e85bc815835e78839fcd1375a02f9ed2.ppt

- Количество слайдов: 15

INNOVATIONS IN THE PRIVATE SECTOR RESPONSE TO CLIMATE CHANGE AND THE AFRICAN CARBON MARKET DEVELOPMENT Lloyd Chingambo Seventh African Development Forum Addis Ababa. Ethiopia October 15, 2010

INNOVATIONS IN THE PRIVATE SECTOR RESPONSE TO CLIMATE CHANGE AND THE AFRICAN CARBON MARKET DEVELOPMENT Lloyd Chingambo Seventh African Development Forum Addis Ababa. Ethiopia October 15, 2010

The Big Question Private sector as viable partner in dealing Africa’s climate change agenda Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

The Big Question Private sector as viable partner in dealing Africa’s climate change agenda Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

The Current Position Africa has little or no access to finance Private sector remains on the sidelines Domestic financial sector does lending to climate change projects Little or no support for climate change investments Absence of legal framework to support and protect climate change investments Little attempt to use what funds, as are available, to unlock more funds for climate change No real attempts to create/generate funds for climate change Little appreciation of the interlocking relationship between Climate Change and Development. Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

The Current Position Africa has little or no access to finance Private sector remains on the sidelines Domestic financial sector does lending to climate change projects Little or no support for climate change investments Absence of legal framework to support and protect climate change investments Little attempt to use what funds, as are available, to unlock more funds for climate change No real attempts to create/generate funds for climate change Little appreciation of the interlocking relationship between Climate Change and Development. Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

Key Problems of the African Carbon Market 1. LACK OF FINANCE Lack of project finance opportunities stifle low carbon project development 2. LACK OF KNOWLEDGE Lack of awareness, knowledge and competencies to leverage global carbon market at all levels (governments, private sector, financial sector, project developers, etc). 3. LACK OF BASELINE METHODOLOGIES Much of Africa’s economic activities are agro-forestry based. Low Carbon Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

Key Problems of the African Carbon Market 1. LACK OF FINANCE Lack of project finance opportunities stifle low carbon project development 2. LACK OF KNOWLEDGE Lack of awareness, knowledge and competencies to leverage global carbon market at all levels (governments, private sector, financial sector, project developers, etc). 3. LACK OF BASELINE METHODOLOGIES Much of Africa’s economic activities are agro-forestry based. Low Carbon Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

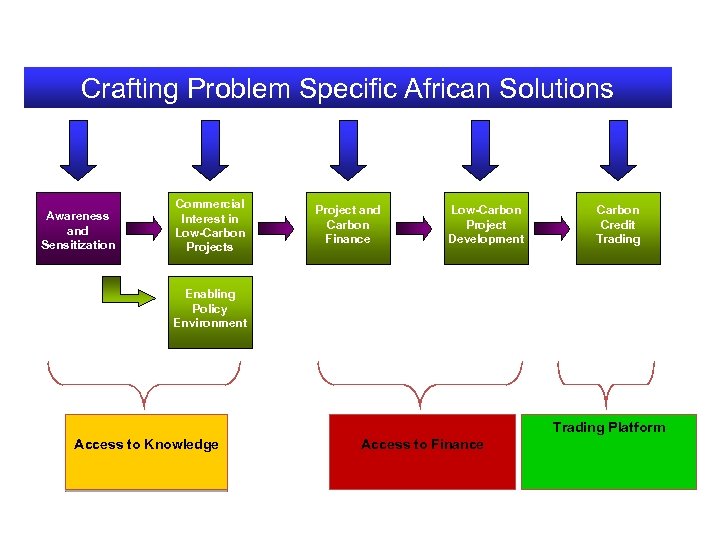

Crafting Problem Specific African Solutions Awareness and Sensitization Commercial Interest in Low-Carbon Projects Project and Carbon Finance Low-Carbon Project Development Carbon Credit Trading Enabling Policy Environment Trading Platform Access to Knowledge Access to Finance

