7a5e194e4fb199e560b27cd76b91b187.ppt

- Количество слайдов: 32

Indexing: The Good, The Bad, And the Ugly

Part 1: The Good

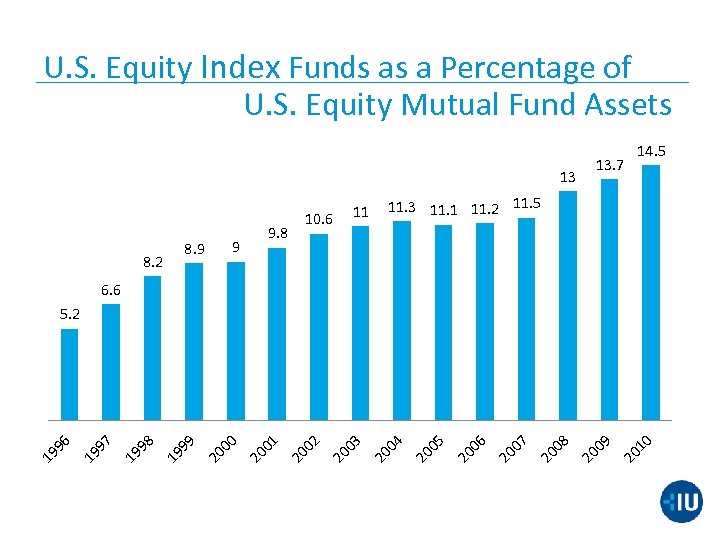

U. S. Equity Index Funds as a Percentage of U. S. Equity Mutual Fund Assets 13 9 8. 2 9. 8 11 10. 6 13. 7 14. 5 11. 3 11. 1 11. 2 11. 5 6. 6 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 19 96 5. 2

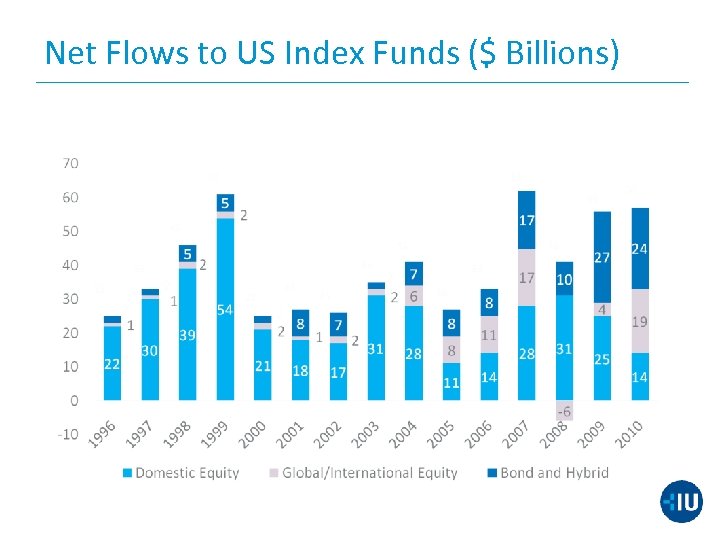

Net Flows to US Index Funds ($ Billions)

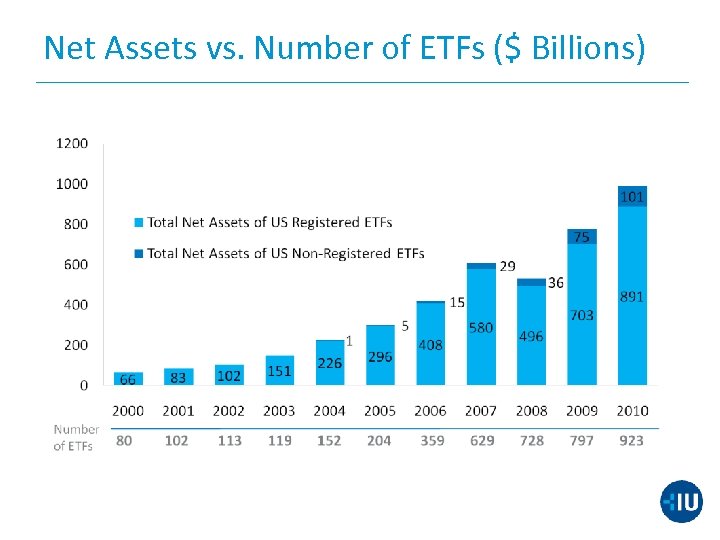

Net Assets vs. Number of ETFs ($ Billions)

The Good: § They’re cheap. § Sometimes, markets actually are efficient.

