010cf07b90830775ecd2a74c4ffa748f.ppt

- Количество слайдов: 27

Information and requirements for exporting to Finland Europe Jouko Kuisma Consultant on Responsible Business (retired Head of Corporate Responsibility at Kesko, the biggest retail group in Finland)

Information and requirements for exporting to Finland Europe Jouko Kuisma Consultant on Responsible Business (retired Head of Corporate Responsibility at Kesko, the biggest retail group in Finland)

Finland as an export market • Finland is the most northern country of the European Union • Population 5. 4 million, capital Helsinki, currency Euro • Languages: Finnish&Swedish, English widely spoken • GDP per capita (2008): 34, 663 € (1 € = 1, 36 USD) • Value of Finland´s exports (2008): 65. 5 bill. € • Value of Finland´s imports (2008): 62. 4 bill. € • Imports from developing countries (2008): 10. 4 bill. € • Growth rate of imports from developing countries averaged 24 % in 2004 -2007

Finland as an export market • Finland is the most northern country of the European Union • Population 5. 4 million, capital Helsinki, currency Euro • Languages: Finnish&Swedish, English widely spoken • GDP per capita (2008): 34, 663 € (1 € = 1, 36 USD) • Value of Finland´s exports (2008): 65. 5 bill. € • Value of Finland´s imports (2008): 62. 4 bill. € • Imports from developing countries (2008): 10. 4 bill. € • Growth rate of imports from developing countries averaged 24 % in 2004 -2007

For many companies (like Kesko), market area is around the Baltic Sea c. 45 million consumers Norway 4. 5 m Sweden 9 m • Finland: all divisions • Sweden: home improvement and furniture trade • Norway: home improvement trade • the Baltics: home Finland improvement, furniture trade, 5. 2 m St. Petersburg agricultural and machinery region 5 m trade Estonia 1. 4 m • St. Petersburg region: home Latvia 2. 3 m Moscow region 15 m improvement trade Lithuania 3. 4 m • Moscow region: home improvement trade Kesko Corporation

For many companies (like Kesko), market area is around the Baltic Sea c. 45 million consumers Norway 4. 5 m Sweden 9 m • Finland: all divisions • Sweden: home improvement and furniture trade • Norway: home improvement trade • the Baltics: home Finland improvement, furniture trade, 5. 2 m St. Petersburg agricultural and machinery region 5 m trade Estonia 1. 4 m • St. Petersburg region: home Latvia 2. 3 m Moscow region 15 m improvement trade Lithuania 3. 4 m • Moscow region: home improvement trade Kesko Corporation

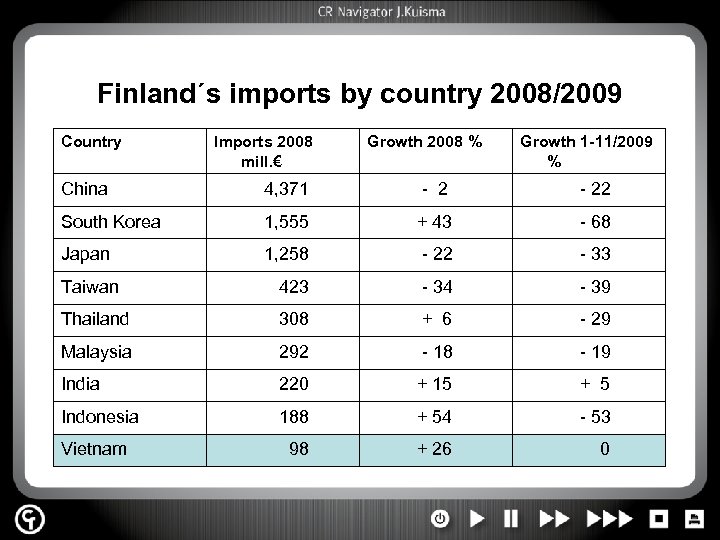

Finland´s imports by country 2008/2009 Country Imports 2008 mill. € Growth 2008 % Growth 1 -11/2009 % China 4, 371 - 22 South Korea 1, 555 + 43 - 68 Japan 1, 258 - 22 - 33 Taiwan 423 - 34 - 39 Thailand 308 + 6 - 29 Malaysia 292 - 18 - 19 India 220 + 15 + 5 Indonesia 188 + 54 - 53 98 + 26 0 Vietnam

