c0f5277dde039e75ff289f4b1e091c1d.ppt

- Количество слайдов: 24

Infrastructure meets Business Globally: What to Expect from PFI? Nuno Gil Manchester Business School (on sabbatical) Global Research Awardee (Royal Academy of Engineering) CRGP, Stanford University (visiting scholar) © Nuno Gil Hong Kong, 2009

Infrastructure meets Business • Infrastructure Gap is Massive (~ $53 trillion OECD 07) – population growth, migration towards cities, deteriorated infrastructure, globalization of supply chains • Governments worldwide resort to privatesector capital due to constrained budgets and neo-liberal ideology © Nuno Gil Hong Kong, 2009

Infrastructure meets Business – transportation (airports, railways, highways, ports) – utilities (water, electricity, gas) – social assets (hospitals, schools, prisons) © Nuno Gil Hong Kong, 2009

• The Funding Issue i) user charges ii) government budget iii) hybrid scheme © Nuno Gil Hong Kong, 2009

The Financing Issue • Public finance - bonds; central government funds • • Private-capital involvement - privatization of state-owned infrastructure firms - private finance initiatives (PFIs)/concessions - contracting out provision of public services • Key players: - public listed companies (suppliers & clients) - pension funds, private investors, family houses; infrastructure funds; funds of infrastructure funds © Nuno Gil Hong Kong, 2009

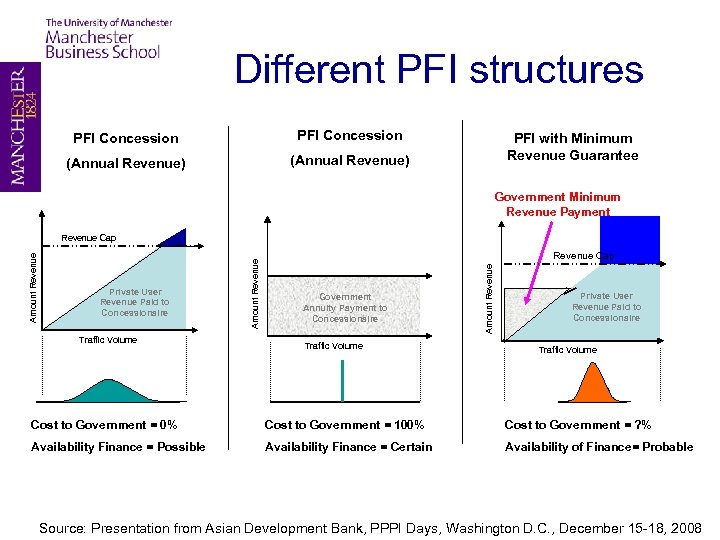

Different PFI structures PFI Concession (Annual Revenue) PFI with Minimum Revenue Guarantee Government Minimum Revenue Payment Traffic Volume Revenue Cap Government Annuity Payment to Concessionaire Traffic Volume Amount Revenue Private User Revenue Paid to Concessionaire Amount Revenue Cap Private User Revenue Paid to Concessionaire Traffic Volume Cost to Government = 0% Cost to Government = 100% Cost to Government = ? % Availability Finance = Possible Availability Finance = Certain Availability of Finance= Probable Source: Presentation from Asian Development Bank, PPPI Days, Washington D. C. , December 15 -18, 2008