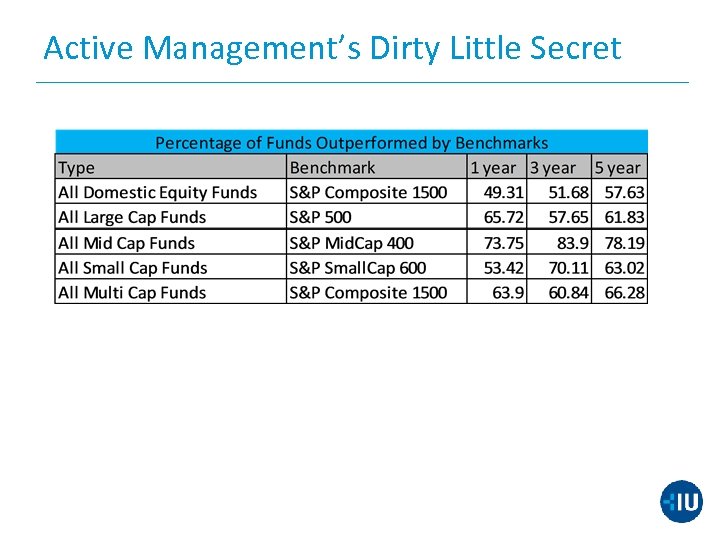

Active Management’s Dirty Little Secret

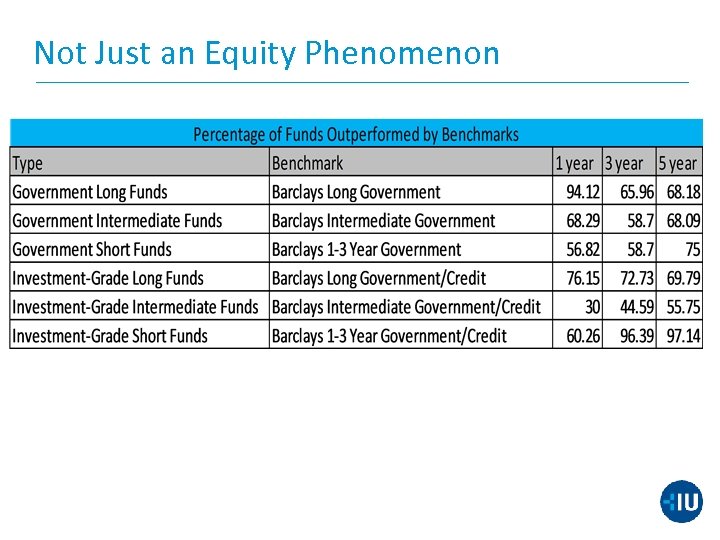

Not Just an Equity Phenomenon

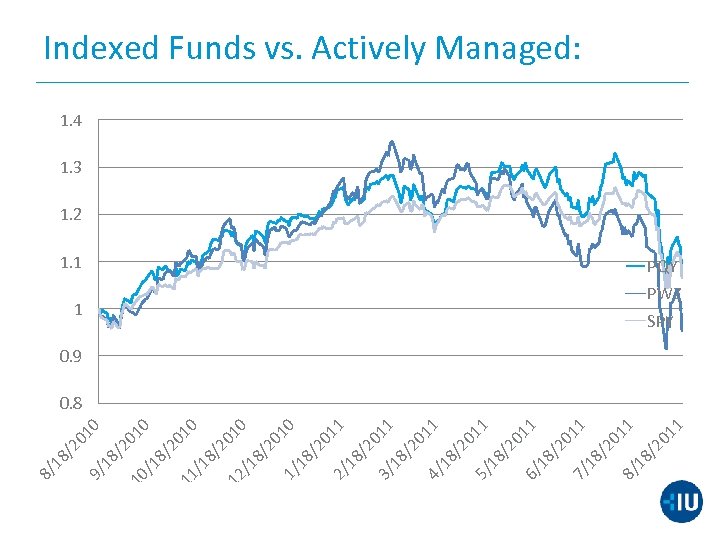

1 1 1 01 /2 18 8/ 01 01 /2 18 7/ 1 1 01 01 /2 18 6/ /2 18 5/ 01 /2 18 4/ 01 /2 18 3/ 1 10 01 /2 18 2/ /2 18 1/ 10 10 20 20 8/ /1 12 8/ /1 11 0 0 01 01 8/ 20 /1 10 /2 18 9/ /2 18 8/ Indexed Funds vs. Actively Managed: 1. 4 1. 3 1. 2 1. 1 PQY 1 PWZ SPY 0. 9 0. 8

