36f6fa245e91b3e50436da8f7a084172.ppt

- Количество слайдов: 28

Infrastructure, environment, facilities First half year results 2007 Harrie Noy, CEO Analyst meeting, August 8, 2007, Amsterdam, the Netherlands

Infrastructure, environment, facilities First half year results 2007 Harrie Noy, CEO Analyst meeting, August 8, 2007, Amsterdam, the Netherlands

Strong results continued in second quarter Organic gross revenue growth to record of 19% Strong growth in all regions and service areas Net income from operations rose 19%, in the first half year 26% Considerable margin improvement Acquisition RTKL milestone for ARCADIS Outlook remains good Stronger focus on growth and margins is successful

Strong results continued in second quarter Organic gross revenue growth to record of 19% Strong growth in all regions and service areas Net income from operations rose 19%, in the first half year 26% Considerable margin improvement Acquisition RTKL milestone for ARCADIS Outlook remains good Stronger focus on growth and margins is successful

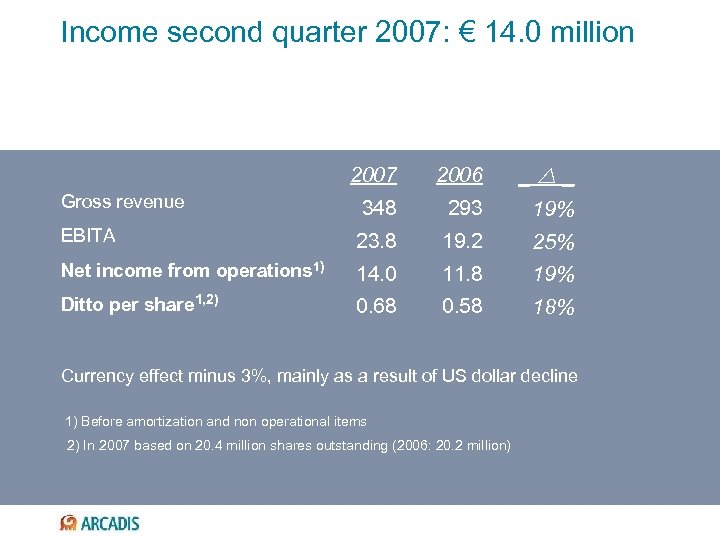

Income second quarter 2007: € 14. 0 million 2007 2006 _ _ 348 293 19% EBITA 23. 8 19. 2 25% Net income from operations 1) 14. 0 11. 8 19% Ditto per share 1, 2) 0. 68 0. 58 18% Gross revenue Currency effect minus 3%, mainly as a result of US dollar decline 1) Before amortization and non operational items 2) In 2007 based on 20. 4 million shares outstanding (2006: 20. 2 million)

Income second quarter 2007: € 14. 0 million 2007 2006 _ _ 348 293 19% EBITA 23. 8 19. 2 25% Net income from operations 1) 14. 0 11. 8 19% Ditto per share 1, 2) 0. 68 0. 58 18% Gross revenue Currency effect minus 3%, mainly as a result of US dollar decline 1) Before amortization and non operational items 2) In 2007 based on 20. 4 million shares outstanding (2006: 20. 2 million)

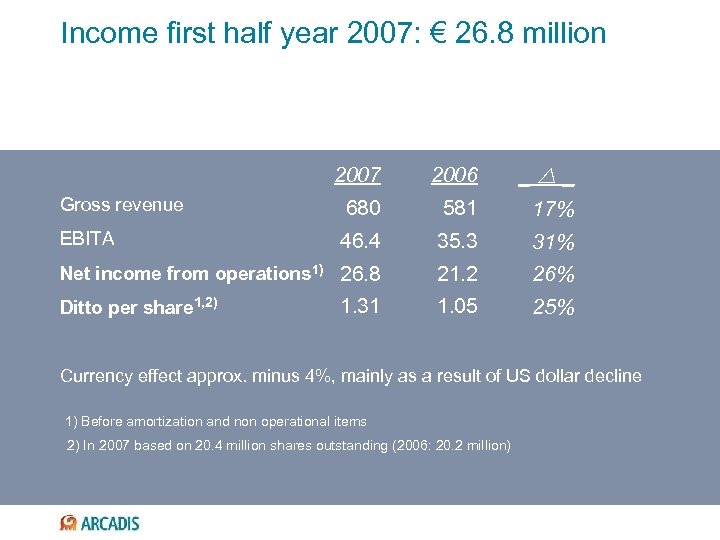

Income first half year 2007: € 26. 8 million 2007 2006 _ _ 680 581 17% 46. 4 35. 3 31% Net income from operations 1) 26. 8 21. 2 26% 1. 31 1. 05 25% Gross revenue EBITA Ditto per share 1, 2) Currency effect approx. minus 4%, mainly as a result of US dollar decline 1) Before amortization and non operational items 2) In 2007 based on 20. 4 million shares outstanding (2006: 20. 2 million)

