926de99eac4dcc84edd6bda4d84ee871.ppt

- Количество слайдов: 30

® Infosys – A Unique Business Model

® Safe Harbor Certain statements in this presentation concerning our future growth prospects are forward looking statements which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding fluctuations in earnings, our ability to manage growth, intense competition in IT services including those factors which may affect our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which Infosys has made strategic investments, withdrawal of governmental fiscal incentives, political instability, legal restrictions on raising capital or acquiring companies outside India, and unauthorized use of our intellectual property and general economic conditions affecting our industry. Additional risks that could affect our future operating results are more fully described in our United States Securities and Exchange Commission filings including our Annual Report on Form 20 -F for the fiscal year ended March 31, 2000, and our Quarterly Reports filed on Form 6 -K for the quarters ended June 30, 2000, September 30, 2000 and December 31, 2000. These filings are available at www. sec. gov. Infosys may, from time to time, make additional written and oral forward looking statements, including statements contained in the company’s filings with the Securities and Exchange Commission and our reports to shareholders. The company does not undertake to update any forward looking statement that may be made from time to time by or on behalf of the company.

® Infosys - An Overview l End-to-end IT solutions provider l One of the most profitable software services providers in the world l Publicly traded in India since 1993 l Fifth most valuable company in India l Listed on NASDAQ since March 1999 l Present market cap at US$ 5. 5 billion (as of May 11, 2001) [based on BSE prices]

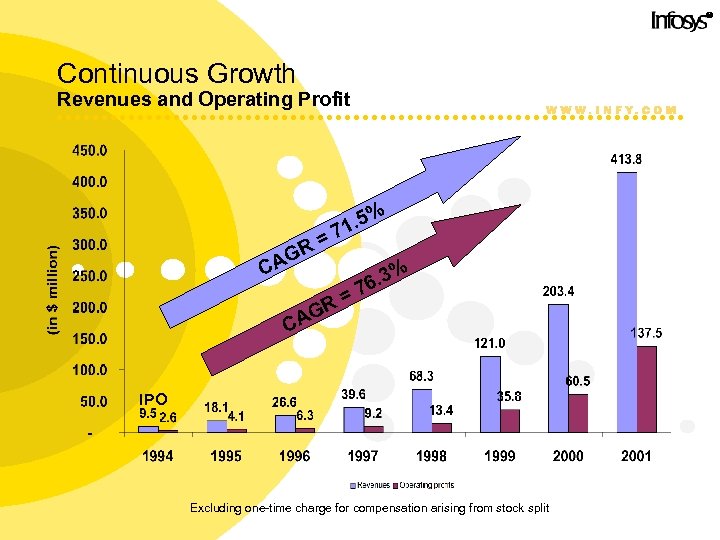

® Continuous Growth Revenues and Operating Profit % CA R= G . 5 71 R= G % 6. 3 7 CA IPO Excluding one-time charge for compensation arising from stock split

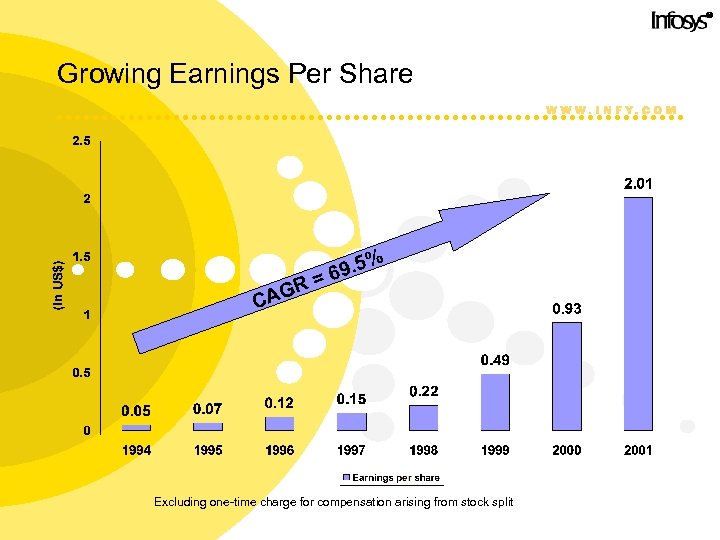

® Growing Earnings Per Share CAG R 9. 5% =6 Excluding one-time charge for compensation arising from stock split

