fb2ef864fc951f71588f152520000576.ppt

- Количество слайдов: 28

Information Technology Sector Stocks June 1 st, 2010 Greg Price Greg Shaskus Min Shen Matt Sims Chris Stuart

Information Technology Sector Stocks June 1 st, 2010 Greg Price Greg Shaskus Min Shen Matt Sims Chris Stuart

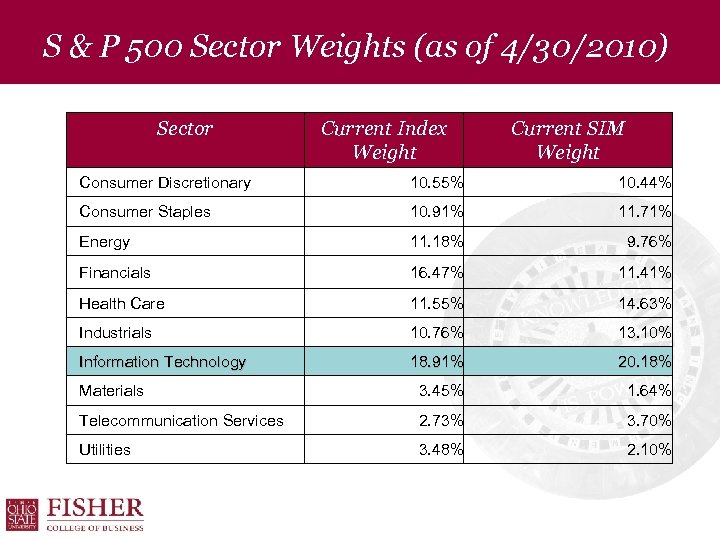

S & P 500 Sector Weights (as of 4/30/2010) Sector Current Index Weight Current SIM Weight Consumer Discretionary 10. 55% 10. 44% Consumer Staples 10. 91% 11. 71% Energy 11. 18% 9. 76% Financials 16. 47% 11. 41% Health Care 11. 55% 14. 63% Industrials 10. 76% 13. 10% Information Technology 18. 91% 20. 18% Materials 3. 45% 1. 64% Telecommunication Services 2. 73% 3. 70% Utilities 3. 48% 2. 10%

S & P 500 Sector Weights (as of 4/30/2010) Sector Current Index Weight Current SIM Weight Consumer Discretionary 10. 55% 10. 44% Consumer Staples 10. 91% 11. 71% Energy 11. 18% 9. 76% Financials 16. 47% 11. 41% Health Care 11. 55% 14. 63% Industrials 10. 76% 13. 10% Information Technology 18. 91% 20. 18% Materials 3. 45% 1. 64% Telecommunication Services 2. 73% 3. 70% Utilities 3. 48% 2. 10%

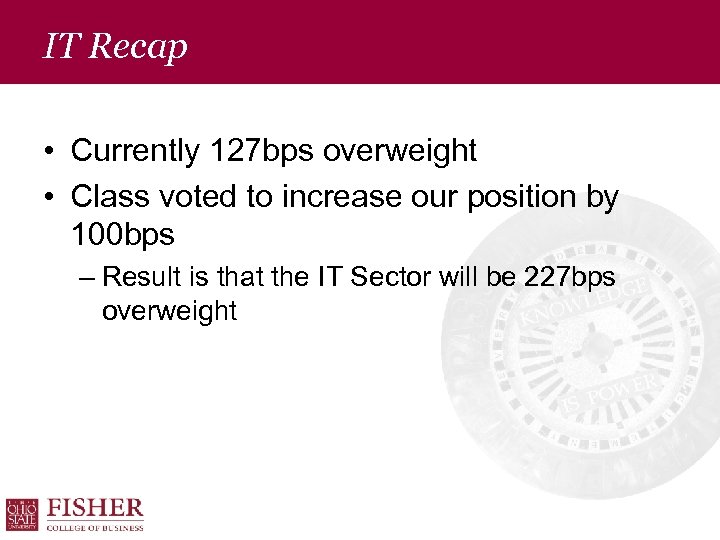

IT Recap • Currently 127 bps overweight • Class voted to increase our position by 100 bps – Result is that the IT Sector will be 227 bps overweight

IT Recap • Currently 127 bps overweight • Class voted to increase our position by 100 bps – Result is that the IT Sector will be 227 bps overweight

