7557e75e732031f450d7290927dc7166.ppt

- Количество слайдов: 43

Innovation centres, Technology Transfer centres and Technology incubators as promoters of innovative entrepreneurship EU Strategy for the Baltic Sea Region Incentive for Innovative Entrepreneurship Dr. Phys. Māris Ēlerts, Deputy Director of LIAA MBA. Evija Pudāne M. Soc. Sc. Viesturs Zeps Riga, 21. 09. 2011

Importance of H-tech sector • America’s robust economic expansion is being led by high-technology sector, which is currently generating one third of real economic growth. US leadership in the high-tech sector highlights the gap between US fast-growing and dynamic economy and the slow-growth economies of Europe and Japan … These income gaps show no sign of narrowing any time soon. • Not only is the volume of funds raised for venture capital investment in the US some five times the European total, but a far higher proportion of equity investment is directed in the US towards high technology sectors. ” Gill D. , Martin C. , Minshall T. , Rigby M. Funding Technology. Lessons from America. 2000

Innovation = Economic Growth “If you want real growth, you have to have new technologies” Source: Business Week Dr. Eli Opper – Chief Scientist, Ministry of Industry, Trade and Labor

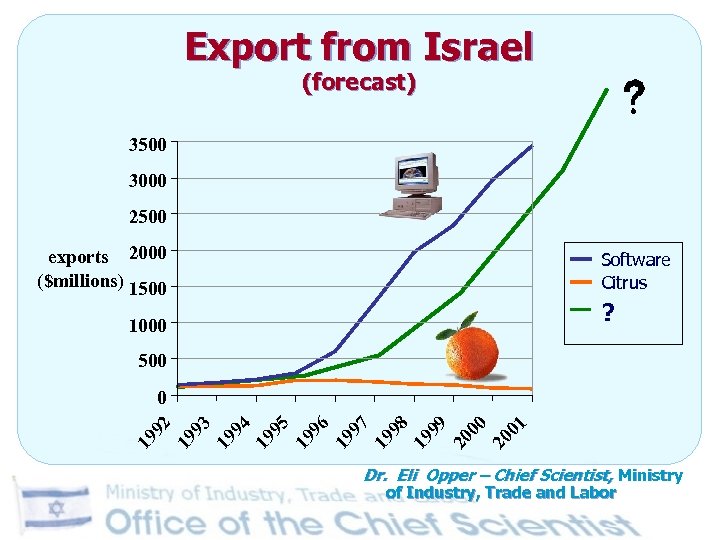

Export from Israel (forecast) 3500 3000 2500 exports 2000 ($millions) 1500 Software Citrus ? 1000 500 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 0 Dr. Eli Opper – Chief Scientist, Ministry of Industry, Trade and Labor

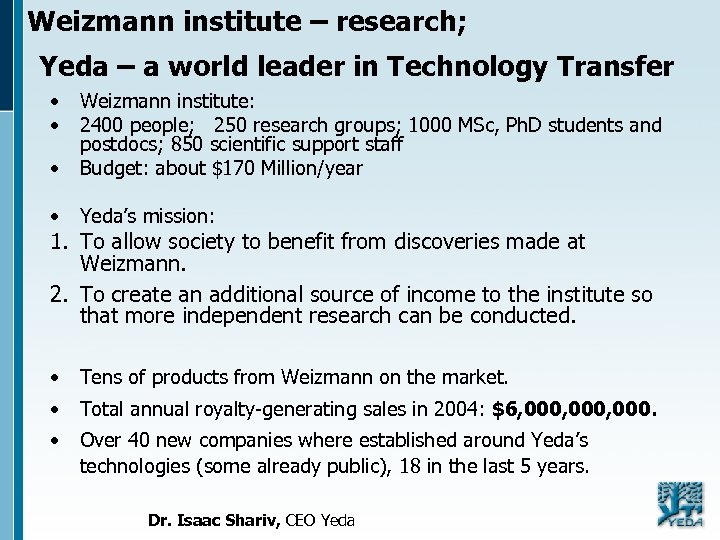

Weizmann institute – research; Yeda – a world leader in Technology Transfer • • • Weizmann institute: 2400 people; 250 research groups; 1000 MSc, Ph. D students and postdocs; 850 scientific support staff Budget: about $170 Million/year • Yeda’s mission: • Tens of products from Weizmann on the market. • Total annual royalty-generating sales in 2004: $6, 000, 000. • Over 40 new companies where established around Yeda’s technologies (some already public), 18 in the last 5 years. 1. To allow society to benefit from discoveries made at Weizmann. 2. To create an additional source of income to the institute so that more independent research can be conducted. Dr. Isaac Shariv, CEO Yeda

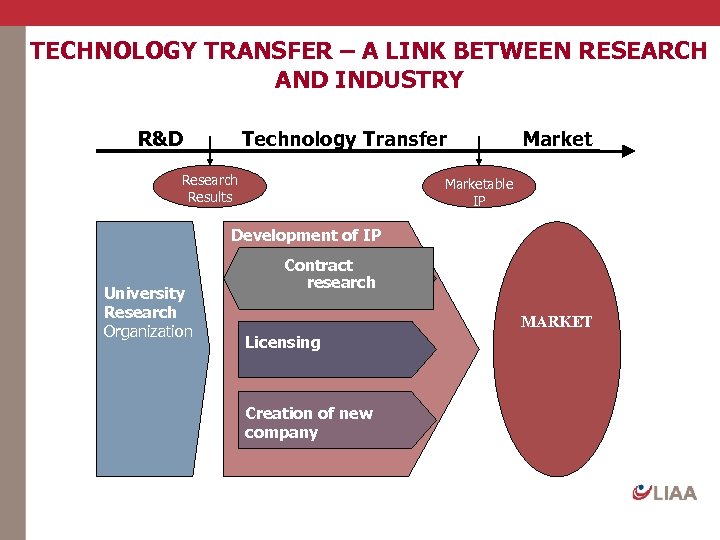

TECHNOLOGY TRANSFER – A LINK BETWEEN RESEARCH AND INDUSTRY R&D Technology Transfer Research Results Marketable IP Development of IP University Research Organization Contract research MARKET Licensing Creation of new company

