4e2152ee53eb6aaa49b2ebb35de1d342.ppt

- Количество слайдов: 45

Information Brief Defence Peter Pedlar Acting CEO To the Joint Standing Committee On Defence Tau Mashigo Head: Business Performance 15 June 2007 Femke Pienaar Head: Client Business Units Cisco van Schaik GM: DOD business Unit Web: www. sita. co. za State Information Technology Agency

Agenda 1. SITA Mandate & Services 2. SITA Financials 3. SITA transformation 4. SITA Strategic Objectives 5. SITA / DOD Relations 6. DOD ICT Spend / Budget 7. DEIS Master Plan 2

SITA MANDATE & SERVICES 3

Mandate and Funding v SITA is an enacted company that derives its mandate from – Ø Ø SITA Act 88/1998 as amended 2002. SITA Act 88/1998: General Regulation NR 904, DPSA, Sept 2005. v Objective Ø To improve service delivery to the public and to promote the efficiency of departments and public bodies through the use of ICT and related services in a secure environment. v Funding Model Ø SITA Pty (Ltd) is a Schedule 3 a Public Company. Ø Financially self sustaining through Products and Services. 4

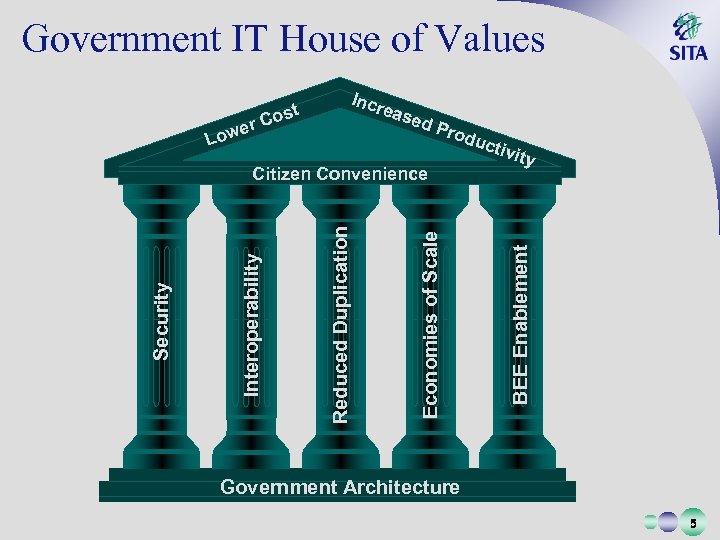

Government IT House of Values Incr eas e d. P rod Economies of Scale Reduced Duplication Interoperability Security Citizen Convenience ucti vity BEE Enablement r owe L t Cos Government Architecture 5

Services to Government … and related Services as per BA (e. g Consult, Train, Support) Transversal Infrastructure Transversal Systems Acquire ICT Solutions ICT Research Standards & Certification IS Inventory Disaster Recovery Strategy IS Convergence Strategy 6

SITA FINANCIALS 7

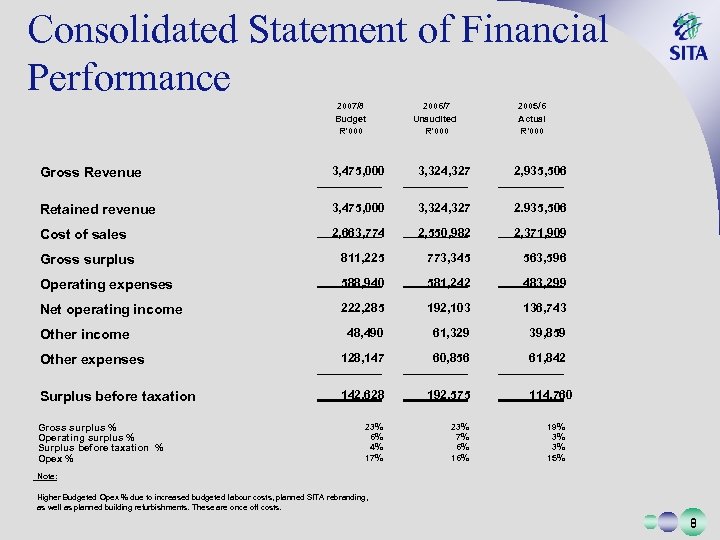

Consolidated Statement of Financial Performance • 2007/8 • 2006/7 • 2005/6 • Budget • Unaudited • Actual • R'000 • Gross Revenue • • 3, 475, 000 • • • 3, 324, 327 • • • 2, 935, 506 • • Retained revenue • • 3, 475, 000 • • • 3, 324, 327 • • • 2. 935, 506 • • Cost of sales • • 2, 663, 774 • • • 2, 550, 982 • • • 2, 371, 909 • • Gross surplus • • 811, 225 • • • 773, 345 • • 563, 596 • Operating expenses • • 588, 940 • • • 581, 242 • • 483, 299 • Net operating income • • 222, 285 • • • 192, 103 • • 136, 743 • Other income • • 48, 490 • • • 61, 329 • • 39, 859 • Other expenses • • 128, 147 • • • 60, 856 • • • 61, 842 • Surplus before taxation • • 142, 628 • • • 192, 575 • • 114, 760 • Gross surplus % • Operating surplus % • Surplus before taxation % • Opex % • 23% • 6% • 4% • 17% • 23% • 7% • 6% • 16% • 19% • 3% • 15% • Note: • Higher Budgeted Opex % due to increased budgeted labour costs, planned SITA rebranding, • as well as planned building refurbishments. These are once off costs. 8

