765d41f72d9babd5f3b0778266e24244.ppt

- Количество слайдов: 48

INDUSTRY AND COMPETITIVE ANALYSIS Dr. Payne (4) “Analysis is the critical starting point of strategic thinking. ” Kenichi Ohmae 1

INDUSTRY AND COMPETITIVE ANALYSIS Dr. Payne (4) “Analysis is the critical starting point of strategic thinking. ” Kenichi Ohmae 1

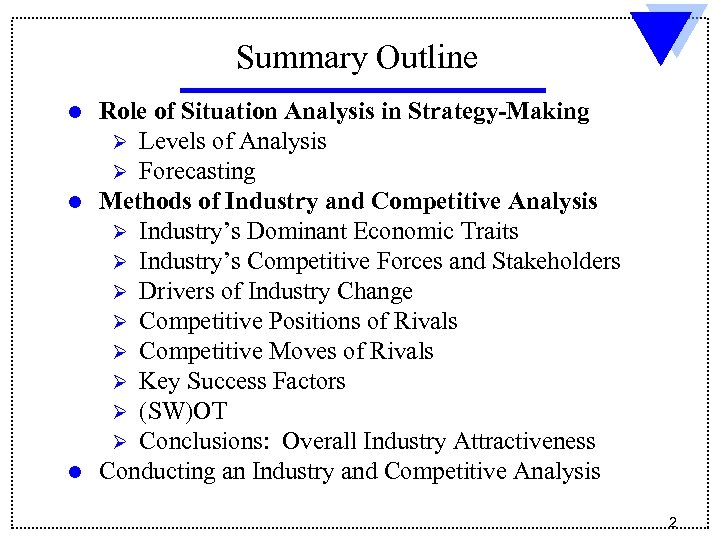

Summary Outline Role of Situation Analysis in Strategy-Making Ø Levels of Analysis Ø Forecasting l Methods of Industry and Competitive Analysis Ø Industry’s Dominant Economic Traits Ø Industry’s Competitive Forces and Stakeholders Ø Drivers of Industry Change Ø Competitive Positions of Rivals Ø Competitive Moves of Rivals Ø Key Success Factors Ø (SW)OT Ø Conclusions: Overall Industry Attractiveness l Conducting an Industry and Competitive Analysis l 2

Summary Outline Role of Situation Analysis in Strategy-Making Ø Levels of Analysis Ø Forecasting l Methods of Industry and Competitive Analysis Ø Industry’s Dominant Economic Traits Ø Industry’s Competitive Forces and Stakeholders Ø Drivers of Industry Change Ø Competitive Positions of Rivals Ø Competitive Moves of Rivals Ø Key Success Factors Ø (SW)OT Ø Conclusions: Overall Industry Attractiveness l Conducting an Industry and Competitive Analysis l 2

What Is (Situation) Strategic Analysis? l Focuses on two considerations: Ø A company’s EXTERNAL or MACROENVIRONMENT Ø Industry and competitive conditions (opportunities and threats) Ø A company’s INTERNAL or MICROENVIRONMENT Ø Its competencies, capabilities, resources, and competitiveness (strengths and weaknesses) 3

What Is (Situation) Strategic Analysis? l Focuses on two considerations: Ø A company’s EXTERNAL or MACROENVIRONMENT Ø Industry and competitive conditions (opportunities and threats) Ø A company’s INTERNAL or MICROENVIRONMENT Ø Its competencies, capabilities, resources, and competitiveness (strengths and weaknesses) 3

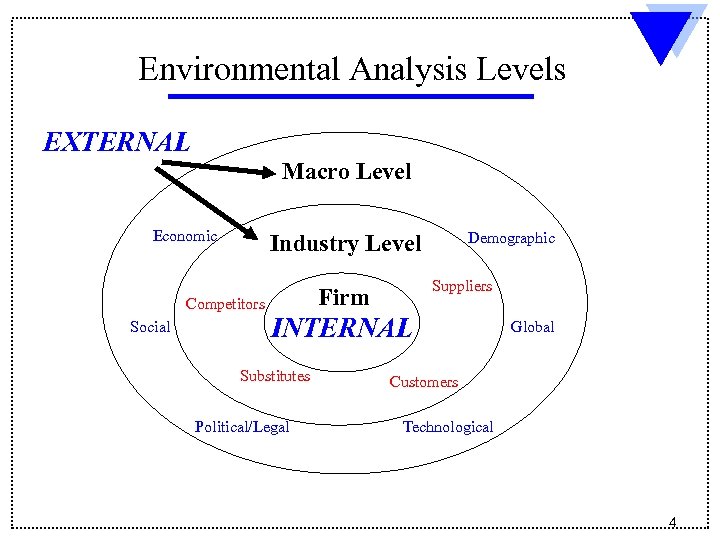

Environmental Analysis Levels EXTERNAL Macro Level Economic Competitors Social Demographic Industry Level Suppliers Firm Connect INTERNAL Substitutes Political/Legal Global Customers Technological 4

Environmental Analysis Levels EXTERNAL Macro Level Economic Competitors Social Demographic Industry Level Suppliers Firm Connect INTERNAL Substitutes Political/Legal Global Customers Technological 4

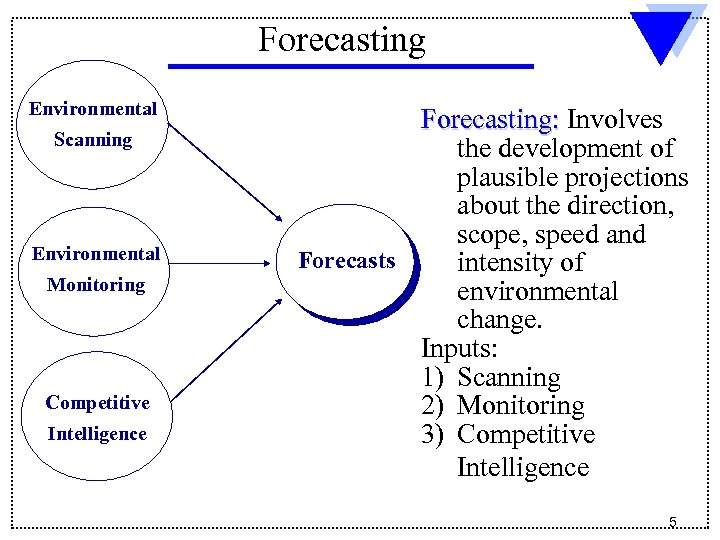

Forecasting Environmental Scanning Environmental Monitoring Competitive Intelligence Forecasting: Involves the development of plausible projections about the direction, scope, speed and Forecasts intensity of environmental change. Inputs: 1) Scanning 2) Monitoring 3) Competitive Intelligence 5

Forecasting Environmental Scanning Environmental Monitoring Competitive Intelligence Forecasting: Involves the development of plausible projections about the direction, scope, speed and Forecasts intensity of environmental change. Inputs: 1) Scanning 2) Monitoring 3) Competitive Intelligence 5

Environmental Scanning: “Awareness” Definition Involves surveillance of a firm’s external environment to predict changes that come and detect changes already underway. Includes social, political, economic, ecological, and technological events that could eventually impact industry. Purpose Alerts organization to trends and events before changes become a pattern and before competitors recognize them as well. l Raise consciousness of managers about potential developments that could: l 1. Have important impact on industry conditions 2. Pose new opportunities and threats 6

Environmental Scanning: “Awareness” Definition Involves surveillance of a firm’s external environment to predict changes that come and detect changes already underway. Includes social, political, economic, ecological, and technological events that could eventually impact industry. Purpose Alerts organization to trends and events before changes become a pattern and before competitors recognize them as well. l Raise consciousness of managers about potential developments that could: l 1. Have important impact on industry conditions 2. Pose new opportunities and threats 6

Environmental Monitoring: “Observation” Definition Tracks the evolution of external environmental trends, sequences of events, and/or streams of activities. Builds from the scanning process. Purpose Enables firms to evaluate how dramatically environmental trends are changing the competitive landscape. l Raise consciousness of managers about existing trends that may impact the firm. l 7

Environmental Monitoring: “Observation” Definition Tracks the evolution of external environmental trends, sequences of events, and/or streams of activities. Builds from the scanning process. Purpose Enables firms to evaluate how dramatically environmental trends are changing the competitive landscape. l Raise consciousness of managers about existing trends that may impact the firm. l 7