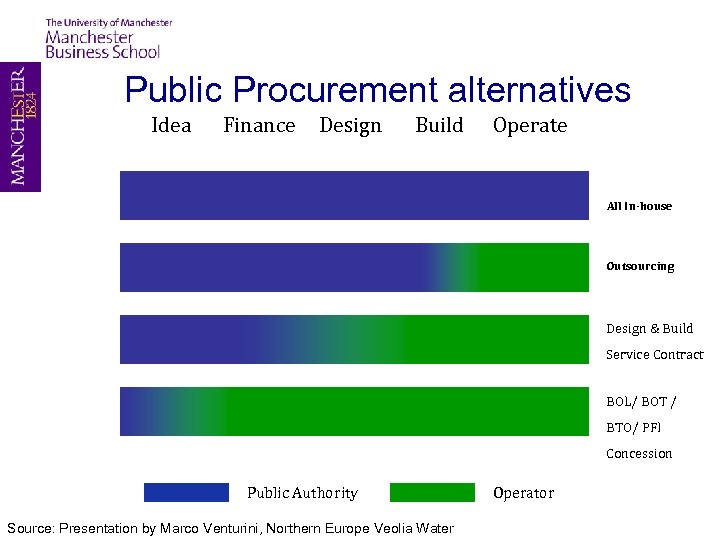

Public Procurement alternatives Idea Finance Design Build Operate All In-house Outsourcing Design & Build Service Contract BOL/ BOT / BTO/ PFI Concession Public Authority Source: Presentation by Marco Venturini, Northern Europe Veolia Water Operator

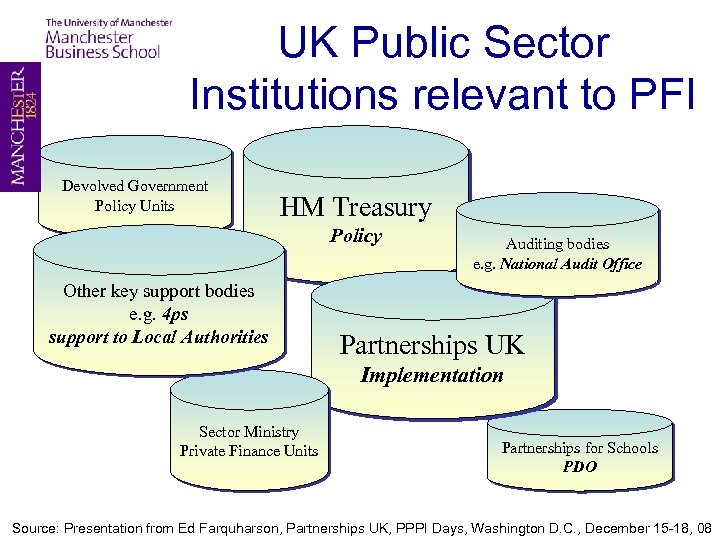

UK Public Sector Institutions relevant to PFI Devolved Government Policy Units HM Treasury Policy Other key support bodies e. g. 4 ps support to Local Authorities Auditing bodies e. g. National Audit Office Partnerships UK Implementation Sector Ministry Private Finance Units Partnerships for Schools PDO Source: Presentation from Ed Farquharson, Partnerships UK, PPPI Days, Washington D. C. , December 15 -18, 08

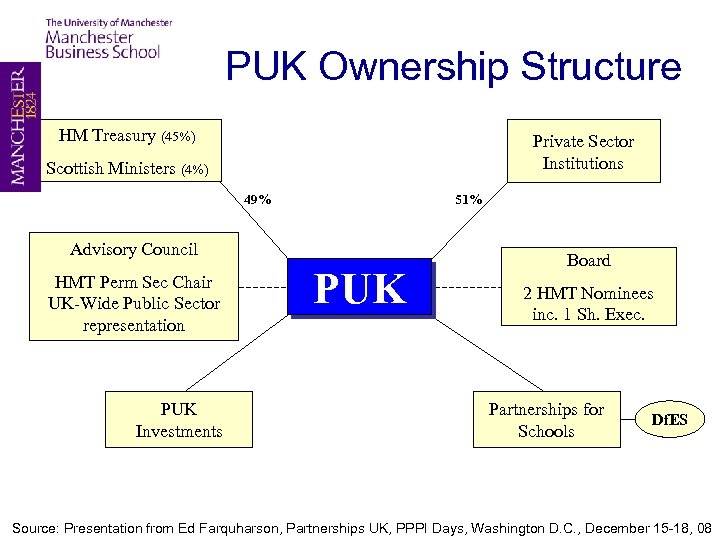

PUK Ownership Structure HM Treasury (45%) Private Sector Institutions Scottish Ministers (4%) 49% 51% Advisory Council HMT Perm Sec Chair UK-Wide Public Sector representation PUK Investments PUK Board 2 HMT Nominees inc. 1 Sh. Exec. Partnerships for Schools Df. ES Source: Presentation from Ed Farquharson, Partnerships UK, PPPI Days, Washington D. C. , December 15 -18, 08

