2e19426c04d1200053d16f3c71cb258a.ppt

- Количество слайдов: 52

INDEPENDENCE GROUP NL & Sydney Mining Club Presentation & April 2005 & The Past, The Present, & The Future

THE PAST & Approximately 300, 000 years ago mankind commenced exploration for rocks with specific characteristics to make tools. & Mining was the 1 st embryonic science? & Evolution of this science has continued throughout history and still continues.

MINING HISTORY & Gold mining commenced approx. 8, 000 years ago. & Copper was smelted at least 6, 200 years ago. & Early exploration involved finding alluvial deposits or outcropping ore bodies in stream head waters.

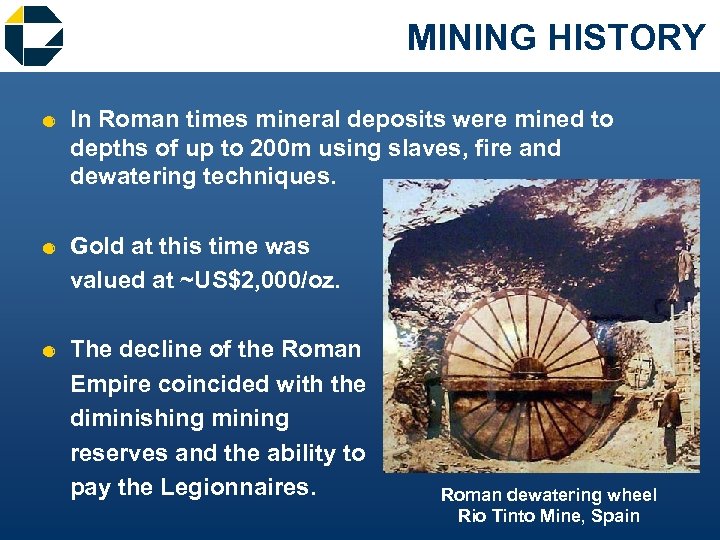

MINING HISTORY & In Roman times mineral deposits were mined to depths of up to 200 m using slaves, fire and dewatering techniques. & Gold at this time was valued at ~US$2, 000/oz. & The decline of the Roman Empire coincided with the diminishing mining reserves and the ability to pay the Legionnaires. Roman dewatering wheel Rio Tinto Mine, Spain

EXPLORATION HISTORY & The exploration techniques developed by the ancients were the mainstay of exploration up to the industrial era. & Significant advances in exploration & exploration technology has occurred over the last 5 decades. & Technological advances still continue.

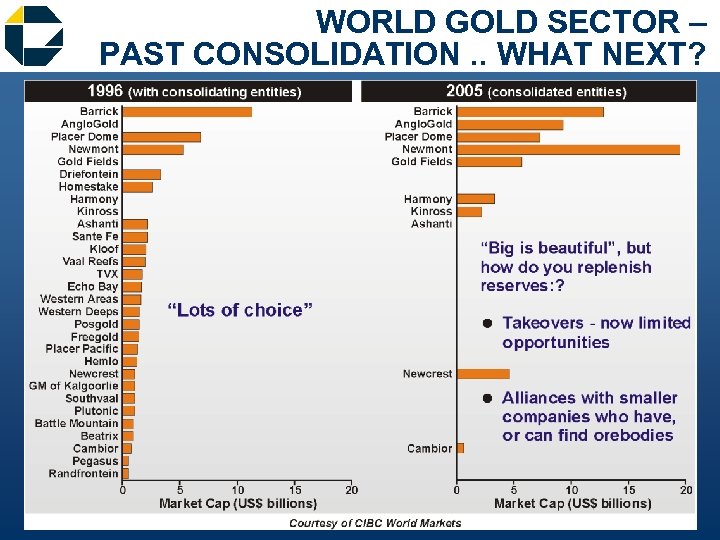

WORLD GOLD SECTOR – PAST CONSOLIDATION. . WHAT NEXT?

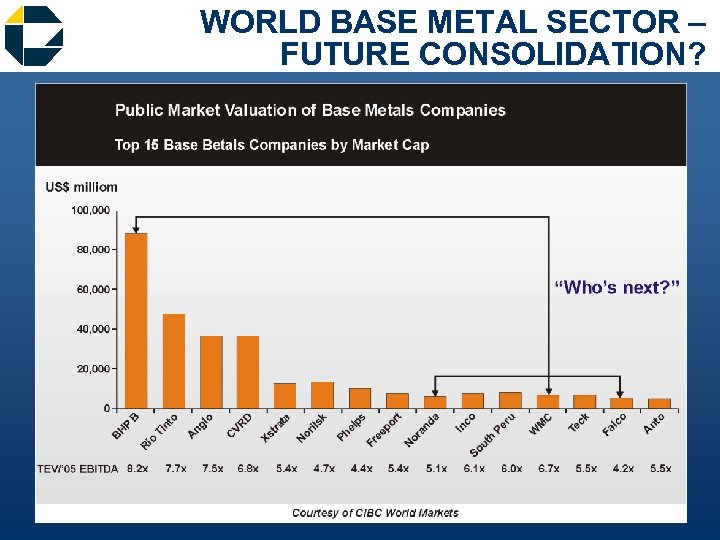

WORLD BASE METAL SECTOR – FUTURE CONSOLIDATION?

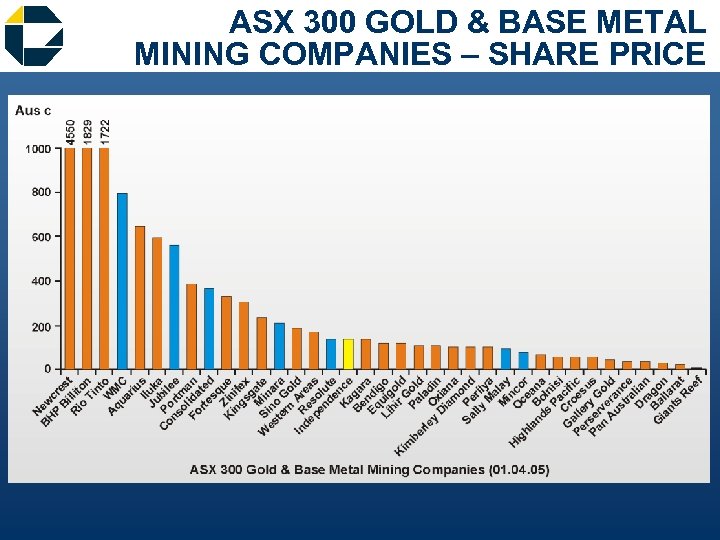

ASX 300 GOLD & BASE METAL MINING COMPANIES – SHARE PRICE

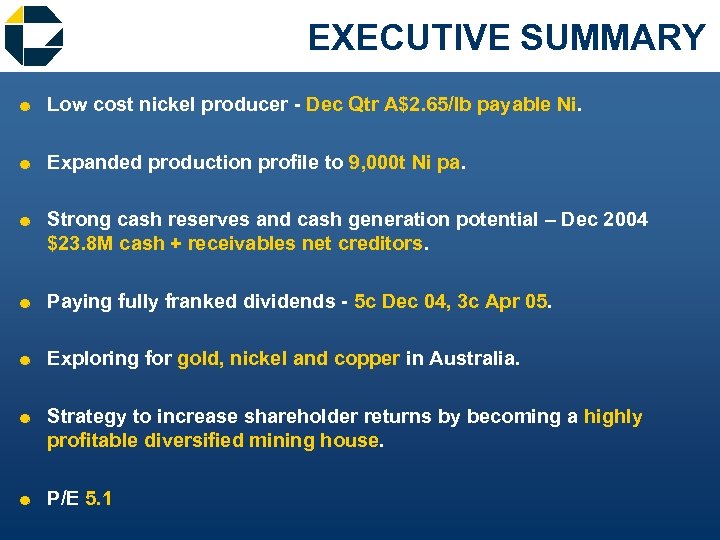

EXECUTIVE SUMMARY & Low cost nickel producer - Dec Qtr A$2. 65/lb payable Ni. & Expanded production profile to 9, 000 t Ni pa. & Strong cash reserves and cash generation potential – Dec 2004 $23. 8 M cash + receivables net creditors. & Paying fully franked dividends - 5 c Dec 04, 3 c Apr 05. & Exploring for gold, nickel and copper in Australia. & Strategy to increase shareholder returns by becoming a highly profitable diversified mining house. & P/E 5. 1

