e2e4309fe1a056d0230de4e0e2ba0167.ppt

- Количество слайдов: 13

Increasing access to finance using mobile banking services: What are the factors MFIs should consider before engaging in m-banking solutions? Malith Gunasekara Senior Consultant contact@e-mfp. eu www. e-mfp. eu

Introduction to Shore. Bank International SBI advises its partners – all types of financial institutions in emerging economies – in inclusive finance Utilizing commercial finance practitioners Focusing on the fundamentals of banking and financial institutions Delivering innovative and market-driven products and services Building capacity in our partners’ ability to increase access to finance locally Sustaining long-term partnerships contact@e-mfp. eu www. e-mfp. eu

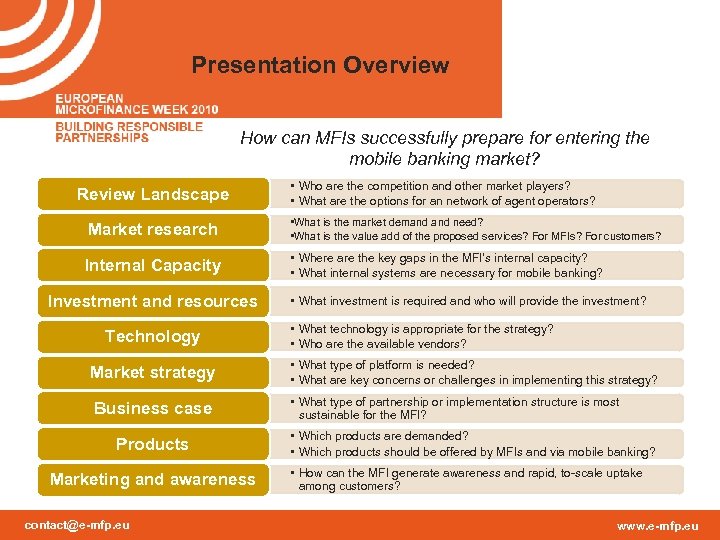

Presentation Overview How can MFIs successfully prepare for entering the mobile banking market? Review Landscape • Who are the competition and other market players? • What are the options for an network of agent operators? Market research • What is the market demand need? • What is the value add of the proposed services? For MFIs? For customers? Internal Capacity • Where are the key gaps in the MFI’s internal capacity? • What internal systems are necessary for mobile banking? Investment and resources Technology Market strategy Business case Products Marketing and awareness contact@e-mfp. eu • What investment is required and who will provide the investment? • What technology is appropriate for the strategy? • Who are the available vendors? • What type of platform is needed? • What are key concerns or challenges in implementing this strategy? • What type of partnership or implementation structure is most sustainable for the MFI? • Which products are demanded? • Which products should be offered by MFIs and via mobile banking? • How can the MFI generate awareness and rapid, to-scale uptake among customers? www. e-mfp. eu

Review Landscape Who are the competitors? • Courier companies • Money transfer agents • Other informal means contact@e-mfp. eu Who are market players to consider? • Financial institutions • Retail network • Telcos What is the existing network of agent operators? • Leverage existing branch network • Supplement branch network What is the regulatory environment? • Are non-banks allowed to offer banking services, and to what extent? www. e-mfp. eu

Market Research What is the need? What is the demand? • Long term success will require developing products that help consumers build and save wealth • Consider the portion of the population without a bank account and with access to mobile phones • Consider the current costs and convenience of financial transactions What is the value add? • For customers • For the financial institution What is the best way to conduct market research? • Focus groups are often more effective than a quantitative survey contact@e-mfp. eu www. e-mfp. eu