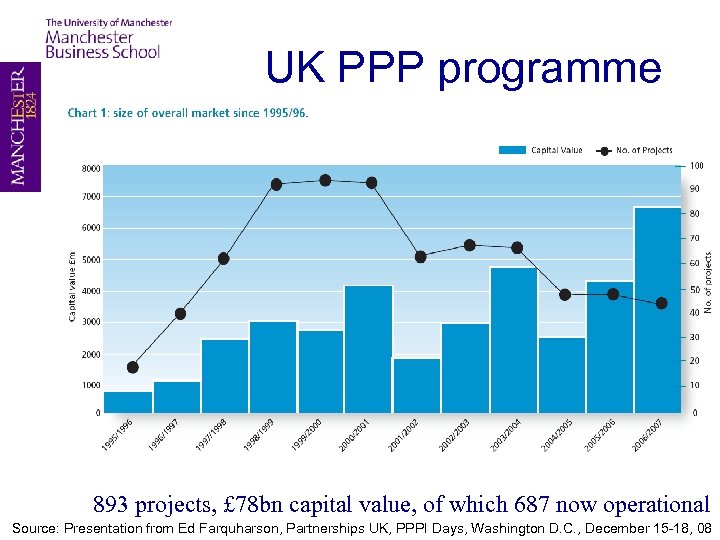

UK PPP programme 893 projects, £ 78 bn capital value, of which 687 now operational Source: Presentation from Ed Farquharson, Partnerships UK, PPPI Days, Washington D. C. , December 15 -18, 08

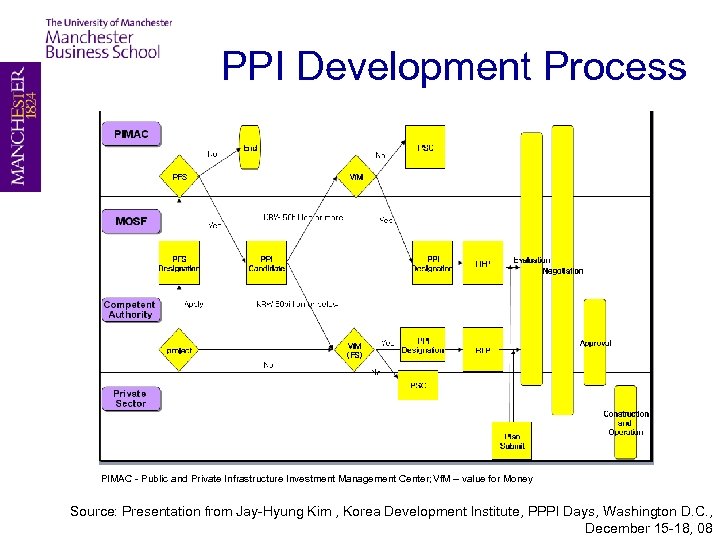

PPI Development Process PIMAC - Public and Private Infrastructure Investment Management Center; Vf. M – value for Money Source: Presentation from Jay-Hyung Kim , Korea Development Institute, PPPI Days, Washington D. C. , December 15 -18, 08