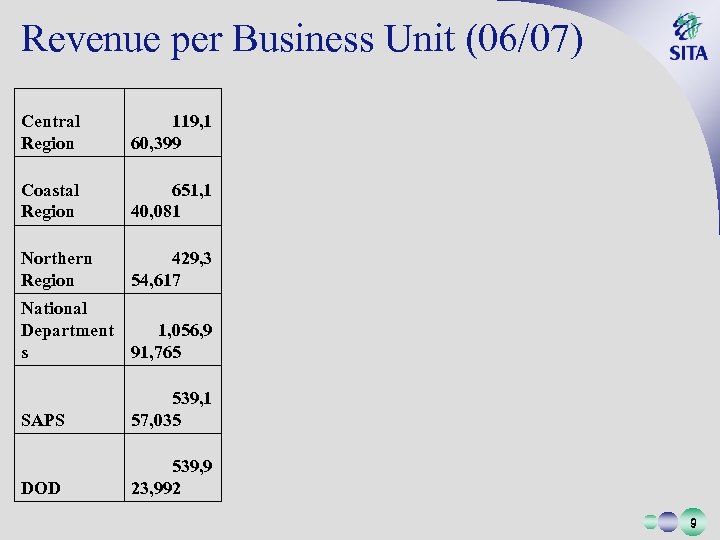

Revenue per Business Unit (06/07) Central Region 119, 1 60, 399 Coastal Region 651, 1 40, 081 Northern Region 429, 3 54, 617 National Department 1, 056, 9 s 91, 765 SAPS 539, 1 57, 035 DOD 539, 9 23, 992 9

SITA TRANSFORMATION 10

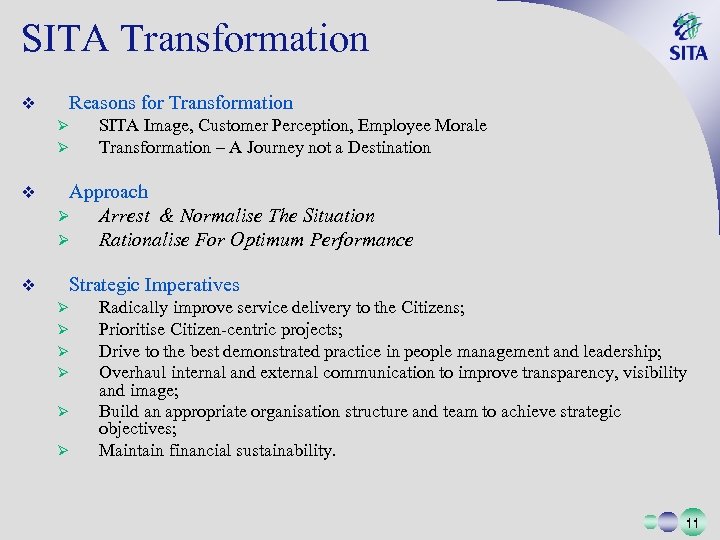

SITA Transformation Reasons for Transformation v Ø Ø v SITA Image, Customer Perception, Employee Morale Transformation – A Journey not a Destination Approach Ø Arrest & Normalise The Situation Ø Rationalise For Optimum Performance Strategic Imperatives v Ø Ø Ø Radically improve service delivery to the Citizens; Prioritise Citizen-centric projects; Drive to the best demonstrated practice in people management and leadership; Overhaul internal and external communication to improve transparency, visibility and image; Build an appropriate organisation structure and team to achieve strategic objectives; Maintain financial sustainability. 11

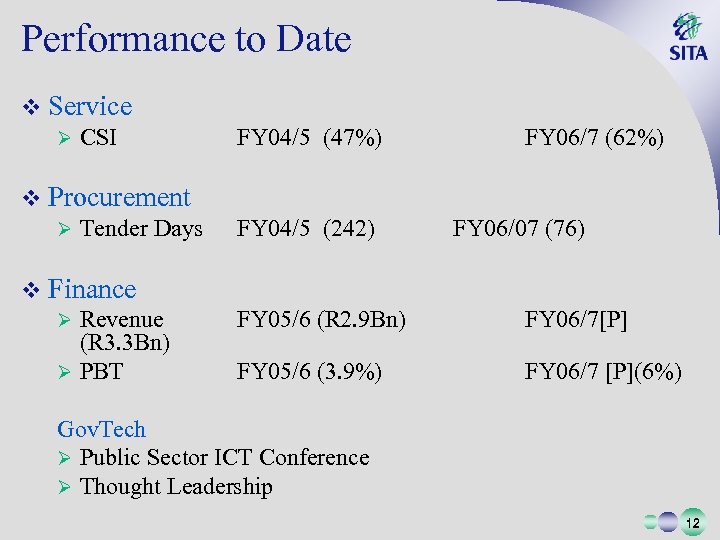

Performance to Date v Service Ø CSI FY 04/5 (47%) v Procurement Ø Tender Days FY 04/5 (242) v Finance Ø Revenue (R 3. 3 Bn) Ø PBT FY 06/7 (62%) FY 06/07 (76) FY 05/6 (R 2. 9 Bn) FY 06/7[P] FY 05/6 (3. 9%) FY 06/7 [P](6%) Gov. Tech Ø Public Sector ICT Conference Ø Thought Leadership 12

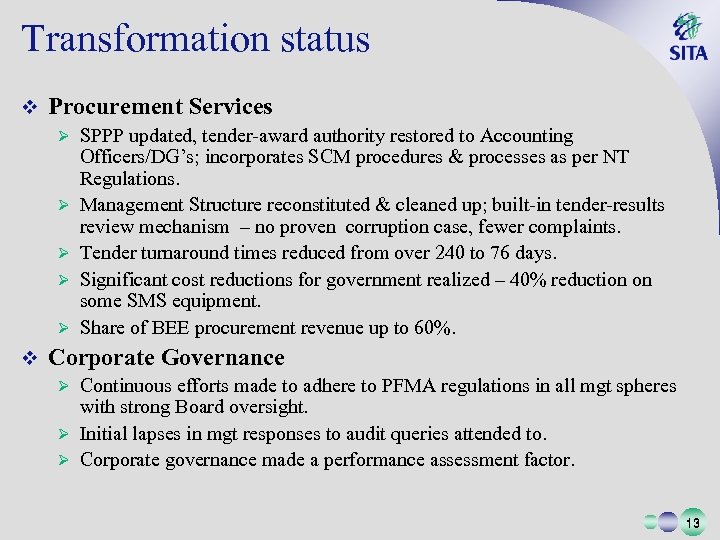

Transformation status v Procurement Services Ø Ø Ø v SPPP updated, tender-award authority restored to Accounting Officers/DG’s; incorporates SCM procedures & processes as per NT Regulations. Management Structure reconstituted & cleaned up; built-in tender-results review mechanism – no proven corruption case, fewer complaints. Tender turnaround times reduced from over 240 to 76 days. Significant cost reductions for government realized – 40% reduction on some SMS equipment. Share of BEE procurement revenue up to 60%. Corporate Governance Continuous efforts made to adhere to PFMA regulations in all mgt spheres with strong Board oversight. Ø Initial lapses in mgt responses to audit queries attended to. Ø Corporate governance made a performance assessment factor. Ø 13

