d9cb0ba85cef5c19d19221036173a8e4.ppt

- Количество слайдов: 51

INCOME TAX ACT – CURRENT ISSUES CA V Ramnath Coimbatore ramnath@ksp. co. in

INCOME TAX ACT – CURRENT ISSUES CA V Ramnath Coimbatore ramnath@ksp. co. in

Heads of Income A firm constructed 5 storey building First floor alone consists of shops Other 4 floors consist of rooms let out on monthly rental basis. Whether the rental income from the building is to be offered under the head House property or business

Heads of Income A firm constructed 5 storey building First floor alone consists of shops Other 4 floors consist of rooms let out on monthly rental basis. Whether the rental income from the building is to be offered under the head House property or business

Heads of Income One house property has twelve residential units. The assesesee collects rent and maintenance charges separately Whether such maintenance charges and other charges collected from the tenant by letting out the property is to be grossed up with the rent and to be assessed under income from House property? Alternatively, the maintenance charges can be assessed as income from other sources? R J Wood P Ltd – 334 ITR 358 (DEL) Sunil Kumar Agarwal 139 TTJ 49 (Lucknow) (UO)

Heads of Income One house property has twelve residential units. The assesesee collects rent and maintenance charges separately Whether such maintenance charges and other charges collected from the tenant by letting out the property is to be grossed up with the rent and to be assessed under income from House property? Alternatively, the maintenance charges can be assessed as income from other sources? R J Wood P Ltd – 334 ITR 358 (DEL) Sunil Kumar Agarwal 139 TTJ 49 (Lucknow) (UO)

Heads of Income Mr. A is a trader in shares He sells a long term capital asset being shares in company and paid STT also on the transaction Can he claim the benefit of sec 10(38) even though he is not the investor ? Smt Alka Agarwal – 48 SOT 493 (Del)

Heads of Income Mr. A is a trader in shares He sells a long term capital asset being shares in company and paid STT also on the transaction Can he claim the benefit of sec 10(38) even though he is not the investor ? Smt Alka Agarwal – 48 SOT 493 (Del)

House property Mr A paid brokerage for soliciting tenant The brokerage is one month rent – Rs. 20000/ Is it deductible against the income from House property? Aravalli Engineers P Ltd – 335 ITR 508 (P&H)

House property Mr A paid brokerage for soliciting tenant The brokerage is one month rent – Rs. 20000/ Is it deductible against the income from House property? Aravalli Engineers P Ltd – 335 ITR 508 (P&H)

House property A Hindu undivided family claims the annual value of one house as self occupied It would like to avail the benefit of exemption u/s. 23? Is it possible? Hariprasad Bhojnagarwala – 342 ITR 69 Guj FB HC

House property A Hindu undivided family claims the annual value of one house as self occupied It would like to avail the benefit of exemption u/s. 23? Is it possible? Hariprasad Bhojnagarwala – 342 ITR 69 Guj FB HC

House property Rent advance received from tenants During the course of assessment, the AO invoked sec 68 and required the assessee to prove the credit. Assessee was unable to prove that the tenant had source for making the rent advance. Therefore, AO would like to make addition u/s. 68?

House property Rent advance received from tenants During the course of assessment, the AO invoked sec 68 and required the assessee to prove the credit. Assessee was unable to prove that the tenant had source for making the rent advance. Therefore, AO would like to make addition u/s. 68?

Business In the partnership deed, the remuneration clause did not quantify the actual amount payable. It merely reproduced the relevant clause of sec 40(b). AO is of the view that the firm is not entitled for claiming the remuneration. Whether the view of the AO is in accordance with law? The Asian Marketing – Raj HC - www. itatonline. org

Business In the partnership deed, the remuneration clause did not quantify the actual amount payable. It merely reproduced the relevant clause of sec 40(b). AO is of the view that the firm is not entitled for claiming the remuneration. Whether the view of the AO is in accordance with law? The Asian Marketing – Raj HC - www. itatonline. org

Business After the death of the partner, lump sum consideration paid to the widow of the deceased partner. Is it liable for tax in the hands of the recipient? Mrs Lakshmi M Aiyer – 142 TTJ 780 (MUM)

Business After the death of the partner, lump sum consideration paid to the widow of the deceased partner. Is it liable for tax in the hands of the recipient? Mrs Lakshmi M Aiyer – 142 TTJ 780 (MUM)

Business Assessee being a company owns certain assets. It has allowed the assets to be used by a firm in which it is a partner. Whether the company (partner) can claim depreciation and insurance premium on the assets as its expenses? Karan Raghav Exports P Ltd – 196 TAXMAN 504 (Del)

Business Assessee being a company owns certain assets. It has allowed the assets to be used by a firm in which it is a partner. Whether the company (partner) can claim depreciation and insurance premium on the assets as its expenses? Karan Raghav Exports P Ltd – 196 TAXMAN 504 (Del)

Business Whether UPS is eligible for depreciation @ 60% (under the head “Computer”)? Orient HC) Ceramics and Industries Ltd – 56 DTR 397 (Del

Business Whether UPS is eligible for depreciation @ 60% (under the head “Computer”)? Orient HC) Ceramics and Industries Ltd – 56 DTR 397 (Del

Business Vehicles though registered in the name of the partners (directors) Vehicles were used by the firm (company) The firm (Company) paid the money for acquiring the vehicle Can the depreciation be allowed in the hands of the firm (company)? Aravali Finlease Ltd – 341 ITR 282 (GUJ)

Business Vehicles though registered in the name of the partners (directors) Vehicles were used by the firm (company) The firm (Company) paid the money for acquiring the vehicle Can the depreciation be allowed in the hands of the firm (company)? Aravali Finlease Ltd – 341 ITR 282 (GUJ)