Crafting Problem Specific African Solutions Awareness and Sensitization Commercial Interest in Low-Carbon Projects Project and Carbon Finance Low-Carbon Project Development Carbon Credit Trading Enabling Policy Environment Trading Platform Access to Knowledge Access to Finance

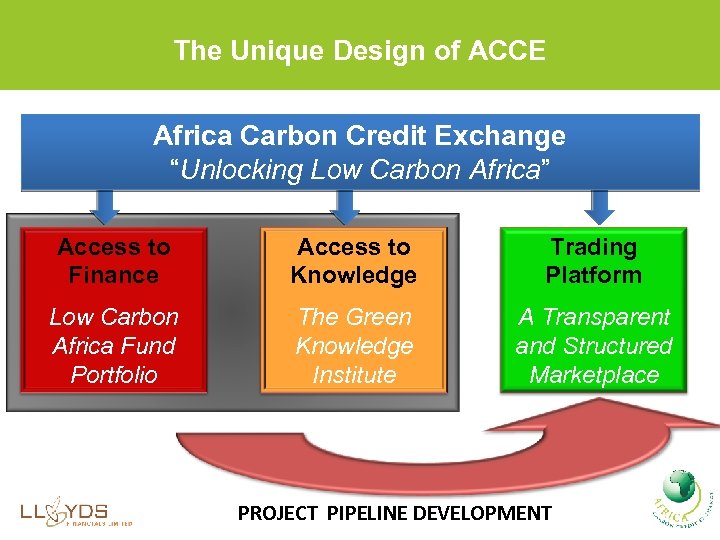

The Unique Design of ACCE Africa Carbon Credit Exchange “Unlocking Low Carbon Africa” Access to Finance Access to Knowledge Trading Platform Low Carbon Africa Fund Portfolio The Green Knowledge Institute A Transparent and Structured Marketplace PROJECT PIPELINE DEVELOPMENT

The Unique Design of ACCE Africa Carbon Credit Exchange “Unlocking Low Carbon Africa” Access to Finance Access to Knowledge Trading Platform Low Carbon Africa Fund Portfolio The Green Knowledge Institute A Transparent and Structured Marketplace PROJECT PIPELINE DEVELOPMENT

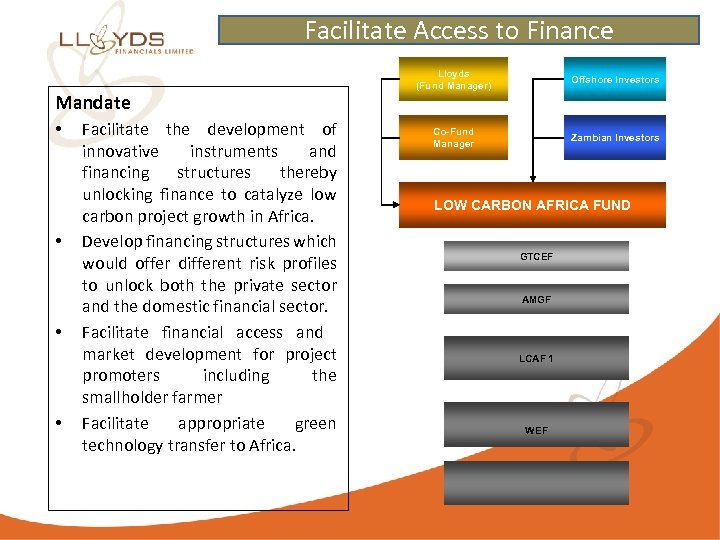

Facilitate Access to Finance Mandate • • Facilitate the development of innovative instruments and financing structures thereby unlocking finance to catalyze low carbon project growth in Africa. Develop financing structures which would offer different risk profiles to unlock both the private sector and the domestic financial sector. Facilitate financial access and market development for project promoters including the smallholder farmer Facilitate appropriate green technology transfer to Africa. Lloyds (Fund Manager) Offshore Investors Co-Fund Manager Zambian Investors LOW CARBON AFRICA FUND GTCEF AMGF LCAF 1 WEF

