52cc273596f29032c8b9c7cb4d8d08b2.ppt

- Количество слайдов: 22

Information on Analysys Mason expertise Understanding the impact of connected TV from a global, 360 -degree viewpoint July 2012 5086 -285

Information on Analysys Mason expertise Understanding the impact of connected TV from a global, 360 -degree viewpoint July 2012 5086 -285

Confidentiality notice § Copyright © 2012. The information contained herein is the property of Analysys Mason Limited and is provided on condition that it will not be reproduced, copied, lent or disclosed, directly or indirectly, nor used for any purpose other than that for which it was specifically furnished 5086 -285

Confidentiality notice § Copyright © 2012. The information contained herein is the property of Analysys Mason Limited and is provided on condition that it will not be reproduced, copied, lent or disclosed, directly or indirectly, nor used for any purpose other than that for which it was specifically furnished 5086 -285

3 Contents Background on Analysys Mason as a leading global advisor Understanding the trends and complexities in connected TV Analysys Mason has a unique combination of expertise How we could we help you take action 5086 -285

3 Contents Background on Analysys Mason as a leading global advisor Understanding the trends and complexities in connected TV Analysys Mason has a unique combination of expertise How we could we help you take action 5086 -285

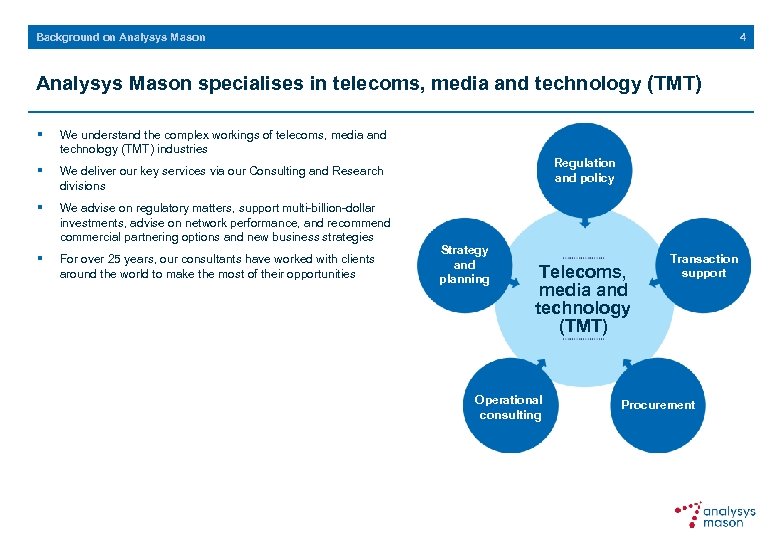

4 Background on Analysys Mason specialises in telecoms, media and technology (TMT) § We understand the complex workings of telecoms, media and technology (TMT) industries § We deliver our key services via our Consulting and Research divisions § § We advise on regulatory matters, support multi-billion-dollar investments, advise on network performance, and recommend commercial partnering options and new business strategies For over 25 years, our consultants have worked with clients around the world to make the most of their opportunities Regulation and policy spectrum Nextgeneration Strategy networks and planning Transaction support Telecoms, media and technology (TMT) Strategy and planning Operational consulting 5086 -285 Transaction support Procurement and ICT Procurement Marketing and products

4 Background on Analysys Mason specialises in telecoms, media and technology (TMT) § We understand the complex workings of telecoms, media and technology (TMT) industries § We deliver our key services via our Consulting and Research divisions § § We advise on regulatory matters, support multi-billion-dollar investments, advise on network performance, and recommend commercial partnering options and new business strategies For over 25 years, our consultants have worked with clients around the world to make the most of their opportunities Regulation and policy spectrum Nextgeneration Strategy networks and planning Transaction support Telecoms, media and technology (TMT) Strategy and planning Operational consulting 5086 -285 Transaction support Procurement and ICT Procurement Marketing and products

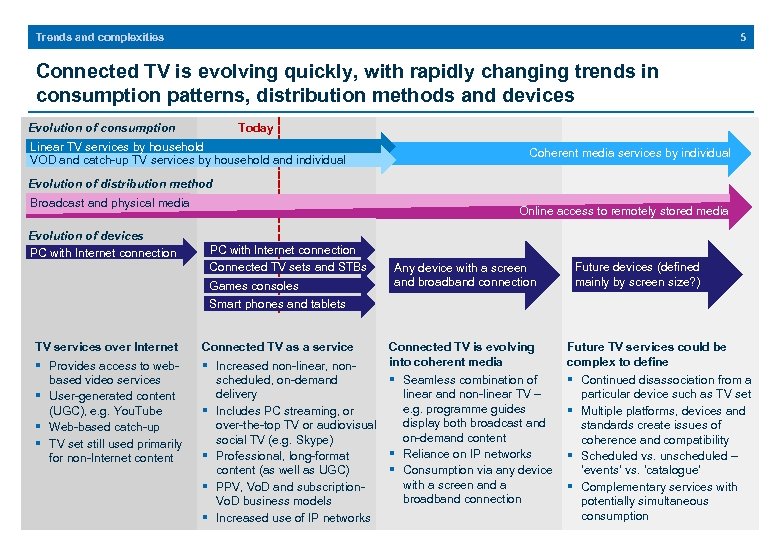

5 Trends and complexities Connected TV is evolving quickly, with rapidly changing trends in consumption patterns, distribution methods and devices Evolution of consumption Today Linear TV services by household VOD and catch-up TV services by household and individual Coherent media services by individual Evolution of distribution method Broadcast and physical media Evolution of devices PC with Internet connection Online access to remotely stored media PC with Internet connection Connected TV sets and STBs Games consoles Any device with a screen and broadband connection Future devices (defined mainly by screen size? ) Smart phones and tablets TV services over Internet Connected TV as a service § Provides access to webbased video services § User-generated content (UGC), e. g. You. Tube § Web-based catch-up § TV set still used primarily for non-Internet content § Increased non-linear, nonscheduled, on-demand § Seamless combination of delivery linear and non-linear TV – e. g. programme guides § Includes PC streaming, or display both broadcast and over-the-top TV or audiovisual on-demand content social TV (e. g. Skype) § Reliance on IP networks § Professional, long-format content (as well as UGC) § Consumption via any device with a screen and a § PPV, Vo. D and subscriptionbroadband connection Vo. D business models § Increased use of IP networks 5086 -285 Connected TV is evolving into coherent media Future TV services could be complex to define § Continued disassociation from a particular device such as TV set § Multiple platforms, devices and standards create issues of coherence and compatibility § Scheduled vs. unscheduled – ‘events’ vs. ‘catalogue’ § Complementary services with potentially simultaneous consumption

5 Trends and complexities Connected TV is evolving quickly, with rapidly changing trends in consumption patterns, distribution methods and devices Evolution of consumption Today Linear TV services by household VOD and catch-up TV services by household and individual Coherent media services by individual Evolution of distribution method Broadcast and physical media Evolution of devices PC with Internet connection Online access to remotely stored media PC with Internet connection Connected TV sets and STBs Games consoles Any device with a screen and broadband connection Future devices (defined mainly by screen size? ) Smart phones and tablets TV services over Internet Connected TV as a service § Provides access to webbased video services § User-generated content (UGC), e. g. You. Tube § Web-based catch-up § TV set still used primarily for non-Internet content § Increased non-linear, nonscheduled, on-demand § Seamless combination of delivery linear and non-linear TV – e. g. programme guides § Includes PC streaming, or display both broadcast and over-the-top TV or audiovisual on-demand content social TV (e. g. Skype) § Reliance on IP networks § Professional, long-format content (as well as UGC) § Consumption via any device with a screen and a § PPV, Vo. D and subscriptionbroadband connection Vo. D business models § Increased use of IP networks 5086 -285 Connected TV is evolving into coherent media Future TV services could be complex to define § Continued disassociation from a particular device such as TV set § Multiple platforms, devices and standards create issues of coherence and compatibility § Scheduled vs. unscheduled – ‘events’ vs. ‘catalogue’ § Complementary services with potentially simultaneous consumption