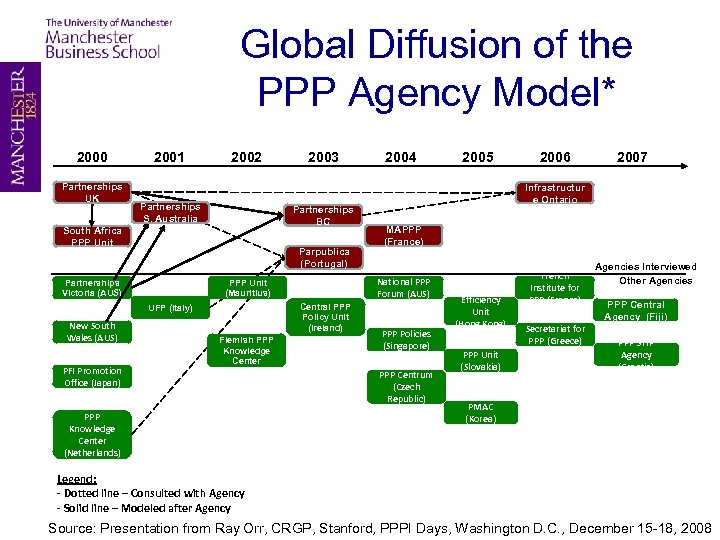

Global Diffusion of the PPP Agency Model* 2000 Partnerships UK 2001 2002 Partnerships S. Australia Partnerships BC South Africa PPP Unit Parpublica (Portugal) Partnerships Victoria (AUS) Central PPP Policy Unit (Ireland) PFI Promotion Office (Japan) Flemish PPP Knowledge Center (Netherlands) 2004 2005 2006 2007 Infrastructur e Ontario MAPPP (France) National PPP Forum (AUS) PPP Unit (Mauritius) UFP (Italy) New South Wales (AUS) 2003 PPP Policies (Singapore) PPP Centrum (Czech Republic) Efficiency Unit (Hong Kong) PPP Unit (Slovakia) French Institute for PPP (France) Secretariat for PPP (Greece) Agencies Interviewed Other Agencies PPP Central Agency (Fiji) PPP STIP Agency (Croatia) PMAC (Korea) Legend: - Dotted line – Consulted with Agency - Solid line – Modeled after Agency Source: Presentation from Ray Orr, CRGP, Stanford, PPPI Days, Washington D. C. , December 15 -18, 2008

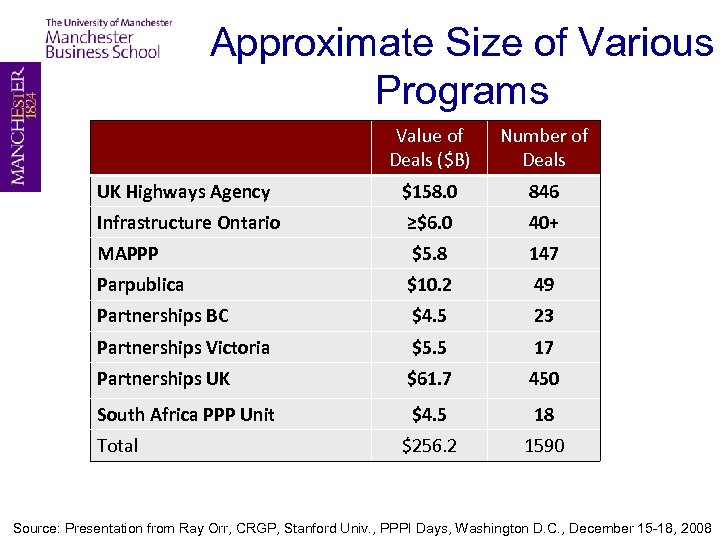

Approximate Size of Various Programs Value of Deals ($B) Number of Deals UK Highways Agency $158. 0 846 Infrastructure Ontario ≥$6. 0 40+ MAPPP $5. 8 147 Parpublica $10. 2 49 Partnerships BC $4. 5 23 Partnerships Victoria $5. 5 17 Partnerships UK $61. 7 450 South Africa PPP Unit $4. 5 18 $256. 2 1590 Total Source: Presentation from Ray Orr, CRGP, Stanford Univ. , PPPI Days, Washington D. C. , December 15 -18, 2008