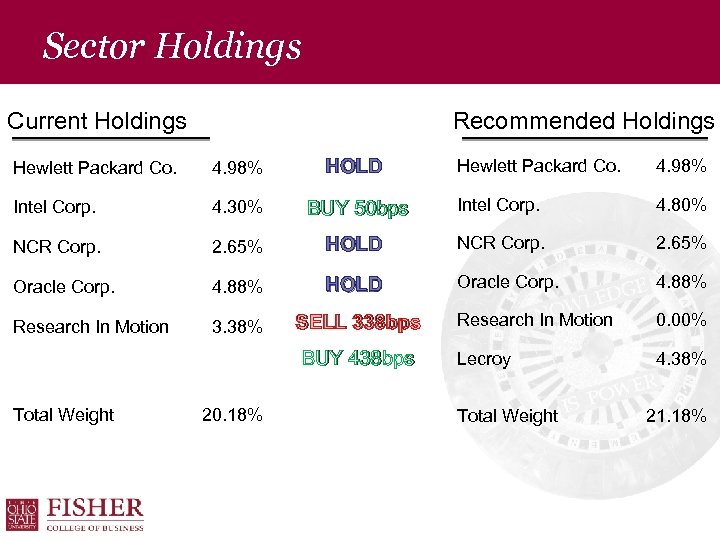

Sector Holdings Current Holdings Recommended Holdings Hewlett Packard Co. 4. 98% HOLD Intel Corp. 4. 30% NCR Corp. Hewlett Packard Co. 4. 98% BUY 50 bps Intel Corp. 4. 80% 2. 65% HOLD NCR Corp. 2. 65% Oracle Corp. 4. 88% HOLD Oracle Corp. 4. 88% Research In Motion 3. 38% SELL 338 bps Research In Motion 0. 00% Lecroy 4. 38% BUY 438 bps Total Weight 20. 18% Total Weight 21. 18%

Sector Holdings Current Holdings Recommended Holdings Hewlett Packard Co. 4. 98% HOLD Intel Corp. 4. 30% NCR Corp. Hewlett Packard Co. 4. 98% BUY 50 bps Intel Corp. 4. 80% 2. 65% HOLD NCR Corp. 2. 65% Oracle Corp. 4. 88% HOLD Oracle Corp. 4. 88% Research In Motion 3. 38% SELL 338 bps Research In Motion 0. 00% Lecroy 4. 38% BUY 438 bps Total Weight 20. 18% Total Weight 21. 18%

Intel—Buy • Intel is the world’s largest semiconductor chip maker • Offers products for personal computers, servers, and mobile devices • Two major growth opportunities: – Asia – “Smart” market • Buy 50 bps – 430 bps 480 bps

Intel—Buy • Intel is the world’s largest semiconductor chip maker • Offers products for personal computers, servers, and mobile devices • Two major growth opportunities: – Asia – “Smart” market • Buy 50 bps – 430 bps 480 bps