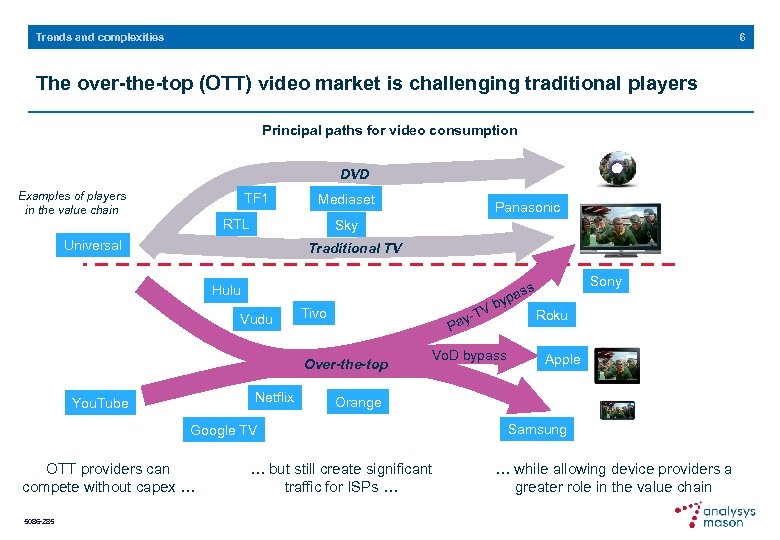

6 Trends and complexities The over-the-top (OTT) video market is challenging traditional players Principal paths for video consumption DVD Examples of players in the value chain TF 1 Mediaset RTL Panasonic Sky Universal Traditional TV Hulu Vudu TV ay- Tivo Netflix Vo. D bypass 5086 -285 Sony Roku Apple Orange Google TV OTT providers can compete without capex … b P Over-the-top You. Tube ss ypa … but still create significant traffic for ISPs … Samsung … while allowing device providers a greater role in the value chain

6 Trends and complexities The over-the-top (OTT) video market is challenging traditional players Principal paths for video consumption DVD Examples of players in the value chain TF 1 Mediaset RTL Panasonic Sky Universal Traditional TV Hulu Vudu TV ay- Tivo Netflix Vo. D bypass 5086 -285 Sony Roku Apple Orange Google TV OTT providers can compete without capex … b P Over-the-top You. Tube ss ypa … but still create significant traffic for ISPs … Samsung … while allowing device providers a greater role in the value chain

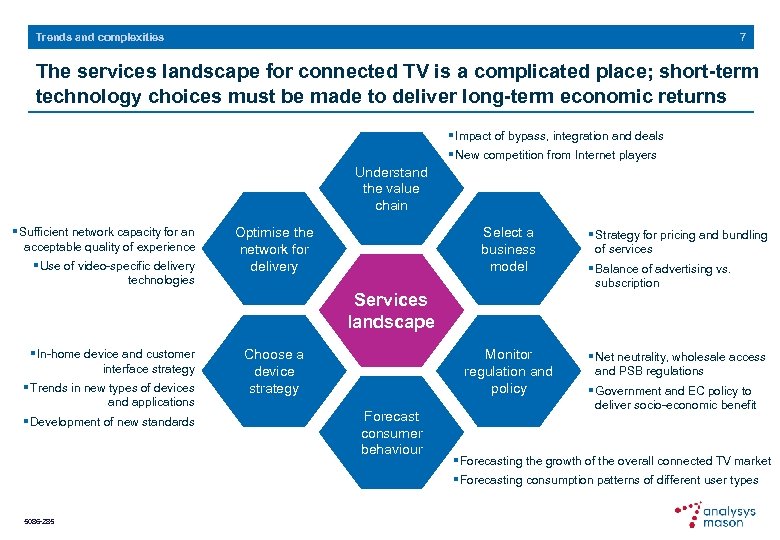

7 Trends and complexities The services landscape for connected TV is a complicated place; short-term technology choices must be made to deliver long-term economic returns § Impact of bypass, integration and deals § New competition from Internet players Understand the value chain § Sufficient network capacity for an acceptable quality of experience § Use of video-specific delivery technologies Optimise the network for delivery Select a business model § Strategy for pricing and bundling of services Monitor regulation and policy § Net neutrality, wholesale access and PSB regulations § Balance of advertising vs. subscription Services landscape § In-home device and customer interface strategy § Trends in new types of devices and applications § Development of new standards Choose a device strategy Forecast consumer behaviour § Government and EC policy to deliver socio-economic benefit § Forecasting the growth of the overall connected TV market § Forecasting consumption patterns of different user types 5086 -285

7 Trends and complexities The services landscape for connected TV is a complicated place; short-term technology choices must be made to deliver long-term economic returns § Impact of bypass, integration and deals § New competition from Internet players Understand the value chain § Sufficient network capacity for an acceptable quality of experience § Use of video-specific delivery technologies Optimise the network for delivery Select a business model § Strategy for pricing and bundling of services Monitor regulation and policy § Net neutrality, wholesale access and PSB regulations § Balance of advertising vs. subscription Services landscape § In-home device and customer interface strategy § Trends in new types of devices and applications § Development of new standards Choose a device strategy Forecast consumer behaviour § Government and EC policy to deliver socio-economic benefit § Forecasting the growth of the overall connected TV market § Forecasting consumption patterns of different user types 5086 -285

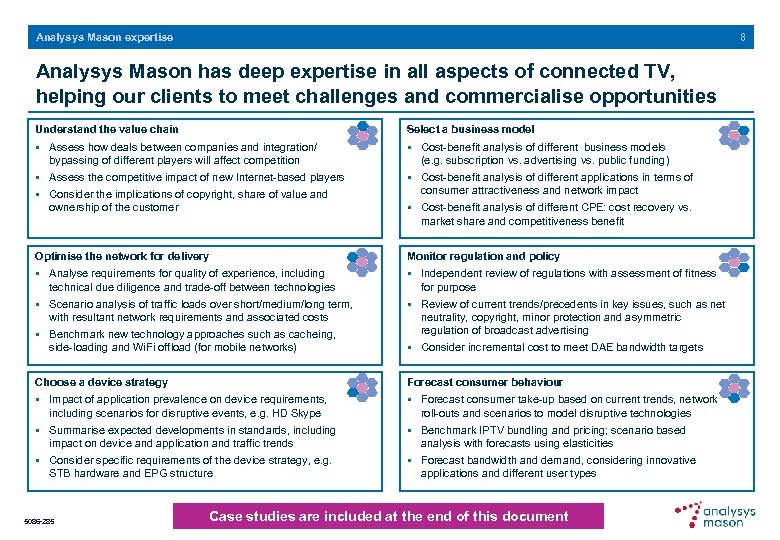

8 Analysys Mason expertise Analysys Mason has deep expertise in all aspects of connected TV, helping our clients to meet challenges and commercialise opportunities Understand the value chain Select a business model § Assess how deals between companies and integration/ bypassing of different players will affect competition § Assess the competitive impact of new Internet-based players § Consider the implications of copyright, share of value and ownership of the customer § Cost-benefit analysis of different business models (e. g. subscription vs. advertising vs. public funding) § Cost-benefit analysis of different applications in terms of consumer attractiveness and network impact § Cost-benefit analysis of different CPE: cost recovery vs. market share and competitiveness benefit Optimise the network for delivery Monitor regulation and policy § Analyse requirements for quality of experience, including technical due diligence and trade-off between technologies § Scenario analysis of traffic loads over short/medium/long term, with resultant network requirements and associated costs § Benchmark new technology approaches such as cacheing, side-loading and Wi. Fi offload (for mobile networks) § Independent review of regulations with assessment of fitness for purpose § Review of current trends/precedents in key issues, such as net neutrality, copyright, minor protection and asymmetric regulation of broadcast advertising § Consider incremental cost to meet DAE bandwidth targets Choose a device strategy Forecast consumer behaviour § Impact of application prevalence on device requirements, including scenarios for disruptive events, e. g. HD Skype § Summarise expected developments in standards, including impact on device and application and traffic trends § Consider specific requirements of the device strategy, e. g. STB hardware and EPG structure § Forecast consumer take-up based on current trends, network roll-outs and scenarios to model disruptive technologies § Benchmark IPTV bundling and pricing; scenario based analysis with forecasts using elasticities § Forecast bandwidth and demand, considering innovative applications and different user types 5086 -285 Case studies are included at the end of this document

