25e5a38b13c7b10d7685ca33ec408c68.ppt

- Количество слайдов: 25

Innovations in Global Vaccine Financing Amie Batson Health, Nutrition, Population The World Bank 1

Global Financing Mechanisms § Three major global financing mechanisms § Buy-downs § Advance Market Commitments (AMCs) § IFFIm § Questions for each mechanism § What is the current situation? What isn’t working? § How would a financing mechanism be able to address the problem or improve the situation? § How would it need to be structured to maximize the benefits but minimize the transaction costs? 2

IDA and IBRD buy-downs What is the problem? • Need to increase financial support to governments on priority activities with significant cross-border externalities • Insufficient focus on performance/results for GPGs • Bank credits and loans not very flexible (e. g. tailor loan/credit terms same regardless of externalities) Donor resources are used to lower the cost of the credits and loan targeted at priority health interventions. Use of donor funds is dependent on performance. 3

Experience with buy-downs: Pakistan and Nigeria polio projects Global Polio Eradication effort required $$’s in few countries with continued polio transmissions. World Bank approached as funder of last resort but grant more appropriate given global public good implications. IDA buy-down allowed IDA credit to be turned into a grant if performance targets achieved. The Gates Foundation, Rotary International, the United Nations Foundation and the US Center for Disease Control provided over $75 million to reduce the cost of polio IDA credits ($175 million) to grants based on defined performance targets. Projects developed in Pakistan and Nigeria Targets: Coverage/province in SIAs >80% and OPV received 5 weeks in advance of NID 4

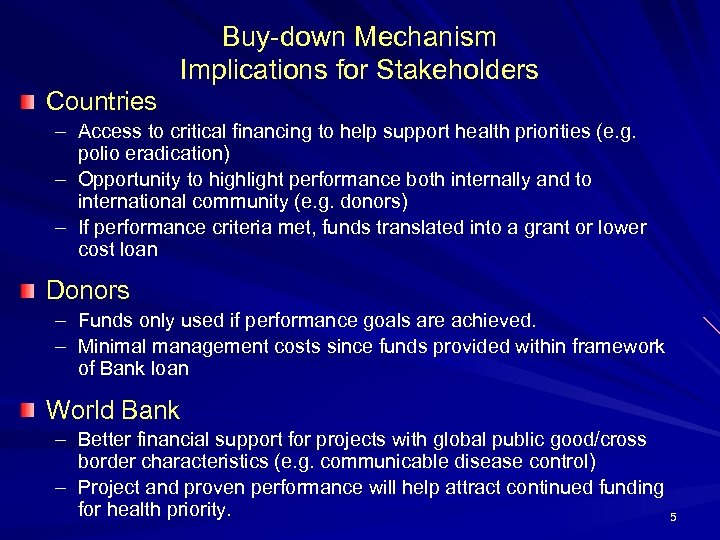

Buy-down Mechanism Implications for Stakeholders Countries – Access to critical financing to help support health priorities (e. g. polio eradication) – Opportunity to highlight performance both internally and to international community (e. g. donors) – If performance criteria met, funds translated into a grant or lower cost loan Donors – Funds only used if performance goals are achieved. – Minimal management costs since funds provided within framework of Bank loan World Bank – Better financial support for projects with global public good/cross border characteristics (e. g. communicable disease control) – Project and proven performance will help attract continued funding for health priority. 5

Global Financing Mechanisms § Three major global financing mechanisms § Buy-downs § Advance Market Commitments (AMCs) § IFFIm § Questions for each mechanism § What is the current situation? What isn’t working? § How would a financing mechanism be able to address the problem or improve the situation? § How would it need to be structured to maximize the benefits but minimize the transaction costs? 6