Finland´s imports by country 2008/2009 Country Imports 2008 mill. € Growth 2008 % Growth 1 -11/2009 % China 4, 371 - 22 South Korea 1, 555 + 43 - 68 Japan 1, 258 - 22 - 33 Taiwan 423 - 34 - 39 Thailand 308 + 6 - 29 Malaysia 292 - 18 - 19 India 220 + 15 + 5 Indonesia 188 + 54 - 53 98 + 26 0 Vietnam

Finland´s imports by product group 2008 • • • Garments 1, 326 mill. € Textiles 588 mill. € Furniture 560 mill. € Fruit & vegetables 681 mill. € Coffee, tea, spices 321 mill. € Shoes 279 mill. € Fish & fish products 213 mill. € Diverse food products 309 mill. € Leather & leather goods 44 mill. € +6% -5% +6% + 14 % +8% +1% + 17 % -1%

Finland´s imports by product group 2008 • • • Garments 1, 326 mill. € Textiles 588 mill. € Furniture 560 mill. € Fruit & vegetables 681 mill. € Coffee, tea, spices 321 mill. € Shoes 279 mill. € Fish & fish products 213 mill. € Diverse food products 309 mill. € Leather & leather goods 44 mill. € +6% -5% +6% + 14 % +8% +1% + 17 % -1%

Finland´s imports from Vietnam (consumer goods) • • Furniture Shoes Garments Textiles Fish (e. g. pangasius) Leather goods Coffee, tea, spices (less significant amounts)

Finland´s imports from Vietnam (consumer goods) • • Furniture Shoes Garments Textiles Fish (e. g. pangasius) Leather goods Coffee, tea, spices (less significant amounts)

Finns are reliable business partners • Finnish business culture is based on high ethics. Finland is ranked as one of the world´s least corrupt countries by Transparency International. • In business negotiations, Finns do not favour small talk but tend to be remote and go quickly to the point. • Finns are very punctual as to agreed hours and very straightforward in handling issues. • Finns value efficient negotiations, explicit offers and terms, even quality, punctuality, compliance with law, contracts and other specified requirements. • If finding reliable suppliers, Finns tend to build long-lasting business relations.

Finns are reliable business partners • Finnish business culture is based on high ethics. Finland is ranked as one of the world´s least corrupt countries by Transparency International. • In business negotiations, Finns do not favour small talk but tend to be remote and go quickly to the point. • Finns are very punctual as to agreed hours and very straightforward in handling issues. • Finns value efficient negotiations, explicit offers and terms, even quality, punctuality, compliance with law, contracts and other specified requirements. • If finding reliable suppliers, Finns tend to build long-lasting business relations.

Efficiently organised retail market • The total value of the Finnish retail market is € 34 billion, of which food is € 13 billion • Hypermarkets and neighbourhood stores have biggest growth. • The retail market is dominated by large chains that also operate in neighbouring countries. • Big chains have strict store concepts, and most decisions are made in central organisations. • The big retail groups buy half of the imported goods directly from foreign suppliers. • There also many import companies and agents used to working with smaller suppliers (see www. agenttiliitto. fi)

Efficiently organised retail market • The total value of the Finnish retail market is € 34 billion, of which food is € 13 billion • Hypermarkets and neighbourhood stores have biggest growth. • The retail market is dominated by large chains that also operate in neighbouring countries. • Big chains have strict store concepts, and most decisions are made in central organisations. • The big retail groups buy half of the imported goods directly from foreign suppliers. • There also many import companies and agents used to working with smaller suppliers (see www. agenttiliitto. fi)