INDEPENDENCE CORPORATE GOALS To increase shareholder wealth by becoming a highly profitable, mid-cap, multi commodity Australian mining company & Focus on share price and dividend increases. (as opposed to market capitalisation). & Growth through exploration and acquisition. & Under promise, over deliver. & Maintain a conservative balance sheet.

SHARE STRUCTURE ASX Code - Shares IGO A$1. 32 (01. 04. 05) IGO average turnover (last 6 months) = 485, 000 shares/day Ordinary shares Contributing shares Unlisted options TOTAL 107. 0 M 3. 1 M 7. 4 M 117. 5 M Undiluted market capitalisation = $142 M ASX 300 Company

TOP TEN SHAREHOLDERS Ordinary Shares as at 11. 03. 05 Equity Trustees ANZ Nominees Forbar Custodians Virtual Genius National Nominees Queensland Investments Westpac Custodian Nominees Yarandi Investments JP Morgan Nominees RBC Global Services 6. 5 M 4. 1 M 3. 5 M 3. 4 M 3. 1 M 2. 9 M 2. 6 M 2. 3 M 2. 1 M 1. 8 M 32. 3 M 6. 1% 3. 9% 3. 3% 3. 2% 2. 9% 2. 8% 2. 4% 2. 1% 2. 0% 1. 7% 30. 4% 5 British institutions on IGO register

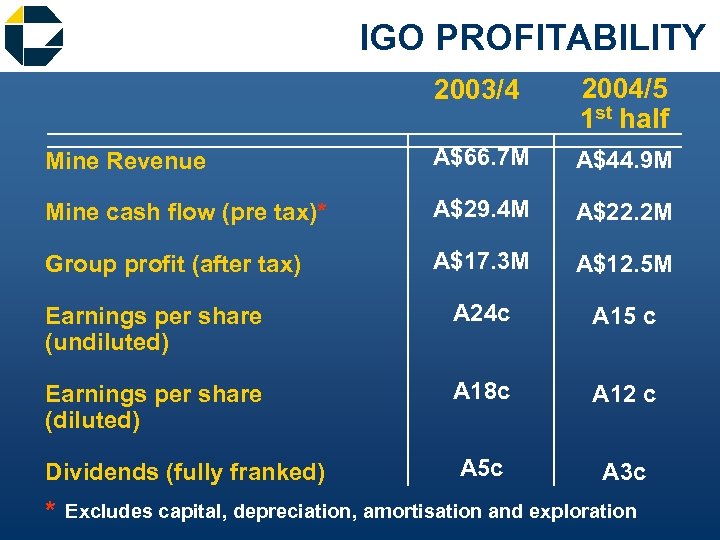

IGO PROFITABILITY 2003/4 2004/5 1 st half Mine Revenue A$66. 7 M A$44. 9 M Mine cash flow (pre tax)* A$29. 4 M A$22. 2 M Group profit (after tax) A$17. 3 M A$12. 5 M Earnings per share (undiluted) A 24 c A 15 c Earnings per share (diluted) A 18 c A 12 c Dividends (fully franked) A 5 c A 3 c * Excludes capital, depreciation, amortisation and exploration

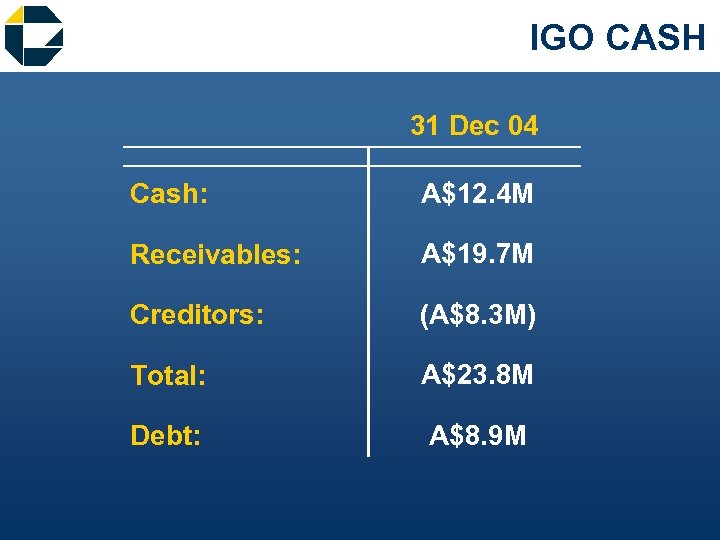

IGO CASH 31 Dec 04 Cash: A$12. 4 M Receivables: A$19. 7 M Creditors: (A$8. 3 M) Total: A$23. 8 M Debt: A$8. 9 M

LONG NICKEL MINE (100% IGO) TARGET: & New nickel discovery to raise production from 9, 000 t Ni pa to 15, 000 t Ni pa in bottom 3 rd of nickel production cash costs

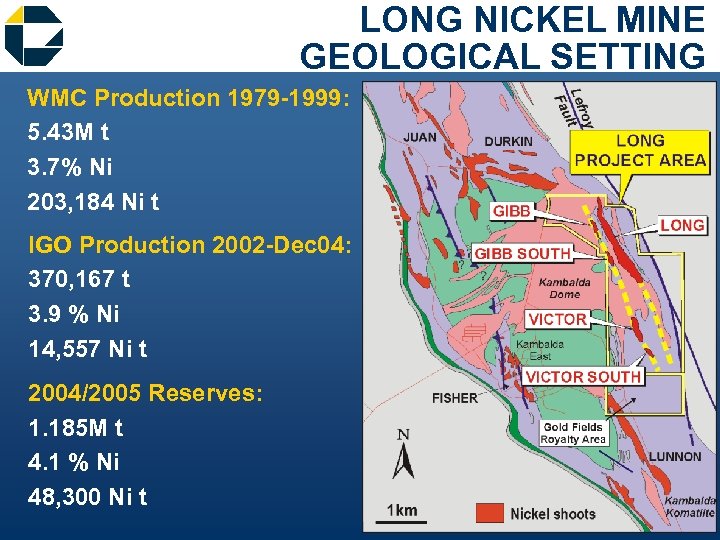

LONG NICKEL MINE GEOLOGICAL SETTING WMC Production 1979 -1999: 5. 43 M t 3. 7% Ni 203, 184 Ni t IGO Production 2002 -Dec 04: 370, 167 t 3. 9 % Ni 14, 557 Ni t 2004/2005 Reserves: 1. 185 M t 4. 1 % Ni 48, 300 Ni t