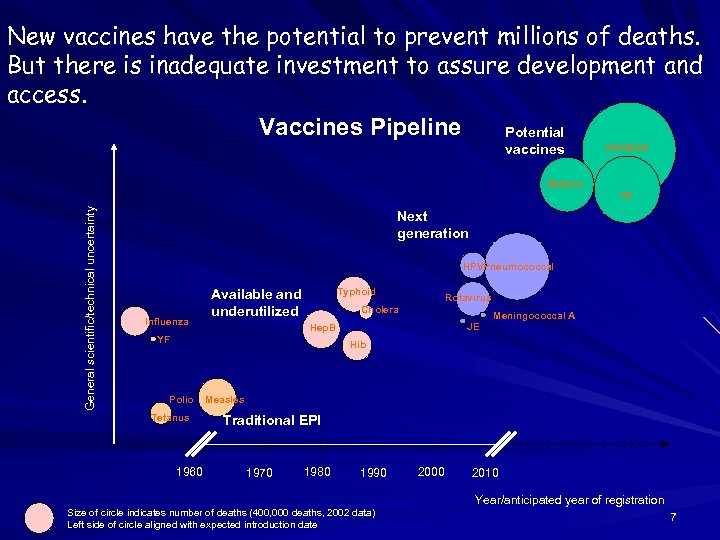

New vaccines have the potential to prevent millions of deaths. But there is inadequate investment to assure development and access. Vaccines Pipeline Potential vaccines HIV/AIDS Malaria General scientific/technical uncertainty TB Next generation HPVPneumococcal Influenza Typhoid Available and underutilized Rotavirus Cholera JE Hep. B YF Meningococcal A Hib Polio Tetanus 1960 Measles Traditional EPI 1970 1980 1990 2000 2010 Year/anticipated year of registration Size of circle indicates number of deaths (400, 000 deaths, 2002 data) Left side of circle aligned with expected introduction date 7

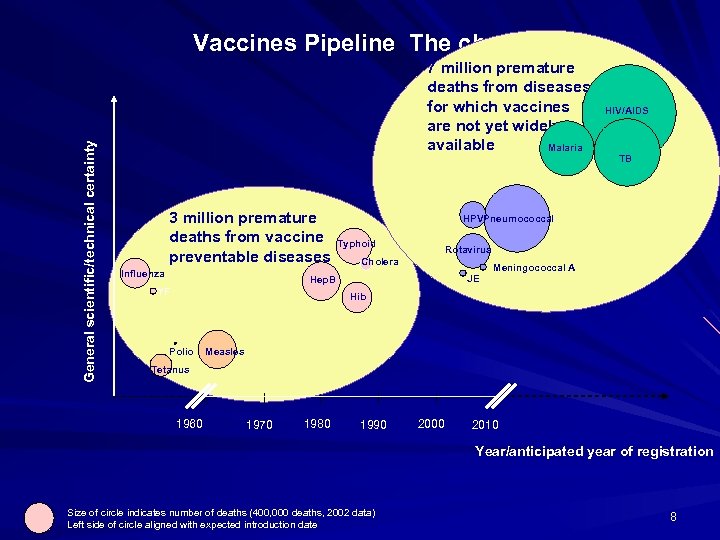

General scientific/technical certainty Vaccines Pipeline The challenge 7 million premature deaths from diseases for which vaccines are not yet widely available Malaria 3 million premature deaths from vaccine preventable diseases Influenza TB HPVPneumococcal Typhoid Rotavirus Cholera JE Hep. B YF HIV/AIDS Meningococcal A Hib Polio Measles Tetanus 1960 1970 1980 1990 2000 2010 Year/anticipated year of registration Size of circle indicates number of deaths (400, 000 deaths, 2002 data) Left side of circle aligned with expected introduction date 8

