bfbeee1fe4e3640e479d41652168bac4.ppt

- Количество слайдов: 39

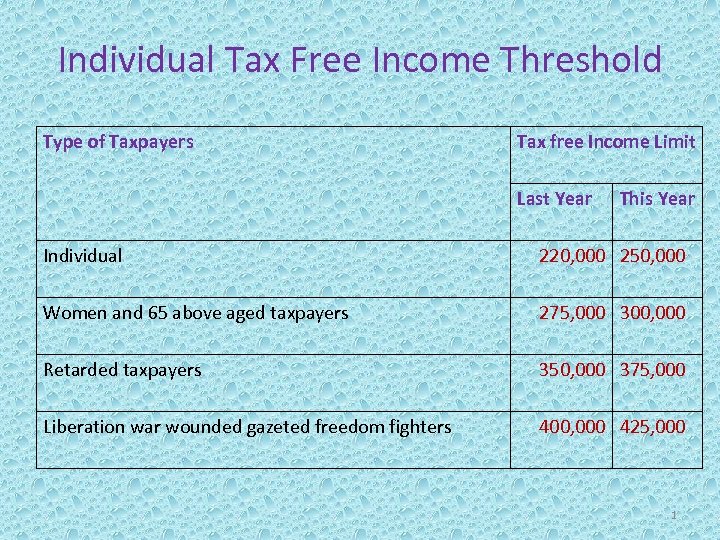

Individual Tax Free Income Threshold Type of Taxpayers Tax free Income Limit Last Year This Year Individual 220, 000 250, 000 Women and 65 above aged taxpayers 275, 000 300, 000 Retarded taxpayers 350, 000 375, 000 Liberation war wounded gazeted freedom fighters 400, 000 425, 000 1

Individual Tax Free Income Threshold Type of Taxpayers Tax free Income Limit Last Year This Year Individual 220, 000 250, 000 Women and 65 above aged taxpayers 275, 000 300, 000 Retarded taxpayers 350, 000 375, 000 Liberation war wounded gazeted freedom fighters 400, 000 425, 000 1

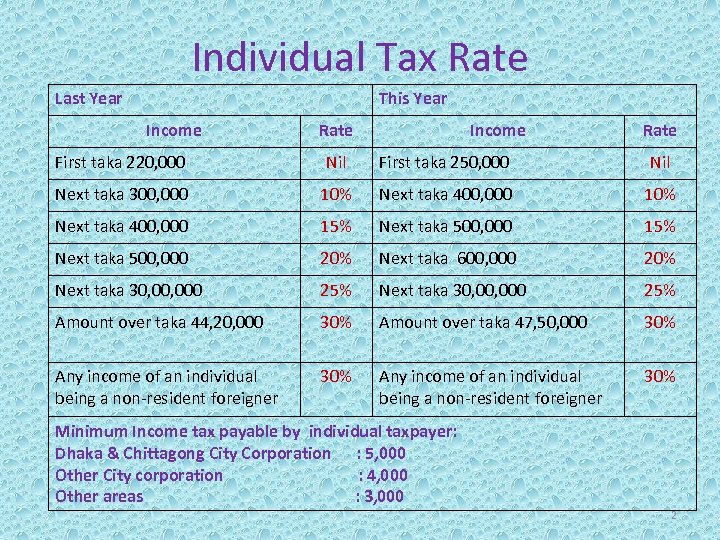

Individual Tax Rate Last Year This Year Income Rate First taka 220, 000 Nil First taka 250, 000 Nil Next taka 300, 000 10% Next taka 400, 000 15% Next taka 500, 000 20% Next taka 600, 000 20% Next taka 30, 00, 000 25% Amount over taka 44, 20, 000 30% Amount over taka 47, 50, 000 30% Any income of an individual being a non-resident foreigner 30% Minimum Income tax payable by individual taxpayer: Dhaka & Chittagong City Corporation : 5, 000 Other City corporation : 4, 000 Other areas : 3, 000 2

Individual Tax Rate Last Year This Year Income Rate First taka 220, 000 Nil First taka 250, 000 Nil Next taka 300, 000 10% Next taka 400, 000 15% Next taka 500, 000 20% Next taka 600, 000 20% Next taka 30, 00, 000 25% Amount over taka 44, 20, 000 30% Amount over taka 47, 50, 000 30% Any income of an individual being a non-resident foreigner 30% Minimum Income tax payable by individual taxpayer: Dhaka & Chittagong City Corporation : 5, 000 Other City corporation : 4, 000 Other areas : 3, 000 2

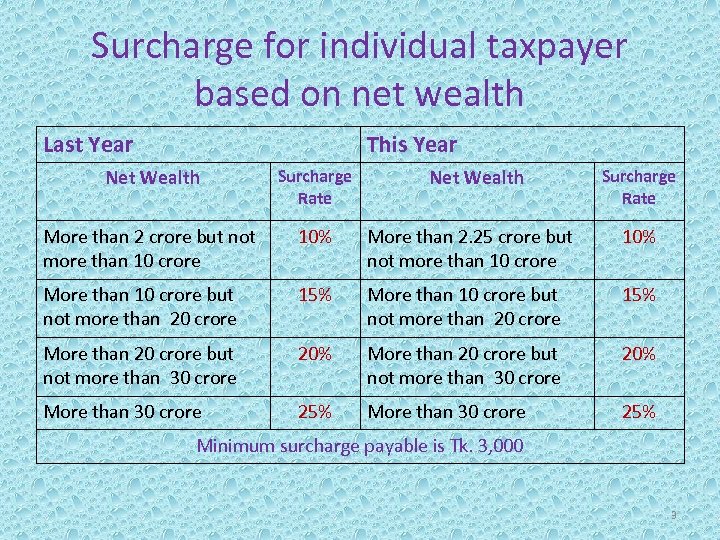

Surcharge for individual taxpayer based on net wealth Last Year This Year Net Wealth Surcharge Rate More than 2 crore but not more than 10 crore 10% More than 2. 25 crore but not more than 10 crore 10% More than 10 crore but not more than 20 crore 15% More than 20 crore but not more than 30 crore 20% More than 30 crore 25% Minimum surcharge payable is Tk. 3, 000 3

Surcharge for individual taxpayer based on net wealth Last Year This Year Net Wealth Surcharge Rate More than 2 crore but not more than 10 crore 10% More than 2. 25 crore but not more than 10 crore 10% More than 10 crore but not more than 20 crore 15% More than 20 crore but not more than 30 crore 20% More than 30 crore 25% Minimum surcharge payable is Tk. 3, 000 3

Corporate Tax Rate Company Last Year This Year Publicly traded company 27. 50% 25% Publicly traded company declaring at least 30% dividend 24. 75% 25% Publicly traded company declaring less than 10% dividend 35% 25% Non-publicly traded company 35% 42. 50% 40% 42. 50% Bank, Insurance & Financial Institute: Listed & 4 th Generation Banks and FIs Non-listed

Corporate Tax Rate Company Last Year This Year Publicly traded company 27. 50% 25% Publicly traded company declaring at least 30% dividend 24. 75% 25% Publicly traded company declaring less than 10% dividend 35% 25% Non-publicly traded company 35% 42. 50% 40% 42. 50% Bank, Insurance & Financial Institute: Listed & 4 th Generation Banks and FIs Non-listed

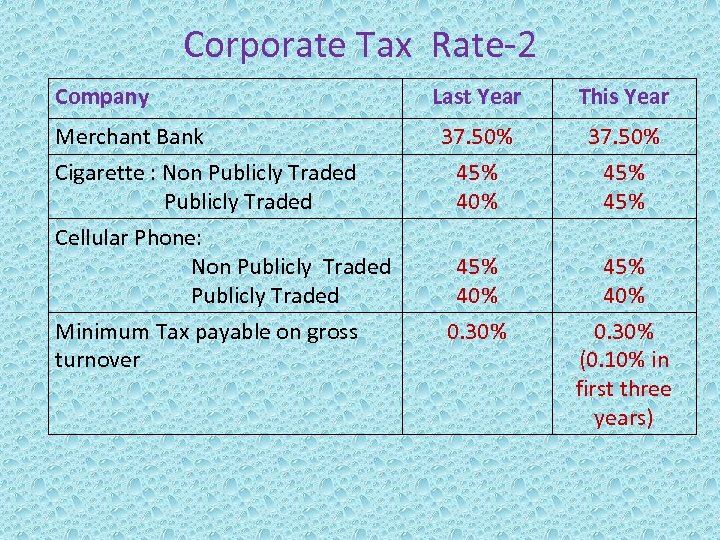

Corporate Tax Rate-2 Company Last Year This Year Merchant Bank Cigarette : Non Publicly Traded Publicly Traded 37. 50% 45% 40% 37. 50% 45% Cellular Phone: Non Publicly Traded Publicly Traded Minimum Tax payable on gross turnover 45% 40% 0. 30% (0. 10% in first three years)