Business The assets were purchased in the month of October 2011. The assets were able to be put to use only in the month of Dec 2012 The assessee would like to claim the depreciation for the full year in the F. Y. 2012 -13

Business The assets were purchased in the month of October 2011. The assets were able to be put to use only in the month of Dec 2012 The assessee would like to claim the depreciation for the full year in the F. Y. 2012 -13

Business A key man insurance policy is taken by the firm in the name of the partner. Whether the firm can claim the premium paid as revenue expenses In the middle of the policy, when the firm assigns the policy in favour of the partners, whether the partner should pay any tax u/s 15, or 28 or 56 Paramount IMpex – 13 ITR 374 (trib) Chandigarh Binjrajka Steel Tubes Ltd – 136 TTJ 113 (Hyd) Rajan Nandha – 249 CTR 141 – Del HC

Business A key man insurance policy is taken by the firm in the name of the partner. Whether the firm can claim the premium paid as revenue expenses In the middle of the policy, when the firm assigns the policy in favour of the partners, whether the partner should pay any tax u/s 15, or 28 or 56 Paramount IMpex – 13 ITR 374 (trib) Chandigarh Binjrajka Steel Tubes Ltd – 136 TTJ 113 (Hyd) Rajan Nandha – 249 CTR 141 – Del HC

Business Assessee firm borrowed loan for purchase of fixed asset. As it was unable to pay the amount, under OTS, the loan was settled with principal waiver. whether the waiver of principle is liable for tax u/s. 41 or u/s. 28 (iv) would it make any difference if the loan is borrowed for working capital purpose instead of acquiring a capital asset? What would the tax treatment in case the waiver amount is reduced from the WDV of assets? Iscaraemaco Regent Ltd – Mad HC – 331 ITR 317 Logitronics P Ltd – 333 ITR 386 (Del) Steel Authority of India Ltd – www. itatonline. org. – Delhi HC

Business Assessee firm borrowed loan for purchase of fixed asset. As it was unable to pay the amount, under OTS, the loan was settled with principal waiver. whether the waiver of principle is liable for tax u/s. 41 or u/s. 28 (iv) would it make any difference if the loan is borrowed for working capital purpose instead of acquiring a capital asset? What would the tax treatment in case the waiver amount is reduced from the WDV of assets? Iscaraemaco Regent Ltd – Mad HC – 331 ITR 317 Logitronics P Ltd – 333 ITR 386 (Del) Steel Authority of India Ltd – www. itatonline. org. – Delhi HC

Business Firm paid advance rent for leasing a property. However, the landlord was unable to provide the premises and being financially not sound, unable to repay the advance amount also. The firm wrote off the advance paid. Whether the advance written off qualifies for deduction u/s. 37(1) Seven Seas Petroleum Ltd – 14 ITR 21 (Chennai ITAT)

Business Firm paid advance rent for leasing a property. However, the landlord was unable to provide the premises and being financially not sound, unable to repay the advance amount also. The firm wrote off the advance paid. Whether the advance written off qualifies for deduction u/s. 37(1) Seven Seas Petroleum Ltd – 14 ITR 21 (Chennai ITAT)

Business Foreign study expenses of managing partner’s son – is it allowable as business expenses in the hands of the firm? Ras Information Technologies P Ltd – 238 CTR 76 (Kar HC) Gournitye Tea & Industries Ltd – Cal HC Echjay Forgings Ltd – 328 ITR 286 (Bom)

Business Foreign study expenses of managing partner’s son – is it allowable as business expenses in the hands of the firm? Ras Information Technologies P Ltd – 238 CTR 76 (Kar HC) Gournitye Tea & Industries Ltd – Cal HC Echjay Forgings Ltd – 328 ITR 286 (Bom)

Business Expenditure incurred such as flooring partition wiring false ceiling, duct and electrical wiring laying network in a lease hold premises for improvement of the same. Would it be revenue expenses or capital expenses? Amway India Enterprises – 65 DTR 313 (DEL HC)

Business Expenditure incurred such as flooring partition wiring false ceiling, duct and electrical wiring laying network in a lease hold premises for improvement of the same. Would it be revenue expenses or capital expenses? Amway India Enterprises – 65 DTR 313 (DEL HC)

Business A lawyer (being a Professional) underwent heart surgery. Whether heart surgery expenses are allowable as business deduction? Shanti Bhushan – Del – 336 ITR 26

Business A lawyer (being a Professional) underwent heart surgery. Whether heart surgery expenses are allowable as business deduction? Shanti Bhushan – Del – 336 ITR 26

Business An actor while participating in a film shooting in a jungle, killed an animal and faced criminal proceedings. Whether the expenses incurred in such a criminal proceedings would be allowed against the professional income? Salman Khan 137 TTJ 15 (Mum)

Business An actor while participating in a film shooting in a jungle, killed an animal and faced criminal proceedings. Whether the expenses incurred in such a criminal proceedings would be allowed against the professional income? Salman Khan 137 TTJ 15 (Mum)

Business The assessee engaged in selling heroine The narcotics department authorities confiscated the heroine The assessee claimed the same as loss AO disallowed the same under Explanation to sec 37 DR T A Quereshi - SC

Business The assessee engaged in selling heroine The narcotics department authorities confiscated the heroine The assessee claimed the same as loss AO disallowed the same under Explanation to sec 37 DR T A Quereshi - SC

Business Firm paid money to traffic police some times as gratuitous money and some times for violation of traffic rules – Whether said expenditure is allowed as deduction? Infosys technologies Ltd – 246 CTR 371 (Kar HC) Kranti Road Transport P Ltd – 50 SOT 15 (VISHAKA) Neelavathi & Others – 322 ITR 643 (Karn)

Business Firm paid money to traffic police some times as gratuitous money and some times for violation of traffic rules – Whether said expenditure is allowed as deduction? Infosys technologies Ltd – 246 CTR 371 (Kar HC) Kranti Road Transport P Ltd – 50 SOT 15 (VISHAKA) Neelavathi & Others – 322 ITR 643 (Karn)

Business The director of the company was in tour on official duty The director was kidnapped and kidnappers demanded money Police expressed the inability to trace the director The company paid money to release the director The company would like to claim the same as deduction. Is it allowable?

