57fdbb432c2a6f442f80962112260a06.ppt

- Количество слайдов: 35

Indiana Multimodal Freight & Mobility Plan Project Update presented to Indiana Logistics Summit Indianapolis, Indiana presented by Keith Bucklew Director - Freight Mobility Indiana Department of Transportation November 12, 2008 Barb Sloan Project Manager Cambridge Systematics

Indiana Multimodal Freight & Mobility Plan Scope of Work Identify Existing and Future Conditions • Supply and Demand • Policy and Issues • Passenger Rail Identify Freight Transportation Gaps & Needs Establish Methodology to Evaluate & Prioritize Freight Projects Explore Funding Sources Establish Implementation & Action Plan 1

Existing & Future Conditions Key Issues from Stakeholder Interviews Truck parking 24 -hour distribution of freight movement / deliveries Increasing highway congestion Availability of skilled labor Rail connectivity to west coast that can bypass Chicago Connectivity between (rail) operators and modes Funding / support for intermodal facilities (several potential locations have been identified) Significant % of pass-through rail traffic in Indiana Growth potential for freight generating uses around Indianapolis International Airport Increased opportunities for ports

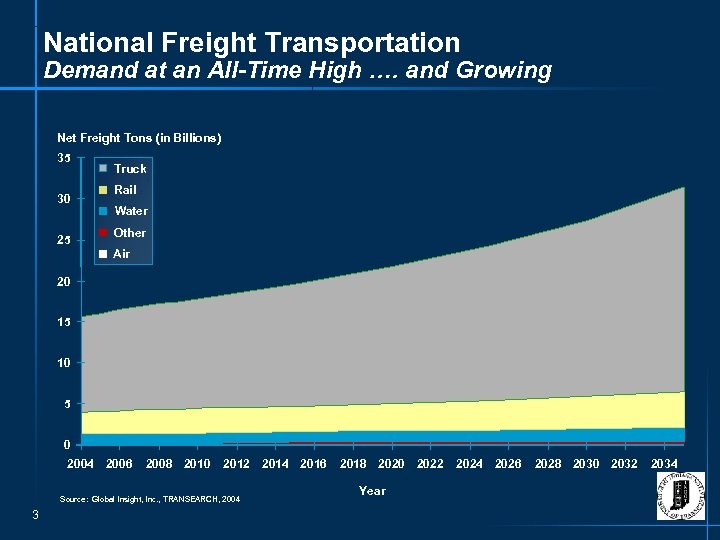

National Freight Transportation Demand at an All-Time High …. and Growing Net Freight Tons (in Billions) 35 30 25 Truck Rail Water Other Air 20 15 10 5 0 2004 2006 2008 2010 2012 2014 2016 Source: Global Insight, Inc. , TRANSEARCH, 2004 3 2018 2020 2022 Year 2024 2026 2028 2030 2032 2034

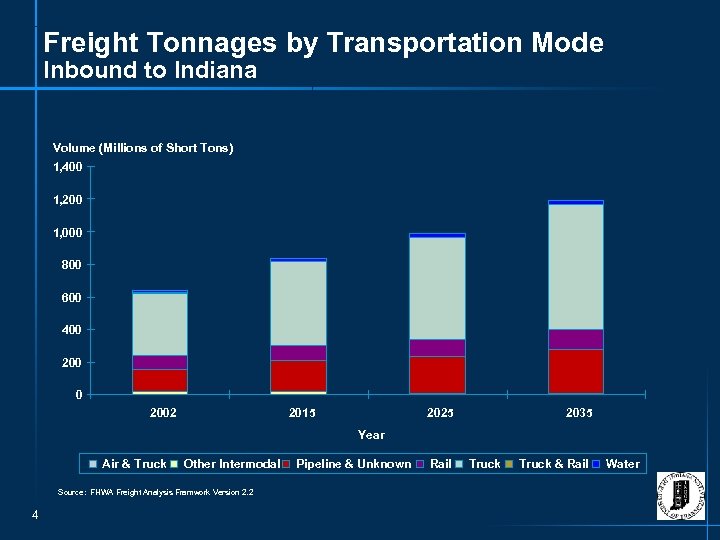

Freight Tonnages by Transportation Mode Inbound to Indiana Volume (Millions of Short Tons) 1, 400 1, 200 1, 000 800 600 400 2002 2015 2025 2035 Year Air & Truck Other Intermodal Source: FHWA Freight Analysis Framwork Version 2. 2 4 Pipeline & Unknown Rail Truck & Rail Water