Corporate Tax Rate-2 Company Last Year This Year Merchant Bank Cigarette : Non Publicly Traded Publicly Traded 37. 50% 45% 40% 37. 50% 45% Cellular Phone: Non Publicly Traded Publicly Traded Minimum Tax payable on gross turnover 45% 40% 0. 30% (0. 10% in first three years)

Separate tax rate for cigarette and co-operative society • Income from Cigarette manufacturing business shall be taxed uniformly @45% irrespective of the status of the taxpayer i. e similar tax rate to apply for publicly listed, public/private companies, firm or individual taxpayers • Trading, money lending, housing business, interest and dividend income of co-operative societies shall be taxed @ 15%. Sub-section (a) and © of Section 47 deleted accordingly 6

Separate tax rate for cigarette and co-operative society • Income from Cigarette manufacturing business shall be taxed uniformly @45% irrespective of the status of the taxpayer i. e similar tax rate to apply for publicly listed, public/private companies, firm or individual taxpayers • Trading, money lending, housing business, interest and dividend income of co-operative societies shall be taxed @ 15%. Sub-section (a) and © of Section 47 deleted accordingly 6

Uniform Income Year Calendar year shall be the income year for bank, insurance and financial institutions Financial year i. e July-June shall be income year for all other taxpayers This new provision shall be applicable from 1 st July 2016 7

Uniform Income Year Calendar year shall be the income year for bank, insurance and financial institutions Financial year i. e July-June shall be income year for all other taxpayers This new provision shall be applicable from 1 st July 2016 7

Imposition of additional tax for unauthorized foreign employment Additional tax @50% of tax payable or taka 5 lakh (whichever is higher) shall be imposed for unauthorized employment of foreign citizens under Section 16 B Imprisonment up to three years along with penalty of taka 5 lakh under Section 165 C for unauthorized foreign employment Any tax holiday or other tax benefit shall be cancelled in case of such unauthorized foreign employment 8

Imposition of additional tax for unauthorized foreign employment Additional tax @50% of tax payable or taka 5 lakh (whichever is higher) shall be imposed for unauthorized employment of foreign citizens under Section 16 B Imprisonment up to three years along with penalty of taka 5 lakh under Section 165 C for unauthorized foreign employment Any tax holiday or other tax benefit shall be cancelled in case of such unauthorized foreign employment 8

Imposition of penalty for submission of fake audit report Penalty of Taka 1 lakh shall be imposed under section 129 B for submission of fake audit report Imprisonment of three years along with fine of Taka 1 lakh under section 165 AA 9

Imposition of penalty for submission of fake audit report Penalty of Taka 1 lakh shall be imposed under section 129 B for submission of fake audit report Imprisonment of three years along with fine of Taka 1 lakh under section 165 AA 9

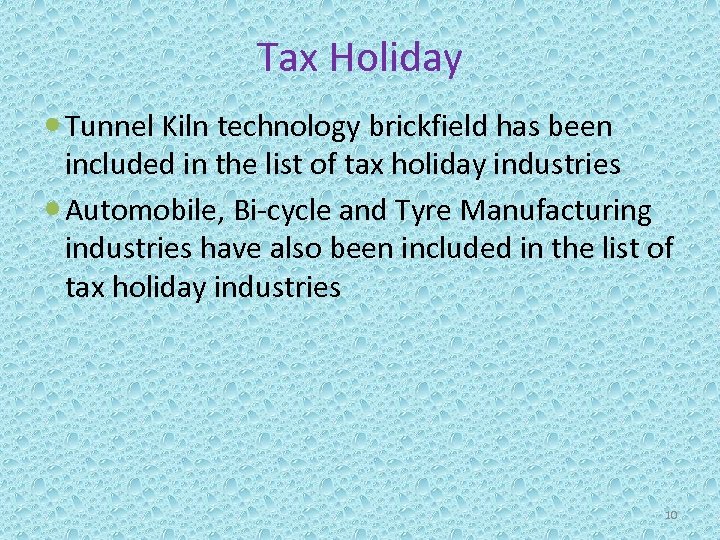

Tax Holiday Tunnel Kiln technology brickfield has been included in the list of tax holiday industries Automobile, Bi-cycle and Tyre Manufacturing industries have also been included in the list of tax holiday industries 10

Tax Holiday Tunnel Kiln technology brickfield has been included in the list of tax holiday industries Automobile, Bi-cycle and Tyre Manufacturing industries have also been included in the list of tax holiday industries 10

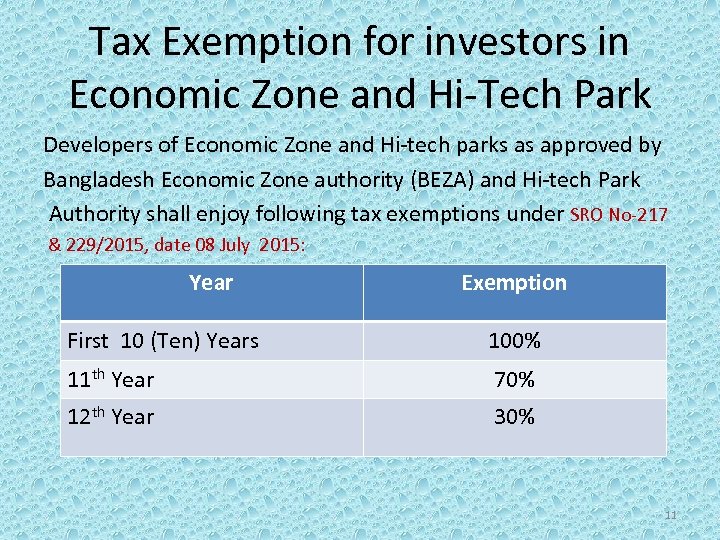

Tax Exemption for investors in Economic Zone and Hi-Tech Park Developers of Economic Zone and Hi-tech parks as approved by Bangladesh Economic Zone authority (BEZA) and Hi-tech Park Authority shall enjoy following tax exemptions under SRO No-217 & 229/2015, date 08 July 2015: Year Exemption First 10 (Ten) Years 100% 11 th Year 70% 12 th Year 30% 11

Tax Exemption for investors in Economic Zone and Hi-Tech Park Developers of Economic Zone and Hi-tech parks as approved by Bangladesh Economic Zone authority (BEZA) and Hi-tech Park Authority shall enjoy following tax exemptions under SRO No-217 & 229/2015, date 08 July 2015: Year Exemption First 10 (Ten) Years 100% 11 th Year 70% 12 th Year 30% 11

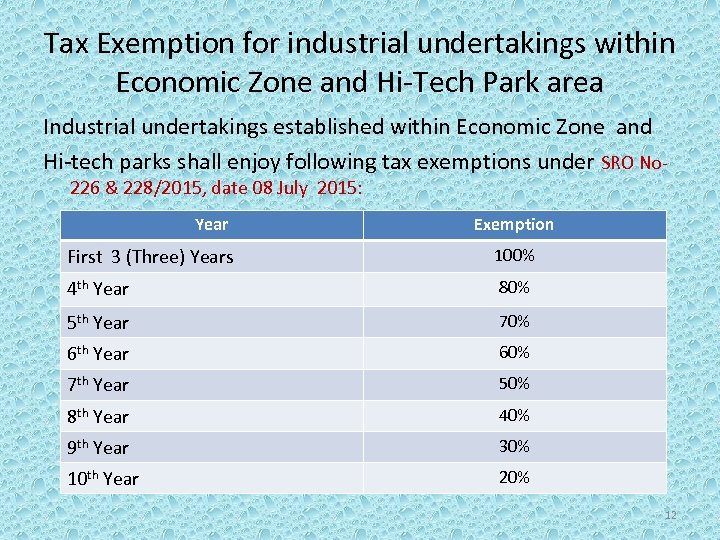

Tax Exemption for industrial undertakings within Economic Zone and Hi-Tech Park area Industrial undertakings established within Economic Zone and Hi-tech parks shall enjoy following tax exemptions under SRO No 226 & 228/2015, date 08 July 2015: Year Exemption First 3 (Three) Years 100% 4 th Year 80% 5 th Year 70% 6 th Year 60% 7 th Year 50% 8 th Year 40% 9 th Year 30% 10 th Year 20% 12