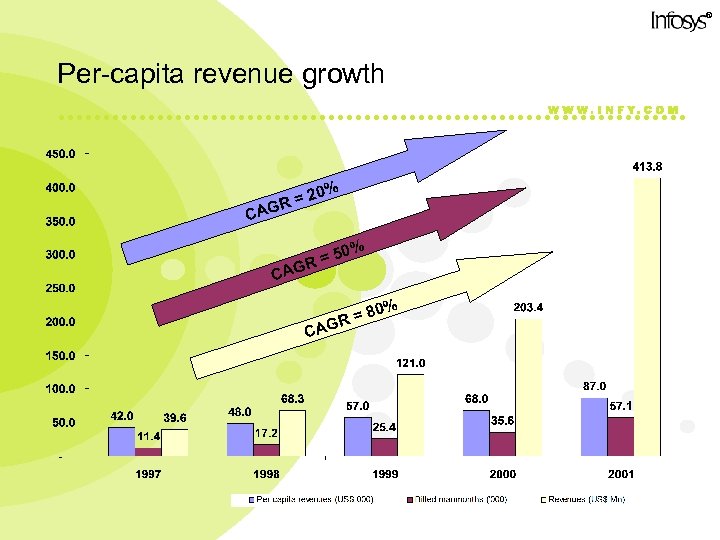

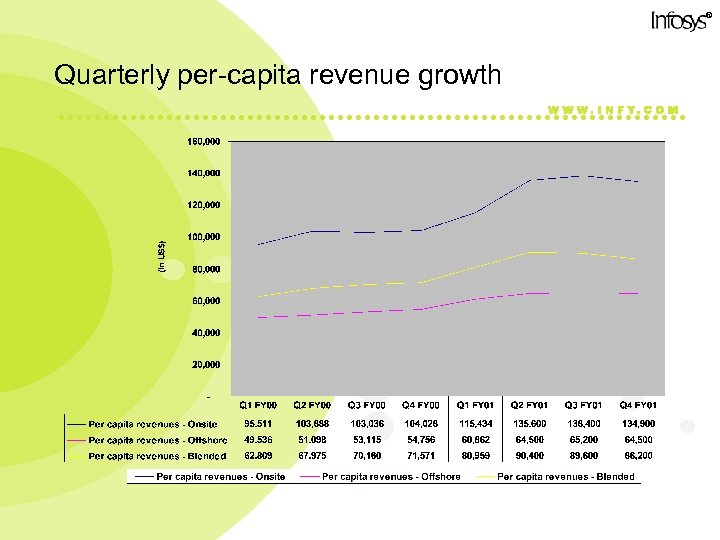

® Per-capita revenue growth % = 20 R CAG % 50 R= CAG C = AGR 80%

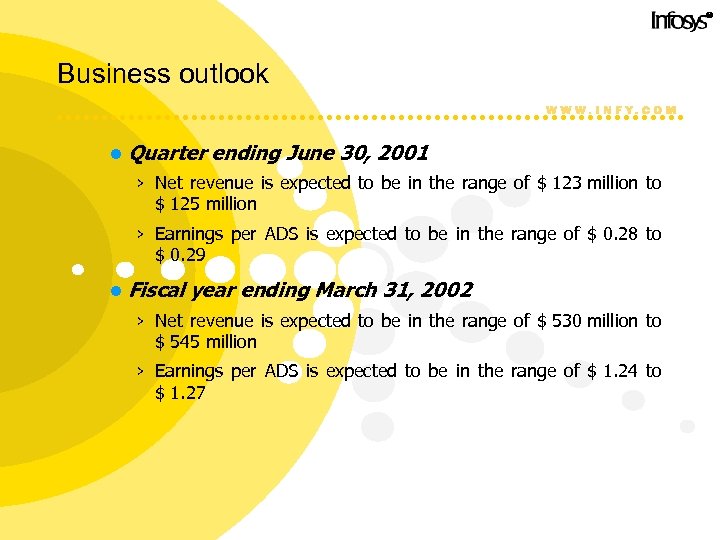

® Business outlook l Quarter ending June 30, 2001 › Net revenue is expected to be in the range of $ 123 million to $ 125 million › Earnings per ADS is expected to be in the range of $ 0. 28 to $ 0. 29 l Fiscal year ending March 31, 2002 › Net revenue is expected to be in the range of $ 530 million to $ 545 million › Earnings per ADS is expected to be in the range of $ 1. 24 to $ 1. 27

