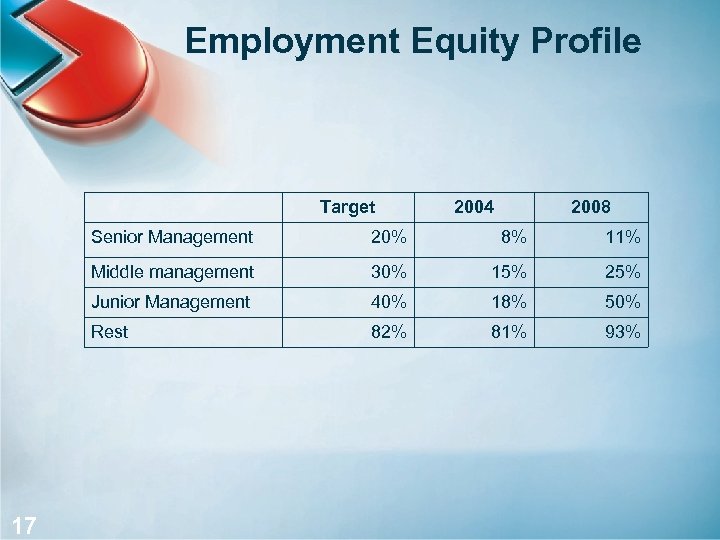

Employment Equity Profile Target 2004 2008 Senior Management 8% 11% Middle management 30% 15% 25% Junior Management 40% 18% 50% Rest 17 17 20% 82% 81% 93%

Key Risks and Mitigants • Credit • Liquidity • Regulatory • Systems • Interest rate • Taxation 18 18

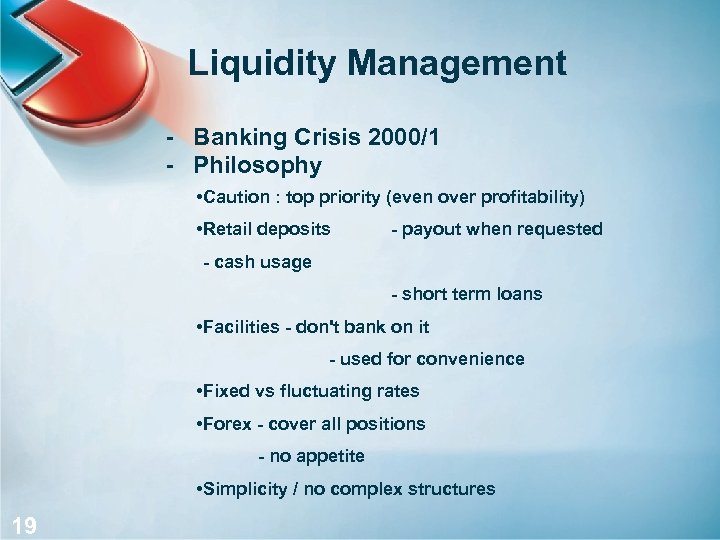

Liquidity Management - Banking Crisis 2000/1 - Philosophy • Caution : top priority (even over profitability) • Retail deposits - payout when requested - cash usage - short term loans • Facilities - don't bank on it - used for convenience • Fixed vs fluctuating rates • Forex - cover all positions - no appetite • Simplicity / no complex structures 19 19