Major players in food retail • S-Group, consumer co-op, market share 41 % - hypermarkets, supermarkets, neighbourhood stores, petrol stations with stores, cafés, hotels, restaurants • Kesko/K-stores, listed company & private retailers, market share 34 % - hypermarkets, supermarkets, neighbourhood stores, petrol station food stores • Tradeka, a Swedish investment company as majority holder, market share 12 % - neighbourhood stores, some hypermarkets, served by Tuko Logistics • Lidl (German) 5 %, others (Stockmann etc. ) 8 %

Major players in food retail • S-Group, consumer co-op, market share 41 % - hypermarkets, supermarkets, neighbourhood stores, petrol stations with stores, cafés, hotels, restaurants • Kesko/K-stores, listed company & private retailers, market share 34 % - hypermarkets, supermarkets, neighbourhood stores, petrol station food stores • Tradeka, a Swedish investment company as majority holder, market share 12 % - neighbourhood stores, some hypermarkets, served by Tuko Logistics • Lidl (German) 5 %, others (Stockmann etc. ) 8 %

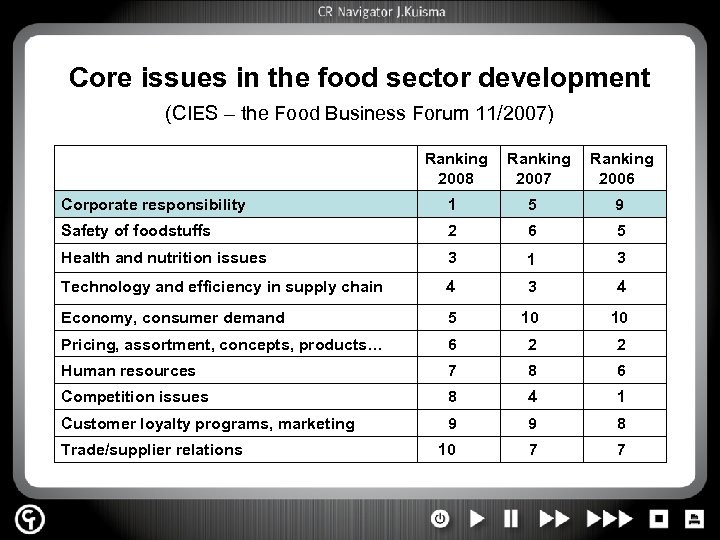

Core issues in the food sector development (CIES – the Food Business Forum 11/2007) Ranking 2008 Ranking 2007 Ranking 2006 Corporate responsibility 1 5 9 Safety of foodstuffs 2 6 5 Health and nutrition issues 3 1 3 Technology and efficiency in supply chain 4 3 4 Economy, consumer demand 5 10 10 Pricing, assortment, concepts, products… 6 2 2 Human resources 7 8 6 Competition issues 8 4 1 Customer loyalty programs, marketing 9 9 8 10 7 7 Trade/supplier relations

Core issues in the food sector development (CIES – the Food Business Forum 11/2007) Ranking 2008 Ranking 2007 Ranking 2006 Corporate responsibility 1 5 9 Safety of foodstuffs 2 6 5 Health and nutrition issues 3 1 3 Technology and efficiency in supply chain 4 3 4 Economy, consumer demand 5 10 10 Pricing, assortment, concepts, products… 6 2 2 Human resources 7 8 6 Competition issues 8 4 1 Customer loyalty programs, marketing 9 9 8 10 7 7 Trade/supplier relations

Major players in garments • • • H&M (Swedish) Texmoda Fashion Group Seppälä (Stockmann) Lindex (Stockmann) Bestseller Kapp. Ahl (Swedish) Dressmann (Norwegian) Specialty stores total Dep. stores, hypermarkets Sporting goods stores 36 stores 257 m€ 87 stores 130 m€ 132 stores 121 m€ 53 stores 77 m€ 93 stores 84 m€ 51 stores 74 m€ 59 stores 52 m€ 3 400 stores 1 920 m€ 1 690 m€ 410 m€