Tax Exemption for industrial undertakings within Economic Zone and Hi-Tech Park area Industrial undertakings established within Economic Zone and Hi-tech parks shall enjoy following tax exemptions under SRO No 226 & 228/2015, date 08 July 2015: Year Exemption First 3 (Three) Years 100% 4 th Year 80% 5 th Year 70% 6 th Year 60% 7 th Year 50% 8 th Year 40% 9 th Year 30% 10 th Year 20% 12

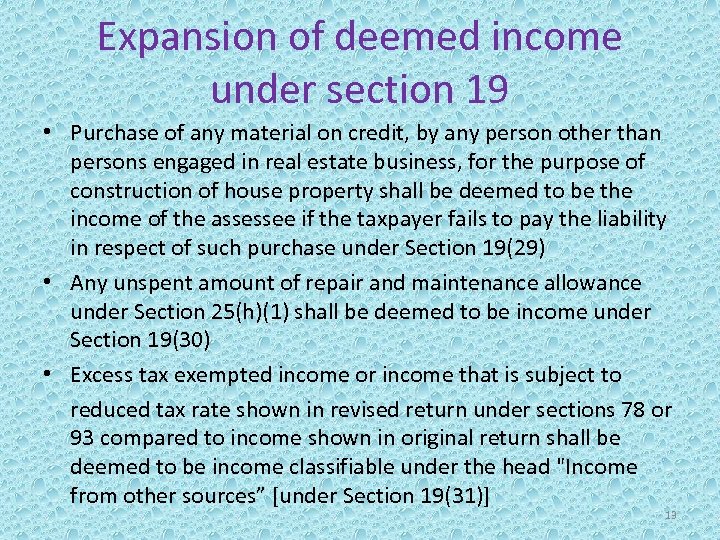

Expansion of deemed income under section 19 • Purchase of any material on credit, by any person other than persons engaged in real estate business, for the purpose of construction of house property shall be deemed to be the income of the assessee if the taxpayer fails to pay the liability in respect of such purchase under Section 19(29) • Any unspent amount of repair and maintenance allowance under Section 25(h)(1) shall be deemed to be income under Section 19(30) • Excess tax exempted income or income that is subject to reduced tax rate shown in revised return under sections 78 or 93 compared to income shown in original return shall be deemed to be income classifiable under the head "Income from other sources” [under Section 19(31)] 13

Expansion of deemed income under section 19 • Purchase of any material on credit, by any person other than persons engaged in real estate business, for the purpose of construction of house property shall be deemed to be the income of the assessee if the taxpayer fails to pay the liability in respect of such purchase under Section 19(29) • Any unspent amount of repair and maintenance allowance under Section 25(h)(1) shall be deemed to be income under Section 19(30) • Excess tax exempted income or income that is subject to reduced tax rate shown in revised return under sections 78 or 93 compared to income shown in original return shall be deemed to be income classifiable under the head "Income from other sources” [under Section 19(31)] 13

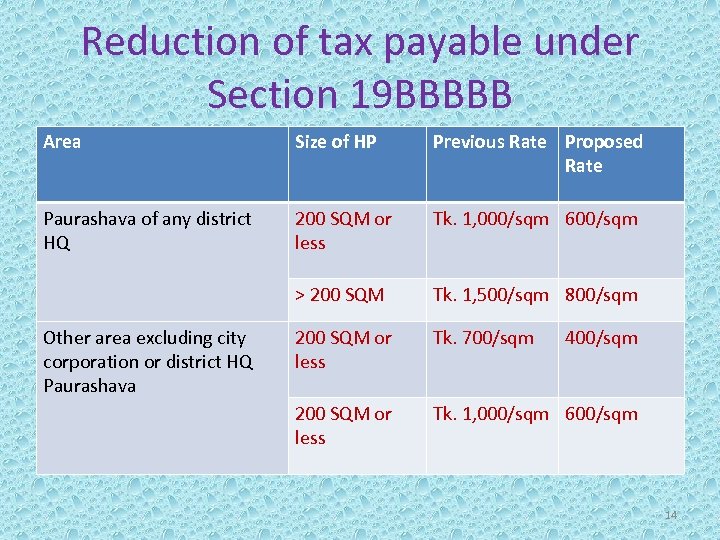

Reduction of tax payable under Section 19 BBBBB Area Size of HP Previous Rate Proposed Rate Paurashava of any district HQ 200 SQM or less Tk. 1, 000/sqm 600/sqm > 200 SQM Tk. 1, 500/sqm 800/sqm 200 SQM or less Tk. 700/sqm 200 SQM or less Tk. 1, 000/sqm 600/sqm Other area excluding city corporation or district HQ Paurashava 400/sqm 14

Reduction of tax payable under Section 19 BBBBB Area Size of HP Previous Rate Proposed Rate Paurashava of any district HQ 200 SQM or less Tk. 1, 000/sqm 600/sqm > 200 SQM Tk. 1, 500/sqm 800/sqm 200 SQM or less Tk. 700/sqm 200 SQM or less Tk. 1, 000/sqm 600/sqm Other area excluding city corporation or district HQ Paurashava 400/sqm 14

Changes in computation of business income • Financial institutions to get similar benefit like banks in computing interest income from classified loan under Section 28(3) • Obsolescence allowance for any fixed asset excluding imported software under Section 29(1)(xi) • Excess perquisite limit enhanced to Tk. 450, 000 from Tk. 350, 000 under Section 30(e) • Maximum allowable limit for business car purchase shall be 10% of paid up capital together with reserve and accumulated profit under Section 19(27) 15

Changes in computation of business income • Financial institutions to get similar benefit like banks in computing interest income from classified loan under Section 28(3) • Obsolescence allowance for any fixed asset excluding imported software under Section 29(1)(xi) • Excess perquisite limit enhanced to Tk. 450, 000 from Tk. 350, 000 under Section 30(e) • Maximum allowable limit for business car purchase shall be 10% of paid up capital together with reserve and accumulated profit under Section 19(27) 15

Withholding tax • TDS on Government employee salary at average rate under Section 50 • Withdrawal of 5% upfront tax on Treasury Bond and Treasury Bill under Section 51 • 3% AIT on MRP of cigarette to be collected at VAT collection stage under Section 52 B • TDS @ 0. 30% of ticket value or cargo value for carrying passenger or cargo as a final tax on income of travel agency or cargo agency under Section 52 JJ. Ticket value or cargo value to include all charges except embarkation fees, travel tax, flight safety insurance, security tax and airport tax 16

Withholding tax • TDS on Government employee salary at average rate under Section 50 • Withdrawal of 5% upfront tax on Treasury Bond and Treasury Bill under Section 51 • 3% AIT on MRP of cigarette to be collected at VAT collection stage under Section 52 B • TDS @ 0. 30% of ticket value or cargo value for carrying passenger or cargo as a final tax on income of travel agency or cargo agency under Section 52 JJ. Ticket value or cargo value to include all charges except embarkation fees, travel tax, flight safety insurance, security tax and airport tax 16

Withholding tax…. contd • TDS rate has been increased to 4% from existing 3% on Vatable value of band roles of soft drinks and mineral water under Section 52 S • Withdrawal of TDS under Section 52 U on computer or computer accessories, jute, cotton and yarn purchased through local LC • 0. 60% TDS on all exports including ready made garments under Section 53 BB and Section 53 BBBB [SRO No-224/2015, date- 2 July 2015, shall be applicable till 30 June 2016] • TDS from all exports shall be considered final discharge of tax liability under Section 82 C 17

Withholding tax…. contd • TDS rate has been increased to 4% from existing 3% on Vatable value of band roles of soft drinks and mineral water under Section 52 S • Withdrawal of TDS under Section 52 U on computer or computer accessories, jute, cotton and yarn purchased through local LC • 0. 60% TDS on all exports including ready made garments under Section 53 BB and Section 53 BBBB [SRO No-224/2015, date- 2 July 2015, shall be applicable till 30 June 2016] • TDS from all exports shall be considered final discharge of tax liability under Section 82 C 17

