701de3805bbb4125af715981683eba09.ppt

- Количество слайдов: 31

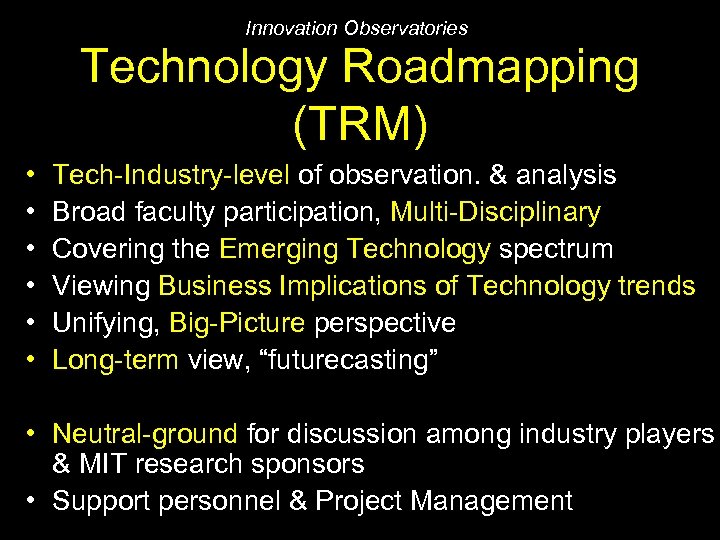

Innovation Observatories Technology Roadmapping (TRM) • • • Tech-Industry-level of observation. & analysis Broad faculty participation, Multi-Disciplinary Covering the Emerging Technology spectrum Viewing Business Implications of Technology trends Unifying, Big-Picture perspective Long-term view, “futurecasting” • Neutral-ground for discussion among industry players & MIT research sponsors • Support personnel & Project Management

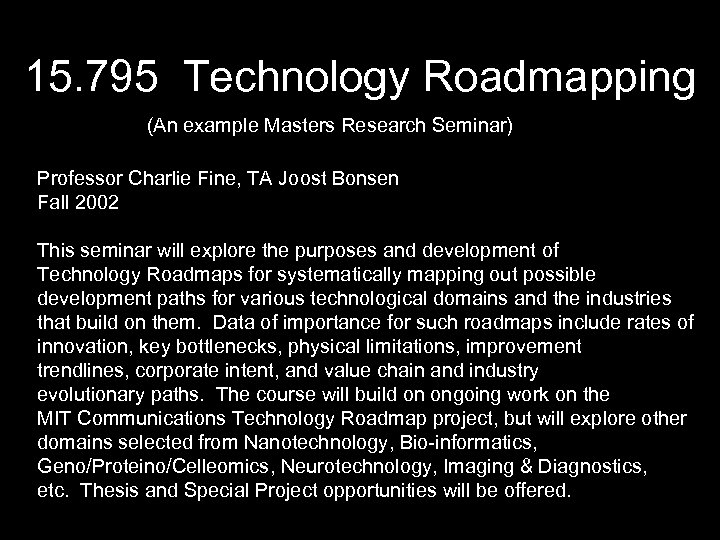

15. 795 Technology Roadmapping (An example Masters Research Seminar) Professor Charlie Fine, TA Joost Bonsen Fall 2002 This seminar will explore the purposes and development of Technology Roadmaps for systematically mapping out possible development paths for various technological domains and the industries that build on them. Data of importance for such roadmaps include rates of innovation, key bottlenecks, physical limitations, improvement trendlines, corporate intent, and value chain and industry evolutionary paths. The course will build on ongoing work on the MIT Communications Technology Roadmap project, but will explore other domains selected from Nanotechnology, Bio-informatics, Geno/Proteino/Celleomics, Neurotechnology, Imaging & Diagnostics, etc. Thesis and Special Project opportunities will be offered.