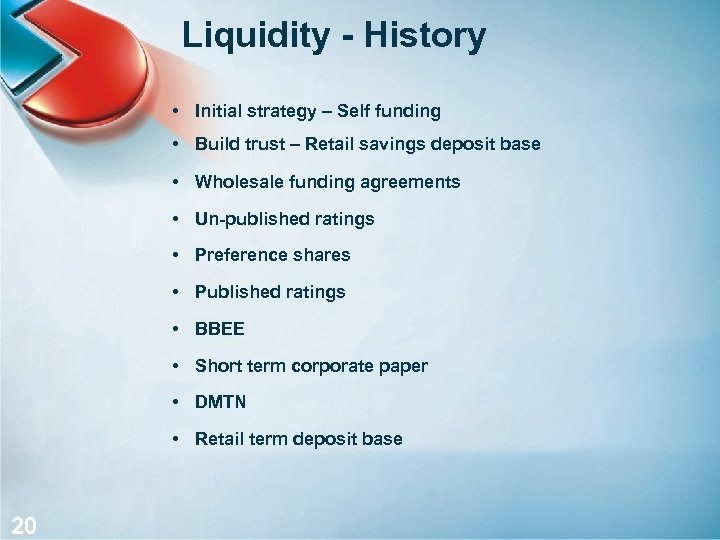

Liquidity - History • Initial strategy – Self funding • Build trust – Retail savings deposit base • Wholesale funding agreements • Un-published ratings • Preference shares • Published ratings • BBEE • Short term corporate paper • DMTN • Retail term deposit base 20 20

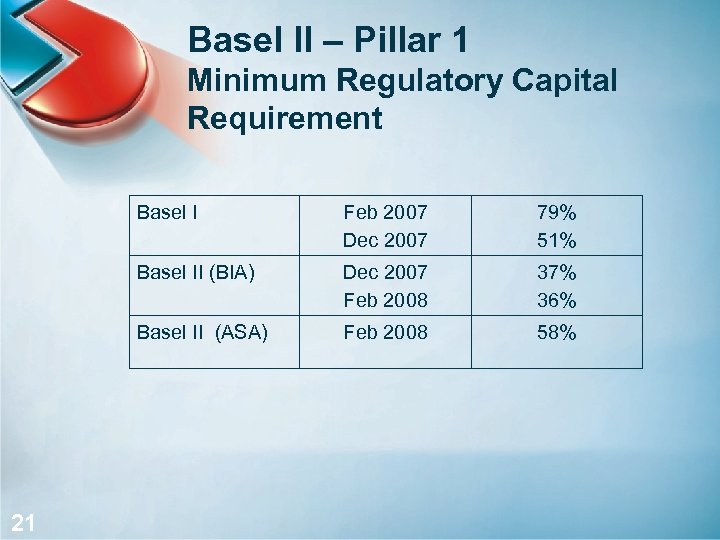

Basel II – Pillar 1 Minimum Regulatory Capital Requirement Basel I 79% 51% Basel II (BIA) Dec 2007 Feb 2008 37% 36% Basel II (ASA) 21 21 Feb 2007 Dec 2007 Feb 2008 58%

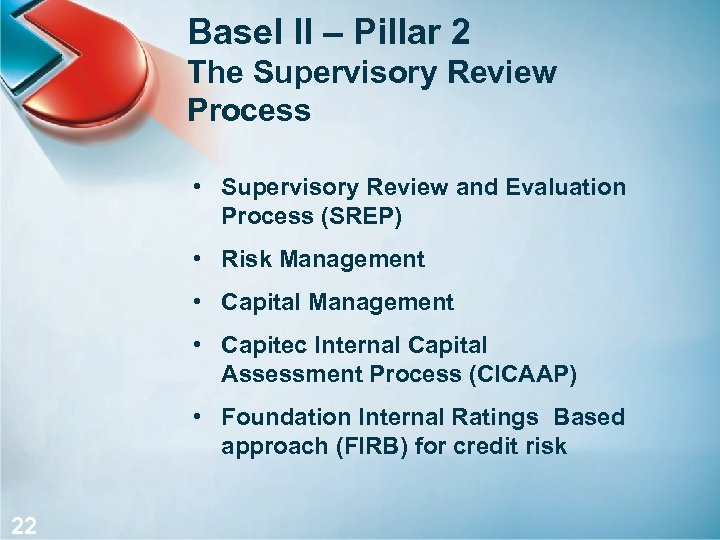

Basel II – Pillar 2 The Supervisory Review Process • Supervisory Review and Evaluation Process (SREP) • Risk Management • Capital Management • Capitec Internal Capital Assessment Process (CICAAP) • Foundation Internal Ratings Based approach (FIRB) for credit risk 22 22

Basel II – Pillar 3 Market Discipline • • Quarterly, Bi-annual and Annual disclosures • 23 23 Regulation 43 Public disclosures Dedicated Website Page under Investor relations