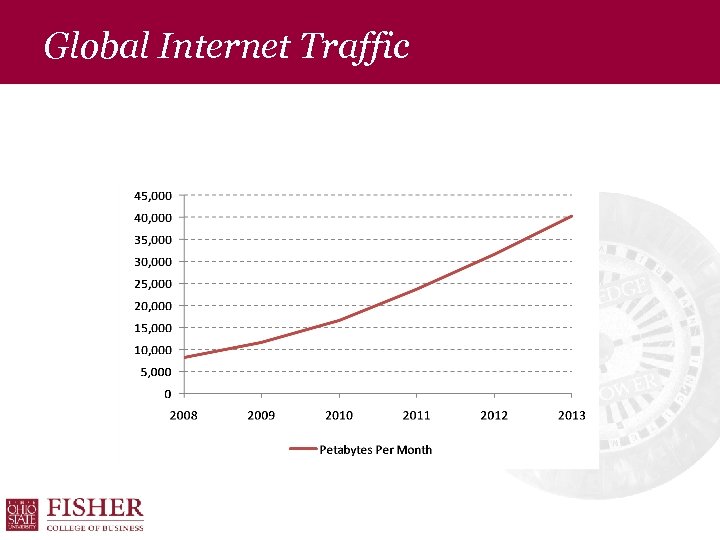

Global Internet Traffic

Global Internet Traffic

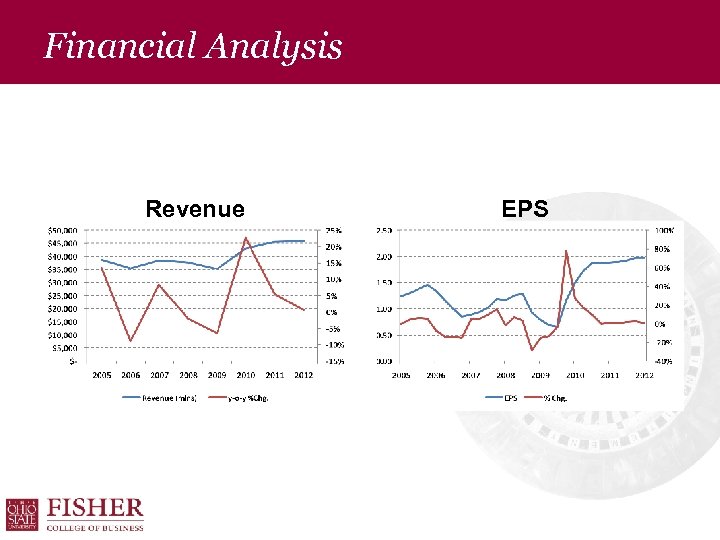

Financial Analysis Revenue EPS

Financial Analysis Revenue EPS

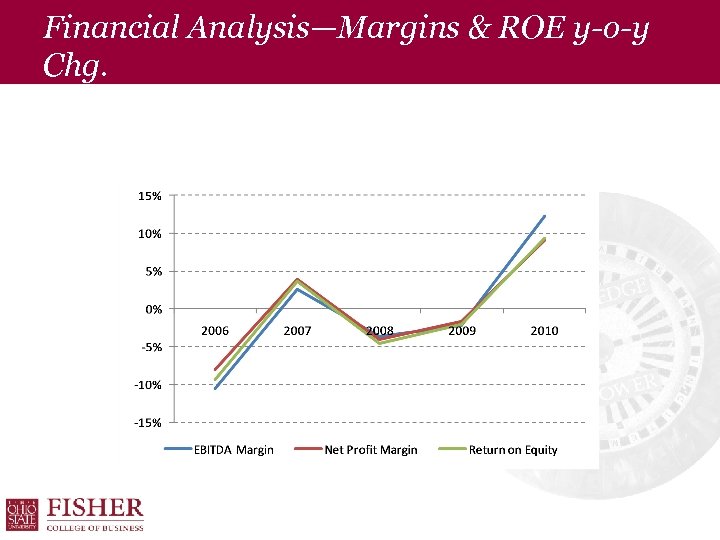

Financial Analysis—Margins & ROE y-o-y Chg.

Financial Analysis—Margins & ROE y-o-y Chg.