Competitive Intelligence: “Knowledge/Decision Making” Definition Includes the intelligence gathering associated with the collection of data on competitors and interpretation of such data for managerial decision making. Purpose Helps firms define and understand their industry. l Helps identify rivals’ strengths and weaknesses. l Helps avoid surprises by anticipating competitors’ moves and decreases of response time. l 8

Competitive Intelligence: “Knowledge/Decision Making” Definition Includes the intelligence gathering associated with the collection of data on competitors and interpretation of such data for managerial decision making. Purpose Helps firms define and understand their industry. l Helps identify rivals’ strengths and weaknesses. l Helps avoid surprises by anticipating competitors’ moves and decreases of response time. l 8

Macro-Environment Analysis PEST(LE) is a mnemonic that can help with this analysis. Generally, we want to identify and evaluate changes/trends that may impact our organization. • Political: Government regulations and legal issues that affect a company. Local, state, and federal power structures should be considered. Ø Examples: tax guidelines, copyright and property law enforcement, political stability, trade regulations, social and environmental policy, employment laws and safety regulations. • Economic: Outside economic issues that can play a role in a company's success. Ø Examples: economic growth, exchange, inflation and interest rates, economic stability, anticipated shifts in commodity and resource costs, unemployment policies, credit availability and unemployment policies. 9

Macro-Environment Analysis PEST(LE) is a mnemonic that can help with this analysis. Generally, we want to identify and evaluate changes/trends that may impact our organization. • Political: Government regulations and legal issues that affect a company. Local, state, and federal power structures should be considered. Ø Examples: tax guidelines, copyright and property law enforcement, political stability, trade regulations, social and environmental policy, employment laws and safety regulations. • Economic: Outside economic issues that can play a role in a company's success. Ø Examples: economic growth, exchange, inflation and interest rates, economic stability, anticipated shifts in commodity and resource costs, unemployment policies, credit availability and unemployment policies. 9

Macro-Environment Analysis • Social: Factors of the social environment of the market that may impact the company. • Examples: cultural trends, demographics, population analytics, ethnic changes, political correctness, etc. • Technological: Innovations in technology that may affect the operations of the industry and the market favorably or unfavorably. Ø Examples: automation, technological awareness, new processes. • Legal: Rules, policies or laws that affect the business. Ø Examples: consumer laws, safety standards, labor laws, etc. • Environmental: Factors that influence or are determined by the surrounding (ecological) environment. More meaningful fo certain industries like tourism, farming, agriculture, etc. Ø Examples: climate, weather, geographical location, global changes in climate, environmental offsets etc. 10

Macro-Environment Analysis • Social: Factors of the social environment of the market that may impact the company. • Examples: cultural trends, demographics, population analytics, ethnic changes, political correctness, etc. • Technological: Innovations in technology that may affect the operations of the industry and the market favorably or unfavorably. Ø Examples: automation, technological awareness, new processes. • Legal: Rules, policies or laws that affect the business. Ø Examples: consumer laws, safety standards, labor laws, etc. • Environmental: Factors that influence or are determined by the surrounding (ecological) environment. More meaningful fo certain industries like tourism, farming, agriculture, etc. Ø Examples: climate, weather, geographical location, global changes in climate, environmental offsets etc. 10

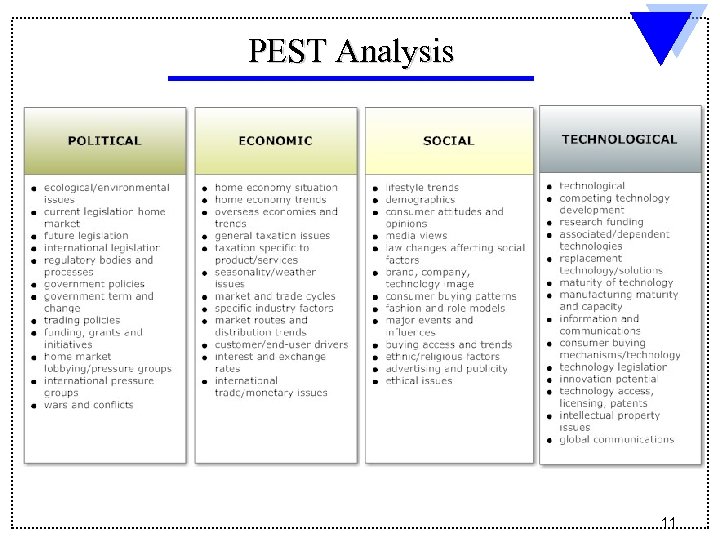

PEST Analysis 11

PEST Analysis 11

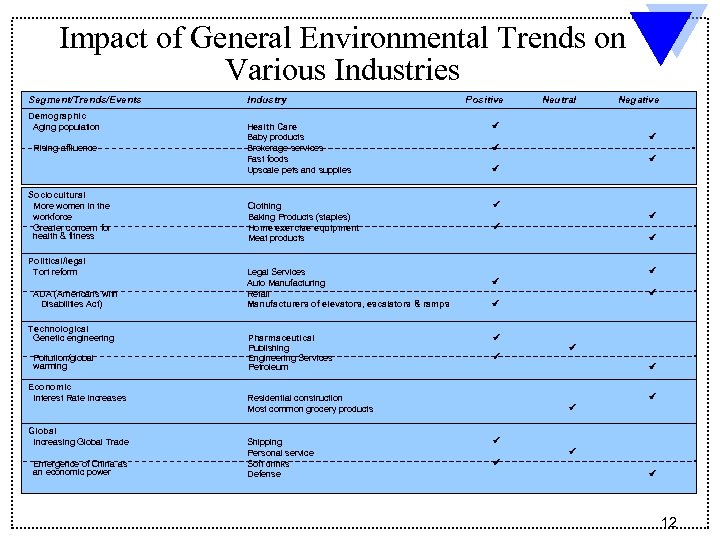

Impact of General Environmental Trends on Various Industries Segment/Trends/Events Demographic Aging population Rising affluence Sociocultural More women in the workforce Greater concern for health & fitness Political/legal Tort reform ADA (Americans with Disabilities Act) Technological Genetic engineering Pollution/global warming Economic Interest Rate Increases Global Increasing Global Trade Emergence of China as an economic power Industry Positive Health Care Baby products Brokerage services Fast foods Upscale pets and supplies Negative Clothing Baking Products (staples) Home exercise equipment Meat products Neutral Legal Services Auto Manufacturing Retail Manufacturers of elevators, escalators & ramps Pharmaceutical Publishing Engineering Services Petroleum Residential construction Most common grocery products Shipping Personal service Soft drinks Defense 12

Impact of General Environmental Trends on Various Industries Segment/Trends/Events Demographic Aging population Rising affluence Sociocultural More women in the workforce Greater concern for health & fitness Political/legal Tort reform ADA (Americans with Disabilities Act) Technological Genetic engineering Pollution/global warming Economic Interest Rate Increases Global Increasing Global Trade Emergence of China as an economic power Industry Positive Health Care Baby products Brokerage services Fast foods Upscale pets and supplies Negative Clothing Baking Products (staples) Home exercise equipment Meat products Neutral Legal Services Auto Manufacturing Retail Manufacturers of elevators, escalators & ramps Pharmaceutical Publishing Engineering Services Petroleum Residential construction Most common grocery products Shipping Personal service Soft drinks Defense 12

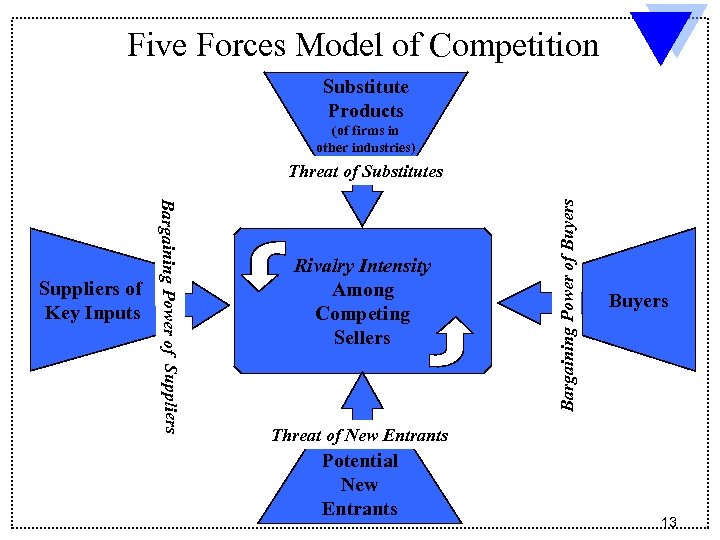

Five Forces Model of Competition Substitute Products (of firms in other industries) Bargaining Power of Suppliers of Key Inputs Rivalry Intensity Among Competing Sellers Bargaining Power of Buyers Threat of Substitutes Buyers Threat of New Entrants Potential New Entrants 13