Part 2: The Bad

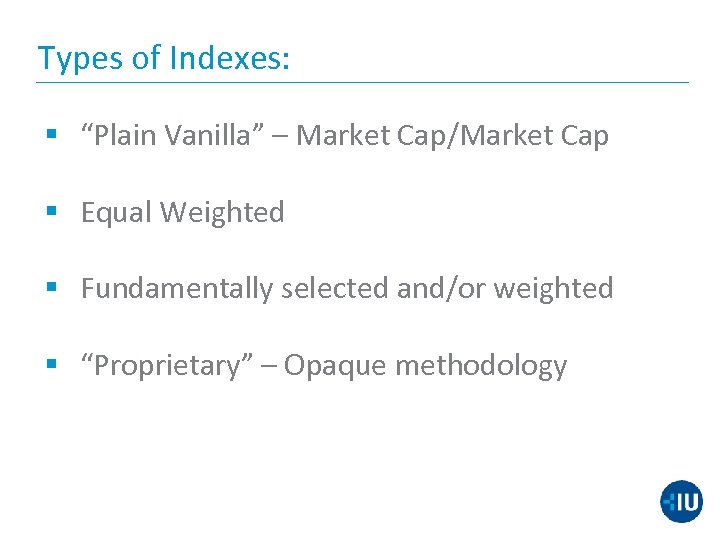

Types of Indexes: § “Plain Vanilla” – Market Cap/Market Cap § Equal Weighted § Fundamentally selected and/or weighted § “Proprietary” – Opaque methodology

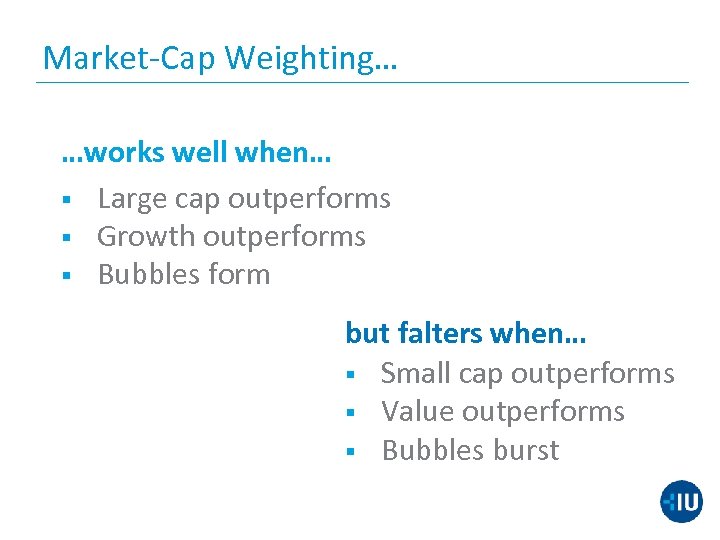

Market-Cap Weighting… …works well when… § Large cap outperforms § Growth outperforms § Bubbles form but falters when… § Small cap outperforms § Value outperforms § Bubbles burst

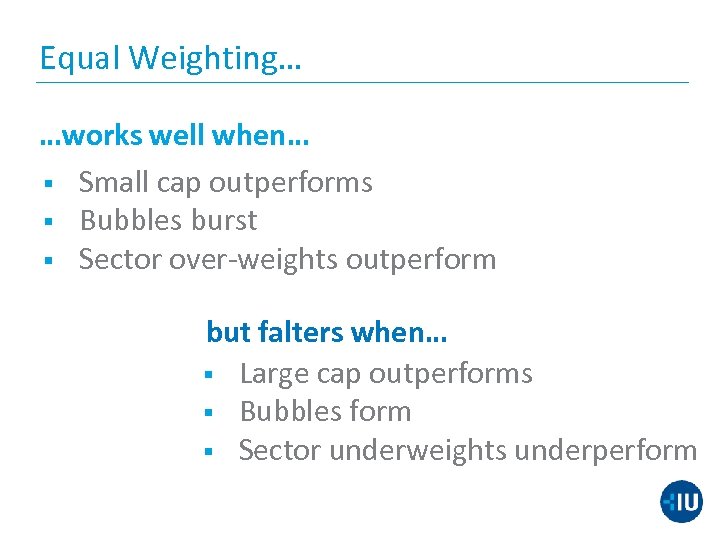

Equal Weighting… …works well when… § Small cap outperforms § Bubbles burst § Sector over-weights outperform but falters when… § Large cap outperforms § Bubbles form § Sector underweights underperform