Income first half year 2007: € 26. 8 million 2007 2006 _ _ 680 581 17% 46. 4 35. 3 31% Net income from operations 1) 26. 8 21. 2 26% 1. 31 1. 05 25% Gross revenue EBITA Ditto per share 1, 2) Currency effect approx. minus 4%, mainly as a result of US dollar decline 1) Before amortization and non operational items 2) In 2007 based on 20. 4 million shares outstanding (2006: 20. 2 million)

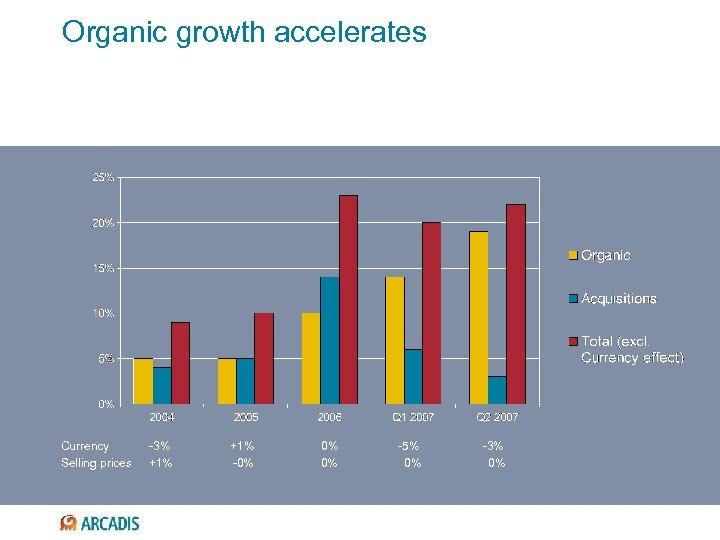

Organic growth accelerates Currency Selling prices -3% +1% -0% 0% 0% -5% 0% -3% 0%

Organic growth accelerates Currency Selling prices -3% +1% -0% 0% 0% -5% 0% -3% 0%

ARCADIS benefits from good market conditions No signs of weakness in the U. S. : organic growth 19% Strong increase in activities in Brazil and Chile Dutch market remains solid with 11% organic growth Market in other European countries improved: organic growth 11% Margin improved to 9. 8% versus 8. 6% last year Smaller acquisitions in home markets (GR € 11 million, 115 staff) Euroconsult (GR € 33 million, 125 staff) sold All percentages related to the first half year

ARCADIS benefits from good market conditions No signs of weakness in the U. S. : organic growth 19% Strong increase in activities in Brazil and Chile Dutch market remains solid with 11% organic growth Market in other European countries improved: organic growth 11% Margin improved to 9. 8% versus 8. 6% last year Smaller acquisitions in home markets (GR € 11 million, 115 staff) Euroconsult (GR € 33 million, 125 staff) sold All percentages related to the first half year

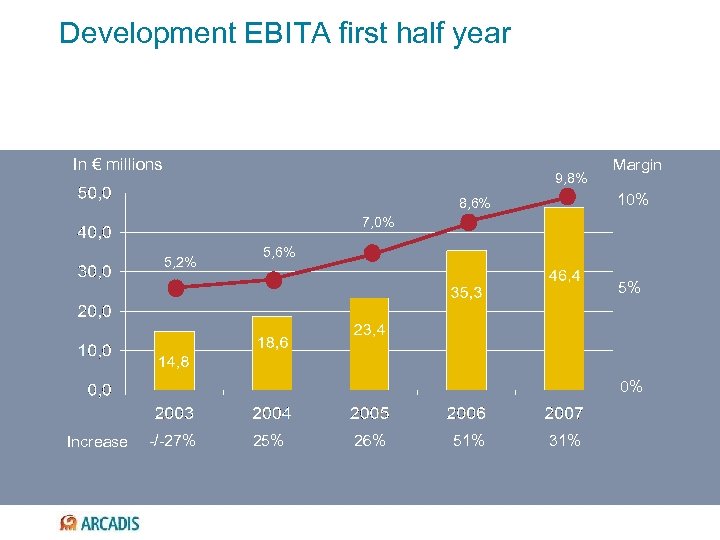

Development EBITA first half year In € millions 9, 8% Margin 10% 8, 6% 7, 0% 5, 2% 5, 6% 5% 0% Increase -/-27% 25% 26% 51% 31%