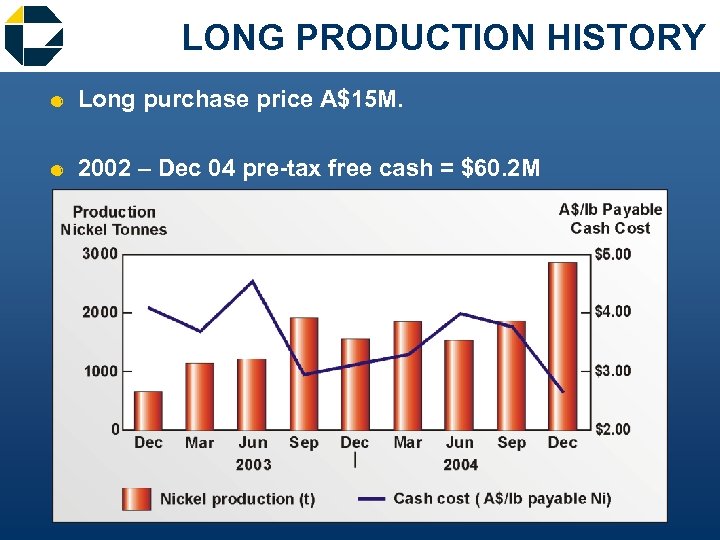

LONG PRODUCTION HISTORY & Long purchase price A$15 M. & 2002 – Dec 04 pre-tax free cash = $60. 2 M

LONG MINE PERSONNEL & Owner operator with 108 salaried employees. & Very experienced team. & Turnover extremely low. & Gain share bonus. & Skilled personnel waiting list. & Only 2 LTI’s since commencement.

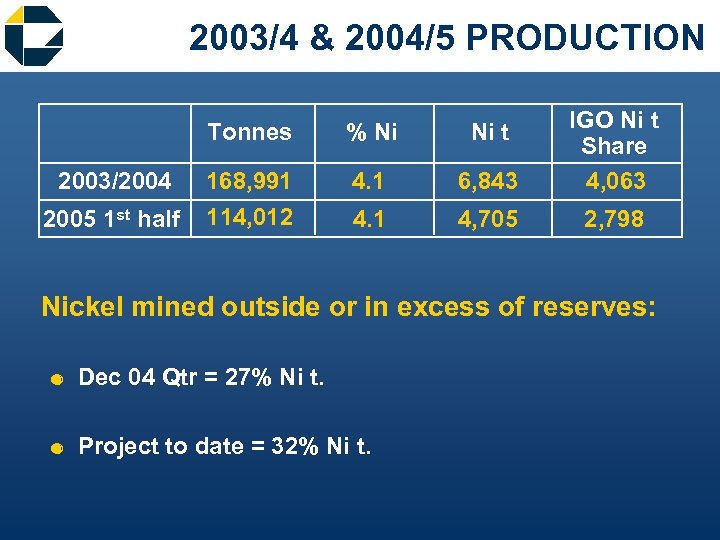

2003/4 & 2004/5 PRODUCTION Tonnes 2003/2004 2005 1 st half % Ni Ni t 168, 991 114, 012 4. 1 6, 843 IGO Ni t Share 4, 063 4. 1 4, 705 2, 798 Nickel mined outside or in excess of reserves: & Dec 04 Qtr = 27% Ni t. & Project to date = 32% Ni t.

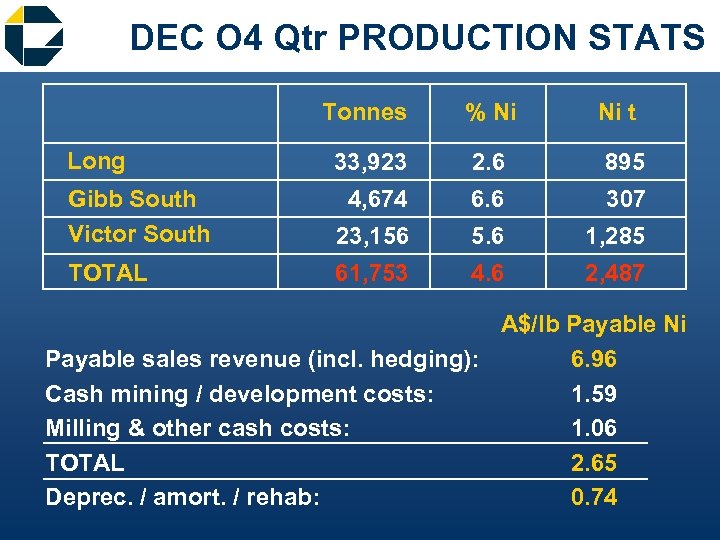

DEC O 4 Qtr PRODUCTION STATS Tonnes Long % Ni Ni t 33, 923 2. 6 895 Gibb South Victor South 4, 674 6. 6 307 23, 156 5. 6 1, 285 TOTAL 61, 753 4. 6 2, 487 A$/lb Payable Ni Payable sales revenue (incl. hedging): 6. 96 Cash mining / development costs: 1. 59 Milling & other cash costs: 1. 06 TOTAL 2. 65 Deprec. / amort. / rehab: 0. 74

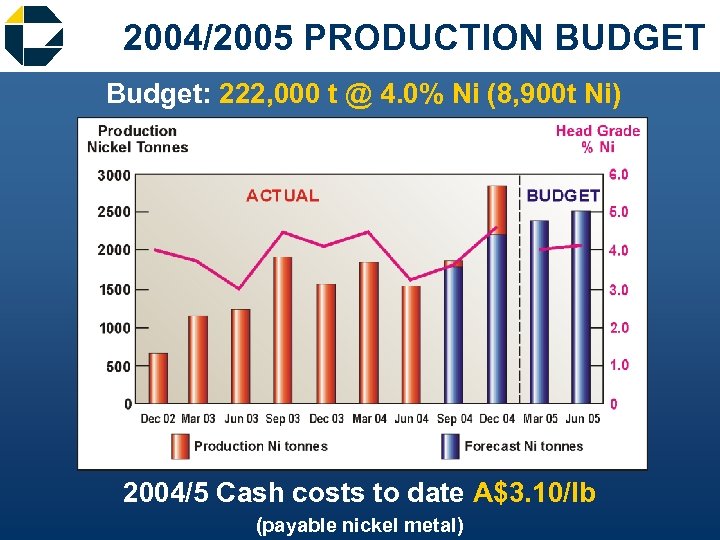

2004/2005 PRODUCTION BUDGET Budget: 222, 000 t @ 4. 0% Ni (8, 900 t Ni) 2004/5 Cash costs to date A$3. 10/lb (payable nickel metal)

