0f249749a28830a9ed9022efd0fd1745.ppt

- Количество слайдов: 19

Innovative Experiences in Access to Finance: Market Friendly Roles for the Visible Hand? Augusto de la Torre and Sergio Schmukler World Bank UN International Forum on the Eradication of Poverty New York, November 15 -16, 2006

Innovative Experiences in Access to Finance: Market Friendly Roles for the Visible Hand? Augusto de la Torre and Sergio Schmukler World Bank UN International Forum on the Eradication of Poverty New York, November 15 -16, 2006

Based on De la Torre, A. , J. C. Gozzi, and S. Schmukler, 2006. “Innovative Experiences in Access to Finance: Market Friendly Roles for the Visible Hand? ” World Bank, Latin America and Caribbean Regional Study. 2

Based on De la Torre, A. , J. C. Gozzi, and S. Schmukler, 2006. “Innovative Experiences in Access to Finance: Market Friendly Roles for the Visible Hand? ” World Bank, Latin America and Caribbean Regional Study. 2

Contents Motivation and objective of study Conceptual building blocks Role of the state – alternative paradigms Market friendly roles for the visible hand? Illustrative experiences NAFIN – Internet-based market for receivables finance FIRA – Working capital structured financing scheme FIRA – Inventory Finance Questions for future policy research 3

Contents Motivation and objective of study Conceptual building blocks Role of the state – alternative paradigms Market friendly roles for the visible hand? Illustrative experiences NAFIN – Internet-based market for receivables finance FIRA – Working capital structured financing scheme FIRA – Inventory Finance Questions for future policy research 3

Motivation and Objective of Study Rising interest in access as key to financial development Observed levels of access to financial services in developing countries is strikingly low, even the middle income Access-related stories are predominant in theorizing on channels through with financial development leads to growth Finance fuels “creative destruction” by leveling the opportunity playing field (Rajan and Zingales 2003) Some evidence that broader access might reduce poverty, although channel not identified Buirgess and Pande (2005) Investigate scope for, and nature of, market-friendly government interventions to broaden sustainable access 4

Motivation and Objective of Study Rising interest in access as key to financial development Observed levels of access to financial services in developing countries is strikingly low, even the middle income Access-related stories are predominant in theorizing on channels through with financial development leads to growth Finance fuels “creative destruction” by leveling the opportunity playing field (Rajan and Zingales 2003) Some evidence that broader access might reduce poverty, although channel not identified Buirgess and Pande (2005) Investigate scope for, and nature of, market-friendly government interventions to broaden sustainable access 4

Conceptual Building Blocks Narrow definition of problem of access (≠ lack of access) A project that would be internally financed if own resources were available does not get external finance “Wedge” between the expected internal rate of return of the project and the rate of return required by external investors Drivers of the “wedge” Principal-agent problems Adverse selection Moral hazard Transaction costs 5

Conceptual Building Blocks Narrow definition of problem of access (≠ lack of access) A project that would be internally financed if own resources were available does not get external finance “Wedge” between the expected internal rate of return of the project and the rate of return required by external investors Drivers of the “wedge” Principal-agent problems Adverse selection Moral hazard Transaction costs 5

Conceptual Building Blocks (cont. ) Role of contractual institutions Weak contractual institutions agency problems are mitigated through personalized relationships and fixed collateral Access limited to a circumscribed network of participants Weak institutions affect differently different credit markets Strong contractual institutions enable arm’s-length financing Contracts are impersonal and rely on transparency and enforcement of general rules by a third party (generally courts) Path dependence Self-reinforcing arrangements due to increasing returns Transplantation of isolated legal or regulatory change from one institutional milieu to another can backfire Role of technological and financial innovation Microfinace thriving even where contractual institutions are weak 6