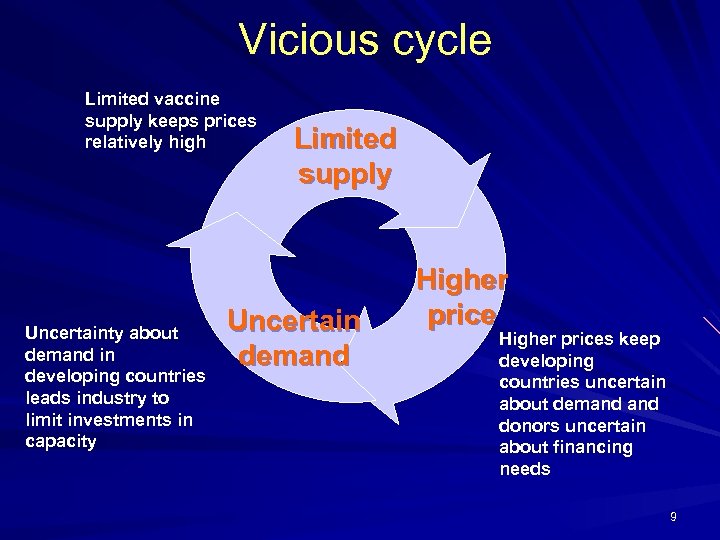

Vicious cycle Limited vaccine supply keeps prices relatively high Uncertainty about demand in developing countries leads industry to limit investments in capacity Limited supply Uncertain demand Higher prices keep developing countries uncertain about demand donors uncertain about financing needs 9

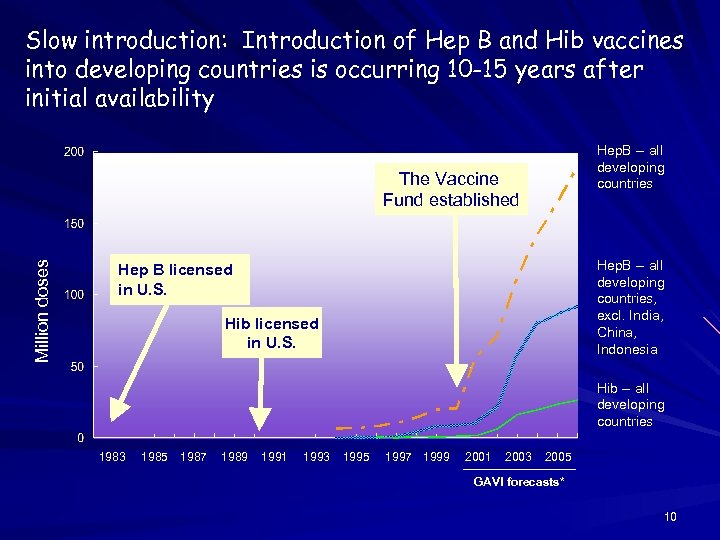

Slow introduction: Introduction of Hep B and Hib vaccines into developing countries is occurring 10 -15 years after initial availability Hep. B -- all developing countries Million doses The Vaccine Fund established Hep. B -- all developing countries, excl. India, China, Indonesia Hep B licensed in U. S. Hib licensed in U. S. Hib -- all developing countries 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 GAVI forecasts* 10

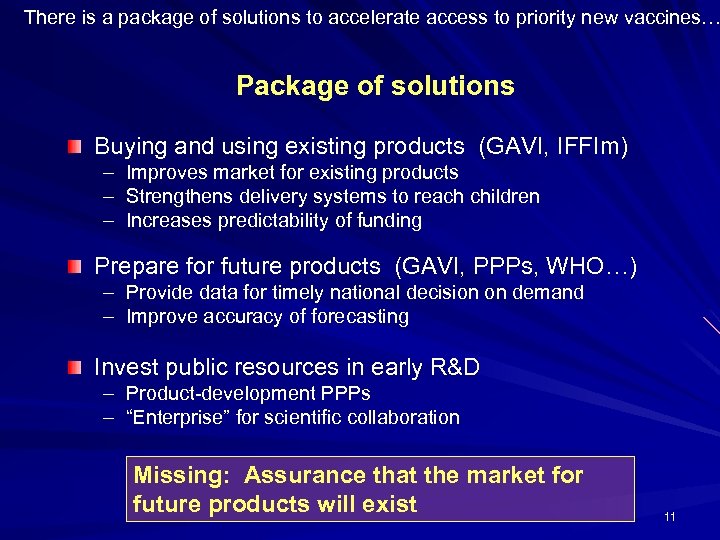

There is a package of solutions to accelerate access to priority new vaccines… Package of solutions Buying and using existing products (GAVI, IFFIm) – Improves market for existing products – Strengthens delivery systems to reach children – Increases predictability of funding Prepare for future products (GAVI, PPPs, WHO…) – Provide data for timely national decision on demand – Improve accuracy of forecasting Invest public resources in early R&D – – Product-development PPPs “Enterprise” for scientific collaboration Missing: Assurance that the market for future products will exist 11