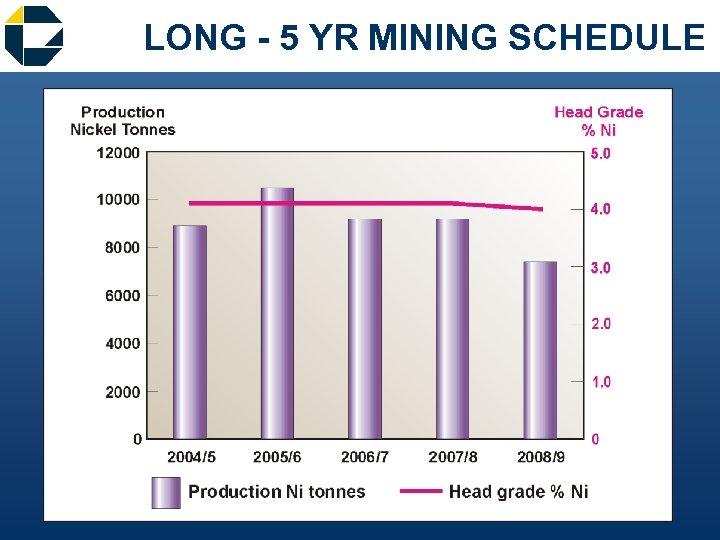

LONG - 5 YR MINING SCHEDULE

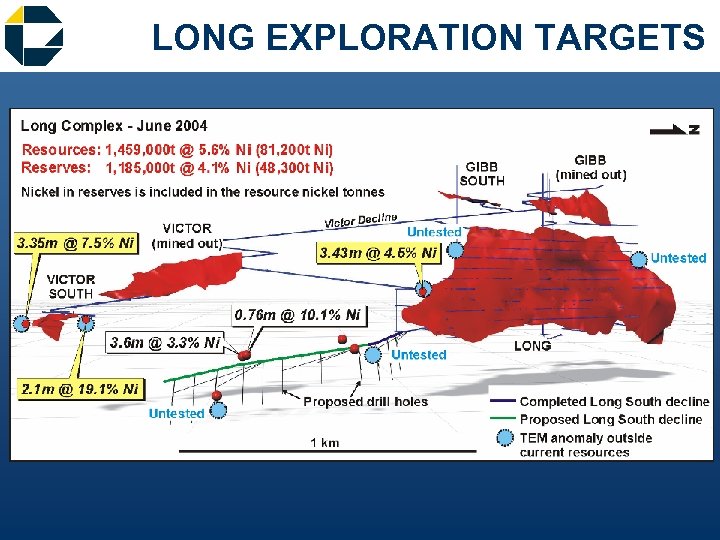

LONG EXPLORATION TARGETS

IGO AUSTRALIAN REGIONAL EXPLORATION STRATEGY: Targeting new, high profit mines by & Exploring under cover and in lightly or unexplored terrains. & Using empirical, conceptual targeting & new innovative exploration technology. & Turning ground over quickly and efficiently. REGIONAL BUDGET: 2004/2005 - A $4 M SIGNIFICANT PROJECTS: 7 Nickel 9 Gold 1 Copper 1 Mineral Sands

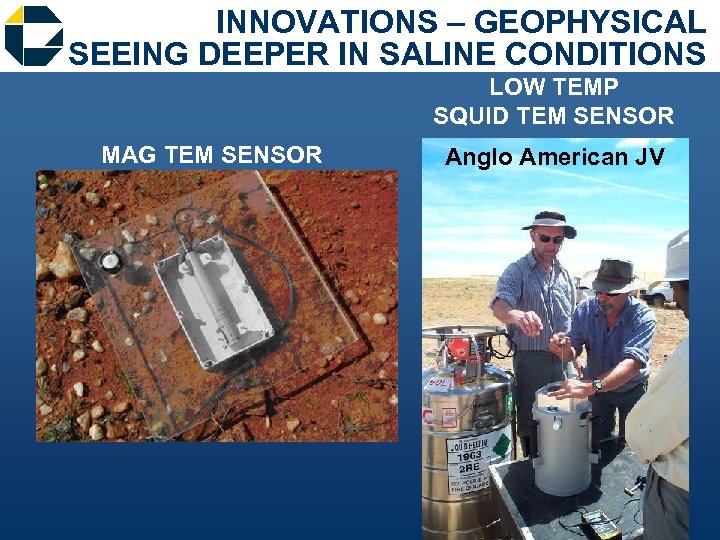

INNOVATIONS – GEOPHYSICAL SEEING DEEPER IN SALINE CONDITIONS LOW TEMP SQUID TEM SENSOR MAG TEM SENSOR Anglo American JV

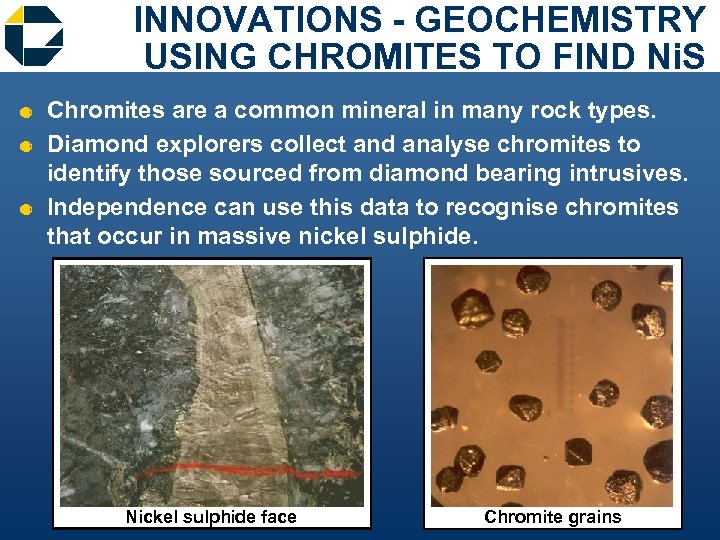

INNOVATIONS - GEOCHEMISTRY USING CHROMITES TO FIND Ni. S & Chromites are a common mineral in many rock types. & Diamond explorers collect and analyse chromites to identify those sourced from diamond bearing intrusives. & Independence can use this data to recognise chromites that occur in massive nickel sulphide. Nickel sulphide face Chromite grains

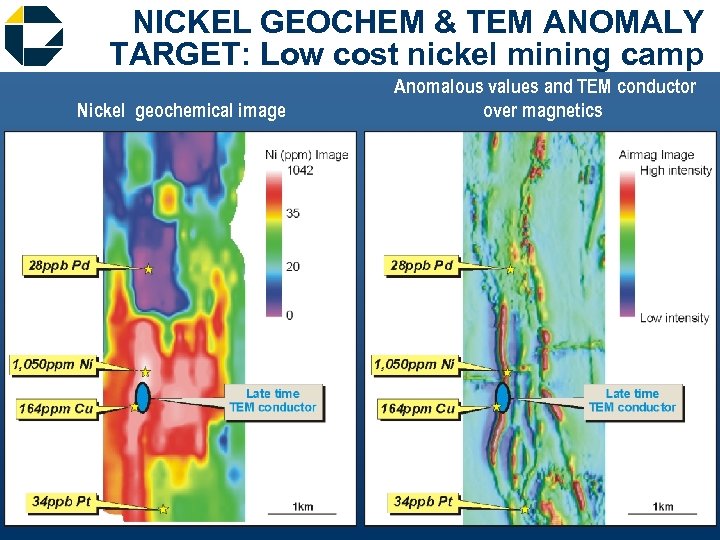

NICKEL GEOCHEM & TEM ANOMALY TARGET: Low cost nickel mining camp Nickel geochemical image Anomalous values and TEM conductor over magnetics

