13a93b09da414028f975bb24cfde85a0.ppt

- Количество слайдов: 22

Inflation Ed. Excel AS Economics 2. 1. 2

Inflation Ed. Excel AS Economics 2. 1. 2

Introduction to Inflation is a sustained increase in the cost of living or the general price level leading to a fall in the purchasing power of money • The rate of inflation is measured by the annual percentage change in consumer prices • The UK government has set an inflation target of 2% using the consumer prices index (CPI) • It is the job of the Bank of England (Bo. E) to set monetary policy interest rates so that inflationary pressures are controlled and the inflation target is reached • A fall in inflation is not the same as a fall in prices! Only when there is deflation will the general price level fall

Introduction to Inflation is a sustained increase in the cost of living or the general price level leading to a fall in the purchasing power of money • The rate of inflation is measured by the annual percentage change in consumer prices • The UK government has set an inflation target of 2% using the consumer prices index (CPI) • It is the job of the Bank of England (Bo. E) to set monetary policy interest rates so that inflationary pressures are controlled and the inflation target is reached • A fall in inflation is not the same as a fall in prices! Only when there is deflation will the general price level fall

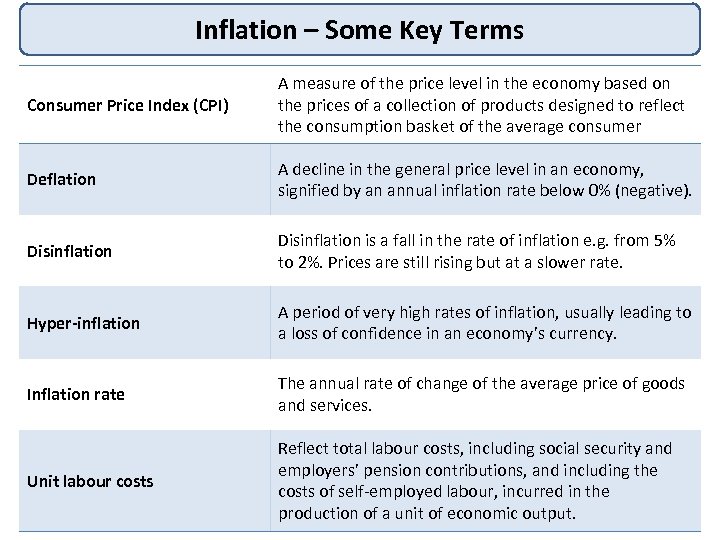

Inflation – Some Key Terms Consumer Price Index (CPI) A measure of the price level in the economy based on the prices of a collection of products designed to reflect the consumption basket of the average consumer Deflation A decline in the general price level in an economy, signified by an annual inflation rate below 0% (negative). Disinflation is a fall in the rate of inflation e. g. from 5% to 2%. Prices are still rising but at a slower rate. Hyper-inflation A period of very high rates of inflation, usually leading to a loss of confidence in an economy’s currency. Inflation rate The annual rate of change of the average price of goods and services. Unit labour costs Reflect total labour costs, including social security and employers’ pension contributions, and including the costs of self-employed labour, incurred in the production of a unit of economic output.

Inflation – Some Key Terms Consumer Price Index (CPI) A measure of the price level in the economy based on the prices of a collection of products designed to reflect the consumption basket of the average consumer Deflation A decline in the general price level in an economy, signified by an annual inflation rate below 0% (negative). Disinflation is a fall in the rate of inflation e. g. from 5% to 2%. Prices are still rising but at a slower rate. Hyper-inflation A period of very high rates of inflation, usually leading to a loss of confidence in an economy’s currency. Inflation rate The annual rate of change of the average price of goods and services. Unit labour costs Reflect total labour costs, including social security and employers’ pension contributions, and including the costs of self-employed labour, incurred in the production of a unit of economic output.

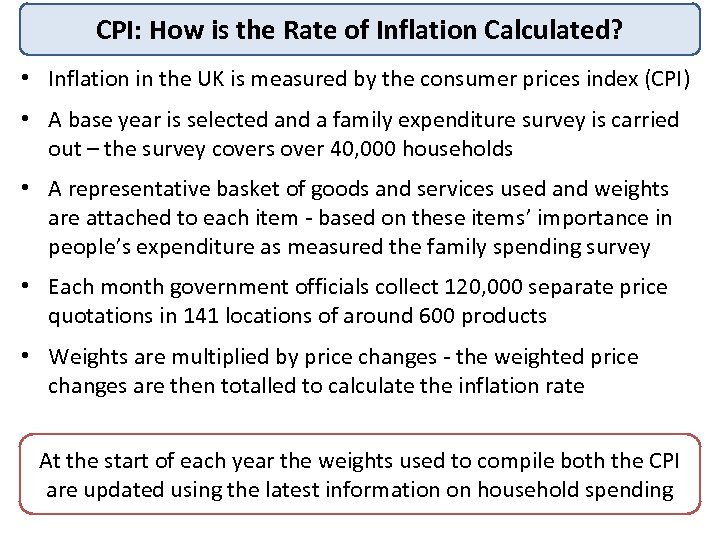

CPI: How is the Rate of Inflation Calculated? • Inflation in the UK is measured by the consumer prices index (CPI) • A base year is selected and a family expenditure survey is carried out – the survey covers over 40, 000 households • A representative basket of goods and services used and weights are attached to each item - based on these items’ importance in people’s expenditure as measured the family spending survey • Each month government officials collect 120, 000 separate price quotations in 141 locations of around 600 products • Weights are multiplied by price changes - the weighted price changes are then totalled to calculate the inflation rate At the start of each year the weights used to compile both the CPI are updated using the latest information on household spending