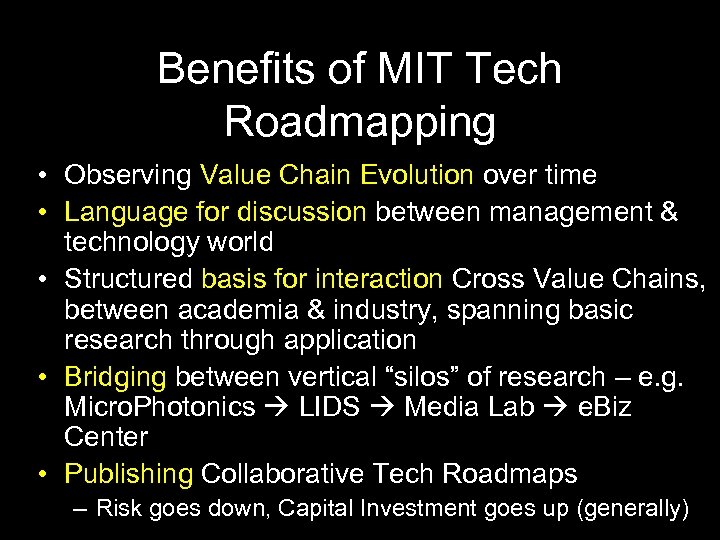

Benefits of MIT Tech Roadmapping • Observing Value Chain Evolution over time • Language for discussion between management & technology world • Structured basis for interaction Cross Value Chains, between academia & industry, spanning basic research through application • Bridging between vertical “silos” of research – e. g. Micro. Photonics LIDS Media Lab e. Biz Center • Publishing Collaborative Tech Roadmaps – Risk goes down, Capital Investment goes up (generally)

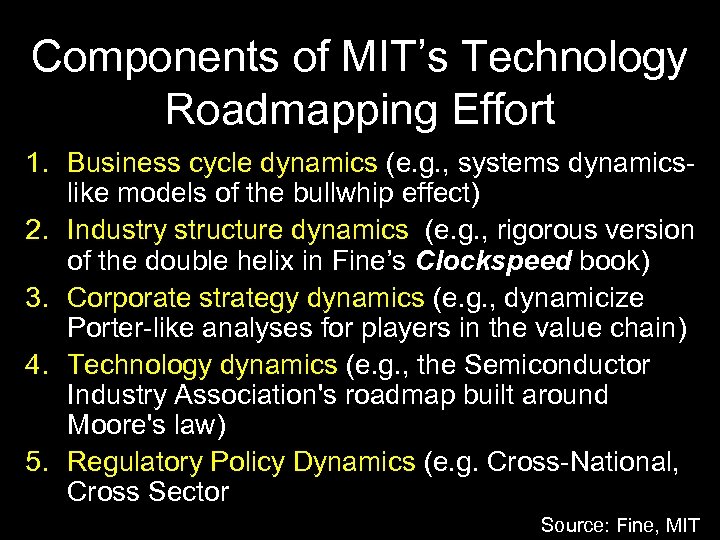

Components of MIT’s Technology Roadmapping Effort 1. Business cycle dynamics (e. g. , systems dynamicslike models of the bullwhip effect) 2. Industry structure dynamics (e. g. , rigorous version of the double helix in Fine’s Clockspeed book) 3. Corporate strategy dynamics (e. g. , dynamicize Porter-like analyses for players in the value chain) 4. Technology dynamics (e. g. , the Semiconductor Industry Association's roadmap built around Moore's law) 5. Regulatory Policy Dynamics (e. g. Cross-National, Cross Sector Source: Fine, MIT