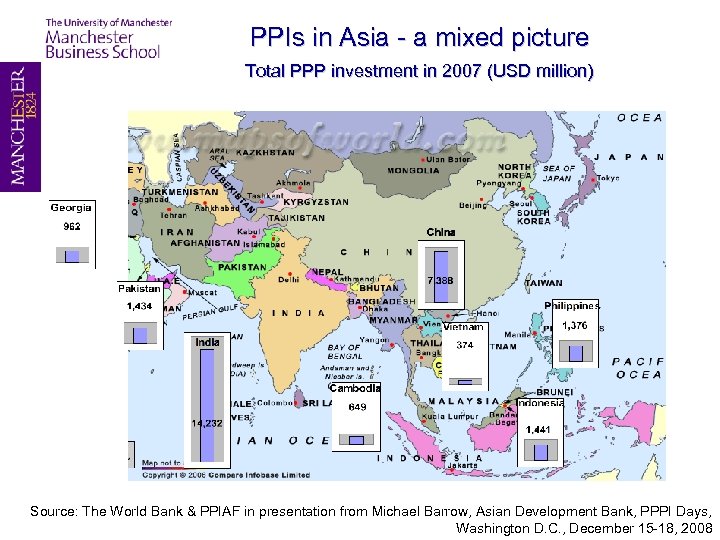

PPIs in Asia - a mixed picture Total PPP investment in 2007 (USD million) Source: The World Bank & PPIAF in presentation from Michael Barrow, Asian Development Bank, PPPI Days, Washington D. C. , December 15 -18, 2008

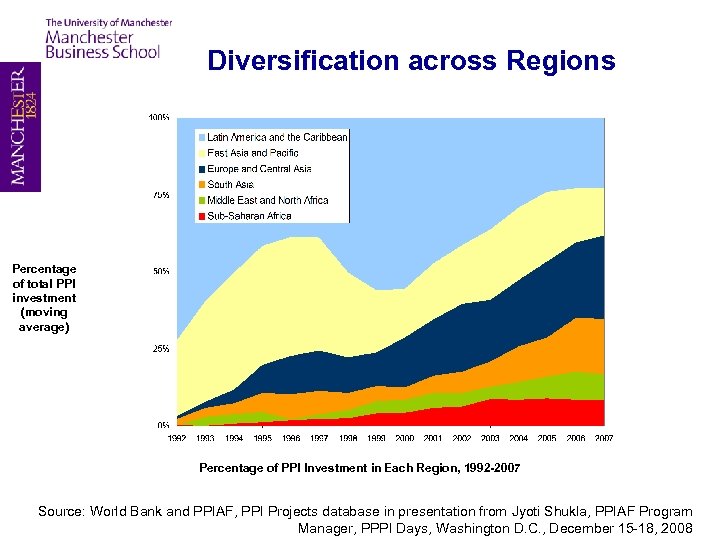

Diversification across Regions Percentage of total PPI investment (moving average) Percentage of PPI Investment in Each Region, 1992 -2007 Source: World Bank and PPIAF, PPI Projects database in presentation from Jyoti Shukla, PPIAF Program Manager, PPPI Days, Washington D. C. , December 15 -18, 2008

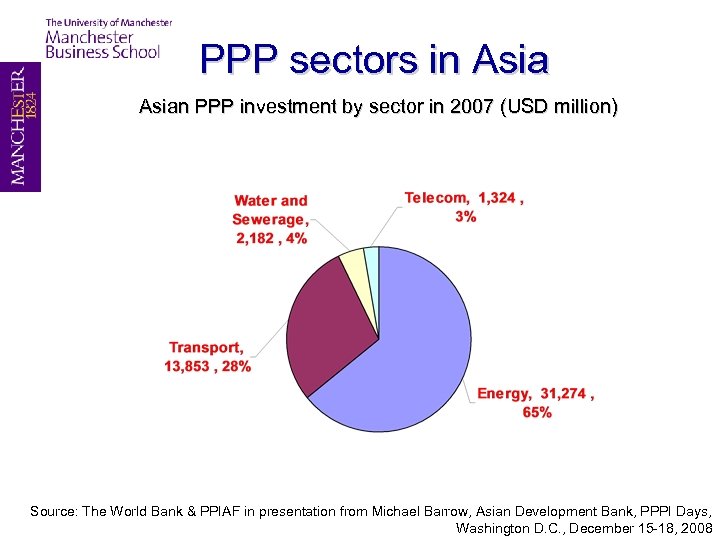

PPP sectors in Asian PPP investment by sector in 2007 (USD million) Source: The World Bank & PPIAF in presentation from Michael Barrow, Asian Development Bank, PPPI Days, Washington D. C. , December 15 -18, 2008