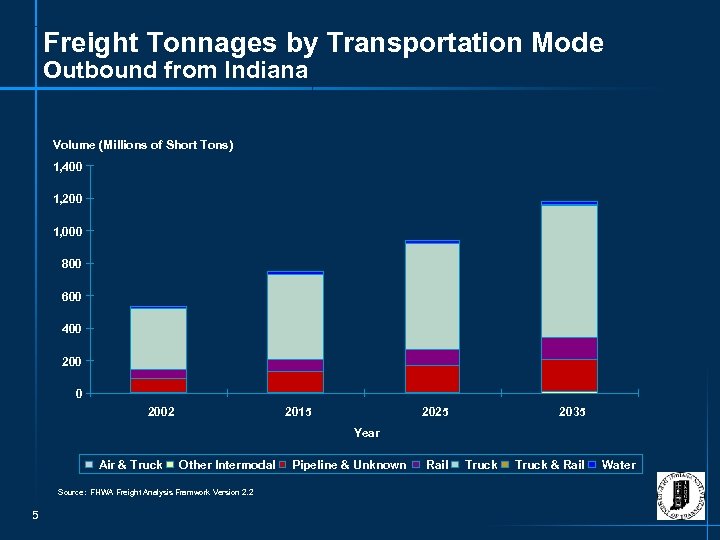

Freight Tonnages by Transportation Mode Outbound from Indiana Volume (Millions of Short Tons) 1, 400 1, 200 1, 000 800 600 400 2002 2015 2025 2035 Year Air & Truck Other Intermodal Source: FHWA Freight Analysis Framwork Version 2. 2 5 Pipeline & Unknown Rail Truck & Rail Water

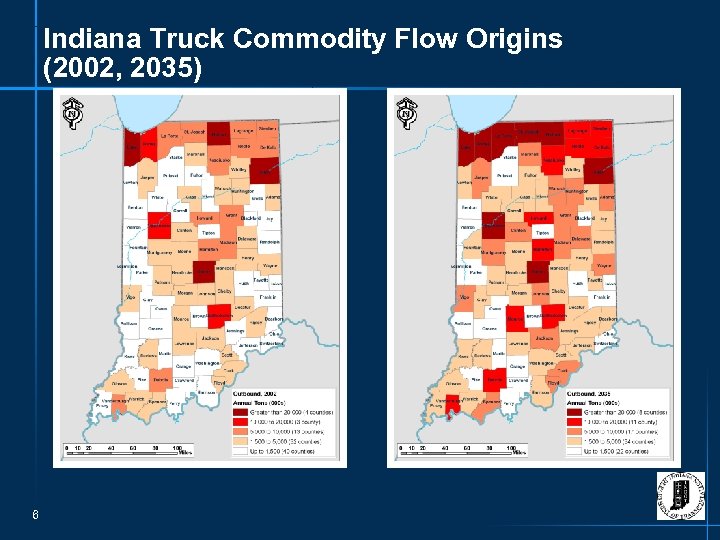

Indiana Truck Commodity Flow Origins (2002, 2035) 6

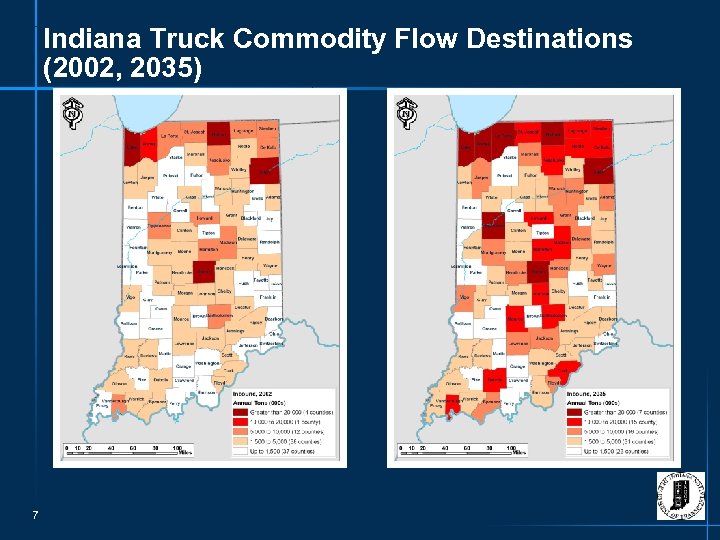

Indiana Truck Commodity Flow Destinations (2002, 2035) 7

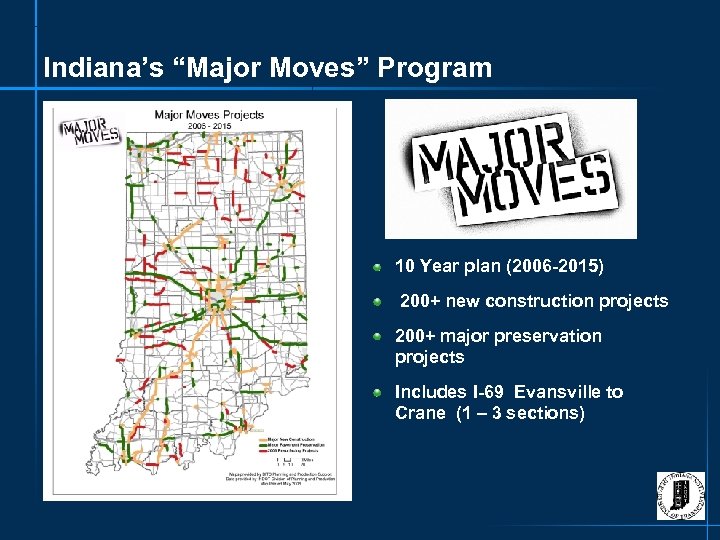

Indiana’s “Major Moves” Program 10 Year plan (2006 -2015) 200+ new construction projects 200+ major preservation projects Includes I-69 Evansville to Crane (1 – 3 sections)

