6c6894311e51035072663ecfafb74d6b.ppt

- Количество слайдов: 20

Indirect Cost Model (ICM) (a Contributing Model of CAICAT) 13 June, 2002 SCEA National Conference Phoenix, AZ CAI Program Data - Distribution limited to US Government and CAI Industry Participants

Agenda CAICAT Overview Soumen Saha Northrop Grumman ICM Development Bernard Fox RAND former MCR ICM Demonstration Debra Lehman MCR Inc. ICM Application Soumen Saha Northrop Grumman Summary Soumen Saha Northrop Grumman

CAICAT Objective • Develop a Credible Rapid Cost Evaluation System for an Airframe Which Can Address State-of-Practice, State-of-the-Art, and Emerging Design and Manufacturing Technologies. The Tool Should Address All Elements of Direct and Indirect Costs

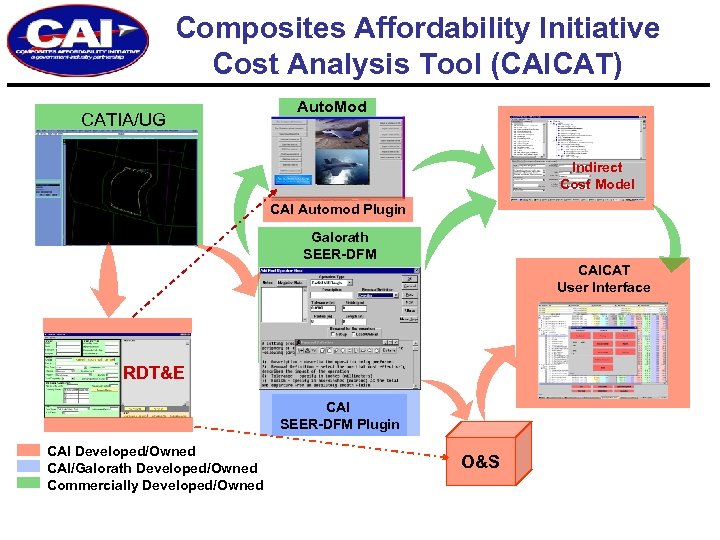

Composites Affordability Initiative Cost Analysis Tool (CAICAT) CATIA/UG Auto. Mod Indirect Cost Model CAI Automod Plugin Galorath SEER-DFM CAICAT User Interface RDT&E CAI SEER-DFM Plugin CAI Developed/Owned CAI/Galorath Developed/Owned Commercially Developed/Owned O&S

CAICAT Status • Individual Modules Version 1. 0 Complete – – – Direct (SEER DFM-w-CAI Plug-In) Indirect (MCR Developed) RDT&E Simulation (Automod) O&S • Validation – Functional Validation Completed – Some Modules Validated at All Companies • Integration – Systems Requirements Document Completed – Systems Requirement Specification Completed – Prototype Integration Done

Agenda • CAICAT Overview Soumen Saha Northrop Grumman • ICM Development Bernard Fox RAND former MCR • ICM Demonstration Debra Lehman MCR Inc. • ICM Application Soumen Saha Northrop Grumman • Summary Soumen Saha Northrop Grumman

ICM Development Team MCR Inc. Bernard Fox Debra Lehman Jeff Johnson Boeing Joseph Falque Lockheed Martin Bryan Tom General Electric Steve Mitchell Mark Cook Northrop Grumman Soumen Saha USAF Alan Herner NAVAIR Raj Raman

Background • Direct Costs – Resources Consumed in Development, Production, and Delivery of Identifiable Product, e. g. Fab/Ass’y. Labor, Direct Material – Normally Tracked and Assigned to Specific Products • Indirect Costs – Supporting Resources Which Cannot Be Easily Identified With a Specific Product, e. g. Facilities, Services, Support Labor – Normally Tracked As a “Pool” and Allocated to Direct Costs on the Basis of Direct Labor Hours, Direct Material $, Floor Space, Etc.

Background (Cont’d) • <30% of Product Cost Is Touch Labor or Direct Material • Indirect Cost Effects of Design/ Process Decisions Are Not Explicitly Addressed by Current Cost Models – Traditional Approach Is To Estimate Direct Costs and Apply a “Wrap Rate” – Wrap Rates Vary Across Companies and Within Companies Over Time – Approach Is Not Sensitive To Alternatives Which May Change Wrap Rates • Need Capability to Do Total Cost Tradeoffs

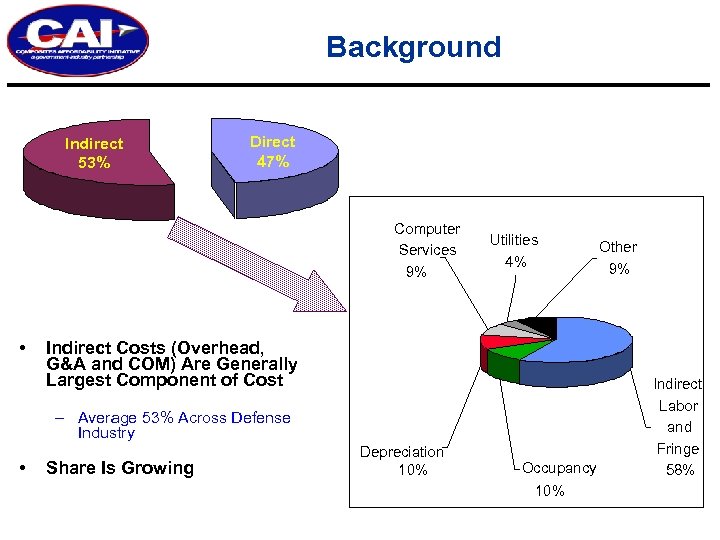

Background Indirect 53% Direct 47% Computer Services 9% • Utilities 4% Indirect Costs (Overhead, G&A and COM) Are Generally Largest Component of Cost – Average 53% Across Defense Industry • Share Is Growing Depreciation 10% Occupancy 10% Other 9% Indirect Labor and Fringe 58%

