e6fa5aa22bac6cf1d631a479b6ac7bef.ppt

- Количество слайдов: 47

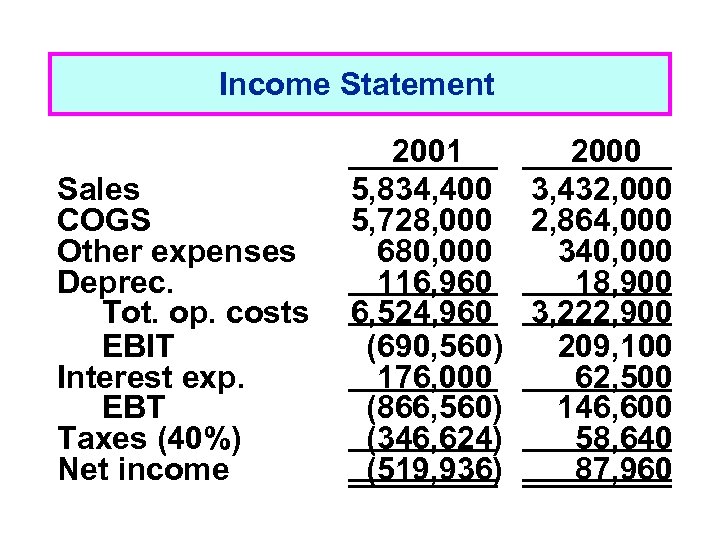

Income Statement Sales COGS Other expenses Deprec. Tot. op. costs EBIT Interest exp. EBT Taxes (40%) Net income 2001 2000 5, 834, 400 3, 432, 000 5, 728, 000 2, 864, 000 680, 000 340, 000 116, 960 18, 900 6, 524, 960 3, 222, 900 (690, 560) 209, 100 176, 000 62, 500 (866, 560) 146, 600 (346, 624) 58, 640 (519, 936) 87, 960

Income Statement Sales COGS Other expenses Deprec. Tot. op. costs EBIT Interest exp. EBT Taxes (40%) Net income 2001 2000 5, 834, 400 3, 432, 000 5, 728, 000 2, 864, 000 680, 000 340, 000 116, 960 18, 900 6, 524, 960 3, 222, 900 (690, 560) 209, 100 176, 000 62, 500 (866, 560) 146, 600 (346, 624) 58, 640 (519, 936) 87, 960

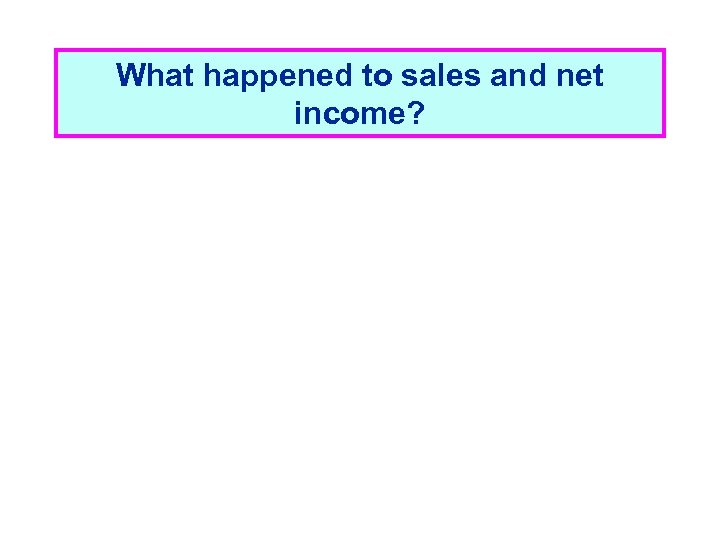

What happened to sales and net income?

What happened to sales and net income?