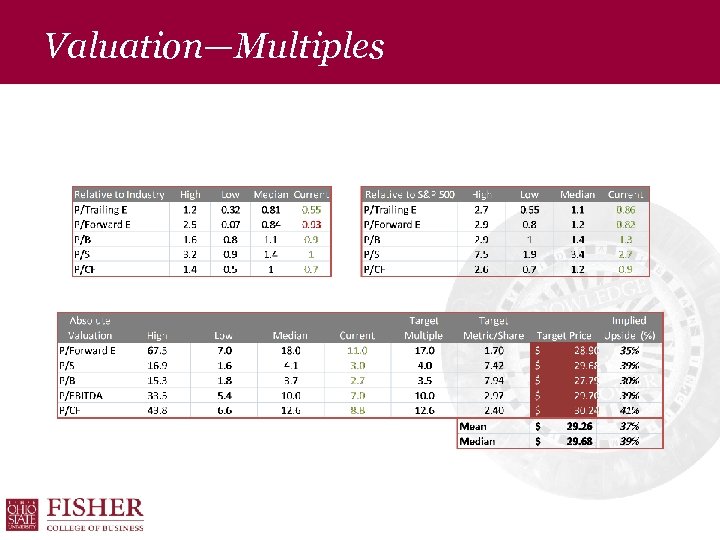

Valuation—Multiples

Valuation—Multiples

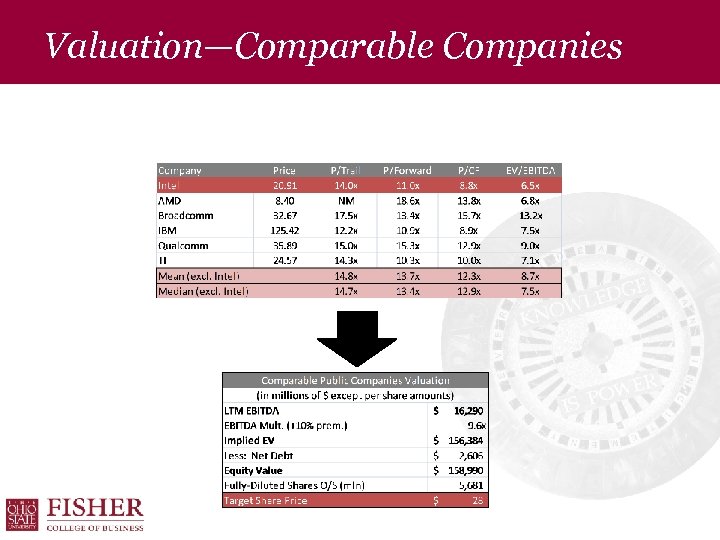

Valuation—Comparable Companies

Valuation—Comparable Companies

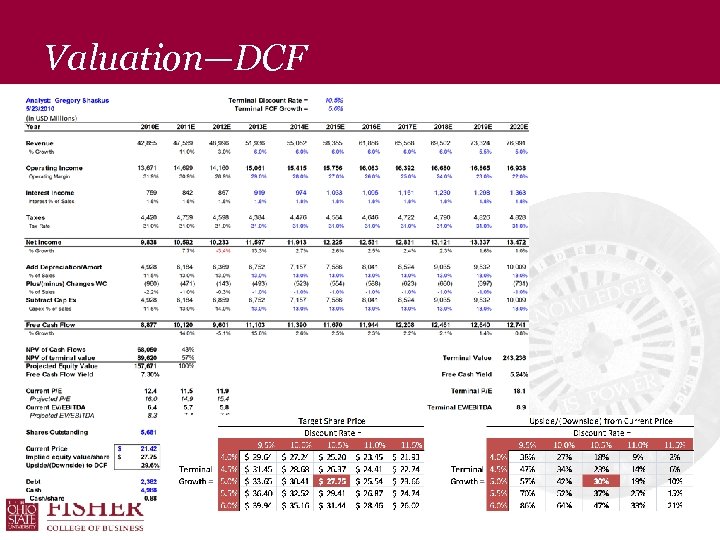

Valuation—DCF

Valuation—DCF

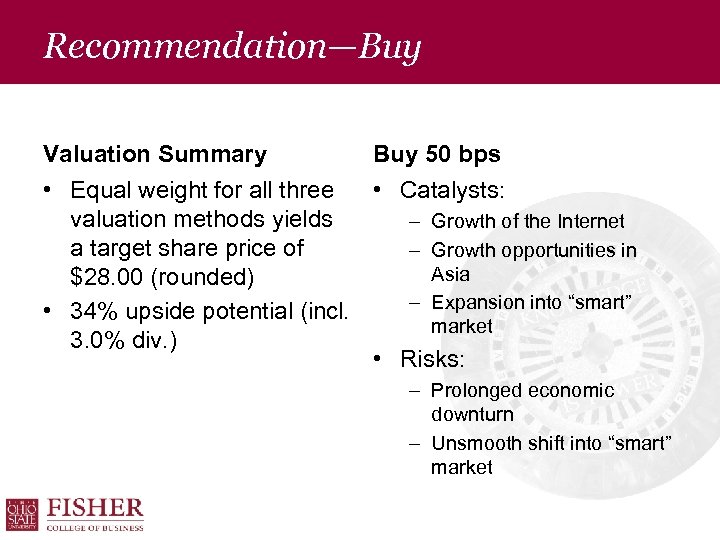

Recommendation—Buy Valuation Summary Buy 50 bps • Equal weight for all three • Catalysts: valuation methods yields – Growth of the Internet a target share price of – Growth opportunities in Asia $28. 00 (rounded) – Expansion into “smart” • 34% upside potential (incl. market 3. 0% div. ) • Risks: – Prolonged economic downturn – Unsmooth shift into “smart” market

Recommendation—Buy Valuation Summary Buy 50 bps • Equal weight for all three • Catalysts: valuation methods yields – Growth of the Internet a target share price of – Growth opportunities in Asia $28. 00 (rounded) – Expansion into “smart” • 34% upside potential (incl. market 3. 0% div. ) • Risks: – Prolonged economic downturn – Unsmooth shift into “smart” market

Research In Motion • Designs, manufacturers, and markets innovative wireless solutions for a global mobile communication market (aka Blackberry) – Its popularity was based on the convenience of its mobile email system and its cost compared to competitors • Debut of new 6. 0 Operating System next quarter • Rumors about entering the Tablet PC market • Sell all BP’s of RIM

Research In Motion • Designs, manufacturers, and markets innovative wireless solutions for a global mobile communication market (aka Blackberry) – Its popularity was based on the convenience of its mobile email system and its cost compared to competitors • Debut of new 6. 0 Operating System next quarter • Rumors about entering the Tablet PC market • Sell all BP’s of RIM