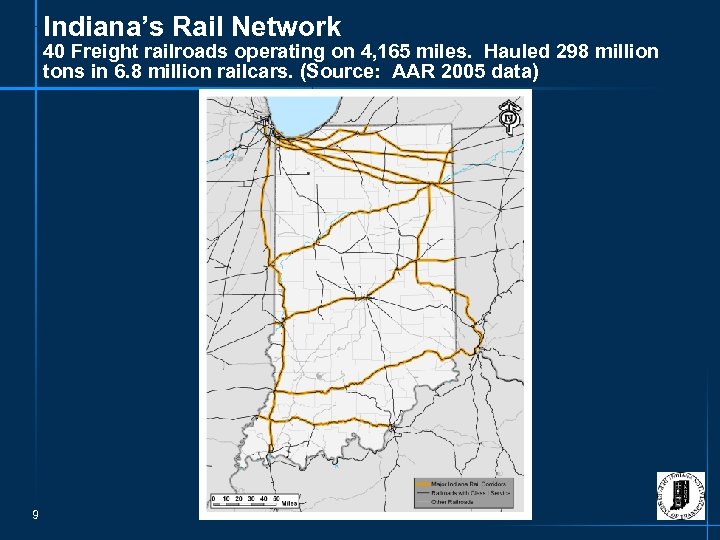

Indiana’s Rail Network 40 Freight railroads operating on 4, 165 miles. Hauled 298 million tons in 6. 8 million railcars. (Source: AAR 2005 data) 9

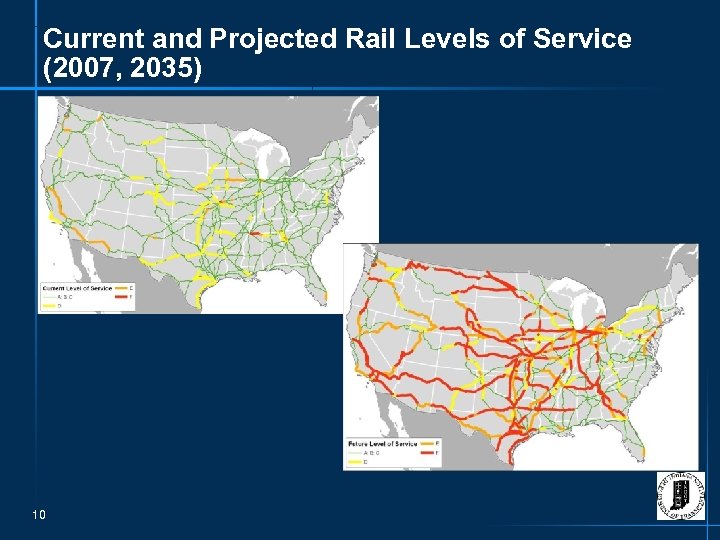

Current and Projected Rail Levels of Service (2007, 2035) 10

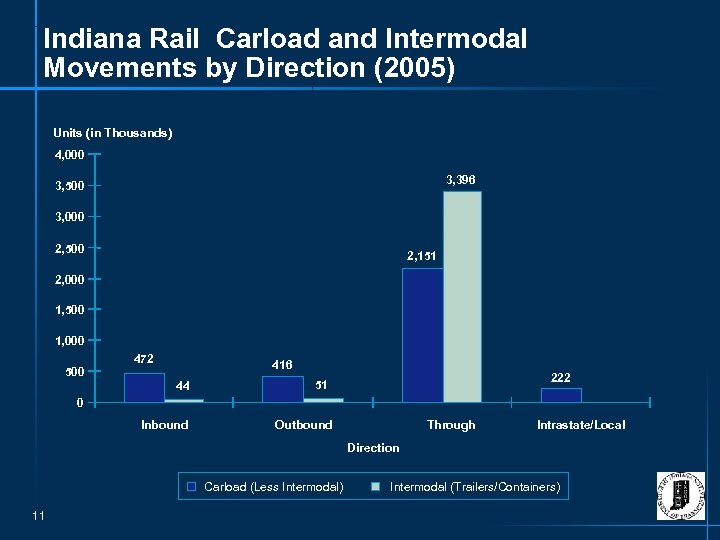

Indiana Rail Carload and Intermodal Movements by Direction (2005) Units (in Thousands) 4, 000 3, 396 3, 500 3, 000 2, 500 2, 151 2, 000 1, 500 1, 000 500 472 416 44 222 51 0 Inbound Outbound Through Intrastate/Local Direction Carload (Less Intermodal) 11 Intermodal (Trailers/Containers)