Business The director of the company was in tour on official duty The director was kidnapped and kidnappers demanded money Police expressed the inability to trace the director The company paid money to release the director The company would like to claim the same as deduction. Is it allowable?

Business A company has paid sales tax penalty for nonsubmission of returns and interest for delayed payment of tax. Also, it had paid penalty for belated submission of TDS return and interest for the delayed payment of TDS. It would like to know whether the same would qualify for business deduction Lachmandas Mathurdas – 254 ITR 799 (SC)

Business A company has paid sales tax penalty for nonsubmission of returns and interest for delayed payment of tax. Also, it had paid penalty for belated submission of TDS return and interest for the delayed payment of TDS. It would like to know whether the same would qualify for business deduction Lachmandas Mathurdas – 254 ITR 799 (SC)

Business Assessee partner received over and above his capital account balance in the partnership firm. Whether the surplus is taxable in the hands of the partner? Mohanbhai Pamabhai – 165 ITR 166 (SC) Tribhuvandas patel – 236 ITR 515 (SC Lingmallu Raghukumar 247 ITR 801 (SC)

Business Assessee partner received over and above his capital account balance in the partnership firm. Whether the surplus is taxable in the hands of the partner? Mohanbhai Pamabhai – 165 ITR 166 (SC) Tribhuvandas patel – 236 ITR 515 (SC Lingmallu Raghukumar 247 ITR 801 (SC)

Business The partners are unable to explain the source of investments made into the partnership. Can there be addition made in the hands of the firm u/s 68 or in the hands of the partners’ u/ 69 or in the hands of both the parties? Meghmalhar Developers 134 ITD 437 (Ahd)

Business The partners are unable to explain the source of investments made into the partnership. Can there be addition made in the hands of the firm u/s 68 or in the hands of the partners’ u/ 69 or in the hands of both the parties? Meghmalhar Developers 134 ITD 437 (Ahd)

Business A lady partner of the firm was paid remuneration well within the limits of sec 40(b). However, AO would like to invoke the provisions of sec 40 A(2). Whether the action of the AO is in accordance with law? Munjal Sales Corporation - SC

Business A lady partner of the firm was paid remuneration well within the limits of sec 40(b). However, AO would like to invoke the provisions of sec 40 A(2). Whether the action of the AO is in accordance with law? Munjal Sales Corporation - SC

Business Mr. A is a proprietor of his readymade garment business His income from business is Rs. 2. 5 lacs on the turnover of Rs. 50 lacs He has commission receipts of Rs. 5000/He would like to know whether he has to get his books audited u/s. 44 AB since he has not got the minimum income specified u/s. 44 AD

Business Mr. A is a proprietor of his readymade garment business His income from business is Rs. 2. 5 lacs on the turnover of Rs. 50 lacs He has commission receipts of Rs. 5000/He would like to know whether he has to get his books audited u/s. 44 AB since he has not got the minimum income specified u/s. 44 AD

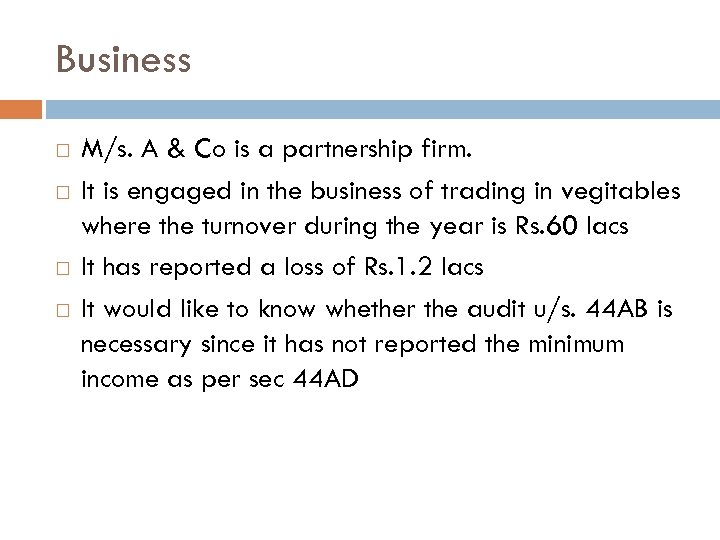

Business M/s. A & Co is a partnership firm. It is engaged in the business of trading in vegitables where the turnover during the year is Rs. 60 lacs It has reported a loss of Rs. 1. 2 lacs It would like to know whether the audit u/s. 44 AB is necessary since it has not reported the minimum income as per sec 44 AD

Business M/s. A & Co is a partnership firm. It is engaged in the business of trading in vegitables where the turnover during the year is Rs. 60 lacs It has reported a loss of Rs. 1. 2 lacs It would like to know whether the audit u/s. 44 AB is necessary since it has not reported the minimum income as per sec 44 AD