Conceptual Building Blocks (cont. ) Role of contractual institutions Weak contractual institutions agency problems are mitigated through personalized relationships and fixed collateral Access limited to a circumscribed network of participants Weak institutions affect differently different credit markets Strong contractual institutions enable arm’s-length financing Contracts are impersonal and rely on transparency and enforcement of general rules by a third party (generally courts) Path dependence Self-reinforcing arrangements due to increasing returns Transplantation of isolated legal or regulatory change from one institutional milieu to another can backfire Role of technological and financial innovation Microfinace thriving even where contractual institutions are weak 6

Role of the State – Alternative Paradigms Virtual consensus that some type of government intervention is crucial to foster financial development… …but views vary on specific nature of intervention Three typological views: Interventionist – widespread market failures require government direct involvement in mobilizing and allocating financial resources Laissez-faire – focus only on improving the enabling environment and let the market do its magic Pro-market activism – in addition to long-term institution building, direct government actions are required in the transition to promote and complete financial market development 7

Role of the State – Alternative Paradigms Virtual consensus that some type of government intervention is crucial to foster financial development… …but views vary on specific nature of intervention Three typological views: Interventionist – widespread market failures require government direct involvement in mobilizing and allocating financial resources Laissez-faire – focus only on improving the enabling environment and let the market do its magic Pro-market activism – in addition to long-term institution building, direct government actions are required in the transition to promote and complete financial market development 7

Market Friendly Roles for the Visible Hand? An evolving list of interventions to Solve coordination failures, overcome first mover disadvantages, align incentives of multiple stakeholders Promote achievement of economies of scale to lower costs Encourage adoption of technological and financial innovation Pool risk and group otherwise atomized borrowers Share risk (e. g. , through partial credit guarantees) “Smart subsidies” Selective interventions focused on solving specific market failures by “crowding in” the private sector Tailored to specific needs and institutional settings 8

Market Friendly Roles for the Visible Hand? An evolving list of interventions to Solve coordination failures, overcome first mover disadvantages, align incentives of multiple stakeholders Promote achievement of economies of scale to lower costs Encourage adoption of technological and financial innovation Pool risk and group otherwise atomized borrowers Share risk (e. g. , through partial credit guarantees) “Smart subsidies” Selective interventions focused on solving specific market failures by “crowding in” the private sector Tailored to specific needs and institutional settings 8

Illustrative Experiences from Latin America Public provision of market infrastructure BANSEFI (Mexico) NAFIN’s Reverse Factoring Program (Mexico) Correspondent Banking (Brazil) Structured finance FIRA’s working capital and inventory financing schemes (Mexico) Partial credit guarantee programs FOGAPE (Chile) Transaction cost subsidies FIRA’s SIEBAN program (Mexico) Microfinance Banco. Estado (Chile) 9

Illustrative Experiences from Latin America Public provision of market infrastructure BANSEFI (Mexico) NAFIN’s Reverse Factoring Program (Mexico) Correspondent Banking (Brazil) Structured finance FIRA’s working capital and inventory financing schemes (Mexico) Partial credit guarantee programs FOGAPE (Chile) Transaction cost subsidies FIRA’s SIEBAN program (Mexico) Microfinance Banco. Estado (Chile) 9

NAFIN – Internet Based Receivables Finance The Problem Mexican SMEs had limited or no access to working capital financing from banks SMEs required to grant trade credit (30 -90 days) to their buying clients, many of which are big and reputable firms Receivables not perceived as good collateral Lack of reliable registry system for receivables Ample room for double-pledging or forging of receivables No effective way to “bridge” part of the problem by taking advantage of creditworthiness of issuers of receivables 10

NAFIN – Internet Based Receivables Finance The Problem Mexican SMEs had limited or no access to working capital financing from banks SMEs required to grant trade credit (30 -90 days) to their buying clients, many of which are big and reputable firms Receivables not perceived as good collateral Lack of reliable registry system for receivables Ample room for double-pledging or forging of receivables No effective way to “bridge” part of the problem by taking advantage of creditworthiness of issuers of receivables 10