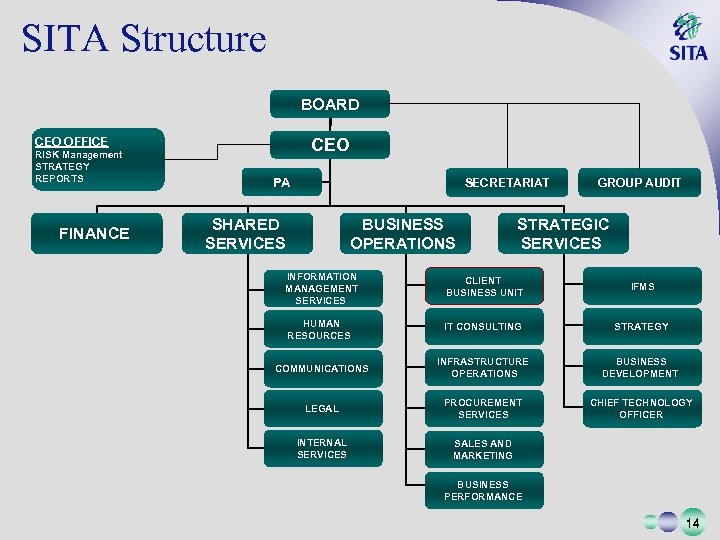

SITA Structure BOARD CEO OFFICE RISK Management STRATEGY REPORTS FINANCE PA SECRETARIAT SHARED SERVICES BUSINESS OPERATIONS GROUP AUDIT STRATEGIC SERVICES INFORMATION MANAGEMENT SERVICES CLIENT BUSINESS UNIT IFMS HUMAN RESOURCES IT CONSULTING STRATEGY COMMUNICATIONS INFRASTRUCTURE OPERATIONS BUSINESS DEVELOPMENT LEGAL PROCUREMENT SERVICES CHIEF TECHNOLOGY OFFICER INTERNAL SERVICES SALES AND MARKETING BUSINESS PERFORMANCE 14

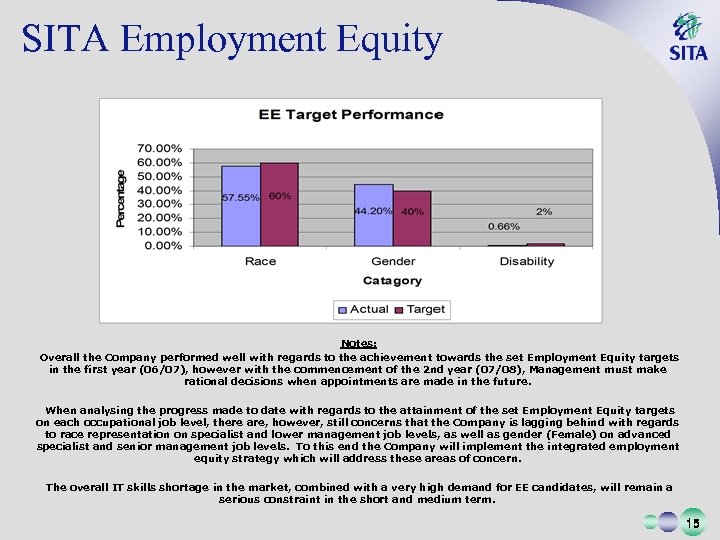

SITA Employment Equity • Notes: • Overall the Company performed well with regards to the achievement towards the set Employment Equity targets in the first year (06/07), however with the commencement of the 2 nd year (07/08), Management must make rational decisions when appointments are made in the future. • When analysing the progress made to date with regards to the attainment of the set Employment Equity targets on each occupational job level, there are, however, still concerns that the Company is lagging behind with regards to race representation on specialist and lower management job levels, as well as gender (Female) on advanced specialist and senior management job levels. To this end the Company will implement the integrated employment equity strategy which will address these areas of concern. • The overall IT skills shortage in the market, combined with a very high demand for EE candidates, will remain a serious constraint in the short and medium term. 15

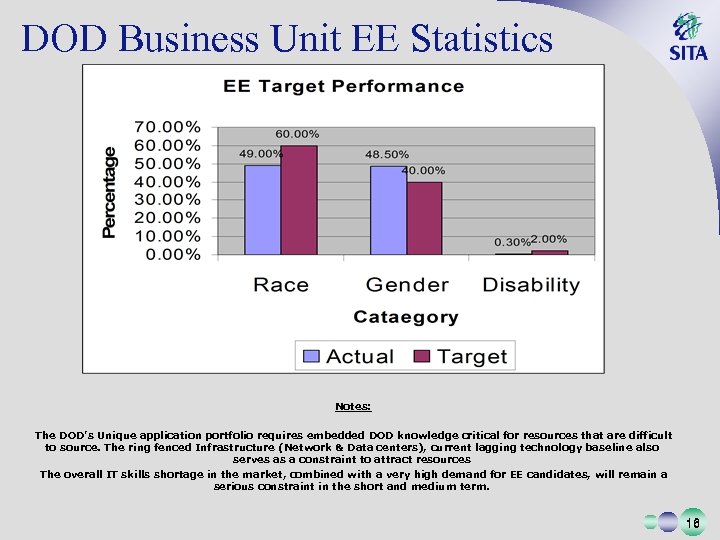

DOD Business Unit EE Statistics • Notes: • The DOD’s Unique application portfolio requires embedded DOD knowledge critical for resources that are difficult to source. The ring fenced Infrastructure (Network & Data centers), current lagging technology baseline also serves as a constraint to attract resources • The overall IT skills shortage in the market, combined with a very high demand for EE candidates, will remain a serious constraint in the short and medium term. 16

