dbb1f0e3fa2ebec2e7aa348e963a7d6a.ppt

- Количество слайдов: 19

Industrial Research Personal Finance

Industrial Research Personal Finance

What is personal finance? n Personal finance is a study of economic factors and personal decisions that affect a person’s financial well being. How people spend l How people save l How people protect l How people invest l

What is personal finance? n Personal finance is a study of economic factors and personal decisions that affect a person’s financial well being. How people spend l How people save l How people protect l How people invest l

The growing importance of personal finance today n Sluggish growth in personal income -l n Between 1980 & 1997 personal income growth rate only slightly more than 2% More options available for your money l Increasing number of choices offered in banking, credit, investments, and retirement planning. Also more benefit options

The growing importance of personal finance today n Sluggish growth in personal income -l n Between 1980 & 1997 personal income growth rate only slightly more than 2% More options available for your money l Increasing number of choices offered in banking, credit, investments, and retirement planning. Also more benefit options

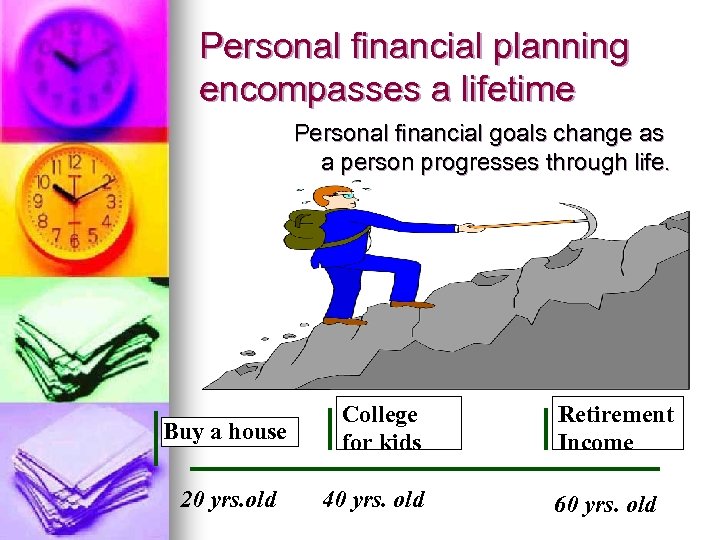

Personal financial planning encompasses a lifetime Personal financial goals change as a person progresses through life. Buy a house 20 yrs. old College for kids 40 yrs. old Retirement Income 60 yrs. old

Personal financial planning encompasses a lifetime Personal financial goals change as a person progresses through life. Buy a house 20 yrs. old College for kids 40 yrs. old Retirement Income 60 yrs. old

Objectives of Financial Planning Maximize wealth n Practice efficient consumption n Achieve life satisfaction n Maintain financial stability n Prepare for retirement n

Objectives of Financial Planning Maximize wealth n Practice efficient consumption n Achieve life satisfaction n Maintain financial stability n Prepare for retirement n

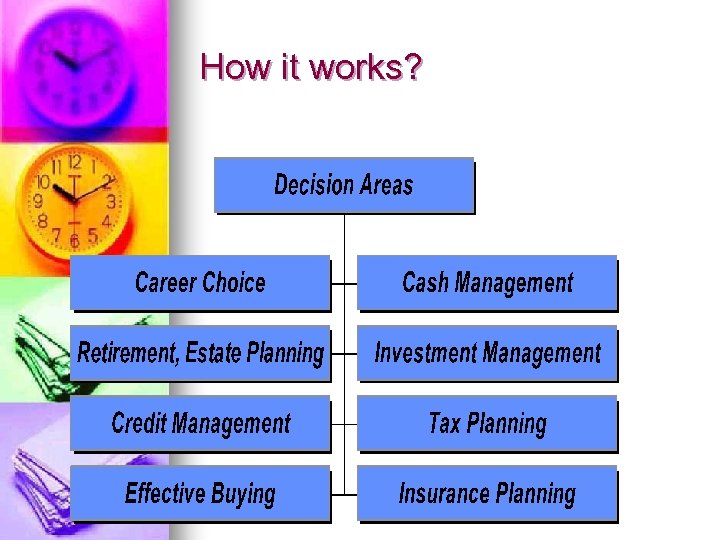

How it works?