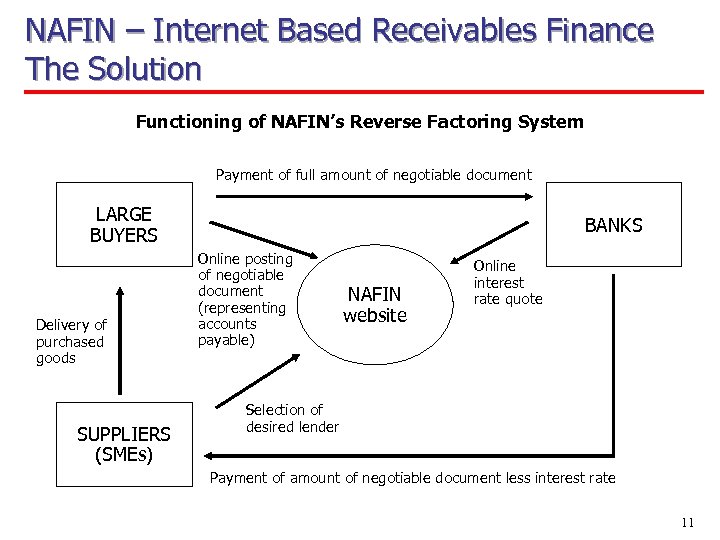

NAFIN – Internet Based Receivables Finance The Solution Functioning of NAFIN’s Reverse Factoring System Payment of full amount of negotiable document LARGE BUYERS Delivery of purchased goods SUPPLIERS (SMEs) BANKS Online posting of negotiable document (representing accounts payable) NAFIN website Online interest rate quote Selection of desired lender Payment of amount of negotiable document less interest rate 11

NAFIN – Internet Based Receivables Finance The Solution Functioning of NAFIN’s Reverse Factoring System Payment of full amount of negotiable document LARGE BUYERS Delivery of purchased goods SUPPLIERS (SMEs) BANKS Online posting of negotiable document (representing accounts payable) NAFIN website Online interest rate quote Selection of desired lender Payment of amount of negotiable document less interest rate 11

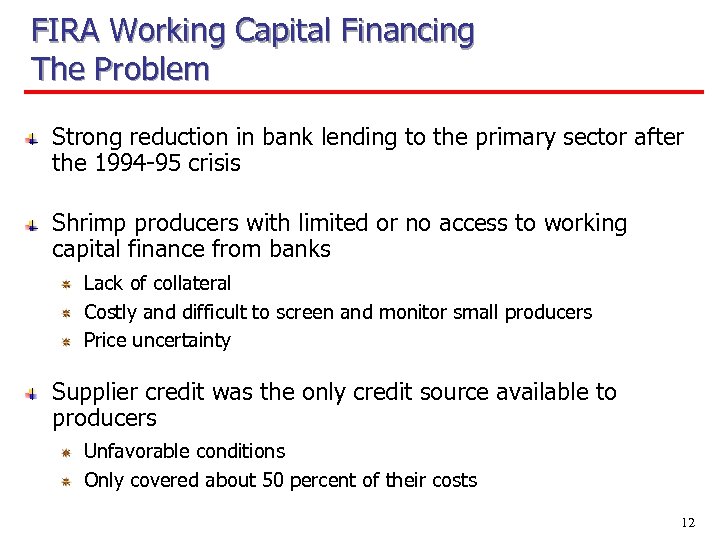

FIRA Working Capital Financing The Problem Strong reduction in bank lending to the primary sector after the 1994 -95 crisis Shrimp producers with limited or no access to working capital finance from banks Lack of collateral Costly and difficult to screen and monitor small producers Price uncertainty Supplier credit was the only credit source available to producers Unfavorable conditions Only covered about 50 percent of their costs 12

FIRA Working Capital Financing The Problem Strong reduction in bank lending to the primary sector after the 1994 -95 crisis Shrimp producers with limited or no access to working capital finance from banks Lack of collateral Costly and difficult to screen and monitor small producers Price uncertainty Supplier credit was the only credit source available to producers Unfavorable conditions Only covered about 50 percent of their costs 12