Development EBITA first half year In € millions 9, 8% Margin 10% 8, 6% 7, 0% 5, 2% 5, 6% 5% 0% Increase -/-27% 25% 26% 51% 31%

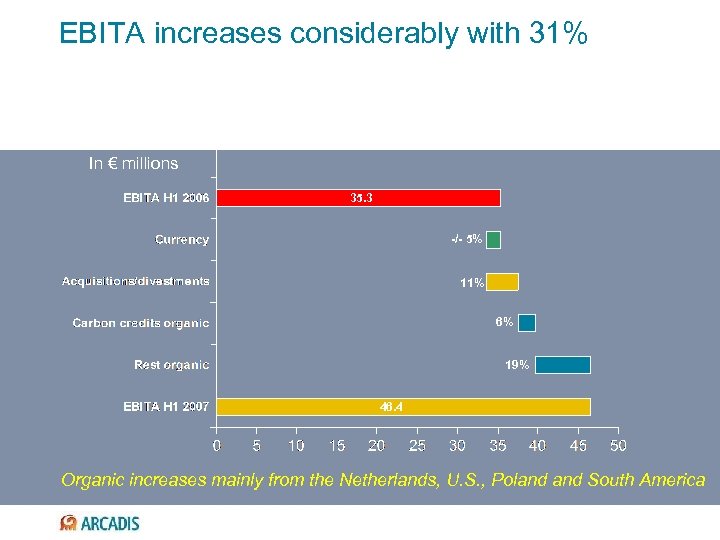

EBITA increases considerably with 31% In € millions 35. 3 -/- 5% 11% 6% 19% 46. 4 Organic increases mainly from the Netherlands, U. S. , Poland South America

EBITA increases considerably with 31% In € millions 35. 3 -/- 5% 11% 6% 19% 46. 4 Organic increases mainly from the Netherlands, U. S. , Poland South America

Some financial details Carbon credits contribute € 2. 1 million to EBITA – Generated at landfills in Brazil by Biogas (33. 3% ALogos) – Sold in 2006/2007: 1 million carbon credits – Delivered Q 406: 180 m; Q 107: 570 m; Q 207: 70 m; expected H 207: 180 m – Contract with Kf. W price range € 10 - € 20 – Total amount expected 2006 -2012: 5 million carbon credits – ARCADIS owns 50. 01% of Alogos Financing charges higher through growth and one-off gain Q 206 Associated companies slightly negative: energy project Brazil Minority interest higher due to good operational performance Brazil

Some financial details Carbon credits contribute € 2. 1 million to EBITA – Generated at landfills in Brazil by Biogas (33. 3% ALogos) – Sold in 2006/2007: 1 million carbon credits – Delivered Q 406: 180 m; Q 107: 570 m; Q 207: 70 m; expected H 207: 180 m – Contract with Kf. W price range € 10 - € 20 – Total amount expected 2006 -2012: 5 million carbon credits – ARCADIS owns 50. 01% of Alogos Financing charges higher through growth and one-off gain Q 206 Associated companies slightly negative: energy project Brazil Minority interest higher due to good operational performance Brazil

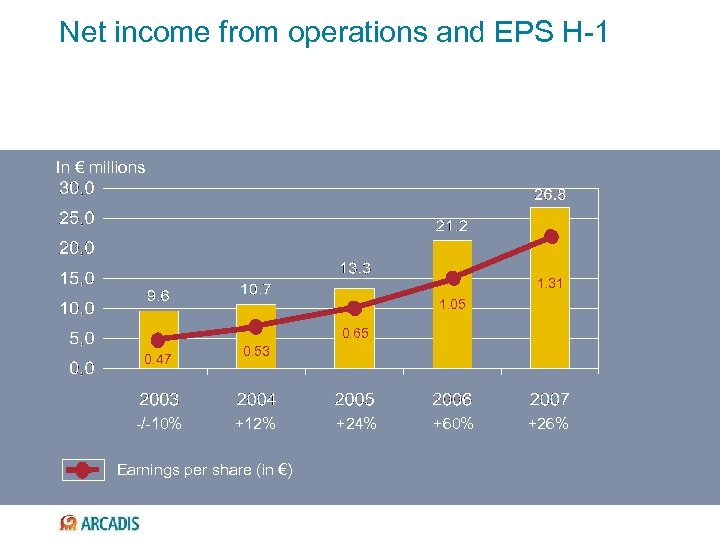

Net income from operations and EPS H-1 In € millions 1. 31 1. 05 0. 65 0. 47 -/-10% 0. 53 +12% Earnings per share (in €) +24% +60% +26%