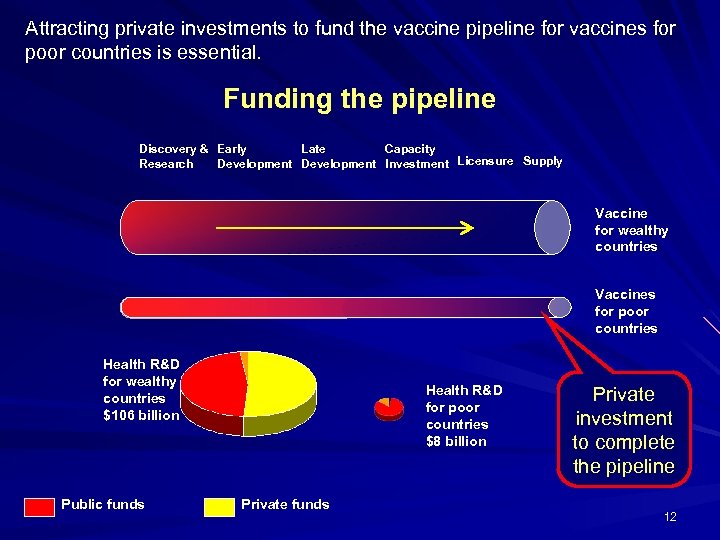

Attracting private investments to fund the vaccine pipeline for vaccines for poor countries is essential. Funding the pipeline Discovery & Early Late Capacity Research Development Investment Licensure Supply Vaccine for wealthy countries Vaccines for poor countries Health R&D for wealthy countries $106 billion Public funds Health R&D for poor countries $8 billion Private funds Private investment to complete the pipeline 12

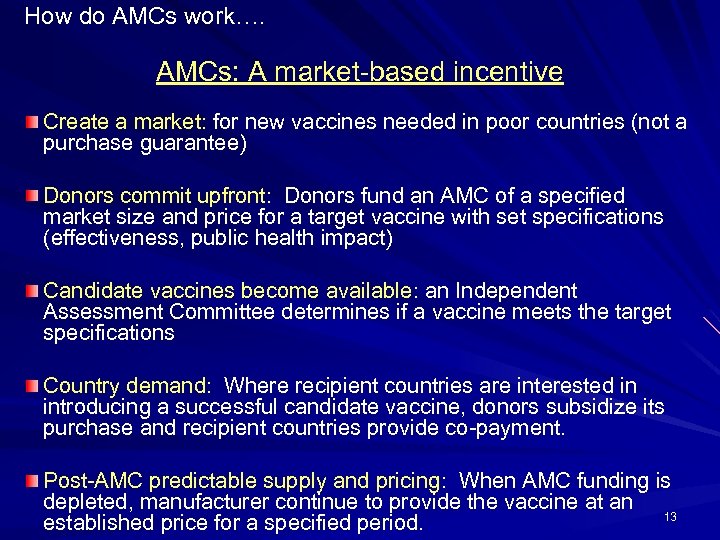

How do AMCs work…. AMCs: A market-based incentive Create a market: for new vaccines needed in poor countries (not a purchase guarantee) Donors commit upfront: Donors fund an AMC of a specified market size and price for a target vaccine with set specifications (effectiveness, public health impact) Candidate vaccines become available: an Independent Assessment Committee determines if a vaccine meets the target specifications Country demand: Where recipient countries are interested in introducing a successful candidate vaccine, donors subsidize its purchase and recipient countries provide co-payment. Post-AMC predictable supply and pricing: When AMC funding is depleted, manufacturer continue to provide the vaccine at an 13 established price for a specified period.