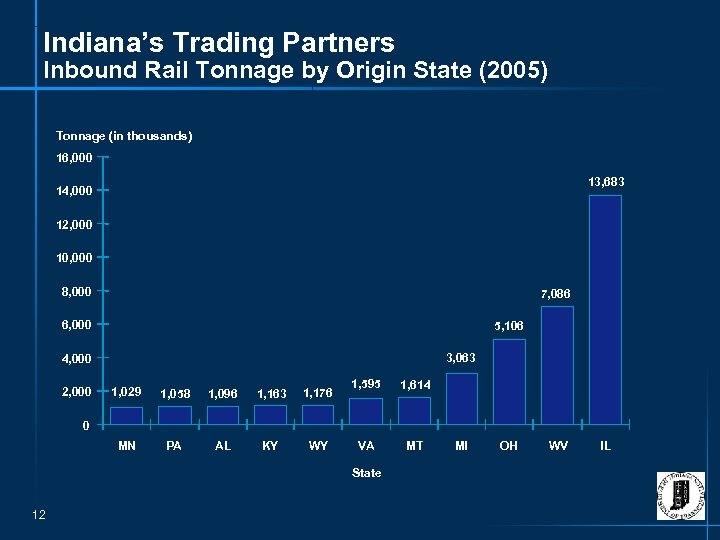

Indiana’s Trading Partners Inbound Rail Tonnage by Origin State (2005) Tonnage (in thousands) 16, 000 13, 683 14, 000 12, 000 10, 000 8, 000 7, 086 6, 000 5, 106 3, 063 4, 000 2, 000 1, 029 1, 058 1, 096 1, 163 1, 176 MN PA AL KY WY 1, 595 1, 614 VA MT 0 State 12 MI OH WV IL

Indiana’s Trading Partners Outbound Rail Tonnage by Destination State (2005) Tonnage (in Thousands) 4, 500 3, 867 4, 000 3, 947 3, 480 3, 500 3, 000 2, 338 2, 500 NC TN 1, 883 2, 000 1, 497 1, 500 2, 457 1, 578 KY MI 1, 188 1, 000 500 0 FL AL State 13 OH GA IL

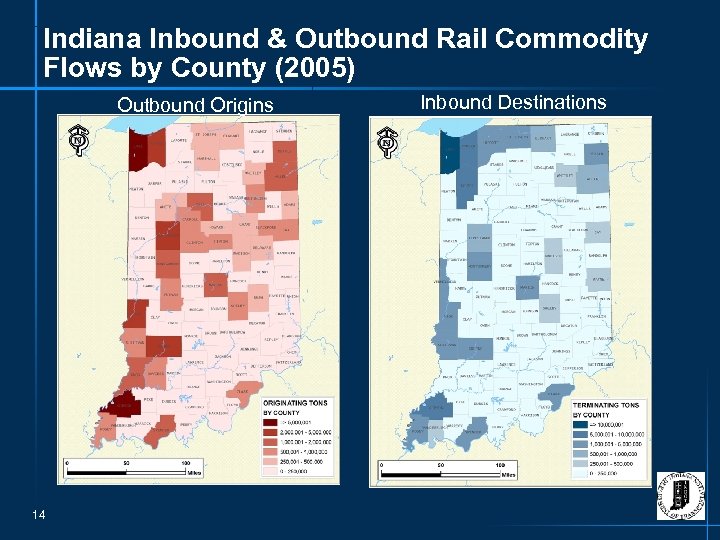

Indiana Inbound & Outbound Rail Commodity Flows by County (2005) Outbound Origins 14 Inbound Destinations

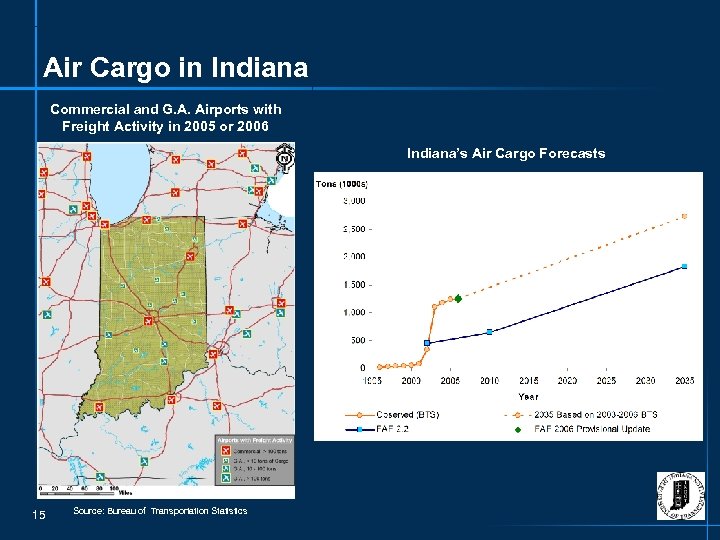

Air Cargo in Indiana Commercial and G. A. Airports with Freight Activity in 2005 or 2006 Indiana’s Air Cargo Forecasts 15 Source: Bureau of Transportation Statistics

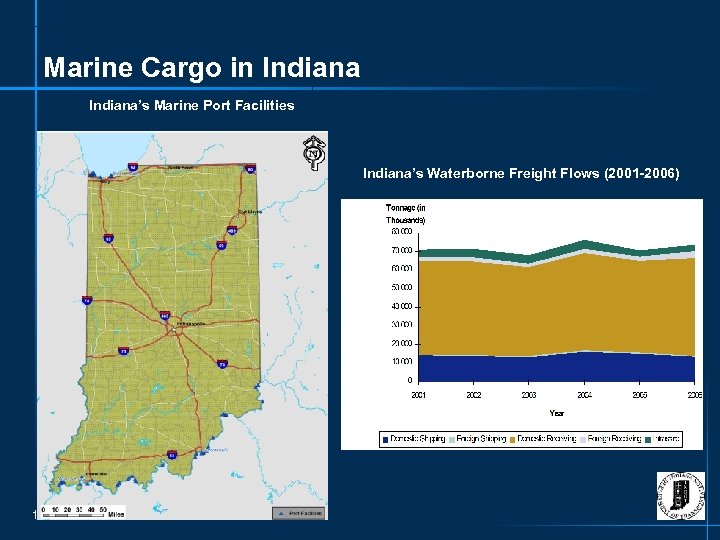

Marine Cargo in Indiana’s Marine Port Facilities Indiana’s Waterborne Freight Flows (2001 -2006) 16