STRATEGIC OBJECTIVES 17

Strategic Focus v Reposition for Public Sector ICT Leadership Ø Accelerate the Implementation of e-Government. Ø Provide Thought Leadership. Ø Develop Appropriate Partnerships and Alliances. v Manage Operations Ø Radically Improve Customer Experience of SITA. Ø Focus on Operational Efficiency and Effectiveness. 18

Trends and Drivers v Communication Convergence v Service Oriented Architecture v e. Government Maturity v Identity Management v Open Source Movement v Strategic Out Tasking v Consolidation and Partnerships 19

Initiatives v Destination to Success - Change Management v Service Improvement Programme v e-Government Revitalisation v Municipality Blueprint v Integrated Financial Management System v New Generation Network Platform v OSS Project Management Office v Industry Wide Skills Development 20

The Future SITA v Integrated Solution & Service Delivery (Client Centric) v Skills Development v Black Economic Empowerment v Intellectual Property v Strategic Partnering v Facilitate Government-wide Architecture 21

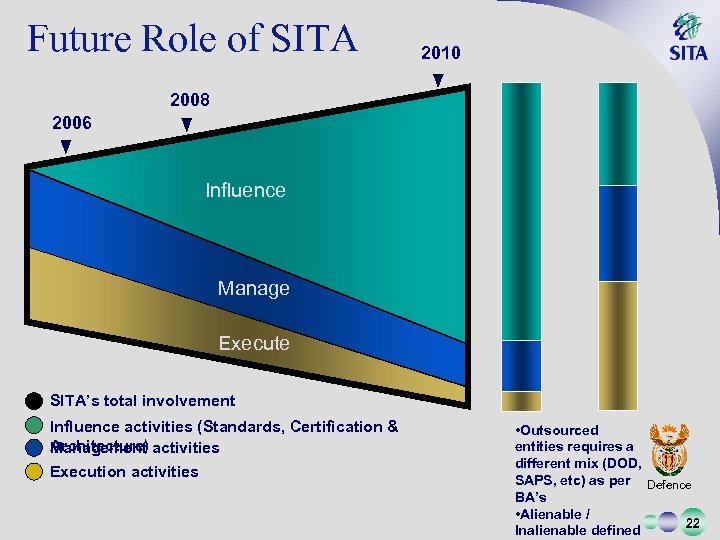

Future Role of SITA 2010 2008 2006 Influence Manage Execute SITA’s total involvement Influence activities (Standards, Certification & Architecture) Management activities Execution activities • Outsourced entities requires a different mix (DOD, SAPS, etc) as per Defence BA’s • Alienable / 22 Inalienable defined

DOD / SITA Relations 23

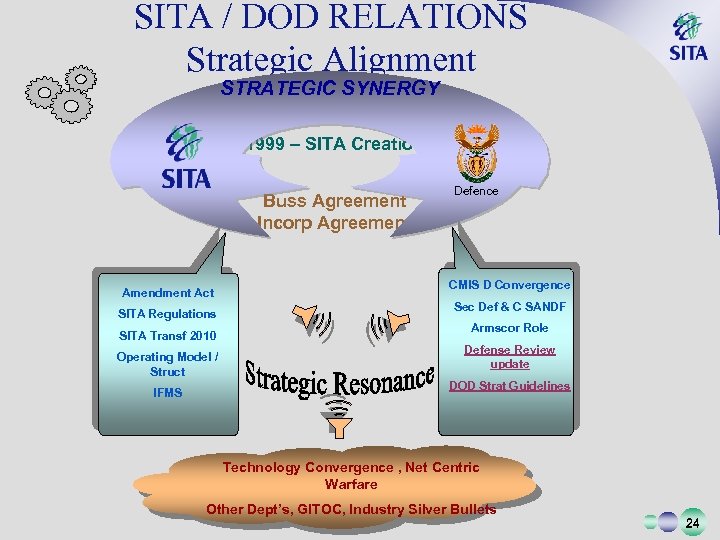

SITA / DOD RELATIONS Strategic Alignment STRATEGIC SYNERGY 1999 – SITA Creation Buss Agreement Incorp Agreement Amendment Act SITA Regulations SITA Transf 2010 Operating Model / Struct IFMS Defence CMIS D Convergence Sec Def & C SANDF Armscor Role Defense Review update DOD Strat Guidelines Technology Convergence , Net Centric Warfare Other Dept’s, GITOC, Industry Silver Bullets 24

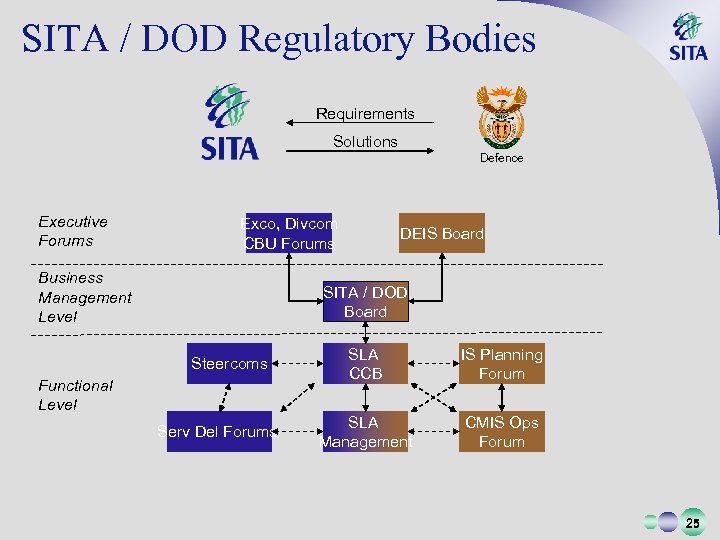

SITA / DOD Regulatory Bodies Requirements Solutions Executive Forums Exco, Divcom CBU Forums Business Management Level Defence DEIS Board SITA / DOD Board Steercoms Functional Level Serv Del Forums SLA CCB IS Planning Forum SLA Management CMIS Ops Forum 25