Major players in garments • • • H&M (Swedish) Texmoda Fashion Group Seppälä (Stockmann) Lindex (Stockmann) Bestseller Kapp. Ahl (Swedish) Dressmann (Norwegian) Specialty stores total Dep. stores, hypermarkets Sporting goods stores 36 stores 257 m€ 87 stores 130 m€ 132 stores 121 m€ 53 stores 77 m€ 93 stores 84 m€ 51 stores 74 m€ 59 stores 52 m€ 3 400 stores 1 920 m€ 1 690 m€ 410 m€

Major players in sporting goods • • • Intersport (Kesko) Sportia Top-Sport Stadium (Swedish) Kesport (Kesko) Prisma hypermarkets K-citymarkets (Kesko) Stockmann Total 61 stores 59 stores 26 stores 8 stores 38 stores 59 stores 64 stores 7 stores 1 350 stores 259 m€ 67 m€ 46 m€ 38 m€ 31 m€ 92 m€ 63 m€ 26 m€ 1 015 m€

Major players in sporting goods • • • Intersport (Kesko) Sportia Top-Sport Stadium (Swedish) Kesport (Kesko) Prisma hypermarkets K-citymarkets (Kesko) Stockmann Total 61 stores 59 stores 26 stores 8 stores 38 stores 59 stores 64 stores 7 stores 1 350 stores 259 m€ 67 m€ 46 m€ 38 m€ 31 m€ 92 m€ 63 m€ 26 m€ 1 015 m€

Major players in furniture retail • • • Ikea (Swedish) Indoor Group (Kesko) Kodin Ykkönen (Kesko) Masku Others Total 3 stores 85 stores 8 stores 48 stores 650 stores 213 m€ 203 m€ 181 m€ 134 m€ 959 m€ 1 690 m€ • DIY-stores (K-Rauta, Rautia etc. ), hypermarkets and department stores sell garden furniture.

Major players in furniture retail • • • Ikea (Swedish) Indoor Group (Kesko) Kodin Ykkönen (Kesko) Masku Others Total 3 stores 85 stores 8 stores 48 stores 650 stores 213 m€ 203 m€ 181 m€ 134 m€ 959 m€ 1 690 m€ • DIY-stores (K-Rauta, Rautia etc. ), hypermarkets and department stores sell garden furniture.

Commercial expectations • Having complied with technical requirements and specifications: • Quality must always meet the expectations • Retail price in Finland must be competitive and attract customers (but low prices must be due to responsible practices) • Supplied quantities must be sufficient for a big retail chain´s needs by agreement • Reliability of shipments must be 100 % • For small suppliers, it is wise to work in close collaboration in exporting to meet customers´ needs

Commercial expectations • Having complied with technical requirements and specifications: • Quality must always meet the expectations • Retail price in Finland must be competitive and attract customers (but low prices must be due to responsible practices) • Supplied quantities must be sufficient for a big retail chain´s needs by agreement • Reliability of shipments must be 100 % • For small suppliers, it is wise to work in close collaboration in exporting to meet customers´ needs

Complying with legal requirements • Finnish legislation is harmonised with EU legislation, if there are exceptions, Finland is on the strict side. • Finnish partners will assist in complying with the requirements. Customs laboratory is strict and precise. • The essential regulations include: • Product Safety > Aim is to safeguard consumers’ health. Product safety shall always be controlled before a product enters the market. • Product liability > If a consumer can prove that a defective product has caused injury or damage, s/he can claim financial compensation