8 Analysys Mason expertise Analysys Mason has deep expertise in all aspects of connected TV, helping our clients to meet challenges and commercialise opportunities Understand the value chain Select a business model § Assess how deals between companies and integration/ bypassing of different players will affect competition § Assess the competitive impact of new Internet-based players § Consider the implications of copyright, share of value and ownership of the customer § Cost-benefit analysis of different business models (e. g. subscription vs. advertising vs. public funding) § Cost-benefit analysis of different applications in terms of consumer attractiveness and network impact § Cost-benefit analysis of different CPE: cost recovery vs. market share and competitiveness benefit Optimise the network for delivery Monitor regulation and policy § Analyse requirements for quality of experience, including technical due diligence and trade-off between technologies § Scenario analysis of traffic loads over short/medium/long term, with resultant network requirements and associated costs § Benchmark new technology approaches such as cacheing, side-loading and Wi. Fi offload (for mobile networks) § Independent review of regulations with assessment of fitness for purpose § Review of current trends/precedents in key issues, such as net neutrality, copyright, minor protection and asymmetric regulation of broadcast advertising § Consider incremental cost to meet DAE bandwidth targets Choose a device strategy Forecast consumer behaviour § Impact of application prevalence on device requirements, including scenarios for disruptive events, e. g. HD Skype § Summarise expected developments in standards, including impact on device and application and traffic trends § Consider specific requirements of the device strategy, e. g. STB hardware and EPG structure § Forecast consumer take-up based on current trends, network roll-outs and scenarios to model disruptive technologies § Benchmark IPTV bundling and pricing; scenario based analysis with forecasts using elasticities § Forecast bandwidth and demand, considering innovative applications and different user types 5086 -285 Case studies are included at the end of this document

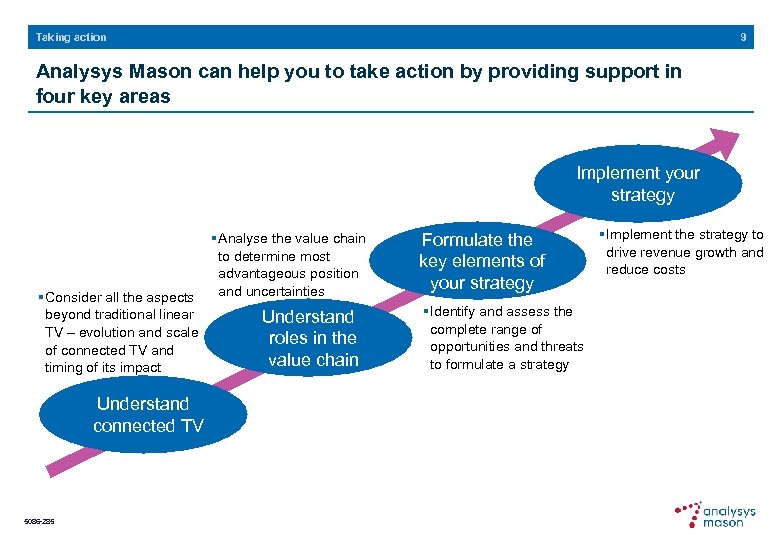

9 Taking action Analysys Mason can help you to take action by providing support in four key areas Implement your strategy § Consider all the aspects beyond traditional linear TV – evolution and scale of connected TV and timing of its impact Understand connected TV 5086 -285 § Analyse the value chain to determine most advantageous position and uncertainties Understand roles in the value chain Formulate the key elements of your strategy § Identify and assess the complete range of opportunities and threats to formulate a strategy § Implement the strategy to drive revenue growth and reduce costs

9 Taking action Analysys Mason can help you to take action by providing support in four key areas Implement your strategy § Consider all the aspects beyond traditional linear TV – evolution and scale of connected TV and timing of its impact Understand connected TV 5086 -285 § Analyse the value chain to determine most advantageous position and uncertainties Understand roles in the value chain Formulate the key elements of your strategy § Identify and assess the complete range of opportunities and threats to formulate a strategy § Implement the strategy to drive revenue growth and reduce costs

10 Case studies In the following slides we present details of a sample of our media work 5086 -285

10 Case studies In the following slides we present details of a sample of our media work 5086 -285

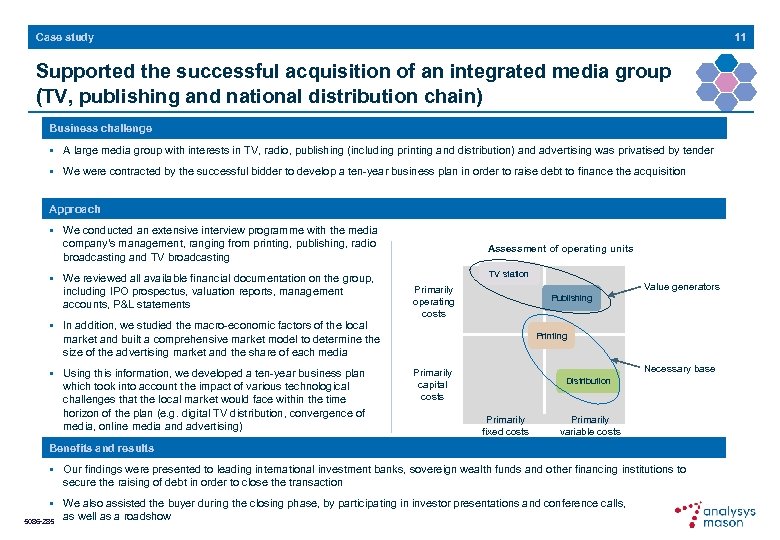

11 Case study Supported the successful acquisition of an integrated media group (TV, publishing and national distribution chain) Business challenge § A large media group with interests in TV, radio, publishing (including printing and distribution) and advertising was privatised by tender § We were contracted by the successful bidder to develop a ten-year business plan in order to raise debt to finance the acquisition Approach § We conducted an extensive interview programme with the media company's management, ranging from printing, publishing, radio broadcasting and TV broadcasting § We reviewed all available financial documentation on the group, including IPO prospectus, valuation reports, management accounts, P&L statements Assessment of operating units TV station Value generators Primarily operating costs Publishing § In addition, we studied the macro-economic factors of the local market and built a comprehensive market model to determine the size of the advertising market and the share of each media § Using this information, we developed a ten-year business plan which took into account the impact of various technological challenges that the local market would face within the time horizon of the plan (e. g. digital TV distribution, convergence of media, online media and advertising) Printing Necessary base Primarily capital costs Distribution Primarily fixed costs Primarily variable costs Benefits and results § Our findings were presented to leading international investment banks, sovereign wealth funds and other financing institutions to secure the raising of debt in order to close the transaction § We also assisted the buyer during the closing phase, by participating in investor presentations and conference calls, as well as a roadshow 5086 -285