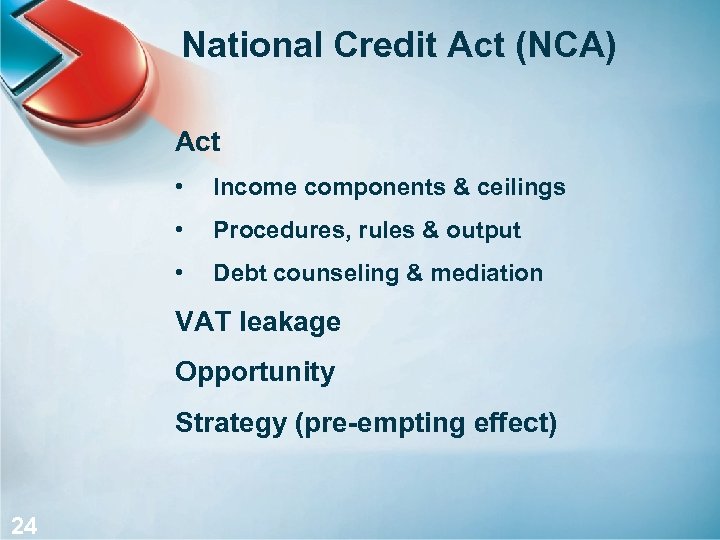

National Credit Act (NCA) Act • Income components & ceilings • Procedures, rules & output • Debt counseling & mediation VAT leakage Opportunity Strategy (pre-empting effect) 24 24

Financial Highlights

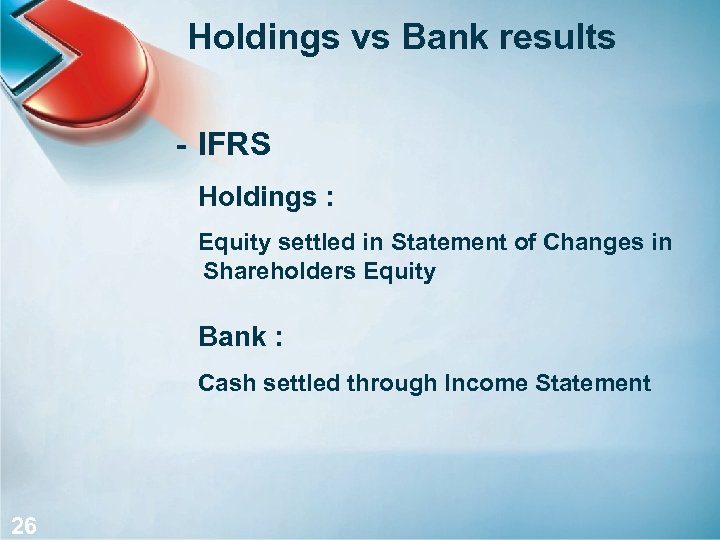

Holdings vs Bank results - IFRS Holdings : Equity settled in Statement of Changes in Shareholders Equity Bank : Cash settled through Income Statement 26 26

Loans Advanced 6, 000 5, 162 4, 500 Rm 2, 259 3, 000 1, 477 2, 863 3, 449 1, 904 1, 500 0 27 27 2003 2004 2005 2006 2007 2008