Five Forces Model of Competition Substitute Products (of firms in other industries) Bargaining Power of Suppliers of Key Inputs Rivalry Intensity Among Competing Sellers Bargaining Power of Buyers Threat of Substitutes Buyers Threat of New Entrants Potential New Entrants 13

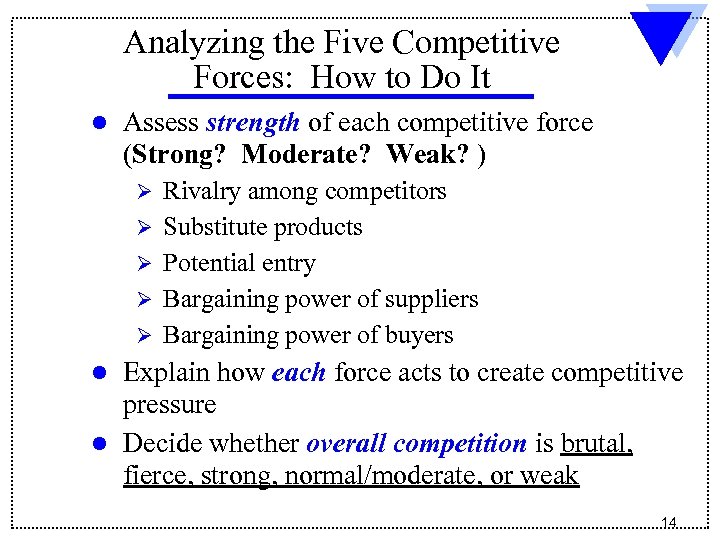

Analyzing the Five Competitive Forces: How to Do It l Assess strength of each competitive force (Strong? Moderate? Weak? ) Ø Ø Ø Rivalry among competitors Substitute products Potential entry Bargaining power of suppliers Bargaining power of buyers Explain how each force acts to create competitive pressure l Decide whether overall competition is brutal, fierce, strong, normal/moderate, or weak l 14

Analyzing the Five Competitive Forces: How to Do It l Assess strength of each competitive force (Strong? Moderate? Weak? ) Ø Ø Ø Rivalry among competitors Substitute products Potential entry Bargaining power of suppliers Bargaining power of buyers Explain how each force acts to create competitive pressure l Decide whether overall competition is brutal, fierce, strong, normal/moderate, or weak l 14

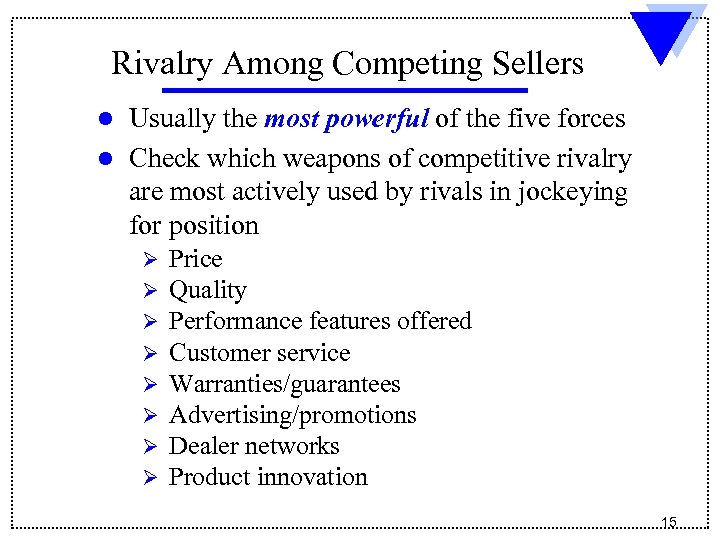

Rivalry Among Competing Sellers Usually the most powerful of the five forces l Check which weapons of competitive rivalry are most actively used by rivals in jockeying for position l Ø Ø Ø Ø Price Quality Performance features offered Customer service Warranties/guarantees Advertising/promotions Dealer networks Product innovation 15

Rivalry Among Competing Sellers Usually the most powerful of the five forces l Check which weapons of competitive rivalry are most actively used by rivals in jockeying for position l Ø Ø Ø Ø Price Quality Performance features offered Customer service Warranties/guarantees Advertising/promotions Dealer networks Product innovation 15

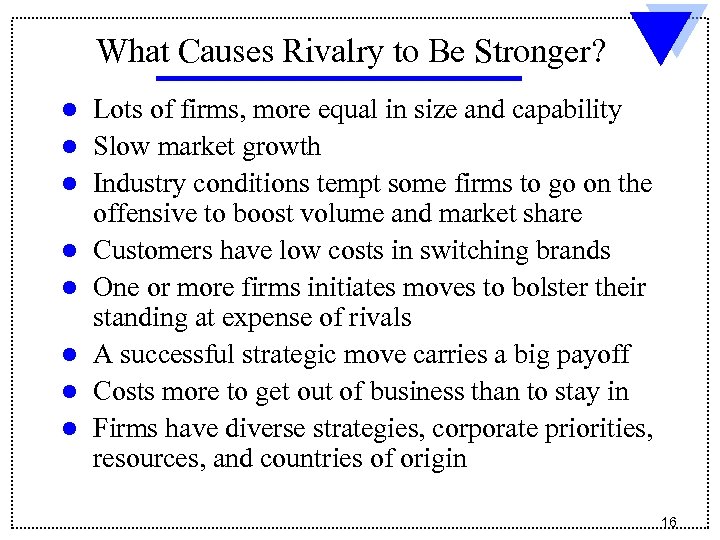

What Causes Rivalry to Be Stronger? l l l l Lots of firms, more equal in size and capability Slow market growth Industry conditions tempt some firms to go on the offensive to boost volume and market share Customers have low costs in switching brands One or more firms initiates moves to bolster their standing at expense of rivals A successful strategic move carries a big payoff Costs more to get out of business than to stay in Firms have diverse strategies, corporate priorities, resources, and countries of origin 16

What Causes Rivalry to Be Stronger? l l l l Lots of firms, more equal in size and capability Slow market growth Industry conditions tempt some firms to go on the offensive to boost volume and market share Customers have low costs in switching brands One or more firms initiates moves to bolster their standing at expense of rivals A successful strategic move carries a big payoff Costs more to get out of business than to stay in Firms have diverse strategies, corporate priorities, resources, and countries of origin 16

Competitive Force of Threat of New Entry l Seriousness of threat depends primarily on: Ø Ø l Barriers to entry Reaction of existing firms to entry Barriers exist when: Ø Newcomers confront obstacles Ø Economic factors put potential entrant at a disadvantage relative to incumbent firms 17

Competitive Force of Threat of New Entry l Seriousness of threat depends primarily on: Ø Ø l Barriers to entry Reaction of existing firms to entry Barriers exist when: Ø Newcomers confront obstacles Ø Economic factors put potential entrant at a disadvantage relative to incumbent firms 17

Common Barriers to Entry l l l l Economies of scale Inability to gain access to specialized technology Existence of learning/experience curve effects Strong brand preferences and customer loyalty Capital requirements and/or other specialized resource requirements Cost disadvantages independent of size Access to distribution channels Regulatory policies, tariffs, trade restrictions 18

Common Barriers to Entry l l l l Economies of scale Inability to gain access to specialized technology Existence of learning/experience curve effects Strong brand preferences and customer loyalty Capital requirements and/or other specialized resource requirements Cost disadvantages independent of size Access to distribution channels Regulatory policies, tariffs, trade restrictions 18

How to Tell Whether Substitute Products Are a Strong Force Sales of substitutes are growing rapidly l Producers of substitutes are planning to add new capacity l Substitutes’ profits are up l The competitive threat of substitutes is stronger when they are: Readily available Attractively priced Believed to have comparable or better performance features Ø Customer switching costs are low Ø Ø Ø 19

How to Tell Whether Substitute Products Are a Strong Force Sales of substitutes are growing rapidly l Producers of substitutes are planning to add new capacity l Substitutes’ profits are up l The competitive threat of substitutes is stronger when they are: Readily available Attractively priced Believed to have comparable or better performance features Ø Customer switching costs are low Ø Ø Ø 19