11 Case study Supported the successful acquisition of an integrated media group (TV, publishing and national distribution chain) Business challenge § A large media group with interests in TV, radio, publishing (including printing and distribution) and advertising was privatised by tender § We were contracted by the successful bidder to develop a ten-year business plan in order to raise debt to finance the acquisition Approach § We conducted an extensive interview programme with the media company's management, ranging from printing, publishing, radio broadcasting and TV broadcasting § We reviewed all available financial documentation on the group, including IPO prospectus, valuation reports, management accounts, P&L statements Assessment of operating units TV station Value generators Primarily operating costs Publishing § In addition, we studied the macro-economic factors of the local market and built a comprehensive market model to determine the size of the advertising market and the share of each media § Using this information, we developed a ten-year business plan which took into account the impact of various technological challenges that the local market would face within the time horizon of the plan (e. g. digital TV distribution, convergence of media, online media and advertising) Printing Necessary base Primarily capital costs Distribution Primarily fixed costs Primarily variable costs Benefits and results § Our findings were presented to leading international investment banks, sovereign wealth funds and other financing institutions to secure the raising of debt in order to close the transaction § We also assisted the buyer during the closing phase, by participating in investor presentations and conference calls, as well as a roadshow 5086 -285

12 Case study Advised a large European telecoms operator on its potential acquisition of domestic football league rights Business challenge § A large European telecoms operator was considering the acquisition of the audiovisual rights for its top domestic football league, and was analysing the best approach to monetising those rights § Analysys Mason provided research and analysis to inform the review of the key drivers of the business plan(s) and the identification of the most important assumptions, in terms of operational, commercial and technology risks Approach § We reviewed and provided tactical inputs and insights to negotiate the draft tender documents prepared by the football league Only a handful football web TV services are offered and/or priced separately from other platform services § We researched and developed case studies to understand the existing and emerging business models to exploit audiovisual football rights including the way the leagues sell their rights and the way operators sell or resell (wholesale) the acquired rights § We collected benchmarks about acquisition and exploitation of football rights, including some key ratios, such as the size of the football premium rights versus that of the underlying broadcasting and telecoms markets, to help assess and validate the key business plan drivers (revenues, opex, capex) § We also provided some ad-hoc input to support the operator in its negotiations with the incumbent pay-TV operator for the acquisition of Internet-only rights Benefits and results § The operator used the insights we provided to develop its bidding strategy and to agree it internally § It did not acquire the rights but used the information to get a wholesale agreement with the incumbent pay-TV retailer 5086 -285

12 Case study Advised a large European telecoms operator on its potential acquisition of domestic football league rights Business challenge § A large European telecoms operator was considering the acquisition of the audiovisual rights for its top domestic football league, and was analysing the best approach to monetising those rights § Analysys Mason provided research and analysis to inform the review of the key drivers of the business plan(s) and the identification of the most important assumptions, in terms of operational, commercial and technology risks Approach § We reviewed and provided tactical inputs and insights to negotiate the draft tender documents prepared by the football league Only a handful football web TV services are offered and/or priced separately from other platform services § We researched and developed case studies to understand the existing and emerging business models to exploit audiovisual football rights including the way the leagues sell their rights and the way operators sell or resell (wholesale) the acquired rights § We collected benchmarks about acquisition and exploitation of football rights, including some key ratios, such as the size of the football premium rights versus that of the underlying broadcasting and telecoms markets, to help assess and validate the key business plan drivers (revenues, opex, capex) § We also provided some ad-hoc input to support the operator in its negotiations with the incumbent pay-TV operator for the acquisition of Internet-only rights Benefits and results § The operator used the insights we provided to develop its bidding strategy and to agree it internally § It did not acquire the rights but used the information to get a wholesale agreement with the incumbent pay-TV retailer 5086 -285

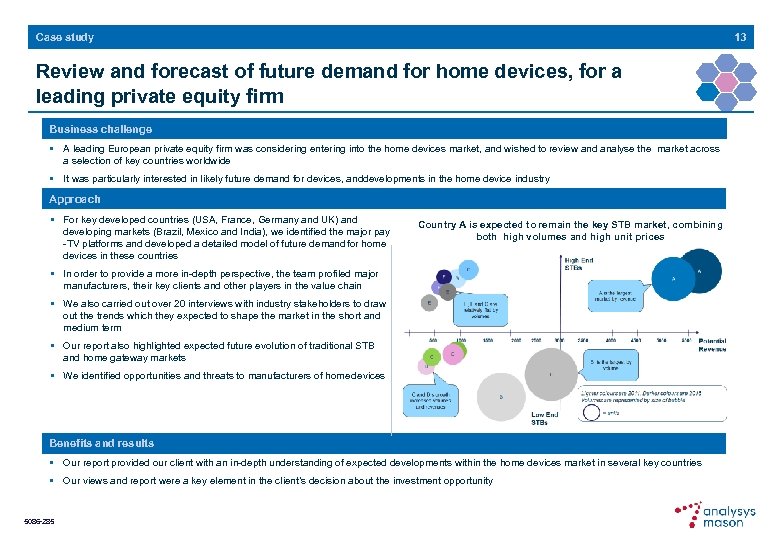

13 Case study Review and forecast of future demand for home devices, for a leading private equity firm Business challenge § A leading European private equity firm was considering entering into the home devices market, and wished to review and analyse the market across a selection of key countries worldwide § It was particularly interested in likely future demand for devices, anddevelopments in the home device industry Approach § For key developed countries (USA, France, Germany and UK) and developing markets (Brazil, Mexico and India), we identified the major pay -TV platforms and developed a detailed model of future demand for home devices in these countries Country A is expected to remain the key STB market, combining both high volumes and high unit prices § In order to provide a more in-depth perspective, the team profiled major manufacturers, their key clients and other players in the value chain § We also carried out over 20 interviews with industry stakeholders to draw out the trends which they expected to shape the market in the short and medium term § Our report also highlighted expected future evolution of traditional STB and home gateway markets § We identified opportunities and threats to manufacturers of home devices Benefits and results § Our report provided our client with an in-depth understanding of expected developments within the home devices market in several key countries § Our views and report were a key element in the client’s decision about the investment opportunity 5086 -285

13 Case study Review and forecast of future demand for home devices, for a leading private equity firm Business challenge § A leading European private equity firm was considering entering into the home devices market, and wished to review and analyse the market across a selection of key countries worldwide § It was particularly interested in likely future demand for devices, anddevelopments in the home device industry Approach § For key developed countries (USA, France, Germany and UK) and developing markets (Brazil, Mexico and India), we identified the major pay -TV platforms and developed a detailed model of future demand for home devices in these countries Country A is expected to remain the key STB market, combining both high volumes and high unit prices § In order to provide a more in-depth perspective, the team profiled major manufacturers, their key clients and other players in the value chain § We also carried out over 20 interviews with industry stakeholders to draw out the trends which they expected to shape the market in the short and medium term § Our report also highlighted expected future evolution of traditional STB and home gateway markets § We identified opportunities and threats to manufacturers of home devices Benefits and results § Our report provided our client with an in-depth understanding of expected developments within the home devices market in several key countries § Our views and report were a key element in the client’s decision about the investment opportunity 5086 -285

