6b2263dac57ac8b42a99218b781b84d9.ppt

- Количество слайдов: 25

Independent Oil Tools ASA Presentation to the general meeting May 24, 2005

Independent Oil Tools ASA Presentation to the general meeting May 24, 2005

Agenda 1. Review of 2004 financial results 2. Proposed authorization to increase share capital (issue new shares) 3. Proposed authorization to buy back own shares 4. Board remuneration 5. Remuneration of auditor 6. Election of new board members 7. Indemnification of board of directors and management 8. Reduction of share premium fund (transfer to ”free equity”) 9. Information regarding planned stock exchange listing 10. General business update May 24, 2005 Presentation to IOT ASA general meeting 2

Agenda 1. Review of 2004 financial results 2. Proposed authorization to increase share capital (issue new shares) 3. Proposed authorization to buy back own shares 4. Board remuneration 5. Remuneration of auditor 6. Election of new board members 7. Indemnification of board of directors and management 8. Reduction of share premium fund (transfer to ”free equity”) 9. Information regarding planned stock exchange listing 10. General business update May 24, 2005 Presentation to IOT ASA general meeting 2

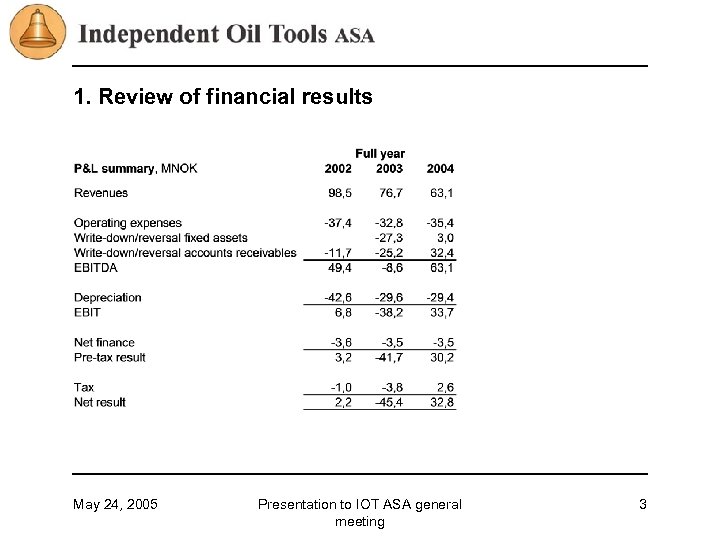

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 3

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 3