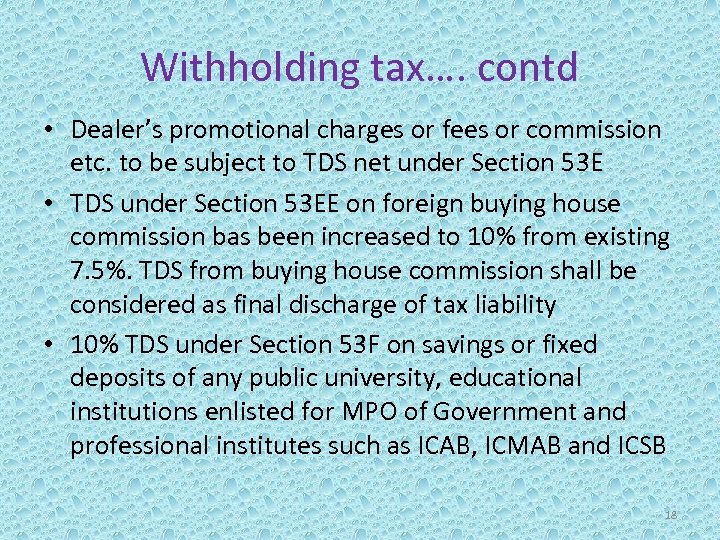

Withholding tax…. contd • Dealer’s promotional charges or fees or commission etc. to be subject to TDS net under Section 53 E • TDS under Section 53 EE on foreign buying house commission bas been increased to 10% from existing 7. 5%. TDS from buying house commission shall be considered as final discharge of tax liability • 10% TDS under Section 53 F on savings or fixed deposits of any public university, educational institutions enlisted for MPO of Government and professional institutes such as ICAB, ICMAB and ICSB 18

Withholding tax…. contd • Dealer’s promotional charges or fees or commission etc. to be subject to TDS net under Section 53 E • TDS under Section 53 EE on foreign buying house commission bas been increased to 10% from existing 7. 5%. TDS from buying house commission shall be considered as final discharge of tax liability • 10% TDS under Section 53 F on savings or fixed deposits of any public university, educational institutions enlisted for MPO of Government and professional institutes such as ICAB, ICMAB and ICSB 18

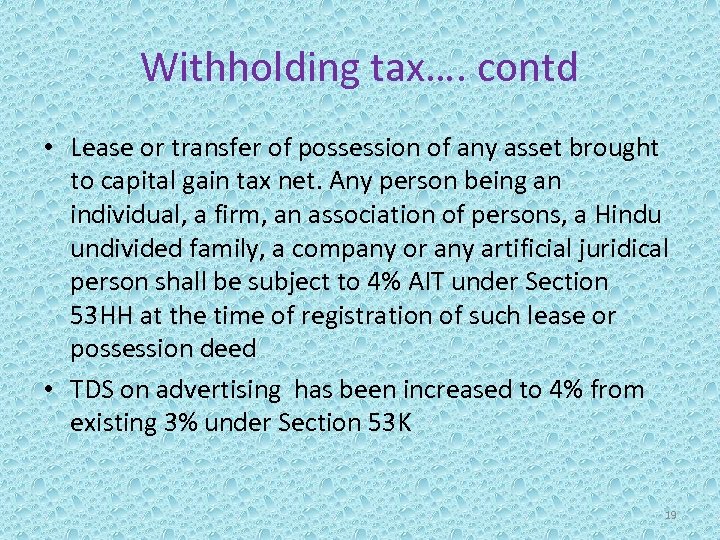

Withholding tax…. contd • Lease or transfer of possession of any asset brought to capital gain tax net. Any person being an individual, a firm, an association of persons, a Hindu undivided family, a company or any artificial juridical person shall be subject to 4% AIT under Section 53 HH at the time of registration of such lease or possession deed • TDS on advertising has been increased to 4% from existing 3% under Section 53 K 19

Withholding tax…. contd • Lease or transfer of possession of any asset brought to capital gain tax net. Any person being an individual, a firm, an association of persons, a Hindu undivided family, a company or any artificial juridical person shall be subject to 4% AIT under Section 53 HH at the time of registration of such lease or possession deed • TDS on advertising has been increased to 4% from existing 3% under Section 53 K 19

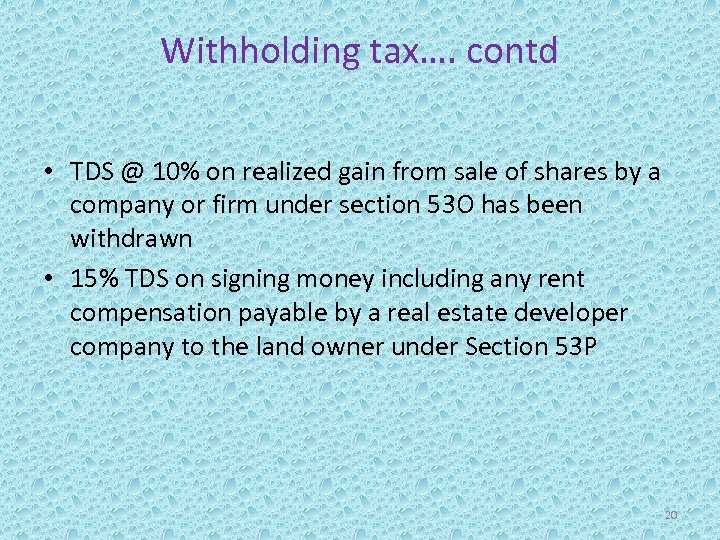

Withholding tax…. contd • TDS @ 10% on realized gain from sale of shares by a company or firm under section 53 O has been withdrawn • 15% TDS on signing money including any rent compensation payable by a real estate developer company to the land owner under Section 53 P 20

Withholding tax…. contd • TDS @ 10% on realized gain from sale of shares by a company or firm under section 53 O has been withdrawn • 15% TDS on signing money including any rent compensation payable by a real estate developer company to the land owner under Section 53 P 20

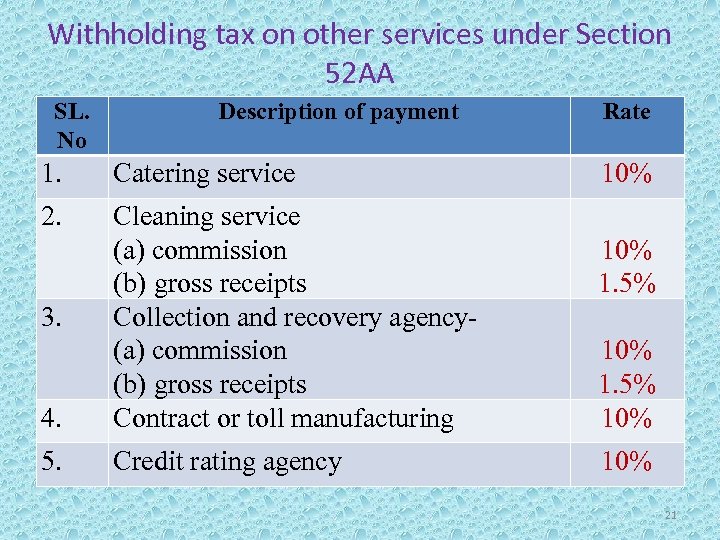

Withholding tax on other services under Section 52 AA SL. No Description of payment 1. Catering service 2. 4. Cleaning service (a) commission (b) gross receipts Collection and recovery agency(a) commission (b) gross receipts Contract or toll manufacturing 5. Credit rating agency 3. Rate 10% 1. 5% 10% 10% 21

Withholding tax on other services under Section 52 AA SL. No Description of payment 1. Catering service 2. 4. Cleaning service (a) commission (b) gross receipts Collection and recovery agency(a) commission (b) gross receipts Contract or toll manufacturing 5. Credit rating agency 3. Rate 10% 1. 5% 10% 10% 21