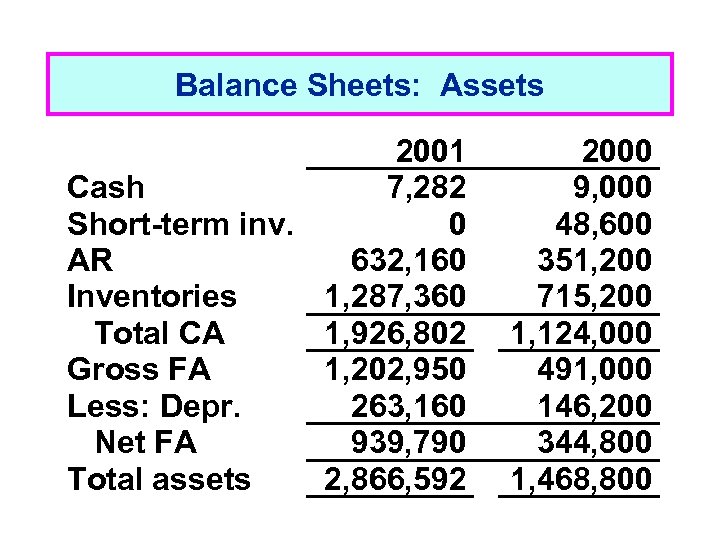

Balance Sheets: Assets 2001 Cash 7, 282 Short-term inv. 0 AR 632, 160 Inventories 1, 287, 360 Total CA 1, 926, 802 Gross FA 1, 202, 950 Less: Depr. 263, 160 Net FA 939, 790 Total assets 2, 866, 592 2000 9, 000 48, 600 351, 200 715, 200 1, 124, 000 491, 000 146, 200 344, 800 1, 468, 800

Balance Sheets: Assets 2001 Cash 7, 282 Short-term inv. 0 AR 632, 160 Inventories 1, 287, 360 Total CA 1, 926, 802 Gross FA 1, 202, 950 Less: Depr. 263, 160 Net FA 939, 790 Total assets 2, 866, 592 2000 9, 000 48, 600 351, 200 715, 200 1, 124, 000 491, 000 146, 200 344, 800 1, 468, 800

What effect did the expansion have on the asset section of the balance sheet?

What effect did the expansion have on the asset section of the balance sheet?

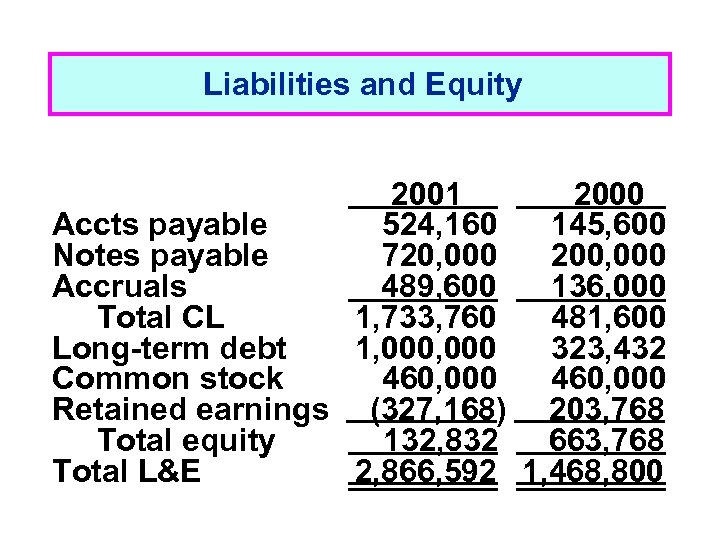

Liabilities and Equity 2001 2000 Accts payable 524, 160 145, 600 Notes payable 720, 000 200, 000 Accruals 489, 600 136, 000 Total CL 1, 733, 760 481, 600 Long-term debt 1, 000 323, 432 Common stock 460, 000 Retained earnings (327, 168) 203, 768 Total equity 132, 832 663, 768 Total L&E 2, 866, 592 1, 468, 800

Liabilities and Equity 2001 2000 Accts payable 524, 160 145, 600 Notes payable 720, 000 200, 000 Accruals 489, 600 136, 000 Total CL 1, 733, 760 481, 600 Long-term debt 1, 000 323, 432 Common stock 460, 000 Retained earnings (327, 168) 203, 768 Total equity 132, 832 663, 768 Total L&E 2, 866, 592 1, 468, 800

What effect did the expansion have on liabilities & equity?

What effect did the expansion have on liabilities & equity?