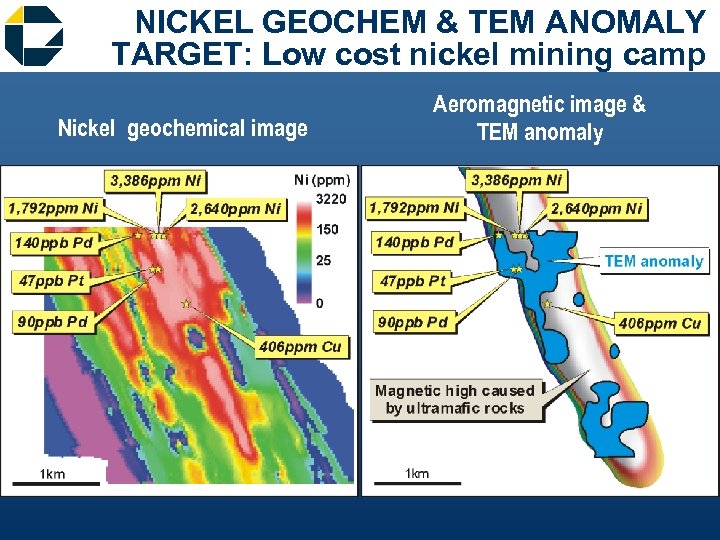

NICKEL GEOCHEM & TEM ANOMALY TARGET: Low cost nickel mining camp Nickel geochemical image Aeromagnetic image & TEM anomaly

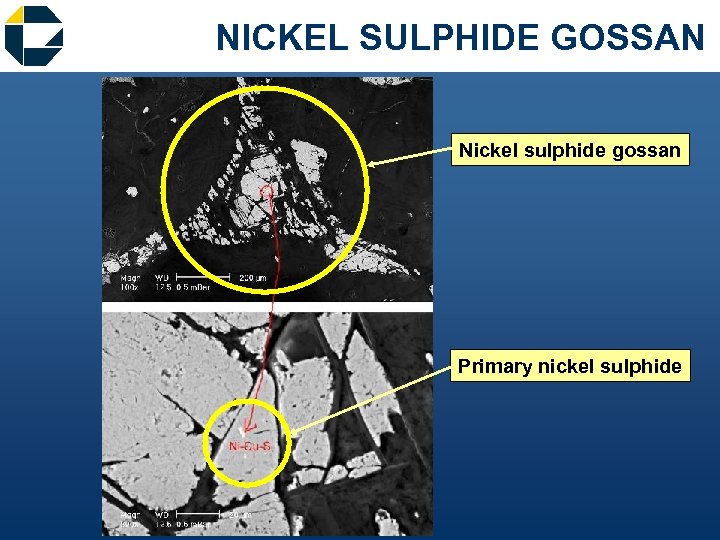

NICKEL SULPHIDE GOSSAN Nickel sulphide gossan Primary nickel sulphide

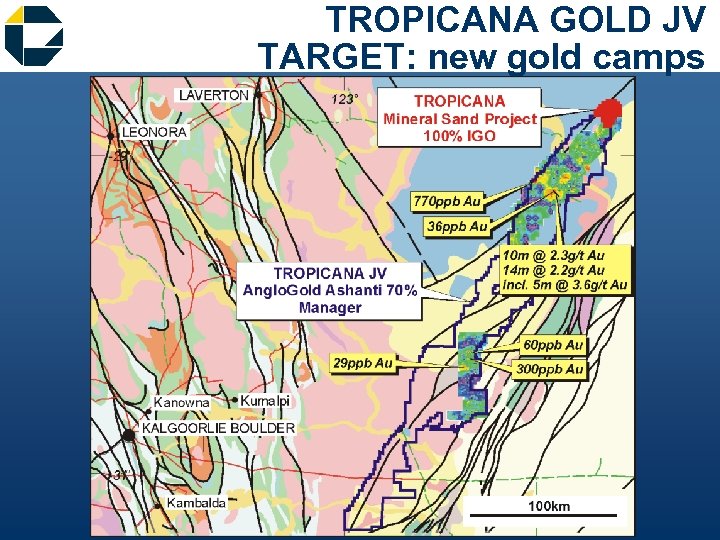

TROPICANA GOLD JV TARGET: new gold camps

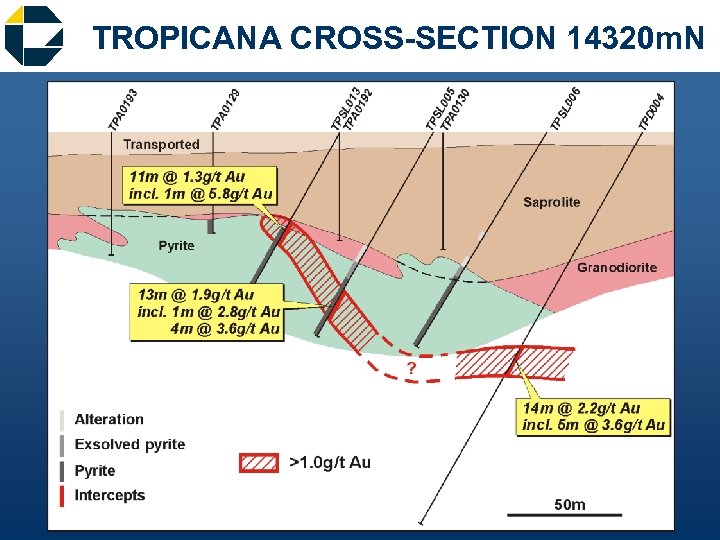

TROPICANA CROSS-SECTION 14320 m. N

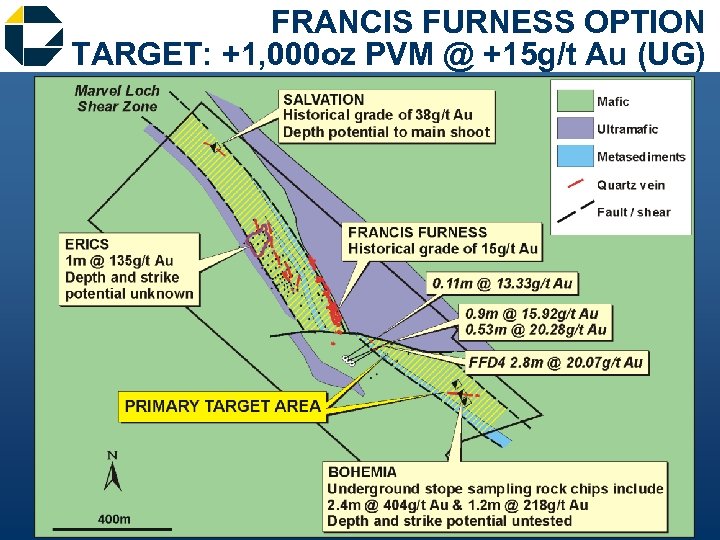

FRANCIS FURNESS OPTION TARGET: +1, 000 oz PVM @ +15 g/t Au (UG)

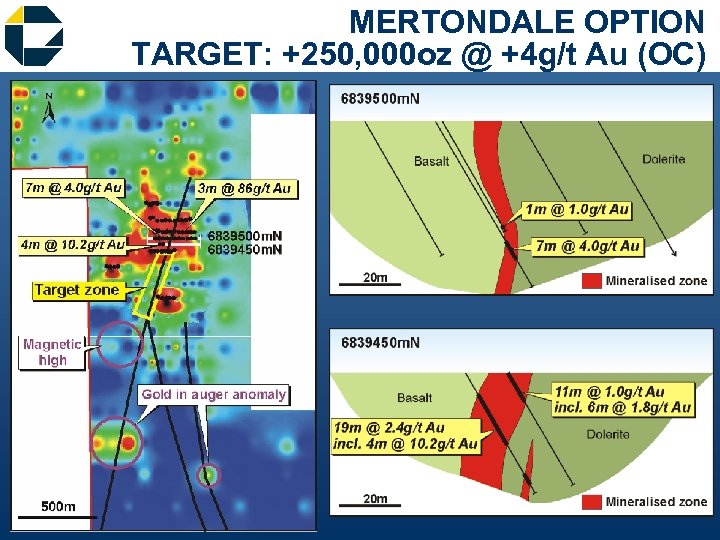

MERTONDALE OPTION TARGET: +250, 000 oz @ +4 g/t Au (OC)