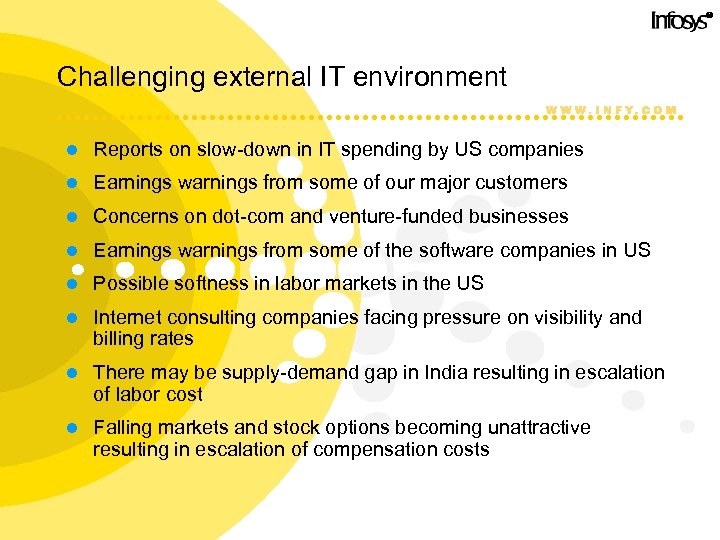

® Challenging external IT environment l Reports on slow-down in IT spending by US companies l Earnings warnings from some of our major customers l Concerns on dot-com and venture-funded businesses l Earnings warnings from some of the software companies in US l Possible softness in labor markets in the US l Internet consulting companies facing pressure on visibility and billing rates l There may be supply-demand gap in India resulting in escalation of labor cost l Falling markets and stock options becoming unattractive resulting in escalation of compensation costs

® Investors’ Concerns l Business Ø Effect of slow-down in IT spending in US on Infosys Ø Visibility in business Ø Future revenue growth l Per capita revenues Ø Ability to increase the per-capita revenues on a go-forward basis Ø Impact on the per-capita revenue growth rate due to reduced dot-com / venture-funded businesses l Hiring and Utilization Ø Ability to attract the best and the brightest Ø Lower utilization rates coupled with increased hiring Ø Labor cost escalation due to falling market price of the stock l Margins Ø Ability to maintain or grow the margins on a go-forward basis l Exposure to dot-com/venture funded companies Ø Strategic investments and accounts receivable

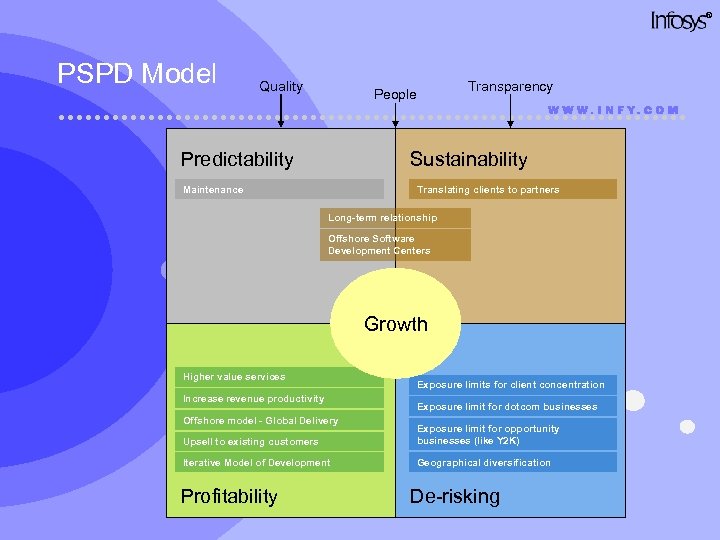

® PSPD Model Quality People Predictability Transparency Sustainability Maintenance Translating clients to partners Long-term relationship Offshore Software Development Centers Growth Higher value services Increase revenue productivity Offshore model - Global Delivery Exposure limits for client concentration Exposure limit for dotcom businesses Upsell to existing customers Exposure limit for opportunity businesses (like Y 2 K) Iterative Model of Development Geographical diversification Profitability De-risking