Competitive Force of Substitute Products Concept Substitutes matter when customers are attracted to the products or services of firms in other industries Examples v Eyeglasses vs. Contact Lens v Plastic vs. Glass vs. Metal v Sugar vs. Artificial Sweeteners v Newspapers vs. TV vs. Internet 20

Competitive Force of Substitute Products Concept Substitutes matter when customers are attracted to the products or services of firms in other industries Examples v Eyeglasses vs. Contact Lens v Plastic vs. Glass vs. Metal v Sugar vs. Artificial Sweeteners v Newspapers vs. TV vs. Internet 20

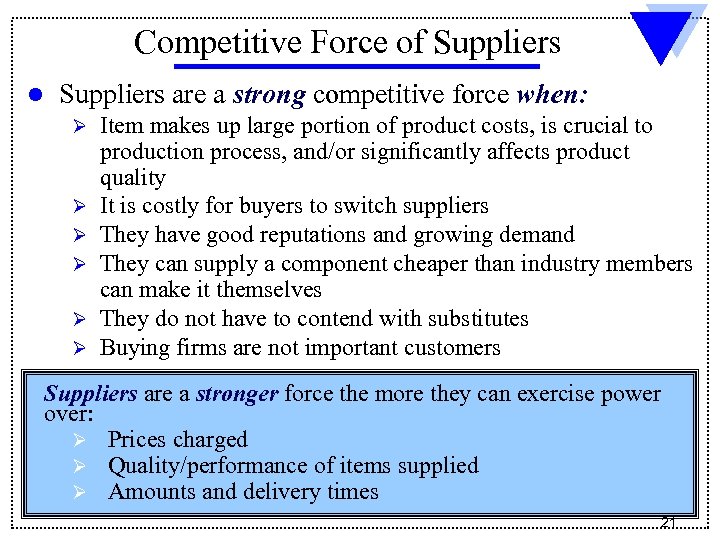

Competitive Force of Suppliers l Suppliers are a strong competitive force when: Ø Ø Ø Item makes up large portion of product costs, is crucial to production process, and/or significantly affects product quality It is costly for buyers to switch suppliers They have good reputations and growing demand They can supply a component cheaper than industry members can make it themselves They do not have to contend with substitutes Buying firms are not important customers Suppliers are a stronger force the more they can exercise power over: Ø Prices charged Ø Quality/performance of items supplied Ø Amounts and delivery times 21

Competitive Force of Suppliers l Suppliers are a strong competitive force when: Ø Ø Ø Item makes up large portion of product costs, is crucial to production process, and/or significantly affects product quality It is costly for buyers to switch suppliers They have good reputations and growing demand They can supply a component cheaper than industry members can make it themselves They do not have to contend with substitutes Buying firms are not important customers Suppliers are a stronger force the more they can exercise power over: Ø Prices charged Ø Quality/performance of items supplied Ø Amounts and delivery times 21

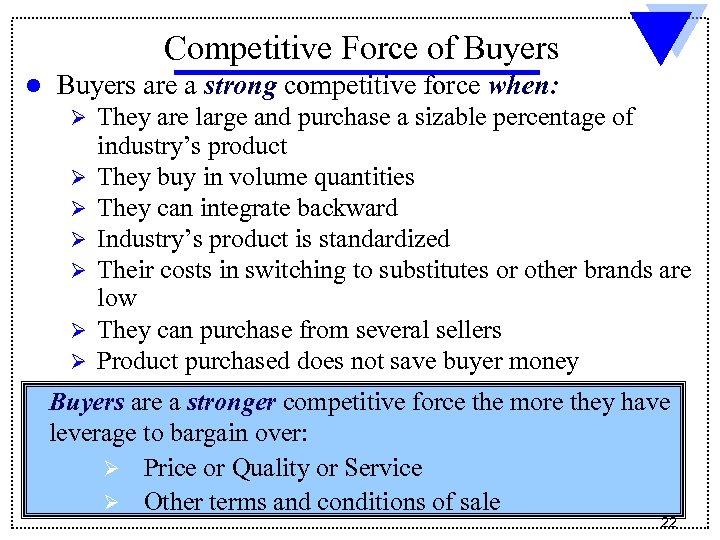

Competitive Force of Buyers l Buyers are a strong competitive force when: Ø Ø Ø Ø They are large and purchase a sizable percentage of industry’s product They buy in volume quantities They can integrate backward Industry’s product is standardized Their costs in switching to substitutes or other brands are low They can purchase from several sellers Product purchased does not save buyer money Buyers are a stronger competitive force the more they have leverage to bargain over: Ø Price or Quality or Service Ø Other terms and conditions of sale 22

Competitive Force of Buyers l Buyers are a strong competitive force when: Ø Ø Ø Ø They are large and purchase a sizable percentage of industry’s product They buy in volume quantities They can integrate backward Industry’s product is standardized Their costs in switching to substitutes or other brands are low They can purchase from several sellers Product purchased does not save buyer money Buyers are a stronger competitive force the more they have leverage to bargain over: Ø Price or Quality or Service Ø Other terms and conditions of sale 22

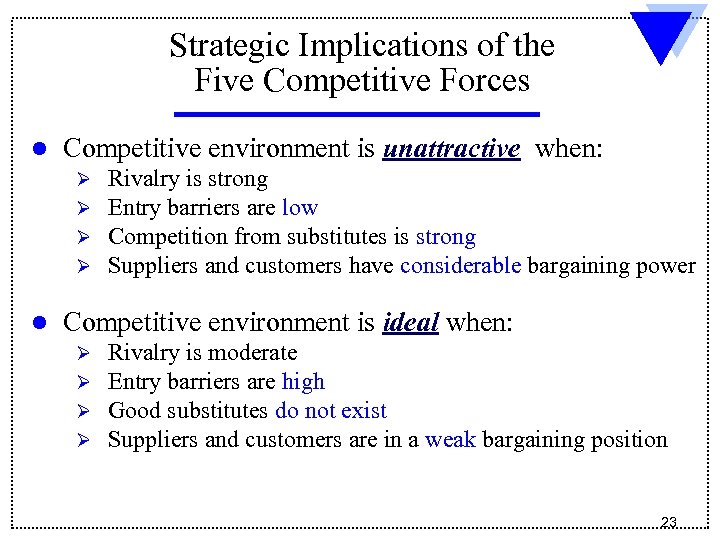

Strategic Implications of the Five Competitive Forces l Competitive environment is unattractive when: Ø Ø l Rivalry is strong Entry barriers are low Competition from substitutes is strong Suppliers and customers have considerable bargaining power Competitive environment is ideal when: Ø Ø Rivalry is moderate Entry barriers are high Good substitutes do not exist Suppliers and customers are in a weak bargaining position 23

Strategic Implications of the Five Competitive Forces l Competitive environment is unattractive when: Ø Ø l Rivalry is strong Entry barriers are low Competition from substitutes is strong Suppliers and customers have considerable bargaining power Competitive environment is ideal when: Ø Ø Rivalry is moderate Entry barriers are high Good substitutes do not exist Suppliers and customers are in a weak bargaining position 23

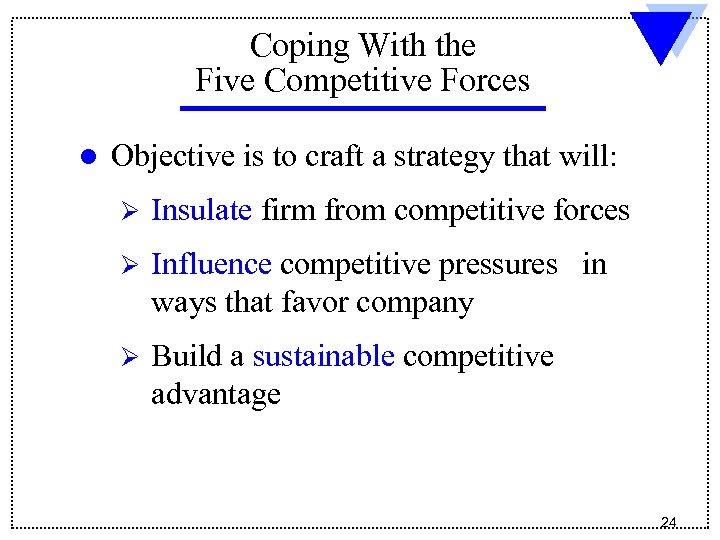

Coping With the Five Competitive Forces l Objective is to craft a strategy that will: Ø Insulate firm from competitive forces Ø Influence competitive pressures in ways that favor company Ø Build a sustainable competitive advantage 24