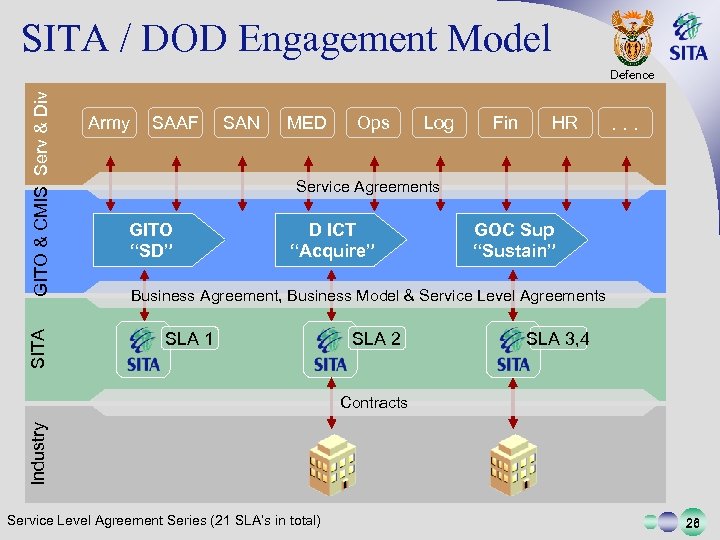

SITA / DOD Engagement Model SITA GITO & CMIS Serv & Div Defence Army SAAF SAN MED Ops Log Fin HR . . . Service Agreements GITO “SD” D ICT “Acquire” GOC Sup “Sustain” Business Agreement, Business Model & Service Level Agreements SLA 1 SLA 2 SLA 3, 4 Industry Contracts Service Level Agreement Series (21 SLA’s in total) 26

Relationship summary Defence v Formal engagement channels that are duly constituted. v Strong contract management (SLA) v Excellent financial controls and payment record (debtor) v Strategic partner/relationship v Embedded knowledge of DOD IT business. v Quality Embedded System approach (ISO 9000 Certified) v SITA’s 2 nd largest client. 27

Defence DOD ICT Expenditure (SITA) 28

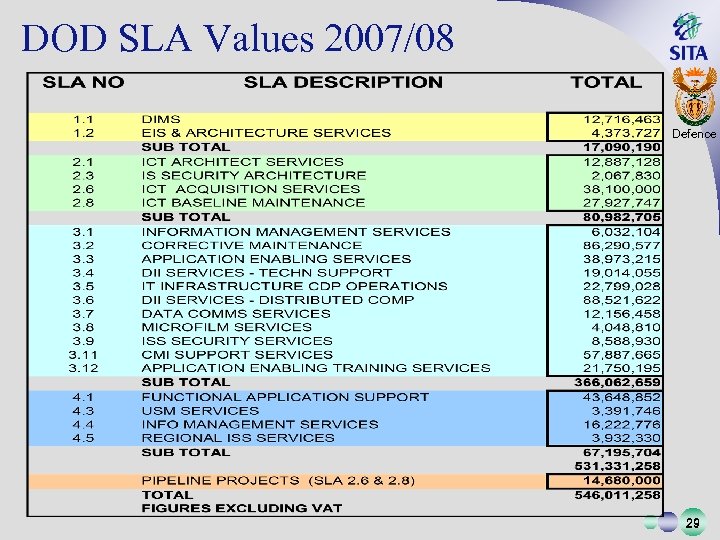

DOD SLA Values 2007/08 Defence 29

DOD – Some statistics Defence v Approximately 500 (120 major) Information Systems (excluding embedded C 2 information systems)… v used by over 720 organisations … v supporting over 30 000 “business” & “military” users … v in Land, Maritime, Air & Information operations … v that are deployed nationally & internationally. 30

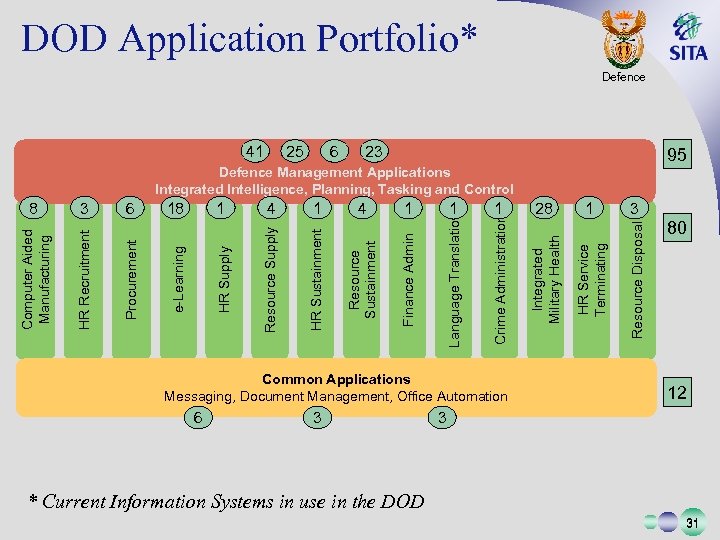

DOD Application Portfolio* Defence 41 25 6 23 95 Defence Management Applications Integrated Intelligence, Planning, Tasking and Control Common Applications Messaging, Document Management, Office Automation 6 3 1 3 Resource Disposal 28 HR Service Terminating 1 Integrated Military Health 1 Crime Administration 1 Language Translation 4 Finance Admin 1 Resource Sustainment HR Supply 4 HR Sustainment 1 Resource Supply 18 e-Learning 6 Procurement 3 HR Recruitment Computer Aided Manufacturing 8 80 12 3 * Current Information Systems in use in the DOD 31