ICM Objectives • Capture Effects of Various Airframe Production Alternatives on Indirect Costs • Evaluate Indirect Cost Impacts as Part of Design Trades • Focus on Relative Costs Among Alternatives • Demonstrate Ability to Model Relevant Indirect Costs Using Available Data Sources – Current Practices – Future Directions

ICM Approach • Review Each Member’s Account Structure and Data Availability – Ensure Model Will Be Usable, Credible • Use MCR “Cost Estimating Generic Structure” (CEGS) – Map Cost Accounts Into Standardized Cost Element Structure – Focus on Most Relevant Cost Elements • High Value • High Variability • Address Total Cost Impacts • Assume Greenfield Site for Initial Model Development – New, Dedicated Facility – “Industry Average” Cost Relationships Developed by Member Consensus – Extendable to Handle Existing Facilities and Actual Data of Each Member Company

ICM Features • Works in Windows 95/98/2000 Environment • Cost Elements Can Be Easily Restructured to Meet Company Needs & Accounting Systems • Estimating Relationships Can Be Developed for Any Meaningful Parameter Using Linear, Quadratic & Iterative Relationships With up to Three Variables • ICM Has Been Designed to Work in Stand-Alone Mode or in an Automated Manner With Other Contributing Models of CAICAT

Agenda • CAICAT Overview Soumen Saha Northrop Grumman • ICM Development Bernard Fox RAND former MCR • ICM Demonstration Debra Lehman MCR Inc. • ICM Application Soumen Saha Northrop Grumman • Summary Soumen Saha Northrop Grumman

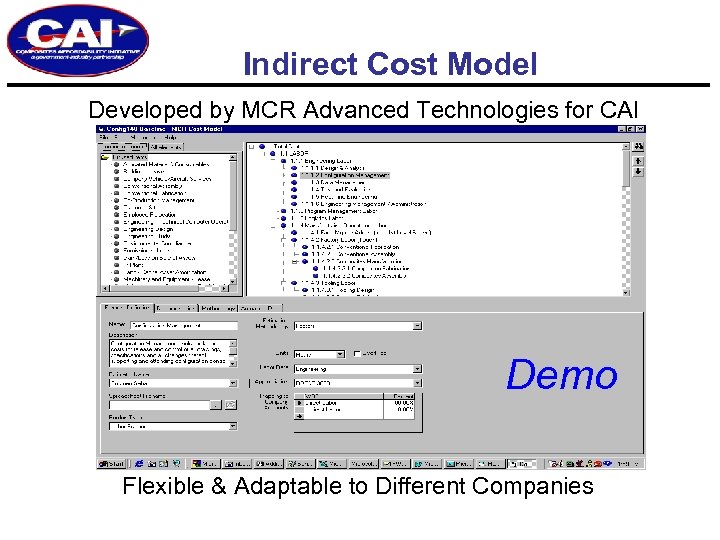

Indirect Cost Model Developed by MCR Advanced Technologies for CAI Demo Flexible & Adaptable to Different Companies

Agenda • CAICAT Overview Soumen Saha Northrop Grumman • ICM Development Bernard Fox RAND former MCR • ICM Demonstration Debra Lehman MCR Inc. • ICM Application Soumen Saha Northrop Grumman • Summary Soumen Saha Northrop Grumman

ICM Application • ICM May Be Used in Different Ways to Meet Specific Company Objectives • ICM Is Not Intended to Replace Accounting Structures • ICM May Be Used for Evaluation of Program Alternates at Greenfield Sites Based on Product Configuration and Program Parametrics • ICM May Be Used for Trade Studies and What-ifs for Configuration/Process/Schedule/Make-Buy Decisions in Existing Business Environment • ICM Is Effective at Program Levels and Not at the Detail Part Level • ICM Takes into Account All Cost Elements of Product Cost

An Application Approach • Populate ICM With Actual Program Data – – – – Schedule Labor Rates Facilities Required Touch Labor Hours Direct Material $ CERs for Cost Elements Other • Match Bottom Line $ to Traditional Cost Sheet • Review CER’s of Support Elements and Adjust for Meaningful Relationship Matching Bottom Line $ • Run Model for Different Scenarios to Reflect Changed Cost at Program Level

Agenda • CAICAT Overview Soumen Saha Northrop Grumman • ICM Development Bernard Fox RAND former MCR • ICM Demonstration Debra Lehman MCR Inc. • ICM Application Soumen Saha Northrop Grumman • Summary Soumen Saha Northrop Grumman

Summary • ICM Is an Unique Cost Model Developed to Address the Effects on Non-touch Labor & Nondirect Material Cost Elements • ICM Is Flexible to Accommodate the Accounting Structure of Different Companies • ICM Can Evaluate the Cost Effects of Changing Configuration, Process, Schedule & Make-buy Decisions • ICM Identifies for Management the Key Cost Drivers of Product Cost

6c6894311e51035072663ecfafb74d6b.ppt