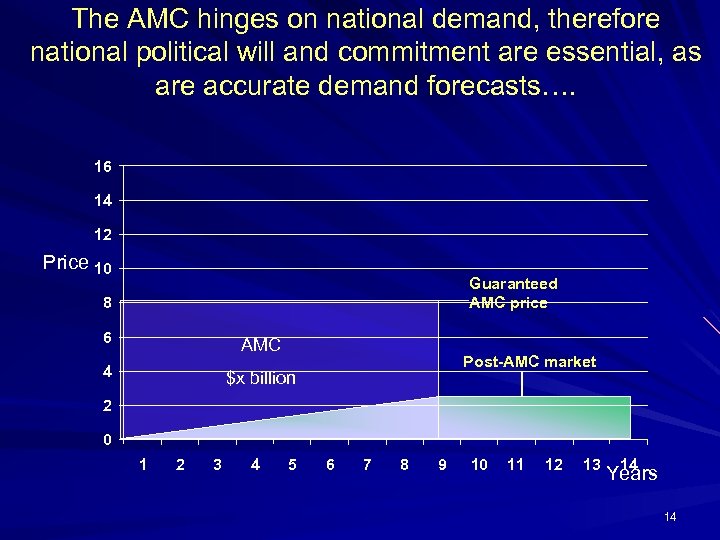

The AMC hinges on national demand, therefore national political will and commitment are essential, as are accurate demand forecasts…. 16 14 12 Price 10 Guaranteed AMC price 8 6 AMC 4 Post-AMC market $x billion 2 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Years 14

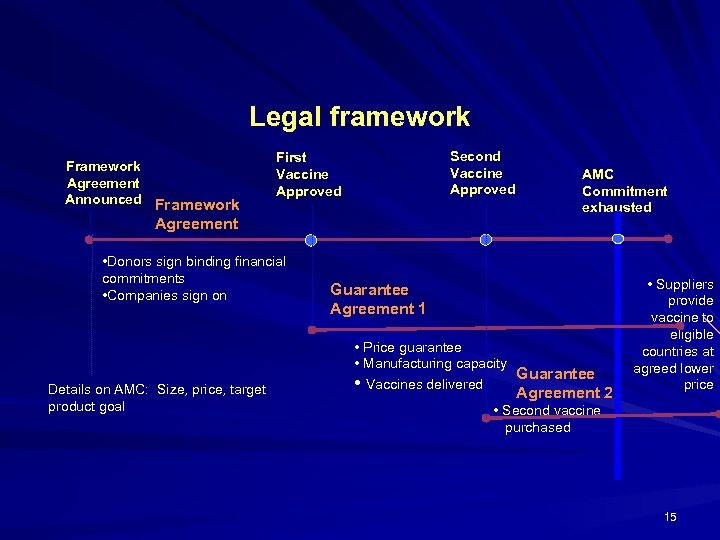

Legal framework Framework Agreement Announced Framework Second Vaccine Approved First Vaccine Approved Agreement • Donors sign binding financial commitments • Companies sign on Details on AMC: Size, price, target product goal AMC Commitment exhausted Guarantee Agreement 1 • Price guarantee • Manufacturing capacity Guarantee • Vaccines delivered Agreement 2 • Suppliers provide vaccine to eligible countries at agreed lower price • Second vaccine purchased 15