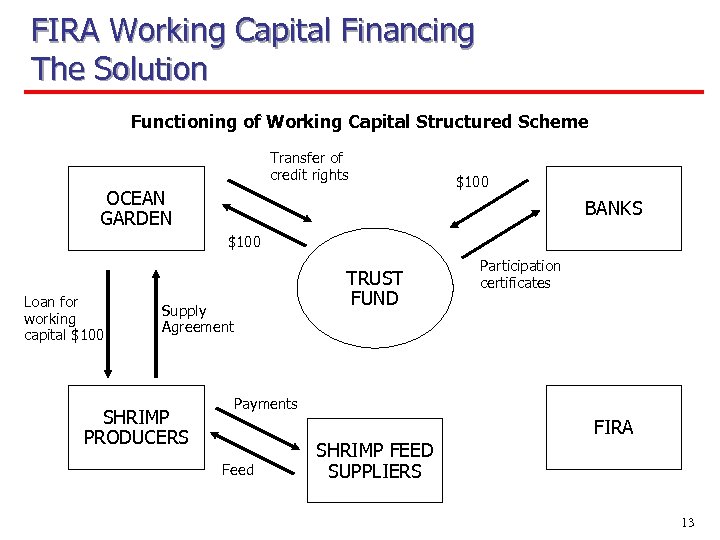

FIRA Working Capital Financing The Solution Functioning of Working Capital Structured Scheme Transfer of credit rights OCEAN GARDEN $100 BANKS $100 Loan for working capital $100 Supply Agreement SHRIMP PRODUCERS TRUST FUND Participation certificates Payments FIRA Feed SHRIMP FEED SUPPLIERS 13

FIRA Working Capital Financing The Solution Functioning of Working Capital Structured Scheme Transfer of credit rights OCEAN GARDEN $100 BANKS $100 Loan for working capital $100 Supply Agreement SHRIMP PRODUCERS TRUST FUND Participation certificates Payments FIRA Feed SHRIMP FEED SUPPLIERS 13

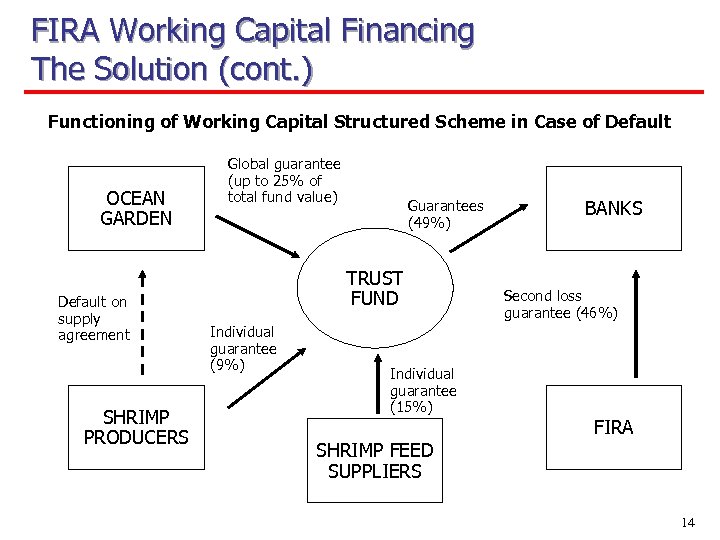

FIRA Working Capital Financing The Solution (cont. ) Functioning of Working Capital Structured Scheme in Case of Default OCEAN GARDEN Default on supply agreement SHRIMP PRODUCERS Global guarantee (up to 25% of total fund value) Guarantees (49%) TRUST FUND Individual guarantee (9%) Individual guarantee (15%) BANKS Second loss guarantee (46%) FIRA SHRIMP FEED SUPPLIERS 14

FIRA Working Capital Financing The Solution (cont. ) Functioning of Working Capital Structured Scheme in Case of Default OCEAN GARDEN Default on supply agreement SHRIMP PRODUCERS Global guarantee (up to 25% of total fund value) Guarantees (49%) TRUST FUND Individual guarantee (9%) Individual guarantee (15%) BANKS Second loss guarantee (46%) FIRA SHRIMP FEED SUPPLIERS 14