CPI: How is the Rate of Inflation Calculated? • Inflation in the UK is measured by the consumer prices index (CPI) • A base year is selected and a family expenditure survey is carried out – the survey covers over 40, 000 households • A representative basket of goods and services used and weights are attached to each item - based on these items’ importance in people’s expenditure as measured the family spending survey • Each month government officials collect 120, 000 separate price quotations in 141 locations of around 600 products • Weights are multiplied by price changes - the weighted price changes are then totalled to calculate the inflation rate At the start of each year the weights used to compile both the CPI are updated using the latest information on household spending

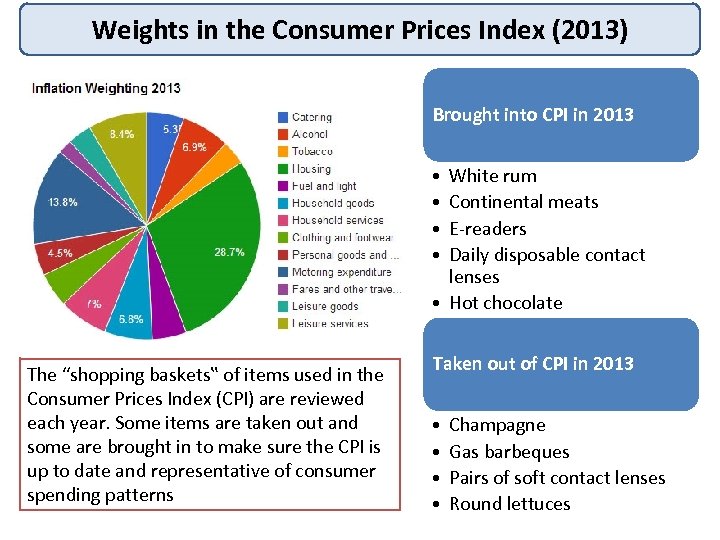

Weights in the Consumer Prices Index (2013) Brought into CPI in 2013 • • White rum Continental meats E-readers Daily disposable contact lenses • Hot chocolate The “shopping baskets‟ of items used in the Consumer Prices Index (CPI) are reviewed each year. Some items are taken out and some are brought in to make sure the CPI is up to date and representative of consumer spending patterns Taken out of CPI in 2013 • • Champagne Gas barbeques Pairs of soft contact lenses Round lettuces

Weights in the Consumer Prices Index (2013) Brought into CPI in 2013 • • White rum Continental meats E-readers Daily disposable contact lenses • Hot chocolate The “shopping baskets‟ of items used in the Consumer Prices Index (CPI) are reviewed each year. Some items are taken out and some are brought in to make sure the CPI is up to date and representative of consumer spending patterns Taken out of CPI in 2013 • • Champagne Gas barbeques Pairs of soft contact lenses Round lettuces

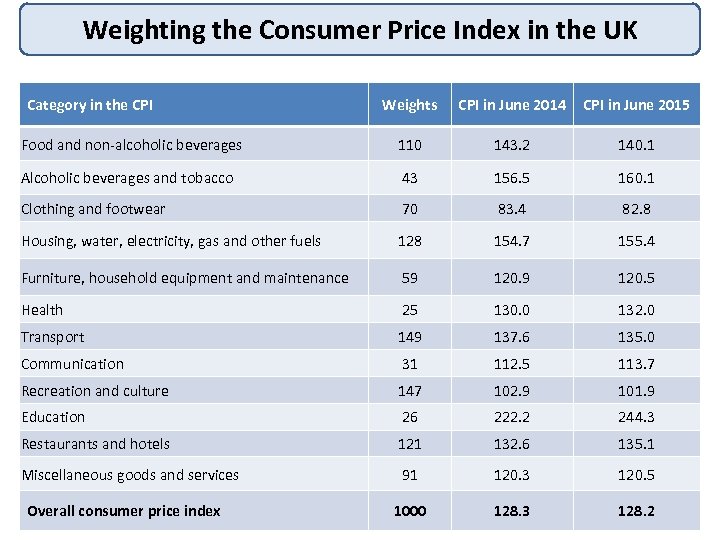

Weighting the Consumer Price Index in the UK Category in the CPI Weights CPI in June 2014 CPI in June 2015 Food and non-alcoholic beverages 110 143. 2 140. 1 Alcoholic beverages and tobacco 43 156. 5 160. 1 Clothing and footwear 70 83. 4 82. 8 Housing, water, electricity, gas and other fuels 128 154. 7 155. 4 Furniture, household equipment and maintenance 59 120. 5 Health 25 130. 0 132. 0 Transport 149 137. 6 135. 0 Communication 31 112. 5 113. 7 Recreation and culture 147 102. 9 101. 9 Education 26 222. 2 244. 3 Restaurants and hotels 121 132. 6 135. 1 Miscellaneous goods and services 91 120. 3 120. 5 1000 128. 3 128. 2 Overall consumer price index