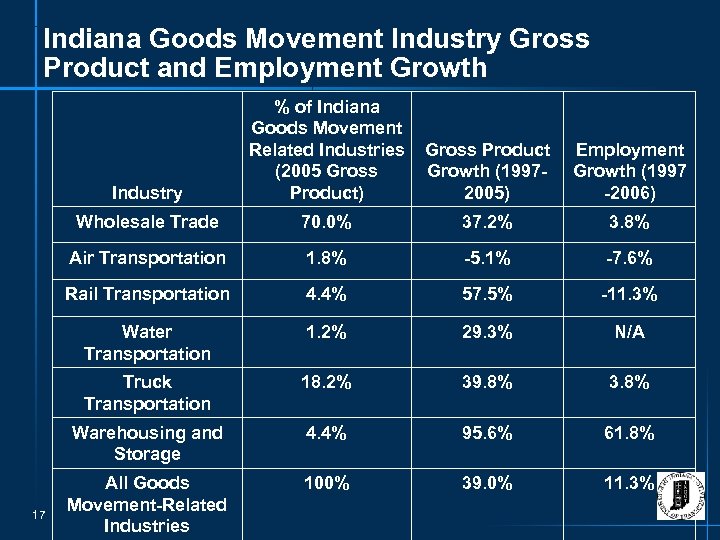

Indiana Goods Movement Industry Gross Product and Employment Growth Industry Gross Product Growth (19972005) Employment Growth (1997 -2006) Wholesale Trade 70. 0% 37. 2% 3. 8% Air Transportation 1. 8% -5. 1% -7. 6% Rail Transportation 4. 4% 57. 5% -11. 3% Water Transportation 1. 2% 29. 3% N/A Truck Transportation 18. 2% 39. 8% 3. 8% Warehousing and Storage 17 % of Indiana Goods Movement Related Industries (2005 Gross Product) 4. 4% 95. 6% 61. 8% All Goods Movement-Related Industries 100% 39. 0% 11. 3%

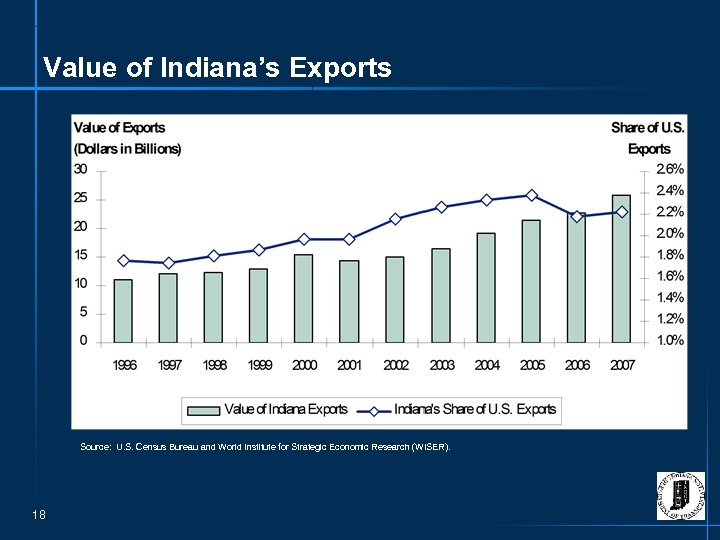

Value of Indiana’s Exports Source: U. S. Census Bureau and World Institute for Strategic Economic Research (WISER). 18

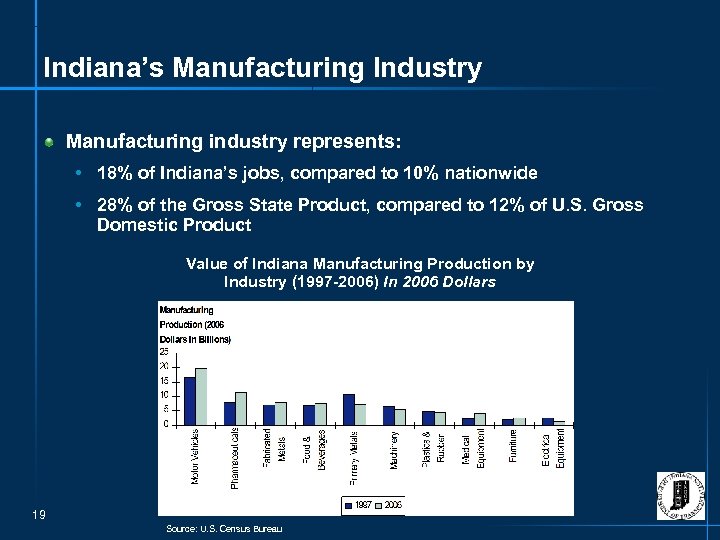

Indiana’s Manufacturing Industry Manufacturing industry represents: • 18% of Indiana’s jobs, compared to 10% nationwide • 28% of the Gross State Product, compared to 12% of U. S. Gross Domestic Product Value of Indiana Manufacturing Production by Industry (1997 -2006) In 2006 Dollars 19 Source: U. S. Census Bureau