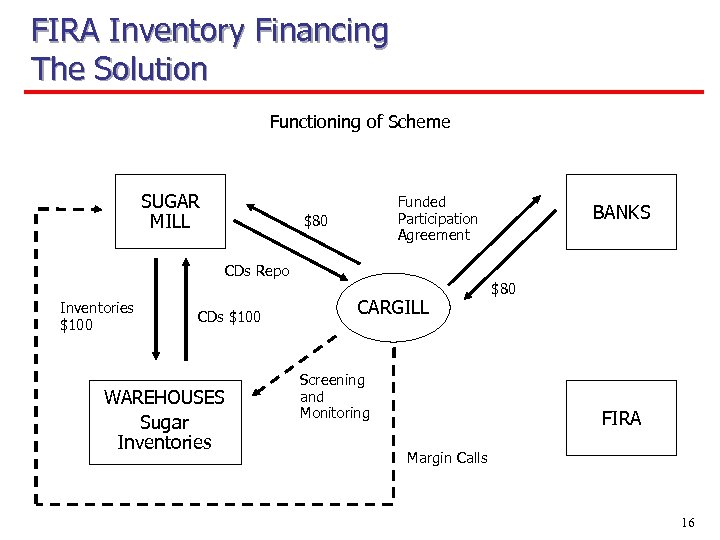

FIRA Inventory Financing The Solution Functioning of Scheme SUGAR MILL Funded Participation Agreement $80 BANKS CDs Repo Inventories $100 CDs $100 WAREHOUSES Sugar Inventories CARGILL Screening and Monitoring $80 FIRA Margin Calls 16

FIRA Inventory Financing The Solution Functioning of Scheme SUGAR MILL Funded Participation Agreement $80 BANKS CDs Repo Inventories $100 CDs $100 WAREHOUSES Sugar Inventories CARGILL Screening and Monitoring $80 FIRA Margin Calls 16

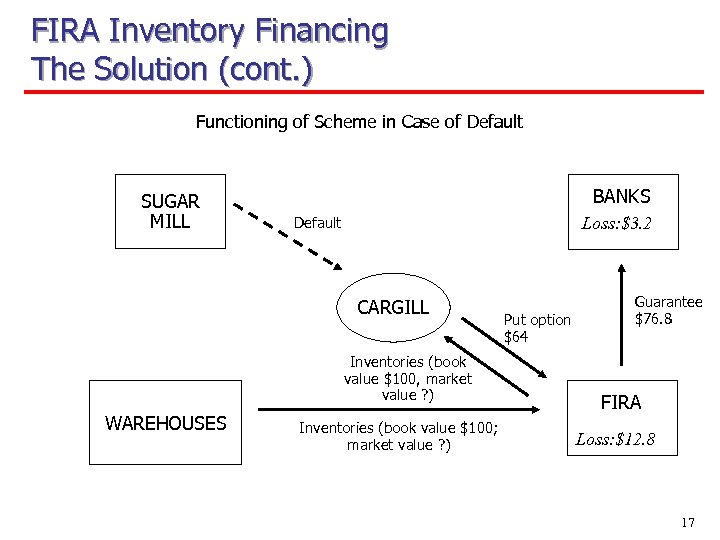

FIRA Inventory Financing The Solution (cont. ) Functioning of Scheme in Case of Default SUGAR MILL BANKS Default Loss: $3. 2 CARGILL Inventories (book value $100, market value ? ) WAREHOUSES Inventories (book value $100; market value ? ) Put option $64 Guarantee $76. 8 FIRA Loss: $12. 8 17

FIRA Inventory Financing The Solution (cont. ) Functioning of Scheme in Case of Default SUGAR MILL BANKS Default Loss: $3. 2 CARGILL Inventories (book value $100, market value ? ) WAREHOUSES Inventories (book value $100; market value ? ) Put option $64 Guarantee $76. 8 FIRA Loss: $12. 8 17