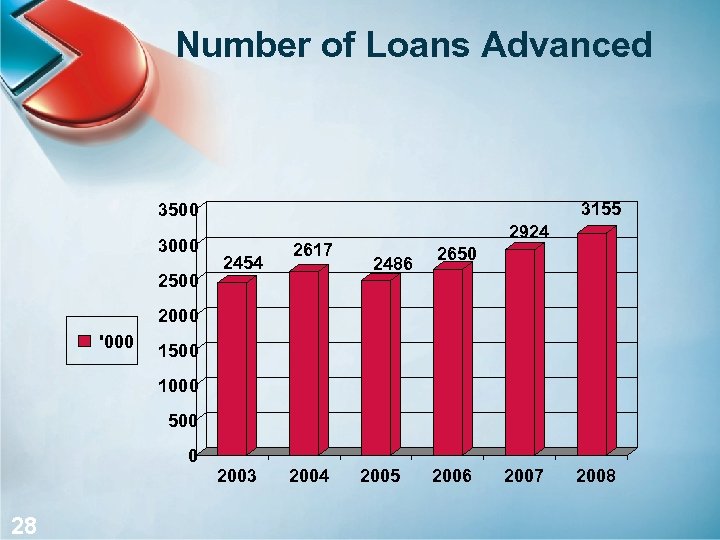

Number of Loans Advanced 3155 3500 3000 2500 2454 2617 2924 2486 2650 2000 '000 1500 1000 500 0 28 28 2003 2004 2005 2006 2007 2008

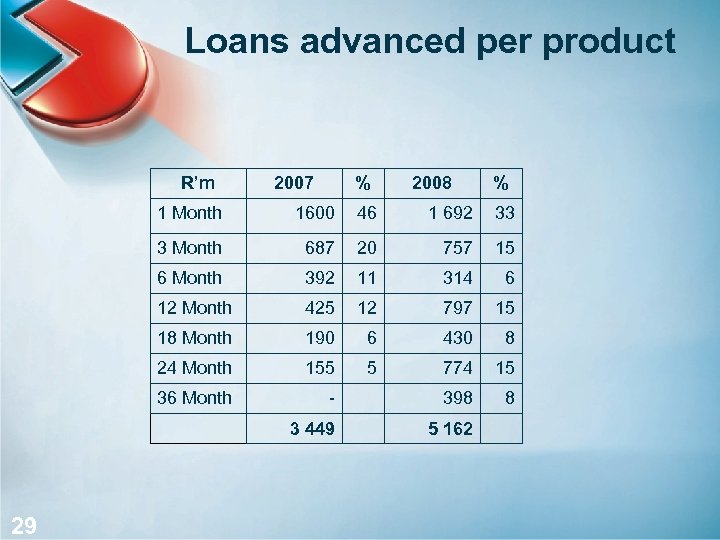

Loans advanced per product R’m 2007 % 2008 % 1 Month 46 1 692 33 3 Month 687 20 757 15 6 Month 392 11 314 6 12 Month 425 12 797 15 18 Month 190 6 430 8 24 Month 155 5 774 15 36 Month - 398 8 3 449 29 29 1600 5 162

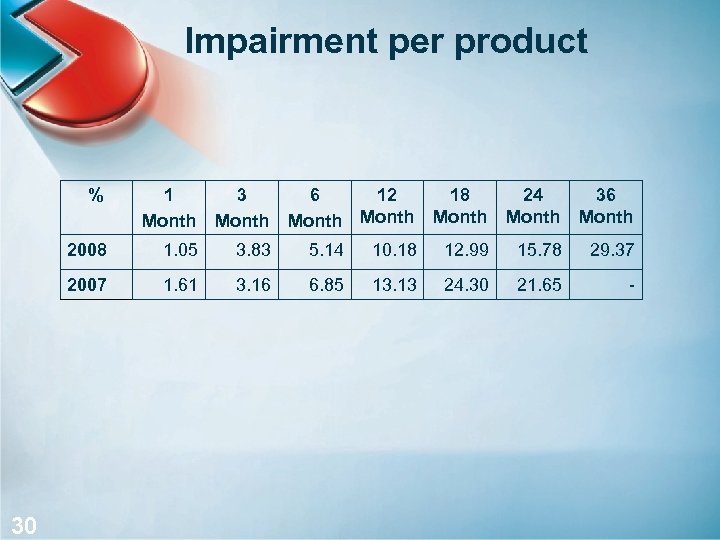

Impairment per product % 3 Month 6 Month 12 Month 18 Month 24 Month 36 Month 2008 1. 05 3. 83 5. 14 10. 18 12. 99 15. 78 29. 37 2007 30 30 1 Month 1. 61 3. 16 6. 85 13. 13 24. 30 21. 65 -