Weighting the Consumer Price Index in the UK Category in the CPI Weights CPI in June 2014 CPI in June 2015 Food and non-alcoholic beverages 110 143. 2 140. 1 Alcoholic beverages and tobacco 43 156. 5 160. 1 Clothing and footwear 70 83. 4 82. 8 Housing, water, electricity, gas and other fuels 128 154. 7 155. 4 Furniture, household equipment and maintenance 59 120. 5 Health 25 130. 0 132. 0 Transport 149 137. 6 135. 0 Communication 31 112. 5 113. 7 Recreation and culture 147 102. 9 101. 9 Education 26 222. 2 244. 3 Restaurants and hotels 121 132. 6 135. 1 Miscellaneous goods and services 91 120. 3 120. 5 1000 128. 3 128. 2 Overall consumer price index

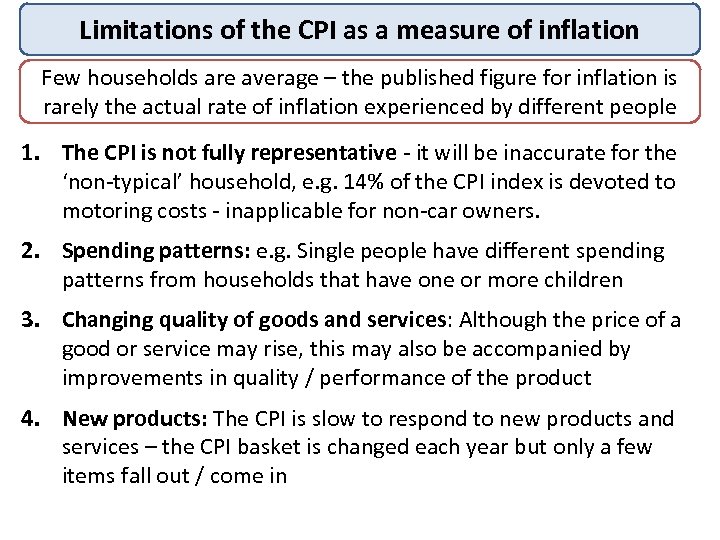

Limitations of the CPI as a measure of inflation Few households are average – the published figure for inflation is rarely the actual rate of inflation experienced by different people 1. The CPI is not fully representative - it will be inaccurate for the ‘non-typical’ household, e. g. 14% of the CPI index is devoted to motoring costs - inapplicable for non-car owners. 2. Spending patterns: e. g. Single people have different spending patterns from households that have one or more children 3. Changing quality of goods and services: Although the price of a good or service may rise, this may also be accompanied by improvements in quality / performance of the product 4. New products: The CPI is slow to respond to new products and services – the CPI basket is changed each year but only a few items fall out / come in

Limitations of the CPI as a measure of inflation Few households are average – the published figure for inflation is rarely the actual rate of inflation experienced by different people 1. The CPI is not fully representative - it will be inaccurate for the ‘non-typical’ household, e. g. 14% of the CPI index is devoted to motoring costs - inapplicable for non-car owners. 2. Spending patterns: e. g. Single people have different spending patterns from households that have one or more children 3. Changing quality of goods and services: Although the price of a good or service may rise, this may also be accompanied by improvements in quality / performance of the product 4. New products: The CPI is slow to respond to new products and services – the CPI basket is changed each year but only a few items fall out / come in

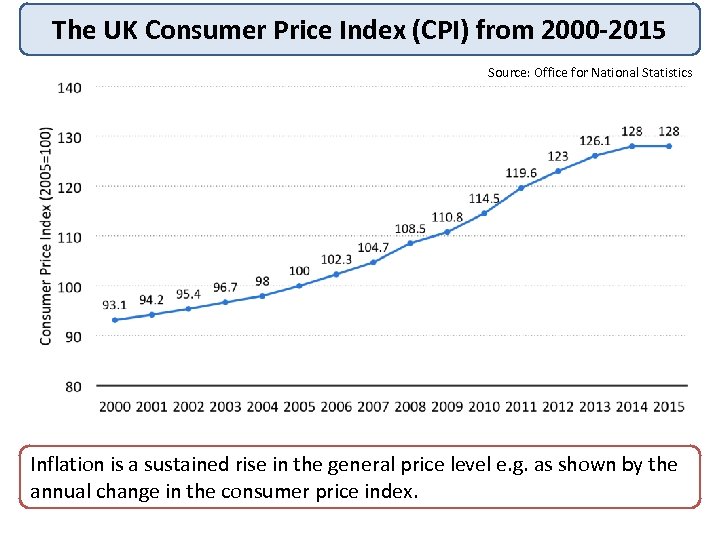

The UK Consumer Price Index (CPI) from 2000 -2015 Source: Office for National Statistics Text goes sustained rise in the general price level e. g. as shown by the Inflation is ahere annual change in the consumer price index.

The UK Consumer Price Index (CPI) from 2000 -2015 Source: Office for National Statistics Text goes sustained rise in the general price level e. g. as shown by the Inflation is ahere annual change in the consumer price index.