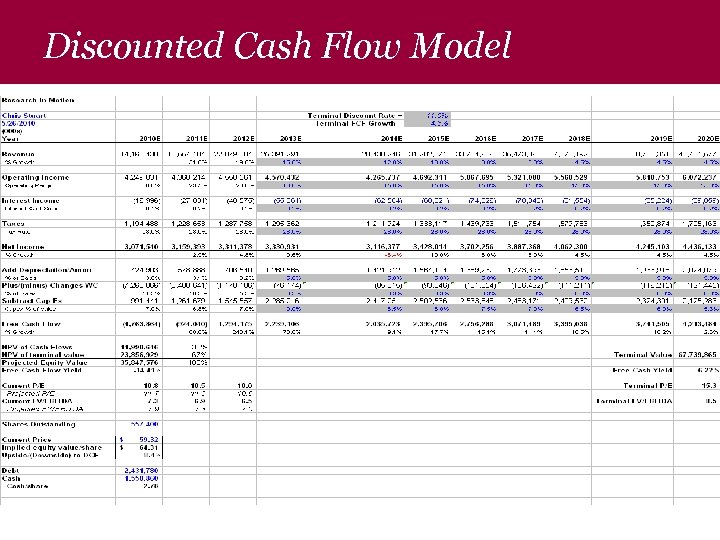

Discounted Cash Flow Model

Discounted Cash Flow Model

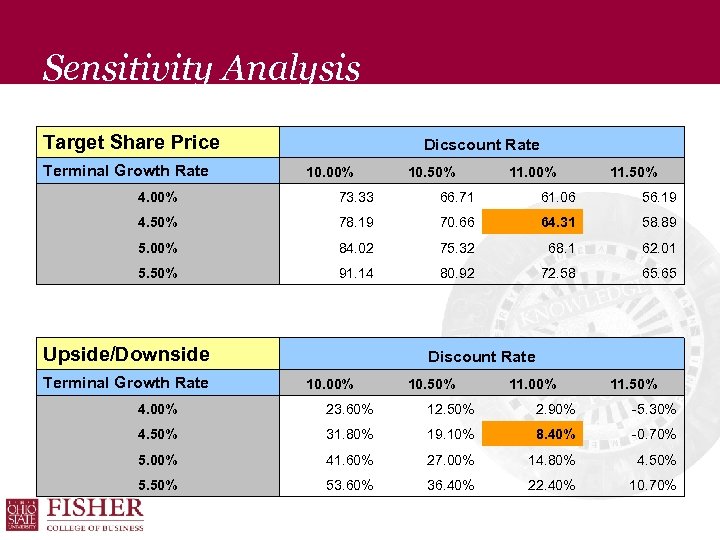

Sensitivity Analysis Target Share Price Terminal Growth Rate Dicscount Rate 10. 00% 10. 50% 11. 00% 11. 50% 4. 00% 73. 33 66. 71 61. 06 56. 19 4. 50% 78. 19 70. 66 64. 31 58. 89 5. 00% 84. 02 75. 32 68. 1 62. 01 5. 50% 91. 14 80. 92 72. 58 65. 65 Upside/Downside Terminal Growth Rate Discount Rate 10. 00% 10. 50% 11. 00% 11. 50% 4. 00% 23. 60% 12. 50% 2. 90% -5. 30% 4. 50% 31. 80% 19. 10% 8. 40% -0. 70% 5. 00% 41. 60% 27. 00% 14. 80% 4. 50% 53. 60% 36. 40% 22. 40% 10. 70%

Sensitivity Analysis Target Share Price Terminal Growth Rate Dicscount Rate 10. 00% 10. 50% 11. 00% 11. 50% 4. 00% 73. 33 66. 71 61. 06 56. 19 4. 50% 78. 19 70. 66 64. 31 58. 89 5. 00% 84. 02 75. 32 68. 1 62. 01 5. 50% 91. 14 80. 92 72. 58 65. 65 Upside/Downside Terminal Growth Rate Discount Rate 10. 00% 10. 50% 11. 00% 11. 50% 4. 00% 23. 60% 12. 50% 2. 90% -5. 30% 4. 50% 31. 80% 19. 10% 8. 40% -0. 70% 5. 00% 41. 60% 27. 00% 14. 80% 4. 50% 53. 60% 36. 40% 22. 40% 10. 70%

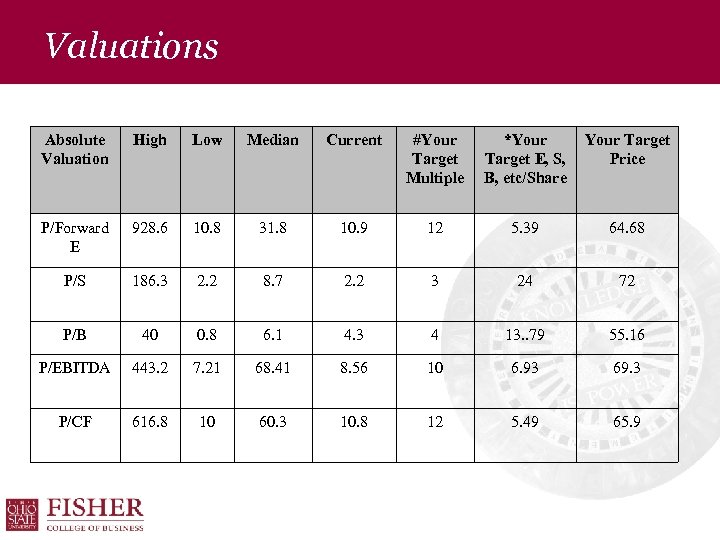

Valuations Absolute Valuation High Low Median Current #Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price P/Forward E 928. 6 10. 8 31. 8 10. 9 12 5. 39 64. 68 P/S 186. 3 2. 2 8. 7 2. 2 3 24 72 P/B 40 0. 8 6. 1 4. 3 4 13. . 79 55. 16 P/EBITDA 443. 2 7. 21 68. 41 8. 56 10 6. 93 69. 3 P/CF 616. 8 10 60. 3 10. 8 12 5. 49 65. 9

Valuations Absolute Valuation High Low Median Current #Your Target Multiple *Your Target E, S, B, etc/Share Your Target Price P/Forward E 928. 6 10. 8 31. 8 10. 9 12 5. 39 64. 68 P/S 186. 3 2. 2 8. 7 2. 2 3 24 72 P/B 40 0. 8 6. 1 4. 3 4 13. . 79 55. 16 P/EBITDA 443. 2 7. 21 68. 41 8. 56 10 6. 93 69. 3 P/CF 616. 8 10 60. 3 10. 8 12 5. 49 65. 9

