8209de0d31be339ad01eabf602e87cf8.ppt

- Количество слайдов: 18

INFRASTRUCTURE INVESTMENTS – THE ROLE OF THE INSURANCE SECTOR by Desmond Matete Executive Director - Infrastructure Projects Elephant Hills Hotel Resort 9 November 2015

INFRASTRUCTURE INVESTMENTS – THE ROLE OF THE INSURANCE SECTOR by Desmond Matete Executive Director - Infrastructure Projects Elephant Hills Hotel Resort 9 November 2015

PRESENTATION OUTLINE 1. IDBZ Profile 2. IDBZ Roles 3. Infrastructure Development Impact 4. National Infrastructure Needs Agenda 5. Financing Options 6. Bond Instrument Characteristics 7. Infrastructure Development Bonds 8. IDBs Salient Features 9. IDBZ Track Record 10. Future Capital Raising Initiatives 11. Conclusion

PRESENTATION OUTLINE 1. IDBZ Profile 2. IDBZ Roles 3. Infrastructure Development Impact 4. National Infrastructure Needs Agenda 5. Financing Options 6. Bond Instrument Characteristics 7. Infrastructure Development Bonds 8. IDBs Salient Features 9. IDBZ Track Record 10. Future Capital Raising Initiatives 11. Conclusion

1. IDBZ PROFILE • IDBZ Mandate To promote economic development & growth, and to improve the living standards of Zimbabweans, through the development of infrastructure i. e. Roads; Dams; Energy; Water; Housing; Technology; Utilities. • How does the Bank Achieve this? ü Providing Capital ü Mobilizing Internal and External Resources ü Institutional Capacity Building ü Evaluation, Planning & Implementation Monitoring ü Technical and Financial Advisory Support

1. IDBZ PROFILE • IDBZ Mandate To promote economic development & growth, and to improve the living standards of Zimbabweans, through the development of infrastructure i. e. Roads; Dams; Energy; Water; Housing; Technology; Utilities. • How does the Bank Achieve this? ü Providing Capital ü Mobilizing Internal and External Resources ü Institutional Capacity Building ü Evaluation, Planning & Implementation Monitoring ü Technical and Financial Advisory Support

2. IDBZ ROLES Financier • Provides debt, equity, technical assistance grants and other funding instruments to infrastructure programmes and projects Resource Mobilisor • Secures fund raising/arranger mandates and proceeds to mobilise appropriate domestic and foreign funding for infrastructure projects. Partner • Enters into Joint Ventures, Co-financing/ Syndication, Agency Services and Information sharing arrangements with strategic partners. Advisor • Advises both public and private sector project promoters in terms of project preparation, packaging, financing & project management.

2. IDBZ ROLES Financier • Provides debt, equity, technical assistance grants and other funding instruments to infrastructure programmes and projects Resource Mobilisor • Secures fund raising/arranger mandates and proceeds to mobilise appropriate domestic and foreign funding for infrastructure projects. Partner • Enters into Joint Ventures, Co-financing/ Syndication, Agency Services and Information sharing arrangements with strategic partners. Advisor • Advises both public and private sector project promoters in terms of project preparation, packaging, financing & project management.

3. INFRASTRUCTURE DEVELOPMENT IMPACT Bhattacharya et al. (2012) state that: • Infrastructure can drive growth through higher employment—a USD 100 million investment can generate up to 50, 000 annualized direct and indirect jobs; • Higher costs due to transport and logistics now account for a higher share of the cost of trade than policies (e. g. , tariffs, duties and quotas); and • Improved infrastructure can lead to better health outcomes—a lack of rural roads correlates with maternal mortality, and a lack of comprehensive road safety policies kills 1. 2 million people and injures 50 million per year, 90 percent of them in the developing world. It is estimated that each one percent of GDP growth requires that one percent of GDP be invested in infrastructure (telecommunications, energy, transport and water)1. 1 Cited by Bhattacharya, A. , Romania, M. , Stern, N. (2012)

3. INFRASTRUCTURE DEVELOPMENT IMPACT Bhattacharya et al. (2012) state that: • Infrastructure can drive growth through higher employment—a USD 100 million investment can generate up to 50, 000 annualized direct and indirect jobs; • Higher costs due to transport and logistics now account for a higher share of the cost of trade than policies (e. g. , tariffs, duties and quotas); and • Improved infrastructure can lead to better health outcomes—a lack of rural roads correlates with maternal mortality, and a lack of comprehensive road safety policies kills 1. 2 million people and injures 50 million per year, 90 percent of them in the developing world. It is estimated that each one percent of GDP growth requires that one percent of GDP be invested in infrastructure (telecommunications, energy, transport and water)1. 1 Cited by Bhattacharya, A. , Romania, M. , Stern, N. (2012)