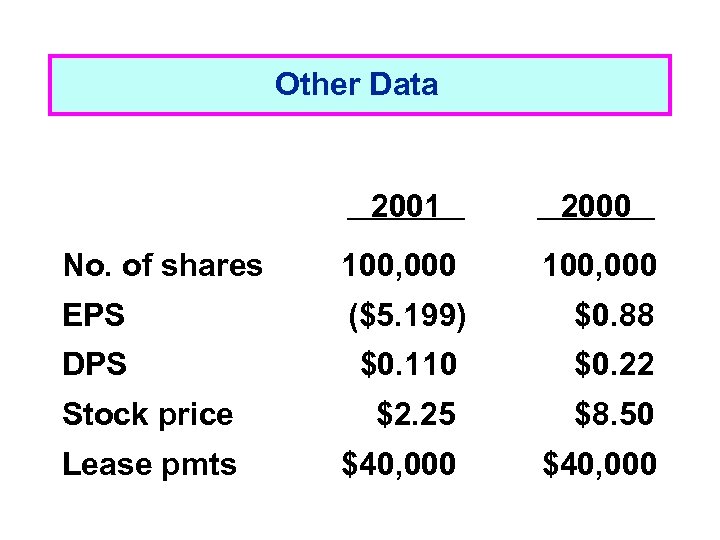

Other Data 2001 2000 No. of shares 100, 000 EPS ($5. 199) $0. 88 DPS $0. 110 $0. 22 Stock price $2. 25 $8. 50 Lease pmts $40, 000

Other Data 2001 2000 No. of shares 100, 000 EPS ($5. 199) $0. 88 DPS $0. 110 $0. 22 Stock price $2. 25 $8. 50 Lease pmts $40, 000

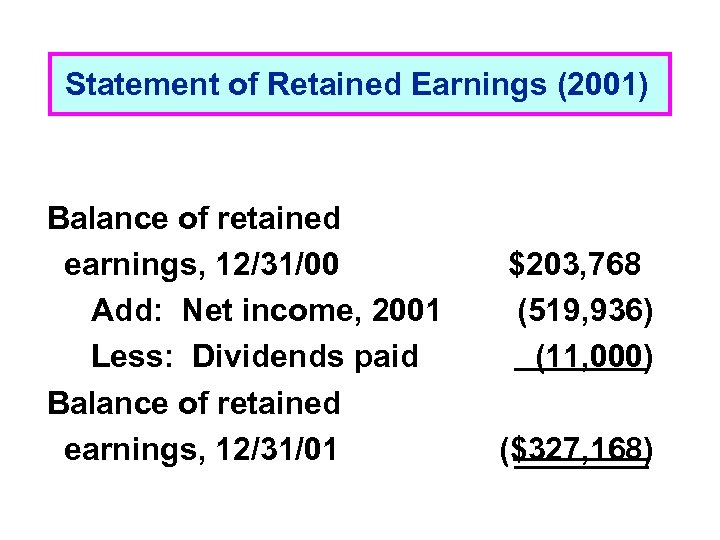

Statement of Retained Earnings (2001) Balance of retained earnings, 12/31/00 Add: Net income, 2001 Less: Dividends paid Balance of retained earnings, 12/31/01 $203, 768 (519, 936) (11, 000) ($327, 168)

Statement of Retained Earnings (2001) Balance of retained earnings, 12/31/00 Add: Net income, 2001 Less: Dividends paid Balance of retained earnings, 12/31/01 $203, 768 (519, 936) (11, 000) ($327, 168)

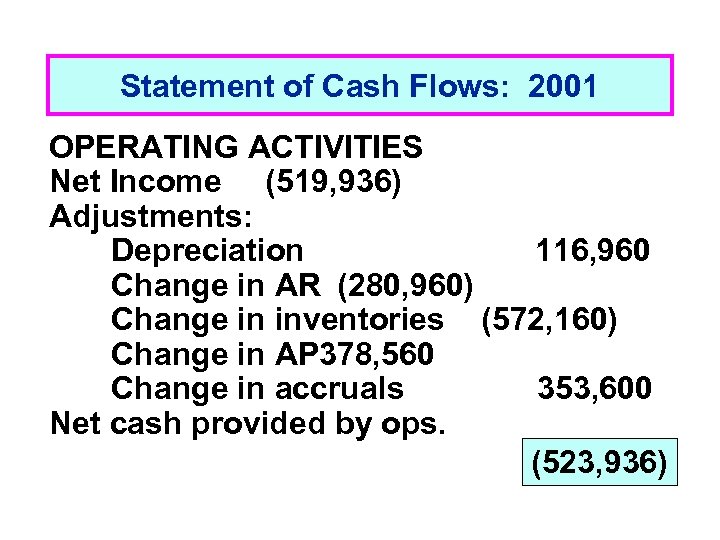

Statement of Cash Flows: 2001 OPERATING ACTIVITIES Net Income (519, 936) Adjustments: Depreciation 116, 960 Change in AR (280, 960) Change in inventories (572, 160) Change in AP 378, 560 Change in accruals 353, 600 Net cash provided by ops. (523, 936)