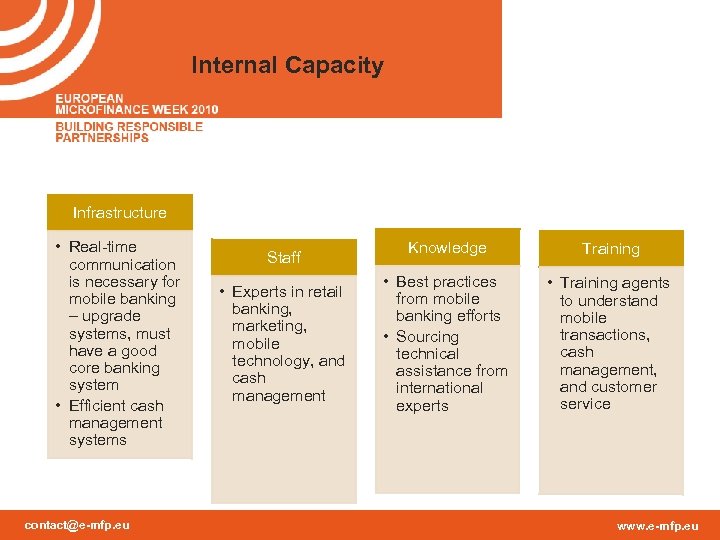

Internal Capacity Infrastructure • Real-time communication is necessary for mobile banking – upgrade systems, must have a good core banking system • Efficient cash management systems contact@e-mfp. eu Staff • Experts in retail banking, marketing, mobile technology, and cash management Knowledge Training • Best practices from mobile banking efforts • Sourcing technical assistance from international experts • Training agents to understand mobile transactions, cash management, and customer service www. e-mfp. eu

Resources and Investment • Mobile banking/ agent banking requires committed investment, both internally and from outside investors o Ex: KBS in India expanding branchless banking services required a strong backend system • New initiatives require buy-in from top management, but resources may come from outside o Ex: In Pakistan, a MFB wanted to acquire software that costs $6 -7 million to do branchless banking, but its Board rejected this • The amount of investment required can be very high o An MNO-led model in East Africa spent $30 million scaling their service o Another telco in Uganda has spent $10. 5 million contact@e-mfp. eu www. e-mfp. eu

Technology Requirements • MFIs need to be able to understand the technology and have the capacity to negotiate flexibility for functionality with the vendors • What technology is appropriate? o Flexibility, functionality, and cost effective • Consider and weigh vendor options o Early negotiations are crucial, as mobile banking services are often locked into a specific vendor • Off-the-shelf solutions vs. ability to cater to MFI and products Technology is not a panacea for all issues and is only as good as the people using it and benefiting from it; its value to the MFI and customer is related to their trust and its functionality contact@e-mfp. eu www. e-mfp. eu

Develop Market Strategy • Developing a “go to market” strategy requires understanding of the product, placement, pricing, and promotion • Marketing strategy can include phased roll outs with different market segments • Institutional platform needs to be developed for effective marketing • Leveraging another platform – financial institution, telco, or third party operator – can help expand reach • The agent network itself is a key part of marketing, messaging, and branding • Must protect FI’s clients and personal client data contact@e-mfp. eu www. e-mfp. eu

Business Case Can mobile banking be a profitable business? • Can a FI form a profitable partnership with a larger bank or Telco? o Ex: A leading provider in East Africa charges fees that are too high for MFIs to profitably partner o Ex: Large telcos may buy a bank • How large does an MFI have to be to do it alone? o Ex: MFB in Pakistan debated partnering v. individual provision (requires investment in network and platform) contact@e-mfp. eu www. e-mfp. eu

Products • Development of products depends on the business case • Complementary products can leverage mobile banking data and clients – mobile banking and MFIs are not competing • MFIs can leverage an existing mobile banking platforms to disburse its own loans o Ex: MFIs in East Africa can leverage existing platforms • MFIs are strong in providing credit, and mobile banking can offer other services • Currently, m-banking providers do not provide credit but allow for transfer and savings, so they are not competing with the MFIs o Ex: A bank in Pakistan (transfer, storing money) and an MFI that SBI is working with (can bring in new users as credit clients) contact@e-mfp. eu www. e-mfp. eu

Marketing and awareness Creating awareness among the target market about the available services and products is an important cornerstone for success Marketing delivery channels: • Village meetings • Sponsorship of local events • Marketing van with audio-visual capabilities • Print, television, billboards contact@e-mfp. eu Branding: • “Reaching the unreached” • “Your local bank at your doorstep” www. e-mfp. eu

The Potential of Mobile Banking: Financial Inclusion Outreach of Mobile Banking Providers (From CGAP FN 66) • In eight branchless banking pioneers, 37% (on average 1. 39 million) of active clients were previously unbanked. • In five of the eight cases, the branchless banking provider reaches more previously unbanked people than the largest MFI in the same country: on average 79% more. • The same five providers grew rapidly, needing on average three years to acquire more unbanked clients than the largest MFI in the same market. • Mobile banking is cheaper than traditional banking, but the price advantage may not be as wide as one might anticipate. On average, branchless banking is 19% cheaper than comparable products offered by banks via traditional channels. contact@e-mfp. eu www. e-mfp. eu

e2e4309fe1a056d0230de4e0e2ba0167.ppt