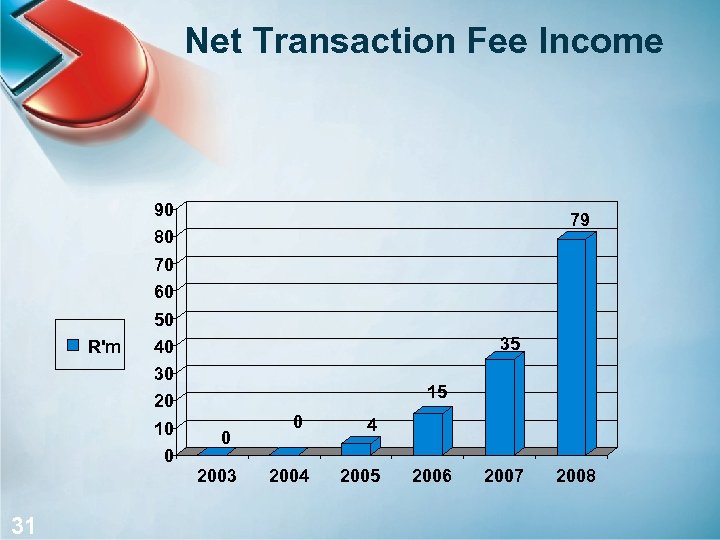

Net Transaction Fee Income 90 79 80 70 60 R'm 50 40 35 30 15 20 10 0 31 31 0 2003 0 2004 4 2005 2006 2007 2008

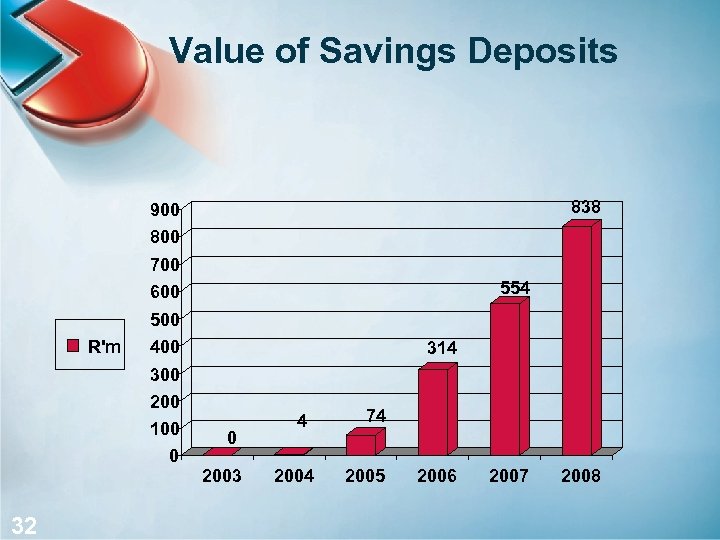

Value of Savings Deposits 838 900 800 700 600 R'm 554 500 400 314 300 200 100 0 32 32 0 2003 4 2004 74 2005 2006 2007 2008

Operations

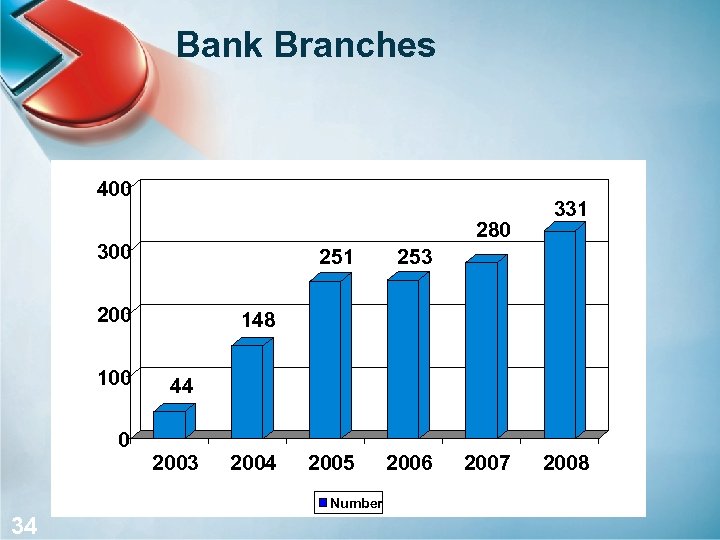

Bank Branches 400 280 300 251 200 100 0 34 34 253 2005 2006 331 148 44 2003 2004 Number 2007 2008