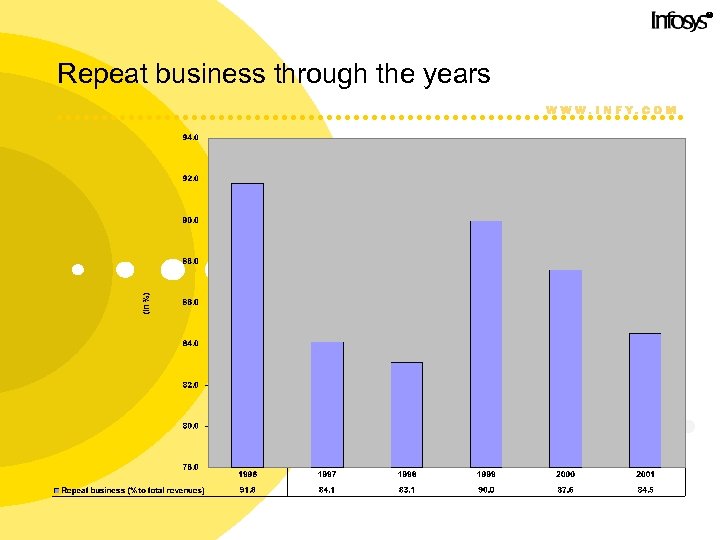

® Repeat business through the years

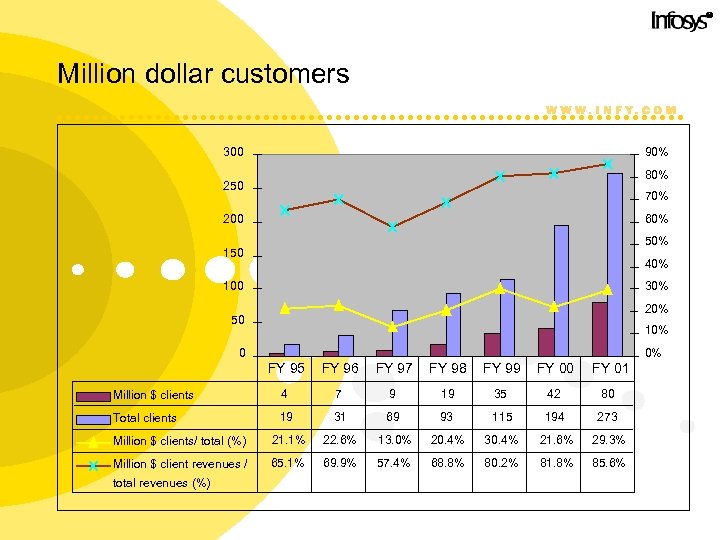

® Million dollar customers 300 90% 80% 250 70% 200 60% 50% 150 40% 100 30% 20% 50 10% 0 0% FY 95 FY 96 FY 97 FY 98 FY 99 FY 00 FY 01 Million $ clients 4 7 9 19 35 42 80 Total clients 19 31 69 93 115 194 273 Million $ clients/ total (%) 21. 1% 22. 6% 13. 0% 20. 4% 30. 4% 21. 6% 29. 3% Million $ client revenues / 65. 1% 69. 9% 57. 4% 68. 8% 80. 2% 81. 8% 85. 6% total revenues (%)