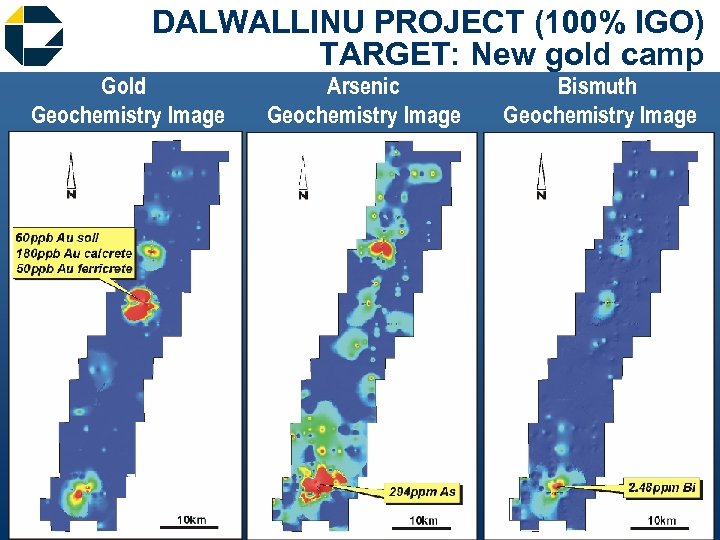

DALWALLINU PROJECT (100% IGO) TARGET: New gold camp Gold Geochemistry Image Arsenic Geochemistry Image Bismuth Geochemistry Image

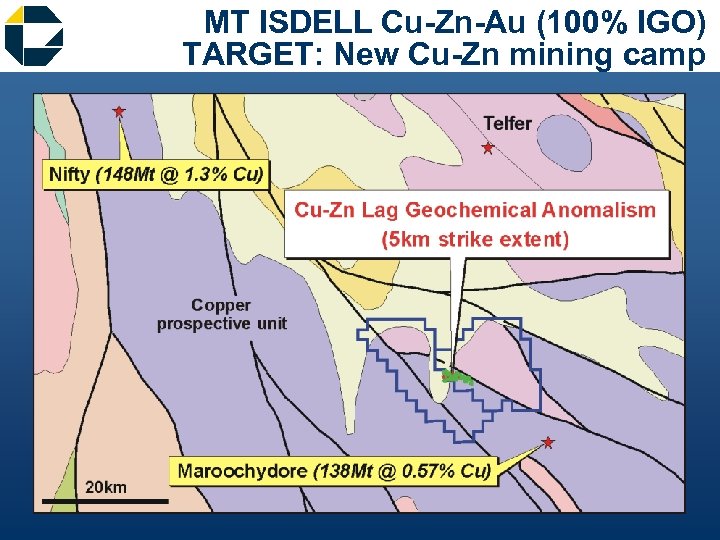

MT ISDELL Cu-Zn-Au (100% IGO) TARGET: New Cu-Zn mining camp

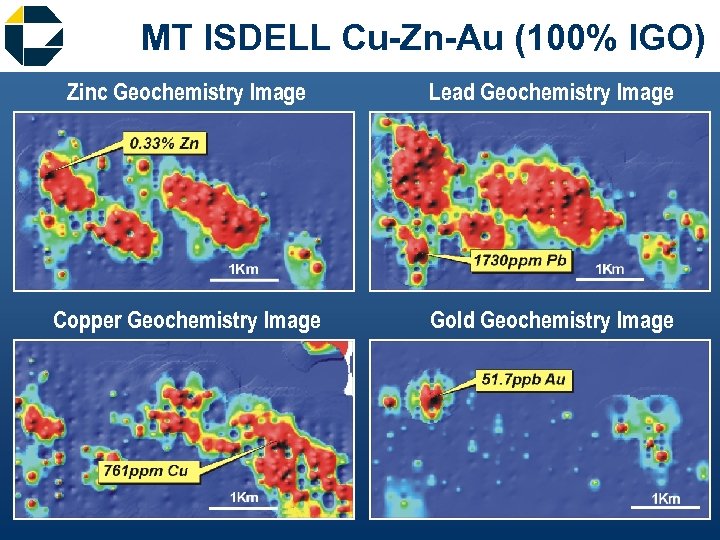

MT ISDELL Cu-Zn-Au (100% IGO) Zinc Geochemistry Image Lead Geochemistry Image Copper Geochemistry Image Gold Geochemistry Image

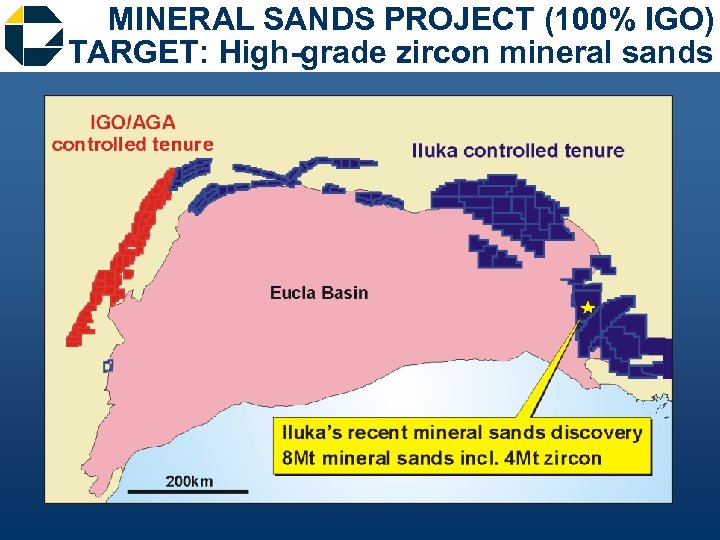

MINERAL SANDS PROJECT (100% IGO) TARGET: High-grade zircon mineral sands

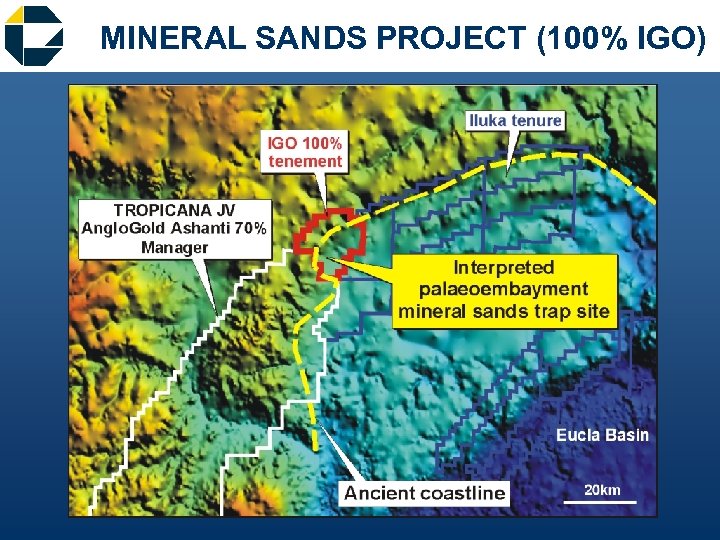

MINERAL SANDS PROJECT (100% IGO)

IGO INVESTMENT CRITERIA Acquisition / Merger Investment Tenets: & Production cash costs in the lowest 3 rd of worldwide costs. & Long-term mine-life. & Appropriate capital cost and cash generation timing. & Significant exploration upside.