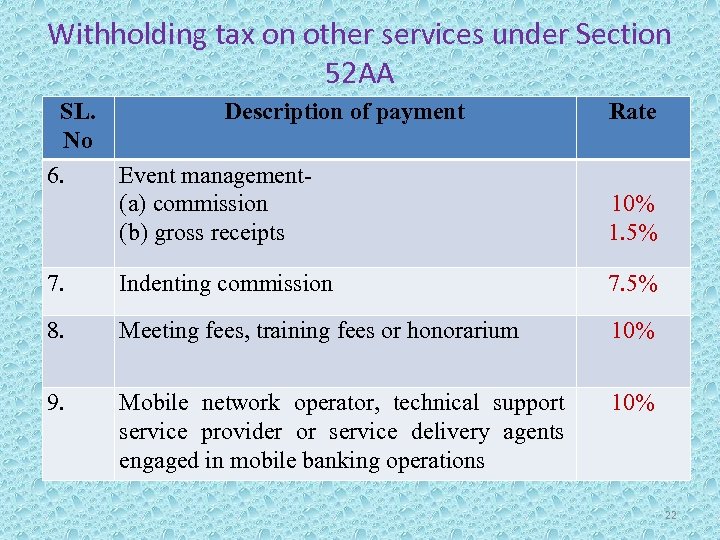

Withholding tax on other services under Section 52 AA SL. Description of payment No 6. Event management(a) commission (b) gross receipts Rate 10% 1. 5% 7. Indenting commission 7. 5% 8. Meeting fees, training fees or honorarium 10% 9. Mobile network operator, technical support service provider or service delivery agents engaged in mobile banking operations 10% 22

Withholding tax on other services under Section 52 AA SL. Description of payment No 6. Event management(a) commission (b) gross receipts Rate 10% 1. 5% 7. Indenting commission 7. 5% 8. Meeting fees, training fees or honorarium 10% 9. Mobile network operator, technical support service provider or service delivery agents engaged in mobile banking operations 10% 22

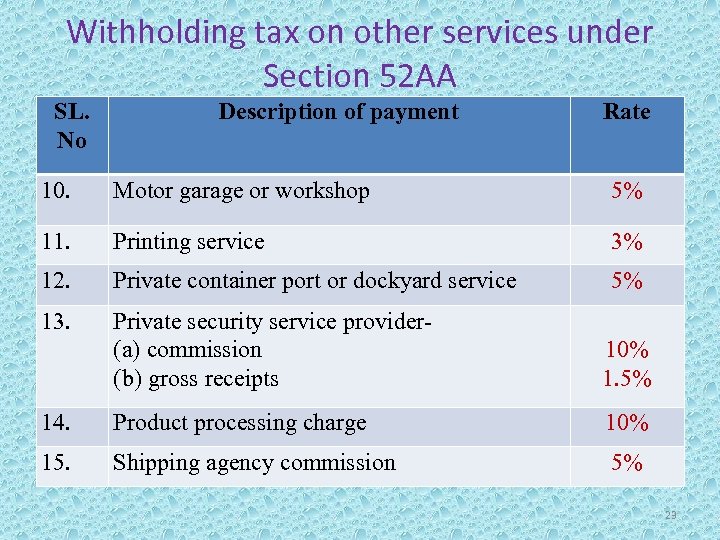

Withholding tax on other services under Section 52 AA SL. No Description of payment Rate 10. Motor garage or workshop 5% 11. Printing service 3% 12. Private container port or dockyard service 5% 13. Private security service provider(a) commission (b) gross receipts 10% 1. 5% 14. Product processing charge 10% 15. Shipping agency commission 5% 23

Withholding tax on other services under Section 52 AA SL. No Description of payment Rate 10. Motor garage or workshop 5% 11. Printing service 3% 12. Private container port or dockyard service 5% 13. Private security service provider(a) commission (b) gross receipts 10% 1. 5% 14. Product processing charge 10% 15. Shipping agency commission 5% 23

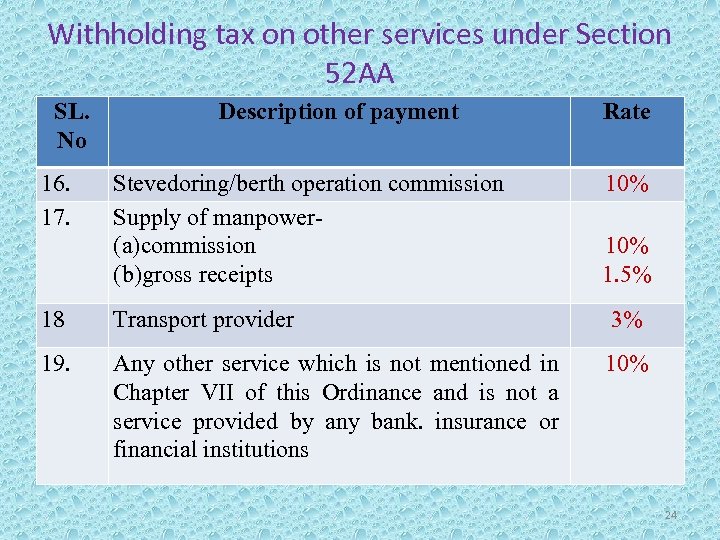

Withholding tax on other services under Section 52 AA SL. No 16. 17. Description of payment Stevedoring/berth operation commission Supply of manpower(a)commission (b)gross receipts Rate 10% 1. 5% 18 Transport provider 3% 19. Any other service which is not mentioned in Chapter VII of this Ordinance and is not a service provided by any bank. insurance or financial institutions 10% 24

Withholding tax on other services under Section 52 AA SL. No 16. 17. Description of payment Stevedoring/berth operation commission Supply of manpower(a)commission (b)gross receipts Rate 10% 1. 5% 18 Transport provider 3% 19. Any other service which is not mentioned in Chapter VII of this Ordinance and is not a service provided by any bank. insurance or financial institutions 10% 24

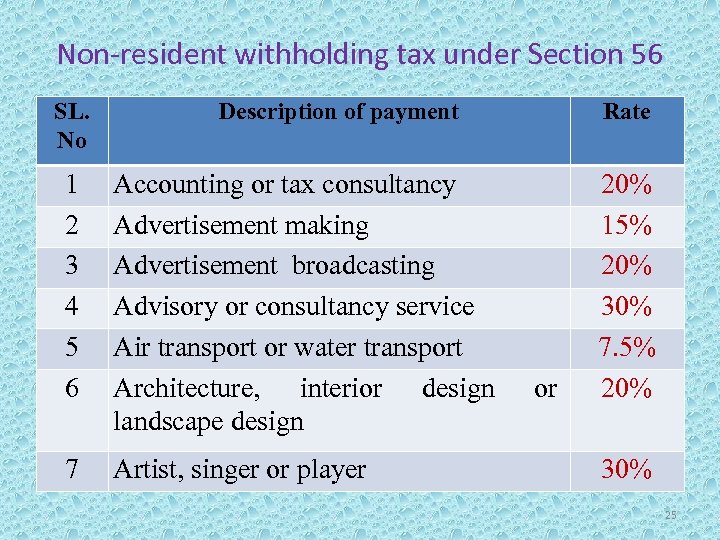

Non-resident withholding tax under Section 56 SL. No Description of payment 1 2 3 4 5 6 Accounting or tax consultancy Advertisement making Advertisement broadcasting Advisory or consultancy service Air transport or water transport Architecture, interior design landscape design 7 Artist, singer or player Rate or 20% 15% 20% 30% 7. 5% 20% 30% 25

Non-resident withholding tax under Section 56 SL. No Description of payment 1 2 3 4 5 6 Accounting or tax consultancy Advertisement making Advertisement broadcasting Advisory or consultancy service Air transport or water transport Architecture, interior design landscape design 7 Artist, singer or player Rate or 20% 15% 20% 30% 7. 5% 20% 30% 25

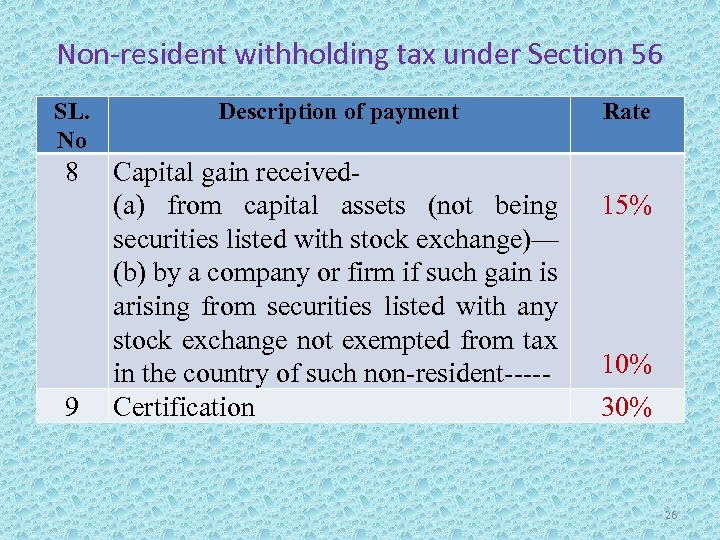

Non-resident withholding tax under Section 56 SL. No Description of payment 8 Capital gain received(a) from capital assets (not being securities listed with stock exchange)— (b) by a company or firm if such gain is arising from securities listed with any stock exchange not exempted from tax in the country of such non-resident----Certification 9 Rate 15% 10% 30% 26