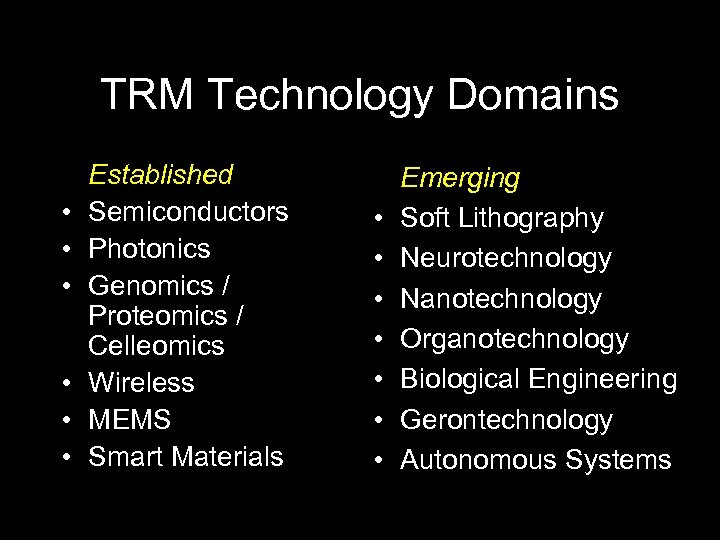

TRM Technology Domains • • • Established Semiconductors Photonics Genomics / Proteomics / Celleomics Wireless MEMS Smart Materials • • Emerging Soft Lithography Neurotechnology Nanotechnology Organotechnology Biological Engineering Gerontechnology Autonomous Systems

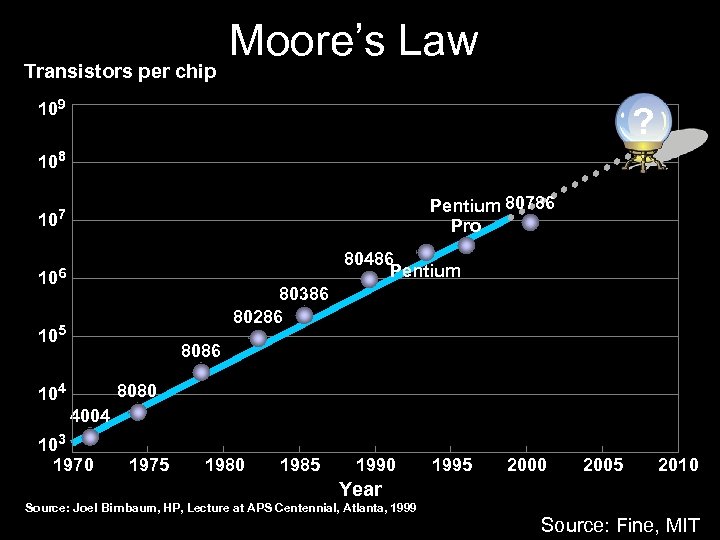

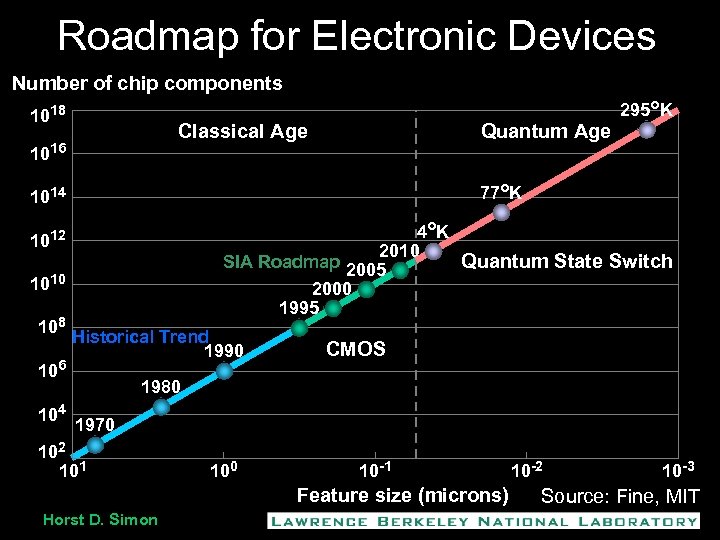

Generalizing & Enriching Historic Technology & Demand Trends • Historical Efforts – – Moore’s Law Electronic Devices Sematech Roadmap Disk Drives • Ongoing – Optical Networking – Wireless • Future – New technologies …

Transistors per chip Moore’s Law 109 ? 108 Pentium 80786 Pro 107 80486 Pentium 106 80386 80286 105 8086 104 8080 4004 103 1970 1975 1980 1985 1990 1995 2000 2005 2010 Year Source: Joel Birnbaum, HP, Lecture at APS Centennial, Atlanta, 1999 Source: Fine, MIT