Facilitate Access to Finance Mandate • • Facilitate the development of innovative instruments and financing structures thereby unlocking finance to catalyze low carbon project growth in Africa. Develop financing structures which would offer different risk profiles to unlock both the private sector and the domestic financial sector. Facilitate financial access and market development for project promoters including the smallholder farmer Facilitate appropriate green technology transfer to Africa. Lloyds (Fund Manager) Offshore Investors Co-Fund Manager Zambian Investors LOW CARBON AFRICA FUND GTCEF AMGF LCAF 1 WEF

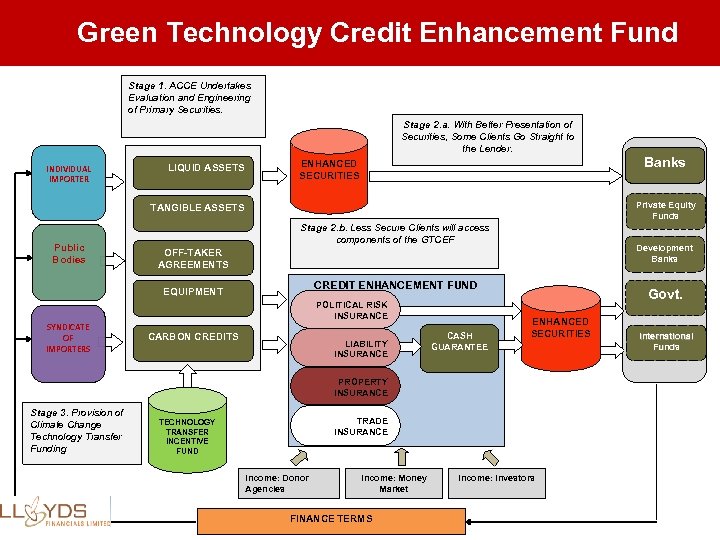

Green Technology Credit Enhancement Fund Stage 1. ACCE Undertakes Evaluation and Engineering of Primary Securities. Stage 2. a. With Better Presentation of Securities, Some Clients Go Straight to the Lender. INDIVIDUAL IMPORTER LIQUID ASSETS ENHANCED SECURITIES Private Equity Funds TANGIBLE ASSETS Public Bodies Stage 2. b. Less Secure Clients will access components of the GTCEF Development Banks OFF-TAKER AGREEMENTS CREDIT ENHANCEMENT FUND EQUIPMENT POLITICAL RISK INSURANCE SYNDICATE OF IMPORTERS CARBON CREDITS LIABILITY INSURANCE CASH GUARANTEE Govt. ENHANCED SECURITIES PROPERTY INSURANCE Stage 3. Provision of Climate Change Technology Transfer Funding Banks TRADE INSURANCE TECHNOLOGY TRANSFER INCENTIVE FUND Income: Donor Agencies Income: Money Market FINANCE TERMS Income: Investors International Funds

Green Technology Credit Enhancement Fund Stage 1. ACCE Undertakes Evaluation and Engineering of Primary Securities. Stage 2. a. With Better Presentation of Securities, Some Clients Go Straight to the Lender. INDIVIDUAL IMPORTER LIQUID ASSETS ENHANCED SECURITIES Private Equity Funds TANGIBLE ASSETS Public Bodies Stage 2. b. Less Secure Clients will access components of the GTCEF Development Banks OFF-TAKER AGREEMENTS CREDIT ENHANCEMENT FUND EQUIPMENT POLITICAL RISK INSURANCE SYNDICATE OF IMPORTERS CARBON CREDITS LIABILITY INSURANCE CASH GUARANTEE Govt. ENHANCED SECURITIES PROPERTY INSURANCE Stage 3. Provision of Climate Change Technology Transfer Funding Banks TRADE INSURANCE TECHNOLOGY TRANSFER INCENTIVE FUND Income: Donor Agencies Income: Money Market FINANCE TERMS Income: Investors International Funds