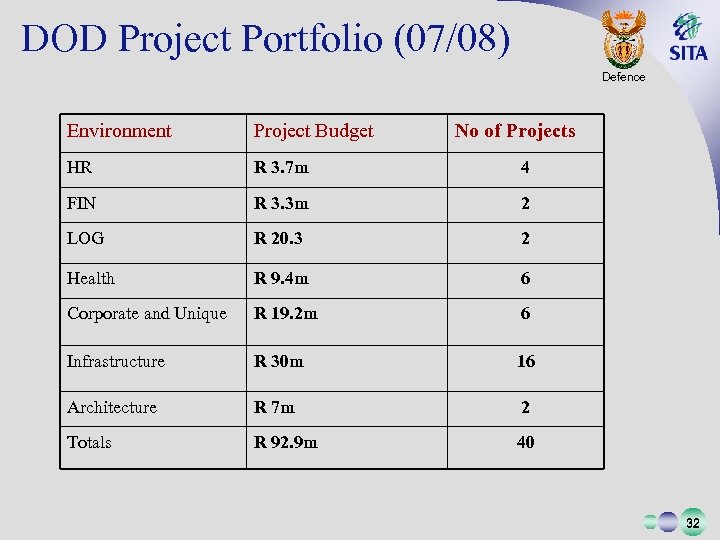

DOD Project Portfolio (07/08) Defence Environment Project Budget No of Projects HR R 3. 7 m 4 FIN R 3. 3 m 2 LOG R 20. 3 2 Health R 9. 4 m 6 Corporate and Unique R 19. 2 m 6 Infrastructure R 30 m 16 Architecture R 7 m 2 Totals R 92. 9 m 40 32

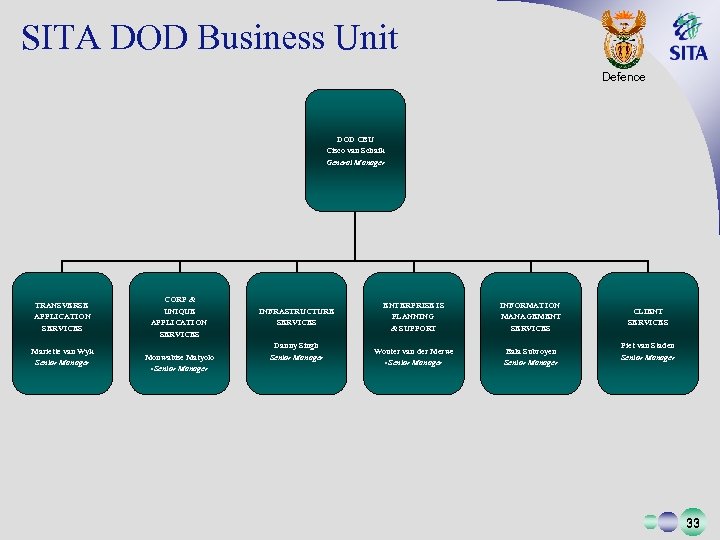

SITA DOD Business Unit Defence DOD CBU Cisco van Schaik General Manager TRANSVERSE APPLICATION SERVICES Mariette van Wyk Senior Manager CORP & UNIQUE APPLICATION SERVICES Monwabise Matyolo • Senior Manager INFRASTRUCTURE SERVICES Danny Singh Senior Manager ENTERPRISE IS PLANNING & SUPPORT INFORMATION MANAGEMENT SERVICES Wouter van der Merwe • Senior Manager Bala Subroyen Senior Manager CLIENT SERVICES Piet van Staden Senior Manager 33

Defence DEFENCE ENTERPRISE INFORMATION SYSTEM MASTER PLAN (DEIS MP) 34

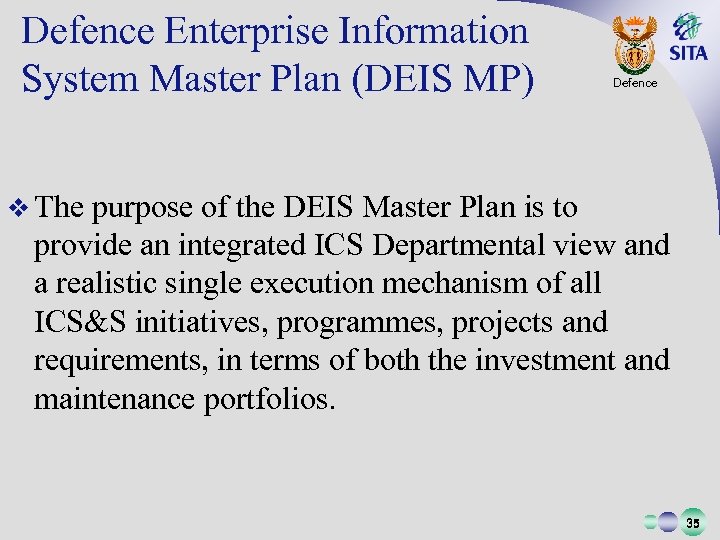

Defence Enterprise Information System Master Plan (DEIS MP) Defence v The purpose of the DEIS Master Plan is to provide an integrated ICS Departmental view and a realistic single execution mechanism of all ICS&S initiatives, programmes, projects and requirements, in terms of both the investment and maintenance portfolios. 35