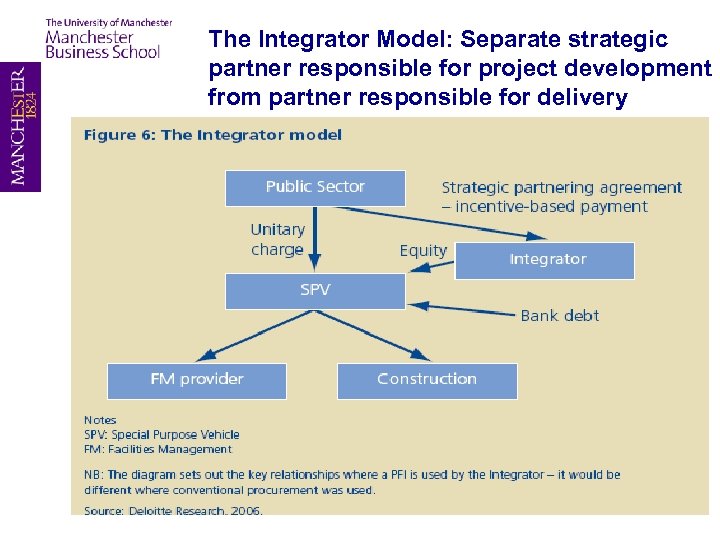

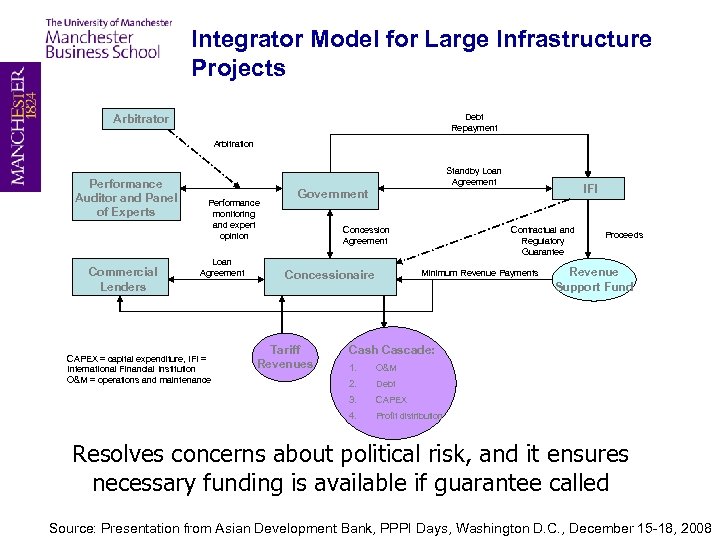

The Integrator Model: Separate strategic partner responsible for project development from partner responsible for delivery

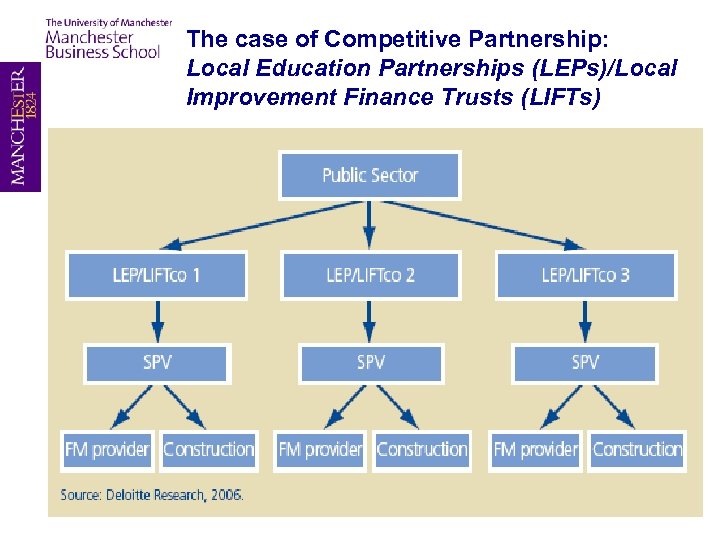

The case of Competitive Partnership: Local Education Partnerships (LEPs)/Local Improvement Finance Trusts (LIFTs)