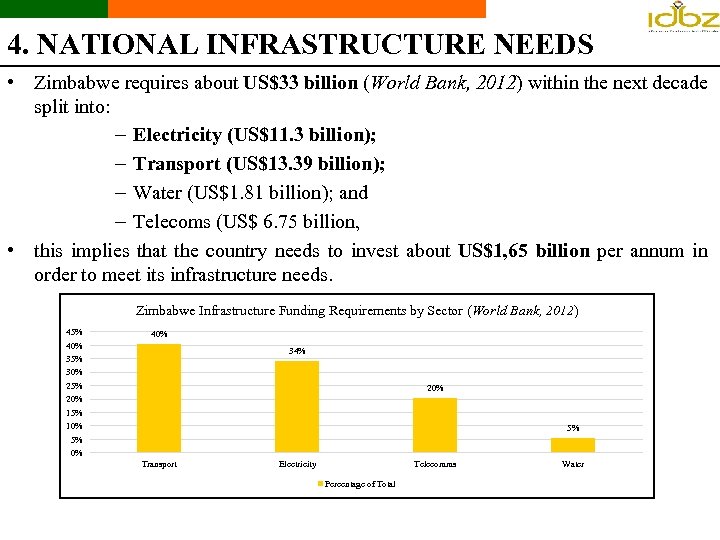

4. NATIONAL INFRASTRUCTURE NEEDS • Zimbabwe requires about US$33 billion (World Bank, 2012) within the next decade split into: – Electricity (US$11. 3 billion); – Transport (US$13. 39 billion); – Water (US$1. 81 billion); and – Telecoms (US$ 6. 75 billion, • this implies that the country needs to invest about US$1, 65 billion per annum in order to meet its infrastructure needs. Zimbabwe Infrastructure Funding Requirements by Sector (World Bank, 2012) 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 40% 34% 20% 5% Transport Electricity Telecomms Percentage of Total Water

4. NATIONAL INFRASTRUCTURE NEEDS • Zimbabwe requires about US$33 billion (World Bank, 2012) within the next decade split into: – Electricity (US$11. 3 billion); – Transport (US$13. 39 billion); – Water (US$1. 81 billion); and – Telecoms (US$ 6. 75 billion, • this implies that the country needs to invest about US$1, 65 billion per annum in order to meet its infrastructure needs. Zimbabwe Infrastructure Funding Requirements by Sector (World Bank, 2012) 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% 40% 34% 20% 5% Transport Electricity Telecomms Percentage of Total Water

5. FINANCING OPTIONS Traditional Sources • Debt i. e. Bank Loans and Bonds • Equity • Internal Financing by Implementing Agents • Pension Funds (Our National Savings) Alternative Sources • Sovereign Wealth Funds (& CSOTs? ? ) • Infrastructure Funds • External Sovereign Bonds • Private Equity Funds • Securitization of Diaspora Remittances • Engagement of Existing and New Development Partners e. g. BRICS Bank • PPPs - important framework for harnessing collaboration between private and public sector in transport projects funding. Concession negotiations.

5. FINANCING OPTIONS Traditional Sources • Debt i. e. Bank Loans and Bonds • Equity • Internal Financing by Implementing Agents • Pension Funds (Our National Savings) Alternative Sources • Sovereign Wealth Funds (& CSOTs? ? ) • Infrastructure Funds • External Sovereign Bonds • Private Equity Funds • Securitization of Diaspora Remittances • Engagement of Existing and New Development Partners e. g. BRICS Bank • PPPs - important framework for harnessing collaboration between private and public sector in transport projects funding. Concession negotiations.

6. BOND INSTRUMENT CHARACTERISTICS • Bonds are debt instruments issued for a period of more than one (1) year with the purpose of raising capital by borrowing in a specific market. • Instrument is floated in the market for uptake, normally with a fixed rate of return and specific time period. • These funds are then channelled towards the construction and expansion of infrastructure assets. • Bonds need to be supported by a highly sustainable repayment strategy such as a sinking fund escrowing cash flows for securing repayment capacity. • Repayment can be tailor made to suit market requirements e. g. annually, semi-annually allowing for smoothening of investor liquidity needs during the life of the instrument.