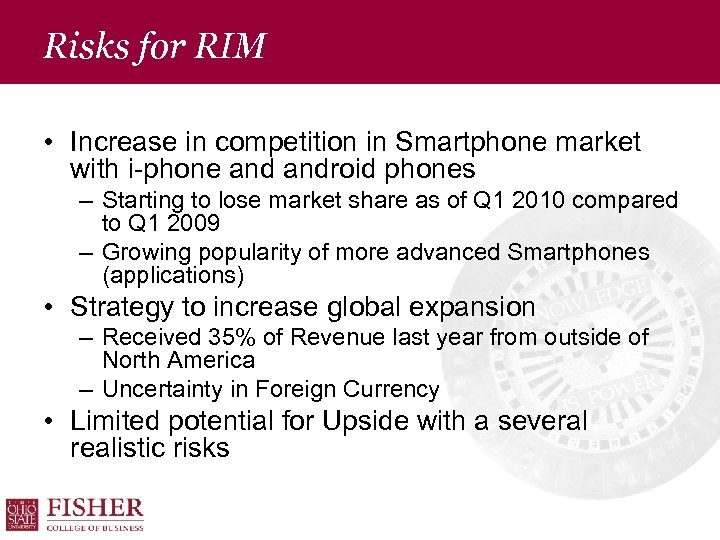

Risks for RIM • Increase in competition in Smartphone market with i-phone android phones – Starting to lose market share as of Q 1 2010 compared to Q 1 2009 – Growing popularity of more advanced Smartphones (applications) • Strategy to increase global expansion – Received 35% of Revenue last year from outside of North America – Uncertainty in Foreign Currency • Limited potential for Upside with a several realistic risks

Risks for RIM • Increase in competition in Smartphone market with i-phone android phones – Starting to lose market share as of Q 1 2010 compared to Q 1 2009 – Growing popularity of more advanced Smartphones (applications) • Strategy to increase global expansion – Received 35% of Revenue last year from outside of North America – Uncertainty in Foreign Currency • Limited potential for Upside with a several realistic risks

Lecroy—Buy • Operates in Test and Measurement industry • Products are used to design, develop, and manufacture electronic equipment • Develops, manufactures, sells, and licenses highperformance oscilloscopes and global communication protocol analyzers – Oscilloscopes are tools used to measure and analyze electronic signals (volts) – Protocol analyzers are tools used to analyze communication between two electronic devices – Lecroy’s products are used in the computer, semiconductor, data storage, communications, consumer electronics, automotive/industrial, and defense industries • Buy 438 bps

Lecroy—Buy • Operates in Test and Measurement industry • Products are used to design, develop, and manufacture electronic equipment • Develops, manufactures, sells, and licenses highperformance oscilloscopes and global communication protocol analyzers – Oscilloscopes are tools used to measure and analyze electronic signals (volts) – Protocol analyzers are tools used to analyze communication between two electronic devices – Lecroy’s products are used in the computer, semiconductor, data storage, communications, consumer electronics, automotive/industrial, and defense industries • Buy 438 bps

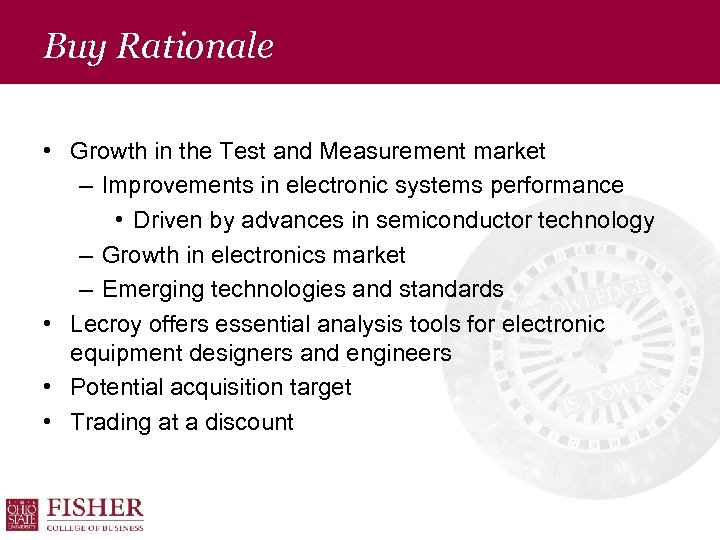

Buy Rationale • Growth in the Test and Measurement market – Improvements in electronic systems performance • Driven by advances in semiconductor technology – Growth in electronics market – Emerging technologies and standards • Lecroy offers essential analysis tools for electronic equipment designers and engineers • Potential acquisition target • Trading at a discount

Buy Rationale • Growth in the Test and Measurement market – Improvements in electronic systems performance • Driven by advances in semiconductor technology – Growth in electronics market – Emerging technologies and standards • Lecroy offers essential analysis tools for electronic equipment designers and engineers • Potential acquisition target • Trading at a discount