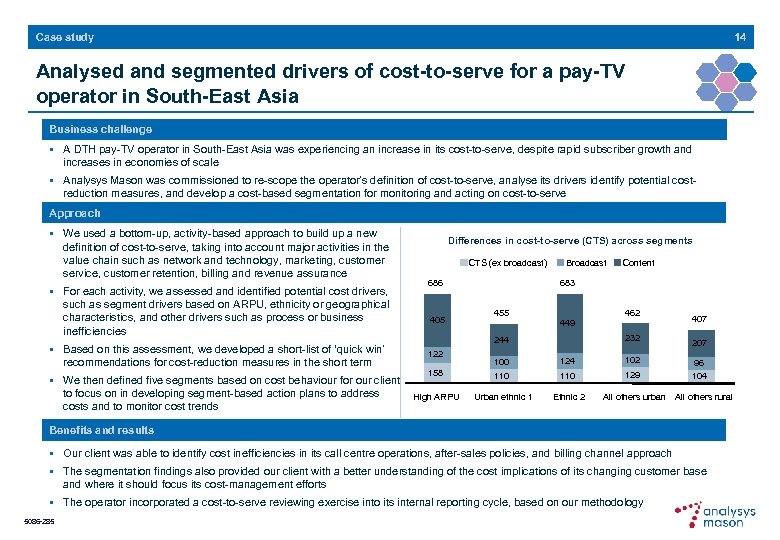

14 Case study Analysed and segmented drivers of cost-to-serve for a pay-TV operator in South-East Asia Business challenge § A DTH pay-TV operator in South-East Asia was experiencing an increase in its cost-to-serve, despite rapid subscriber growth and increases in economies of scale § Analysys Mason was commissioned to re-scope the operator’s definition of cost-to-serve, analyse its drivers identify potential costreduction measures, and develop a cost-based segmentation for monitoring and acting on cost-to-serve Approach § We used a bottom-up, activity-based approach to build up a new definition of cost-to-serve, taking into account major activities in the value chain such as network and technology, marketing, customer service, customer retention, billing and revenue assurance § For each activity, we assessed and identified potential cost drivers, such as segment drivers based on ARPU, ethnicity or geographical characteristics, and other drivers such as process or business inefficiencies § Based on this assessment, we developed a short-list of ‘quick win’ recommendations for cost-reduction measures in the short term § We then defined five segments based on cost behaviour for our client to focus on in developing segment-based action plans to address costs and to monitor cost trends Differences in cost-to-serve (CTS) across segments CTS (ex broadcast) 686 405 Broadcast 683 455 462 449 232 244 122 Content 100 110 124 102 158 110 129 High ARPU Urban ethnic 1 Ethnic 2 All others urban 407 207 96 104 All others rural Benefits and results § Our client was able to identify cost inefficiencies in its call centre operations, after-sales policies, and billing channel approach § The segmentation findings also provided our client with a better understanding of the cost implications of its changing customer base and where it should focus its cost-management efforts § The operator incorporated a cost-to-serve reviewing exercise into its internal reporting cycle, based on our methodology 5086 -285

14 Case study Analysed and segmented drivers of cost-to-serve for a pay-TV operator in South-East Asia Business challenge § A DTH pay-TV operator in South-East Asia was experiencing an increase in its cost-to-serve, despite rapid subscriber growth and increases in economies of scale § Analysys Mason was commissioned to re-scope the operator’s definition of cost-to-serve, analyse its drivers identify potential costreduction measures, and develop a cost-based segmentation for monitoring and acting on cost-to-serve Approach § We used a bottom-up, activity-based approach to build up a new definition of cost-to-serve, taking into account major activities in the value chain such as network and technology, marketing, customer service, customer retention, billing and revenue assurance § For each activity, we assessed and identified potential cost drivers, such as segment drivers based on ARPU, ethnicity or geographical characteristics, and other drivers such as process or business inefficiencies § Based on this assessment, we developed a short-list of ‘quick win’ recommendations for cost-reduction measures in the short term § We then defined five segments based on cost behaviour for our client to focus on in developing segment-based action plans to address costs and to monitor cost trends Differences in cost-to-serve (CTS) across segments CTS (ex broadcast) 686 405 Broadcast 683 455 462 449 232 244 122 Content 100 110 124 102 158 110 129 High ARPU Urban ethnic 1 Ethnic 2 All others urban 407 207 96 104 All others rural Benefits and results § Our client was able to identify cost inefficiencies in its call centre operations, after-sales policies, and billing channel approach § The segmentation findings also provided our client with a better understanding of the cost implications of its changing customer base and where it should focus its cost-management efforts § The operator incorporated a cost-to-serve reviewing exercise into its internal reporting cycle, based on our methodology 5086 -285

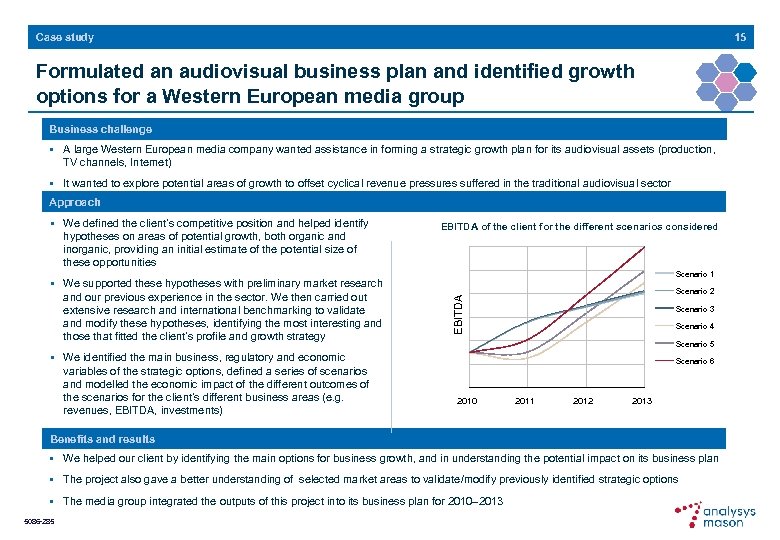

15 Case study Formulated an audiovisual business plan and identified growth options for a Western European media group Business challenge § A large Western European media company wanted assistance in forming a strategic growth plan for its audiovisual assets (production, TV channels, Internet) § It wanted to explore potential areas of growth to offset cyclical revenue pressures suffered in the traditional audiovisual sector Approach § We supported these hypotheses with preliminary market research and our previous experience in the sector. We then carried out extensive research and international benchmarking to validate and modify these hypotheses, identifying the most interesting and those that fitted the client’s profile and growth strategy § We identified the main business, regulatory and economic variables of the strategic options, defined a series of scenarios and modelled the economic impact of the different outcomes of the scenarios for the client’s different business areas (e. g. revenues, EBITDA, investments) EBITDA of the client for the different scenarios considered Scenario 1 Scenario 2 EBITDA § We defined the client’s competitive position and helped identify hypotheses on areas of potential growth, both organic and inorganic, providing an initial estimate of the potential size of these opportunities Scenario 3 Scenario 4 Scenario 5 Scenario 6 2010 2011 2012 2013 Benefits and results § We helped our client by identifying the main options for business growth, and in understanding the potential impact on its business plan § The project also gave a better understanding of selected market areas to validate/modify previously identified strategic options § The media group integrated the outputs of this project into its business plan for 2010– 2013 5086 -285

15 Case study Formulated an audiovisual business plan and identified growth options for a Western European media group Business challenge § A large Western European media company wanted assistance in forming a strategic growth plan for its audiovisual assets (production, TV channels, Internet) § It wanted to explore potential areas of growth to offset cyclical revenue pressures suffered in the traditional audiovisual sector Approach § We supported these hypotheses with preliminary market research and our previous experience in the sector. We then carried out extensive research and international benchmarking to validate and modify these hypotheses, identifying the most interesting and those that fitted the client’s profile and growth strategy § We identified the main business, regulatory and economic variables of the strategic options, defined a series of scenarios and modelled the economic impact of the different outcomes of the scenarios for the client’s different business areas (e. g. revenues, EBITDA, investments) EBITDA of the client for the different scenarios considered Scenario 1 Scenario 2 EBITDA § We defined the client’s competitive position and helped identify hypotheses on areas of potential growth, both organic and inorganic, providing an initial estimate of the potential size of these opportunities Scenario 3 Scenario 4 Scenario 5 Scenario 6 2010 2011 2012 2013 Benefits and results § We helped our client by identifying the main options for business growth, and in understanding the potential impact on its business plan § The project also gave a better understanding of selected market areas to validate/modify previously identified strategic options § The media group integrated the outputs of this project into its business plan for 2010– 2013 5086 -285

16 Case study Assisted a major audiovisual player in its negotiations with ISPs and with net neutrality issues Business challenge § The consumption of video content over a broadband connection is booming, and this represented both a significant opportunity and a challenge for our client § The company faced two specific issues: - increasing pressure from ISPs to raise the fees charged for the quality of the transmission service required - potential discriminatory behaviour from ISPs (e. g. trying to prioritise other types of traffic, such as their own content) Approach § We analysed the possible discriminatory practices that ISPs may employ and reviewed the network neutrality debate in a set of relevant countries § We then analysed the value chain for video distribution via fixed networks, including players and likely evolution § Using this information, we conducted both technical and economic analyses (including the implementation of a detailed bottom-up cost model to calculate the incremental cost of delivering nonlinear TV – see right) Benefits and results § Our presentation and conclusion were approved by board members, and our recommendations were implemented 5086 -285