Coping With the Five Competitive Forces l Objective is to craft a strategy that will: Ø Insulate firm from competitive forces Ø Influence competitive pressures in ways that favor company Ø Build a sustainable competitive advantage 24

Group Exercise Analyze the External Environment for your Organization: 1) List at least five key external environmental trends or driving forces impacting your Organization. 2) Develop a Five-Forces Model complete with overall strength assessments of each force and the rational behind them. 25

Group Exercise Analyze the External Environment for your Organization: 1) List at least five key external environmental trends or driving forces impacting your Organization. 2) Develop a Five-Forces Model complete with overall strength assessments of each force and the rational behind them. 25

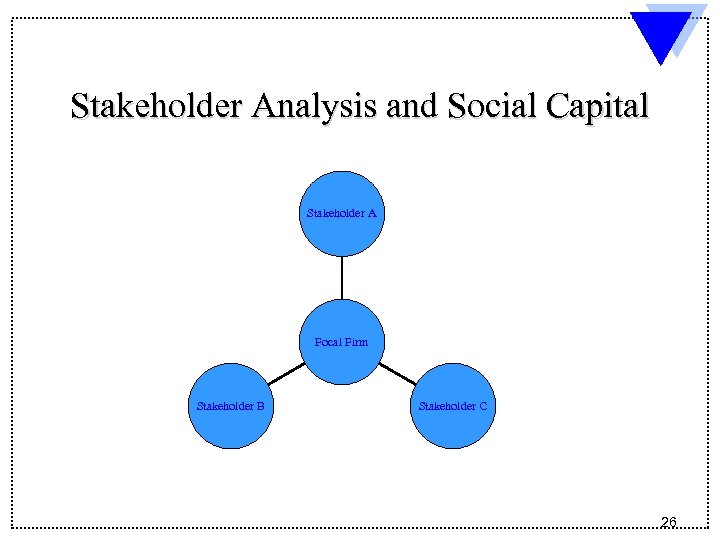

Stakeholder Analysis and Social Capital Stakeholder A Focal Firm Stakeholder B Stakeholder C 26

Stakeholder Analysis and Social Capital Stakeholder A Focal Firm Stakeholder B Stakeholder C 26

Who are Stakeholders? l Identifying stakeholders is one way of sizing up the internal and external constituents that influence the firm. ü ü Stakeholders are individuals and groups who can affect and are affected by a firm’s strategic outcomes and who have enforceable claims on its performance Stakeholders include individuals, groups, and other organizations who have an interest in the actions of an organization and who have the ability to influence it 27

Who are Stakeholders? l Identifying stakeholders is one way of sizing up the internal and external constituents that influence the firm. ü ü Stakeholders are individuals and groups who can affect and are affected by a firm’s strategic outcomes and who have enforceable claims on its performance Stakeholders include individuals, groups, and other organizations who have an interest in the actions of an organization and who have the ability to influence it 27

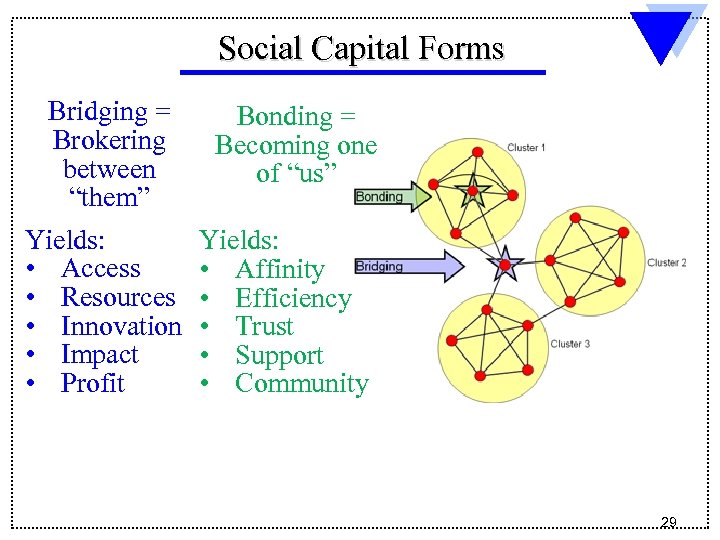

Social Capital l Social capital is “the sum of actual and potential resources embedded within, available through, and derived from the network of relationships possessed by individuals or social units, ” Nahapiet and Ghoshal’s (1998, p. 243) Ø Ø The “bonding” view of social capital suggests that persons derive social capital from the internal forces within their collective. This is achieved primarily as the collective matures and strong recursive bonds develop between actors who interact frequently (Coleman, 1988). The “bridging” view of social capital (e. g. , Burt, 2000) represents the value of resources derived from connections spanning structural holes in a network. 28

Social Capital l Social capital is “the sum of actual and potential resources embedded within, available through, and derived from the network of relationships possessed by individuals or social units, ” Nahapiet and Ghoshal’s (1998, p. 243) Ø Ø The “bonding” view of social capital suggests that persons derive social capital from the internal forces within their collective. This is achieved primarily as the collective matures and strong recursive bonds develop between actors who interact frequently (Coleman, 1988). The “bridging” view of social capital (e. g. , Burt, 2000) represents the value of resources derived from connections spanning structural holes in a network. 28

Social Capital Forms Bridging = Brokering between “them” Yields: • Access • Resources • Innovation • Impact • Profit Bonding = Becoming one of “us” Yields: • Affinity • Efficiency • Trust • Support • Community 29

Social Capital Forms Bridging = Brokering between “them” Yields: • Access • Resources • Innovation • Impact • Profit Bonding = Becoming one of “us” Yields: • Affinity • Efficiency • Trust • Support • Community 29

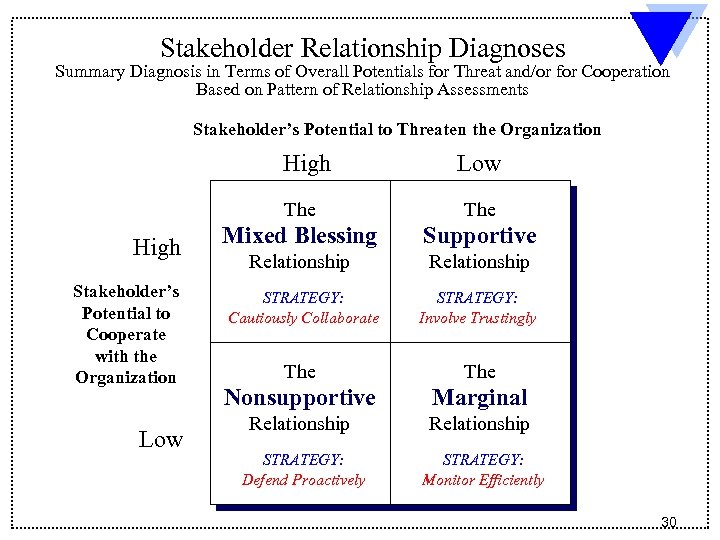

Stakeholder Relationship Diagnoses Summary Diagnosis in Terms of Overall Potentials for Threat and/or for Cooperation Based on Pattern of Relationship Assessments Stakeholder’s Potential to Threaten the Organization High Low The High Stakeholder’s Potential to Cooperate with the Organization Low The Mixed Blessing Supportive Relationship STRATEGY: Cautiously Collaborate STRATEGY: Involve Trustingly The Nonsupportive Marginal Relationship STRATEGY: Defend Proactively STRATEGY: Monitor Efficiently 30

Stakeholder Relationship Diagnoses Summary Diagnosis in Terms of Overall Potentials for Threat and/or for Cooperation Based on Pattern of Relationship Assessments Stakeholder’s Potential to Threaten the Organization High Low The High Stakeholder’s Potential to Cooperate with the Organization Low The Mixed Blessing Supportive Relationship STRATEGY: Cautiously Collaborate STRATEGY: Involve Trustingly The Nonsupportive Marginal Relationship STRATEGY: Defend Proactively STRATEGY: Monitor Efficiently 30