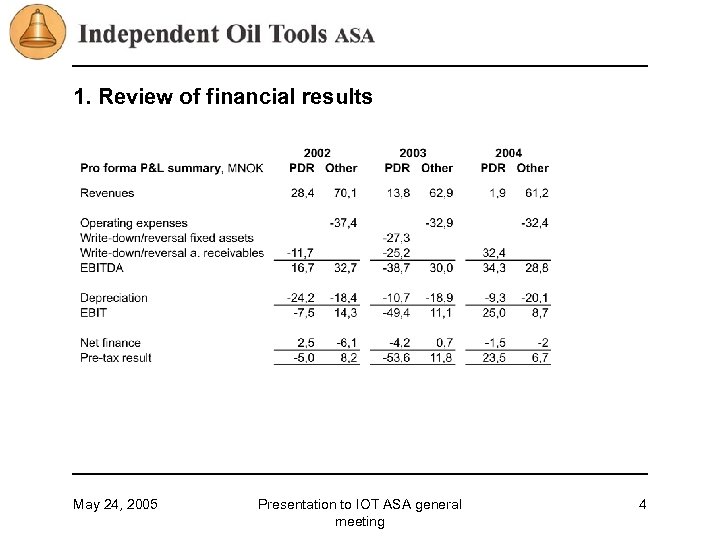

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 4

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 4

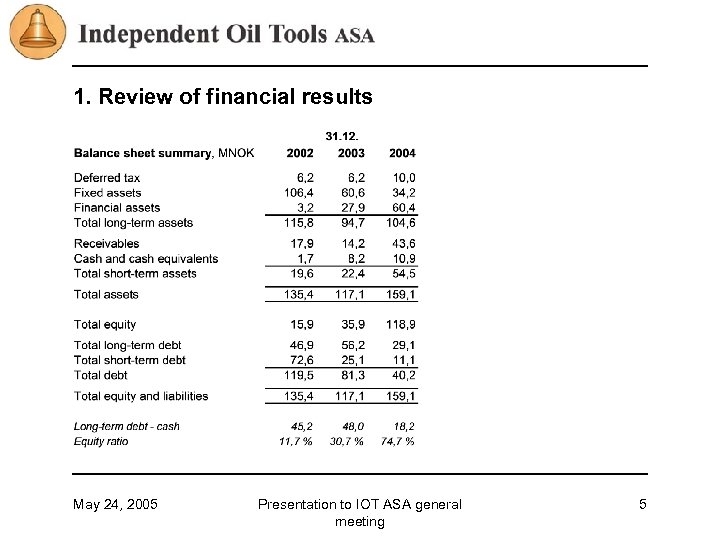

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 5

1. Review of financial results May 24, 2005 Presentation to IOT ASA general meeting 5

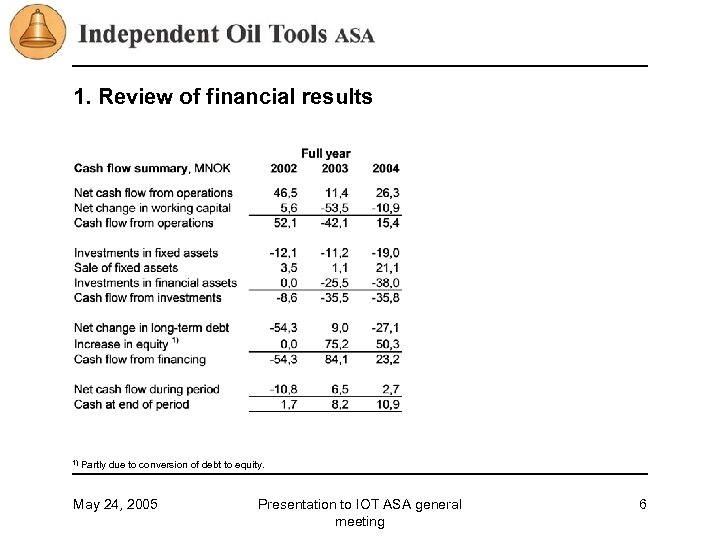

1. Review of financial results 1) Partly due to conversion of debt to equity. May 24, 2005 Presentation to IOT ASA general meeting 6

1. Review of financial results 1) Partly due to conversion of debt to equity. May 24, 2005 Presentation to IOT ASA general meeting 6

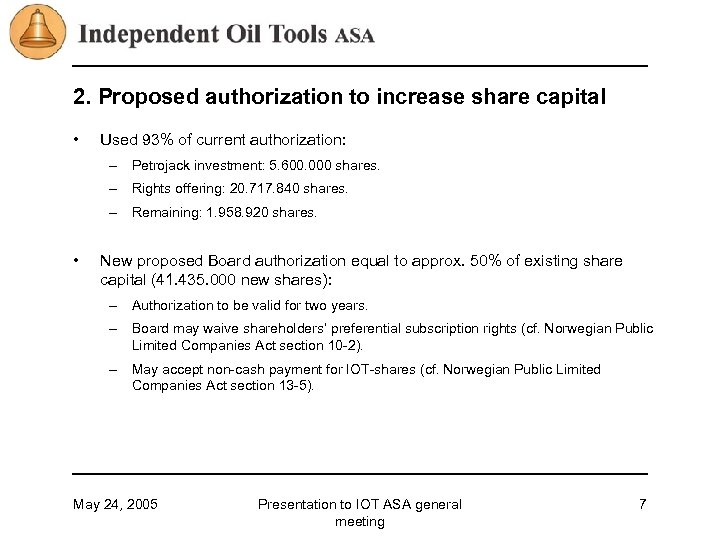

2. Proposed authorization to increase share capital • Used 93% of current authorization: – Petrojack investment: 5. 600. 000 shares. – Rights offering: 20. 717. 840 shares. – Remaining: 1. 958. 920 shares. • New proposed Board authorization equal to approx. 50% of existing share capital (41. 435. 000 new shares): – Authorization to be valid for two years. – Board may waive shareholders’ preferential subscription rights (cf. Norwegian Public Limited Companies Act section 10 -2). – May accept non-cash payment for IOT-shares (cf. Norwegian Public Limited Companies Act section 13 -5). May 24, 2005 Presentation to IOT ASA general meeting 7