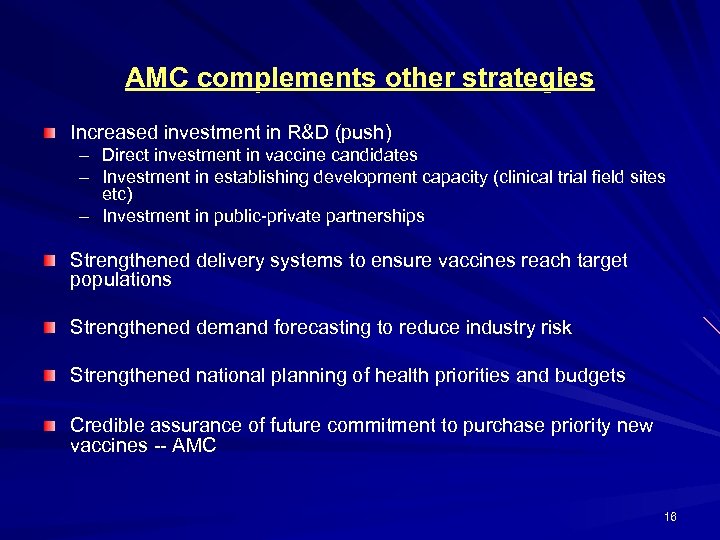

AMC complements other strategies Increased investment in R&D (push) – Direct investment in vaccine candidates – Investment in establishing development capacity (clinical trial field sites etc) – Investment in public-private partnerships Strengthened delivery systems to ensure vaccines reach target populations Strengthened demand forecasting to reduce industry risk Strengthened national planning of health priorities and budgets Credible assurance of future commitment to purchase priority new vaccines -- AMC 16

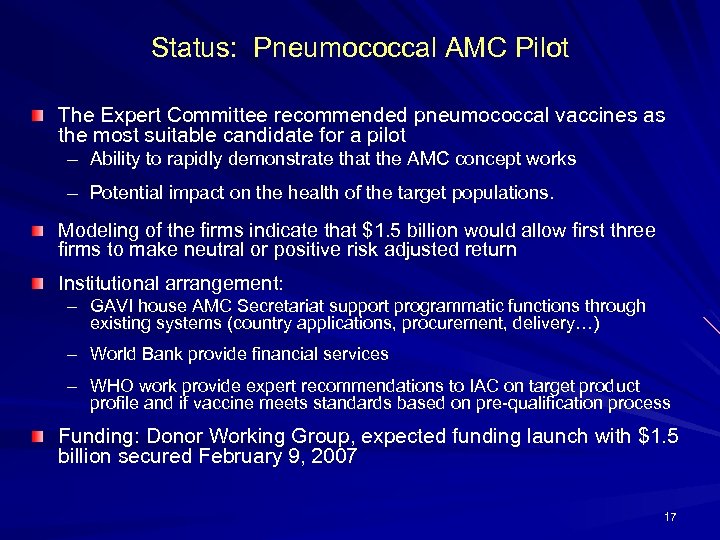

Status: Pneumococcal AMC Pilot The Expert Committee recommended pneumococcal vaccines as the most suitable candidate for a pilot – Ability to rapidly demonstrate that the AMC concept works – Potential impact on the health of the target populations. Modeling of the firms indicate that $1. 5 billion would allow first three firms to make neutral or positive risk adjusted return Institutional arrangement: – GAVI house AMC Secretariat support programmatic functions through existing systems (country applications, procurement, delivery…) – World Bank provide financial services – WHO work provide expert recommendations to IAC on target product profile and if vaccine meets standards based on pre-qualification process Funding: Donor Working Group, expected funding launch with $1. 5 billion secured February 9, 2007 17

Global Financing Mechanisms § Three major global financing mechanisms § § § Buy-downs Advance Market Commitments (AMCs) IFFIm § Questions for each mechanism § What is the current situation? What isn’t working? § How would a financing mechanism be able to address the problem or improve the situation? § How would it need to be structured to maximize the benefits but minimize the transaction costs? 18