Non-resident withholding tax under Section 56 SL. No Description of payment 8 Capital gain received(a) from capital assets (not being securities listed with stock exchange)— (b) by a company or firm if such gain is arising from securities listed with any stock exchange not exempted from tax in the country of such non-resident----Certification 9 Rate 15% 10% 30% 26

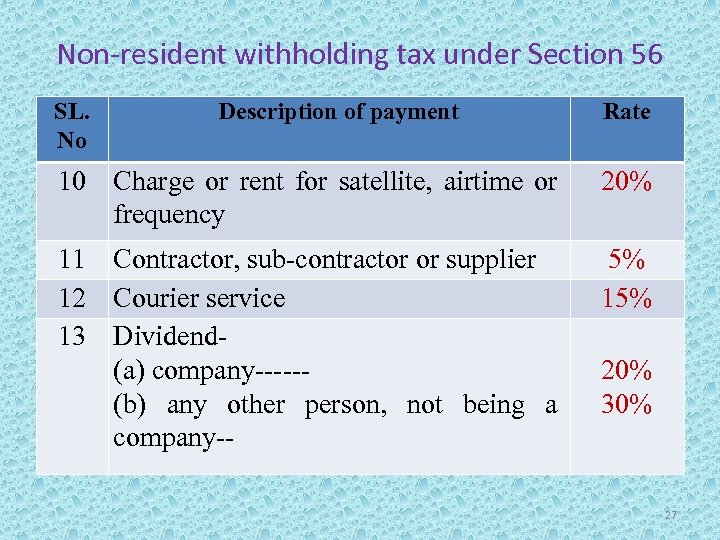

Non-resident withholding tax under Section 56 SL. No Description of payment Rate 10 Charge or rent for satellite, airtime or frequency 20% 11 Contractor, sub-contractor or supplier 12 Courier service 13 Dividend(a) company-----(b) any other person, not being a company-- 5% 15% 20% 30% 27

Non-resident withholding tax under Section 56 SL. No Description of payment Rate 10 Charge or rent for satellite, airtime or frequency 20% 11 Contractor, sub-contractor or supplier 12 Courier service 13 Dividend(a) company-----(b) any other person, not being a company-- 5% 15% 20% 30% 27

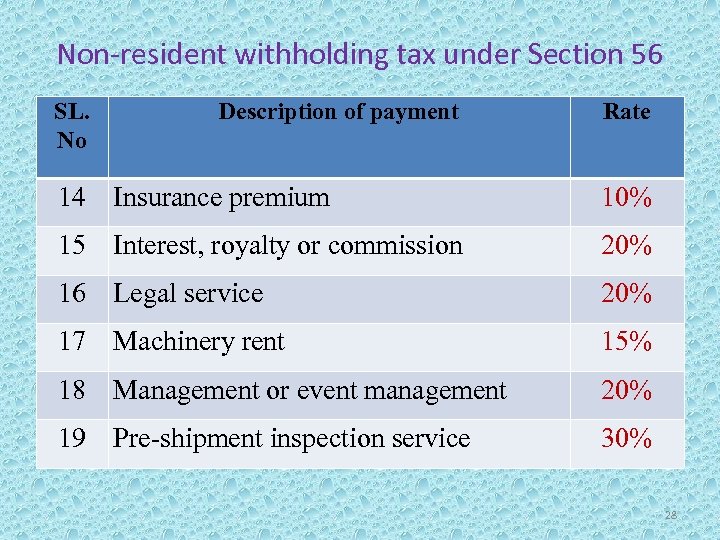

Non-resident withholding tax under Section 56 SL. No Description of payment Rate 14 Insurance premium 10% 15 Interest, royalty or commission 20% 16 Legal service 20% 17 Machinery rent 15% 18 Management or event management 20% 19 Pre-shipment inspection service 30% 28

Non-resident withholding tax under Section 56 SL. No Description of payment Rate 14 Insurance premium 10% 15 Interest, royalty or commission 20% 16 Legal service 20% 17 Machinery rent 15% 18 Management or event management 20% 19 Pre-shipment inspection service 30% 28

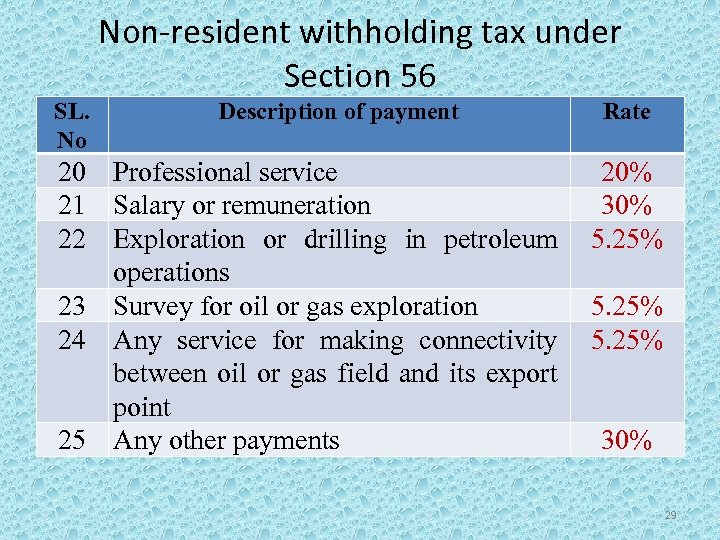

Non-resident withholding tax under Section 56 SL. No Description of payment 20 Professional service 21 Salary or remuneration 22 Exploration or drilling in petroleum operations 23 Survey for oil or gas exploration 24 Any service for making connectivity between oil or gas field and its export point 25 Any other payments Rate 20% 30% 5. 25% 30% 29

Non-resident withholding tax under Section 56 SL. No Description of payment 20 Professional service 21 Salary or remuneration 22 Exploration or drilling in petroleum operations 23 Survey for oil or gas exploration 24 Any service for making connectivity between oil or gas field and its export point 25 Any other payments Rate 20% 30% 5. 25% 30% 29

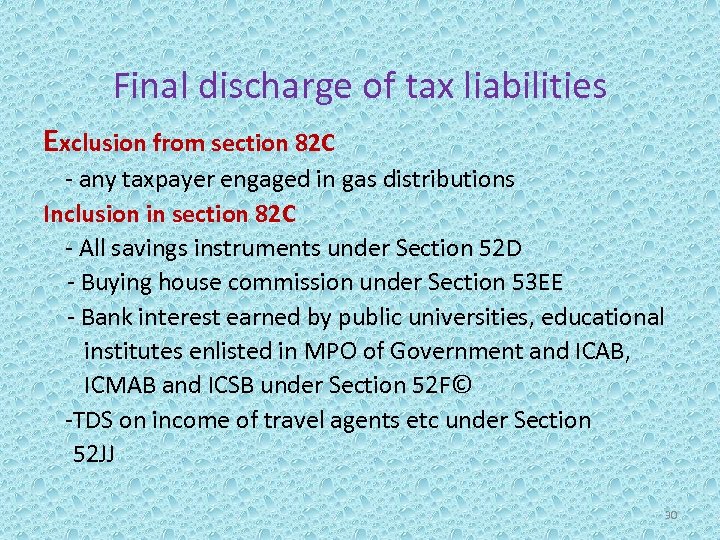

Final discharge of tax liabilities Exclusion from section 82 C - any taxpayer engaged in gas distributions Inclusion in section 82 C - All savings instruments under Section 52 D - Buying house commission under Section 53 EE - Bank interest earned by public universities, educational institutes enlisted in MPO of Government and ICAB, ICMAB and ICSB under Section 52 F© -TDS on income of travel agents etc under Section 52 JJ 30

Final discharge of tax liabilities Exclusion from section 82 C - any taxpayer engaged in gas distributions Inclusion in section 82 C - All savings instruments under Section 52 D - Buying house commission under Section 53 EE - Bank interest earned by public universities, educational institutes enlisted in MPO of Government and ICAB, ICMAB and ICSB under Section 52 F© -TDS on income of travel agents etc under Section 52 JJ 30