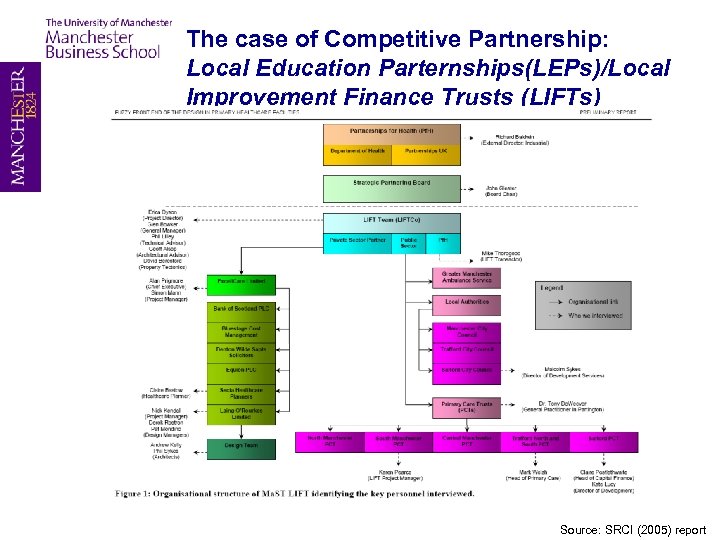

The case of Competitive Partnership: Local Education Parternships(LEPs)/Local Improvement Finance Trusts (LIFTs) Source: SRCI (2005) report

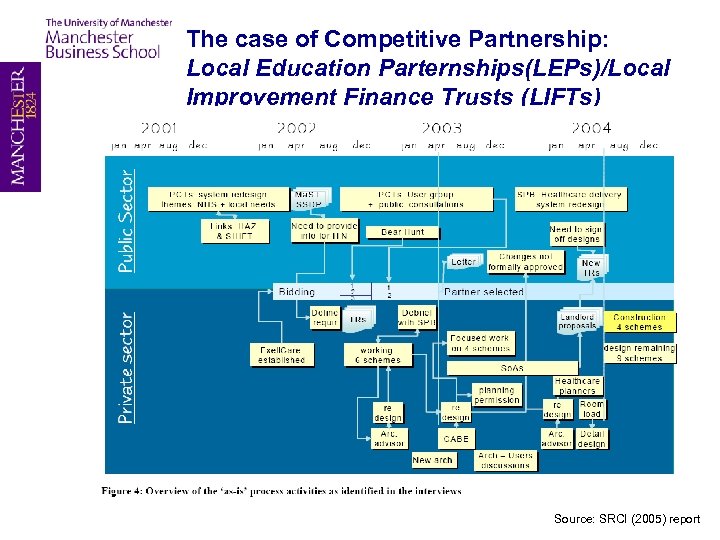

The case of Competitive Partnership: Local Education Parternships(LEPs)/Local Improvement Finance Trusts (LIFTs) Source: SRCI (2005) report

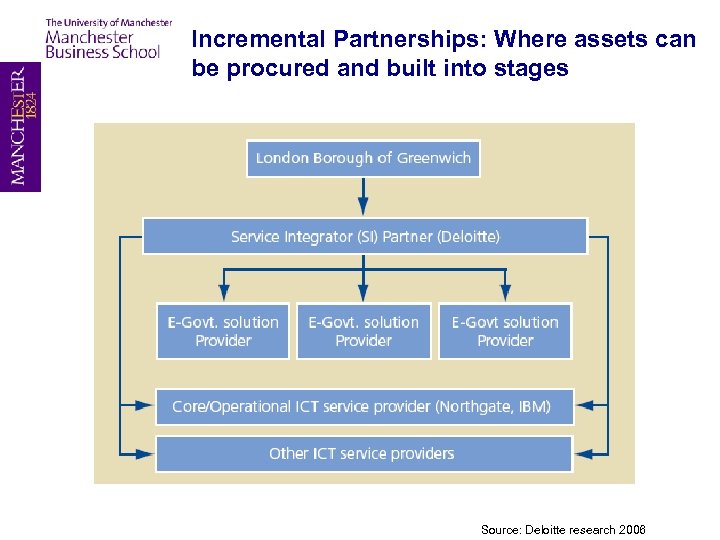

Incremental Partnerships: Where assets can be procured and built into stages Source: Deloitte research 2006