® Quarterly per-capita revenue growth

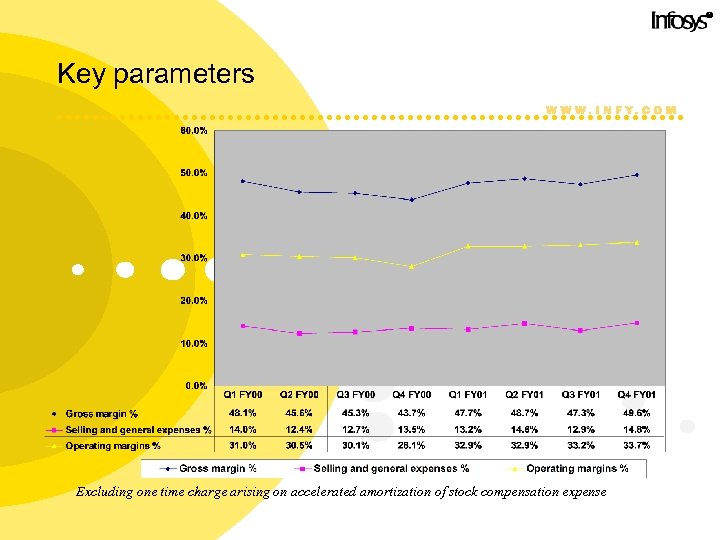

® Key parameters Excluding one time charge arising on accelerated amortization of stock compensation expense

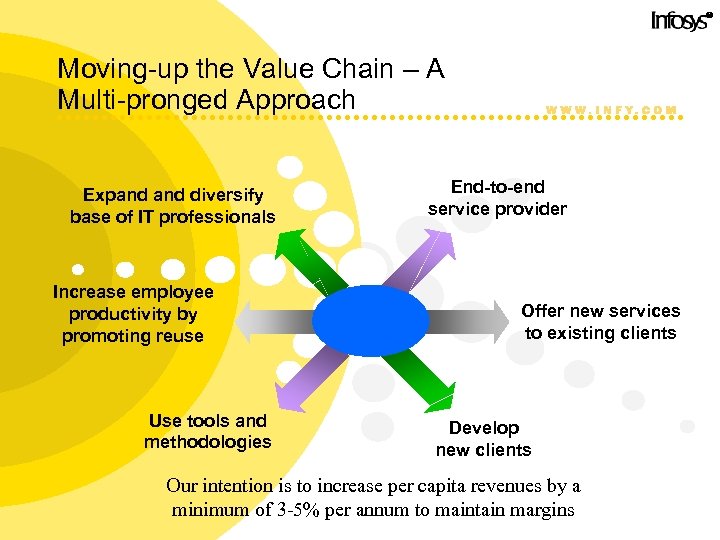

® Moving-up the Value Chain – A Multi-pronged Approach Expand diversify base of IT professionals Increase employee productivity by promoting reuse Use tools and methodologies End-to-end service provider Offer new services to existing clients Develop new clients Our intention is to increase per capita revenues by a minimum of 3 -5% per annum to maintain margins

® Hiring and utilization

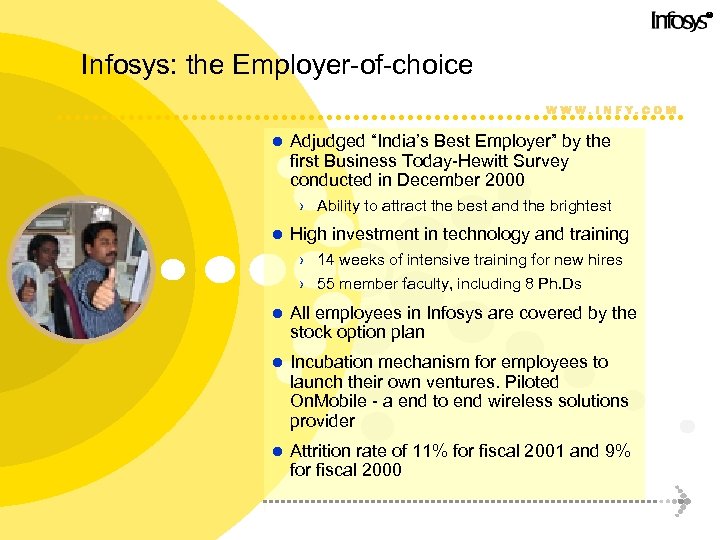

® Infosys: the Employer-of-choice l Adjudged “India’s Best Employer” by the first Business Today-Hewitt Survey conducted in December 2000 › Ability to attract the best and the brightest l High investment in technology and training › 14 weeks of intensive training for new hires › 55 member faculty, including 8 Ph. Ds l All employees in Infosys are covered by the stock option plan l Incubation mechanism for employees to launch their own ventures. Piloted On. Mobile - a end to end wireless solutions provider l Attrition rate of 11% for fiscal 2001 and 9% for fiscal 2000