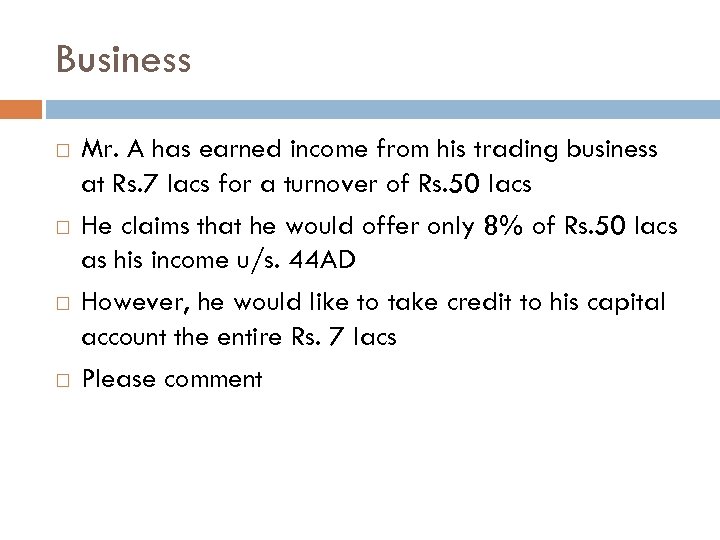

Business Mr. A has earned income from his trading business at Rs. 7 lacs for a turnover of Rs. 50 lacs He claims that he would offer only 8% of Rs. 50 lacs as his income u/s. 44 AD However, he would like to take credit to his capital account the entire Rs. 7 lacs Please comment

Business Mr. A has earned income from his trading business at Rs. 7 lacs for a turnover of Rs. 50 lacs He claims that he would offer only 8% of Rs. 50 lacs as his income u/s. 44 AD However, he would like to take credit to his capital account the entire Rs. 7 lacs Please comment

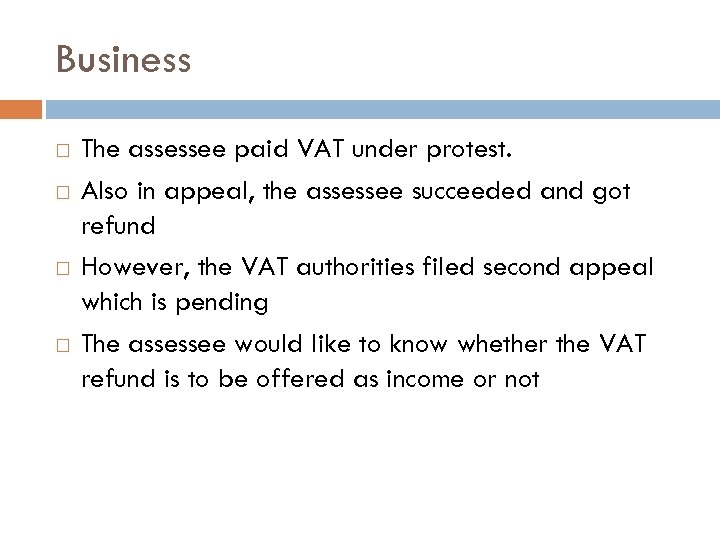

Business The assessee paid VAT under protest. Also in appeal, the assessee succeeded and got refund However, the VAT authorities filed second appeal which is pending The assessee would like to know whether the VAT refund is to be offered as income or not

Business The assessee paid VAT under protest. Also in appeal, the assessee succeeded and got refund However, the VAT authorities filed second appeal which is pending The assessee would like to know whether the VAT refund is to be offered as income or not

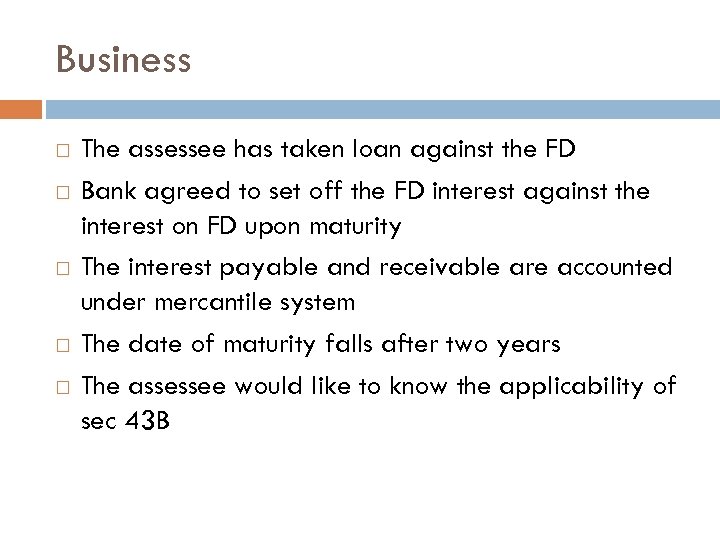

Business The assessee has taken loan against the FD Bank agreed to set off the FD interest against the interest on FD upon maturity The interest payable and receivable are accounted under mercantile system The date of maturity falls after two years The assessee would like to know the applicability of sec 43 B

Business The assessee has taken loan against the FD Bank agreed to set off the FD interest against the interest on FD upon maturity The interest payable and receivable are accounted under mercantile system The date of maturity falls after two years The assessee would like to know the applicability of sec 43 B