Competitor Analysis l Successful strategists take great pains in scouting competitors Ø Understanding their strategies Ø Watching their actions Ø Evaluating their vulnerability to driving forces and competitive pressures Ø Sizing up their resource strengths and weaknesses and their capabilities Ø Trying to anticipate rivals’ next moves 31

Competitor Analysis l Successful strategists take great pains in scouting competitors Ø Understanding their strategies Ø Watching their actions Ø Evaluating their vulnerability to driving forces and competitive pressures Ø Sizing up their resource strengths and weaknesses and their capabilities Ø Trying to anticipate rivals’ next moves 31

Predicting Moves of Rivals l Predicting rivals’ next moves involves: Ø Analyzing their current competitive positions Ø Examining public pronouncements about what it will take to be successful in industry Ø Gathering information from grapevine about current activities and potential changes Ø Studying past actions and leadership Ø Determining who has flexibility to make major strategic changes and who is locked into pursuing same basic strategy 32

Predicting Moves of Rivals l Predicting rivals’ next moves involves: Ø Analyzing their current competitive positions Ø Examining public pronouncements about what it will take to be successful in industry Ø Gathering information from grapevine about current activities and potential changes Ø Studying past actions and leadership Ø Determining who has flexibility to make major strategic changes and who is locked into pursuing same basic strategy 32

Which Companies/Competitors are in Strongest/Weakest Positions? l One technique for revealing the different competitive positions of industry rivals is strategic group mapping l A strategic group consists of those rivals with similar competitive approaches in an industry 33

Which Companies/Competitors are in Strongest/Weakest Positions? l One technique for revealing the different competitive positions of industry rivals is strategic group mapping l A strategic group consists of those rivals with similar competitive approaches in an industry 33

Strategic Group Mapping l Firms in same strategic group have two or more competitive characteristics in common. . . Ø Sell in same price/quality range Cover same geographic areas Ø Be vertically integrated to same degree Ø Have comparable product line breadth Ø Emphasize same types of distribution channels Ø Offer buyers similar services Ø Use identical technological approaches Ø 34

Strategic Group Mapping l Firms in same strategic group have two or more competitive characteristics in common. . . Ø Sell in same price/quality range Cover same geographic areas Ø Be vertically integrated to same degree Ø Have comparable product line breadth Ø Emphasize same types of distribution channels Ø Offer buyers similar services Ø Use identical technological approaches Ø 34

Procedure: Constructing a Strategic Group Map STEP 1: Identify competitive characteristics that differentiate firms in an industry from one another STEP 2: Plot firms on a two-variable map using pairs of these differentiating characteristics STEP 3: Assign firms that fall in about the same strategy space to same strategic group STEP 4: Draw circles around each group, making circles proportional to size of group’s respective share of total industry sales 35

Procedure: Constructing a Strategic Group Map STEP 1: Identify competitive characteristics that differentiate firms in an industry from one another STEP 2: Plot firms on a two-variable map using pairs of these differentiating characteristics STEP 3: Assign firms that fall in about the same strategy space to same strategic group STEP 4: Draw circles around each group, making circles proportional to size of group’s respective share of total industry sales 35

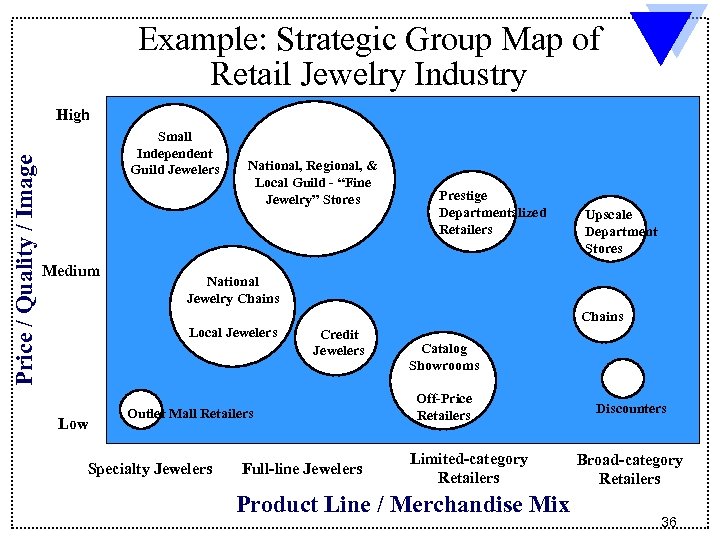

Example: Strategic Group Map of Retail Jewelry Industry Price / Quality / Image High Small Independent Guild Jewelers Medium National, Regional, & Local Guild - “Fine Jewelry” Stores Prestige Departmentalized Retailers Upscale Department Stores National Jewelry Chains Local Jewelers Low Credit Jewelers Outlet Mall Retailers Specialty Jewelers Full-line Jewelers Catalog Showrooms Off-Price Retailers Limited-category Retailers Product Line / Merchandise Mix Discounters Broad-category Retailers 36

Example: Strategic Group Map of Retail Jewelry Industry Price / Quality / Image High Small Independent Guild Jewelers Medium National, Regional, & Local Guild - “Fine Jewelry” Stores Prestige Departmentalized Retailers Upscale Department Stores National Jewelry Chains Local Jewelers Low Credit Jewelers Outlet Mall Retailers Specialty Jewelers Full-line Jewelers Catalog Showrooms Off-Price Retailers Limited-category Retailers Product Line / Merchandise Mix Discounters Broad-category Retailers 36

Guidelines: Strategic Group Maps l l l Variables selected as axes should not be highly correlated Variables chosen as axes should expose big differences in how rivals compete Variables do not have to be either quantitative or continuous Drawing sizes of circles proportional to combined sales of firms in each strategic group allows map to reflect relative sizes of each strategic group If more than two good competitive variables can be used, several maps can be drawn 37

Guidelines: Strategic Group Maps l l l Variables selected as axes should not be highly correlated Variables chosen as axes should expose big differences in how rivals compete Variables do not have to be either quantitative or continuous Drawing sizes of circles proportional to combined sales of firms in each strategic group allows map to reflect relative sizes of each strategic group If more than two good competitive variables can be used, several maps can be drawn 37

Interpreting Strategic Group Maps l Driving forces and competitive pressures often favor some strategic groups and hurt others l Profit potential of different strategic groups varies due to strengths and weaknesses in each group’s market position l The closer strategic groups are on map, the stronger the competitive rivalry among member firms tends to be 38

Interpreting Strategic Group Maps l Driving forces and competitive pressures often favor some strategic groups and hurt others l Profit potential of different strategic groups varies due to strengths and weaknesses in each group’s market position l The closer strategic groups are on map, the stronger the competitive rivalry among member firms tends to be 38

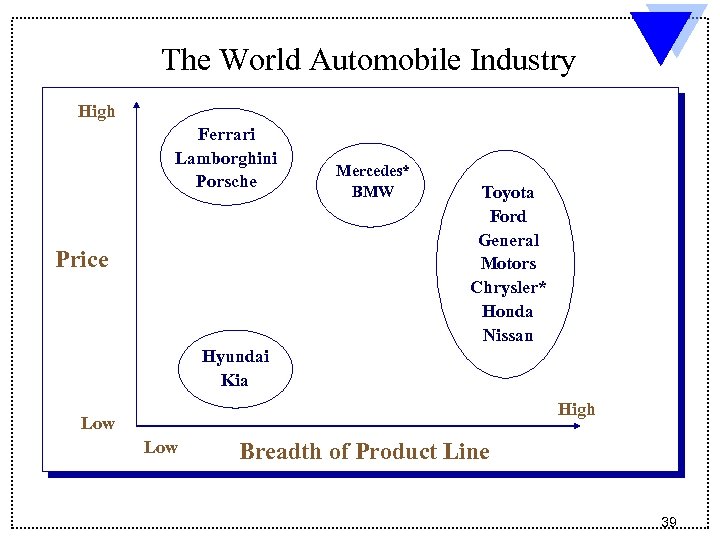

The World Automobile Industry High Ferrari Lamborghini Porsche Price Mercedes* BMW Toyota Ford General Motors Chrysler* Honda Nissan Hyundai Kia High Low Breadth of Product Line 39

The World Automobile Industry High Ferrari Lamborghini Porsche Price Mercedes* BMW Toyota Ford General Motors Chrysler* Honda Nissan Hyundai Kia High Low Breadth of Product Line 39