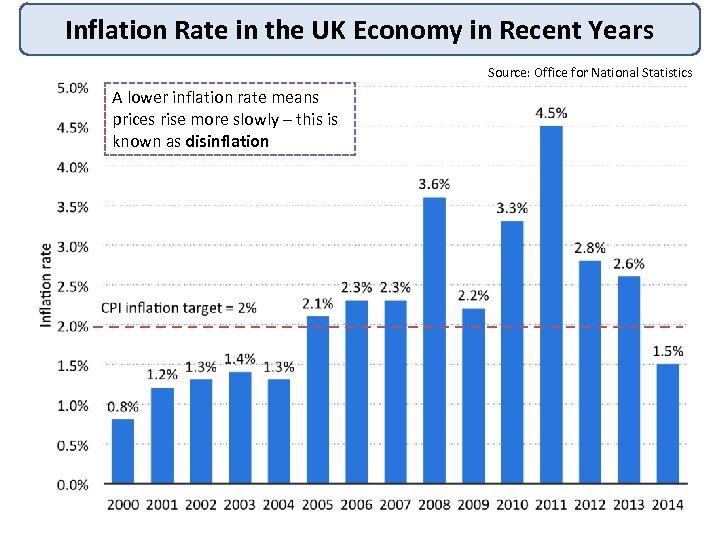

Inflation Rate in the UK Economy in Recent Years Source: Office for National Statistics A lower inflation rate means prices rise more slowly – this is known as disinflation

Inflation Rate in the UK Economy in Recent Years Source: Office for National Statistics A lower inflation rate means prices rise more slowly – this is known as disinflation

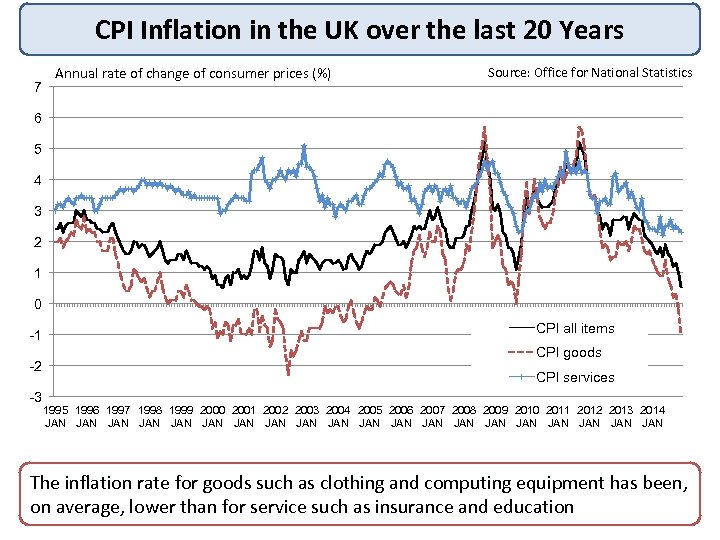

CPI Inflation in the UK over the last 20 Years 7 Annual rate of change of consumer prices (%) Source: Office for National Statistics 6 5 4 3 2 1 0 -1 -2 -3 CPI all items CPI goods CPI services 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 JAN JAN JAN JAN JAN The inflation rate for goods such as clothing and computing equipment has been, on average, lower than for service such as insurance and education

CPI Inflation in the UK over the last 20 Years 7 Annual rate of change of consumer prices (%) Source: Office for National Statistics 6 5 4 3 2 1 0 -1 -2 -3 CPI all items CPI goods CPI services 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 JAN JAN JAN JAN JAN The inflation rate for goods such as clothing and computing equipment has been, on average, lower than for service such as insurance and education

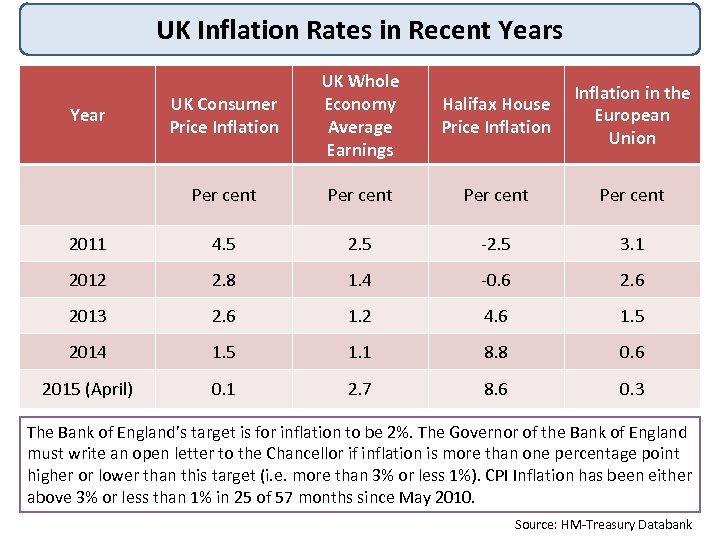

UK Inflation Rates in Recent Years UK Consumer Price Inflation UK Whole Economy Average Earnings Halifax House Price Inflation in the European Union Per cent 2011 4. 5 2. 5 -2. 5 3. 1 2012 2. 8 1. 4 -0. 6 2013 2. 6 1. 2 4. 6 1. 5 2014 1. 5 1. 1 8. 8 0. 6 2015 (April) 0. 1 2. 7 8. 6 0. 3 Year The Bank of England’s target is for inflation to be 2%. The Governor of the Bank of England must write an open letter to the Chancellor if inflation is more than one percentage point higher or lower than this target (i. e. more than 3% or less 1%). CPI Inflation has been either above 3% or less than 1% in 25 of 57 months since May 2010. Source: HM-Treasury Databank