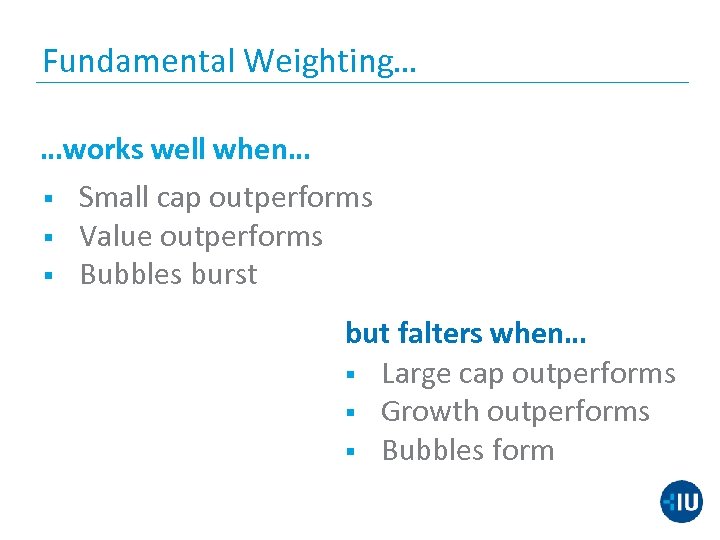

Fundamental Weighting… …works well when… § § § Small cap outperforms Value outperforms Bubbles burst but falters when… § Large cap outperforms § Growth outperforms § Bubbles form

Proprietary Indexes… Falter when… § Small cap outperforms § Value outperforms § Bubbles burst

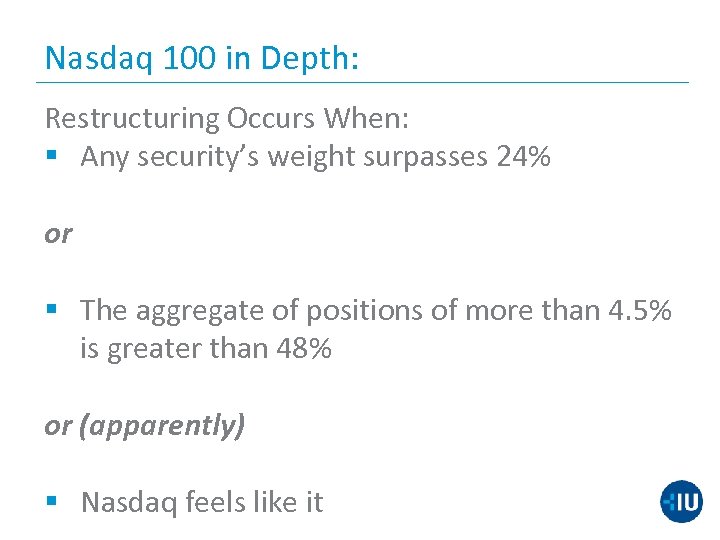

Nasdaq 100 in Depth: Restructuring Occurs When: § Any security’s weight surpasses 24% or § The aggregate of positions of more than 4. 5% is greater than 48% or (apparently) § Nasdaq feels like it