6. BOND INSTRUMENT CHARACTERISTICS • Bonds are debt instruments issued for a period of more than one (1) year with the purpose of raising capital by borrowing in a specific market. • Instrument is floated in the market for uptake, normally with a fixed rate of return and specific time period. • These funds are then channelled towards the construction and expansion of infrastructure assets. • Bonds need to be supported by a highly sustainable repayment strategy such as a sinking fund escrowing cash flows for securing repayment capacity. • Repayment can be tailor made to suit market requirements e. g. annually, semi-annually allowing for smoothening of investor liquidity needs during the life of the instrument.

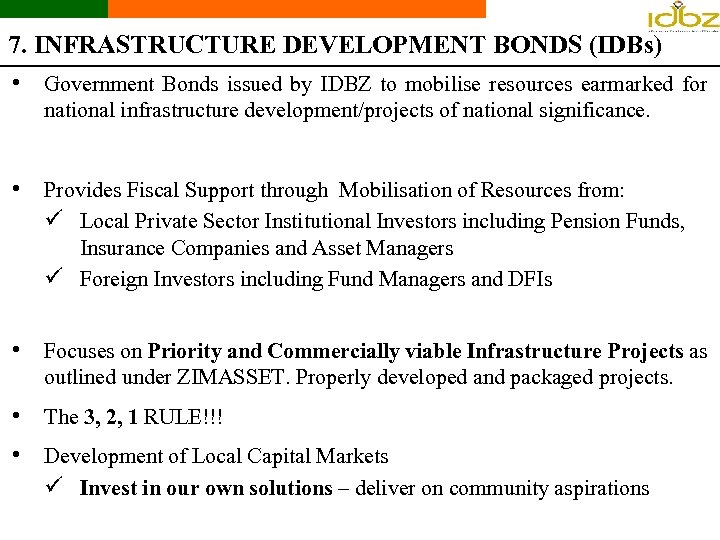

7. INFRASTRUCTURE DEVELOPMENT BONDS (IDBs) • Government Bonds issued by IDBZ to mobilise resources earmarked for national infrastructure development/projects of national significance. • Provides Fiscal Support through Mobilisation of Resources from: ü Local Private Sector Institutional Investors including Pension Funds, Insurance Companies and Asset Managers ü Foreign Investors including Fund Managers and DFIs • Focuses on Priority and Commercially viable Infrastructure Projects as outlined under ZIMASSET. Properly developed and packaged projects. • The 3, 2, 1 RULE!!! • Development of Local Capital Markets ü Invest in our own solutions – deliver on community aspirations

7. INFRASTRUCTURE DEVELOPMENT BONDS (IDBs) • Government Bonds issued by IDBZ to mobilise resources earmarked for national infrastructure development/projects of national significance. • Provides Fiscal Support through Mobilisation of Resources from: ü Local Private Sector Institutional Investors including Pension Funds, Insurance Companies and Asset Managers ü Foreign Investors including Fund Managers and DFIs • Focuses on Priority and Commercially viable Infrastructure Projects as outlined under ZIMASSET. Properly developed and packaged projects. • The 3, 2, 1 RULE!!! • Development of Local Capital Markets ü Invest in our own solutions – deliver on community aspirations

