87022f3998c3b3749b56adb29e469de3.ppt

- Количество слайдов: 11

Initial thoughts on methods to optimise capacity availability between ASEPs Transmission Workstream, 2 nd March 06

Content AMSEC auction results ® Options to optimisation capacity availability ® Key development areas ®

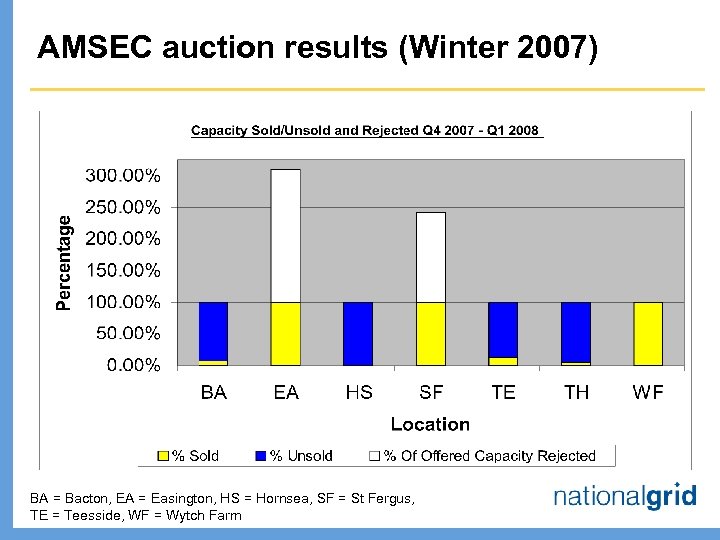

AMSEC auction results (Winter 2007) BA = Bacton, EA = Easington, HS = Hornsea, SF = St Fergus, TE = Teesside, WF = Wytch Farm

Optimisation of Capacity between ASEPs ® AMSEC auction results show ® Several ASEPs sold out for some periods, often with bids far in excess of available capacity ® Limited ability to complete investments to seek to satisfy user requirements within constrained period ® Other ® ASEPs with unsold capacity Are there methods by which unsold capacity at an ASEP could be “transferred” to other ASEPs to allow optimisation of available capacity?

Optimisation methods ®Assuming baselines remain fixed, two potential ways in which capacity may be optimised: ®Option 1 - Transfer of Unsold Capacity between interacting ASEPs ®Option 2 - Transfer of Sold Capacity between interacting ASEPs – “Market Maker”

Option 1. Transfer of unsold capacity - Principles ® ® Provide shippers at an ASEP with ability to obtain unsold capacity at other interacting ASEPs Amount of transfer dependant on “exchange rate” between ASEPs ® results in areas of possible transfer e. g. Easington, Hornsea, Aldborough, Theddlethorpe, Bacton, Teesside ® ® Unsold capacity for year ahead after AMSEC auction aggregated into one “pot” Allocate aggregate unsold capacity to interacting ASEPs based on ® unsatisfied bids in AMSEC auction; or ® bids placed in new auction held after AMSEC and before RMSEC

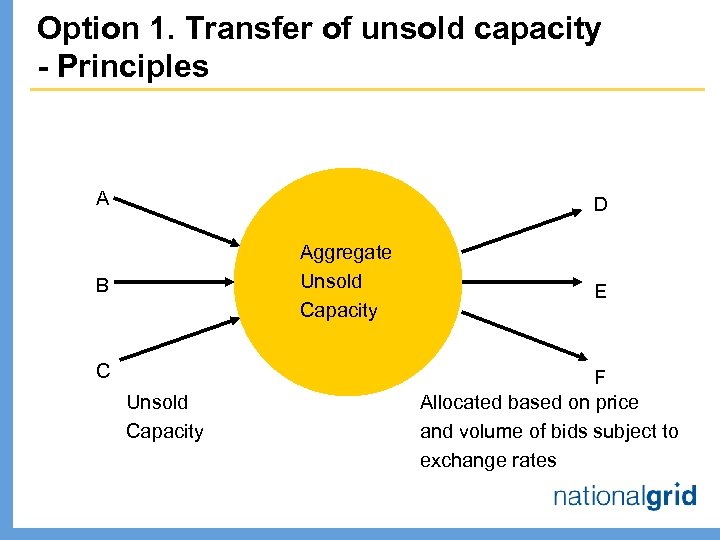

Option 1. Transfer of unsold capacity - Principles A D Aggregate Unsold Capacity B C Unsold Capacity E F Allocated based on price and volume of bids subject to exchange rates