UK Inflation Rates in Recent Years UK Consumer Price Inflation UK Whole Economy Average Earnings Halifax House Price Inflation in the European Union Per cent 2011 4. 5 2. 5 -2. 5 3. 1 2012 2. 8 1. 4 -0. 6 2013 2. 6 1. 2 4. 6 1. 5 2014 1. 5 1. 1 8. 8 0. 6 2015 (April) 0. 1 2. 7 8. 6 0. 3 Year The Bank of England’s target is for inflation to be 2%. The Governor of the Bank of England must write an open letter to the Chancellor if inflation is more than one percentage point higher or lower than this target (i. e. more than 3% or less 1%). CPI Inflation has been either above 3% or less than 1% in 25 of 57 months since May 2010. Source: HM-Treasury Databank

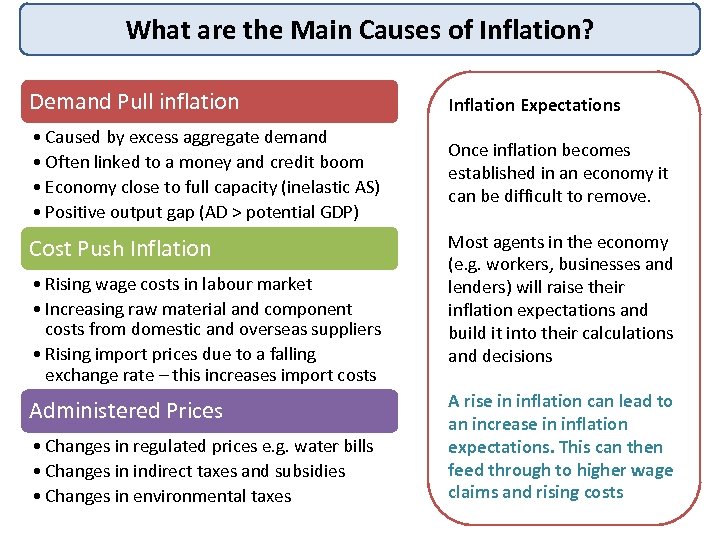

What are the Main Causes of Inflation? Demand Pull inflation Inflation Expectations • Caused by excess aggregate demand • Often linked to a money and credit boom • Economy close to full capacity (inelastic AS) • Positive output gap (AD > potential GDP) Once inflation becomes established in an economy it can be difficult to remove. Cost Push Inflation • Rising wage costs in labour market • Increasing raw material and component costs from domestic and overseas suppliers • Rising import prices due to a falling exchange rate – this increases import costs Administered Prices • Changes in regulated prices e. g. water bills • Changes in indirect taxes and subsidies • Changes in environmental taxes Most agents in the economy (e. g. workers, businesses and lenders) will raise their inflation expectations and build it into their calculations and decisions A rise in inflation can lead to an increase in inflation expectations. This can then feed through to higher wage claims and rising costs

What are the Main Causes of Inflation? Demand Pull inflation Inflation Expectations • Caused by excess aggregate demand • Often linked to a money and credit boom • Economy close to full capacity (inelastic AS) • Positive output gap (AD > potential GDP) Once inflation becomes established in an economy it can be difficult to remove. Cost Push Inflation • Rising wage costs in labour market • Increasing raw material and component costs from domestic and overseas suppliers • Rising import prices due to a falling exchange rate – this increases import costs Administered Prices • Changes in regulated prices e. g. water bills • Changes in indirect taxes and subsidies • Changes in environmental taxes Most agents in the economy (e. g. workers, businesses and lenders) will raise their inflation expectations and build it into their calculations and decisions A rise in inflation can lead to an increase in inflation expectations. This can then feed through to higher wage claims and rising costs

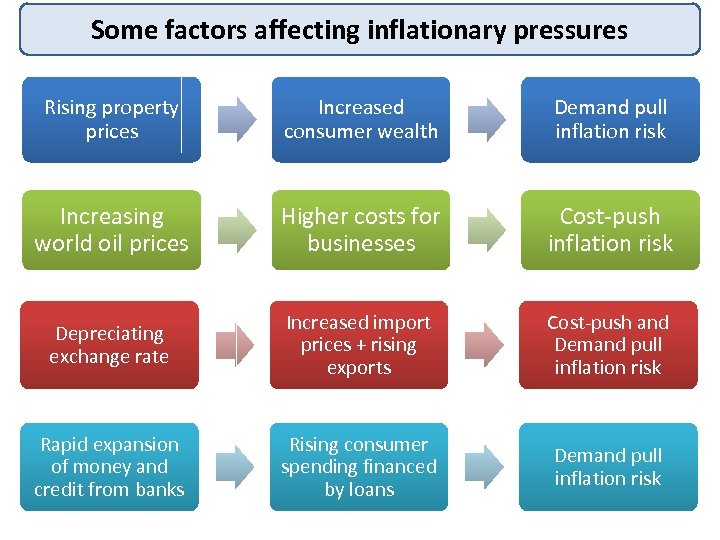

Some factors affecting inflationary pressures Rising property prices Increased consumer wealth Demand pull inflation risk Increasing world oil prices Higher costs for businesses Cost-push inflation risk Depreciating exchange rate Increased import prices + rising exports Cost-push and Demand pull inflation risk Rapid expansion of money and credit from banks Rising consumer spending financed by loans Demand pull inflation risk

Some factors affecting inflationary pressures Rising property prices Increased consumer wealth Demand pull inflation risk Increasing world oil prices Higher costs for businesses Cost-push inflation risk Depreciating exchange rate Increased import prices + rising exports Cost-push and Demand pull inflation risk Rapid expansion of money and credit from banks Rising consumer spending financed by loans Demand pull inflation risk