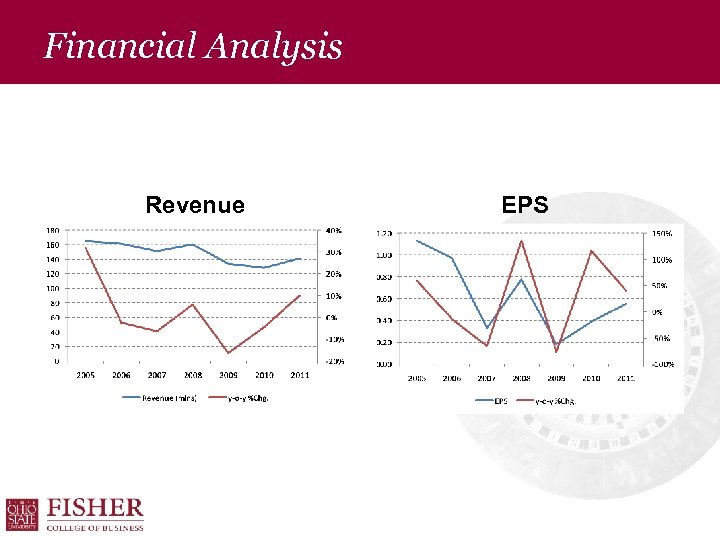

Financial Analysis Revenue EPS

Financial Analysis Revenue EPS

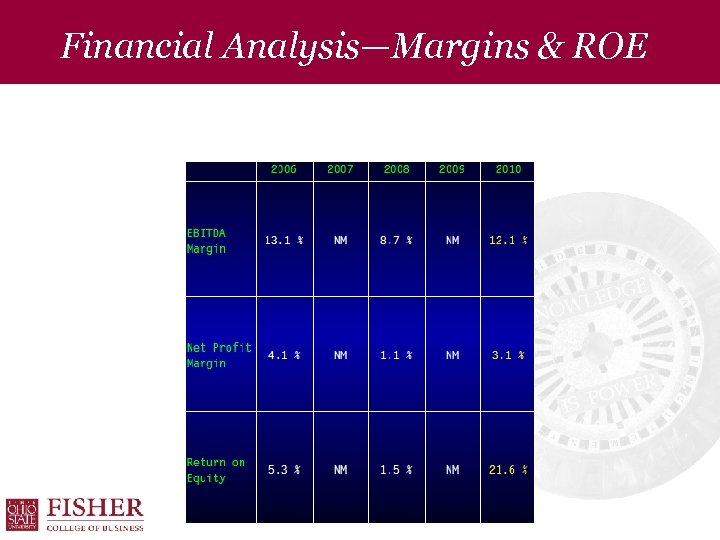

Financial Analysis—Margins & ROE

Financial Analysis—Margins & ROE

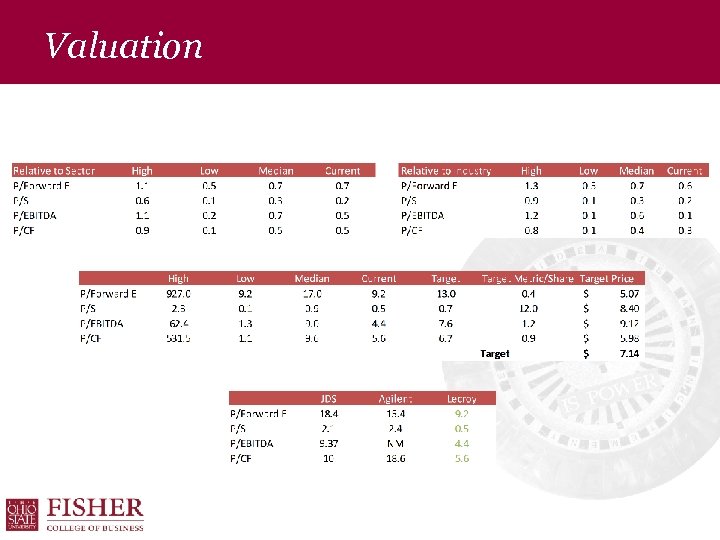

Valuation

Valuation

Recommendation—Buy Valuation Summary Buy 438 bps • Target Price of $7. 00 derived from absolute valuation • 40% upside from current price of $5. 00 • Catalysts: – Growth in electronics markets – Improvements in technology – New technological standards • Risks – Prolonged economic downturn – Competition • Lecroy is much smaller than its competitors

Recommendation—Buy Valuation Summary Buy 438 bps • Target Price of $7. 00 derived from absolute valuation • 40% upside from current price of $5. 00 • Catalysts: – Growth in electronics markets – Improvements in technology – New technological standards • Risks – Prolonged economic downturn – Competition • Lecroy is much smaller than its competitors

Questions

Questions

Hewlett Packard Fundamental Drivers: • Focus on offering a complete solution for all of a company’s IT needs • Transforming from a purely infrastructure company to a services and infrastructure company • Aggressive approach to winning business from rivals • Sales in the Brazil, Russia, India, and China regions

Hewlett Packard Fundamental Drivers: • Focus on offering a complete solution for all of a company’s IT needs • Transforming from a purely infrastructure company to a services and infrastructure company • Aggressive approach to winning business from rivals • Sales in the Brazil, Russia, India, and China regions