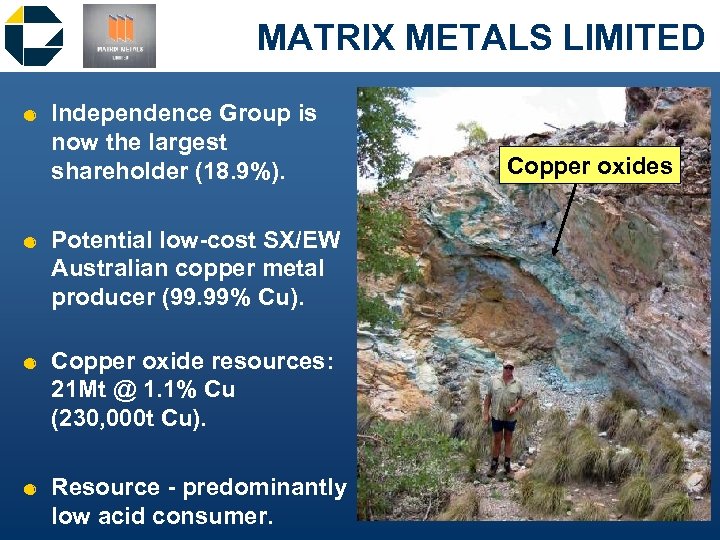

MATRIX METALS LIMITED & Independence Group is now the largest shareholder (18. 9%). & Potential low-cost SX/EW Australian copper metal producer (99. 99% Cu). & Copper oxide resources: 21 Mt @ 1. 1% Cu (230, 000 t Cu). & Resource - predominantly low acid consumer. Copper oxides

MATRIX METALS LIMITED - A SNAPSHOT Listed on the Australian Stock Exchange ASX code – MRX. & Ordinary shares Unlisted Options 575. 4 M 12. 0 M & MRX cash as at 31. 12. 04 A$16. 8 M & Tax losses A$24. 0 M & Market Cap as at 01. 04. 05 (quoted at 8. 8 c) A$50. 6 M (undiluted) & Matrix Enterprise value A$28. 4 M (undiluted)

MT CUTHBERT SX/EW PLANT & Proven dump leach SX/EW in-house expertise.

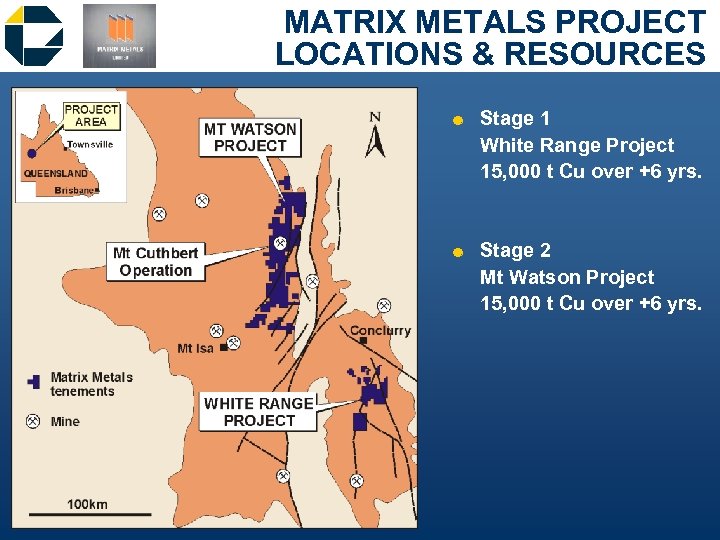

MATRIX METALS PROJECT LOCATIONS & RESOURCES & Stage 1 White Range Project 15, 000 t Cu over +6 yrs. & Stage 2 Mt Watson Project 15, 000 t Cu over +6 yrs.

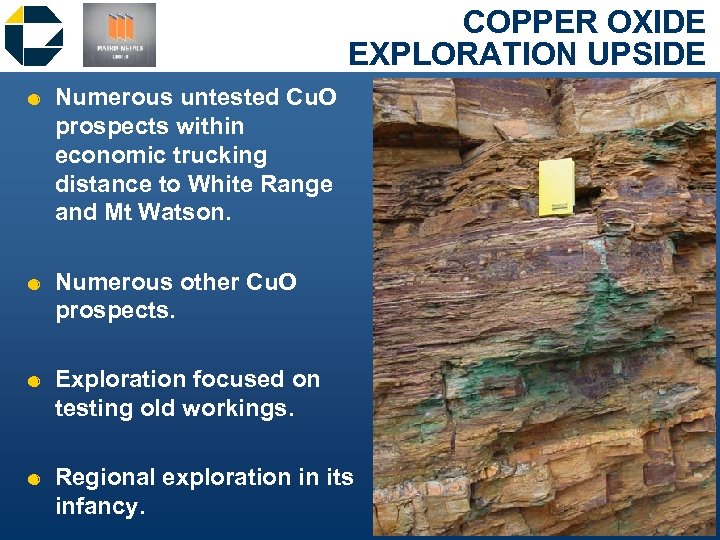

COPPER OXIDE EXPLORATION UPSIDE & Numerous untested Cu. O prospects within economic trucking distance to White Range and Mt Watson. & Numerous other Cu. O prospects. & Exploration focused on testing old workings. & Regional exploration in its infancy.

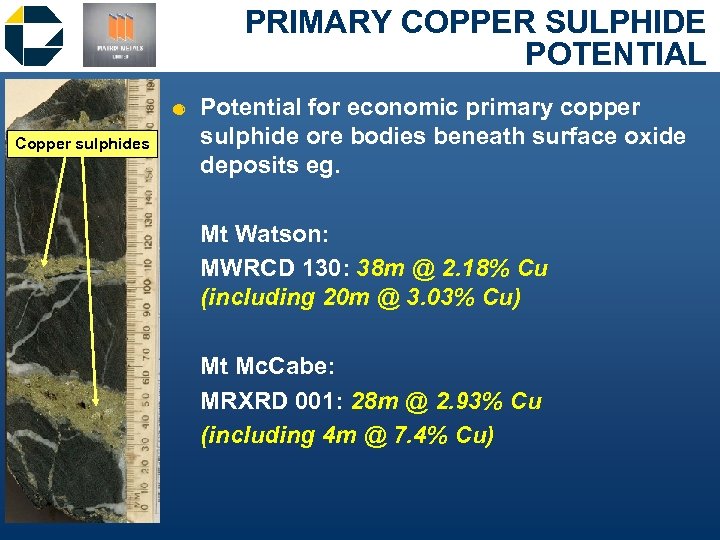

PRIMARY COPPER SULPHIDE POTENTIAL Copper sulphides & Potential for economic primary copper sulphide ore bodies beneath surface oxide deposits eg. Mt Watson: MWRCD 130: 38 m @ 2. 18% Cu (including 20 m @ 3. 03% Cu) Mt Mc. Cabe: MRXRD 001: 28 m @ 2. 93% Cu (including 4 m @ 7. 4% Cu)