Roadmap for Electronic Devices Number of chip components 1018 Classical Age 1016 Quantum Age 77 o. K 1014 4 o K 2010 SIA Roadmap 2005 Quantum State Switch 2000 1995 1012 1010 108 106 104 295 o. K Historical Trend 1990 CMOS 1980 1970 102 101 100 10 -1 Feature size (microns) Horst D. Simon 10 -2 10 -3 Source: Fine, MIT

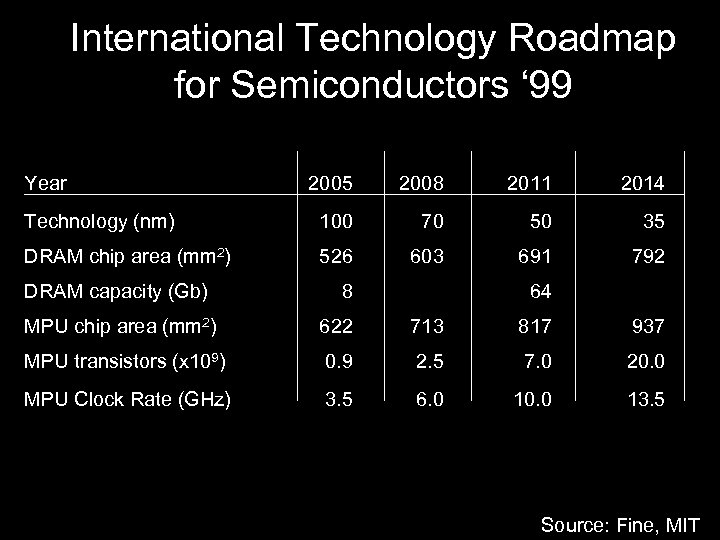

International Technology Roadmap for Semiconductors ‘ 99 Year 2005 2008 2011 2014 Technology (nm) 100 70 50 35 DRAM chip area (mm 2) 526 603 691 792 DRAM capacity (Gb) 8 64 MPU chip area (mm 2) 622 713 817 937 MPU transistors (x 109) 0. 9 2. 5 7. 0 20. 0 MPU Clock Rate (GHz) 3. 5 6. 0 10. 0 13. 5 Source: Fine, MIT

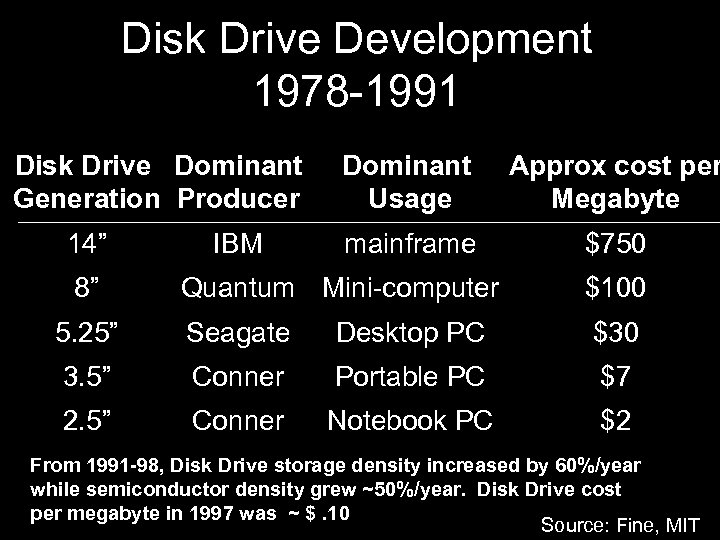

Disk Drive Development 1978 -1991 Disk Drive Dominant Generation Producer 14” 8” IBM Dominant Usage Approx cost per Megabyte mainframe $750 Quantum Mini-computer $100 5. 25” Seagate Desktop PC $30 3. 5” Conner Portable PC $7 2. 5” Conner Notebook PC $2 From 1991 -98, Disk Drive storage density increased by 60%/year while semiconductor density grew ~50%/year. Disk Drive cost per megabyte in 1997 was ~ $. 10 Source: Fine, MIT