2. Proposed authorization to increase share capital • Used 93% of current authorization: – Petrojack investment: 5. 600. 000 shares. – Rights offering: 20. 717. 840 shares. – Remaining: 1. 958. 920 shares. • New proposed Board authorization equal to approx. 50% of existing share capital (41. 435. 000 new shares): – Authorization to be valid for two years. – Board may waive shareholders’ preferential subscription rights (cf. Norwegian Public Limited Companies Act section 10 -2). – May accept non-cash payment for IOT-shares (cf. Norwegian Public Limited Companies Act section 13 -5). May 24, 2005 Presentation to IOT ASA general meeting 7

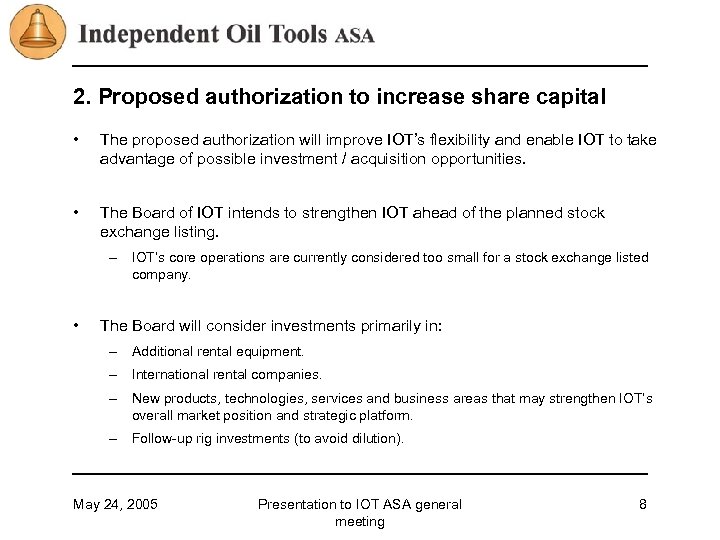

2. Proposed authorization to increase share capital • The proposed authorization will improve IOT’s flexibility and enable IOT to take advantage of possible investment / acquisition opportunities. • The Board of IOT intends to strengthen IOT ahead of the planned stock exchange listing. – IOT’s core operations are currently considered too small for a stock exchange listed company. • The Board will consider investments primarily in: – Additional rental equipment. – International rental companies. – New products, technologies, services and business areas that may strengthen IOT’s overall market position and strategic platform. – Follow-up rig investments (to avoid dilution). May 24, 2005 Presentation to IOT ASA general meeting 8

2. Proposed authorization to increase share capital • The proposed authorization will improve IOT’s flexibility and enable IOT to take advantage of possible investment / acquisition opportunities. • The Board of IOT intends to strengthen IOT ahead of the planned stock exchange listing. – IOT’s core operations are currently considered too small for a stock exchange listed company. • The Board will consider investments primarily in: – Additional rental equipment. – International rental companies. – New products, technologies, services and business areas that may strengthen IOT’s overall market position and strategic platform. – Follow-up rig investments (to avoid dilution). May 24, 2005 Presentation to IOT ASA general meeting 8

3. Proposed authorization to buy back own shares • May acquire up to 100. 000 shares (with a nominal value of NOK 2. 500. 000) under new proposed authorization. – – – IOT may not own treasury shares exceeding 10% of IOT’s total share capital. The max. amount to be paid per share = NOK 20, 00. The min. amount to be paid per share = NOK 0, 50. The authorization shall be valid for 18 months. The Board is free to decide how to buy own shares and sell treasury shares: • • • All shareholders shall be treated equally. In the Board’s opinion, the current valuation of IOT is below the “fair value” of IOT. By acquiring own shares at “low” levels, the Board may: – Contribute to a positive share price development. – Create shareholder value. – Have shares available in connection with possible acquisitions. • Investments in own shares should create shareholder value relative to other investment opportunities or relative to possible dividend payments. May 24, 2005 Presentation to IOT ASA general meeting 9