How it works?

The big player – HSBC

The big player – HSBC

Background Information >130 years ago n >9, 500 offices in 80 countries n Eg, Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. n domestic commercial banking and financial services n

Background Information >130 years ago n >9, 500 offices in 80 countries n Eg, Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. n domestic commercial banking and financial services n

Personal Financial Service 1. 2. 3. 4. 5. 6. 7. Banking Service Card Services Personal Credit Services Mortgage Services Insurance Services Investment Services Payment Services

Personal Financial Service 1. 2. 3. 4. 5. 6. 7. Banking Service Card Services Personal Credit Services Mortgage Services Insurance Services Investment Services Payment Services

1. Banking Service provides different banking services n Eg, Internet banking, Phone banking, Self-service banking, Mobile banking and Branch banking n i) University Student Account n ii) HSBC Premier n

1. Banking Service provides different banking services n Eg, Internet banking, Phone banking, Self-service banking, Mobile banking and Branch banking n i) University Student Account n ii) HSBC Premier n

1. i) University Student Account n 1. 2. 3. 4. help university student achieve financial independence through a range of special privileges and services free credit card current account university student Travel. Surance integrated protection plus

1. i) University Student Account n 1. 2. 3. 4. help university student achieve financial independence through a range of special privileges and services free credit card current account university student Travel. Surance integrated protection plus

1. ii) HSBC Premier n 1. 2. 3. 4. help high premium customer make the most of their wealth Offering world-wide access Providing single banking portfolio with consolidated statement Supporting comprehensive range of investment tools Affording free financial planning review

1. ii) HSBC Premier n 1. 2. 3. 4. help high premium customer make the most of their wealth Offering world-wide access Providing single banking portfolio with consolidated statement Supporting comprehensive range of investment tools Affording free financial planning review

2. Card Services n different card for different client 1. HSBC Visa and HSBC Master Card HSBC JCB Gold i. Can card 2. 3.

2. Card Services n different card for different client 1. HSBC Visa and HSBC Master Card HSBC JCB Gold i. Can card 2. 3.

3. Personal Credit Services n provide instant answer to customer’s immediate financial needs. 1. Personal Instalment Loan Revolving Credit Facility Car Loan Extra 2. 3.

3. Personal Credit Services n provide instant answer to customer’s immediate financial needs. 1. Personal Instalment Loan Revolving Credit Facility Car Loan Extra 2. 3.

4. Mortgage Services n different mortgage services for different investors and citizens 1. First-time Home Buyers Free Choice Mortgage Refinancing 2. 3.

4. Mortgage Services n different mortgage services for different investors and citizens 1. First-time Home Buyers Free Choice Mortgage Refinancing 2. 3.

5. Insurance Services different insurance packages to protect yourself and your family 1. Travel insurance 2. Home and Motor insurance 3. Accident and Health insurance -

5. Insurance Services different insurance packages to protect yourself and your family 1. Travel insurance 2. Home and Motor insurance 3. Accident and Health insurance -

6. Investment Services - 1. 2. 3. different investment services no matter in risk investment and life planning Financial Planning Purchase of securities and bonds, IPO Offering financial information

6. Investment Services - 1. 2. 3. different investment services no matter in risk investment and life planning Financial Planning Purchase of securities and bonds, IPO Offering financial information

7. Payment Services - 1. 2. 3. different payment services to enable it to provide fast and 24 -hours services Bill payment-Auto Pay Overseas Transfer Local Money Transfer

7. Payment Services - 1. 2. 3. different payment services to enable it to provide fast and 24 -hours services Bill payment-Auto Pay Overseas Transfer Local Money Transfer

Conclusion

Conclusion