Statement of Cash Flows: 2001 OPERATING ACTIVITIES Net Income (519, 936) Adjustments: Depreciation 116, 960 Change in AR (280, 960) Change in inventories (572, 160) Change in AP 378, 560 Change in accruals 353, 600 Net cash provided by ops. (523, 936)

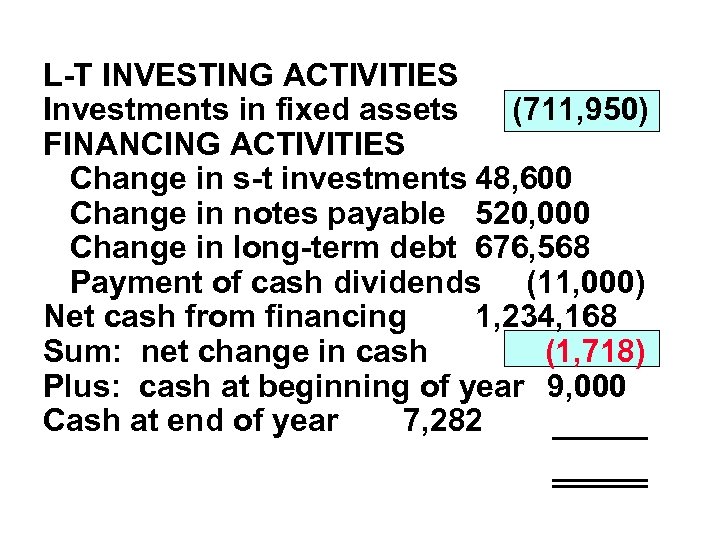

L-T INVESTING ACTIVITIES Investments in fixed assets (711, 950) FINANCING ACTIVITIES Change in s-t investments 48, 600 Change in notes payable 520, 000 Change in long-term debt 676, 568 Payment of cash dividends (11, 000) Net cash from financing 1, 234, 168 Sum: net change in cash (1, 718) Plus: cash at beginning of year 9, 000 Cash at end of year 7, 282

L-T INVESTING ACTIVITIES Investments in fixed assets (711, 950) FINANCING ACTIVITIES Change in s-t investments 48, 600 Change in notes payable 520, 000 Change in long-term debt 676, 568 Payment of cash dividends (11, 000) Net cash from financing 1, 234, 168 Sum: net change in cash (1, 718) Plus: cash at beginning of year 9, 000 Cash at end of year 7, 282

What can you conclude about the company’s financial condition from its statement of cash flows?

What can you conclude about the company’s financial condition from its statement of cash flows?

What are operating current assets?

What are operating current assets?

What are operating current liabilities?

What are operating current liabilities?

What effect did the expansion have on net operating working capital (NOWC)? Operating NOWC = CA CL

What effect did the expansion have on net operating working capital (NOWC)? Operating NOWC = CA CL

What effect did the expansion have on capital used in operations? Operating capital

What effect did the expansion have on capital used in operations? Operating capital

Did the expansion create additional net operating profit after taxes (NOPAT)?

Did the expansion create additional net operating profit after taxes (NOPAT)?

What is your initial assessment of the expansion’s effect on operations?

What is your initial assessment of the expansion’s effect on operations?

What effect did the company’s expansion have on its net cash flow and operating cash flow?

What effect did the company’s expansion have on its net cash flow and operating cash flow?