3. Proposed authorization to buy back own shares • May acquire up to 100. 000 shares (with a nominal value of NOK 2. 500. 000) under new proposed authorization. – – – IOT may not own treasury shares exceeding 10% of IOT’s total share capital. The max. amount to be paid per share = NOK 20, 00. The min. amount to be paid per share = NOK 0, 50. The authorization shall be valid for 18 months. The Board is free to decide how to buy own shares and sell treasury shares: • • • All shareholders shall be treated equally. In the Board’s opinion, the current valuation of IOT is below the “fair value” of IOT. By acquiring own shares at “low” levels, the Board may: – Contribute to a positive share price development. – Create shareholder value. – Have shares available in connection with possible acquisitions. • Investments in own shares should create shareholder value relative to other investment opportunities or relative to possible dividend payments. May 24, 2005 Presentation to IOT ASA general meeting 9

4. Proposed 2004 board remuneration • Proposed total 2004 remuneration of Board of Directors: NOK 87. 952. (NOK 25. 000 to each board member) May 24, 2005 Presentation to IOT ASA general meeting 10

4. Proposed 2004 board remuneration • Proposed total 2004 remuneration of Board of Directors: NOK 87. 952. (NOK 25. 000 to each board member) May 24, 2005 Presentation to IOT ASA general meeting 10

5. Proposed 2004 remuneration of auditor • Proposed remuneration of Ernst & Young of NOK 134. 400. May 24, 2005 Presentation to IOT ASA general meeting 11

5. Proposed 2004 remuneration of auditor • Proposed remuneration of Ernst & Young of NOK 134. 400. May 24, 2005 Presentation to IOT ASA general meeting 11

6. Election of new board members • Current Board members were elected on November 16, 2004, succeeding two DNO board members. • Siv F. Christensen proposed as new Board member: – Employed by Statoil ASA (division for natural gas). – Former VP & Treasurer of Kverneland ASA. – Former senior project leader of business development of Orkla ASA. – Former associate of The LEK Partnership, UK and U. S. – M. Sc. University of Oxford and B. Sc. Wharton School. • Siv F. Christensen has considerable international M&A experience. • Other Board members are: Petter Tomren (Chairman), Harald Smedsvik (Managing Director), Lars Moldestad (Petrolia Drilling ASA) and Martin Nordaas (oil & offshore consultant). • Further changes to the Board of Directors may be expected ahead of the planned stock exchange listing to fully comply with Oslo Stock Exchange’s corporate governance guidelines. May 24, 2005 Presentation to IOT ASA general meeting 12

6. Election of new board members • Current Board members were elected on November 16, 2004, succeeding two DNO board members. • Siv F. Christensen proposed as new Board member: – Employed by Statoil ASA (division for natural gas). – Former VP & Treasurer of Kverneland ASA. – Former senior project leader of business development of Orkla ASA. – Former associate of The LEK Partnership, UK and U. S. – M. Sc. University of Oxford and B. Sc. Wharton School. • Siv F. Christensen has considerable international M&A experience. • Other Board members are: Petter Tomren (Chairman), Harald Smedsvik (Managing Director), Lars Moldestad (Petrolia Drilling ASA) and Martin Nordaas (oil & offshore consultant). • Further changes to the Board of Directors may be expected ahead of the planned stock exchange listing to fully comply with Oslo Stock Exchange’s corporate governance guidelines. May 24, 2005 Presentation to IOT ASA general meeting 12

7. Indemnification of board of directors and management • According to the Norwegian Public Limited Companies Act section 17 -5, the Board is proposing the following “hold harmless statement”: “The Company shall hold the Board of Directors and top management harmless to the extent permissible by relevant law for any responsibility and costs related to all civil- or criminal legal and administrative processes which these may be liable for through their work for the company, including liabilities towards the company and due to the preparation and approval for the yearly financial accounts. ” May 24, 2005 Presentation to IOT ASA general meeting 13

7. Indemnification of board of directors and management • According to the Norwegian Public Limited Companies Act section 17 -5, the Board is proposing the following “hold harmless statement”: “The Company shall hold the Board of Directors and top management harmless to the extent permissible by relevant law for any responsibility and costs related to all civil- or criminal legal and administrative processes which these may be liable for through their work for the company, including liabilities towards the company and due to the preparation and approval for the yearly financial accounts. ” May 24, 2005 Presentation to IOT ASA general meeting 13