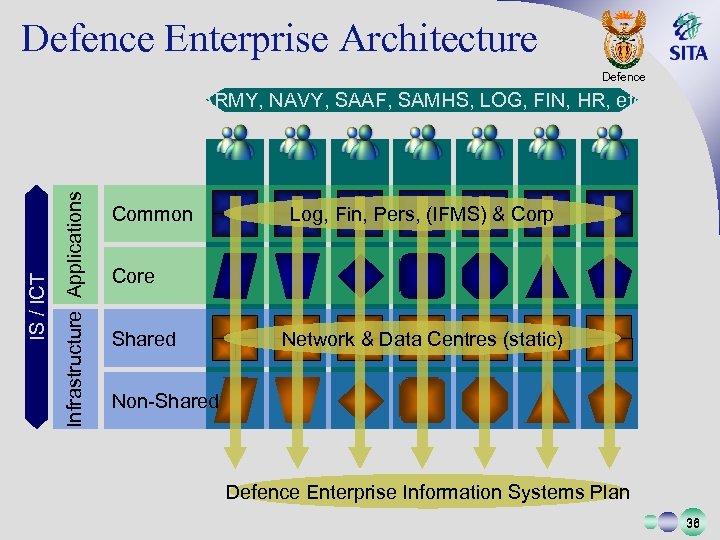

Defence Enterprise Architecture Defence Infrastructure Applications IS / ICT ARMY, NAVY, SAAF, SAMHS, LOG, FIN, HR, etc Common Log, Fin, Pers, (IFMS) & Corp Core Shared Network & Data Centres (static) Non-Shared Defence Enterprise Information Systems Plan 36

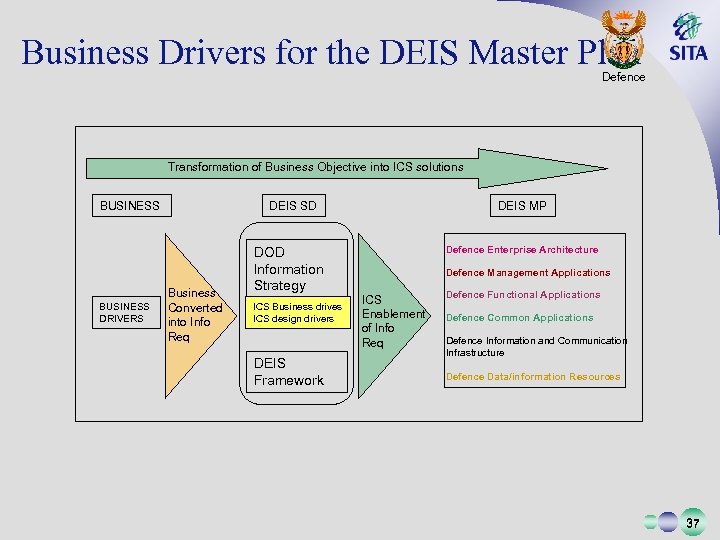

Business Drivers for the DEIS Master Plan Defence Transformation of Business Objective into ICS solutions DEIS SD BUSINESS DRIVERS Business Converted into Info Req DOD Information Strategy ICS Business drives ICS design drivers DEIS Framework DEIS MP Defence Enterprise Architecture Defence Management Applications ICS Enablement of Info Req Defence Functional Applications Defence Common Applications Defence Information and Communication Infrastructure Defence Data/information Resources 37

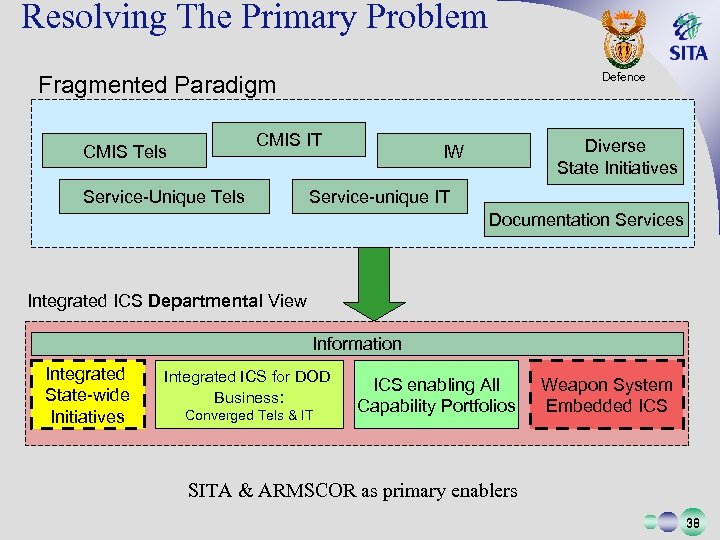

Resolving The Primary Problem Defence Fragmented Paradigm CMIS IT CMIS Tels Service-Unique Tels Diverse State Initiatives IW Service-unique IT Documentation Services Integrated ICS Departmental View Information Integrated State-wide Initiatives Integrated ICS for DOD Business: Converged Tels & IT • SITA ICS enabling All Capability Portfolios Weapon System Embedded ICS & ARMSCOR as primary enablers 38

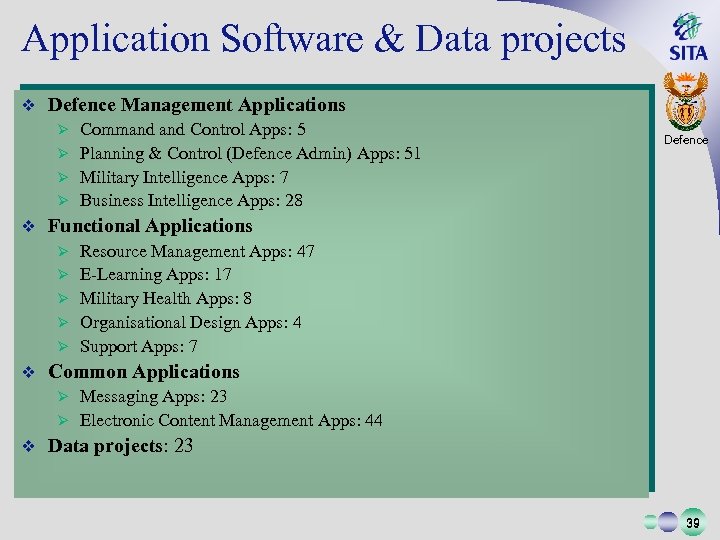

Application Software & Data projects v Defence Management Applications Command Control Apps: 5 Ø Planning & Control (Defence Admin) Apps: 51 Ø Military Intelligence Apps: 7 Ø Business Intelligence Apps: 28 Ø v Functional Applications Ø Ø Ø v Defence Resource Management Apps: 47 E-Learning Apps: 17 Military Health Apps: 8 Organisational Design Apps: 4 Support Apps: 7 Common Applications Messaging Apps: 23 Ø Electronic Content Management Apps: 44 Ø v Data projects: 23 39