16 Case study Assisted a major audiovisual player in its negotiations with ISPs and with net neutrality issues Business challenge § The consumption of video content over a broadband connection is booming, and this represented both a significant opportunity and a challenge for our client § The company faced two specific issues: - increasing pressure from ISPs to raise the fees charged for the quality of the transmission service required - potential discriminatory behaviour from ISPs (e. g. trying to prioritise other types of traffic, such as their own content) Approach § We analysed the possible discriminatory practices that ISPs may employ and reviewed the network neutrality debate in a set of relevant countries § We then analysed the value chain for video distribution via fixed networks, including players and likely evolution § Using this information, we conducted both technical and economic analyses (including the implementation of a detailed bottom-up cost model to calculate the incremental cost of delivering nonlinear TV – see right) Benefits and results § Our presentation and conclusion were approved by board members, and our recommendations were implemented 5086 -285

Case study Assessed the impact of the BBC’s catch-up TV service, i. Player, on the UK broadband market Business challenge § Following a successful trial, the BBC wanted to launch i. Player across the UK § As part of its public-value test (PVT), the BBC needed to conduct a market impact assessment to determine what kind of effect i. Player might have on the market, and in particular on ISPs’ costs § It needed to satisfy both Ofcom and the BBC Trust that i. Player would not have a detrimental impact on the UK broadband market Approach § We assessed a range of scenarios for how the Internet market may develop over a period of five years, taking into account plausible growths in other (non-BBC) rich media services § We considered how ISPs could use different broadband products to deliver rich media content, and what these meant for distribution costs § We considered four main i. Player services: catch-up TV over the Internet; simulcast TV over the Internet; non-DRM audio downloads; and catch-up TV over cable § We estimated both the volume and cost impact of i. Player on the various types of ISPs that may distribute such content, under a range of scenarios for underlying Internet growth and household consumption of content Benefits and results § We quantified the impact that i. Player may have on the UK broadband market, and presented our results to Ofcom and the BBC Trust § Our impact analysis played a significant role in the PVT, and the BBC’s proposals were approved by the BBC Trust 5086 -285 17

Case study Assessed the impact of the BBC’s catch-up TV service, i. Player, on the UK broadband market Business challenge § Following a successful trial, the BBC wanted to launch i. Player across the UK § As part of its public-value test (PVT), the BBC needed to conduct a market impact assessment to determine what kind of effect i. Player might have on the market, and in particular on ISPs’ costs § It needed to satisfy both Ofcom and the BBC Trust that i. Player would not have a detrimental impact on the UK broadband market Approach § We assessed a range of scenarios for how the Internet market may develop over a period of five years, taking into account plausible growths in other (non-BBC) rich media services § We considered how ISPs could use different broadband products to deliver rich media content, and what these meant for distribution costs § We considered four main i. Player services: catch-up TV over the Internet; simulcast TV over the Internet; non-DRM audio downloads; and catch-up TV over cable § We estimated both the volume and cost impact of i. Player on the various types of ISPs that may distribute such content, under a range of scenarios for underlying Internet growth and household consumption of content Benefits and results § We quantified the impact that i. Player may have on the UK broadband market, and presented our results to Ofcom and the BBC Trust § Our impact analysis played a significant role in the PVT, and the BBC’s proposals were approved by the BBC Trust 5086 -285 17

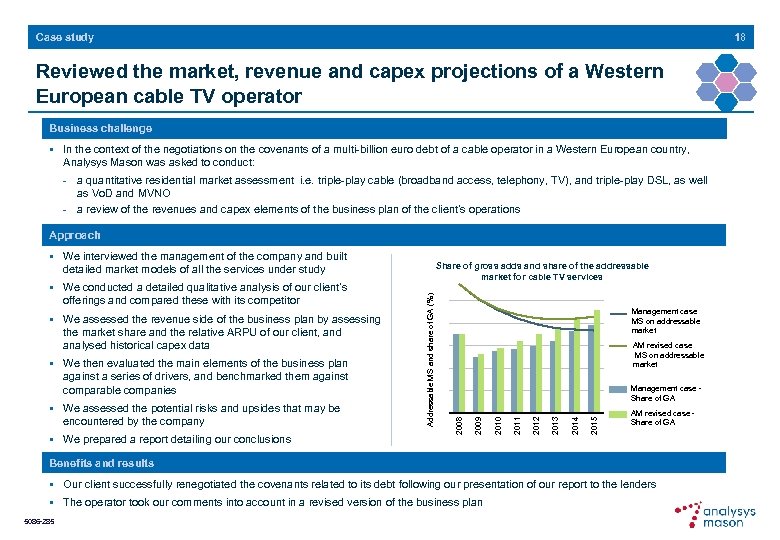

18 Case study Reviewed the market, revenue and capex projections of a Western European cable TV operator Business challenge § In the context of the negotiations on the covenants of a multi-billion euro debt of a cable operator in a Western European country, Analysys Mason was asked to conduct: - a quantitative residential market assessment i. e. triple-play cable (broadband access, telephony, TV), and triple-play DSL, as well as Vo. D and MVNO - a review of the revenues and capex elements of the business plan of the client’s operations Approach § We interviewed the management of the company and built detailed market models of all the services under study 2015 2014 2013 2012 2011 § We prepared a report detailing our conclusions Management case Share of GA 2010 § We assessed the potential risks and upsides that may be encountered by the company AM revised case MS on addressable market 2009 § We then evaluated the main elements of the business plan against a series of drivers, and benchmarked them against comparable companies Management case MS on addressable market 2008 § We assessed the revenue side of the business plan by assessing the market share and the relative ARPU of our client, and analysed historical capex data Addressable MS and share of GA (%) § We conducted a detailed qualitative analysis of our client’s offerings and compared these with its competitor Share of gross adds and share of the addressable market for cable TV services AM revised case Share of GA Benefits and results § Our client successfully renegotiated the covenants related to its debt following our presentation of our report to the lenders § The operator took our comments into account in a revised version of the business plan 5086 -285

18 Case study Reviewed the market, revenue and capex projections of a Western European cable TV operator Business challenge § In the context of the negotiations on the covenants of a multi-billion euro debt of a cable operator in a Western European country, Analysys Mason was asked to conduct: - a quantitative residential market assessment i. e. triple-play cable (broadband access, telephony, TV), and triple-play DSL, as well as Vo. D and MVNO - a review of the revenues and capex elements of the business plan of the client’s operations Approach § We interviewed the management of the company and built detailed market models of all the services under study 2015 2014 2013 2012 2011 § We prepared a report detailing our conclusions Management case Share of GA 2010 § We assessed the potential risks and upsides that may be encountered by the company AM revised case MS on addressable market 2009 § We then evaluated the main elements of the business plan against a series of drivers, and benchmarked them against comparable companies Management case MS on addressable market 2008 § We assessed the revenue side of the business plan by assessing the market share and the relative ARPU of our client, and analysed historical capex data Addressable MS and share of GA (%) § We conducted a detailed qualitative analysis of our client’s offerings and compared these with its competitor Share of gross adds and share of the addressable market for cable TV services AM revised case Share of GA Benefits and results § Our client successfully renegotiated the covenants related to its debt following our presentation of our report to the lenders § The operator took our comments into account in a revised version of the business plan 5086 -285