Net income from operations and EPS H-1 In € millions 1. 31 1. 05 0. 65 0. 47 -/-10% 0. 53 +12% Earnings per share (in €) +24% +60% +26%

The service areas Infrastructure Environment Facilities

The service areas Infrastructure Environment Facilities

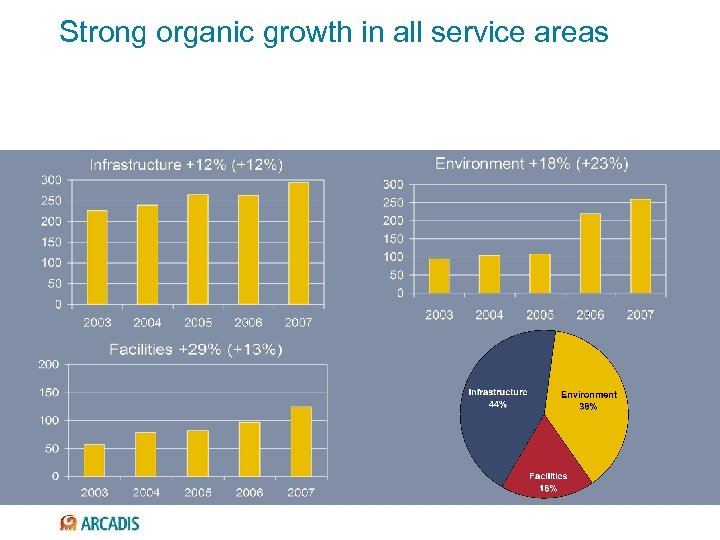

Strong organic growth in all service areas

Strong organic growth in all service areas

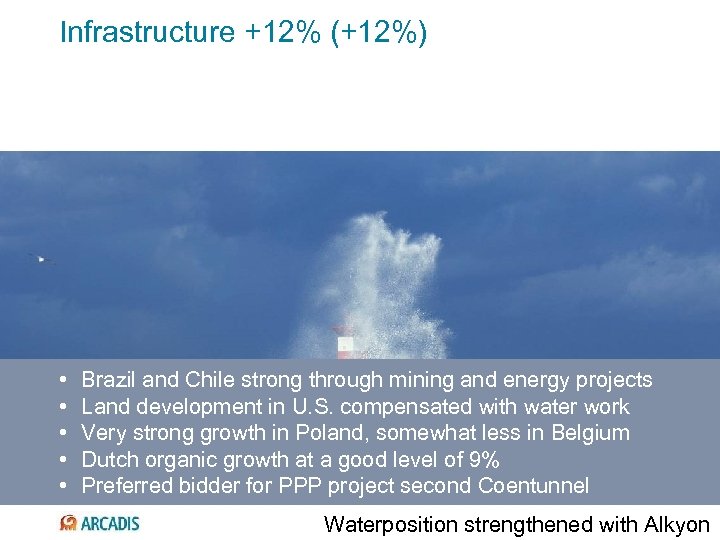

Infrastructure +12% (+12%) • • • Brazil and Chile strong through mining and energy projects Land development in U. S. compensated with water work Very strong growth in Poland, somewhat less in Belgium Dutch organic growth at a good level of 9% Preferred bidder for PPP project second Coentunnel Waterposition strengthened with Alkyon

Infrastructure +12% (+12%) • • • Brazil and Chile strong through mining and energy projects Land development in U. S. compensated with water work Very strong growth in Poland, somewhat less in Belgium Dutch organic growth at a good level of 9% Preferred bidder for PPP project second Coentunnel Waterposition strengthened with Alkyon

Environment +18% (+23%) • • • At 23% organic growth very strong, particularly in the U. S. Market share grows through combination with BBL Brazil: more services for multinationals Europe: growth in almost all countries – especially private sector Consistent Health & Safety policy: stronger competitive position REACH: more work for multinationals

Environment +18% (+23%) • • • At 23% organic growth very strong, particularly in the U. S. Market share grows through combination with BBL Brazil: more services for multinationals Europe: growth in almost all countries – especially private sector Consistent Health & Safety policy: stronger competitive position REACH: more work for multinationals