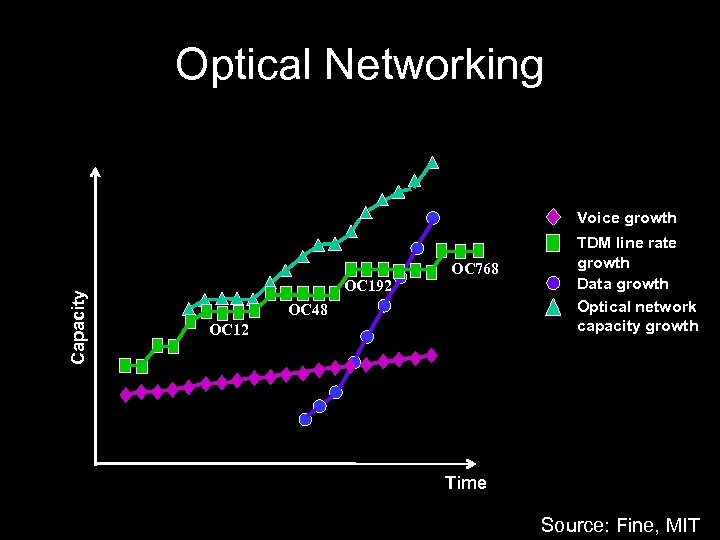

Optical Networking Capacity Voice growth OC 192 OC 768 OC 48 OC 12 TDM line rate growth Data growth Optical network capacity growth Time Source: Fine, MIT

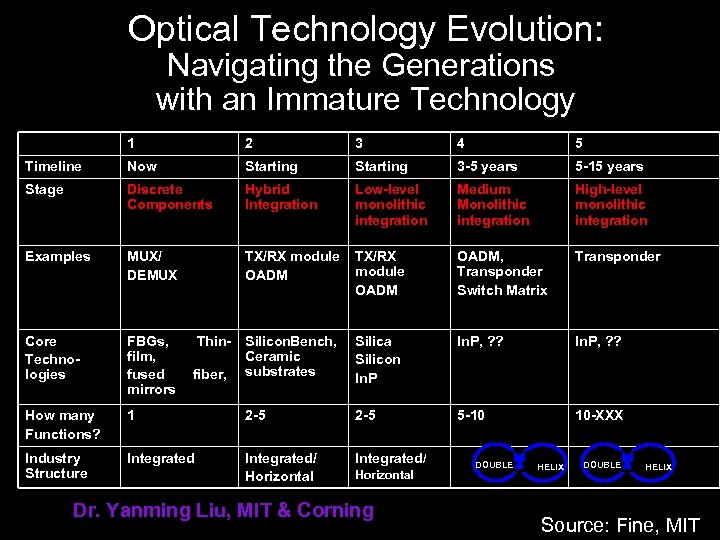

Optical Technology Evolution: Navigating the Generations with an Immature Technology 1 2 3 4 5 Timeline Now Starting 3 -5 years 5 -15 years Stage Discrete Components Hybrid Integration Low-level monolithic integration Medium Monolithic integration High-level monolithic integration Examples MUX/ DEMUX TX/RX module OADM, Transponder Switch Matrix Transponder Core Technologies FBGs, film, fused mirrors Silicon. Bench, Ceramic substrates Silica Silicon In. P, ? ? How many Functions? 1 2 -5 5 -10 10 -XXX Industry Structure Integrated/ Horizontal Integrated/ Thinfiber, Horizontal Dr. Yanming Liu, MIT & Corning DOUBLE HELIX Source: Fine, MIT