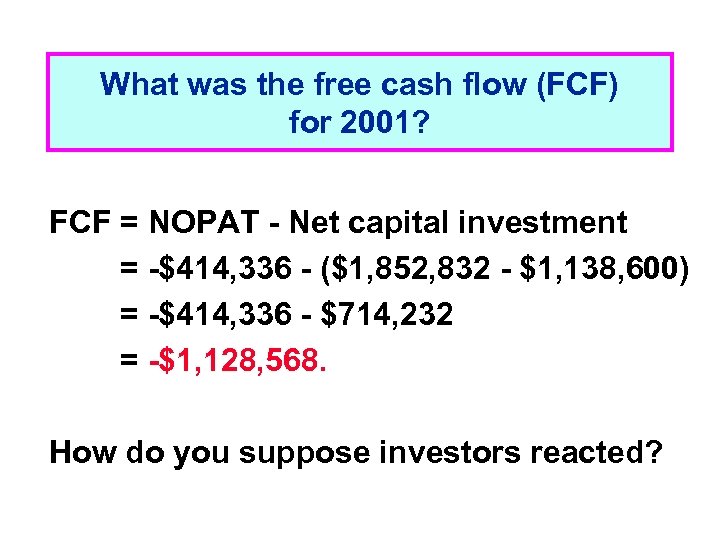

What was the free cash flow (FCF) for 2001? FCF = NOPAT - Net capital investment = -$414, 336 - ($1, 852, 832 - $1, 138, 600) = -$414, 336 - $714, 232 = -$1, 128, 568. How do you suppose investors reacted?

What was the free cash flow (FCF) for 2001? FCF = NOPAT - Net capital investment = -$414, 336 - ($1, 852, 832 - $1, 138, 600) = -$414, 336 - $714, 232 = -$1, 128, 568. How do you suppose investors reacted?

What is free cash flow (FCF)? Why is it important?

What is free cash flow (FCF)? Why is it important?

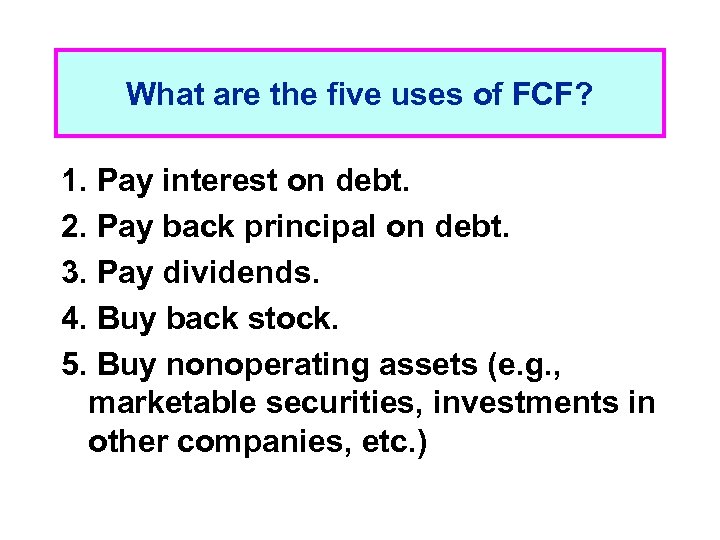

What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e. g. , marketable securities, investments in other companies, etc. )

What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy nonoperating assets (e. g. , marketable securities, investments in other companies, etc. )

What is the company’s EVA? Assume the firm’s after-tax cost of capital (WACC) was 11% in 2000 and 13% in 2001.

What is the company’s EVA? Assume the firm’s after-tax cost of capital (WACC) was 11% in 2000 and 13% in 2001.

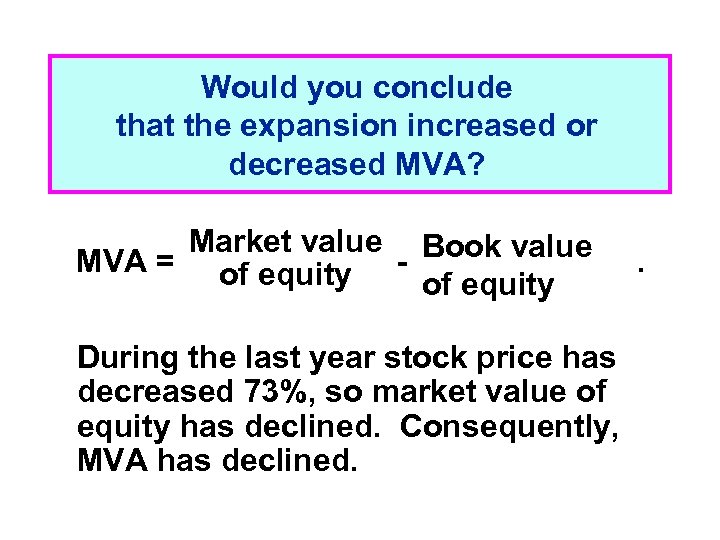

Would you conclude that the expansion increased or decreased MVA? Market value Book value MVA = of equity During the last year stock price has decreased 73%, so market value of equity has declined. Consequently, MVA has declined. .