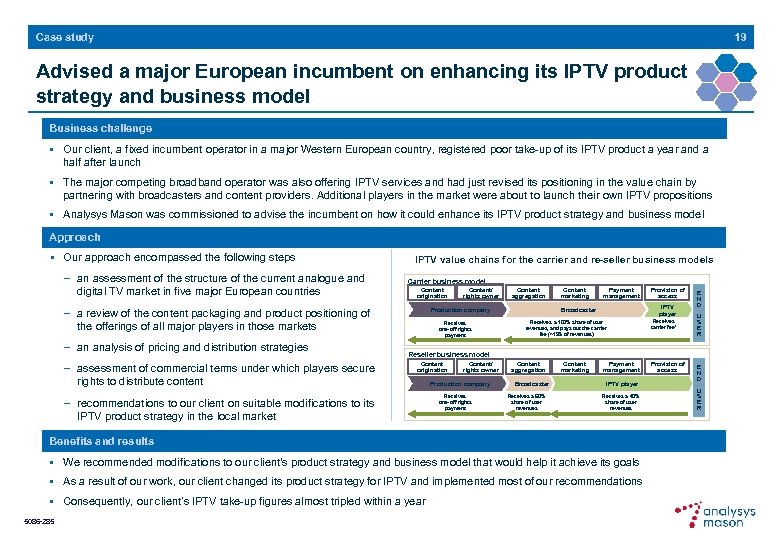

19 Case study Advised a major European incumbent on enhancing its IPTV product strategy and business model Business challenge § Our client, a fixed incumbent operator in a major Western European country, registered poor take-up of its IPTV product a year and a half after launch § The major competing broadband operator was also offering IPTV services and had just revised its positioning in the value chain by partnering with broadcasters and content providers. Additional players in the market were about to launch their own IPTV propositions § Analysys Mason was commissioned to advise the incumbent on how it could enhance its IPTV product strategy and business model Approach § Our approach encompassed the following steps - an assessment of the structure of the current analogue and digital TV market in five major European countries IPTV value chains for the carrier and re-seller business models Carrier business model Content origination - a review of the content packaging and product positioning of the offerings of all major players in those markets - an analysis of pricing and distribution strategies - assessment of commercial terms under which players secure rights to distribute content Content/ rights owner Content aggregation Production company Receives one-off rights payment Content marketing Payment management IPTV player Broadcaster Receives a 100% share of user revenues, and pays out the carrier fee (~15% of revenues) Receives carrier fee* E N D U S E R Reseller business model Content origination - recommendations to our client on suitable modifications to its IPTV product strategy in the local market Content/ rights owner Production company Receives one-off rights payment Content aggregation Broadcaster Receives a 60% share of user revenues Content marketing Payment management IPTV player Receives a 40% share of user revenues Benefits and results § We recommended modifications to our client's product strategy and business model that would help it achieve its goals § As a result of our work, our client changed its product strategy for IPTV and implemented most of our recommendations § Consequently, our client’s IPTV take-up figures almost tripled within a year 5086 -285 Provision of access E N D U S E R

19 Case study Advised a major European incumbent on enhancing its IPTV product strategy and business model Business challenge § Our client, a fixed incumbent operator in a major Western European country, registered poor take-up of its IPTV product a year and a half after launch § The major competing broadband operator was also offering IPTV services and had just revised its positioning in the value chain by partnering with broadcasters and content providers. Additional players in the market were about to launch their own IPTV propositions § Analysys Mason was commissioned to advise the incumbent on how it could enhance its IPTV product strategy and business model Approach § Our approach encompassed the following steps - an assessment of the structure of the current analogue and digital TV market in five major European countries IPTV value chains for the carrier and re-seller business models Carrier business model Content origination - a review of the content packaging and product positioning of the offerings of all major players in those markets - an analysis of pricing and distribution strategies - assessment of commercial terms under which players secure rights to distribute content Content/ rights owner Content aggregation Production company Receives one-off rights payment Content marketing Payment management IPTV player Broadcaster Receives a 100% share of user revenues, and pays out the carrier fee (~15% of revenues) Receives carrier fee* E N D U S E R Reseller business model Content origination - recommendations to our client on suitable modifications to its IPTV product strategy in the local market Content/ rights owner Production company Receives one-off rights payment Content aggregation Broadcaster Receives a 60% share of user revenues Content marketing Payment management IPTV player Receives a 40% share of user revenues Benefits and results § We recommended modifications to our client's product strategy and business model that would help it achieve its goals § As a result of our work, our client changed its product strategy for IPTV and implemented most of our recommendations § Consequently, our client’s IPTV take-up figures almost tripled within a year 5086 -285 Provision of access E N D U S E R

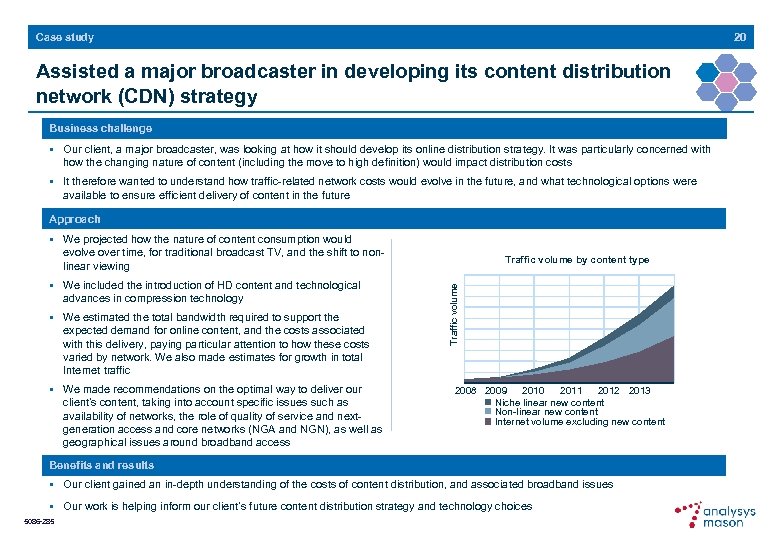

20 Case study Assisted a major broadcaster in developing its content distribution network (CDN) strategy Business challenge § Our client, a major broadcaster, was looking at how it should develop its online distribution strategy. It was particularly concerned with how the changing nature of content (including the move to high definition) would impact distribution costs § It therefore wanted to understand how traffic-related network costs would evolve in the future, and what technological options were available to ensure efficient delivery of content in the future Approach § We projected how the nature of content consumption would evolve over time, for traditional broadcast TV, and the shift to nonlinear viewing § We estimated the total bandwidth required to support the expected demand for online content, and the costs associated with this delivery, paying particular attention to how these costs varied by network. We also made estimates for growth in total Internet traffic § We made recommendations on the optimal way to deliver our client’s content, taking into account specific issues such as availability of networks, the role of quality of service and nextgeneration access and core networks (NGA and NGN), as well as geographical issues around broadband access Traffic volume § We included the introduction of HD content and technological advances in compression technology Traffic volume by content type 2008 2009 2010 2011 2012 2013 Niche linear new content Non-linear new content Internet volume excluding new content Benefits and results § Our client gained an in-depth understanding of the costs of content distribution, and associated broadband issues § Our work is helping inform our client’s future content distribution strategy and technology choices 5086 -285

20 Case study Assisted a major broadcaster in developing its content distribution network (CDN) strategy Business challenge § Our client, a major broadcaster, was looking at how it should develop its online distribution strategy. It was particularly concerned with how the changing nature of content (including the move to high definition) would impact distribution costs § It therefore wanted to understand how traffic-related network costs would evolve in the future, and what technological options were available to ensure efficient delivery of content in the future Approach § We projected how the nature of content consumption would evolve over time, for traditional broadcast TV, and the shift to nonlinear viewing § We estimated the total bandwidth required to support the expected demand for online content, and the costs associated with this delivery, paying particular attention to how these costs varied by network. We also made estimates for growth in total Internet traffic § We made recommendations on the optimal way to deliver our client’s content, taking into account specific issues such as availability of networks, the role of quality of service and nextgeneration access and core networks (NGA and NGN), as well as geographical issues around broadband access Traffic volume § We included the introduction of HD content and technological advances in compression technology Traffic volume by content type 2008 2009 2010 2011 2012 2013 Niche linear new content Non-linear new content Internet volume excluding new content Benefits and results § Our client gained an in-depth understanding of the costs of content distribution, and associated broadband issues § Our work is helping inform our client’s future content distribution strategy and technology choices 5086 -285