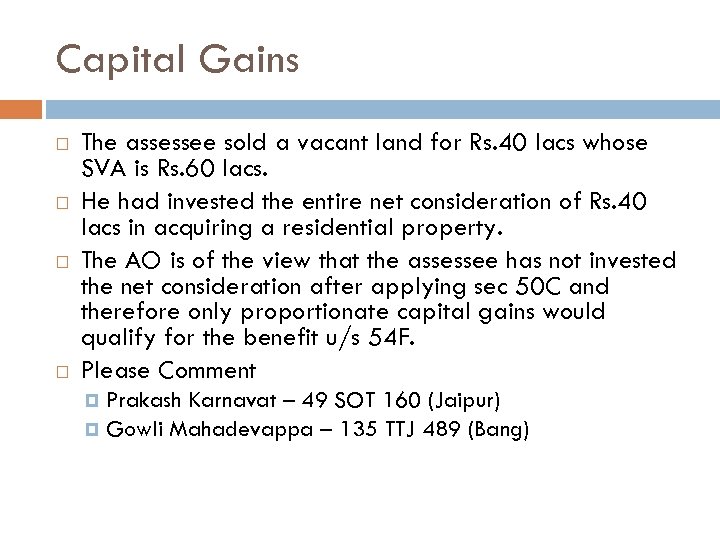

Capital Gains The assessee sold a vacant land for Rs. 40 lacs whose SVA is Rs. 60 lacs. He had invested the entire net consideration of Rs. 40 lacs in acquiring a residential property. The AO is of the view that the assessee has not invested the net consideration after applying sec 50 C and therefore only proportionate capital gains would qualify for the benefit u/s 54 F. Please Comment Prakash Karnavat – 49 SOT 160 (Jaipur) Gowli Mahadevappa – 135 TTJ 489 (Bang)

Capital Gains The assessee sold a vacant land for Rs. 40 lacs whose SVA is Rs. 60 lacs. He had invested the entire net consideration of Rs. 40 lacs in acquiring a residential property. The AO is of the view that the assessee has not invested the net consideration after applying sec 50 C and therefore only proportionate capital gains would qualify for the benefit u/s 54 F. Please Comment Prakash Karnavat – 49 SOT 160 (Jaipur) Gowli Mahadevappa – 135 TTJ 489 (Bang)

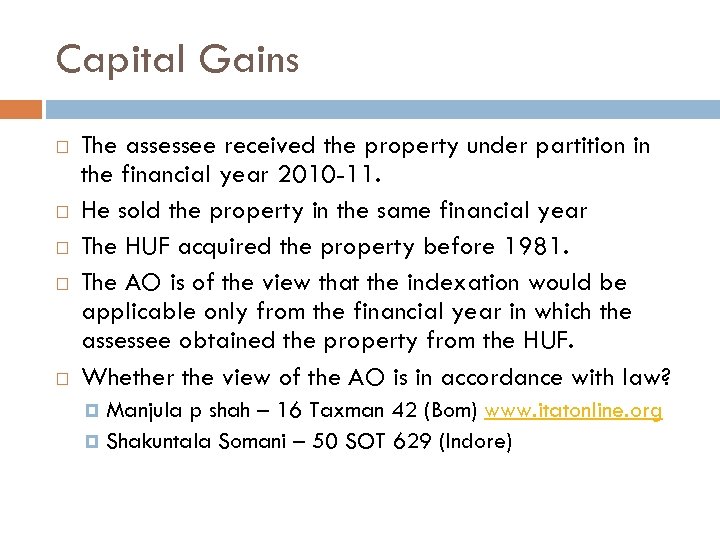

Capital Gains The assessee received the property under partition in the financial year 2010 -11. He sold the property in the same financial year The HUF acquired the property before 1981. The AO is of the view that the indexation would be applicable only from the financial year in which the assessee obtained the property from the HUF. Whether the view of the AO is in accordance with law? Manjula p shah – 16 Taxman 42 (Bom) www. itatonline. org Shakuntala Somani – 50 SOT 629 (Indore)

Capital Gains The assessee received the property under partition in the financial year 2010 -11. He sold the property in the same financial year The HUF acquired the property before 1981. The AO is of the view that the indexation would be applicable only from the financial year in which the assessee obtained the property from the HUF. Whether the view of the AO is in accordance with law? Manjula p shah – 16 Taxman 42 (Bom) www. itatonline. org Shakuntala Somani – 50 SOT 629 (Indore)

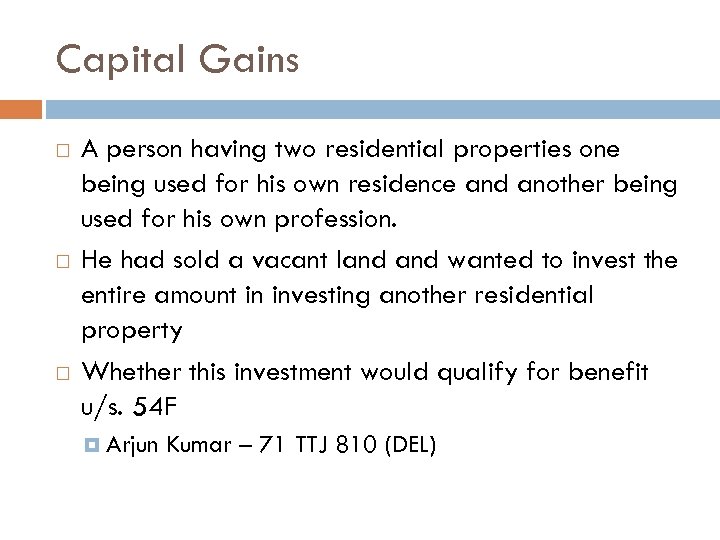

Capital Gains A person having two residential properties one being used for his own residence and another being used for his own profession. He had sold a vacant land wanted to invest the entire amount in investing another residential property Whether this investment would qualify for benefit u/s. 54 F Arjun Kumar – 71 TTJ 810 (DEL)