What Technology Transfer is about? • Technology Transfer is a contact sport… it is about building relationships • Technology Transfer programs are expensive – It takes 10 to 15 years for an office to generate enough revenue to off-set their expenses – One “winner” may make enough money to pay for an office…but most technologies do not generate significant income • Technology Transfer programs do more than commercialize technology – Build relationships with the business community – Build relationships with the financial (Venture Capital) community – Improve community awareness of institutional research activity – Provides institutional participation in economic development – Educate Faculty and Students about intellectual property, market research and commercializing innovative technology • Technology Transfer is a long-term process – From the time a patent is filed until revenue is coming to the institution can be 10+ years Source: Stuart Gordon

The Legal Framework for Technology Transfer • Motivating legislation on protection of intellectual property rights (IPR). Legal structure similar to Bayh – Dole act. Are the laws in Latvia Supportive of University Technology Transfer? – Institutional ownership of the IP and management on behalf of Inventor – Royalty sharing with Inventors is crucial. – Effective Patent and Copyright protection • Easy starting and closing an enterprise • Legislation favorable to risk investors (e. g. – individual income tax benefits) • University has effective policy for IP management – Incentive to Inventor/Author – Effective management of Conflicts of interest • Established policy for corporate sponsored research and consultation – Fair and appropriate access to University research and resources – Guidelines and policies for faculty consultants Government support programs – Incubators – Direct tech transfer support programs • Developed VC community, Entrepreneurs

University and Industry: Two diverse cultures University culture Research to educate, break ground, provide service (economic development) Pace is slower Mission = basic and applied research Technology transfer activities are companion to applied research mission Industry culture Mission toward research / R&D / commercialization Quick-paced Solve problems - develop new products - profit Maintain control of science to explore full potential of discovery (initially) Direct and indirect economic impact

Lessons from Israeli Tech Transfer system • Weizmann Institute is aimed at basic science excellence (not applied science). • Industrial funding (<15% of research budget) are restricted, in order to preserve integrity and academic freedom. • Scientists focus on science, not on commercialization. • Scientists are rewarded for success (40%). • Tech transfer team which knows the campus and the market: Weizmann graduates with industrial background. Þ Þ More significant discoveries and inventions. better patents. Very high income from commercialization. More money for basic research.

The Open Science Model • University (PRO) does not retain any IP rights (no patent applications) • No need for active IP management • Little incentive to invest in applications of inventions • Often no direct impact on regional economy • Still the most widespread model in Europe • Innovation rests on Industry • Most inventions from PROs are not turned into innovations • Responsibility of Inventor for IP © IMG Gmb. H, T. Schwing, 2005 IMG Innovations-Management Gmb. H ESTER-Workshop 23. 09. 2005 / Folie 11

The interaction model • Builds on the Licence Model and IP management • Proof of principle is made in partnership with industry • Demonstration funded in part by public money (example EC framework programs) • Fosters innovation as interactive process • Compatible with PROs missions: – Contributes to Science – PRO can capitalize on foreground – Fair share of returns • Contributes to regional economy • Starts to works in Europe, but could work much IMG Innovations-Management Gmb. H better © IMG Gmb. H, T. Schwing, 2005 ESTER-Workshop 23. 09. 2005 / Folie 12

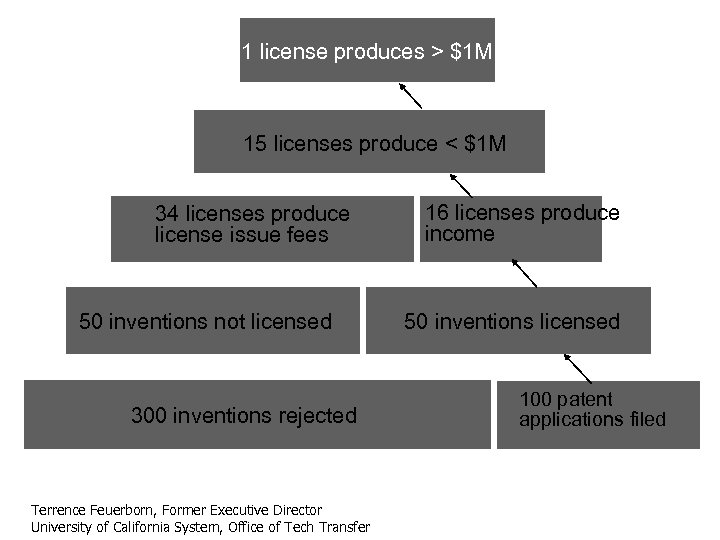

1 license produces > $1 M 15 licenses produce < $1 M 34 licenses produce license issue fees 50 inventions not licensed 300 inventions rejected Terrence Feuerborn, Former Executive Director University of California System, Office of Tech Transfer 16 licenses produce income 50 inventions licensed 100 patent applications filed

The Spin-out Model • Also Build on the licence model and IP management • Background technology is used as platform to develop new business concepts • Proof of principle by the researchers themselves • Development funded by seed capital and funding (difficult) • Only alternative when no industry partner in sight • Contributes to regional development with labour • Contributes to European and national economy • Slow process: more than 10 years for mature companies © IMG Gmb. H, T. Schwing, 2005 IMG Innovations-Management Gmb. H ESTER-Workshop 23. 09. 2005 / Folie 14

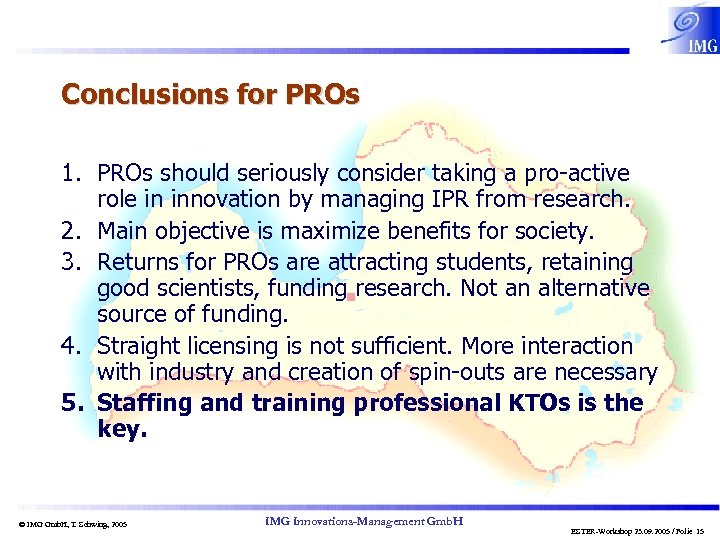

Conclusions for PROs 1. PROs should seriously consider taking a pro-active role in innovation by managing IPR from research. 2. Main objective is maximize benefits for society. 3. Returns for PROs are attracting students, retaining good scientists, funding research. Not an alternative source of funding. 4. Straight licensing is not sufficient. More interaction with industry and creation of spin-outs are necessary 5. Staffing and training professional KTOs is the key. © IMG Gmb. H, T. Schwing, 2005 IMG Innovations-Management Gmb. H ESTER-Workshop 23. 09. 2005 / Folie 15