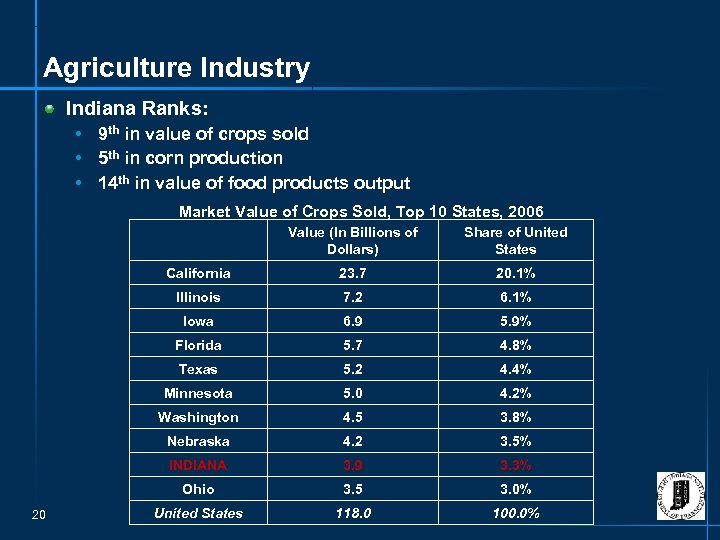

Agriculture Industry Indiana Ranks: • 9 th in value of crops sold • 5 th in corn production • 14 th in value of food products output Market Value of Crops Sold, Top 10 States, 2006 Value (In Billions of Dollars) California 23. 7 20. 1% Illinois 7. 2 6. 1% Iowa 6. 9 5. 9% Florida 5. 7 4. 8% Texas 5. 2 4. 4% Minnesota 5. 0 4. 2% Washington 4. 5 3. 8% Nebraska 4. 2 3. 5% INDIANA 3. 9 3. 3% Ohio 20 Share of United States 3. 5 3. 0% United States 118. 0 100. 0%

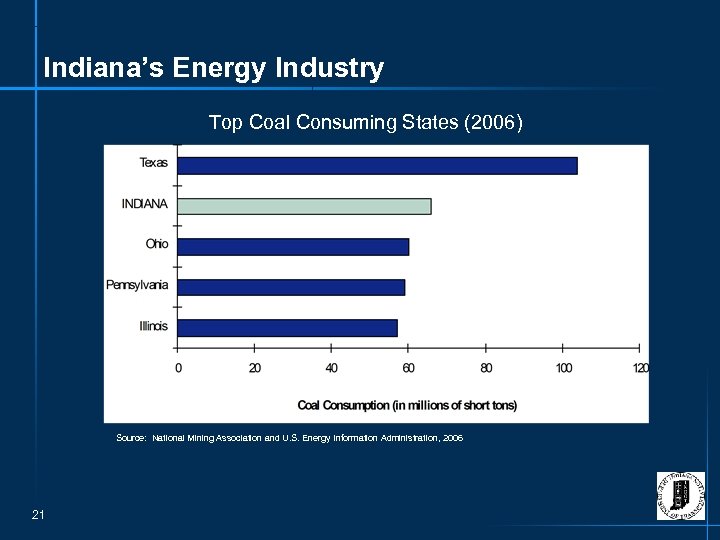

Indiana’s Energy Industry Top Coal Consuming States (2006) Source: National Mining Association and U. S. Energy Information Administration, 2006 21

Freight Related Policy Existing Freight Planning Activities Roles of the MPOs Funding Private Sector Involvement Legislation