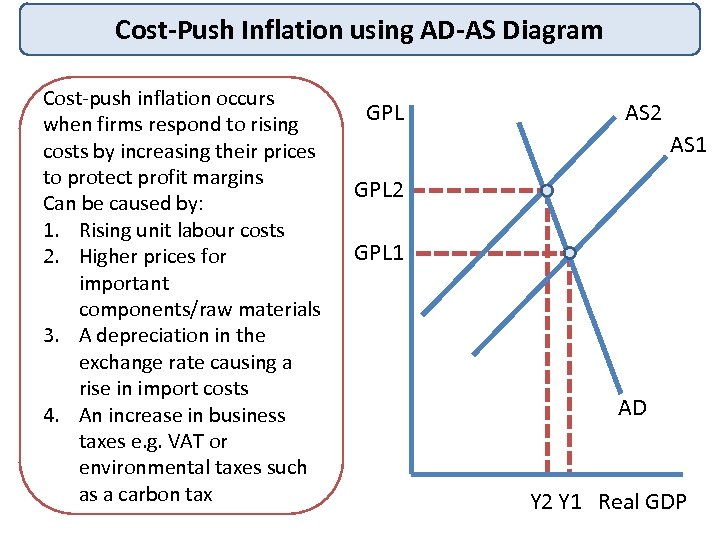

Cost-Push Inflation using AD-AS Diagram Cost-push inflation occurs when firms respond to rising costs by increasing their prices to protect profit margins Can be caused by: 1. Rising unit labour costs 2. Higher prices for important components/raw materials 3. A depreciation in the exchange rate causing a rise in import costs 4. An increase in business taxes e. g. VAT or environmental taxes such as a carbon tax GPL AS 2 AS 1 GPL 2 GPL 1 AD Y 2 Y 1 Real GDP

Cost-Push Inflation using AD-AS Diagram Cost-push inflation occurs when firms respond to rising costs by increasing their prices to protect profit margins Can be caused by: 1. Rising unit labour costs 2. Higher prices for important components/raw materials 3. A depreciation in the exchange rate causing a rise in import costs 4. An increase in business taxes e. g. VAT or environmental taxes such as a carbon tax GPL AS 2 AS 1 GPL 2 GPL 1 AD Y 2 Y 1 Real GDP

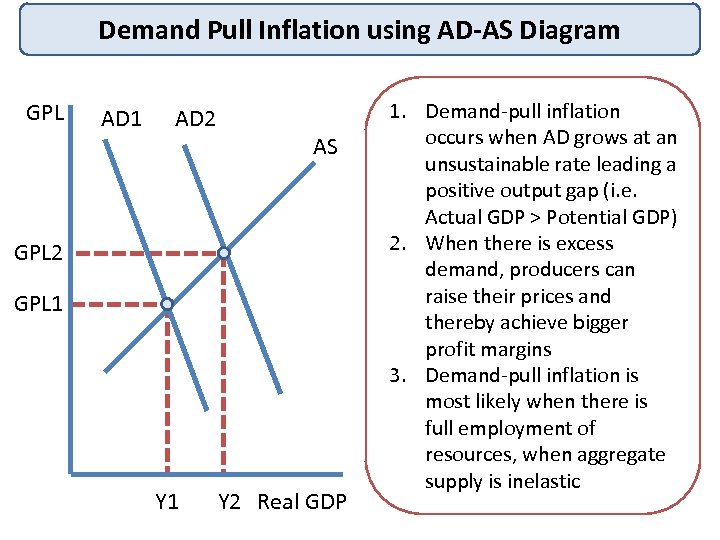

Demand Pull Inflation using AD-AS Diagram GPL AD 1 AD 2 AS GPL 2 GPL 1 Y 2 Real GDP 1. Demand-pull inflation occurs when AD grows at an unsustainable rate leading a positive output gap (i. e. Actual GDP > Potential GDP) 2. When there is excess demand, producers can raise their prices and thereby achieve bigger profit margins 3. Demand-pull inflation is most likely when there is full employment of resources, when aggregate supply is inelastic

Demand Pull Inflation using AD-AS Diagram GPL AD 1 AD 2 AS GPL 2 GPL 1 Y 2 Real GDP 1. Demand-pull inflation occurs when AD grows at an unsustainable rate leading a positive output gap (i. e. Actual GDP > Potential GDP) 2. When there is excess demand, producers can raise their prices and thereby achieve bigger profit margins 3. Demand-pull inflation is most likely when there is full employment of resources, when aggregate supply is inelastic

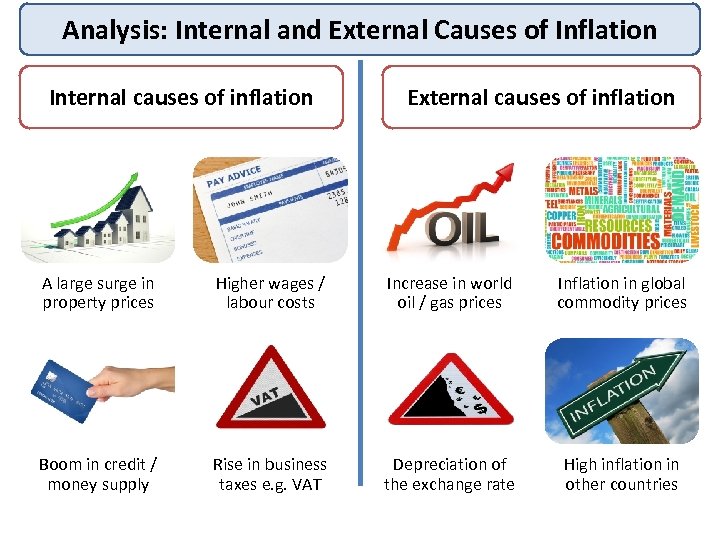

Analysis: Internal and External Causes of Inflation Internal causes of inflation External causes of inflation A large surge in property prices Higher wages / labour costs Increase in world oil / gas prices Inflation in global commodity prices Boom in credit / money supply Rise in business taxes e. g. VAT Depreciation of the exchange rate High inflation in other countries