Facilities +29% (+13%) • • 16% from acquisitions, P 1 + smaller in NL, Belgium, Germany Organic 13%: mainly management services and consulting Netherlands, U. K. and Germany are performing well Real estate investment climate is favorable AWw. PC: Multi Vastgoed contract

Facilities +29% (+13%) • • 16% from acquisitions, P 1 + smaller in NL, Belgium, Germany Organic 13%: mainly management services and consulting Netherlands, U. K. and Germany are performing well Real estate investment climate is favorable AWw. PC: Multi Vastgoed contract

Outlook

Outlook

Outlook per service area Infrastructure • Strong economy has positive effect on investments • Market expansion through PPP initiatives • U. S. : land development soft; growth in water and transportation Environment • Attention for sustainability and climate change drives demand • Remediation (GRi. P®) with redevelopment growth market • Further expansion of market share with multinational clients Facilities • Solid investment climate for real estate • Growth in project management / cost consulting also through AWw. PC • RTKL offers ample opportunity for top line synergy

Outlook per service area Infrastructure • Strong economy has positive effect on investments • Market expansion through PPP initiatives • U. S. : land development soft; growth in water and transportation Environment • Attention for sustainability and climate change drives demand • Remediation (GRi. P®) with redevelopment growth market • Further expansion of market share with multinational clients Facilities • Solid investment climate for real estate • Growth in project management / cost consulting also through AWw. PC • RTKL offers ample opportunity for top line synergy

Outlook for 2007 is good Market conditions are favorable Ample opportunity for growth, also through synergy Margin goal of 10% to be reached this year Acquisitions remain high on our priority list Increase net income from operations of 20 -25% for full year 2007 (barring unforeseen circumstances) ARCADIS is well on track

Outlook for 2007 is good Market conditions are favorable Ample opportunity for growth, also through synergy Margin goal of 10% to be reached this year Acquisitions remain high on our priority list Increase net income from operations of 20 -25% for full year 2007 (barring unforeseen circumstances) ARCADIS is well on track

Thank you

Thank you

Infrastructuur, milieu, gebouwen The merger with RTKL Strategic considerations

Infrastructuur, milieu, gebouwen The merger with RTKL Strategic considerations

ARCADIS strategy is focused on growth in high added value services by building leadership positions in three segments: Infrastructure Environment Facilities

ARCADIS strategy is focused on growth in high added value services by building leadership positions in three segments: Infrastructure Environment Facilities

RTKL, world leader in design and planning Gross revenues $ 195, net revenues $ 142 million 1050 staff in 6 offices in U. S. and 4 in Europe/Asia Architectural design, master planning, specialized engineering Well diversified international portfolio In commercial, health, workplace/civic Operating margin meets our target in facilities Strong brand reputation Among top 10 firms in its field

RTKL, world leader in design and planning Gross revenues $ 195, net revenues $ 142 million 1050 staff in 6 offices in U. S. and 4 in Europe/Asia Architectural design, master planning, specialized engineering Well diversified international portfolio In commercial, health, workplace/civic Operating margin meets our target in facilities Strong brand reputation Among top 10 firms in its field

RTKL fits well in ARCADIS strategy Next step in moving up the value chain Towards building leadership in facilities More involvement in property investments Full service offering – integrated approach Master planning for early entry into urban regeneration Expanded position in China Closer to top 10 position in U. S.

RTKL fits well in ARCADIS strategy Next step in moving up the value chain Towards building leadership in facilities More involvement in property investments Full service offering – integrated approach Master planning for early entry into urban regeneration Expanded position in China Closer to top 10 position in U. S.