Integrator Model for Large Infrastructure Projects Debt Repayment Arbitrator Arbitration Performance Auditor and Panel of Experts Commercial Lenders Standby Loan Agreement Performance monitoring and expert opinion Loan Agreement CAPEX = capital expenditure, IFI = International Financial Institution O&M = operations and maintenance IFI Government Concession Agreement Minimum Revenue Payments Concessionaire Tariff Revenues Contractual and Regulatory Guarantee Proceeds Revenue Support Fund Cash Cascade: 1. O&M 2. Debt 3. CAPEX 4. Profit distribution Resolves concerns about political risk, and it ensures necessary funding is available if guarantee called Source: Presentation from Asian Development Bank, PPPI Days, Washington D. C. , December 15 -18, 2008

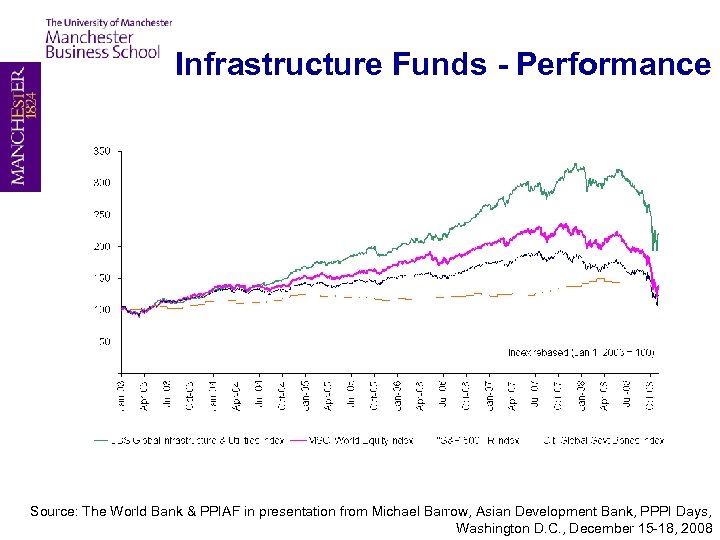

Infrastructure Funds - Performance Source: The World Bank & PPIAF in presentation from Michael Barrow, Asian Development Bank, PPPI Days, Washington D. C. , December 15 -18, 2008

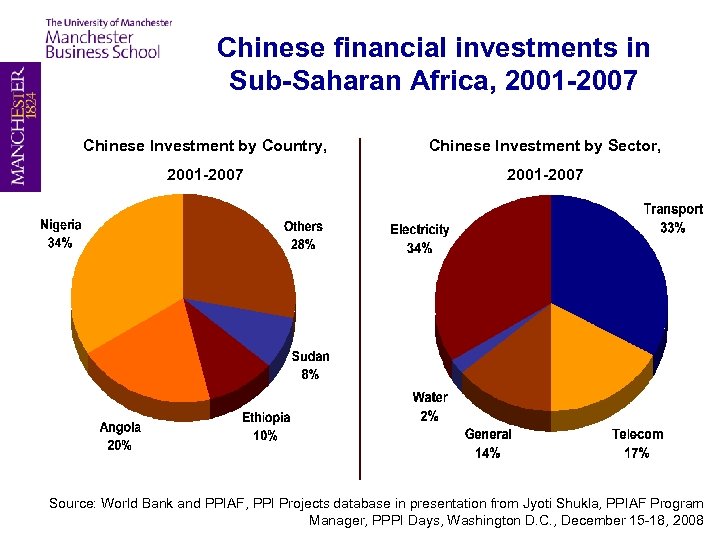

Chinese financial investments in Sub-Saharan Africa, 2001 -2007 Chinese Investment by Country, Chinese Investment by Sector, 2001 -2007 Source: World Bank and PPIAF, PPI Projects database in presentation from Jyoti Shukla, PPIAF Program Manager, PPPI Days, Washington D. C. , December 15 -18, 2008

c0f5277dde039e75ff289f4b1e091c1d.ppt