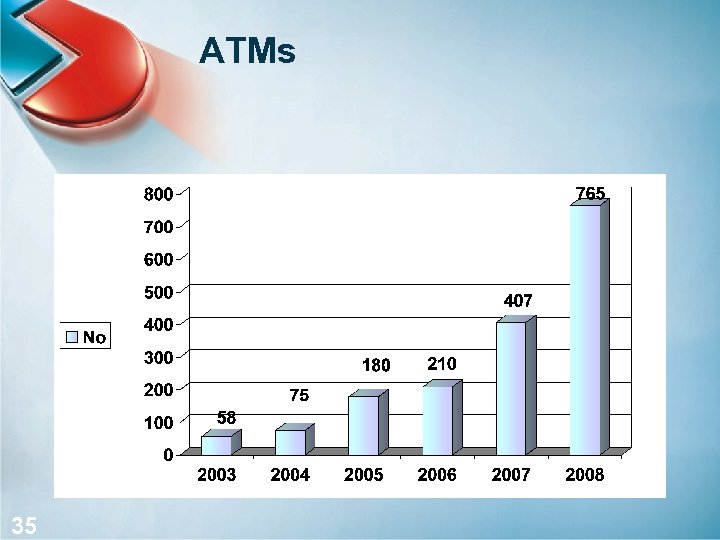

ATMs 35 35

Employees 36 36

Profitability

Headline Earnings 250 212 200 160 150 R'm 100 50 0 38 38 116 30 2003 47 2004 70 2005 2006 2007 2008

Headline Earnings per Share 300 259 250 222 200 Cents 165 150 101 45 70 50 0 39 39 2003 2004 2005 2006 2007 2008

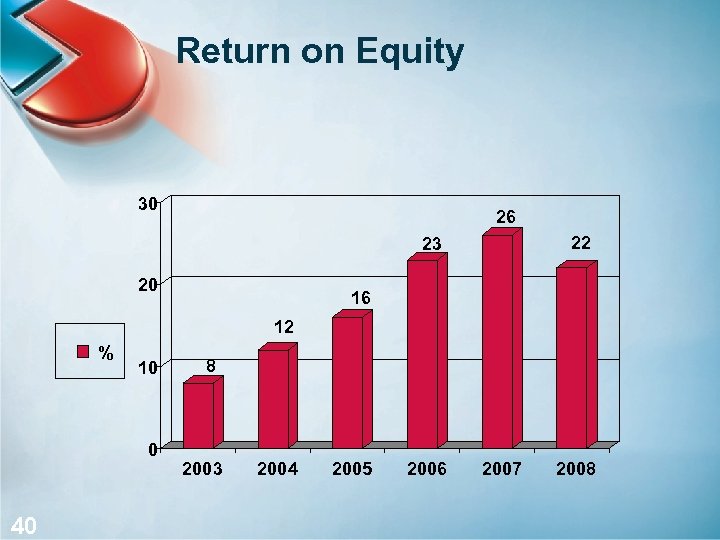

Return on Equity 30 26 22 23 20 16 12 % 10 0 40 40 8 2003 2004 2005 2006 2007 2008