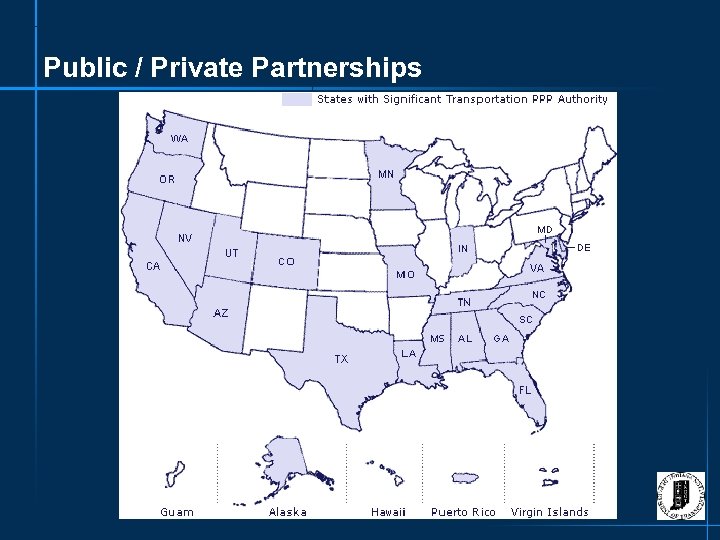

Public / Private Partnerships

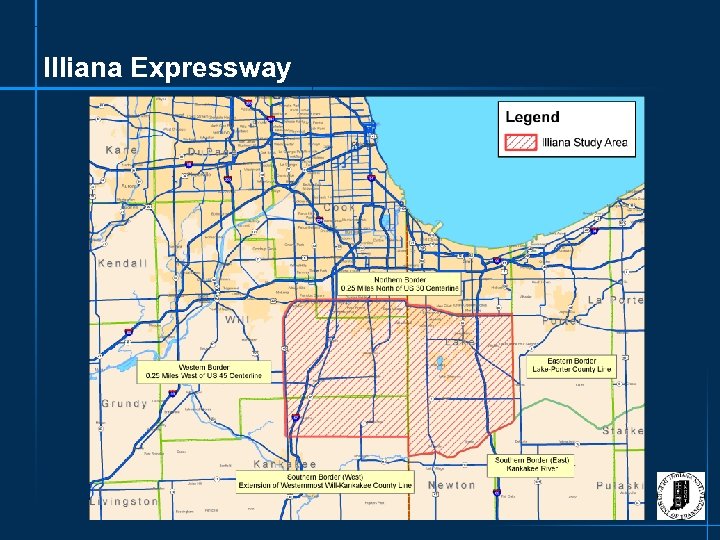

Illiana Expressway

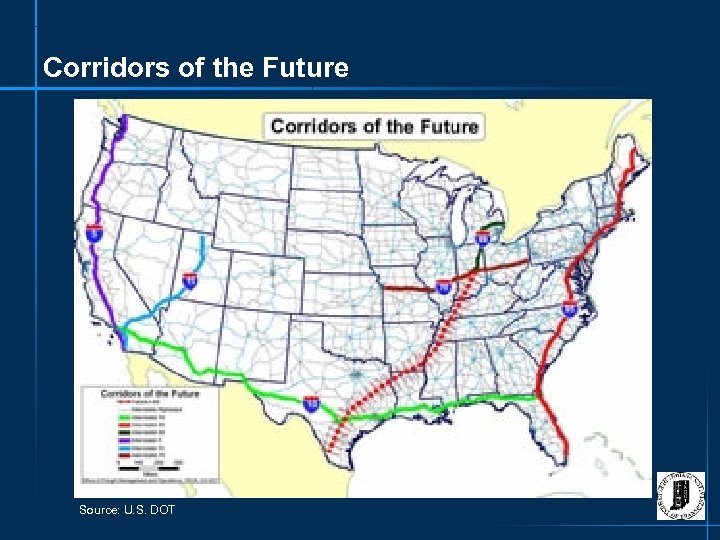

Corridors of the Future Source: U. S. DOT

I-70 Dedicated Truck Lanes

Additional Legislative Issues Corridor Protection Truck Size & Weight Truck Routes Hazardous Material Restrictions Truck Parking Delivery Time Restrictions

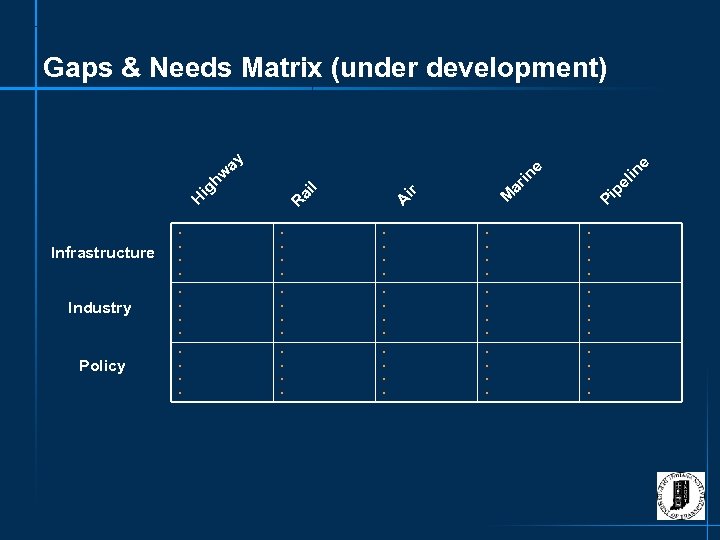

in e Pi pe l in ar l M A ir ai R H ig hw e ay Gaps & Needs Matrix (under development) • • • • • • • • Policy • • Industry • • Infrastructure • • • • • • •

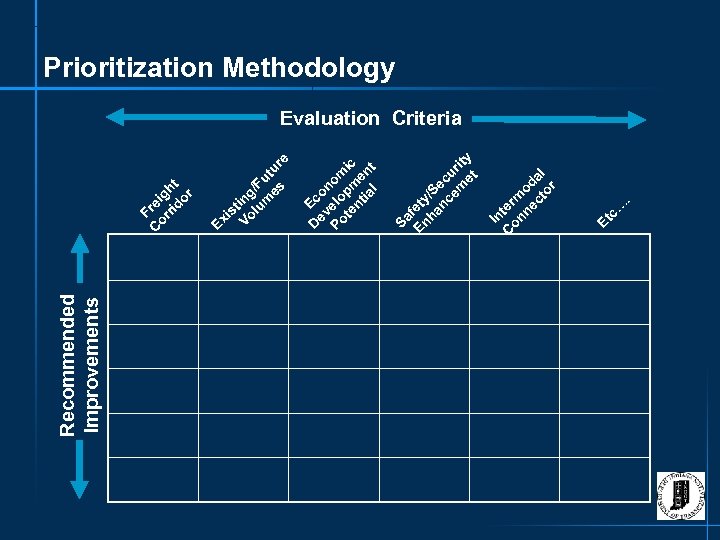

Recommended Improvements . c… Et Sa En fety ha /S nc ec em uri et ty In C ter on m ne od ct al or D Ec ev on Po elo om te pm ic nt e ia nt l Vo ting lu /F m ut es ur e is Ex F C rei or g rid ht or Prioritization Methodology Evaluation Criteria