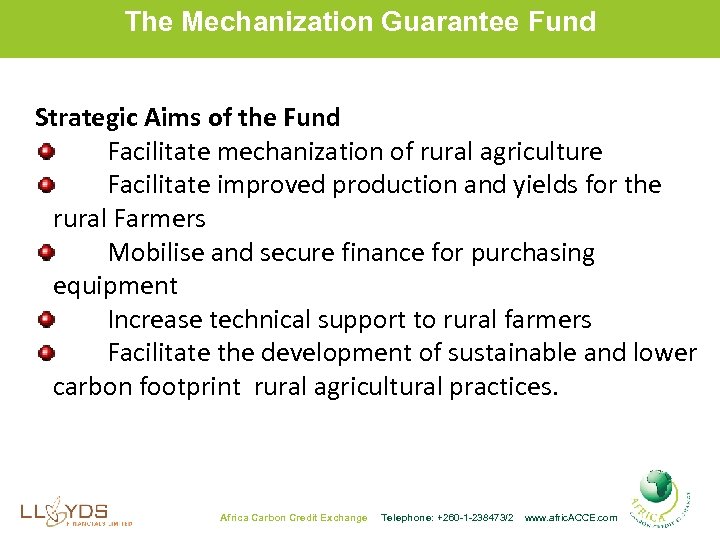

The Mechanization Guarantee Fund Strategic Aims of the Fund Facilitate mechanization of rural agriculture Facilitate improved production and yields for the rural Farmers Mobilise and secure finance for purchasing equipment Increase technical support to rural farmers Facilitate the development of sustainable and lower carbon footprint rural agricultural practices. Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

The Mechanization Guarantee Fund Strategic Aims of the Fund Facilitate mechanization of rural agriculture Facilitate improved production and yields for the rural Farmers Mobilise and secure finance for purchasing equipment Increase technical support to rural farmers Facilitate the development of sustainable and lower carbon footprint rural agricultural practices. Africa Carbon Credit Exchange Telephone: +260 -1 -238473/2 www. afric. ACCE. com

Facilitating Access to Knowledge Green Knowledge Institute (GKI) Strategic Aims of the Institute Knowledge Hub for carbon market development in Africa Information Sharing Hub for African Designated National Authorities (DNAs) Facilitate the development of African appropriate carbon methodologies Deal with issues of sensitization and capacity building issues (e. g. , governments, public and private sectors, NGOs, and private sector GKI is developing into a Bureau for connecting required technical expertise to develop carbon offset projects.

Facilitating Access to Knowledge Green Knowledge Institute (GKI) Strategic Aims of the Institute Knowledge Hub for carbon market development in Africa Information Sharing Hub for African Designated National Authorities (DNAs) Facilitate the development of African appropriate carbon methodologies Deal with issues of sensitization and capacity building issues (e. g. , governments, public and private sectors, NGOs, and private sector GKI is developing into a Bureau for connecting required technical expertise to develop carbon offset projects.

The Trading Platform A Transparent and Structured Marketplace ACCE is building a regulated trading platform on which market players can buy and sell credible compliance and voluntary carbon credits generated in Africa It provides a transparent price discovery mechanism is essential for African project developers to realize market value for carbon credits Through a network of Brokers and local partners across Africa ACCE will provide a medium for transaction, clearing and supporting structures to facilitate climate change/carbon projects.

The Trading Platform A Transparent and Structured Marketplace ACCE is building a regulated trading platform on which market players can buy and sell credible compliance and voluntary carbon credits generated in Africa It provides a transparent price discovery mechanism is essential for African project developers to realize market value for carbon credits Through a network of Brokers and local partners across Africa ACCE will provide a medium for transaction, clearing and supporting structures to facilitate climate change/carbon projects.