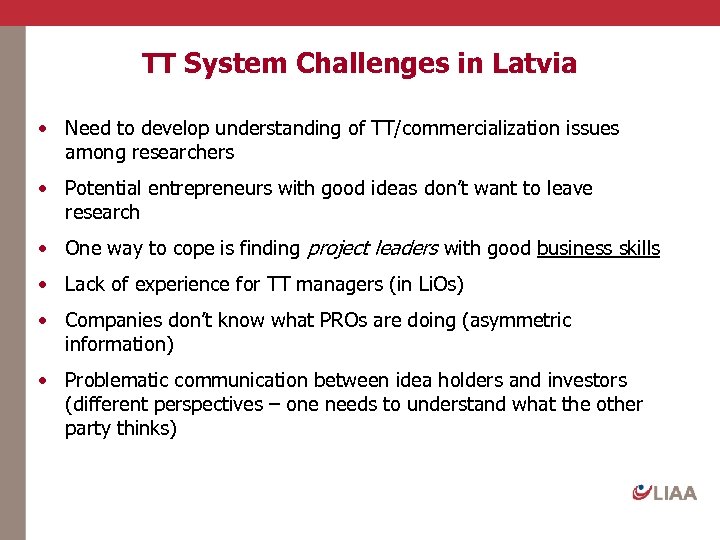

TT System Challenges in Latvia • Need to develop understanding of TT/commercialization issues among researchers • Potential entrepreneurs with good ideas don’t want to leave research • One way to cope is finding project leaders with good business skills • Lack of experience for TT managers (in Li. Os) • Companies don’t know what PROs are doing (asymmetric information) • Problematic communication between idea holders and investors (different perspectives – one needs to understand what the other party thinks)

• European Knowledge Transfer Society (EUKTS) What is EUKTS – a proposal for a new organization ensuring quality in knowledge and technology transfer profession – main objectives is to define professional curriculum and certification and accredit courses and certify individuals – includes existing organizations and networks supported by Member States – not a training provider – not a professional association – a not for-profit organization • FUNCTIONS – Accreditation/reaccreditation of courses – Certification/recertification for professionals(3 levels of certification) – Coordination with main associations working on data collection • PARTNERS – Governmental institutions, Agencies; Universities; Private firms; Network of knowledge transfer offices; IPR professionals; European Patent Organization Academy; LIAA – Italy, Austria, Czech Republic, UK, Netherlands, France, Belgium, Germany, Latvia

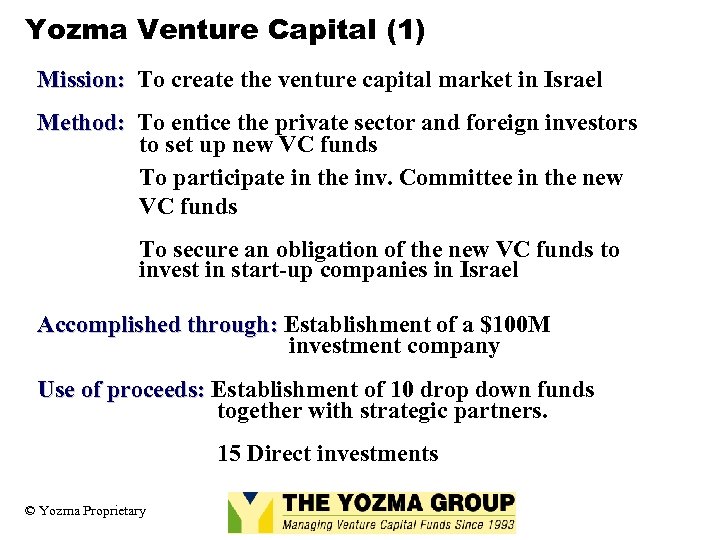

Yozma Venture Capital (1) Mission: To create the venture capital market in Israel Method: To entice the private sector and foreign investors to set up new VC funds To participate in the inv. Committee in the new VC funds To secure an obligation of the new VC funds to invest in start-up companies in Israel Accomplished through: Establishment of a $100 M investment company Use of proceeds: Establishment of 10 drop down funds together with strategic partners. 15 Direct investments © Yozma Proprietary

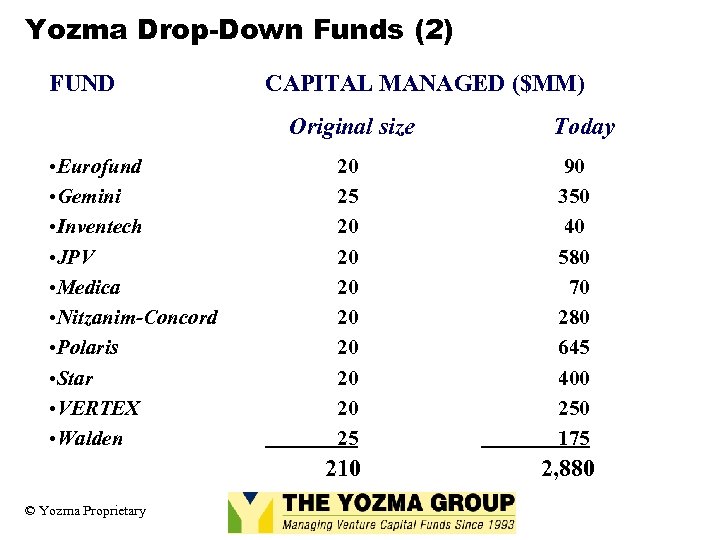

Yozma Drop-Down Funds (2) FUND CAPITAL MANAGED ($MM) Original size • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden Today 90 350 40 580 70 280 645 400 250 175 210 © Yozma Proprietary 20 25 20 20 25 2, 880