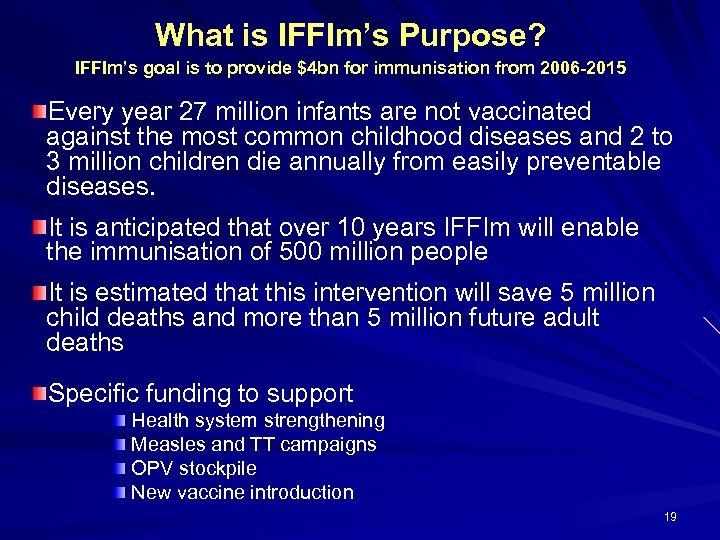

What is IFFIm’s Purpose? IFFIm’s goal is to provide $4 bn for immunisation from 2006 -2015 Every year 27 million infants are not vaccinated against the most common childhood diseases and 2 to 3 million children die annually from easily preventable diseases. It is anticipated that over 10 years IFFIm will enable the immunisation of 500 million people It is estimated that this intervention will save 5 million child deaths and more than 5 million future adult deaths Specific funding to support Health system strengthening Measles and TT campaigns OPV stockpile New vaccine introduction 19

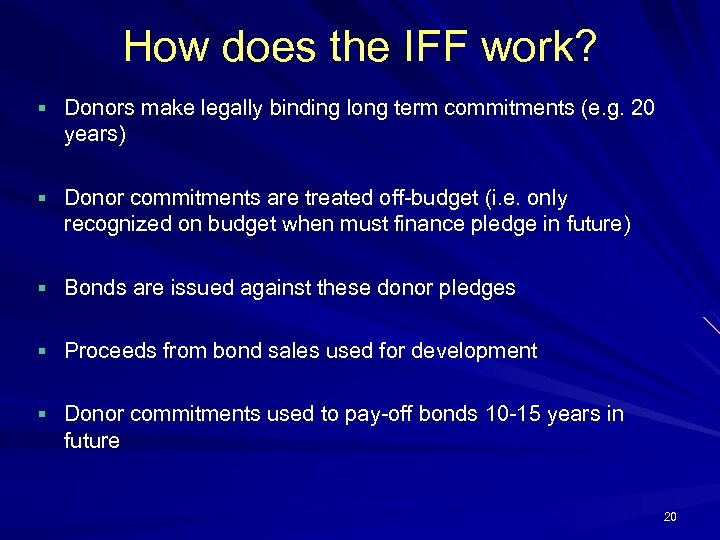

How does the IFF work? § Donors make legally binding long term commitments (e. g. 20 years) § Donor commitments are treated off-budget (i. e. only recognized on budget when must finance pledge in future) § Bonds are issued against these donor pledges § Proceeds from bond sales used for development § Donor commitments used to pay-off bonds 10 -15 years in future 20

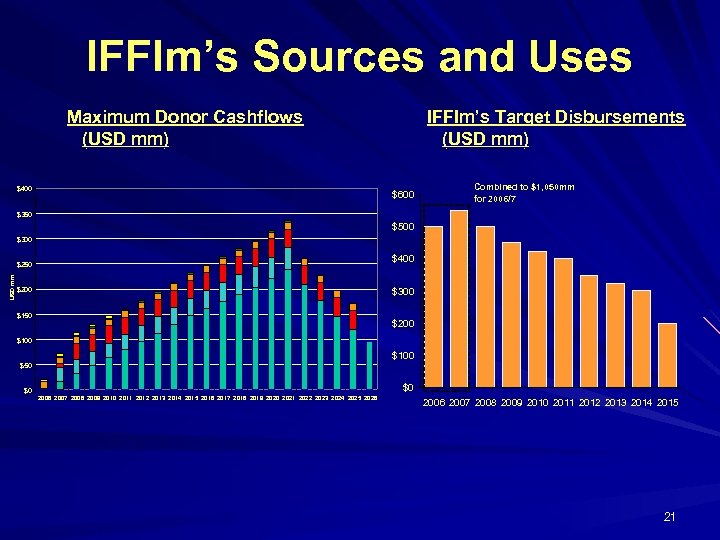

IFFIm’s Sources and Uses Maximum Donor Cashflows (USD mm) $400 IFFIm’s Target Disbursements (USD mm) $600 Combined to $1, 050 mm for 2006/7 $350 $500 $300 $400 USD mm $250 $300 $200 $150 $200 $100 $50 $0 $0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2007 2008 2009 2010 2011 2012 2013 2014 2015 21