Analysis: Internal and External Causes of Inflation Internal causes of inflation External causes of inflation A large surge in property prices Higher wages / labour costs Increase in world oil / gas prices Inflation in global commodity prices Boom in credit / money supply Rise in business taxes e. g. VAT Depreciation of the exchange rate High inflation in other countries

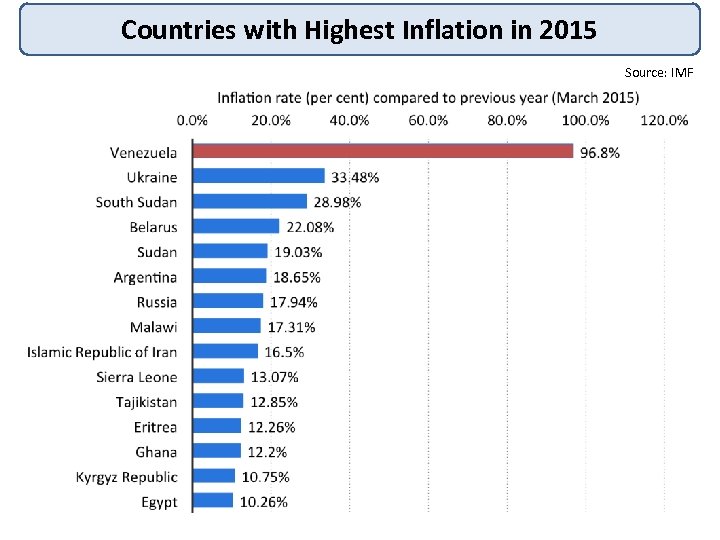

Countries with Highest Inflation in 2015 Source: IMF

Countries with Highest Inflation in 2015 Source: IMF

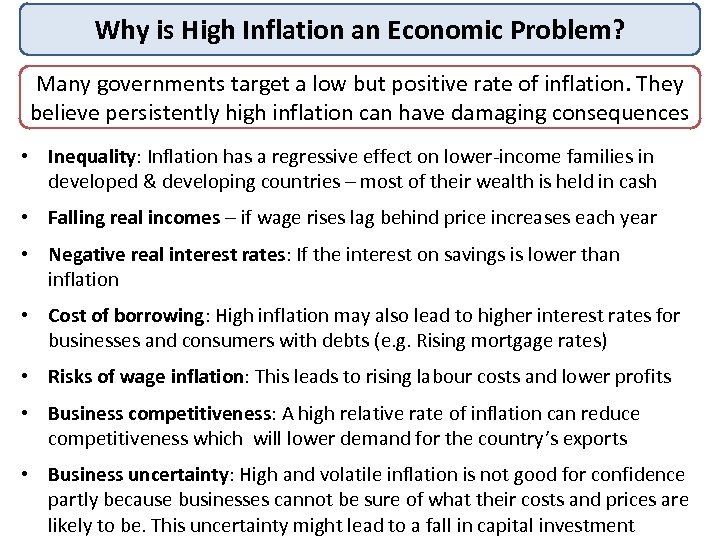

Why is High Inflation an Economic Problem? Many governments target a low but positive rate of inflation. They believe persistently high inflation can have damaging consequences • Inequality: Inflation has a regressive effect on lower-income families in developed & developing countries – most of their wealth is held in cash • Falling real incomes – if wage rises lag behind price increases each year • Negative real interest rates: If the interest on savings is lower than inflation • Cost of borrowing: High inflation may also lead to higher interest rates for businesses and consumers with debts (e. g. Rising mortgage rates) • Risks of wage inflation: This leads to rising labour costs and lower profits • Business competitiveness: A high relative rate of inflation can reduce competitiveness which will lower demand for the country’s exports • Business uncertainty: High and volatile inflation is not good for confidence partly because businesses cannot be sure of what their costs and prices are likely to be. This uncertainty might lead to a fall in capital investment

Why is High Inflation an Economic Problem? Many governments target a low but positive rate of inflation. They believe persistently high inflation can have damaging consequences • Inequality: Inflation has a regressive effect on lower-income families in developed & developing countries – most of their wealth is held in cash • Falling real incomes – if wage rises lag behind price increases each year • Negative real interest rates: If the interest on savings is lower than inflation • Cost of borrowing: High inflation may also lead to higher interest rates for businesses and consumers with debts (e. g. Rising mortgage rates) • Risks of wage inflation: This leads to rising labour costs and lower profits • Business competitiveness: A high relative rate of inflation can reduce competitiveness which will lower demand for the country’s exports • Business uncertainty: High and volatile inflation is not good for confidence partly because businesses cannot be sure of what their costs and prices are likely to be. This uncertainty might lead to a fall in capital investment