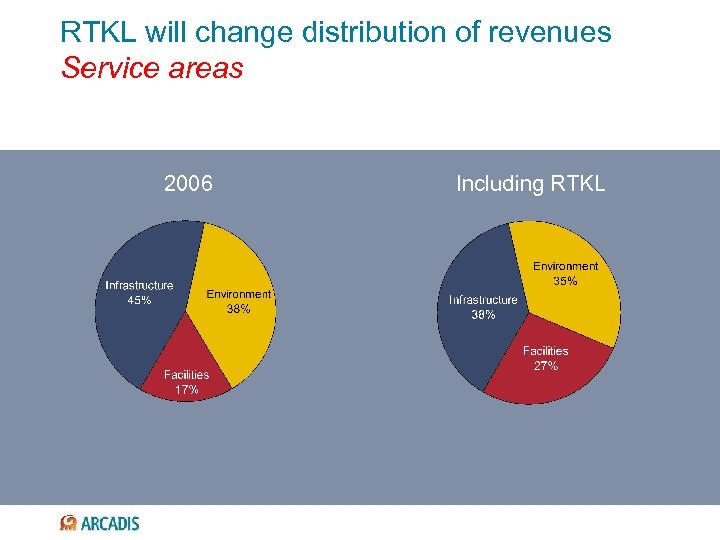

RTKL will change distribution of revenues Service areas 2006 Including RTKL

RTKL will change distribution of revenues Service areas 2006 Including RTKL

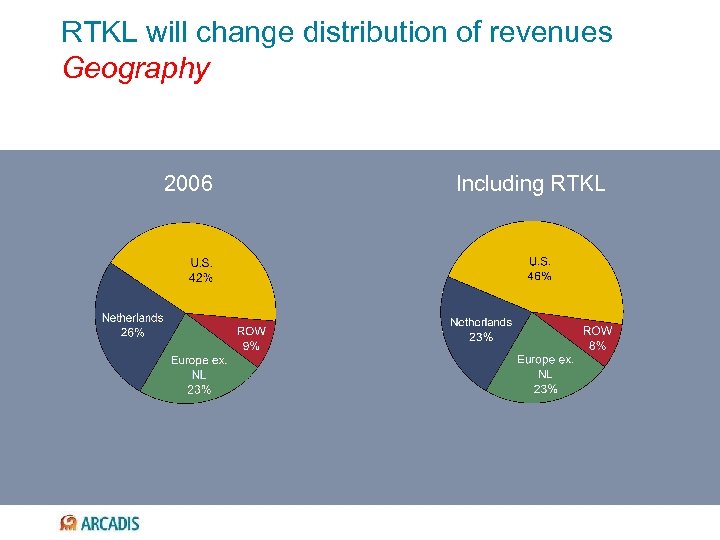

RTKL will change distribution of revenues Geography 2006 Including RTKL

RTKL will change distribution of revenues Geography 2006 Including RTKL

Ample opportunities for synergies Focus on top line synergies Design/planning project and program management Brownfields: remediation + redevelopment ARCADIS footprint to expand RTKL’s business Sustainability: environment + design/planning China, Middle East Synergy plans to capitalize on selected opportunities

Ample opportunities for synergies Focus on top line synergies Design/planning project and program management Brownfields: remediation + redevelopment ARCADIS footprint to expand RTKL’s business Sustainability: environment + design/planning China, Middle East Synergy plans to capitalize on selected opportunities

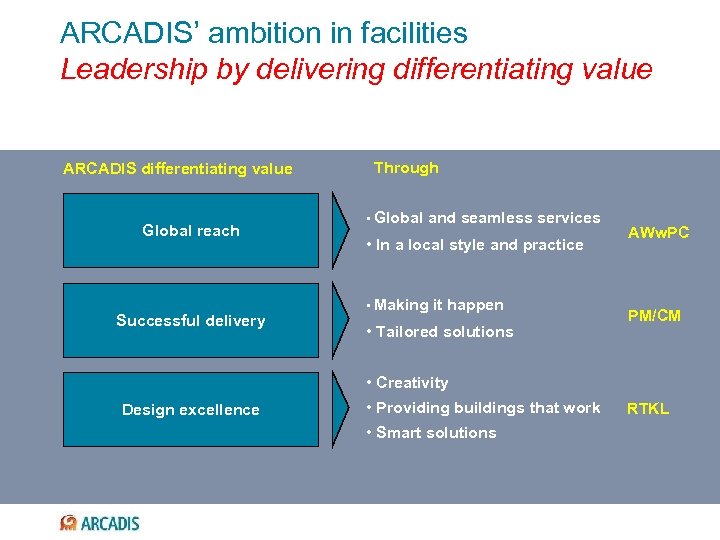

ARCADIS’ ambition in facilities Leadership by delivering differentiating value ARCADIS differentiating value Global reach Successful delivery Through • Global and seamless services • In a local style and practice • Making it happen • Tailored solutions AWw. PC PM/CM • Creativity Design excellence • Providing buildings that work • Smart solutions RTKL

ARCADIS’ ambition in facilities Leadership by delivering differentiating value ARCADIS differentiating value Global reach Successful delivery Through • Global and seamless services • In a local style and practice • Making it happen • Tailored solutions AWw. PC PM/CM • Creativity Design excellence • Providing buildings that work • Smart solutions RTKL

Imagine the result Thank you

Imagine the result Thank you