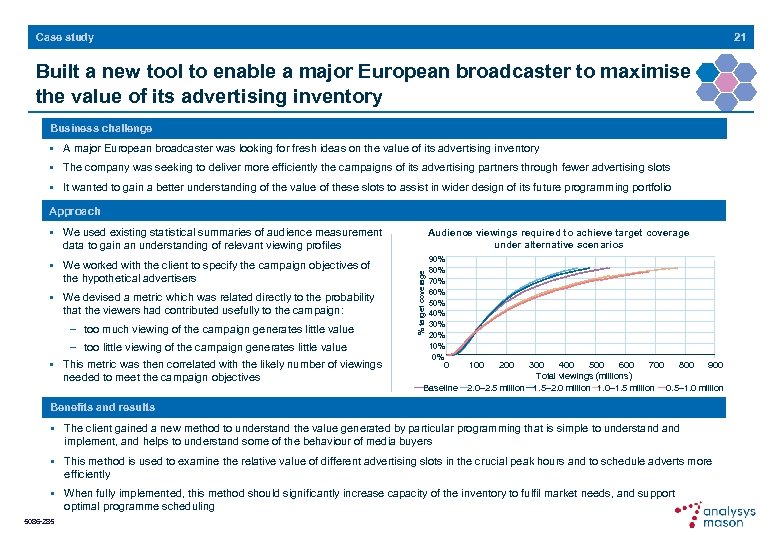

21 Case study Built a new tool to enable a major European broadcaster to maximise the value of its advertising inventory Business challenge § A major European broadcaster was looking for fresh ideas on the value of its advertising inventory § The company was seeking to deliver more efficiently the campaigns of its advertising partners through fewer advertising slots § It wanted to gain a better understanding of the value of these slots to assist in wider design of its future programming portfolio Approach Audience viewings required to achieve target coverage under alternative scenarios § We worked with the client to specify the campaign objectives of the hypothetical advertisers 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% § We devised a metric which was related directly to the probability that the viewers had contributed usefully to the campaign: - too much viewing of the campaign generates little value - too little viewing of the campaign generates little value § This metric was then correlated with the likely number of viewings needed to meet the campaign objectives % target coverage § We used existing statistical summaries of audience measurement data to gain an understanding of relevant viewing profiles 0 Baseline 100 200 300 400 500 600 700 800 900 Total viewings (millions) 2. 0– 2. 5 million 1. 5– 2. 0 million 1. 0– 1. 5 million 0. 5– 1. 0 million Benefits and results § The client gained a new method to understand the value generated by particular programming that is simple to understand implement, and helps to understand some of the behaviour of media buyers § This method is used to examine the relative value of different advertising slots in the crucial peak hours and to schedule adverts more efficiently § When fully implemented, this method should significantly increase capacity of the inventory to fulfil market needs, and support optimal programme scheduling 5086 -285

21 Case study Built a new tool to enable a major European broadcaster to maximise the value of its advertising inventory Business challenge § A major European broadcaster was looking for fresh ideas on the value of its advertising inventory § The company was seeking to deliver more efficiently the campaigns of its advertising partners through fewer advertising slots § It wanted to gain a better understanding of the value of these slots to assist in wider design of its future programming portfolio Approach Audience viewings required to achieve target coverage under alternative scenarios § We worked with the client to specify the campaign objectives of the hypothetical advertisers 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% § We devised a metric which was related directly to the probability that the viewers had contributed usefully to the campaign: - too much viewing of the campaign generates little value - too little viewing of the campaign generates little value § This metric was then correlated with the likely number of viewings needed to meet the campaign objectives % target coverage § We used existing statistical summaries of audience measurement data to gain an understanding of relevant viewing profiles 0 Baseline 100 200 300 400 500 600 700 800 900 Total viewings (millions) 2. 0– 2. 5 million 1. 5– 2. 0 million 1. 0– 1. 5 million 0. 5– 1. 0 million Benefits and results § The client gained a new method to understand the value generated by particular programming that is simple to understand implement, and helps to understand some of the behaviour of media buyers § This method is used to examine the relative value of different advertising slots in the crucial peak hours and to schedule adverts more efficiently § When fully implemented, this method should significantly increase capacity of the inventory to fulfil market needs, and support optimal programme scheduling 5086 -285

22 Contact For more information, please don’t hesitate to contact us Lluís Borrell Matt Yardley Partner (Broadband) Matt. Yardley@analysysmason. com Michael Kende Partner (New internet players) Michael. Kende@analysysmason. com 5086 -285 Dubai Tel: +971 (0)4 446 7473 Fax: +971 (0)4 446 9827 dubai@analysysmason. com Milan Tel: +39 02 76 31 88 34 Fax: +39 02 36 50 45 50 milan@analysysmason. com Dublin Tel: +353 (0)1 602 4755 Fax: +353 (0)1 602 4777 dublin@analysysmason. com New Delhi Tel: +91 11 4700 3100 Fax: +91 11 4700 3102 newdelhi@analysysmason. com Edinburgh Tel: +44 (0)845 600 5244 Fax: +44 (0)131 443 9944 edinburgh@analysysmason. com Paris Tel: +33 (0)1 72 71 96 96 Fax: +33 (0)1 72 71 96 97 paris@analysysmason. com Singapore Tel: +65 6493 6038 Fax: +65 6720 6038 singapore@analysysmason. com Madrid Tel: +34 91 399 5016 Fax: +34 91 451 8071 madrid@analysysmason. com Lluis. Borrell@analysysmason. com Manchester Tel: +44 (0)845 600 5244 Fax: +44 (0)161 877 7810 manchester@analysysmason. com London Tel: +44 (0)845 600 5244 Fax: +44 (0)20 7395 9001 london@analysysmason. com Partner (Media) Cambridge Tel: +44 (0)845 600 5244 Fax: +44 (0)1223 460866 cambridge@analysysmason. com Washington DC Tel: +1 202 331 3080 Fax: +1 202 331 3083 washingtondc@analysysmason. com

22 Contact For more information, please don’t hesitate to contact us Lluís Borrell Matt Yardley Partner (Broadband) Matt. Yardley@analysysmason. com Michael Kende Partner (New internet players) Michael. Kende@analysysmason. com 5086 -285 Dubai Tel: +971 (0)4 446 7473 Fax: +971 (0)4 446 9827 dubai@analysysmason. com Milan Tel: +39 02 76 31 88 34 Fax: +39 02 36 50 45 50 milan@analysysmason. com Dublin Tel: +353 (0)1 602 4755 Fax: +353 (0)1 602 4777 dublin@analysysmason. com New Delhi Tel: +91 11 4700 3100 Fax: +91 11 4700 3102 newdelhi@analysysmason. com Edinburgh Tel: +44 (0)845 600 5244 Fax: +44 (0)131 443 9944 edinburgh@analysysmason. com Paris Tel: +33 (0)1 72 71 96 96 Fax: +33 (0)1 72 71 96 97 paris@analysysmason. com Singapore Tel: +65 6493 6038 Fax: +65 6720 6038 singapore@analysysmason. com Madrid Tel: +34 91 399 5016 Fax: +34 91 451 8071 madrid@analysysmason. com Lluis. Borrell@analysysmason. com Manchester Tel: +44 (0)845 600 5244 Fax: +44 (0)161 877 7810 manchester@analysysmason. com London Tel: +44 (0)845 600 5244 Fax: +44 (0)20 7395 9001 london@analysysmason. com Partner (Media) Cambridge Tel: +44 (0)845 600 5244 Fax: +44 (0)1223 460866 cambridge@analysysmason. com Washington DC Tel: +1 202 331 3080 Fax: +1 202 331 3083 washingtondc@analysysmason. com