Complying with legal requirements • Finnish legislation is harmonised with EU legislation, if there are exceptions, Finland is on the strict side. • Finnish partners will assist in complying with the requirements. Customs laboratory is strict and precise. • The essential regulations include: • Product Safety > Aim is to safeguard consumers’ health. Product safety shall always be controlled before a product enters the market. • Product liability > If a consumer can prove that a defective product has caused injury or damage, s/he can claim financial compensation

Complying with legal requirements • The essential regulations (continued) • Food safety > Aims to ensure a high level of protection of human life and health with due regard for animal health and welfare, plant health and the environment • Packaging and labeling > Aims to ensure that the quality and hygiene of the product lasts until it reaches the consumer and to provide consumers with relevant information about the product • Demonstration of compliance > Importers have to document compliance with legal requirements (for higher risk products this includes laboratory test reports, inspection reports)

Complying with legal requirements • The essential regulations (continued) • Food safety > Aims to ensure a high level of protection of human life and health with due regard for animal health and welfare, plant health and the environment • Packaging and labeling > Aims to ensure that the quality and hygiene of the product lasts until it reaches the consumer and to provide consumers with relevant information about the product • Demonstration of compliance > Importers have to document compliance with legal requirements (for higher risk products this includes laboratory test reports, inspection reports)

Private sector standards and codes • Companies are scrutinized by different stakeholders and they need to safeguard their reputation. • Corporate responsibility includes economic, environmental and social responsibility, working conditions being an important part of corporate responsibility. • Many buyers use voluntary standards and codes as part of their basic requirements for suppliers: ISO 9001 standard for quality management, ISO 14001 for environmental management, OHSAS 18001 for work safety, HACCP) for food safety, Global. GAP for good agricultural practice • Labour standards are also extremely important.

Private sector standards and codes • Companies are scrutinized by different stakeholders and they need to safeguard their reputation. • Corporate responsibility includes economic, environmental and social responsibility, working conditions being an important part of corporate responsibility. • Many buyers use voluntary standards and codes as part of their basic requirements for suppliers: ISO 9001 standard for quality management, ISO 14001 for environmental management, OHSAS 18001 for work safety, HACCP) for food safety, Global. GAP for good agricultural practice • Labour standards are also extremely important.

Major issues in developing the supply chain • Product safety, in some cases traceability • Origin & sustainability of raw material – certifications like FSC (timber, furniture, parquet), MSC (fish). . . • Decent working conditions - compliance with national labour laws and/or ILO conventions (the ones that are the most stringent) • Cooperation between European retail chains to carry out social audits among ”risk suppliers” → Business Social Compliance Initiative BSCI – over 400 retail chains as members, over 10 000 audits in database • Third party audit – the only valid proof on compliance

Major issues in developing the supply chain • Product safety, in some cases traceability • Origin & sustainability of raw material – certifications like FSC (timber, furniture, parquet), MSC (fish). . . • Decent working conditions - compliance with national labour laws and/or ILO conventions (the ones that are the most stringent) • Cooperation between European retail chains to carry out social audits among ”risk suppliers” → Business Social Compliance Initiative BSCI – over 400 retail chains as members, over 10 000 audits in database • Third party audit – the only valid proof on compliance

Definition of a risk supplier – does not have appropriate health and safety policies in place – does not have appropriate environmental management systems in place – utilizes materials which contain hazardous substances – employs hazardous processes – employs low skill level / manual labour or processes – is at risk of not following international human rights or labour standards – has a reputation for unethical behavior – involves contracts of significant value, with large commission payments – involves (significant) cash payments

Definition of a risk supplier – does not have appropriate health and safety policies in place – does not have appropriate environmental management systems in place – utilizes materials which contain hazardous substances – employs hazardous processes – employs low skill level / manual labour or processes – is at risk of not following international human rights or labour standards – has a reputation for unethical behavior – involves contracts of significant value, with large commission payments – involves (significant) cash payments