8. Reduction of share premium fund (transfer to ”free equity”) • The Board is proposing to transfer NOK 49. 890. 218 from the premium fund to free equity. • Premium fund is currently approximately MNOK 91 (as per March 31, 2005, pro forma for recent rights offering): – Represents approximately 56% of total equity. • As per December 31, 2004, the actual premium fund equaled MNOK 50. • As per March 31, 2005, the actual premium fund equaled MNOK 60. • A transfer to free equity will increase the flexibility of the general meeting regarding future equity dispositions hereunder dividend payments. May 24, 2005 Presentation to IOT ASA general meeting 14

8. Reduction of share premium fund (transfer to ”free equity”) • The Board is proposing to transfer NOK 49. 890. 218 from the premium fund to free equity. • Premium fund is currently approximately MNOK 91 (as per March 31, 2005, pro forma for recent rights offering): – Represents approximately 56% of total equity. • As per December 31, 2004, the actual premium fund equaled MNOK 50. • As per March 31, 2005, the actual premium fund equaled MNOK 60. • A transfer to free equity will increase the flexibility of the general meeting regarding future equity dispositions hereunder dividend payments. May 24, 2005 Presentation to IOT ASA general meeting 14

8. Reduction of share premium fund (transfer to ”free equity”) • In order to improve the visibility of IOT’s core business, the Board may consider distributing shares in PDR as extraordinary dividend in 2005. – The transfer from the premium fund to free equity may bee seen in this context. – The Board has not yet made a time schedule for such dividend payment, but has started a review of necessary prerequisites. – The timing of such dividend payment will also depend on the near-term development of PDR (especially the final outcome of the dispute with the owners of the drill ship DS Valentin Shashin). • Prior to proposing such a dividend payment, the Board will seek to review alternative ways of maximizing the return on IOT’s investment in PDR. • Such dividend distribution may reduce the volatility of the IOT-share price and make it “easier” to price the IOT-share. May 24, 2005 Presentation to IOT ASA general meeting 15

8. Reduction of share premium fund (transfer to ”free equity”) • In order to improve the visibility of IOT’s core business, the Board may consider distributing shares in PDR as extraordinary dividend in 2005. – The transfer from the premium fund to free equity may bee seen in this context. – The Board has not yet made a time schedule for such dividend payment, but has started a review of necessary prerequisites. – The timing of such dividend payment will also depend on the near-term development of PDR (especially the final outcome of the dispute with the owners of the drill ship DS Valentin Shashin). • Prior to proposing such a dividend payment, the Board will seek to review alternative ways of maximizing the return on IOT’s investment in PDR. • Such dividend distribution may reduce the volatility of the IOT-share price and make it “easier” to price the IOT-share. May 24, 2005 Presentation to IOT ASA general meeting 15

9. Information regarding planned stock exchange listing • IOT intends to seek stock exchange listing in late 2005. – The listing-process has been initiated and all Board decisions will be made with such listing in mind. • Prior to the listing, the Board intends to: – Hire a new CFO. – Review possible acquisitions and investments in IOT’s core business area: • • • Rental. New products. New technologies. To strengthen IOT’s core rental operations – Implement International Financial Reporting Standards (IFRS). • The development of PDR may also impact the timing of IOT’s listing. – The Board of IOT is hopeful that uncertainty concerning PDR (disputes and rig contracts) has been eliminated by the second half of 2005. • IOT will also consider a stock exchange listing through integration with a suitable stock exchange listed partner. May 24, 2005 Presentation to IOT ASA general meeting 16

9. Information regarding planned stock exchange listing • IOT intends to seek stock exchange listing in late 2005. – The listing-process has been initiated and all Board decisions will be made with such listing in mind. • Prior to the listing, the Board intends to: – Hire a new CFO. – Review possible acquisitions and investments in IOT’s core business area: • • • Rental. New products. New technologies. To strengthen IOT’s core rental operations – Implement International Financial Reporting Standards (IFRS). • The development of PDR may also impact the timing of IOT’s listing. – The Board of IOT is hopeful that uncertainty concerning PDR (disputes and rig contracts) has been eliminated by the second half of 2005. • IOT will also consider a stock exchange listing through integration with a suitable stock exchange listed partner. May 24, 2005 Presentation to IOT ASA general meeting 16