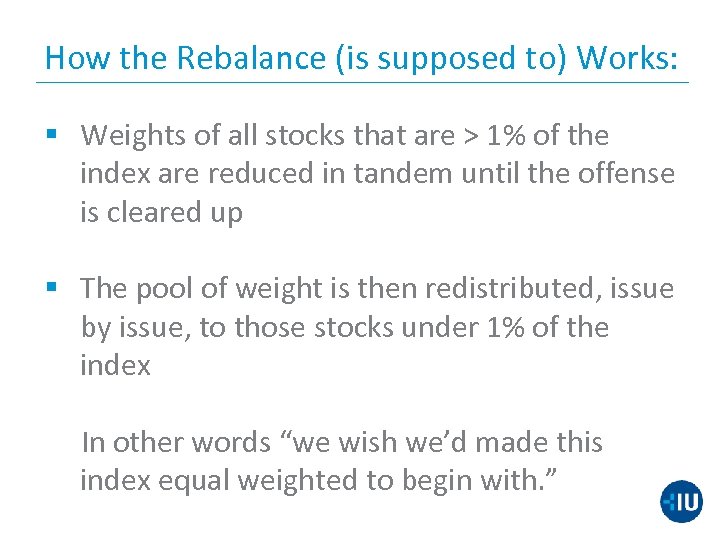

How the Rebalance (is supposed to) Works: § Weights of all stocks that are > 1% of the index are reduced in tandem until the offense is cleared up § The pool of weight is then redistributed, issue by issue, to those stocks under 1% of the index In other words “we wish we’d made this index equal weighted to begin with. ”

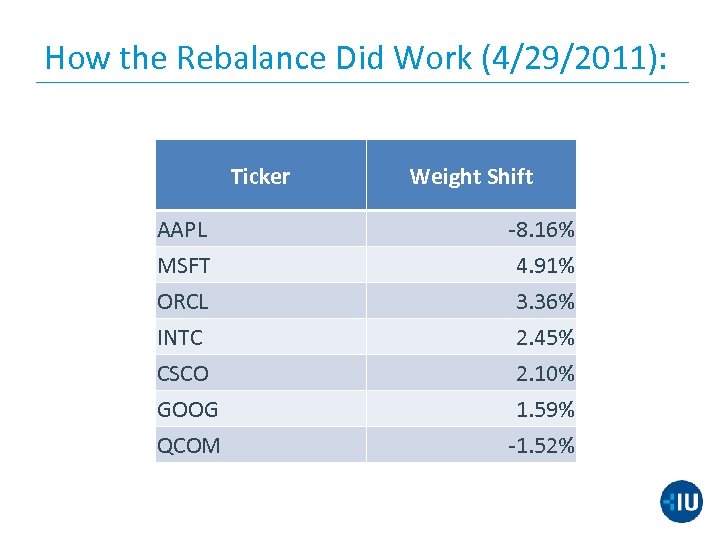

How the Rebalance Did Work (4/29/2011): Ticker Weight Shift AAPL -8. 16% MSFT 4. 91% ORCL INTC CSCO GOOG QCOM 3. 36% 2. 45% 2. 10% 1. 59% -1. 52%

What’s Wrong with the S&P 500: Why Committees Aren’t Great: ▪ Human discretion instead of Rules based decision making ▪ Present uncertainty around rebalance and inclusions, decreasing market efficiencies ▪ Possible conflicts of interest

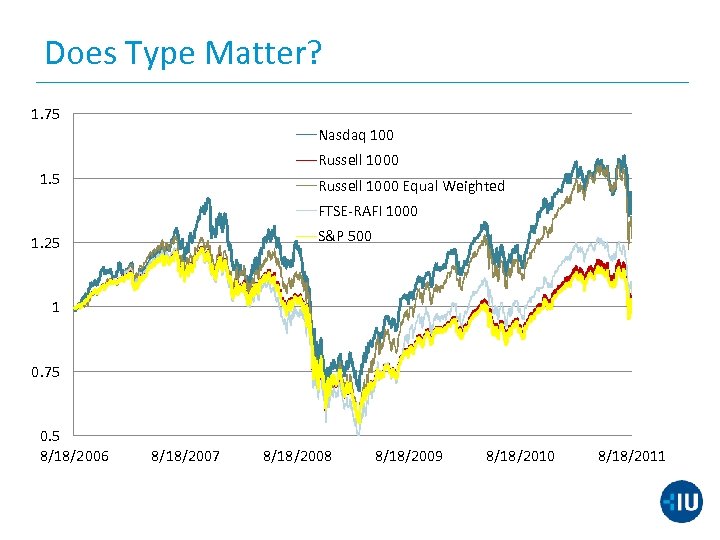

Does Type Matter? 1. 75 Nasdaq 100 Russell 1000 1. 5 Russell 1000 Equal Weighted FTSE-RAFI 1000 S&P 500 1. 25 1 0. 75 0. 5 8/18/2006 8/18/2007 8/18/2008 8/18/2009 8/18/2010 8/18/2011