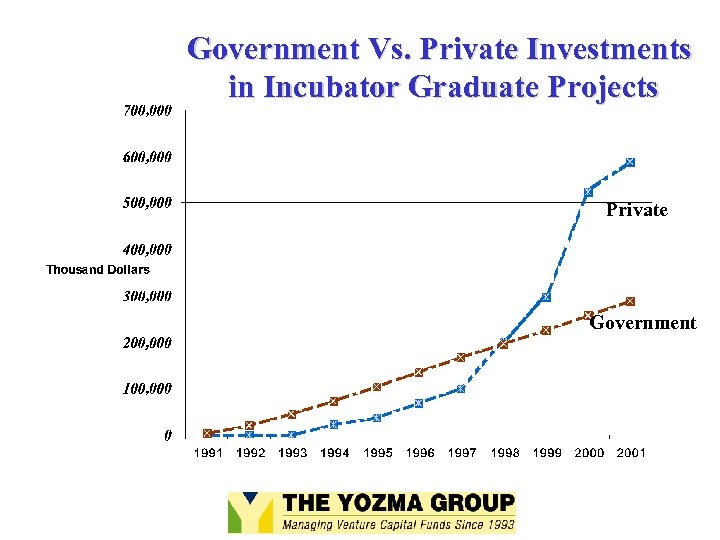

Government Vs. Private Investments in Incubator Graduate Projects Private Government

Lessons from Israeli Tech Transfer system Venture capital funds and “angels” are the most important sources for investment funds The major difficulties: Fund raising – Establishment of business contacts: strategic partners and – marketing Protection & management of IPR – The most meaningful government assistance: Promoting the establishment of VC funds through the – Yozma program Industrial background and experience enforce the creation of successful enterprises Investment s in R&D promote an “R&D culture” that becomes a breeding ground for entrepreneurs and entrepreneurial ideas The incubators program provides a “ balancing” measure to concentrating in few market trendy industrial sectors The involvement of “angels” and other individuals in funding the surge of establishing start-ups needs to be evaluated • •

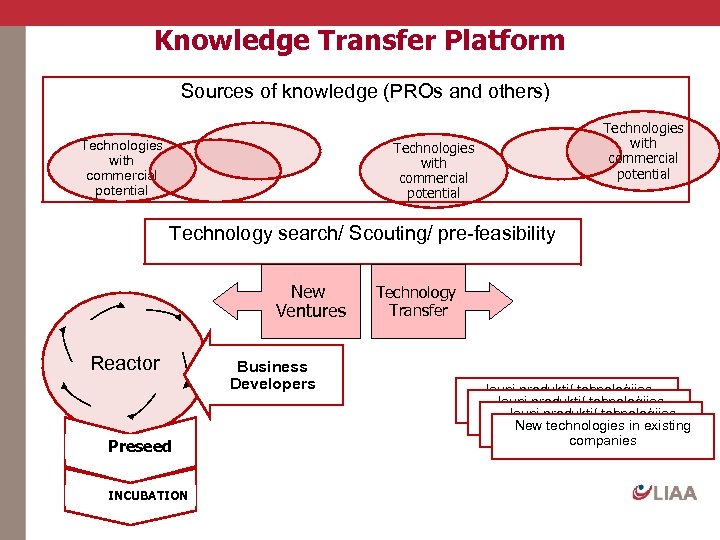

Knowledge Transfer Platform Sources of knowledge (PROs and others) Technologies with commercial potential Technology search/ Scouting/ pre-feasibility New Ventures Reactor Preseed Pirmsinkubācija INCUBATION Inkubācija Business Developers Technology Transfer Jauni produkti/ tehnoloģijas esošiem uzņēmumiem New technologies in existing esošiem uzņēmumiem companies

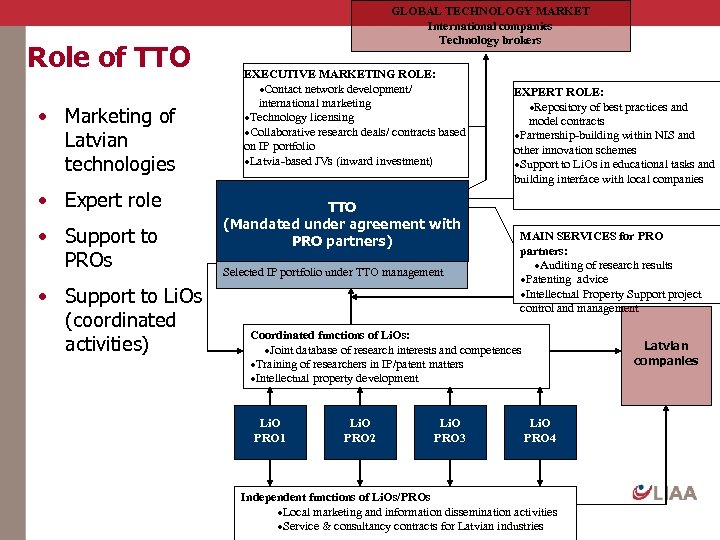

Role of TTO • Marketing of Latvian technologies • Expert role • Support to PROs • Support to Li. Os (coordinated activities) GLOBAL TECHNOLOGY MARKET International companies Technology brokers EXECUTIVE MARKETING ROLE: ·Contact network development/ international marketing ·Technology licensing ·Collaborative research deals/ contracts based on IP portfolio ·Latvia-based JVs (inward investment) TTO (Mandated under agreement with PRO partners) Selected IP portfolio under TTO management EXPERT ROLE: ·Repository of best practices and model contracts ·Partnership-building within NIS and other innovation schemes ·Support to Li. Os in educational tasks and building interface with local companies MAIN SERVICES for PRO partners: ·Auditing of research results ·Patenting advice ·Intellectual Property Support project control and management Coordinated functions of Li. Os: ·Joint database of research interests and competences ·Training of researchers in IP/patent matters ·Intellectual property development Li. O PRO 1 Li. O PRO 2 Li. O PRO 3 Latvian companies Li. O PRO 4 Independent functions of Li. Os/PROs ·Local marketing and information dissemination activities ·Service & consultancy contracts for Latvian industries