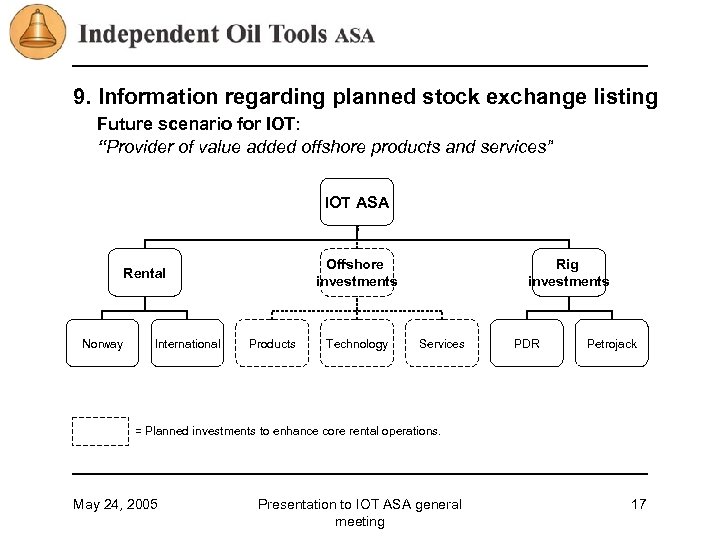

9. Information regarding planned stock exchange listing Future scenario for IOT: “Provider of value added offshore products and services” IOT ASA Offshore investments Rental Norway International Products Technology Rig investments Services PDR Petrojack = Planned investments to enhance core rental operations. May 24, 2005 Presentation to IOT ASA general meeting 17

9. Information regarding planned stock exchange listing Future scenario for IOT: “Provider of value added offshore products and services” IOT ASA Offshore investments Rental Norway International Products Technology Rig investments Services PDR Petrojack = Planned investments to enhance core rental operations. May 24, 2005 Presentation to IOT ASA general meeting 17

Agenda 10. General business update: • Review of First Quarter 2005 Results • Brief discussion of market outlook May 24, 2005 Presentation to IOT ASA general meeting 18

Agenda 10. General business update: • Review of First Quarter 2005 Results • Brief discussion of market outlook May 24, 2005 Presentation to IOT ASA general meeting 18