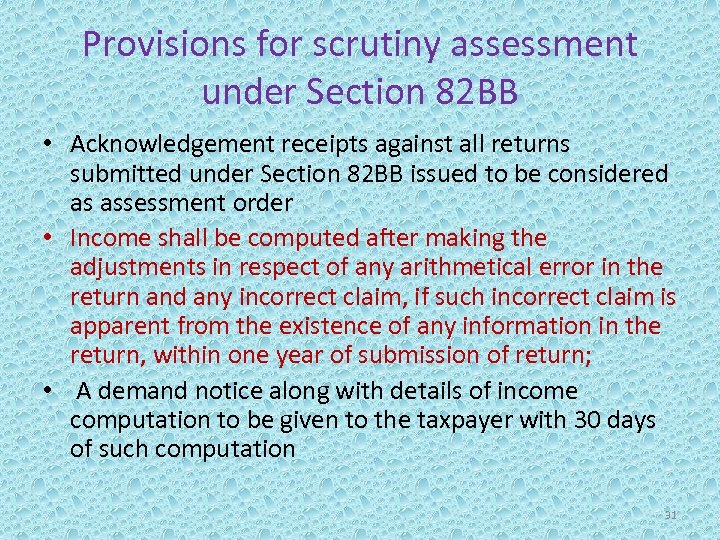

Provisions for scrutiny assessment under Section 82 BB • Acknowledgement receipts against all returns submitted under Section 82 BB issued to be considered as assessment order • Income shall be computed after making the adjustments in respect of any arithmetical error in the return and any incorrect claim, if such incorrect claim is apparent from the existence of any information in the return, within one year of submission of return; • A demand notice along with details of income computation to be given to the taxpayer with 30 days of such computation 31

Provisions for scrutiny assessment under Section 82 BB • Acknowledgement receipts against all returns submitted under Section 82 BB issued to be considered as assessment order • Income shall be computed after making the adjustments in respect of any arithmetical error in the return and any incorrect claim, if such incorrect claim is apparent from the existence of any information in the return, within one year of submission of return; • A demand notice along with details of income computation to be given to the taxpayer with 30 days of such computation 31

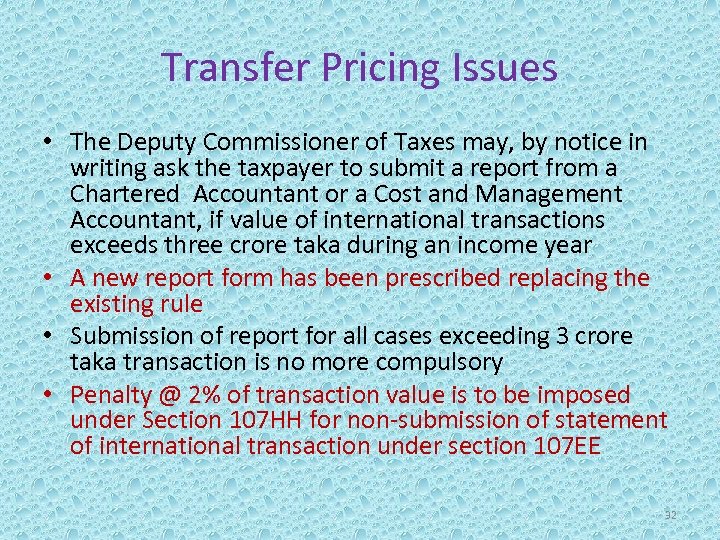

Transfer Pricing Issues • The Deputy Commissioner of Taxes may, by notice in writing ask the taxpayer to submit a report from a Chartered Accountant or a Cost and Management Accountant, if value of international transactions exceeds three crore taka during an income year • A new report form has been prescribed replacing the existing rule • Submission of report for all cases exceeding 3 crore taka transaction is no more compulsory • Penalty @ 2% of transaction value is to be imposed under Section 107 HH for non-submission of statement of international transaction under section 107 EE 32

Transfer Pricing Issues • The Deputy Commissioner of Taxes may, by notice in writing ask the taxpayer to submit a report from a Chartered Accountant or a Cost and Management Accountant, if value of international transactions exceeds three crore taka during an income year • A new report form has been prescribed replacing the existing rule • Submission of report for all cases exceeding 3 crore taka transaction is no more compulsory • Penalty @ 2% of transaction value is to be imposed under Section 107 HH for non-submission of statement of international transaction under section 107 EE 32

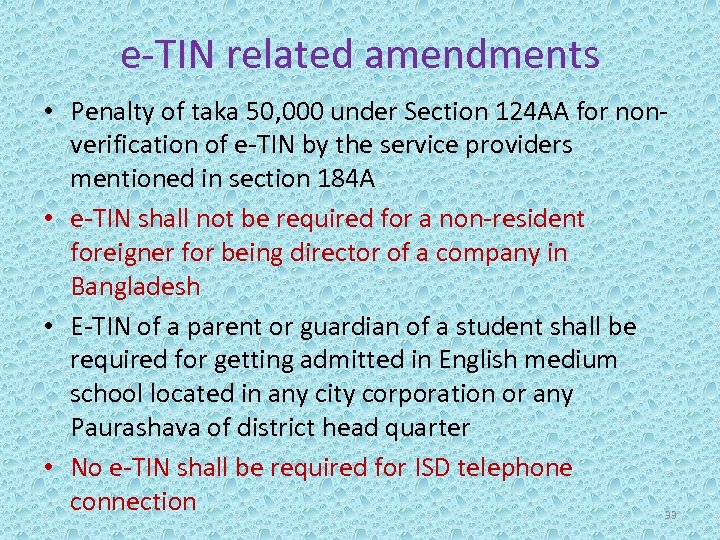

e-TIN related amendments • Penalty of taka 50, 000 under Section 124 AA for nonverification of e-TIN by the service providers mentioned in section 184 A • e-TIN shall not be required for a non-resident foreigner for being director of a company in Bangladesh • E-TIN of a parent or guardian of a student shall be required for getting admitted in English medium school located in any city corporation or any Paurashava of district head quarter • No e-TIN shall be required for ISD telephone connection 33

e-TIN related amendments • Penalty of taka 50, 000 under Section 124 AA for nonverification of e-TIN by the service providers mentioned in section 184 A • e-TIN shall not be required for a non-resident foreigner for being director of a company in Bangladesh • E-TIN of a parent or guardian of a student shall be required for getting admitted in English medium school located in any city corporation or any Paurashava of district head quarter • No e-TIN shall be required for ISD telephone connection 33

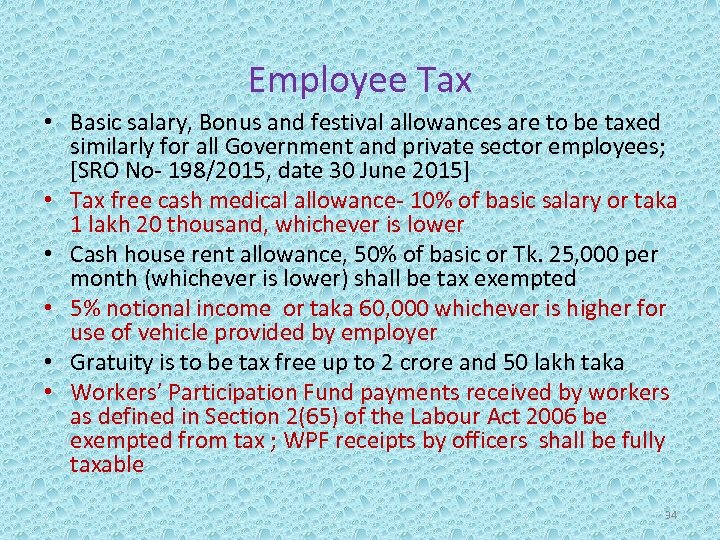

Employee Tax • Basic salary, Bonus and festival allowances are to be taxed similarly for all Government and private sector employees; [SRO No- 198/2015, date 30 June 2015] • Tax free cash medical allowance- 10% of basic salary or taka 1 lakh 20 thousand, whichever is lower • Cash house rent allowance, 50% of basic or Tk. 25, 000 per month (whichever is lower) shall be tax exempted • 5% notional income or taka 60, 000 whichever is higher for use of vehicle provided by employer • Gratuity is to be tax free up to 2 crore and 50 lakh taka • Workers’ Participation Fund payments received by workers as defined in Section 2(65) of the Labour Act 2006 be exempted from tax ; WPF receipts by officers shall be fully taxable 34