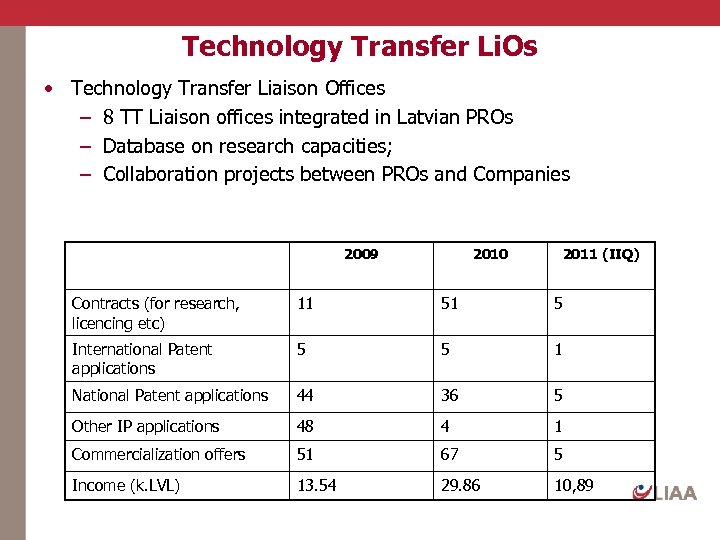

Technology Transfer Li. Os • Technology Transfer Liaison Offices – 8 TT Liaison offices integrated in Latvian PROs – Database on research capacities; – Collaboration projects between PROs and Companies 2009 2010 2011 (IIQ) Contracts (for research, licencing etc) 11 51 5 International Patent applications 5 5 1 National Patent applications 44 36 5 Other IP applications 48 4 1 Commercialization offers 51 67 5 Income (k. LVL) 13. 54 29. 86 10, 89

The international technology development and commercialization project “Commercialization reactor ” in collaboration with Virtual CEO Project aim is to connect researchers with serial entrepreneurs who will lead the invention or technology to the market place and who will attract investors and the support needed to create and operate a successful high tech start-up in Latvia and the European Union. Process Technology and researcher + Entrepreneurs New enterprise New investment opportunity

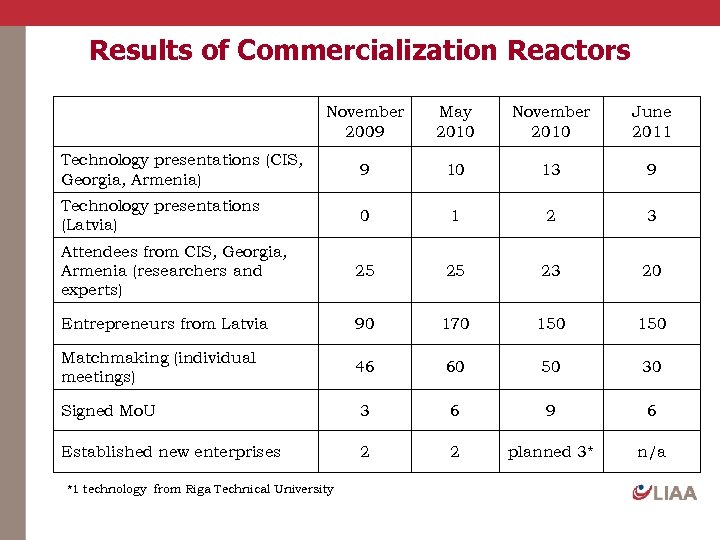

Results of Commercialization Reactors November 2009 May 2010 November 2010 June 2011 Technology presentations (CIS, Georgia, Armenia) 9 10 13 9 Technology presentations (Latvia) 0 1 2 3 Attendees from CIS, Georgia, Armenia (researchers and experts) 25 25 23 20 Entrepreneurs from Latvia 90 170 150 Matchmaking (individual meetings) 46 60 50 30 Signed Mo. U 3 6 9 6 Established new enterprises 2 2 planned 3* n/a *1 technology from Riga Technical University

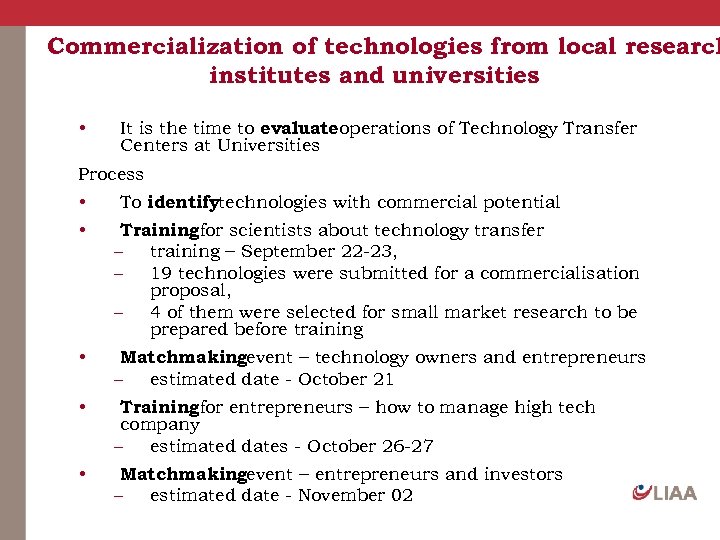

Commercialization of technologies from local research institutes and universities • It is the time to evaluateoperations of Technology Transfer Centers at Universities Process • To identifytechnologies with commercial potential • Trainingfor scientists about technology transfer – training – September 22 -23, – 19 technologies were submitted for a commercialisation proposal, – 4 of them were selected for small market research to be prepared before training • Matchmakingevent – technology owners and entrepreneurs – estimated date - October 21 • Trainingfor entrepreneurs – how to manage high tech company – estimated dates - October 26 -27 • Matchmakingevent – entrepreneurs and investors – estimated date - November 02

New forms of Business Incubation In late 1990 s has been driven to multiply the number of succesful, fast-growth, high technology businesses in US a) b) c) Its led by serial entrepreneur; it has its own seed fund drawn from founder’s own, VCF or corporate partner’s capital; it may have specific sector focus Conventional incubators offer “heat, light and dial tone”, but “Smart” Venture Investment claim to offer more, developing ideas and incubating them in-house as well as providing late seed capital and A, B and C round investment. Incubation today is seen as a way in which capital can be efficiently applied to support new technology businesses Gill D. , Martin C. , Minshall T. , Rigby M. Funding Technology. Lessons from America. 2000