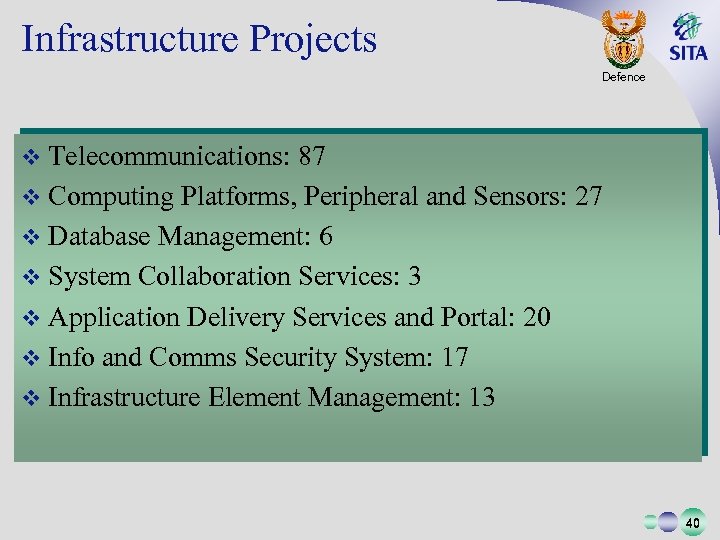

Infrastructure Projects Defence v Telecommunications: 87 v Computing Platforms, Peripheral and Sensors: 27 v Database Management: 6 v System Collaboration Services: 3 v Application Delivery Services and Portal: 20 v Info and Comms Security System: 17 v Infrastructure Element Management: 13 40

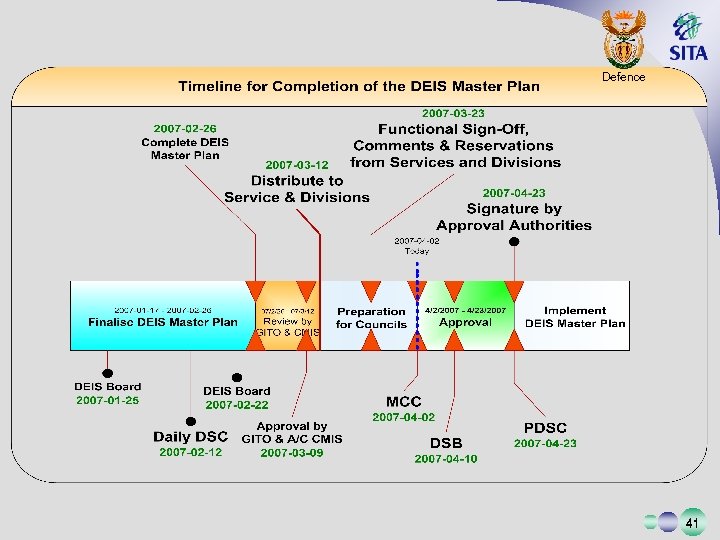

Defence 41

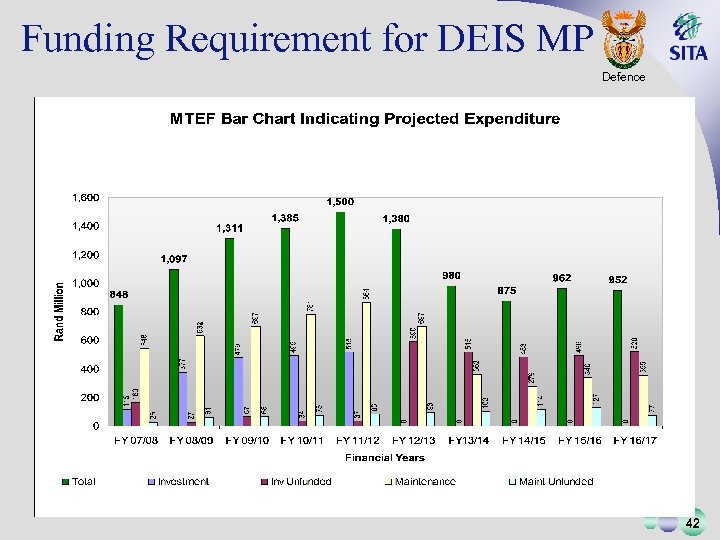

Funding Requirement for DEIS MP Defence NOTE: This excludes Item 10 Funds 42

Benefits of DEIS MP Defence v v v Integrated ICS Departmental view and a realistic single execution mechanism of all Information and Communication Systems Funding will be managed corporately Mission critical capabilities of the DOD have adequate ICS support and enablers Mission-critical information for decision making is available Compliance to the DOD Regulatory Framework and National Legislation Secure Information and Communication Systems 43

Conclusions (DEIS MP) Defence v Priorities are determined by the DOD as guided by the DEIS Master Plan v All acquisition and partnerships will follow the transparent procurement processes. v This event is the start of a long process, pursuing a cooperative engagement of 4 parties (DOD, SITA, Armscor, Industry). 44

Defence Thank You Q&A Peter Pedlar Acting CEO Cel no 083 450 6596 (012) 482 3321 Tau Mashigo “A man who does not think and plan long ahead will find trouble right at his door. ” - Confucius Head: Business Performance Femke Pienaar Head: Client Business Units Cisco van Schaik GM: DOD business Unit 45

4e2152ee53eb6aaa49b2ebb35de1d342.ppt