Criteria to be examined Based on ILO Conventions for core labour standards: § Prohibition of abusive forms of child labour § Prohibition of forced and bonded labour § Hours of work § Wages (statutory minimum wage vs. living wage) § Prohibition of discrimination (race, sex etc. ) § Safety and health of the employees § Rights to freedom of association and collective bargaining

Criteria to be examined Based on ILO Conventions for core labour standards: § Prohibition of abusive forms of child labour § Prohibition of forced and bonded labour § Hours of work § Wages (statutory minimum wage vs. living wage) § Prohibition of discrimination (race, sex etc. ) § Safety and health of the employees § Rights to freedom of association and collective bargaining

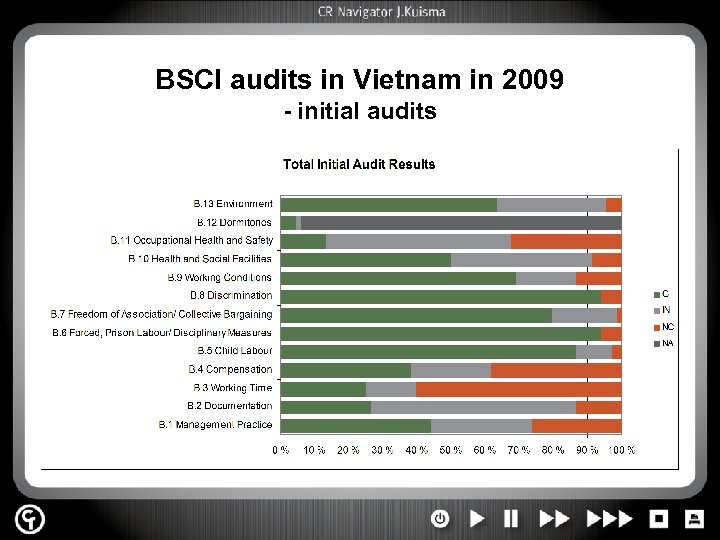

BSCI audits in Vietnam in 2009 - initial audits

BSCI audits in Vietnam in 2009 - initial audits

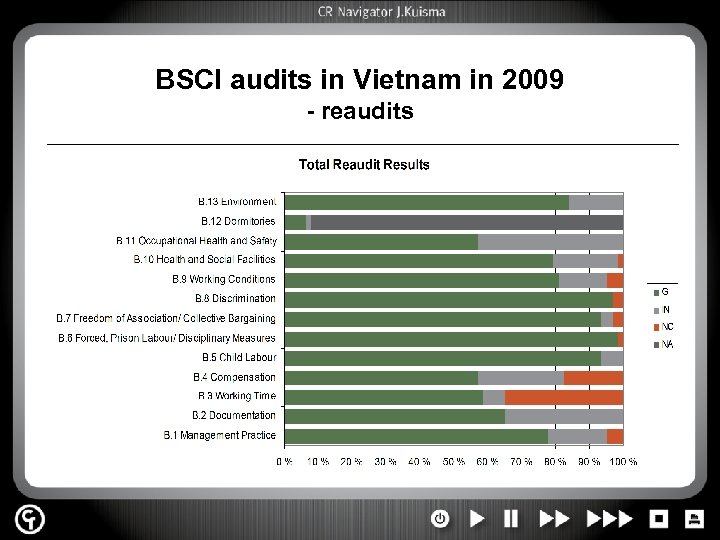

BSCI audits in Vietnam in 2009 - reaudits

BSCI audits in Vietnam in 2009 - reaudits

Big news in November 2007 • Child labour found on the Uzbekistan cotton fields • Krenholm in Estonia, part of the Swedish corporation Borås Wäfveri, supplies cotton cloth, partly made of the Uzbek cotton, to H&M, Marimekko, Anttila etc. • Borås Wäfveri decides to stop buying cotton from Uzbekistan • Marimekko announces in public that they stop buying cloth from Krenholm • H&M, Kesko and SASK (Solidarity Center of Finnish Trade Unions) comment that the case has to be studied and negotiated carefully