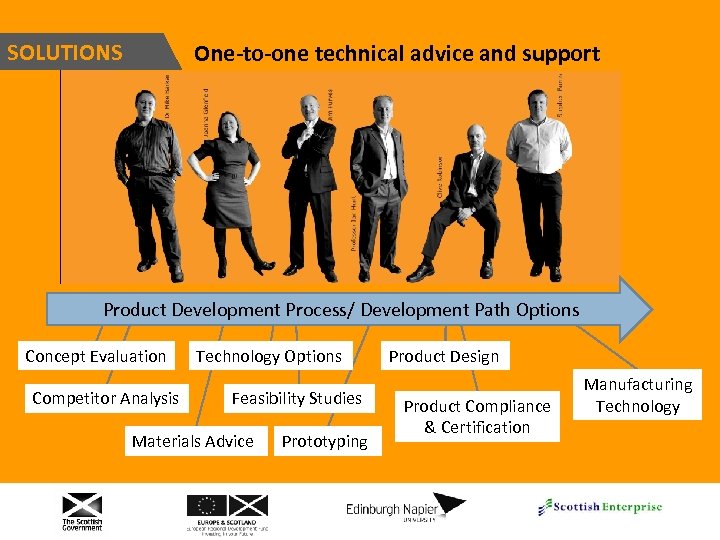

SOLUTIONS One-to-one technical advice and support Product Development Process/ Development Path Options Concept Evaluation Competitor Analysis Technology Options Feasibility Studies Materials Advice Prototyping Product Design Product Compliance & Certification Manufacturing Technology

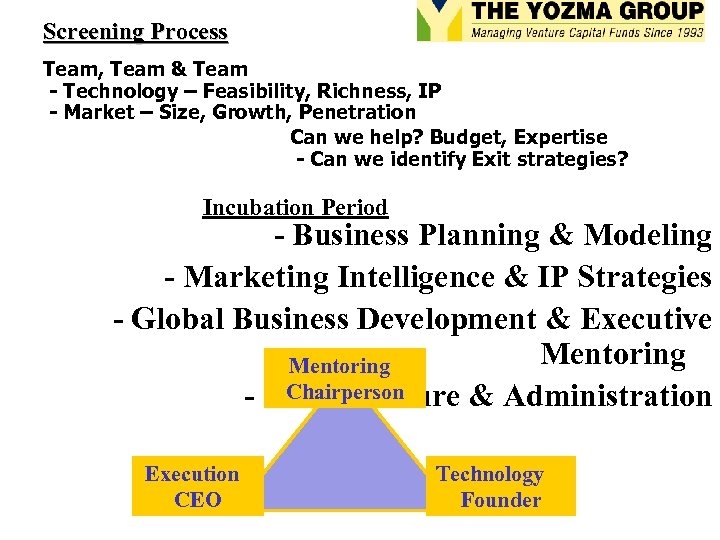

Screening Process Team, Team & Team - Technology – Feasibility, Richness, IP - Market – Size, Growth, Penetration Can we help? Budget, Expertise - Can we identify Exit strategies? Incubation Period - Business Planning & Modeling - Marketing Intelligence & IP Strategies - Global Business Development & Executive Mentoring Chairperson - Infrastructure & Administration Execution CEO Technology Founder

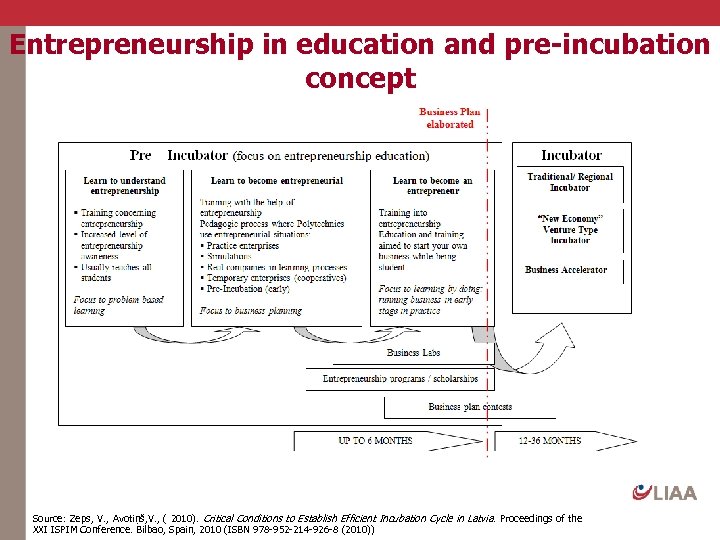

Entrepreneurship in education and pre-incubation concept Source: Zeps, V. , Avotiņš, V. , ( 2010). Critical Conditions to Establish Efficient Incubation Cycle in Latvia. Proceedings of the XXI ISPIM Conference. Bilbao, Spain, 2010 (ISBN 978 -952 -214 -926 -8 (2010))

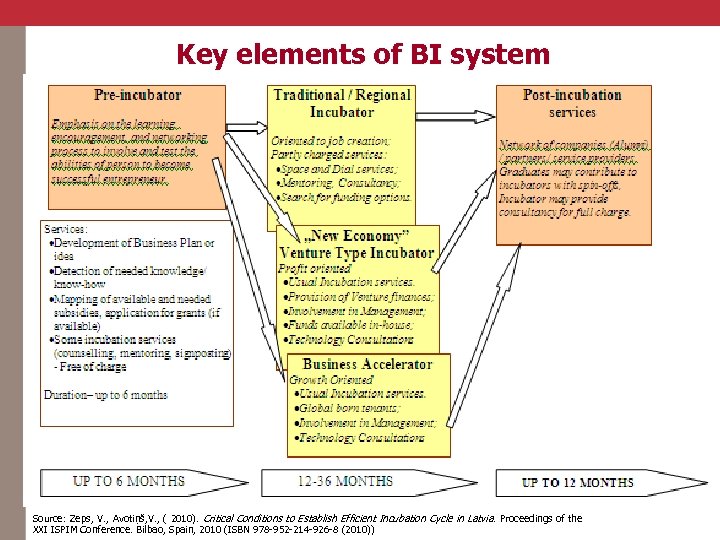

Key elements of BI system Source: Zeps, V. , Avotiņš, V. , ( 2010). Critical Conditions to Establish Efficient Incubation Cycle in Latvia. Proceedings of the XXI ISPIM Conference. Bilbao, Spain, 2010 (ISBN 978 -952 -214 -926 -8 (2010))