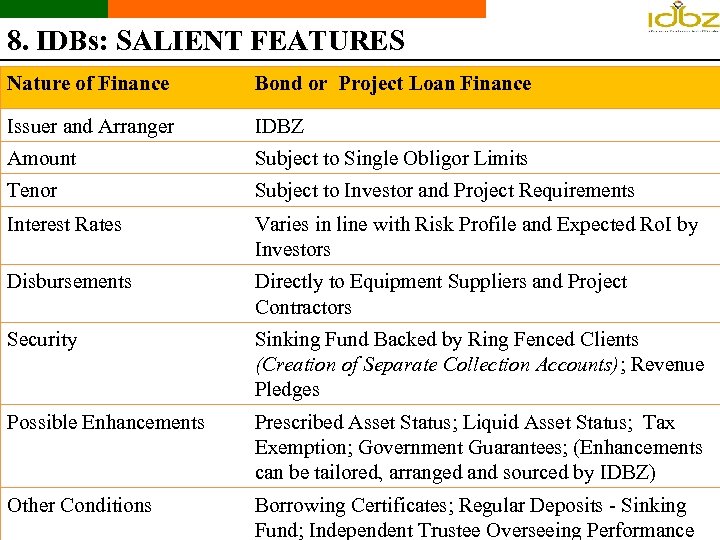

8. IDBs: SALIENT FEATURES Nature of Finance Bond or Project Loan Finance Issuer and Arranger IDBZ Amount Subject to Single Obligor Limits Tenor Subject to Investor and Project Requirements Interest Rates Varies in line with Risk Profile and Expected Ro. I by Investors Disbursements Directly to Equipment Suppliers and Project Contractors Security Sinking Fund Backed by Ring Fenced Clients (Creation of Separate Collection Accounts); Revenue Pledges Possible Enhancements Prescribed Asset Status; Liquid Asset Status; Tax Exemption; Government Guarantees; (Enhancements can be tailored, arranged and sourced by IDBZ) Other Conditions Borrowing Certificates; Regular Deposits - Sinking Fund; Independent Trustee Overseeing Performance

8. IDBs: SALIENT FEATURES Nature of Finance Bond or Project Loan Finance Issuer and Arranger IDBZ Amount Subject to Single Obligor Limits Tenor Subject to Investor and Project Requirements Interest Rates Varies in line with Risk Profile and Expected Ro. I by Investors Disbursements Directly to Equipment Suppliers and Project Contractors Security Sinking Fund Backed by Ring Fenced Clients (Creation of Separate Collection Accounts); Revenue Pledges Possible Enhancements Prescribed Asset Status; Liquid Asset Status; Tax Exemption; Government Guarantees; (Enhancements can be tailored, arranged and sourced by IDBZ) Other Conditions Borrowing Certificates; Regular Deposits - Sinking Fund; Independent Trustee Overseeing Performance

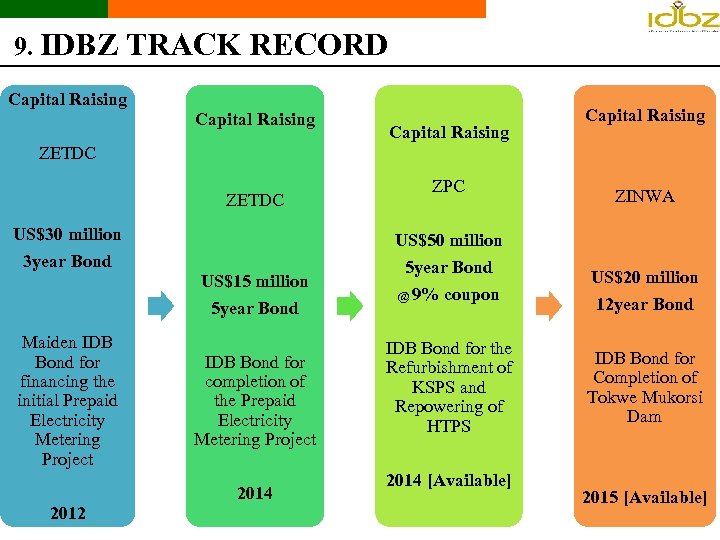

9. IDBZ TRACK RECORD Capital Raising ZETDC US$30 million 3 year Bond Maiden IDB Bond for financing the initial Prepaid Electricity Metering Project 2012 US$15 million 5 year Bond IDB Bond for completion of the Prepaid Electricity Metering Project 2014 ZPC US$50 million 5 year Bond @ 9% coupon IDB Bond for the Refurbishment of KSPS and Repowering of HTPS 2014 [Available] ZINWA US$20 million 12 year Bond IDB Bond for Completion of Tokwe Mukorsi Dam 2015 [Available]

9. IDBZ TRACK RECORD Capital Raising ZETDC US$30 million 3 year Bond Maiden IDB Bond for financing the initial Prepaid Electricity Metering Project 2012 US$15 million 5 year Bond IDB Bond for completion of the Prepaid Electricity Metering Project 2014 ZPC US$50 million 5 year Bond @ 9% coupon IDB Bond for the Refurbishment of KSPS and Repowering of HTPS 2014 [Available] ZINWA US$20 million 12 year Bond IDB Bond for Completion of Tokwe Mukorsi Dam 2015 [Available]