Capital Gains A person having two residential properties one being used for his own residence and another being used for his own profession. He had sold a vacant land wanted to invest the entire amount in investing another residential property Whether this investment would qualify for benefit u/s. 54 F Arjun Kumar – 71 TTJ 810 (DEL)

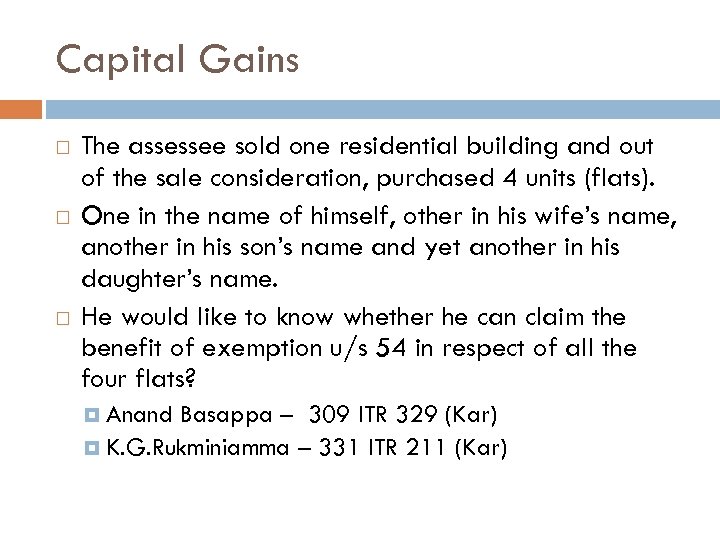

Capital Gains The assessee sold one residential building and out of the sale consideration, purchased 4 units (flats). One in the name of himself, other in his wife’s name, another in his son’s name and yet another in his daughter’s name. He would like to know whether he can claim the benefit of exemption u/s 54 in respect of all the four flats? Anand Basappa – 309 ITR 329 (Kar) K. G. Rukminiamma – 331 ITR 211 (Kar)

Capital Gains The assessee sold one residential building and out of the sale consideration, purchased 4 units (flats). One in the name of himself, other in his wife’s name, another in his son’s name and yet another in his daughter’s name. He would like to know whether he can claim the benefit of exemption u/s 54 in respect of all the four flats? Anand Basappa – 309 ITR 329 (Kar) K. G. Rukminiamma – 331 ITR 211 (Kar)

Capital Gains The assessee’s land was auctioned by the banker for nonpayment of bank dues. Out of the proceeds of Rs. 20 lacs, the loan due of Rs. 18 lacs was set off and the balance of Rs. 2 lacs was given. The indexed cost is only Rs. 1 lac. The assessee would like to claim the loan repayment as deduction. Would there be any difference, if the loan was taken by his father and upon the father’s death the assessee got this property and loan? RM Arunachalam – 227 ITR 222 (SC) Attili N Rao – 252 ITR 880 (SC)

Capital Gains The assessee’s land was auctioned by the banker for nonpayment of bank dues. Out of the proceeds of Rs. 20 lacs, the loan due of Rs. 18 lacs was set off and the balance of Rs. 2 lacs was given. The indexed cost is only Rs. 1 lac. The assessee would like to claim the loan repayment as deduction. Would there be any difference, if the loan was taken by his father and upon the father’s death the assessee got this property and loan? RM Arunachalam – 227 ITR 222 (SC) Attili N Rao – 252 ITR 880 (SC)

Capital Gains The partner invests a building as his capital contribution at a book value of Rs. 5 lacs whose SVA value is Rs. 50 lacs. He would like to know whether the provisions of sec 50 C would apply. He has also transferred the loan borrowed for construction of building having a balance outstanding of Rs. 4 lacs. Assuming sec 50 C is not applicable, he would like to know whether the net amount credited to his account, (i. e. , Rs. 1 lac) alone can be taken as consideration u/s 45(3)

Capital Gains The partner invests a building as his capital contribution at a book value of Rs. 5 lacs whose SVA value is Rs. 50 lacs. He would like to know whether the provisions of sec 50 C would apply. He has also transferred the loan borrowed for construction of building having a balance outstanding of Rs. 4 lacs. Assuming sec 50 C is not applicable, he would like to know whether the net amount credited to his account, (i. e. , Rs. 1 lac) alone can be taken as consideration u/s 45(3)

Capital Gains The assessee firm was dissolved. The business was taken over as sole proprietorship by one of its partners. The partner contends that the value recorded in the books of the firm alone is to be considered for ascertaining the capital gains in the hands of the firm. Om Namah Shivay Builders and Developers – 43 SOT 397 (Mum)

Capital Gains The assessee firm was dissolved. The business was taken over as sole proprietorship by one of its partners. The partner contends that the value recorded in the books of the firm alone is to be considered for ascertaining the capital gains in the hands of the firm. Om Namah Shivay Builders and Developers – 43 SOT 397 (Mum)

Capital Gains The assessee retired from the firm and in settlement of his account, he was given one piece of vacant land by the firm. The firm recorded the transaction at book value. The firm contends that the provisions of sec 45(4) would not apply because there is no dissolution of firm and it is only a retirement of a partner from the firm. A N Naik Associates – 265 ITR 346 (Bom) Vijayalakshmi Metal Industries – 256 ITR 540 (Mad)

Capital Gains The assessee retired from the firm and in settlement of his account, he was given one piece of vacant land by the firm. The firm recorded the transaction at book value. The firm contends that the provisions of sec 45(4) would not apply because there is no dissolution of firm and it is only a retirement of a partner from the firm. A N Naik Associates – 265 ITR 346 (Bom) Vijayalakshmi Metal Industries – 256 ITR 540 (Mad)