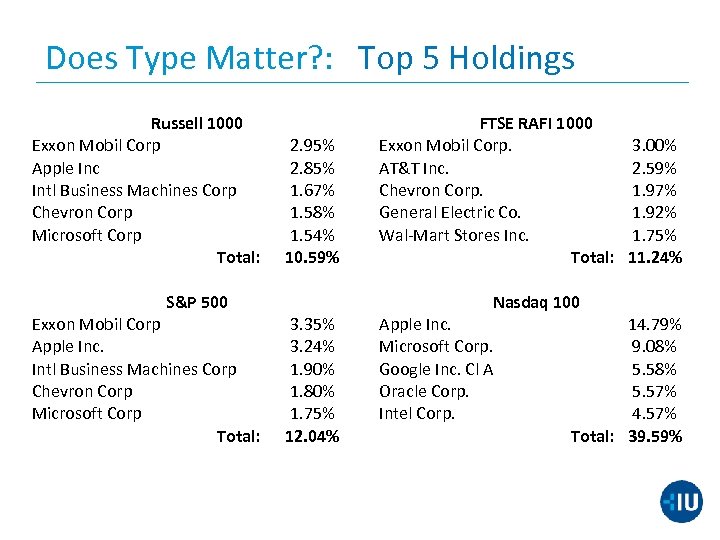

Does Type Matter? : Top 5 Holdings Russell 1000 Exxon Mobil Corp Apple Inc Intl Business Machines Corp Chevron Corp Microsoft Corp Total: 2. 95% 2. 85% 1. 67% 1. 58% 1. 54% 10. 59% S&P 500 Exxon Mobil Corp Apple Inc. Intl Business Machines Corp Chevron Corp Microsoft Corp Total: FTSE RAFI 1000 Exxon Mobil Corp. 3. 00% AT&T Inc. 2. 59% Chevron Corp. 1. 97% General Electric Co. 1. 92% Wal-Mart Stores Inc. 1. 75% Total: 11. 24% Nasdaq 100 3. 35% 3. 24% 1. 90% 1. 80% 1. 75% 12. 04% Apple Inc. Microsoft Corp. Google Inc. Cl A Oracle Corp. Intel Corp. 14. 79% 9. 08% 5. 57% 4. 57% Total: 39. 59%

Part 3: The Ugly

Core Problems with Commodities Indexes: What’s the Market Cap of Wheat? Which “Oil” Do You Buy?