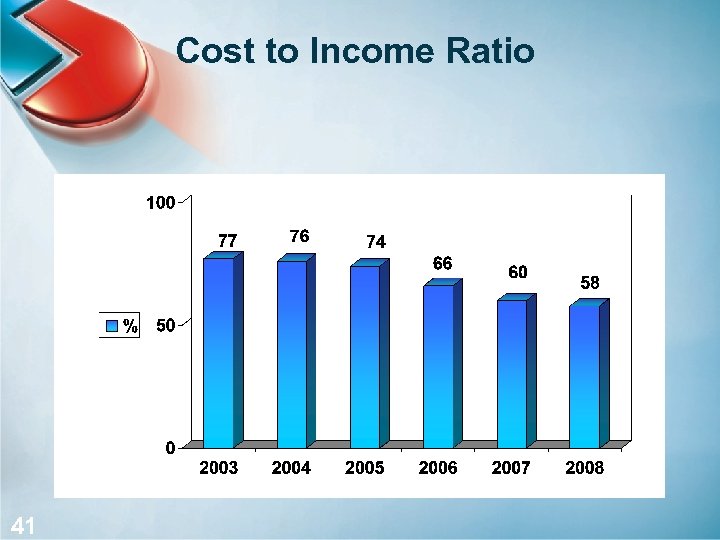

Cost to Income Ratio 41 41

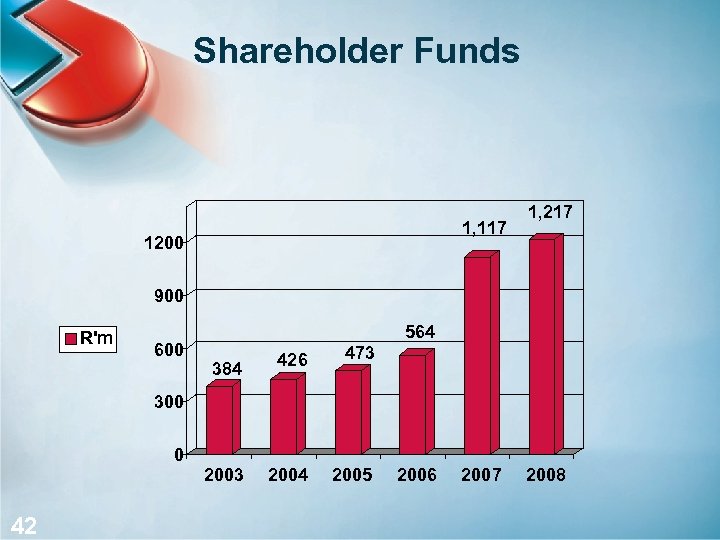

Shareholder Funds 1, 117 1200 1, 217 900 R'm 600 564 384 426 473 2004 2005 300 0 42 42 2006 2007 2008

Market Capitalisation 4000 3500 3, 031 3000 3, 195 2, 233 2500 2000 R'm 1500 1, 072 1000 500 0 43 43 164 2003 399 2004 2005 2006 2007 2008

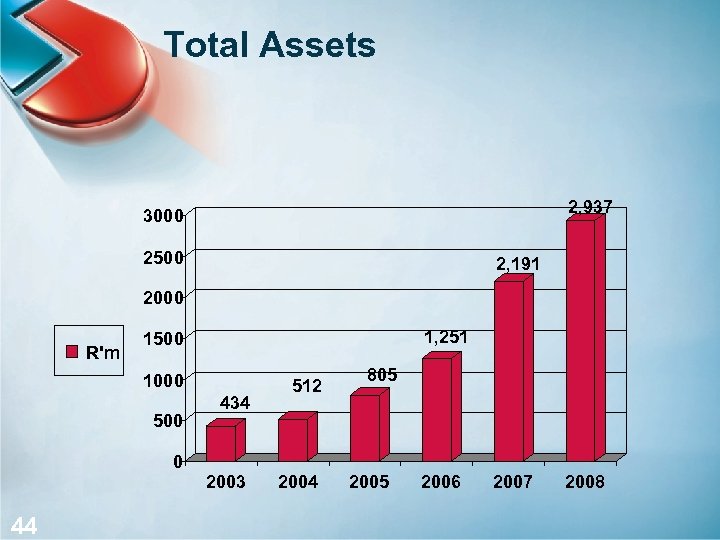

Total Assets 2, 937 3000 2500 2, 191 2000 R'm 1, 251 1500 1000 500 0 44 44 434 2003 512 2004 805 2006 2007 2008

Going Forward

Going forward Investment • Distribution - • +25 Branches +75 Mobile Banks +50 ATMs +2 250 POS devices Technology - Branch Streamlining Challenges 46 46 • • • Cash-plastic Economy Competitors Funding Crime

Thank You Questions ? 47

487515472a741dcda1bece92ac657d3a.ppt