® Our views on labor cost pressures l Wage pressures for freshers may not arise because of increased market penetration. This is due to: › Softening of wages in the US markets due to lay-offs › Slowdown in hiring by second / third tier companies in India due to a decline in business opportunities l Wage pressures already exist in the market for project managers since demand outweighs supply › This situation may not change l We require a growth rate of ~3 -5% in per capita revenues to neutralize wage pressures

® The impact of stock options l Stock options are not a substitute for salaries. l Stock options are granted as additional incentive l Stock options are widely distributed amongst employees l Most of the senior employees of the company (around 1550) are covered under the 1994 stock option plan that created substantial wealth in their hands l 62% of options outstanding under the 1994 plan (covering 1, 472 employees) will vest after 2 years l Part of the grants under the 1998 and 1999 option plan, have already vested l Stock options have created 80 dollar millionaires and over 1, 150 rupee millionaires, at Infosys l The employee ownership in Infosys including the outstanding option grants is 11. 7%

® We continue to focus on margins

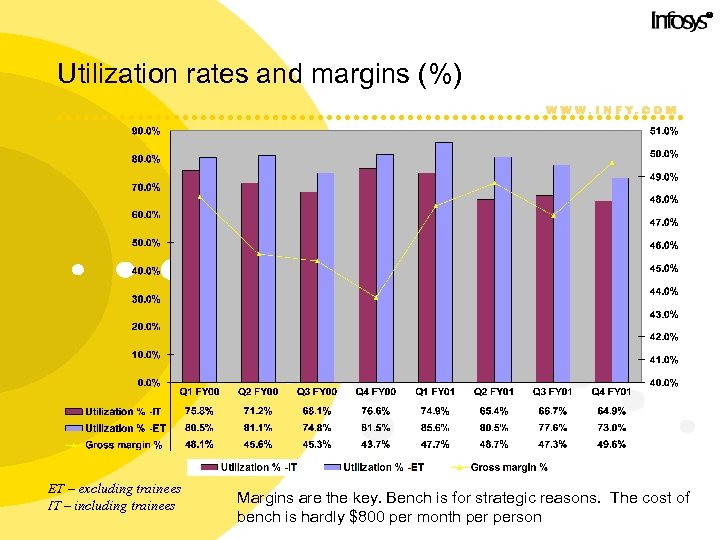

® Utilization rates and margins (%) ET – excluding trainees IT – including trainees Margins are the key. Bench is for strategic reasons. The cost of bench is hardly $800 per month person

® Strategic investments l Investments are key to Infosys’ strategic objectives of gaining access to niche technologies and markets l We leveraged the expertise derived from our relationships with our investee companies to deliver value to large clients across the globe l We become the IT strategic partner for our investee companies l Benefits arise in the form of revenue and net income enhancements l Investments are also envisaged in technology specific venture capital funds l We have invested: › $3 million in Cidra, a developer of photonic devices for high-precision wavelength management and control for next-generation optical networks (FY 01 revenues $1. 7 million and cumulative revenues of $ 2. 1 million) › $ 0. 4 million in M-Commerce Ventures Pte Ltd. , Singapore, an early stage VC fund › $ 1. 5 million in Asia Net Media BVI Ltd. (FY 01 revenues - $0. 9 million and cumulative revenues of $ 1. 1 million) › $ 0. 5 million in Purple. Yogi Inc