Network of Brokers across Africa Network of Brokers Scaling up to Africa

Network of Brokers across Africa Network of Brokers Scaling up to Africa

Partners INSTITUTION TYPE OF SUPPORT 1. USAID/PROFIT § § Initial Financial Support Technical Assistance 2. NORAD § Conservation Farming, § Initial capitalizations into: o Green Tech. Credit Enhancement Fund, o Mechanization Credit Guarantee Fund 3. DANISH GOVT. § Funding the p-CDM activities 4. WORLD BANK/IFC § § Conservation Farming, Green Knowledge Institute. 5. UNEP Risoe § Green Knowledge Institute. 6. QUEENS UNIV. CANADA § Development of Futures Market on the Trading Platform.

Partners INSTITUTION TYPE OF SUPPORT 1. USAID/PROFIT § § Initial Financial Support Technical Assistance 2. NORAD § Conservation Farming, § Initial capitalizations into: o Green Tech. Credit Enhancement Fund, o Mechanization Credit Guarantee Fund 3. DANISH GOVT. § Funding the p-CDM activities 4. WORLD BANK/IFC § § Conservation Farming, Green Knowledge Institute. 5. UNEP Risoe § Green Knowledge Institute. 6. QUEENS UNIV. CANADA § Development of Futures Market on the Trading Platform.

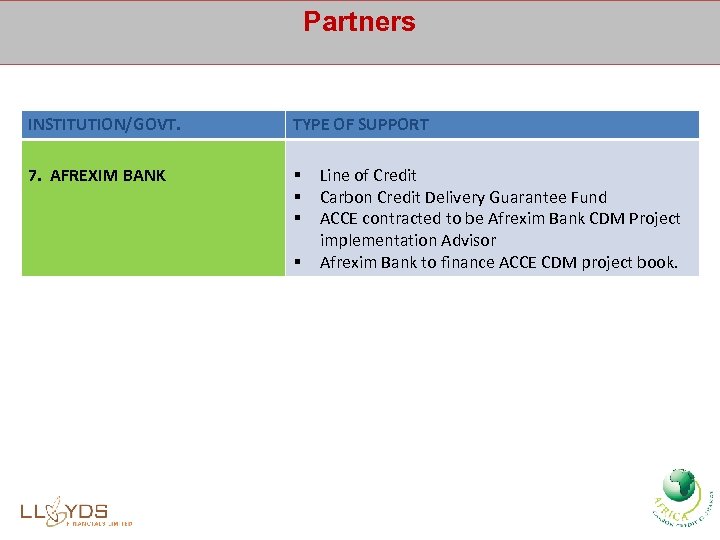

Partners INSTITUTION/GOVT. TYPE OF SUPPORT 7. AFREXIM BANK § § Line of Credit Carbon Credit Delivery Guarantee Fund ACCE contracted to be Afrexim Bank CDM Project implementation Advisor Afrexim Bank to finance ACCE CDM project book.

Partners INSTITUTION/GOVT. TYPE OF SUPPORT 7. AFREXIM BANK § § Line of Credit Carbon Credit Delivery Guarantee Fund ACCE contracted to be Afrexim Bank CDM Project implementation Advisor Afrexim Bank to finance ACCE CDM project book.

CONTACT DETAILS AFRICA CARBON CREDIT EXCHANGE 4 th Floor, Godfrey House. Kabelenga Road. P. O. Box 390035 Lusaka. Zambia lchingambo@africacce. com skhan@africacce. com Website: www. africacce. com Telephone: +260 -1 -238473/2

CONTACT DETAILS AFRICA CARBON CREDIT EXCHANGE 4 th Floor, Godfrey House. Kabelenga Road. P. O. Box 390035 Lusaka. Zambia lchingambo@africacce. com skhan@africacce. com Website: www. africacce. com Telephone: +260 -1 -238473/2