Latvia – selected initiatives in pre-incubation stage Promotion and Awareness ◦ ◦ Student Companies(Junior Acheiveivement Latvia) Business Men in 5 days (Training + Consultations) Idea Cup (Training + Consultations + Awards) ALTUM (Training + Consultations + Credits/ Grants) Business laboratories Mentoring Investment Rediness ◦ Business lab of SSE Riga ◦ SSE Riga MC ◦ SO “Līdere” ◦ CONNECT ◦ SEED Forum ◦ Pre-seed facility

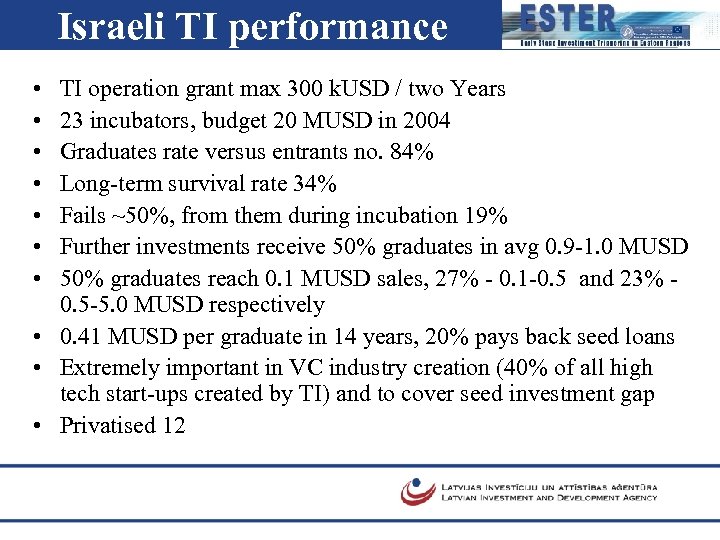

Israeli TI performance • • TI operation grant max 300 k. USD / two Years 23 incubators, budget 20 MUSD in 2004 Graduates rate versus entrants no. 84% Long-term survival rate 34% Fails ~50%, from them during incubation 19% Further investments receive 50% graduates in avg 0. 9 -1. 0 MUSD 50% graduates reach 0. 1 MUSD sales, 27% - 0. 1 -0. 5 and 23% 0. 5 -5. 0 MUSD respectively • 0. 41 MUSD per graduate in 14 years, 20% pays back seed loans • Extremely important in VC industry creation (40% of all high tech start-ups created by TI) and to cover seed investment gap • Privatised 12

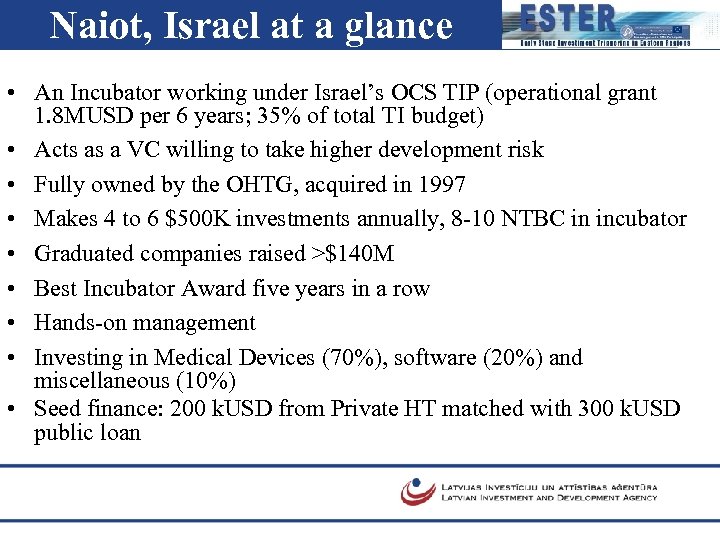

Naiot, Israel at a glance • An Incubator working under Israel’s OCS TIP (operational grant 1. 8 MUSD per 6 years; 35% of total TI budget) • Acts as a VC willing to take higher development risk • Fully owned by the OHTG, acquired in 1997 • Makes 4 to 6 $500 K investments annually, 8 -10 NTBC in incubator • Graduated companies raised >$140 M • Best Incubator Award five years in a row • Hands-on management • Investing in Medical Devices (70%), software (20%) and miscellaneous (10%) • Seed finance: 200 k. USD from Private HT matched with 300 k. USD public loan

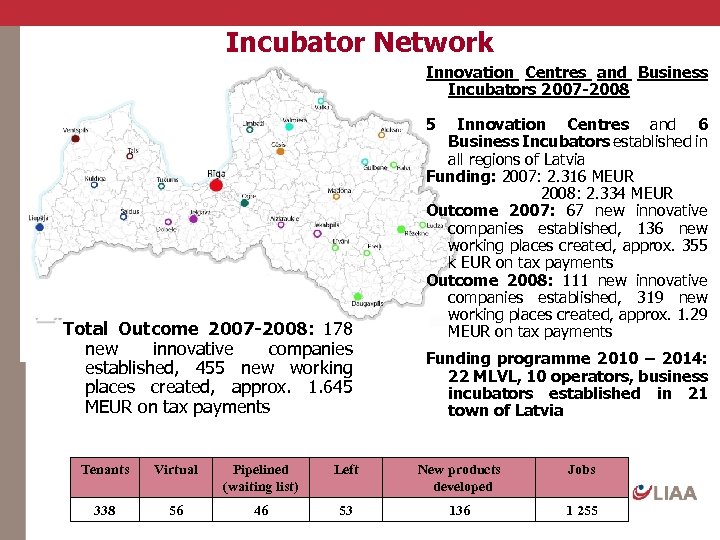

Incubator Network Innovation Centres and Business Incubators 2007 -2008 5 Total Outcome 2007 -2008: 178 new innovative companies established, 455 new working places created, approx. 1. 645 MEUR on tax payments Innovation Centres and 6 Business Incubators established in all regions of Latvia Funding: 2007: 2. 316 MEUR 2008: 2. 334 MEUR Outcome 2007: 67 new innovative companies established, 136 new working places created, approx. 355 k EUR on tax payments Outcome 2008: 111 new innovative companies established, 319 new working places created, approx. 1. 29 MEUR on tax payments Funding programme 2010 – 2014: 22 MLVL, 10 operators, business incubators established in 21 town of Latvia Tenants Virtual Pipelined (waiting list) Left New products developed Jobs 338 56 46 53 136 1 255