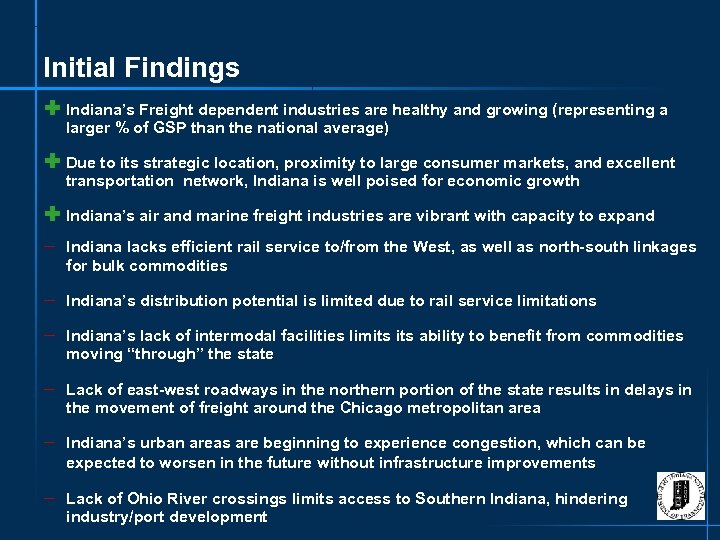

Initial Findings Ì Indiana’s Freight dependent industries are healthy and growing (representing a larger % of GSP than the national average) Ì Due to its strategic location, proximity to large consumer markets, and excellent transportation network, Indiana is well poised for economic growth Ì Indiana’s air and marine freight industries are vibrant with capacity to expand – Indiana lacks efficient rail service to/from the West, as well as north-south linkages for bulk commodities – Indiana’s distribution potential is limited due to rail service limitations – Indiana’s lack of intermodal facilities limits ability to benefit from commodities moving “through” the state – Lack of east-west roadways in the northern portion of the state results in delays in the movement of freight around the Chicago metropolitan area – Indiana’s urban areas are beginning to experience congestion, which can be expected to worsen in the future without infrastructure improvements – Lack of Ohio River crossings limits access to Southern Indiana, hindering industry/port development

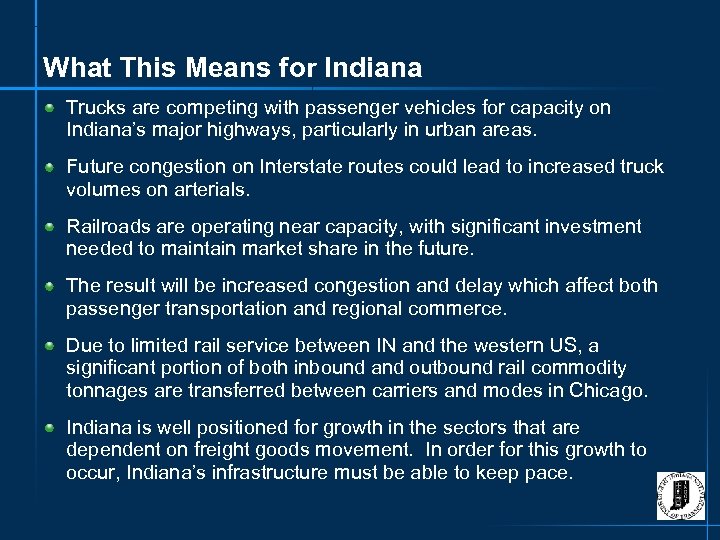

What This Means for Indiana Trucks are competing with passenger vehicles for capacity on Indiana’s major highways, particularly in urban areas. Future congestion on Interstate routes could lead to increased truck volumes on arterials. Railroads are operating near capacity, with significant investment needed to maintain market share in the future. The result will be increased congestion and delay which affect both passenger transportation and regional commerce. Due to limited rail service between IN and the western US, a significant portion of both inbound and outbound rail commodity tonnages are transferred between carriers and modes in Chicago. Indiana is well positioned for growth in the sectors that are dependent on freight goods movement. In order for this growth to occur, Indiana’s infrastructure must be able to keep pace.

Freight Movement is the Economy in Motion FREIGHT MOBILITY

QUESTIONS? ?

For More Information, Contact………… Keith Bucklew Director – Freight Mobility Indiana Department of Transportation Email: kbucklew@indot. in. gov Phone: 317 -233 -2376 Web page: http: //freightmobility. in. gov Barb Sloan, P. E. Senior Associate Cambridge Systematics Email: bsloan@camsys. com Phone: 312 -665 -0201 Web page: www. camsys. com

57fdbb432c2a6f442f80962112260a06.ppt