Employee Tax • Basic salary, Bonus and festival allowances are to be taxed similarly for all Government and private sector employees; [SRO No- 198/2015, date 30 June 2015] • Tax free cash medical allowance- 10% of basic salary or taka 1 lakh 20 thousand, whichever is lower • Cash house rent allowance, 50% of basic or Tk. 25, 000 per month (whichever is lower) shall be tax exempted • 5% notional income or taka 60, 000 whichever is higher for use of vehicle provided by employer • Gratuity is to be tax free up to 2 crore and 50 lakh taka • Workers’ Participation Fund payments received by workers as defined in Section 2(65) of the Labour Act 2006 be exempted from tax ; WPF receipts by officers shall be fully taxable 34

Other amendments 1 • Dividend received from a listed company up to taka 25 thousand shall be tax exempted • Imported software to be allowed depreciation @10% • Cost value of vehicles for depreciation purpose shall be allowed up to taka twenty five lakh • Interest from wage earner bonds (Taka, USD, Pound Sterling, Euro) fully exempted • Income from local software development, ITES services and NTTN shall be tax free up to June 2024 35

Other amendments 1 • Dividend received from a listed company up to taka 25 thousand shall be tax exempted • Imported software to be allowed depreciation @10% • Cost value of vehicles for depreciation purpose shall be allowed up to taka twenty five lakh • Interest from wage earner bonds (Taka, USD, Pound Sterling, Euro) fully exempted • Income from local software development, ITES services and NTTN shall be tax free up to June 2024 35

Other amendments 2 • Income (except interest and dividend) earned by educational institutions enlisted for MPO of Government that follows Government’s educational curriculum and run by Government rules and regulations shall be tax exempted • Income (except interest and dividend) of public university and professional institutions such as ICAB, ICMAB and ICSB shall be tax exempted • Foreign professionals from England, Wales, Scotland, Pakistan and India shall not be allowed for tax practice in Bangladesh 36

Other amendments 2 • Income (except interest and dividend) earned by educational institutions enlisted for MPO of Government that follows Government’s educational curriculum and run by Government rules and regulations shall be tax exempted • Income (except interest and dividend) of public university and professional institutions such as ICAB, ICMAB and ICSB shall be tax exempted • Foreign professionals from England, Wales, Scotland, Pakistan and India shall not be allowed for tax practice in Bangladesh 36

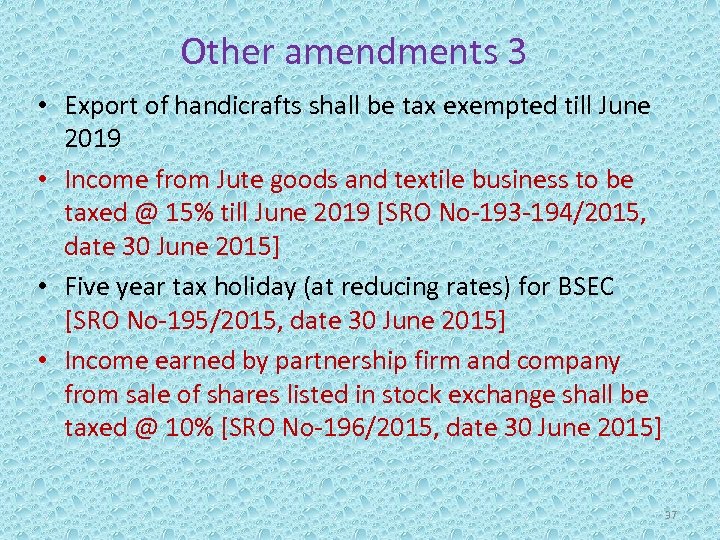

Other amendments 3 • Export of handicrafts shall be tax exempted till June 2019 • Income from Jute goods and textile business to be taxed @ 15% till June 2019 [SRO No-193 -194/2015, date 30 June 2015] • Five year tax holiday (at reducing rates) for BSEC [SRO No-195/2015, date 30 June 2015] • Income earned by partnership firm and company from sale of shares listed in stock exchange shall be taxed @ 10% [SRO No-196/2015, date 30 June 2015] 37

Other amendments 3 • Export of handicrafts shall be tax exempted till June 2019 • Income from Jute goods and textile business to be taxed @ 15% till June 2019 [SRO No-193 -194/2015, date 30 June 2015] • Five year tax holiday (at reducing rates) for BSEC [SRO No-195/2015, date 30 June 2015] • Income earned by partnership firm and company from sale of shares listed in stock exchange shall be taxed @ 10% [SRO No-196/2015, date 30 June 2015] 37

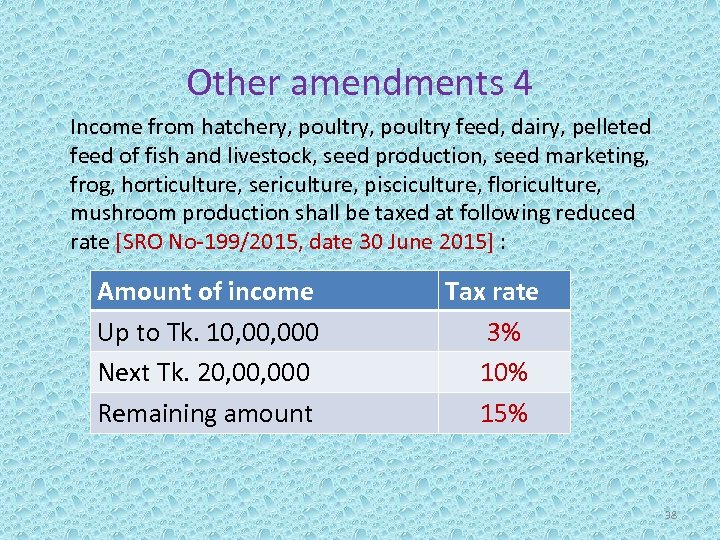

Other amendments 4 Income from hatchery, poultry feed, dairy, pelleted feed of fish and livestock, seed production, seed marketing, frog, horticulture, sericulture, pisciculture, floriculture, mushroom production shall be taxed at following reduced rate [SRO No-199/2015, date 30 June 2015] : Amount of income Up to Tk. 10, 000 Next Tk. 20, 000 Remaining amount Tax rate 3% 10% 15% 38

Other amendments 4 Income from hatchery, poultry feed, dairy, pelleted feed of fish and livestock, seed production, seed marketing, frog, horticulture, sericulture, pisciculture, floriculture, mushroom production shall be taxed at following reduced rate [SRO No-199/2015, date 30 June 2015] : Amount of income Up to Tk. 10, 000 Next Tk. 20, 000 Remaining amount Tax rate 3% 10% 15% 38

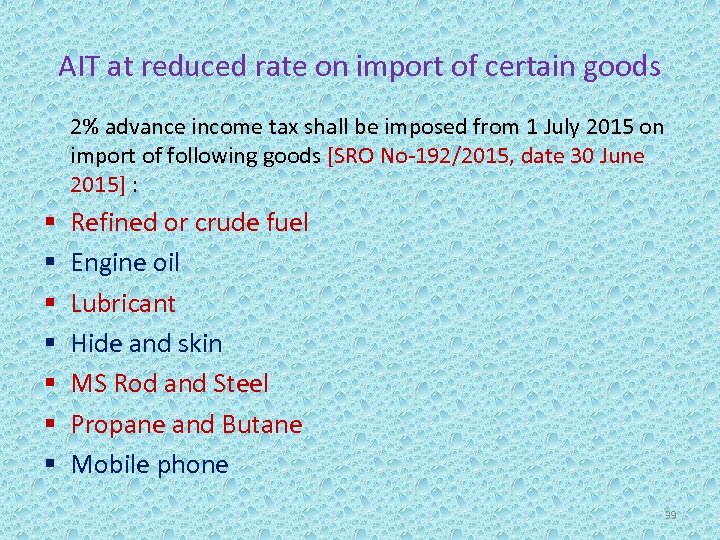

AIT at reduced rate on import of certain goods 2% advance income tax shall be imposed from 1 July 2015 on import of following goods [SRO No-192/2015, date 30 June 2015] : § § § § Refined or crude fuel Engine oil Lubricant Hide and skin MS Rod and Steel Propane and Butane Mobile phone 39

AIT at reduced rate on import of certain goods 2% advance income tax shall be imposed from 1 July 2015 on import of following goods [SRO No-192/2015, date 30 June 2015] : § § § § Refined or crude fuel Engine oil Lubricant Hide and skin MS Rod and Steel Propane and Butane Mobile phone 39