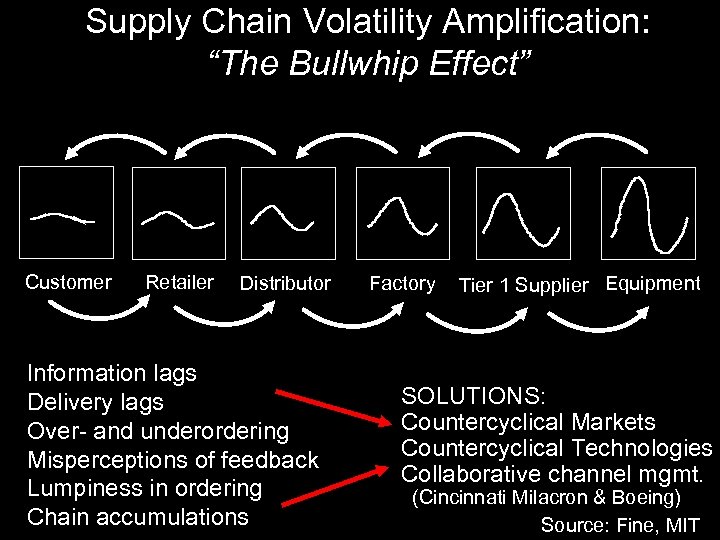

Supply Chain Volatility Amplification: “The Bullwhip Effect” Customer Retailer Distributor Information lags Delivery lags Over- and underordering Misperceptions of feedback Lumpiness in ordering Chain accumulations Factory Tier 1 Supplier Equipment SOLUTIONS: Countercyclical Markets Countercyclical Technologies Collaborative channel mgmt. (Cincinnati Milacron & Boeing) Source: Fine, MIT

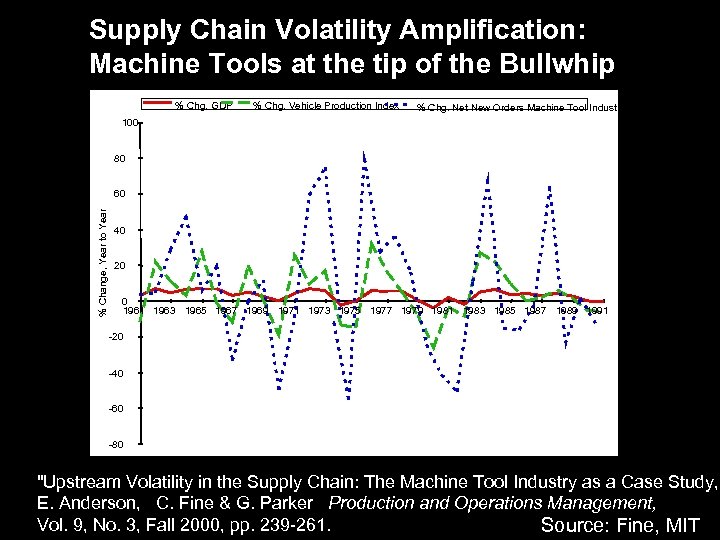

Supply Chain Volatility Amplification: Machine Tools at the tip of the Bullwhip % Chg. GDP % Chg. Vehicle Production Index % Chg. Net New Orders Machine Tool Industry 100 80 % Change, Year to Year 60 40 20 0 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 -20 -40 -60 -80 "Upstream Volatility in the Supply Chain: The Machine Tool Industry as a Case Study, " E. Anderson, C. Fine & G. Parker Production and Operations Management, Vol. 9, No. 3, Fall 2000, pp. 239 -261. Source: Fine, MIT

TRM Industry-Benefits • Economic context for technology decisions & investments • Lowering Risks for capital investments • Not Stalin’s 5 -year plans – rather, coordination & collaboration, co-optition

TRM Literature • Micro. Photonics Center – http: //mph-roadmap. mit. edu • Example Theses – http: //mitsloan. mit. edu/research/clockspeed /main. html • References – http: //www. sandia. gov/Roadmap/

Other Roadmapping Efforts • ITRS – International Technology Roadmapping for Semiconductors – http: //public. itrs. net/ • Electricity Technology Roadmap – http: //www. epri. com/corporate/discover_epri/road map/ • Steel Industry Technology Roadmap – http: //www. steel. org/mt/roadmap. htm • Lighting Technology Roadmap – http: //www. eren. doe. gov/buildings/vision 2020/ • Robotics & Intelligent Machines RM – http: //www. sandia. gov/Roadmap/home. htm