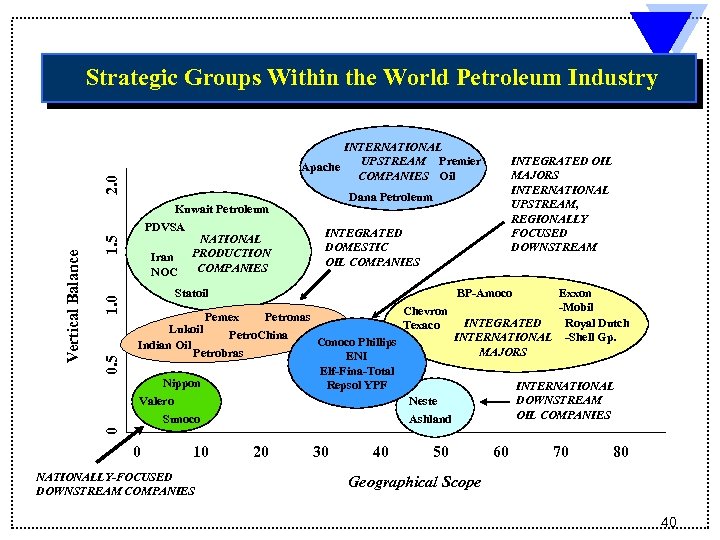

Strategic Groups Within the World Petroleum Industry 0. 5 1. 0 1. 5 Kuwait Petroleum PDVSA NATIONAL Iran PRODUCTION COMPANIES NOC INTEGRATED OIL MAJORS INTERNATIONAL UPSTREAM, REGIONALLY FOCUSED DOWNSTREAM Dana Petroleum INTEGRATED DOMESTIC OIL COMPANIES Statoil BP-Amoco Exxon -Mobil Chevron Pemex Petronas INTEGRATED Royal Dutch Texaco Lukoil Petro. China INTERNATIONAL -Shell Gp. Conoco Phillips Indian Oil Phillips MAJORS Petrobras ENI Elf-Fina-Total ENI Nippon Repsol YPF INTERNATIONAL Repsol DOWNSTREAM Valero Neste OIL COMPANIES Ashland Sunoco 0 Vertical Balance 2. 0 INTERNATIONAL UPSTREAM Premier Apache COMPANIES Oil 0 10 NATIONALLY-FOCUSED DOWNSTREAM COMPANIES 20 30 40 50 60 70 80 Geographical Scope 40

Strategic Groups Within the World Petroleum Industry 0. 5 1. 0 1. 5 Kuwait Petroleum PDVSA NATIONAL Iran PRODUCTION COMPANIES NOC INTEGRATED OIL MAJORS INTERNATIONAL UPSTREAM, REGIONALLY FOCUSED DOWNSTREAM Dana Petroleum INTEGRATED DOMESTIC OIL COMPANIES Statoil BP-Amoco Exxon -Mobil Chevron Pemex Petronas INTEGRATED Royal Dutch Texaco Lukoil Petro. China INTERNATIONAL -Shell Gp. Conoco Phillips Indian Oil Phillips MAJORS Petrobras ENI Elf-Fina-Total ENI Nippon Repsol YPF INTERNATIONAL Repsol DOWNSTREAM Valero Neste OIL COMPANIES Ashland Sunoco 0 Vertical Balance 2. 0 INTERNATIONAL UPSTREAM Premier Apache COMPANIES Oil 0 10 NATIONALLY-FOCUSED DOWNSTREAM COMPANIES 20 30 40 50 60 70 80 Geographical Scope 40

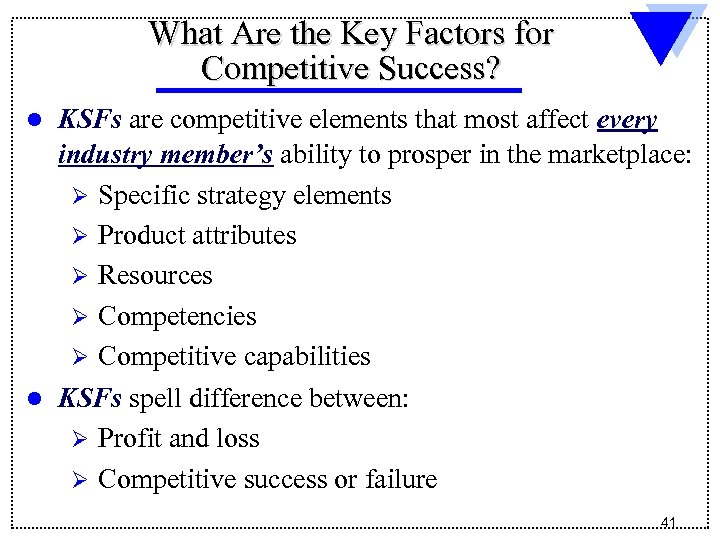

What Are the Key Factors for Competitive Success? KSFs are competitive elements that most affect every industry member’s ability to prosper in the marketplace: Ø Specific strategy elements Ø Product attributes Ø Resources Ø Competencies Ø Competitive capabilities l KSFs spell difference between: Ø Profit and loss Ø Competitive success or failure l 41

What Are the Key Factors for Competitive Success? KSFs are competitive elements that most affect every industry member’s ability to prosper in the marketplace: Ø Specific strategy elements Ø Product attributes Ø Resources Ø Competencies Ø Competitive capabilities l KSFs spell difference between: Ø Profit and loss Ø Competitive success or failure l 41

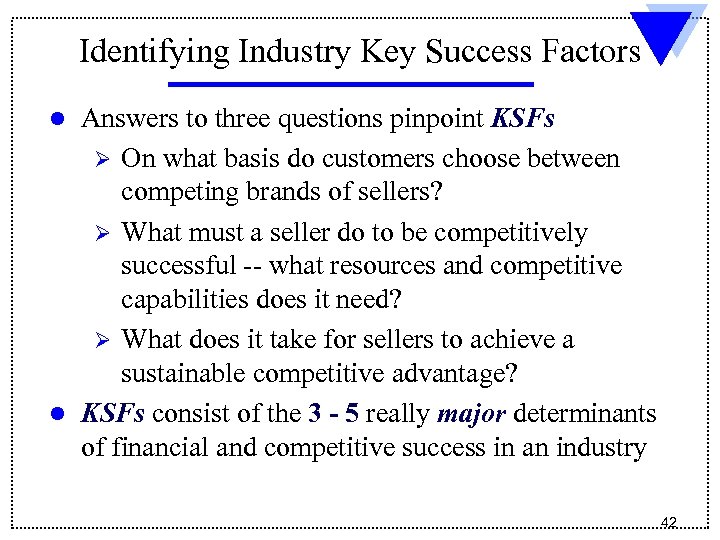

Identifying Industry Key Success Factors l l Answers to three questions pinpoint KSFs Ø On what basis do customers choose between competing brands of sellers? Ø What must a seller do to be competitively successful -- what resources and competitive capabilities does it need? Ø What does it take for sellers to achieve a sustainable competitive advantage? KSFs consist of the 3 - 5 really major determinants of financial and competitive success in an industry 42

Identifying Industry Key Success Factors l l Answers to three questions pinpoint KSFs Ø On what basis do customers choose between competing brands of sellers? Ø What must a seller do to be competitively successful -- what resources and competitive capabilities does it need? Ø What does it take for sellers to achieve a sustainable competitive advantage? KSFs consist of the 3 - 5 really major determinants of financial and competitive success in an industry 42

