a211a909f99a0b0b290a610fe3887c11.ppt

- Количество слайдов: 12

INDIA INTERNATIONAL GOLD CONVENTION - 2017 Commodity Derivatives Shri S K Mohanty (Executive Director) SEBI August 12, 2017 11 - 13 August 2017, Grand Hyatt, Goa 1

INDIA INTERNATIONAL GOLD CONVENTION - 2017 Commodity Derivatives Shri S K Mohanty (Executive Director) SEBI August 12, 2017 11 - 13 August 2017, Grand Hyatt, Goa 1

Historical background • Historical background dates back 1875 • Setting up of Forward Markets Commission (FMC) erstwhile regulator in 1953 • The New National Agricultural Policy of 2000 recognized the role of derivatives markets in price discovery and price risk management • Recognition to the Electronic National Commodity Derivatives Exchanges in 2003 • Power to regulate Commodity Derivatives and its Exchanges transferred to SEBI in 2015 11 - 13 August 2017, Grand Hyatt, Goa 2

Historical background • Historical background dates back 1875 • Setting up of Forward Markets Commission (FMC) erstwhile regulator in 1953 • The New National Agricultural Policy of 2000 recognized the role of derivatives markets in price discovery and price risk management • Recognition to the Electronic National Commodity Derivatives Exchanges in 2003 • Power to regulate Commodity Derivatives and its Exchanges transferred to SEBI in 2015 11 - 13 August 2017, Grand Hyatt, Goa 2

Transition to new regulatory regime • In order to provide continuity to regulatory framework of commodity derivatives markets all prevailing rules, directions and circulars applicable to commodity derivatives exchanges were revisited. • Circulars/Guidelines of erstwhile FMC were analyzed, updated and fresh Circulars issued covering all aspects of the Commodity Derivatives. • Alignment of norms, wherever possible, in the commodity derivatives market with norms applicable in other segments of securities market. • Approval of Byelaws of exchange • Inspections of exchanges and warehouses • Exit of Non-Functional Exchanges 11 - 13 August 2017, Grand Hyatt, Goa 3

Transition to new regulatory regime • In order to provide continuity to regulatory framework of commodity derivatives markets all prevailing rules, directions and circulars applicable to commodity derivatives exchanges were revisited. • Circulars/Guidelines of erstwhile FMC were analyzed, updated and fresh Circulars issued covering all aspects of the Commodity Derivatives. • Alignment of norms, wherever possible, in the commodity derivatives market with norms applicable in other segments of securities market. • Approval of Byelaws of exchange • Inspections of exchanges and warehouses • Exit of Non-Functional Exchanges 11 - 13 August 2017, Grand Hyatt, Goa 3

Strengthening of Risk Management • Membership deposits - Base Minimum Capital & Net worth requirements • Robust Margining system Ø Upfront margin collection from members on online, real time basis Ø Margin has to be collected by members from end-clients. Ø Mark-to-Market (MTM) settlement on daily basis Ø Initial margin of 2 days and concentration margins • Provision for Settlement Guarantee Fund (SGF) whose quantum is determined by periodic stress tests, Stress testing for Default/Liquidity Risk • Applicability of IOSCO Principles on Commodity derivatives exchanges 11 - 13 August 2017, Grand Hyatt, Goa 4

Strengthening of Risk Management • Membership deposits - Base Minimum Capital & Net worth requirements • Robust Margining system Ø Upfront margin collection from members on online, real time basis Ø Margin has to be collected by members from end-clients. Ø Mark-to-Market (MTM) settlement on daily basis Ø Initial margin of 2 days and concentration margins • Provision for Settlement Guarantee Fund (SGF) whose quantum is determined by periodic stress tests, Stress testing for Default/Liquidity Risk • Applicability of IOSCO Principles on Commodity derivatives exchanges 11 - 13 August 2017, Grand Hyatt, Goa 4

Strengthening of delivery infrastructure • Should be in business of public warehousing for at least 3 years. • Fit and proper criteria • Minimum net worth requirement of Rs. 25 crores for multi commodity and Rs. 10 crores for single commodity WSP • Security Deposit: Linked to storage value ranging between 3% to 5% of the total value of goods stored in warehouses. • Comprehensive insurance policy to cover full value of goods stored in warehouses. • Storage value of goods in warehouse not to exceed 33 times of the net worth of WSP. • Management of WSPs and associated entities not allowed to trade in futures on the commodity for which it is accredited by Exchange. • Regular monitoring by exchanges 11 - 13 August 2017, Grand Hyatt, Goa 5

Strengthening of delivery infrastructure • Should be in business of public warehousing for at least 3 years. • Fit and proper criteria • Minimum net worth requirement of Rs. 25 crores for multi commodity and Rs. 10 crores for single commodity WSP • Security Deposit: Linked to storage value ranging between 3% to 5% of the total value of goods stored in warehouses. • Comprehensive insurance policy to cover full value of goods stored in warehouses. • Storage value of goods in warehouse not to exceed 33 times of the net worth of WSP. • Management of WSPs and associated entities not allowed to trade in futures on the commodity for which it is accredited by Exchange. • Regular monitoring by exchanges 11 - 13 August 2017, Grand Hyatt, Goa 5

Developments in commodity derivatives • Notification of new Commodities – Diamond – Brass – Pig Iron – Eggs – Cocoa – Tea • Criteria for Eligibility, Retention and re-introduction of derivative contracts on Commodities • Approval of contracts on commodities like Diamond etc. 11 - 13 August 2017, Grand Hyatt, Goa 6

Developments in commodity derivatives • Notification of new Commodities – Diamond – Brass – Pig Iron – Eggs – Cocoa – Tea • Criteria for Eligibility, Retention and re-introduction of derivative contracts on Commodities • Approval of contracts on commodities like Diamond etc. 11 - 13 August 2017, Grand Hyatt, Goa 6