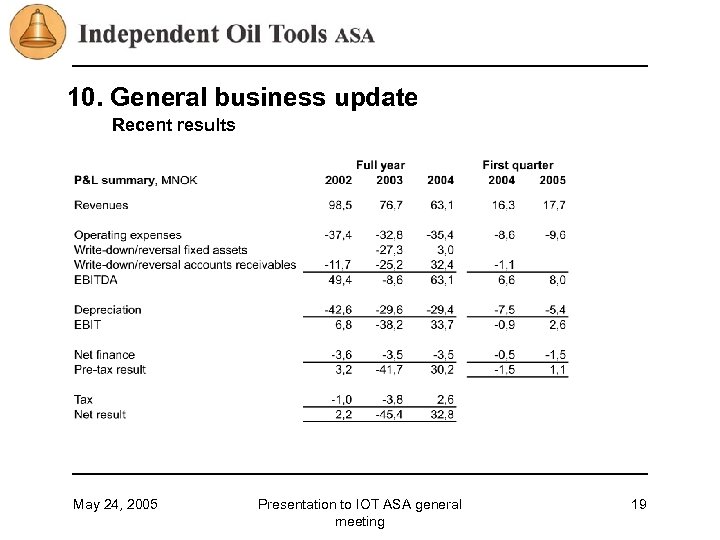

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 19

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 19

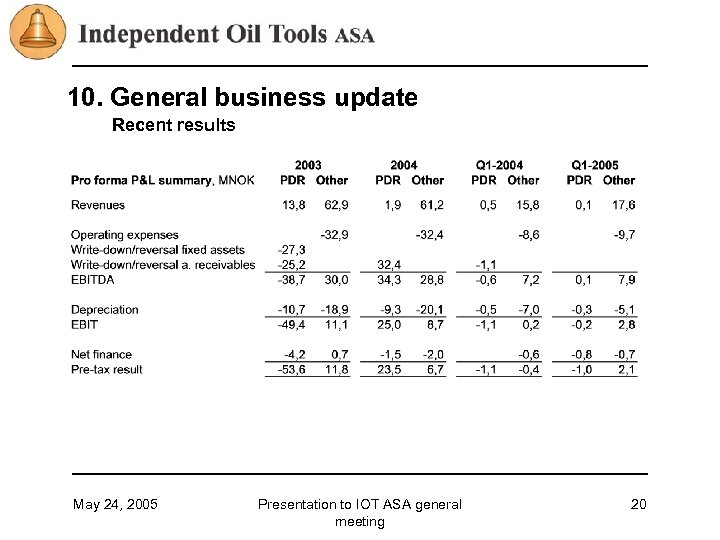

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 20

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 20

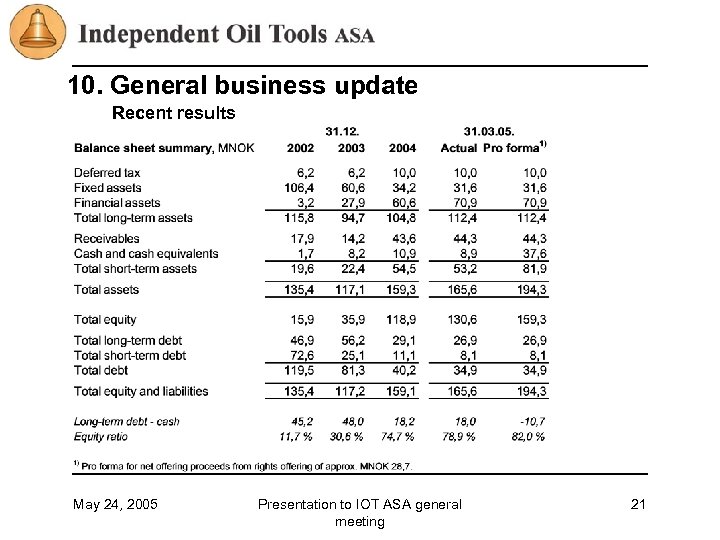

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 21

10. General business update Recent results May 24, 2005 Presentation to IOT ASA general meeting 21

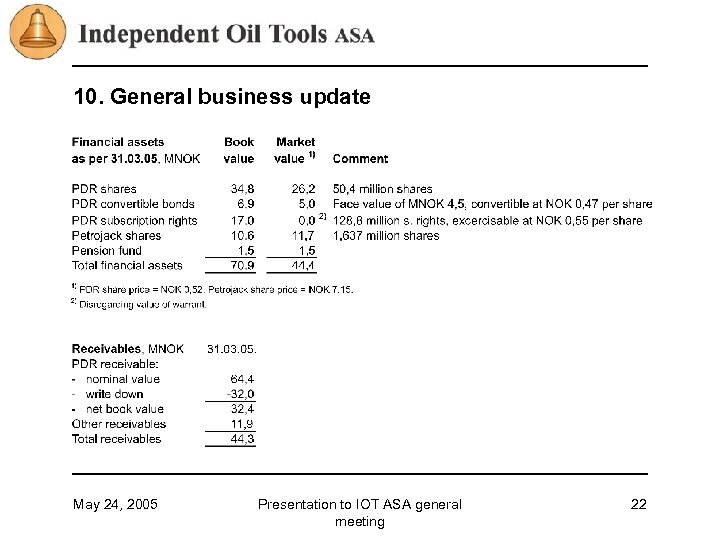

10. General business update May 24, 2005 Presentation to IOT ASA general meeting 22

10. General business update May 24, 2005 Presentation to IOT ASA general meeting 22

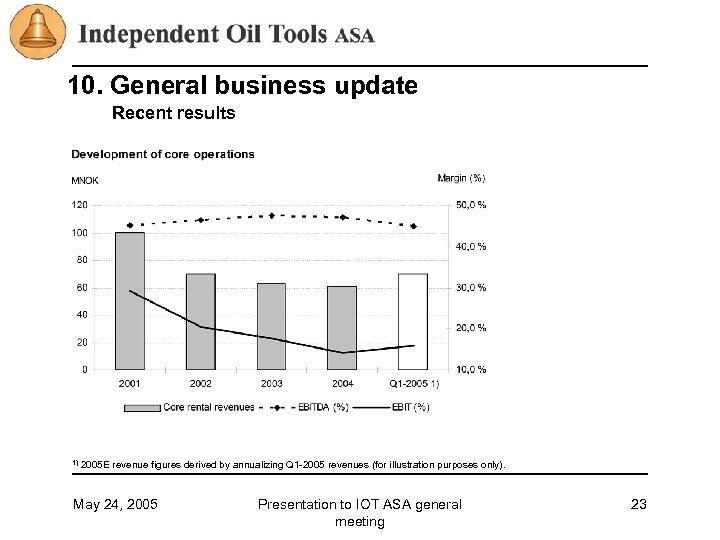

10. General business update Recent results 1) 2005 E revenue figures derived by annualizing Q 1 -2005 revenues (for illustration purposes only). May 24, 2005 Presentation to IOT ASA general meeting 23