Big news in November 2007 • Child labour found on the Uzbekistan cotton fields • Krenholm in Estonia, part of the Swedish corporation Borås Wäfveri, supplies cotton cloth, partly made of the Uzbek cotton, to H&M, Marimekko, Anttila etc. • Borås Wäfveri decides to stop buying cotton from Uzbekistan • Marimekko announces in public that they stop buying cloth from Krenholm • H&M, Kesko and SASK (Solidarity Center of Finnish Trade Unions) comment that the case has to be studied and negotiated carefully

…the story continues… • Big UK chains – Tesco, Marks & Spencer etc. – announce boycott on Uzbek cotton • The case is discussed in the EU parliament and taken into political negotiations with Uzbekistan • H&M stops buying from Krenholm and donates 150, 000 USD to UNICEF, to be used in Uzbekistan

…the story continues… • Big UK chains – Tesco, Marks & Spencer etc. – announce boycott on Uzbek cotton • The case is discussed in the EU parliament and taken into political negotiations with Uzbekistan • H&M stops buying from Krenholm and donates 150, 000 USD to UNICEF, to be used in Uzbekistan

…and continues… • Only a few lines in the Finnish newspapers in December 2007: Krenholm predicts they have to prepare for layoffs of 1, 000 workers in 2008 • No mention in the Finnish media: before summer 2008, Krenholm had laid off 1, 300 workers out of 2, 300 and closed some of its plants in Narva • No follow-up in the media: what happened to those children in Uzbekistan that needed protection?

…and continues… • Only a few lines in the Finnish newspapers in December 2007: Krenholm predicts they have to prepare for layoffs of 1, 000 workers in 2008 • No mention in the Finnish media: before summer 2008, Krenholm had laid off 1, 300 workers out of 2, 300 and closed some of its plants in Narva • No follow-up in the media: what happened to those children in Uzbekistan that needed protection?

How could we cooperate? • Finnish retailers do not want to act as policemen nor as judges when dealing with their suppliers • It is much more useful to cooperate with suppliers in developing their capacities, in order to create a winwin situation • Suppliers should seriously consider ways of implementing the standards their clients are requiring – possibly by help of mutual development projects • Government should invest especially in developing their inspections and advice on labour protection

How could we cooperate? • Finnish retailers do not want to act as policemen nor as judges when dealing with their suppliers • It is much more useful to cooperate with suppliers in developing their capacities, in order to create a winwin situation • Suppliers should seriously consider ways of implementing the standards their clients are requiring – possibly by help of mutual development projects • Government should invest especially in developing their inspections and advice on labour protection

Kesko is one of the frontrunners of sustainability in Finland globally Major indices and ratings: • Dow Jones Sustainability Index: Kesko has been since 2003 in DJSI World ja DJSI STOXX -indices • FTSE 4 Good Index (owned by Financial Times and London Stock Exchange) listed • The World Economic Forum: Kesko is listed among The Global 100 Most Sustainable Corporations (1 800 companies assessed) • SAM Sustainability Yearbook 2010: silver class in food sector + Sector Mover • Other listings: • Kempen/SNS Smaller Europe Index • ASPI Eurozone® Index • oekom Research ”Prime-rating” Kesko Corporation

Kesko is one of the frontrunners of sustainability in Finland globally Major indices and ratings: • Dow Jones Sustainability Index: Kesko has been since 2003 in DJSI World ja DJSI STOXX -indices • FTSE 4 Good Index (owned by Financial Times and London Stock Exchange) listed • The World Economic Forum: Kesko is listed among The Global 100 Most Sustainable Corporations (1 800 companies assessed) • SAM Sustainability Yearbook 2010: silver class in food sector + Sector Mover • Other listings: • Kempen/SNS Smaller Europe Index • ASPI Eurozone® Index • oekom Research ”Prime-rating” Kesko Corporation