New Products • In -principle permission to launch of 'options' in commodity derivatives market in September 2016 • Consultation was conducted with various stakeholders with regards to Option Contract Design • Details regarding the Product Design and Risk Management Framework for options issued • Eligibility criteria for selection of underlying commodities as– shall be amongst the top five futures contracts in terms of total trading – Average daily turnover of at least Rs 200 cr for agricultural and agri-processed commodities and Rs 1000 cr for other commodities 11 - 13 August 2017, Grand Hyatt, Goa 7

New Products • In -principle permission to launch of 'options' in commodity derivatives market in September 2016 • Consultation was conducted with various stakeholders with regards to Option Contract Design • Details regarding the Product Design and Risk Management Framework for options issued • Eligibility criteria for selection of underlying commodities as– shall be amongst the top five futures contracts in terms of total trading – Average daily turnover of at least Rs 200 cr for agricultural and agri-processed commodities and Rs 1000 cr for other commodities 11 - 13 August 2017, Grand Hyatt, Goa 7

New participants • Participation of Category III AIFs in Commodity Derivatives Market • Category III AIFs will participate as ‘Clients’ • Shall not invest more than ten percent of the investable funds in one commodity • May engage in leverage or borrow subject to a maximum limit, as specified by Board from time to time. 11 - 13 August 2017, Grand Hyatt, Goa 8

New participants • Participation of Category III AIFs in Commodity Derivatives Market • Category III AIFs will participate as ‘Clients’ • Shall not invest more than ten percent of the investable funds in one commodity • May engage in leverage or borrow subject to a maximum limit, as specified by Board from time to time. 11 - 13 August 2017, Grand Hyatt, Goa 8

Review of Position limits for Agri Commodities • Reviewed position limits for the agri commodities in consultations with the stakeholders • Categorization of commodities as broad, narrow and sensitive • Concept of Deliverable Supply • Cient level open position limits linked to deliverable supply 11 - 13 August 2017, Grand Hyatt, Goa 9

Review of Position limits for Agri Commodities • Reviewed position limits for the agri commodities in consultations with the stakeholders • Categorization of commodities as broad, narrow and sensitive • Concept of Deliverable Supply • Cient level open position limits linked to deliverable supply 11 - 13 August 2017, Grand Hyatt, Goa 9

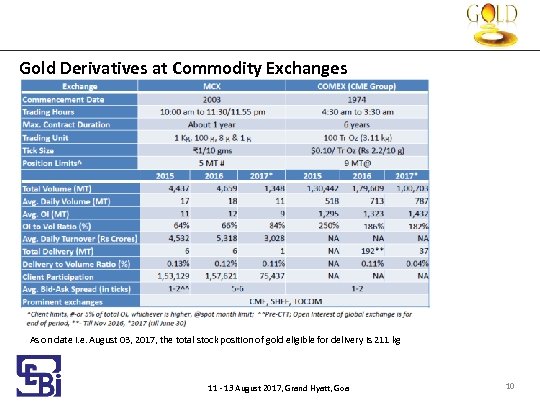

Gold Derivatives at Commodity Exchanges As on date i. e. August 03, 2017, the total stock position of gold eligible for delivery is 211 kg 11 - 13 August 2017, Grand Hyatt, Goa 10

Gold Derivatives at Commodity Exchanges As on date i. e. August 03, 2017, the total stock position of gold eligible for delivery is 211 kg 11 - 13 August 2017, Grand Hyatt, Goa 10

Steps taken for development of Gold Derivatives • Introduction of Options for Commodity Derivatives vide circular dated September 28, 2016 and June 13, 2017 – MCX has applied for Options in Gold Contracts • Increasing institutional participation – Category III AIFs have been allowed to participate in Gold Derivatives – SEBI is in process of consultation with Mutual Funds and PMS for their participation in Gold Derivatives • SEBI is in process of examining inclusion of Commodity Derivatives with Gold as underlying as an eligible Gold related instrument for Gold exchange traded fund • SEBI is in process of framing warehousing norms for Bullion 11 - 13 August 2017, Grand Hyatt, Goa 11

Steps taken for development of Gold Derivatives • Introduction of Options for Commodity Derivatives vide circular dated September 28, 2016 and June 13, 2017 – MCX has applied for Options in Gold Contracts • Increasing institutional participation – Category III AIFs have been allowed to participate in Gold Derivatives – SEBI is in process of consultation with Mutual Funds and PMS for their participation in Gold Derivatives • SEBI is in process of examining inclusion of Commodity Derivatives with Gold as underlying as an eligible Gold related instrument for Gold exchange traded fund • SEBI is in process of framing warehousing norms for Bullion 11 - 13 August 2017, Grand Hyatt, Goa 11

Future Roadmap • Establishment of Clearing Corporation • Guidelines for Warehousing / Storage Service Providers (SSP) norms for non-agri commodities. • Steps for introduction of further new products such as indices • Steps for permitting new participants such as portfolio managers, mutual funds, foreign entities having commodity exposure with India • Convergence of equity and commodity derivatives markets at both broker and exchange level • Review of position limits for Non-agri Contracts 11 - 13 August 2017, Grand Hyatt, Goa 12

Future Roadmap • Establishment of Clearing Corporation • Guidelines for Warehousing / Storage Service Providers (SSP) norms for non-agri commodities. • Steps for introduction of further new products such as indices • Steps for permitting new participants such as portfolio managers, mutual funds, foreign entities having commodity exposure with India • Convergence of equity and commodity derivatives markets at both broker and exchange level • Review of position limits for Non-agri Contracts 11 - 13 August 2017, Grand Hyatt, Goa 12