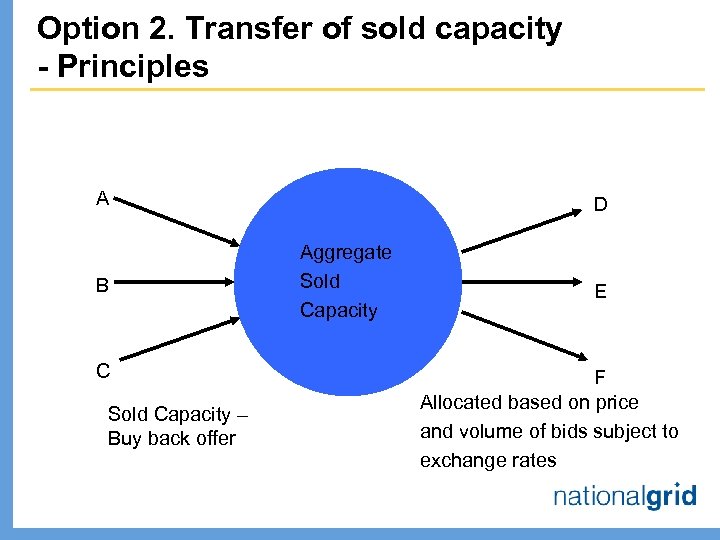

Option 2. Transfer of sold capacity - Principles ® After AMSEC auction, issue buy back tender to all ASEPs ® include [2] months period for acceptance by National Grid If any offers, then undertake additional AMSEC type auction ® Release non-obligated capacity (within [2] months of receipt of offers) where value of bids exceed cost of required buy back offers, subject to exchange rates ®

Option 2. Transfer of sold capacity - Principles A B C Sold Capacity – Buy back offer D Aggregate Sold Capacity E F Allocated based on price and volume of bids subject to exchange rates

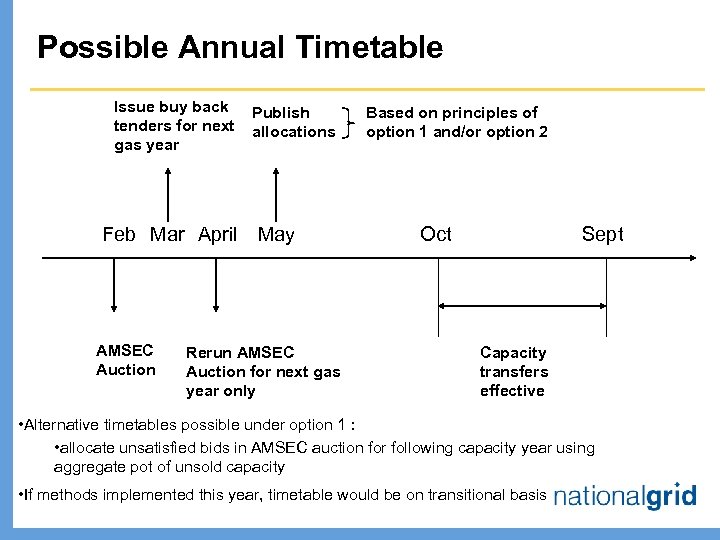

Possible Annual Timetable Issue buy back tenders for next gas year Feb Mar April AMSEC Auction Publish allocations May Rerun AMSEC Auction for next gas year only Based on principles of option 1 and/or option 2 Oct Sept Capacity transfers effective • Alternative timetables possible under option 1 : • allocate unsatisfied bids in AMSEC auction for following capacity year using aggregate pot of unsold capacity • If methods implemented this year, timetable would be on transitional basis

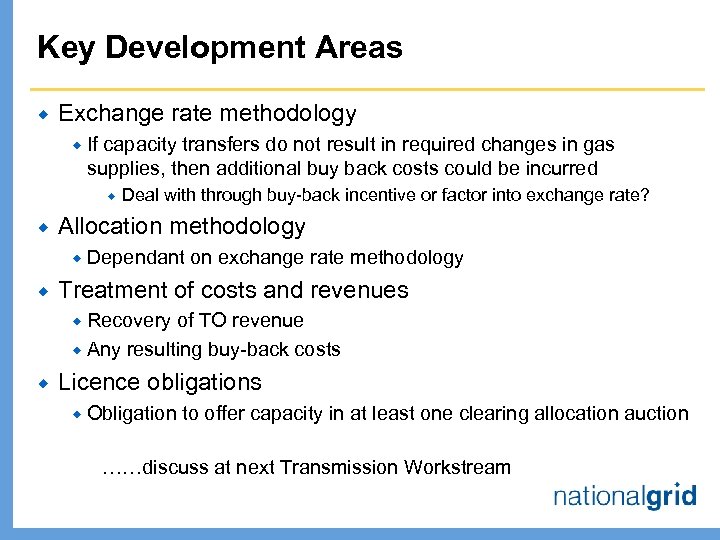

Key Development Areas ® Exchange rate methodology ® If capacity transfers do not result in required changes in gas supplies, then additional buy back costs could be incurred ® ® Deal with through buy-back incentive or factor into exchange rate? Allocation methodology ® Dependant ® on exchange rate methodology Treatment of costs and revenues ® Recovery of TO revenue ® Any resulting buy-back costs ® Licence obligations ® Obligation to offer capacity in at least one clearing allocation auction ……discuss at next Transmission Workstream

87022f3998c3b3749b56adb29e469de3.ppt