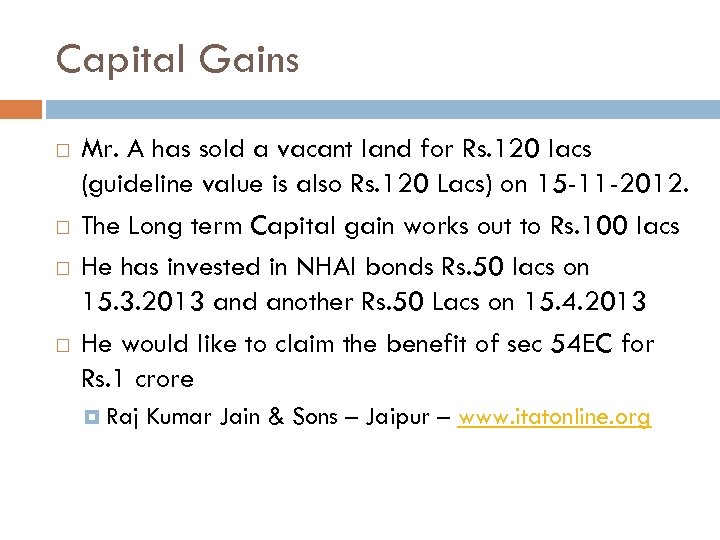

Capital Gains Mr. A has sold a vacant land for Rs. 120 lacs (guideline value is also Rs. 120 Lacs) on 15 -11 -2012. The Long term Capital gain works out to Rs. 100 lacs He has invested in NHAI bonds Rs. 50 lacs on 15. 3. 2013 and another Rs. 50 Lacs on 15. 4. 2013 He would like to claim the benefit of sec 54 EC for Rs. 1 crore Raj Kumar Jain & Sons – Jaipur – www. itatonline. org

Capital Gains Mr. A has sold a vacant land for Rs. 120 lacs (guideline value is also Rs. 120 Lacs) on 15 -11 -2012. The Long term Capital gain works out to Rs. 100 lacs He has invested in NHAI bonds Rs. 50 lacs on 15. 3. 2013 and another Rs. 50 Lacs on 15. 4. 2013 He would like to claim the benefit of sec 54 EC for Rs. 1 crore Raj Kumar Jain & Sons – Jaipur – www. itatonline. org

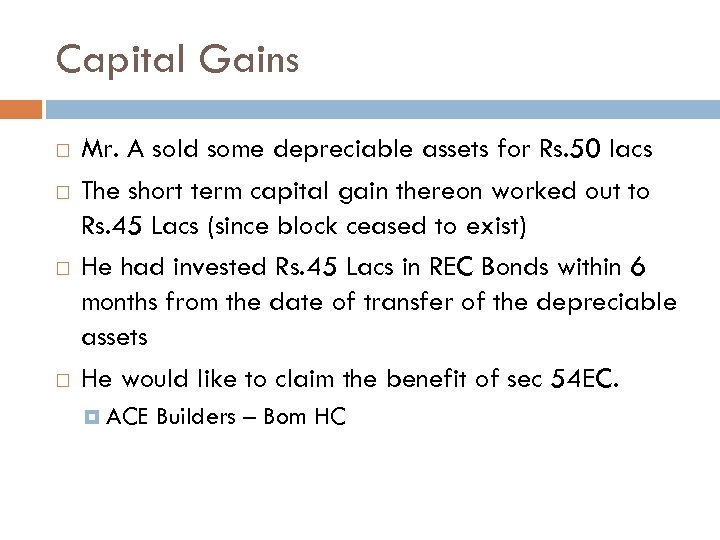

Capital Gains Mr. A sold some depreciable assets for Rs. 50 lacs The short term capital gain thereon worked out to Rs. 45 Lacs (since block ceased to exist) He had invested Rs. 45 Lacs in REC Bonds within 6 months from the date of transfer of the depreciable assets He would like to claim the benefit of sec 54 EC. ACE Builders – Bom HC

Capital Gains Mr. A sold some depreciable assets for Rs. 50 lacs The short term capital gain thereon worked out to Rs. 45 Lacs (since block ceased to exist) He had invested Rs. 45 Lacs in REC Bonds within 6 months from the date of transfer of the depreciable assets He would like to claim the benefit of sec 54 EC. ACE Builders – Bom HC

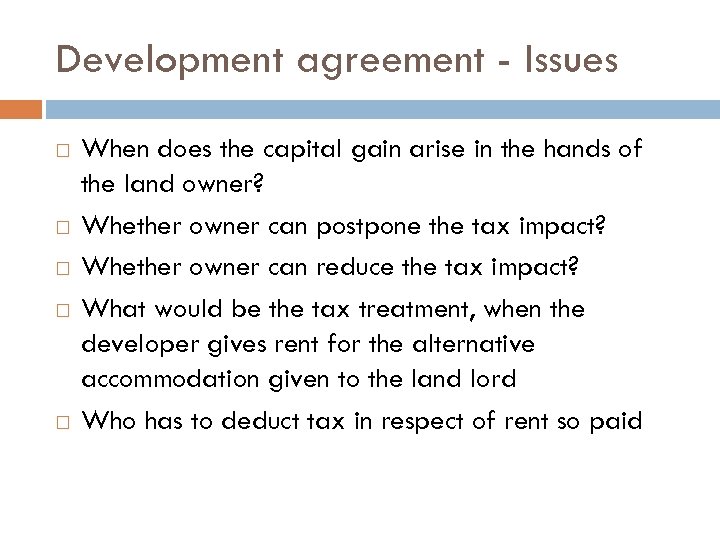

Development agreement - Issues When does the capital gain arise in the hands of the land owner? Whether owner can postpone the tax impact? Whether owner can reduce the tax impact? What would be the tax treatment, when the developer gives rent for the alternative accommodation given to the land lord Who has to deduct tax in respect of rent so paid