® We have today the infrastructure, processes and people to manage future growth

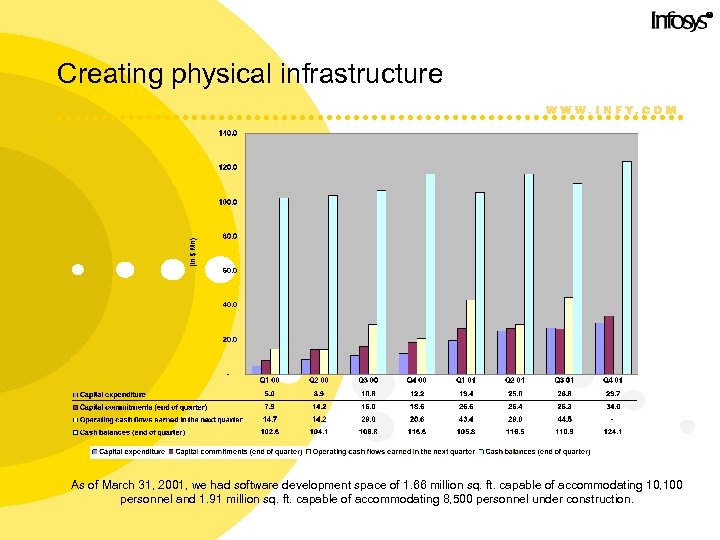

® Creating physical infrastructure As of March 31, 2001, we had software development space of 1. 66 million sq. ft. capable of accommodating 10, 100 personnel and 1. 91 million sq. ft. capable of accommodating 8, 500 personnel under construction.

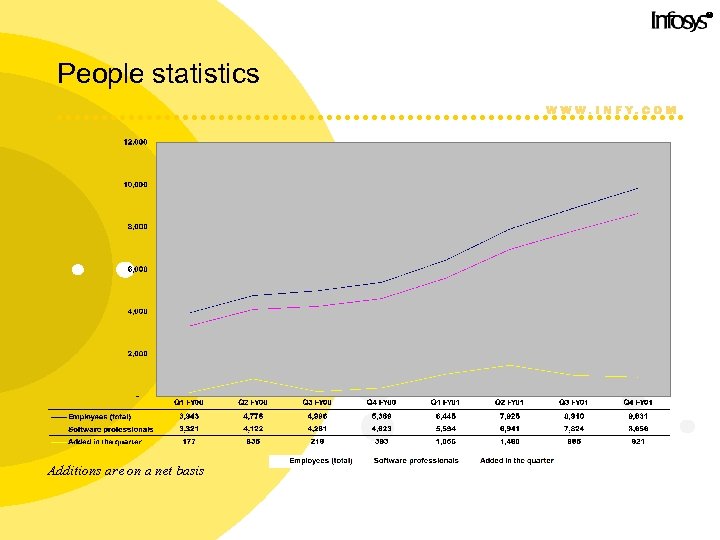

® People statistics Additions are on a net basis

® World-class Quality Processes CMM Level 5 Six Sigma Baldrige w Focus on defect prevention, technology insertion and process changes to improve quality and productivity w Reduction in cycle time and defects for six cross functional processes w Orders Through Remittance (OTR) w Visa processing w US Payroll w Cross functional teams to address improvement areas in strategic management functions w Leadership Development, Customer Relationship Management, Human Resource Management, Information Systems and Process Management We have strong internal quality processes to manage growth

® We have built a strong brand l Prominently covered in Business Week, New York Times and Wall Street Journal l Most admired company in India poll by India’s largest business daily, The Economic Times l Infosys figures in Forbes “ 20 for 2000” l First recipient of the UTI award for corporate governance - chosen from over 7500 listed companies in India

® We have won several awards l The Far Eastern Economic Review rated Infosys as the No. 1 company in India in the Review 2000, an annual survey of Asia's leading companies l Infosys became the first IT company to win the IMC Ramkrishna Bajaj National Quality Award in the services category l We were judged by the Financial Technology Asia Magazine as the Best Regional Software House l The Bank. Away product from Infosys won the CSIWipro award for the Best Packaged Application for the year 2000 l “Silver Shield” Award for the Best Presented Accounts awarded by the ICAI for Non-financial Private Sector Companies for six consecutive years ended March 31, 1995 through 2000

® In summary We have a unique business model which is fully poised to exploit the growth opportunities in the market and minimize risk

® Thank You Visit us at www. infy. com

926de99eac4dcc84edd6bda4d84ee871.ppt