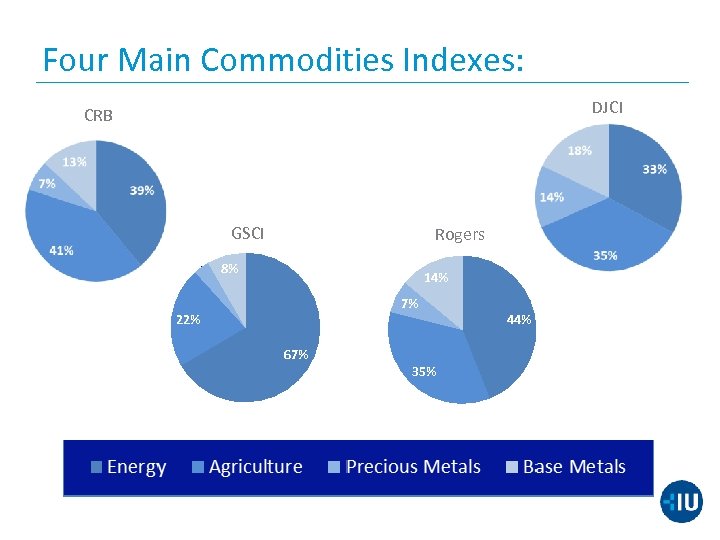

Four Main Commodities Indexes: DJCI CRB GSCI 3% Rogers 8% 14% 7% 22% 67% 35% 44%

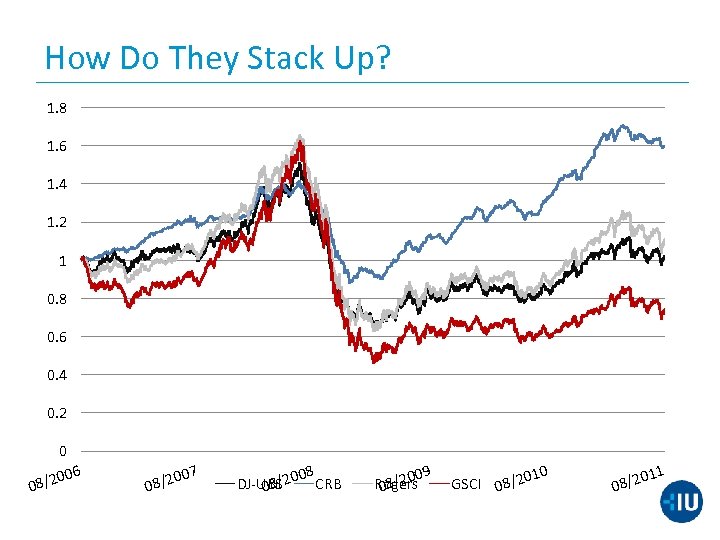

How Do They Stack Up? 1. 8 1. 6 1. 4 1. 2 1 0. 8 0. 6 0. 4 0. 2 08 0 6 /200 007 08/2 08 DJ-UBS 20 CRB 08/ 009 Rogers 08/2 10 GSCI 08/20 011 08/2

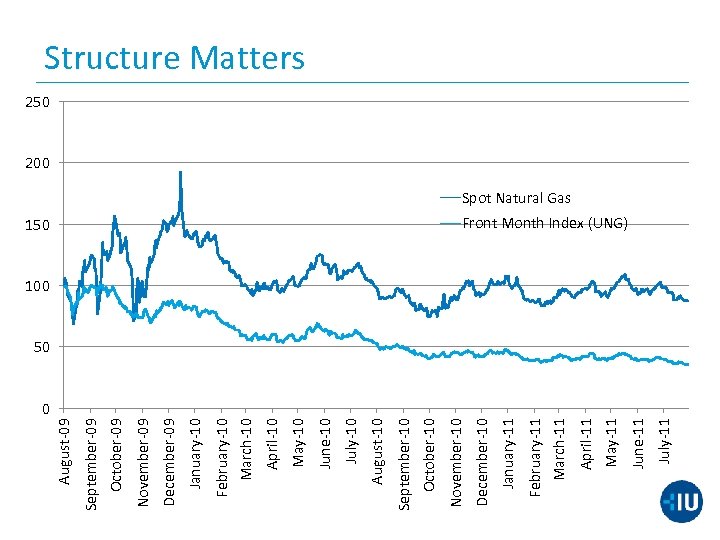

July-11 June-11 May-11 April-11 March-11 February-11 January-11 December-10 150 November-10 October-10 September-10 August-10 July-10 June-10 May-10 April-10 March-10 February-10 January-10 December-09 November-09 October-09 September-09 August-09 Structure Matters 250 200 Spot Natural Gas Front Month Index (UNG) 100 50 0

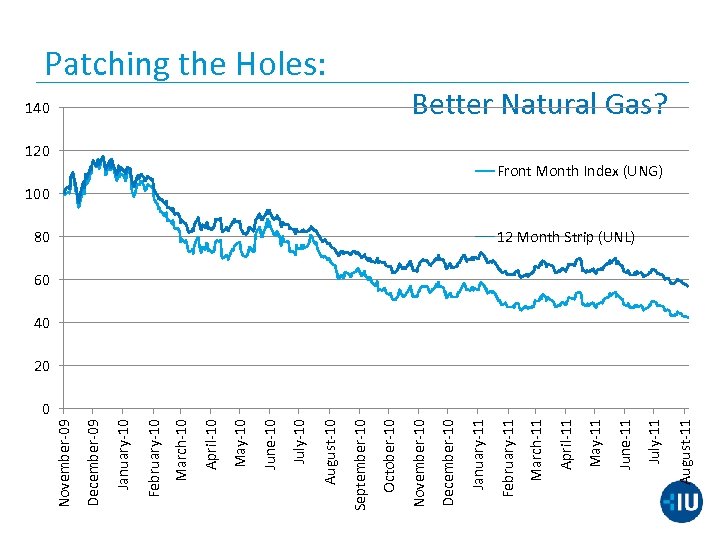

August-11 July-11 June-11 May-11 April-11 March-11 80 February-11 January-11 December-10 140 November-10 October-10 September-10 August-10 July-10 June-10 May-10 April-10 March-10 February-10 January-10 December-09 November-09 Patching the Holes: Better Natural Gas? 120 Front Month Index (UNG) 100 12 Month Strip (UNL) 60 40 20 0