10. General business update Recent results 1) 2005 E revenue figures derived by annualizing Q 1 -2005 revenues (for illustration purposes only). May 24, 2005 Presentation to IOT ASA general meeting 23

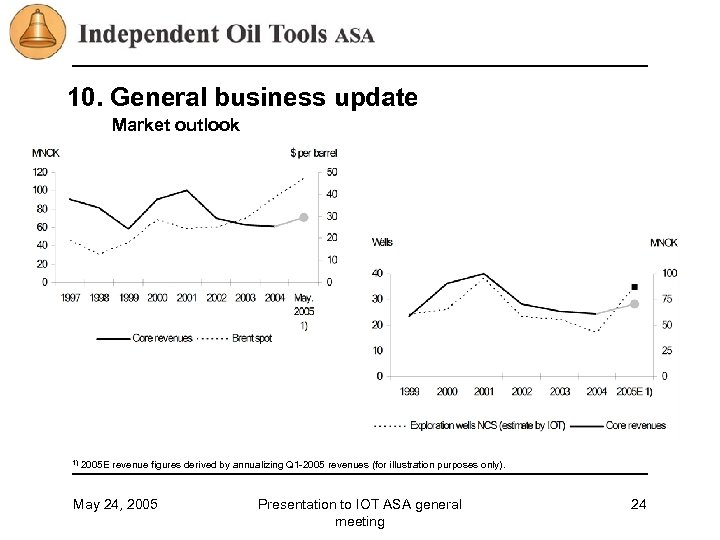

10. General business update Market outlook 1) 2005 E revenue figures derived by annualizing Q 1 -2005 revenues (for illustration purposes only). May 24, 2005 Presentation to IOT ASA general meeting 24

10. General business update Market outlook 1) 2005 E revenue figures derived by annualizing Q 1 -2005 revenues (for illustration purposes only). May 24, 2005 Presentation to IOT ASA general meeting 24

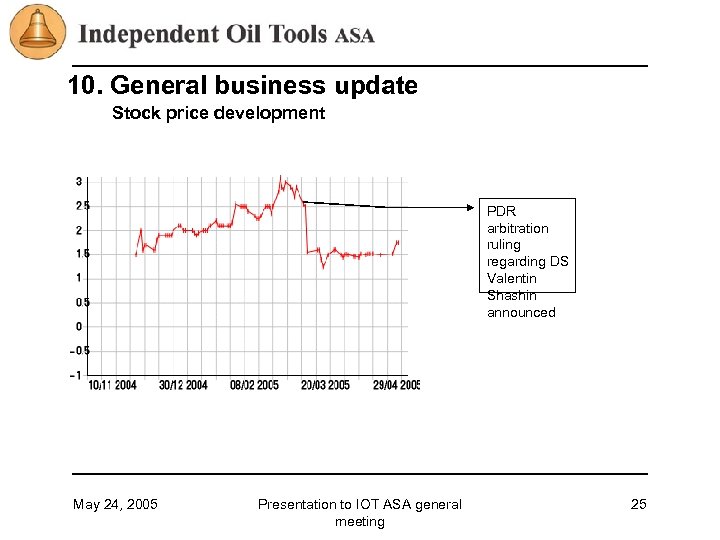

10. General business update Stock price development PDR arbitration ruling regarding DS Valentin Shashin announced May 24, 2005 Presentation to IOT ASA general meeting 25

10. General business update Stock price development PDR arbitration ruling regarding DS Valentin Shashin announced May 24, 2005 Presentation to IOT ASA general meeting 25