Generalizing & Quantifying Clockspeed • Benefits to comparing between Industries • Looking at Fast Industry Dynamics – Cross-species Benchmarking • Quantify & Ultimately Model these Dynamics, improve theoretical understanding

TRM Class Goals • Collaborative efforts between 1 -3 students, MIT researchers, & Industry Sponsors • Across MIT research areas • Cross Industry Benchmarking • Partnered with Industrial Sponsors • Attract students passionate about technology sector, however broadly or narrowly defined • Committed to producing coherent & complete Tech Roadmap (Draft 1. 0) during Fall Semester

What is Tech Roadmapping? • Trends -- Statement of historic performance improvement and extrapolations into future • Consensus – Shared opinion about likely future developments • Commitment -- Shared willingness to pursue particular technologies • Co-Investment -- Basis for agreement on precompetitive research funding • Understanding -- Method of understanding broader socio-economic context of broad technology trends

Degree of Industry Aggregation? • Communications Roadmap – Optical Communications • Micro. Photonics – Wireless • Personal Area Networking • Cellular G 3, G 4, G 5 • Medical Imaging – MRI • Functional MRI • Nanotechnology – Precision Engineering • AFM – Biological Engineering • Bacterial Robotics

TRM Summer Plan • June – – – – Literature & Web review Draft course syllabus ID Guest speaker & researcher/collaborator connections Assemble Readings & web references PPT & graphics assembly Team-formation process Key MIT faculty & labs to engage • July – – Refine syllabus Solidify guests Confirm Readings Industry-specific References, e. g. seminar series • August – Finalize above – Ramp-up Promotion • Posters • Word of Mouth, buzzbuilding

Potential Academia Speakers • Kimerling, Micro. Photonics • Ned Thomas, Soldier Nanotech – http: //web. mit. edu/newsoffice/nr/2002/isnqa. html • Marty Schmidt, MTL / MEMS – http: //www-mtl. mit. edu/mtlhome/ • Bruce Rosen, Martinos / Neuro. MRI – http: //hst. mit. edu/martinos/ • Eric Lander, Whitehead / Genomics – http: //www. wi. mit. edu/news/genome/lander. html • Tom Knight, AI Lab / Computation & Biology – http: //www. ai. mit. edu/people/tk/tk. html

Potential Industry Speakers • John Santini, Micro. CHIPS / MEMS Drug Delivery Systems • Carmichael Roberts, Surface. Logix / Soft Lithography • Noubar Afeyan, Flagship / Biotech • Paolo Gargini, Intel Fellow, Chair of Int’l RM Committee – http: //www. intel. com/research/silicon/itroadmap. htm – http: //www. intel. com/pressroom/kits/bios/gargini. htm

Goal • Start with Communications RM • Presentation from visitors/guests from other technologies; what they think • Students form teams and pursue RM’s on tech of their choice • Project-based course

Syllabus 1. Intro, Overview, Case Examples, Expectations, Technology Themes @ MIT 2. Communications Roadmapping 3. Historic Efforts e. g. Sematech 4. Roadmapping Expectations 5. Biotech Speakers 6. Infotech Speakers 7. Tinytech Speakers 8. … 9. … 10. … 11. Finale

Details to be hashed out… • • Two full-days foci, at end of semester All teams Think about how to make it Attend talks & seminar series in that tech sector, that’s part of the course

One page briefing • • • What’s course Projects delivering value TRMs valuable for sponsors & labs Who are key people? Rope in key faculty

Connections • Ted Piepenrock • Powertrain GM, Fuel Cell • Lean Aero • SD folks interested? • Technology & Industry Roadmapping • How take components & glue them together • SD models for each, and mega model • Orchestration

Financing • Darpa – Microphot, comm industry is fruitfly – Defense aerospace, dinosaur – Multiple industries interesting

todos • Pay Joost – Lessard again – Charlie 50% support?

701de3805bbb4125af715981683eba09.ppt