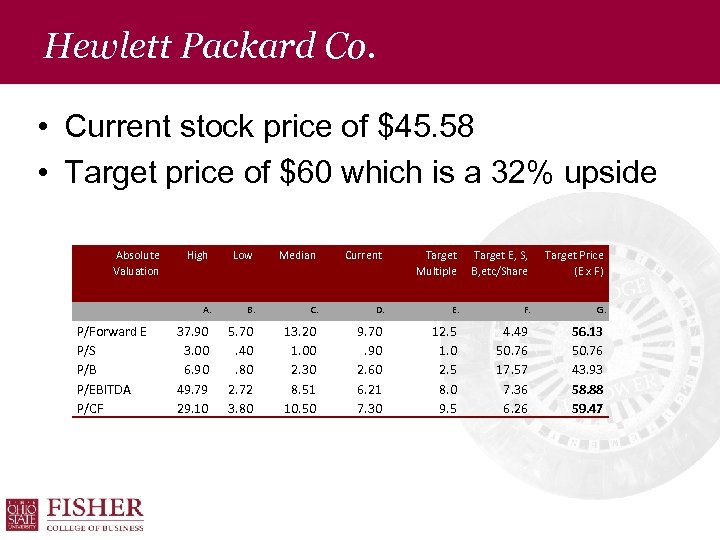

Hewlett Packard Co. • Current stock price of $45. 58 • Target price of $60 which is a 32% upside Absolute Valuation High Low Median Current Target E, S, Multiple B, etc/Share Target Price (E x F) A. P/Forward E P/S P/B P/EBITDA P/CF B. C. D. E. F. G. 37. 90 3. 00 6. 90 49. 79 29. 10 5. 70. 40. 80 2. 72 3. 80 13. 20 1. 00 2. 30 8. 51 10. 50 9. 70. 90 2. 60 6. 21 7. 30 12. 5 1. 0 2. 5 8. 0 9. 5 4. 49 50. 76 17. 57 7. 36 6. 26 56. 13 50. 76 43. 93 58. 88 59. 47

Hewlett Packard Co. • Current stock price of $45. 58 • Target price of $60 which is a 32% upside Absolute Valuation High Low Median Current Target E, S, Multiple B, etc/Share Target Price (E x F) A. P/Forward E P/S P/B P/EBITDA P/CF B. C. D. E. F. G. 37. 90 3. 00 6. 90 49. 79 29. 10 5. 70. 40. 80 2. 72 3. 80 13. 20 1. 00 2. 30 8. 51 10. 50 9. 70. 90 2. 60 6. 21 7. 30 12. 5 1. 0 2. 5 8. 0 9. 5 4. 49 50. 76 17. 57 7. 36 6. 26 56. 13 50. 76 43. 93 58. 88 59. 47

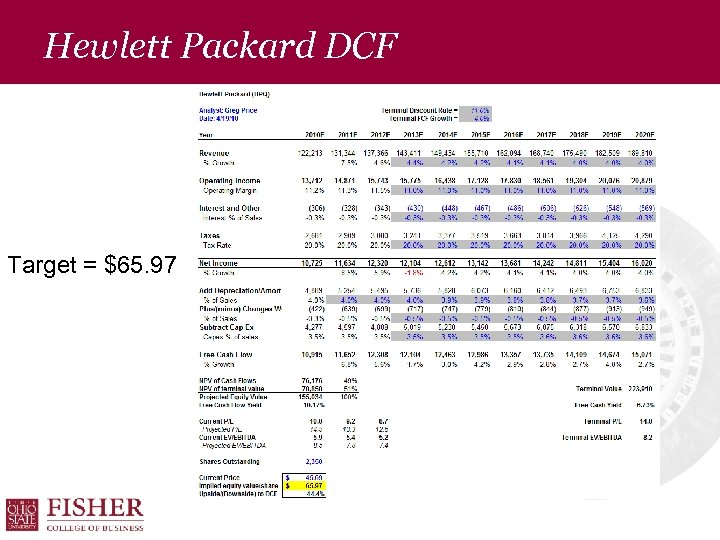

Hewlett Packard DCF Target = $65. 97

Hewlett Packard DCF Target = $65. 97

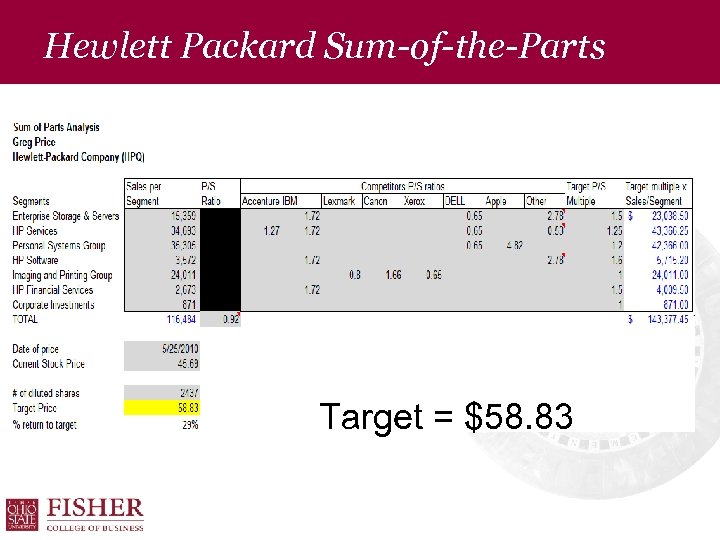

Hewlett Packard Sum-of-the-Parts Target = $58. 83

Hewlett Packard Sum-of-the-Parts Target = $58. 83