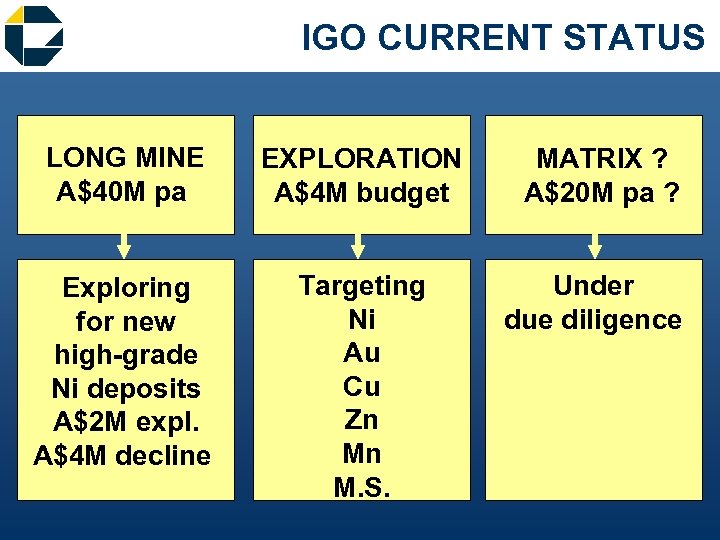

IGO CURRENT STATUS LONG MINE A$40 M pa EXPLORATION A$4 M budget Exploring for new high-grade Ni deposits A$2 M expl. A$4 M decline Targeting Ni Au Cu Zn Mn M. S. MATRIX ? A$20 M pa ? Under due diligence

LONG-TERM GROWTH STRATEGY Targeting +A$100 M profit per annum EXPLORATION LONG MINE 9, 000 t Ni pa ACQUISITON 1 EXPLORATION MINE 1 LONG MINE NEW DISCOVERY 15, 000 t Ni pa ACQUISITON 2 EXPLORATION MINE 2 MATRIX ? ACQUISITON 3

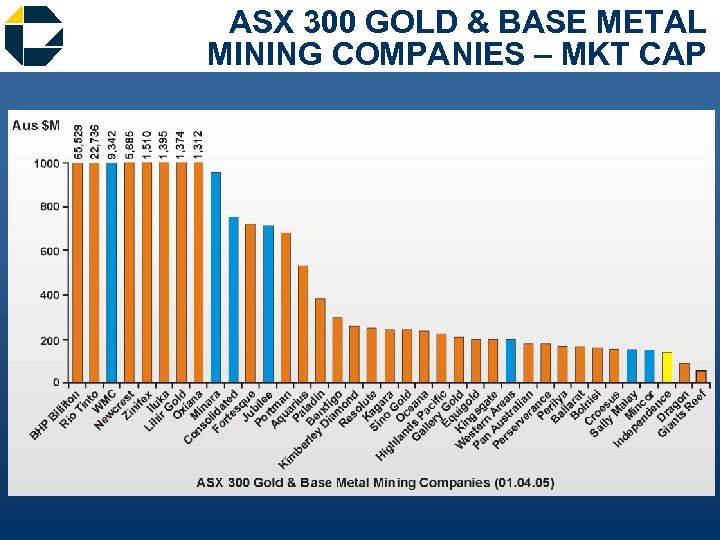

ASX 300 GOLD & BASE METAL MINING COMPANIES – MKT CAP

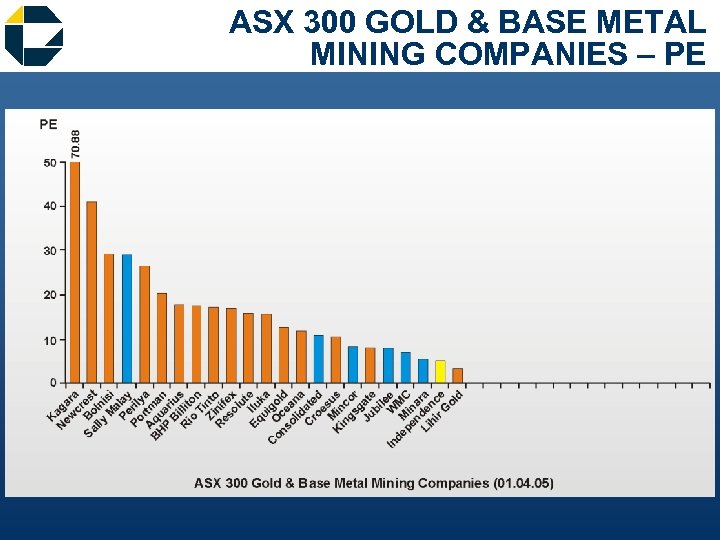

ASX 300 GOLD & BASE METAL MINING COMPANIES – PE

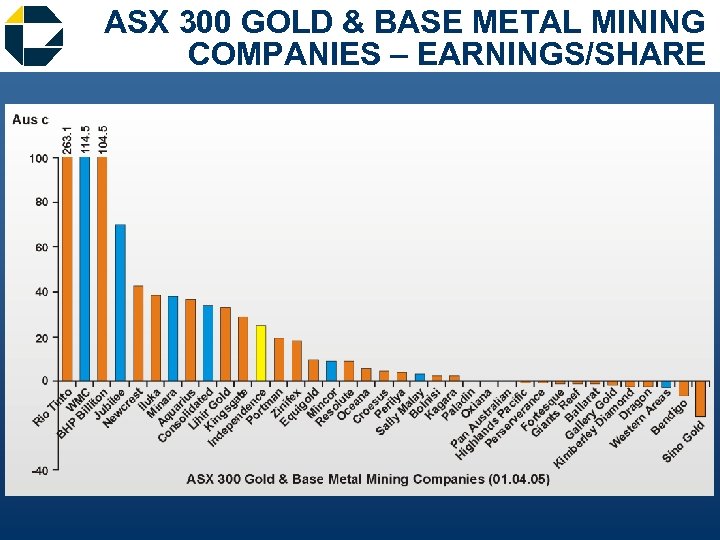

ASX 300 GOLD & BASE METAL MINING COMPANIES – EARNINGS/SHARE

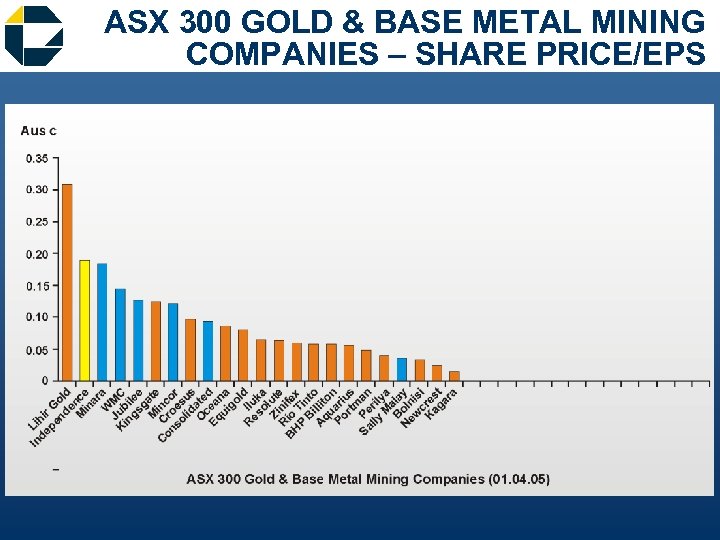

ASX 300 GOLD & BASE METAL MINING COMPANIES – SHARE PRICE/EPS

SUMMARY & +5 year mine life with low cash costs. & Strong cash position. & Significant cash flow available for growth and fully franked dividends. & Exposure to exploration upside at Long and on regional nickel and gold plays. & A$6 M exploration budget plus Long South decline. & Acquisitions must be value accretive.

2e19426c04d1200053d16f3c71cb258a.ppt