Development agreement - Issues When does the capital gain arise in the hands of the land owner? Whether owner can postpone the tax impact? Whether owner can reduce the tax impact? What would be the tax treatment, when the developer gives rent for the alternative accommodation given to the land lord Who has to deduct tax in respect of rent so paid

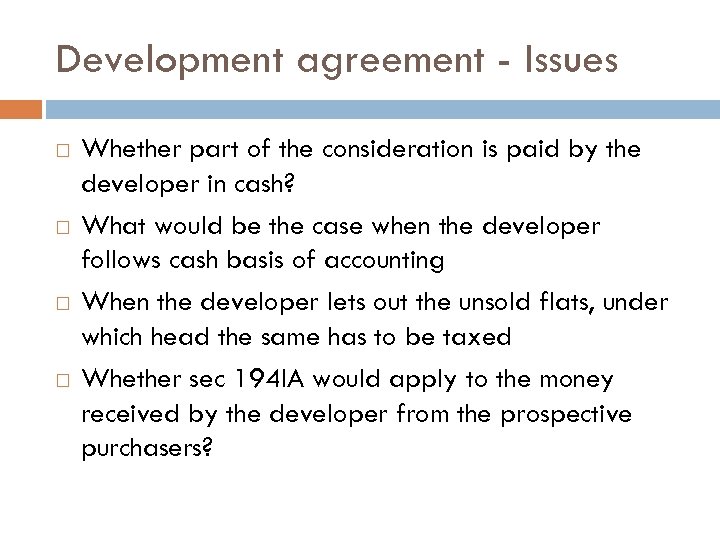

Development agreement - Issues Whether part of the consideration is paid by the developer in cash? What would be the case when the developer follows cash basis of accounting When the developer lets out the unsold flats, under which head the same has to be taxed Whether sec 194 IA would apply to the money received by the developer from the prospective purchasers?

Development agreement - Issues Whether part of the consideration is paid by the developer in cash? What would be the case when the developer follows cash basis of accounting When the developer lets out the unsold flats, under which head the same has to be taxed Whether sec 194 IA would apply to the money received by the developer from the prospective purchasers?

Development agreement - Issues What would be the consequences if the developer sells the land at a consideration less than its guideline value What would be the consequences if the land lord sells the UDS at less than its guideline value What would be the consequences in the hands of the purchasers

Development agreement - Issues What would be the consequences if the developer sells the land at a consideration less than its guideline value What would be the consequences if the land lord sells the UDS at less than its guideline value What would be the consequences in the hands of the purchasers

Capital Gains Can the assessee require the AO to refer the property to VO even though the buyer has asked for revision of the guideline value in the stamp duty proceedings? Can the buyer after paying tax on the difference between the actual consideration and guideline value as the cost for subsequent transactions? Can the provisions of sec 56(2) be applicable for rural agricultural lands?

Capital Gains Can the assessee require the AO to refer the property to VO even though the buyer has asked for revision of the guideline value in the stamp duty proceedings? Can the buyer after paying tax on the difference between the actual consideration and guideline value as the cost for subsequent transactions? Can the provisions of sec 56(2) be applicable for rural agricultural lands?

Other Sources The assessee has got some income from other sources. He wanted to set off the brought forward depreciation loss against the income from other sources. Can he claim so? Virmani Industries Ltd – 216 ITR 607 (SC)

Other Sources The assessee has got some income from other sources. He wanted to set off the brought forward depreciation loss against the income from other sources. Can he claim so? Virmani Industries Ltd – 216 ITR 607 (SC)

Other Sources State government has given the incentive coupon while contributing to PPF. The assessee’s coupon was awarded prize money of 1 KG gold. Is it a lottery income liable for tax @ 30% Thilak (SC)) Raj Karla – 249 CTR 205 (P & H) & 272 ITR 534

Other Sources State government has given the incentive coupon while contributing to PPF. The assessee’s coupon was awarded prize money of 1 KG gold. Is it a lottery income liable for tax @ 30% Thilak (SC)) Raj Karla – 249 CTR 205 (P & H) & 272 ITR 534

Other Sources The assessee has borrowed Rs. 10 lacs for interest @ 12% PA. He has invested the entire sum in the bonds of a company. However, the company has not paid any interest during a particular year. The assessee follows cash basis of accounting. He would like to claim the loss of Rs 1. 20 lacs (being interest paid) against his salary income Rajendra Prasad Moody - 115 ITR 519 (SC)

Other Sources The assessee has borrowed Rs. 10 lacs for interest @ 12% PA. He has invested the entire sum in the bonds of a company. However, the company has not paid any interest during a particular year. The assessee follows cash basis of accounting. He would like to claim the loss of Rs 1. 20 lacs (being interest paid) against his salary income Rajendra Prasad Moody - 115 ITR 519 (SC)

Other Sources The assessee gifted the property on his engagement function to his fiancée. He would like to know whether the clubbing provisions would apply on the income earned from this property after his marriage. Philip John Plasket Thomas – 49 ITR 97 (SC)

Other Sources The assessee gifted the property on his engagement function to his fiancée. He would like to know whether the clubbing provisions would apply on the income earned from this property after his marriage. Philip John Plasket Thomas – 49 ITR 97 (SC)

Thank you

Thank you