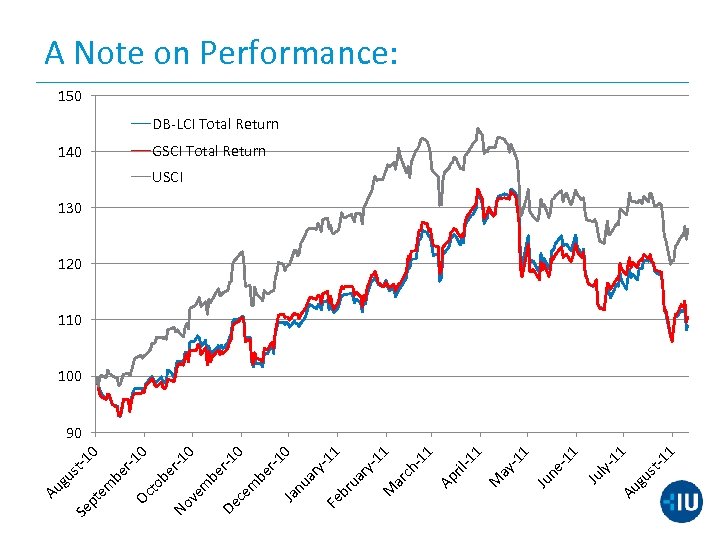

1 11 st -1 gu Au ly- Ju -1 1 ne 140 Ju st Se -1 pt 0 em be r-1 0 Oc to be r-1 No 0 ve m be r-1 De 0 ce m be r-1 0 Ja nu ar y 11 Fe br ua ry -1 1 M ar ch -1 1 Ap ril -1 1 M ay -1 1 gu Au A Note on Performance: 150 DB-LCI Total Return GSCI Total Return USCI 130 120 110 100 90

Fixed Income: Who would you rather lend money to: Bill Gates? Or Donald Trump?

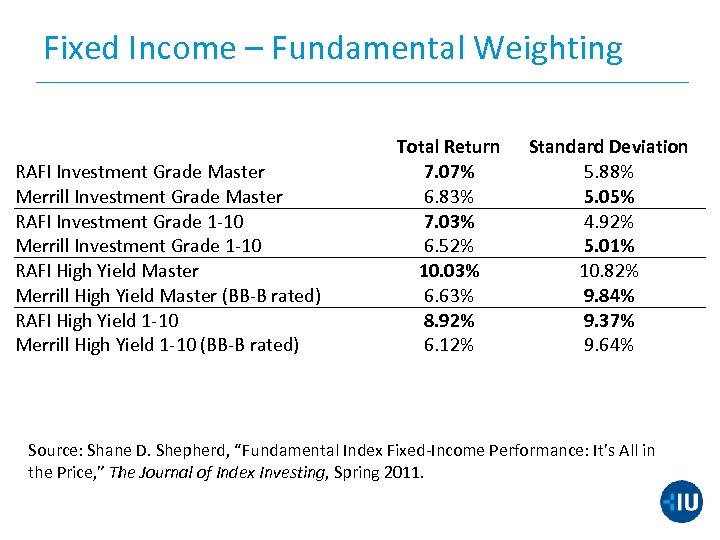

Fixed Income – Fundamental Weighting RAFI Investment Grade Master Merrill Investment Grade Master RAFI Investment Grade 1 -10 Merrill Investment Grade 1 -10 RAFI High Yield Master Merrill High Yield Master (BB-B rated) RAFI High Yield 1 -10 Merrill High Yield 1 -10 (BB-B rated) Total Return 7. 07% 6. 83% 7. 03% 6. 52% 10. 03% 6. 63% 8. 92% 6. 12% Standard Deviation 5. 88% 5. 05% 4. 92% 5. 01% 10. 82% 9. 84% 9. 37% 9. 64% Source: Shane D. Shepherd, “Fundamental Index Fixed-Income Performance: It’s All in the Price, ” The Journal of Index Investing, Spring 2011.

Conclusion

Indexing: The Good, the Bad, and the Ugly

7a5e194e4fb199e560b27cd76b91b187.ppt