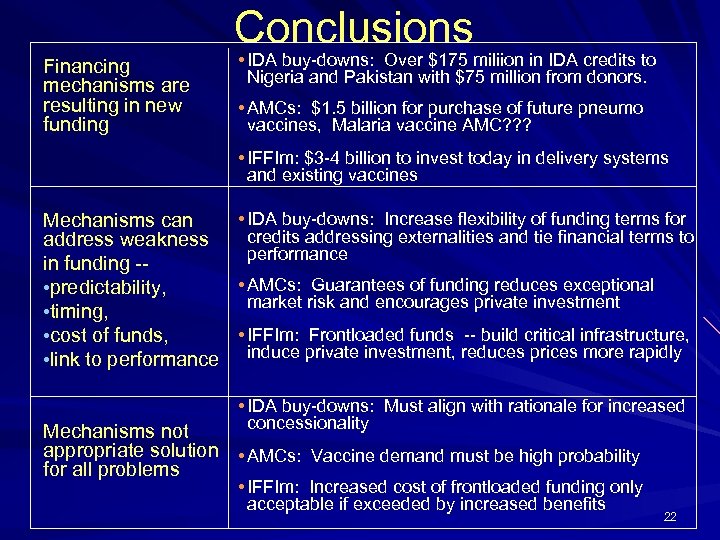

Conclusions Financing mechanisms are resulting in new funding • IDA buy-downs: Over $175 miliion in IDA credits to Nigeria and Pakistan with $75 million from donors. • AMCs: $1. 5 billion for purchase of future pneumo vaccines, Malaria vaccine AMC? ? ? • IFFIm: $3 -4 billion to invest today in delivery systems and existing vaccines • IDA buy-downs: Increase flexibility of funding terms for Mechanisms can credits addressing externalities and tie financial terms to address weakness performance in funding - • AMCs: Guarantees of funding reduces exceptional • predictability, market risk and encourages private investment • timing, • IFFIm: Frontloaded funds -- build critical infrastructure, • cost of funds, • link to performance induce private investment, reduces prices more rapidly • IDA buy-downs: Must align with rationale for increased concessionality Mechanisms not appropriate solution • AMCs: Vaccine demand must be high probability for all problems • IFFIm: Increased cost of frontloaded funding only acceptable if exceeded by increased benefits 22

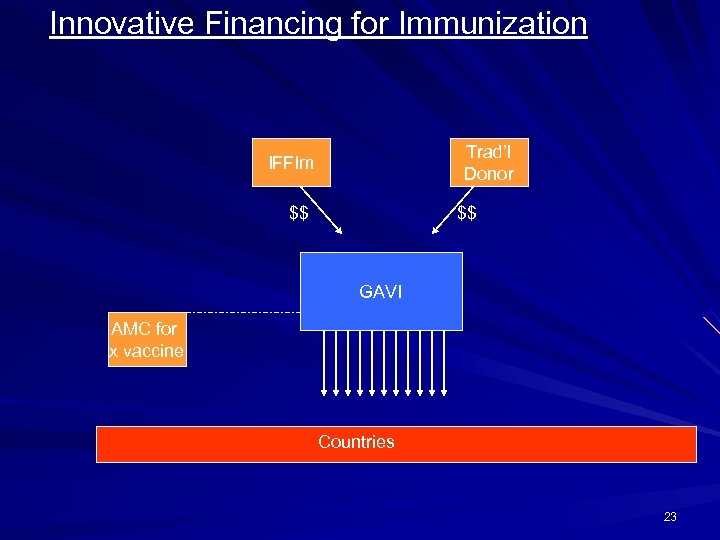

Innovative Financing for Immunization Trad’l Donor IFFIm $$ $$ GAVI AMC for x vaccine Countries 23

BACKUP 24

Advance Market Commitments (AMC) Problem Small, risky and unpredictable markets leads to underinvestment in products of importance to the developing world Industry’s investments in development/capacity determine what products are available, when and to whom Assumptions Assurances of a future market would address financing risk and help reduce demand risk and thus provide an 25 incentive for more timely investment by industry

25e5a38b13c7b10d7685ca33ec408c68.ppt