Possible Winners and Losers from High Inflation One of the effects of inflation is that it can lead to arbitrary changes in the distribution of real incomes and wealth in a country Winners Losers • Workers with strong wage bargaining power • Debtors if real interest rates are negative • Producers if prices rise faster than costs • Retired on fixed incomes • Lenders if real interest rates are negative • Savers if real returns are negative • Workers in low paid jobs

Possible Winners and Losers from High Inflation One of the effects of inflation is that it can lead to arbitrary changes in the distribution of real incomes and wealth in a country Winners Losers • Workers with strong wage bargaining power • Debtors if real interest rates are negative • Producers if prices rise faster than costs • Retired on fixed incomes • Lenders if real interest rates are negative • Savers if real returns are negative • Workers in low paid jobs

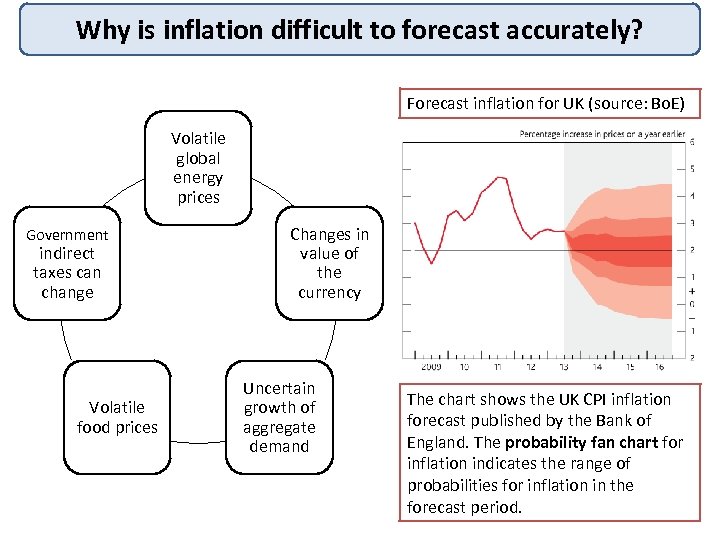

Why is inflation difficult to forecast accurately? Forecast inflation for UK (source: Bo. E) Volatile global energy prices Government indirect taxes can change Volatile food prices Changes in value of the currency Uncertain growth of aggregate demand The chart shows the UK CPI inflation forecast published by the Bank of England. The probability fan chart for inflation indicates the range of probabilities for inflation in the forecast period.

Why is inflation difficult to forecast accurately? Forecast inflation for UK (source: Bo. E) Volatile global energy prices Government indirect taxes can change Volatile food prices Changes in value of the currency Uncertain growth of aggregate demand The chart shows the UK CPI inflation forecast published by the Bank of England. The probability fan chart for inflation indicates the range of probabilities for inflation in the forecast period.

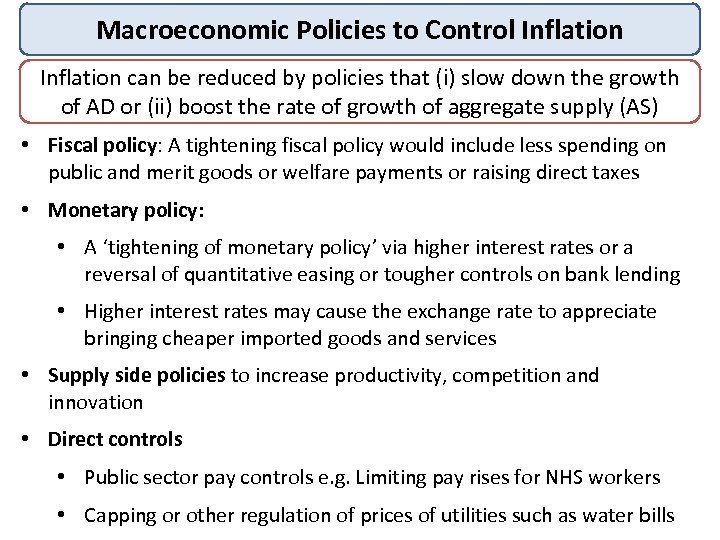

Macroeconomic Policies to Control Inflation can be reduced by policies that (i) slow down the growth of AD or (ii) boost the rate of growth of aggregate supply (AS) • Fiscal policy: A tightening fiscal policy would include less spending on public and merit goods or welfare payments or raising direct taxes • Monetary policy: • A ‘tightening of monetary policy’ via higher interest rates or a reversal of quantitative easing or tougher controls on bank lending • Higher interest rates may cause the exchange rate to appreciate bringing cheaper imported goods and services • Supply side policies to increase productivity, competition and innovation • Direct controls • Public sector pay controls e. g. Limiting pay rises for NHS workers • Capping or other regulation of prices of utilities such as water bills

Macroeconomic Policies to Control Inflation can be reduced by policies that (i) slow down the growth of AD or (ii) boost the rate of growth of aggregate supply (AS) • Fiscal policy: A tightening fiscal policy would include less spending on public and merit goods or welfare payments or raising direct taxes • Monetary policy: • A ‘tightening of monetary policy’ via higher interest rates or a reversal of quantitative easing or tougher controls on bank lending • Higher interest rates may cause the exchange rate to appreciate bringing cheaper imported goods and services • Supply side policies to increase productivity, competition and innovation • Direct controls • Public sector pay controls e. g. Limiting pay rises for NHS workers • Capping or other regulation of prices of utilities such as water bills

Inflation Ed. Excel AS Economics 2. 1. 2

Inflation Ed. Excel AS Economics 2. 1. 2