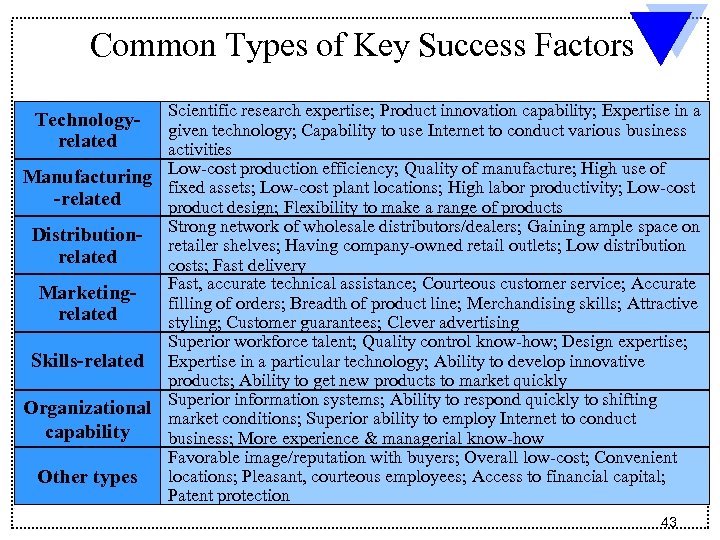

Common Types of Key Success Factors Scientific research expertise; Product innovation capability; Expertise in a given technology; Capability to use Internet to conduct various business activities Manufacturing Low-cost production efficiency; Quality of manufacture; High use of fixed assets; Low-cost plant locations; High labor productivity; Low-cost -related product design; Flexibility to make a range of products Distribution- Strong network of wholesale distributors/dealers; Gaining ample space on retailer shelves; Having company-owned retail outlets; Low distribution related costs; Fast delivery Fast, accurate technical assistance; Courteous customer service; Accurate Marketingfilling of orders; Breadth of product line; Merchandising skills; Attractive related styling; Customer guarantees; Clever advertising Superior workforce talent; Quality control know-how; Design expertise; Skills-related Expertise in a particular technology; Ability to develop innovative products; Ability to get new products to market quickly Organizational Superior information systems; Ability to respond quickly to shifting market conditions; Superior ability to employ Internet to conduct capability business; More experience & managerial know-how Favorable image/reputation with buyers; Overall low-cost; Convenient Other types locations; Pleasant, courteous employees; Access to financial capital; Patent protection Technologyrelated 43

Common Types of Key Success Factors Scientific research expertise; Product innovation capability; Expertise in a given technology; Capability to use Internet to conduct various business activities Manufacturing Low-cost production efficiency; Quality of manufacture; High use of fixed assets; Low-cost plant locations; High labor productivity; Low-cost -related product design; Flexibility to make a range of products Distribution- Strong network of wholesale distributors/dealers; Gaining ample space on retailer shelves; Having company-owned retail outlets; Low distribution related costs; Fast delivery Fast, accurate technical assistance; Courteous customer service; Accurate Marketingfilling of orders; Breadth of product line; Merchandising skills; Attractive related styling; Customer guarantees; Clever advertising Superior workforce talent; Quality control know-how; Design expertise; Skills-related Expertise in a particular technology; Ability to develop innovative products; Ability to get new products to market quickly Organizational Superior information systems; Ability to respond quickly to shifting market conditions; Superior ability to employ Internet to conduct capability business; More experience & managerial know-how Favorable image/reputation with buyers; Overall low-cost; Convenient Other types locations; Pleasant, courteous employees; Access to financial capital; Patent protection Technologyrelated 43

Example: KSFs for Beer Industry l Utilization of brewing capacity -- to keep manufacturing costs low l Strong network of wholesale distributors -to gain access to retail outlets l Clever advertising -- to induce beer drinkers to buy a particular brand 44

Example: KSFs for Beer Industry l Utilization of brewing capacity -- to keep manufacturing costs low l Strong network of wholesale distributors -to gain access to retail outlets l Clever advertising -- to induce beer drinkers to buy a particular brand 44

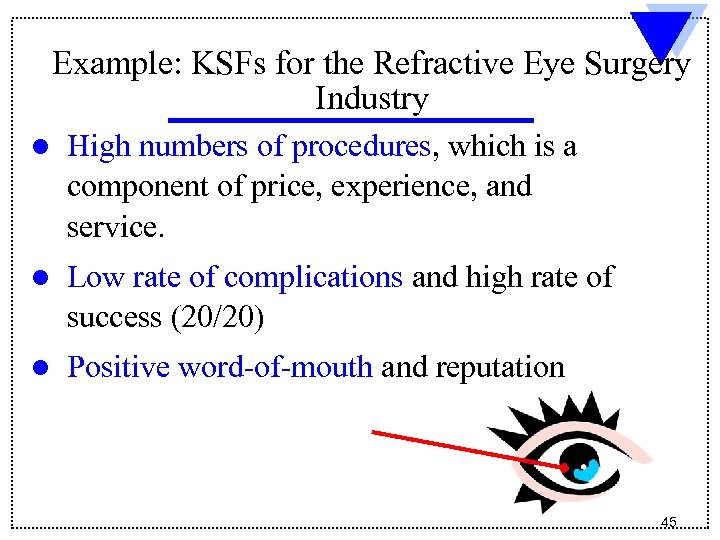

Example: KSFs for the Refractive Eye Surgery Industry l High numbers of procedures, which is a component of price, experience, and service. l Low rate of complications and high rate of success (20/20) l Positive word-of-mouth and reputation 45

Example: KSFs for the Refractive Eye Surgery Industry l High numbers of procedures, which is a component of price, experience, and service. l Low rate of complications and high rate of success (20/20) l Positive word-of-mouth and reputation 45

Strategic Management Principle A sound strategy incorporates efforts to be competent on all industry key success factors and to excel on at least one factor! 46

Strategic Management Principle A sound strategy incorporates efforts to be competent on all industry key success factors and to excel on at least one factor! 46

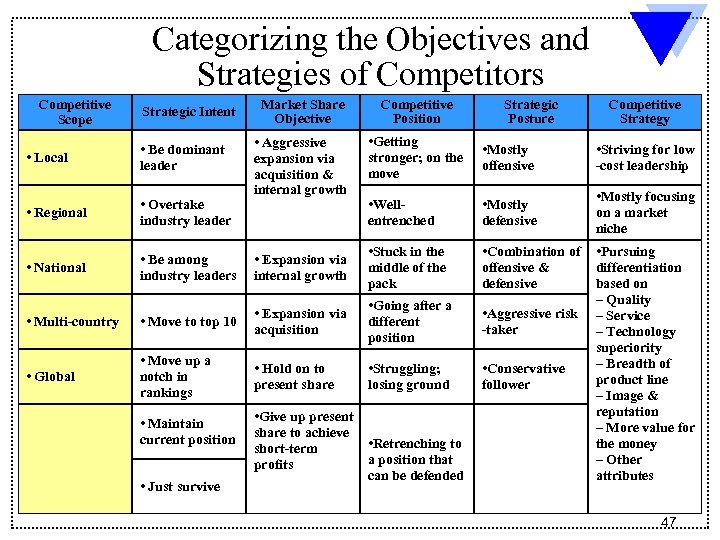

Categorizing the Objectives and Strategies of Competitors Competitive Scope Strategic Intent Market Share Objective Competitive Position Strategic Posture • Aggressive expansion via acquisition & internal growth • Getting stronger; on the move • Mostly offensive • Striving for low -cost leadership • Wellentrenched • Mostly defensive • Mostly focusing on a market niche • Local • Be dominant leader • Regional • Overtake industry leader • National • Be among industry leaders • Expansion via internal growth • Stuck in the middle of the pack • Combination of offensive & defensive • Multi-country • Move to top 10 • Expansion via acquisition • Going after a different position • Aggressive risk -taker • Global • Move up a notch in rankings • Hold on to present share • Struggling; losing ground • Conservative follower • Maintain current position • Just survive • Give up present share to achieve • Retrenching to short-term a position that profits can be defended Competitive Strategy • Pursuing differentiation based on – Quality – Service – Technology superiority – Breadth of product line – Image & reputation – More value for the money – Other attributes 47

Categorizing the Objectives and Strategies of Competitors Competitive Scope Strategic Intent Market Share Objective Competitive Position Strategic Posture • Aggressive expansion via acquisition & internal growth • Getting stronger; on the move • Mostly offensive • Striving for low -cost leadership • Wellentrenched • Mostly defensive • Mostly focusing on a market niche • Local • Be dominant leader • Regional • Overtake industry leader • National • Be among industry leaders • Expansion via internal growth • Stuck in the middle of the pack • Combination of offensive & defensive • Multi-country • Move to top 10 • Expansion via acquisition • Going after a different position • Aggressive risk -taker • Global • Move up a notch in rankings • Hold on to present share • Struggling; losing ground • Conservative follower • Maintain current position • Just survive • Give up present share to achieve • Retrenching to short-term a position that profits can be defended Competitive Strategy • Pursuing differentiation based on – Quality – Service – Technology superiority – Breadth of product line – Image & reputation – More value for the money – Other attributes 47

Group Exercise Analyze the External Environment for your Organization: 1) List at the Key Success Factors for your Organization. 2) Develop a Strategic Group Map for your Organization. 48

Group Exercise Analyze the External Environment for your Organization: 1) List at the Key Success Factors for your Organization. 2) Develop a Strategic Group Map for your Organization. 48