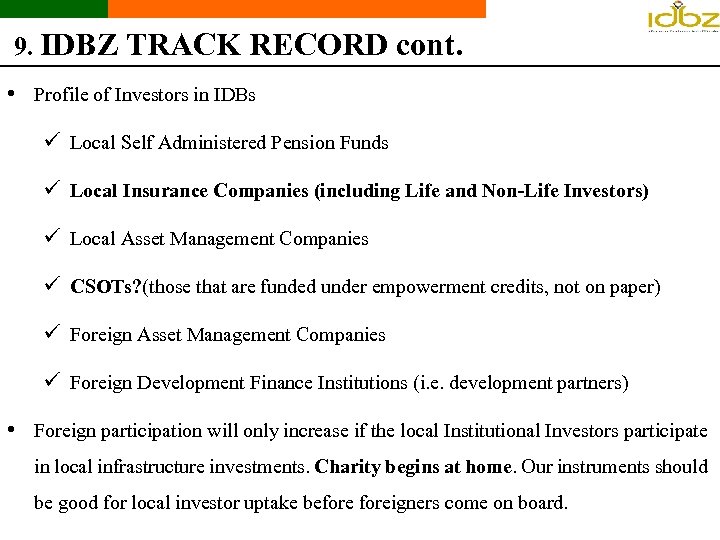

9. IDBZ TRACK RECORD cont. • Profile of Investors in IDBs ü Local Self Administered Pension Funds ü Local Insurance Companies (including Life and Non-Life Investors) ü Local Asset Management Companies ü CSOTs? (those that are funded under empowerment credits, not on paper) ü Foreign Asset Management Companies ü Foreign Development Finance Institutions (i. e. development partners) • Foreign participation will only increase if the local Institutional Investors participate in local infrastructure investments. Charity begins at home. Our instruments should be good for local investor uptake beforeigners come on board.

9. IDBZ TRACK RECORD cont. • Profile of Investors in IDBs ü Local Self Administered Pension Funds ü Local Insurance Companies (including Life and Non-Life Investors) ü Local Asset Management Companies ü CSOTs? (those that are funded under empowerment credits, not on paper) ü Foreign Asset Management Companies ü Foreign Development Finance Institutions (i. e. development partners) • Foreign participation will only increase if the local Institutional Investors participate in local infrastructure investments. Charity begins at home. Our instruments should be good for local investor uptake beforeigners come on board.

10. FUTURE CAPITAL RAISE INITIATIVES • Energy Sector Projects ü Power Generation (New Builds) – up to US$16. 5 Million – Minihydro plant, contribution to EPC costs (addressing the gap between Installed capacity vs. Demand) ü Power Generation (Plant Refurb/Repowering) – up to US$52 Mil – existing thermal plant refurb. (addressing Generation capacity vs. Installed plant capacity) • Transport Sector ü Railways -$25 Million for refurb. (against total requirements circa US$635 Million) ü Investment in our railways system is a very critical and necessary imperative – this will lower cost of transport for bulk goods (mining & Agric) and also avoid excessive wear and tear on our national roads due to reliance on haulage trucking.

10. FUTURE CAPITAL RAISE INITIATIVES • Energy Sector Projects ü Power Generation (New Builds) – up to US$16. 5 Million – Minihydro plant, contribution to EPC costs (addressing the gap between Installed capacity vs. Demand) ü Power Generation (Plant Refurb/Repowering) – up to US$52 Mil – existing thermal plant refurb. (addressing Generation capacity vs. Installed plant capacity) • Transport Sector ü Railways -$25 Million for refurb. (against total requirements circa US$635 Million) ü Investment in our railways system is a very critical and necessary imperative – this will lower cost of transport for bulk goods (mining & Agric) and also avoid excessive wear and tear on our national roads due to reliance on haulage trucking.

11. FUTURE CAPITAL RAISE cont. ü Road Transport – Refurbishment & dualization of major highways (Beitbridge, Hre – Chirundu, Bulawayo-Victoria Falls, Hre-Nyamapanda) – approx. $2 bn - $3 bn in immediate funding/investment will be required, a higher allocation of this going towards Beitbridge, Hre – Chirundu Highway plus feasibility, project preparation and funding for the other major highways connecting Zimbabwe out to the region. • Housing Sector ü Housing Development – up to $100 Million. Mobilisation and deployment over a 5 year period based on funds absorption by funded projects. Enormous downstream benefits/economic activities resulting from housing development at national scale. • ICT – up to US$35 Million for a network enhancement investment by an ICT player.

11. FUTURE CAPITAL RAISE cont. ü Road Transport – Refurbishment & dualization of major highways (Beitbridge, Hre – Chirundu, Bulawayo-Victoria Falls, Hre-Nyamapanda) – approx. $2 bn - $3 bn in immediate funding/investment will be required, a higher allocation of this going towards Beitbridge, Hre – Chirundu Highway plus feasibility, project preparation and funding for the other major highways connecting Zimbabwe out to the region. • Housing Sector ü Housing Development – up to $100 Million. Mobilisation and deployment over a 5 year period based on funds absorption by funded projects. Enormous downstream benefits/economic activities resulting from housing development at national scale. • ICT – up to US$35 Million for a network enhancement investment by an ICT player.