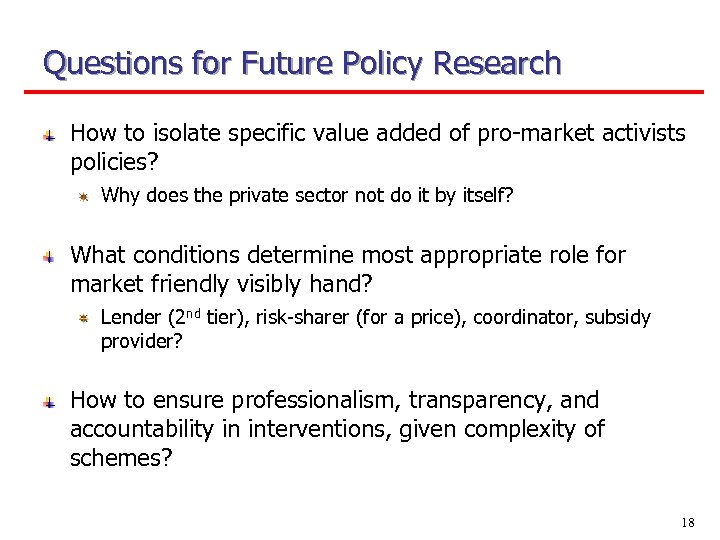

Questions for Future Policy Research How to isolate specific value added of pro-market activists policies? Why does the private sector not do it by itself? What conditions determine most appropriate role for market friendly visibly hand? Lender (2 nd tier), risk-sharer (for a price), coordinator, subsidy provider? How to ensure professionalism, transparency, and accountability in interventions, given complexity of schemes? 18

Questions for Future Policy Research How to isolate specific value added of pro-market activists policies? Why does the private sector not do it by itself? What conditions determine most appropriate role for market friendly visibly hand? Lender (2 nd tier), risk-sharer (for a price), coordinator, subsidy provider? How to ensure professionalism, transparency, and accountability in interventions, given complexity of schemes? 18

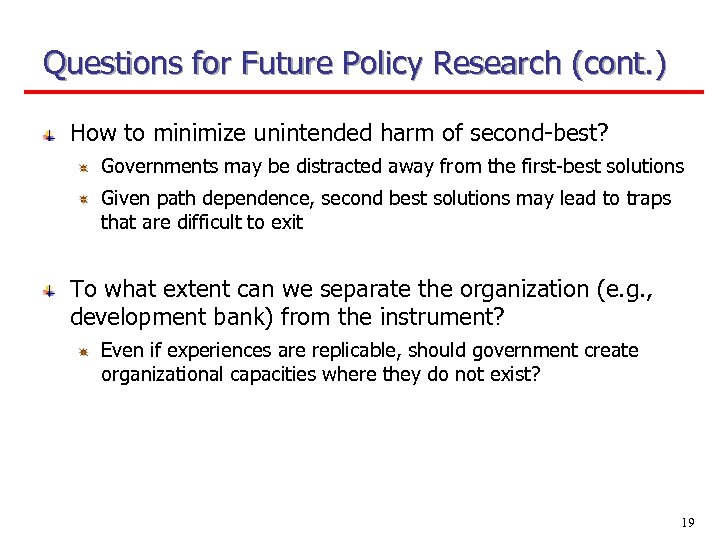

Questions for Future Policy Research (cont. ) How to minimize unintended harm of second-best? Governments may be distracted away from the first-best solutions Given path dependence, second best solutions may lead to traps that are difficult to exit To what extent can we separate the organization (e. g. , development bank) from the instrument? Even if experiences are replicable, should government create organizational capacities where they do not exist? 19

Questions for Future Policy Research (cont. ) How to minimize unintended harm of second-best? Governments may be distracted away from the first-best solutions Given path dependence, second best solutions may lead to traps that are difficult to exit To what extent can we separate the organization (e. g. , development bank) from the instrument? Even if experiences are replicable, should government create organizational capacities where they do not exist? 19

END 20

END 20