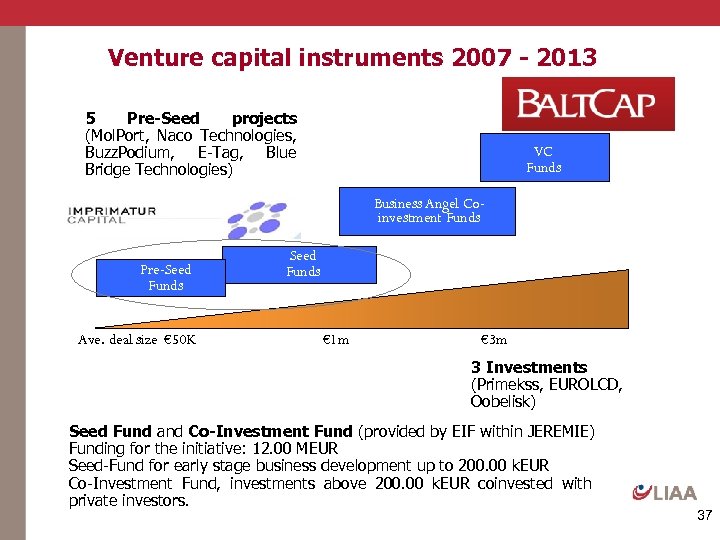

Venture capital instruments 2007 - 2013 5 Pre-Seed projects (Mol. Port, Naco Technologies, Buzz. Podium, E-Tag, Blue Bridge Technologies) VC Funds Business Angel Coinvestment Funds Pre-Seed Funds Ave. deal size € 50 K Seed Funds € 1 m € 3 m 3 Investments (Primekss, EUROLCD, Oobelisk) Seed Fund and Co-Investment Fund (provided by EIF within JEREMIE) Funding for the initiative: 12. 00 MEUR Seed-Fund for early stage business development up to 200. 00 k. EUR Co-Investment Fund, investments above 200. 00 k. EUR coinvested with private investors. 37

Technology Incubators (support system for research related start-ups) • Funding – EIF pre-seed and seed funds • Services ?

“Green” industry Technology incubator Program still in design phase • In cooperation with Innovation Norway and SIVA • Available funding: 8, 0 MEUR • Intended Structure: – Operation costs for TI – Pre-Seed for SMEs, 5. 0 k. EUR, intensity 90% – Seed for SMEs, 200. 0 k. EUR, intensity 70% • Timing: – April 2012, programme proposal accepted by the donor representatives; – May 2012, procurement documentation completed and procurement commenced;

B. The designed draft Growth 4 Future Scheme 1. Technology incubator grant 2. Pre-seed grant – Think for month 3. Seed soft loan (I and II) Management companies or Operators of TI’s – private companies providing space & infrastructure, management and S&M advice, basic business services and private investment structuring in exchange for equity position in the tenant company Target groups: – Potential entrepreneurs from industry – Potential entrepreneurs from academia Tested in Israel, with WB experts, EU experts, local expert panels – Repatriating scientists and R&D personnel – Regional inventors

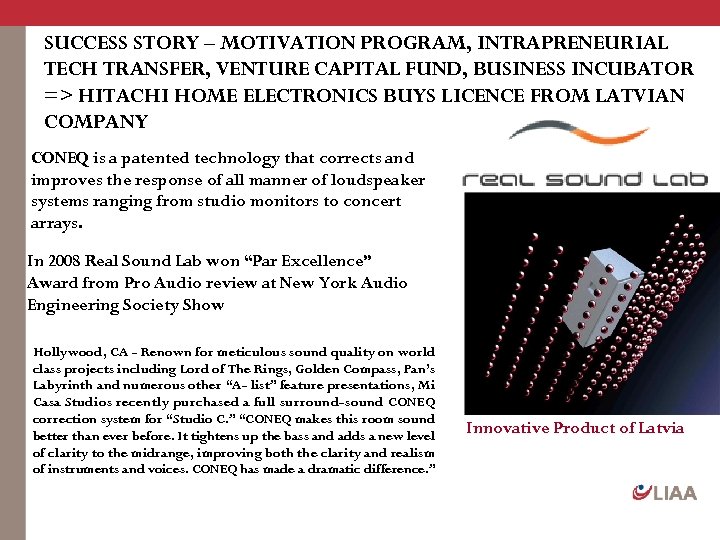

SUCCESS STORY – MOTIVATION PROGRAM, INTRAPRENEURIAL TECH TRANSFER, VENTURE CAPITAL FUND, BUSINESS INCUBATOR => HITACHI HOME ELECTRONICS BUYS LICENCE FROM LATVIAN COMPANY CONEQ is a patented technology that corrects and improves the response of all manner of loudspeaker systems ranging from studio monitors to concert arrays. In 2008 Real Sound Lab won “Par Excellence” Award from Pro Audio review at New York Audio Engineering Society Show Hollywood, CA - Renown for meticulous sound quality on world class projects including Lord of The Rings, Golden Compass, Pan’s Labyrinth and numerous other “A- list” feature presentations, Mi Casa Studios recently purchased a full surround-sound CONEQ correction system for “Studio C. ” “CONEQ makes this room sound better than ever before. It tightens up the bass and adds a new level of clarity to the midrange, improving both the clarity and realism of instruments and voices. CONEQ has made a dramatic difference. ” Innovative Product of Latvia

Few Samples. . . Hygene – compression of natural gas for cars Solar Energy – silicon solar panels

Thank you! Pērses iela 2, Rīga, LV-1442 Tālrunis: +371 67039410 Fakss: +371 67039401 E-pasts: maris. elerts@liaa. gov. lv www. liaa. gov. lv

7557e75e732031f450d7290927dc7166.ppt