12. CONCLUSION Reasons for Increased Participation by Insurance Sector in Infrastructure: • Infrastructure asset class presents long term inflation protected returns which match liabilities of insurance companies. • Exposure to infrastructure investment provides diversified returns from other asset classes i. e. equities, CISs, property and money market. • Enhanced returns on infrastructure bonds will provide cushion and a safety net from low interest rate environment and re-pricing risks. • Investment in infrastructure bonds with prescribed asset status provides avenue for compliance with IPEC Regulations. ü Life Companies – 3% PAR vs 7. 5% PAR Compliance Level ü Life Reassurers – 2% PAR vs 7. 5% PAR Compliance Level ü Short Term ICs – 1. 27% PAR vs 5% PAR Compliance Level

12. CONCLUSION Reasons for Increased Participation by Insurance Sector in Infrastructure: • Infrastructure asset class presents long term inflation protected returns which match liabilities of insurance companies. • Exposure to infrastructure investment provides diversified returns from other asset classes i. e. equities, CISs, property and money market. • Enhanced returns on infrastructure bonds will provide cushion and a safety net from low interest rate environment and re-pricing risks. • Investment in infrastructure bonds with prescribed asset status provides avenue for compliance with IPEC Regulations. ü Life Companies – 3% PAR vs 7. 5% PAR Compliance Level ü Life Reassurers – 2% PAR vs 7. 5% PAR Compliance Level ü Short Term ICs – 1. 27% PAR vs 5% PAR Compliance Level

13. CONCLUSION cont. • By investing domestically Insurance Companies: ü Avoid foreign exchange exposure and risks; ü Contribute to economic growth; ü Aggregated incremental investments towards infrastructure can lower the cost of capital required to finance key infrastructure stock; ü Assist in developing the local financial sector and capital markets; and, ü For long term EBs related liabilities/Pension Funds, invest in infrastructure to better quality of life for retirees & pensioners. Reduce focus on huge cash payouts still taken by cost of key utilities e. g. energy costs, water,

13. CONCLUSION cont. • By investing domestically Insurance Companies: ü Avoid foreign exchange exposure and risks; ü Contribute to economic growth; ü Aggregated incremental investments towards infrastructure can lower the cost of capital required to finance key infrastructure stock; ü Assist in developing the local financial sector and capital markets; and, ü For long term EBs related liabilities/Pension Funds, invest in infrastructure to better quality of life for retirees & pensioners. Reduce focus on huge cash payouts still taken by cost of key utilities e. g. energy costs, water,

14. CONCLUSION cont. • Some Quote I wish to share with you, the eminent words of an acclaimed Ivorian French businessman who had this to say about the importance of infrastructure investment to achievement of national/economic prosperity: “You cannot control your economic destiny if you are not able to mobilize savings and then turn them into productive investments…if you can’t develop infrastructure, if you can’t develop the energy, if you can’t provide clean water, if you don’t have roads, there is absolutely no future possible” Tidiane Thiam THANK YOU

14. CONCLUSION cont. • Some Quote I wish to share with you, the eminent words of an acclaimed Ivorian French businessman who had this to say about the importance of infrastructure investment to achievement of national/economic prosperity: “You cannot control your economic destiny if you are not able to mobilize savings and then turn them into productive investments…if you can’t develop infrastructure, if you can’t develop the energy, if you can’t provide clean water, if you don’t have roads, there is absolutely no future possible” Tidiane Thiam THANK YOU

Contact Details Infrastructure Projects Financing Team Desmond Matete dmatete@idbz. co. zw Willing Zvirevo wzvirevo@idbz. co. zw Philip Jengwa pjengwa@idbz. co. zw Blessings Chiwandire bchiwandire@idbz. co. zw IDBZ House, 99 Rotten Row Road, Harare, Zimbabwe +263 4 750171 -8

Contact Details Infrastructure Projects Financing Team Desmond Matete dmatete@idbz. co. zw Willing Zvirevo wzvirevo@idbz. co. zw Philip Jengwa pjengwa@idbz. co. zw Blessings Chiwandire bchiwandire@idbz. co. zw IDBZ House, 99 Rotten Row Road, Harare, Zimbabwe +263 4 750171 -8