Would you conclude that the expansion increased or decreased MVA? Market value Book value MVA = of equity During the last year stock price has decreased 73%, so market value of equity has declined. Consequently, MVA has declined. .

Does the company pay its suppliers on time?

Does the company pay its suppliers on time?

Does it appear that the sales price exceeds the cost per unit sold?

Does it appear that the sales price exceeds the cost per unit sold?

What effect would each of these actions have on the cash account? 1. The company offers 60 -day credit terms. The improved terms are matched by its competitors, so sales remain constant.

What effect would each of these actions have on the cash account? 1. The company offers 60 -day credit terms. The improved terms are matched by its competitors, so sales remain constant.

2. Sales double as a result of the change in credit terms.

2. Sales double as a result of the change in credit terms.

How was the expansion financed?

How was the expansion financed?

Would external capital have been required if they had broken even in 2001 (Net income = 0)?

Would external capital have been required if they had broken even in 2001 (Net income = 0)?

What happens if fixed assets are depreciated over 7 years (as opposed to the current 10 years)?

What happens if fixed assets are depreciated over 7 years (as opposed to the current 10 years)?

Other policies that can affect financial statements

Other policies that can affect financial statements

Does the company’s positive stock price ($2. 25), in the face of large losses, suggest that investors are irrational?

Does the company’s positive stock price ($2. 25), in the face of large losses, suggest that investors are irrational?

Why did the stock price fall after the dividend was cut?

Why did the stock price fall after the dividend was cut?

What were some other sources of financing used in 2001?

What were some other sources of financing used in 2001?

What is the effect of the $346, 624 tax credit received in 2001.

What is the effect of the $346, 624 tax credit received in 2001.

Key Features of the Tax Code

Key Features of the Tax Code

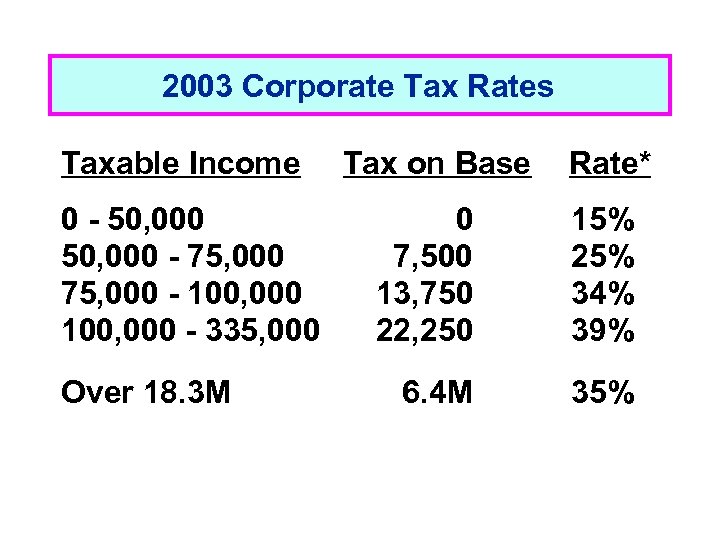

2003 Corporate Tax Rates Taxable Income 0 - 50, 000 - 75, 000 - 100, 000 - 335, 000 Over 18. 3 M Tax on Base Rate* 0 7, 500 13, 750 22, 250 15% 25% 34% 39% 6. 4 M 35%

2003 Corporate Tax Rates Taxable Income 0 - 50, 000 - 75, 000 - 100, 000 - 335, 000 Over 18. 3 M Tax on Base Rate* 0 7, 500 13, 750 22, 250 15% 25% 34% 39% 6. 4 M 35%

Features of Corporate Taxes (Cont. )

Features of Corporate Taxes (Cont. )

Features of Corporate Taxation

Features of Corporate Taxation

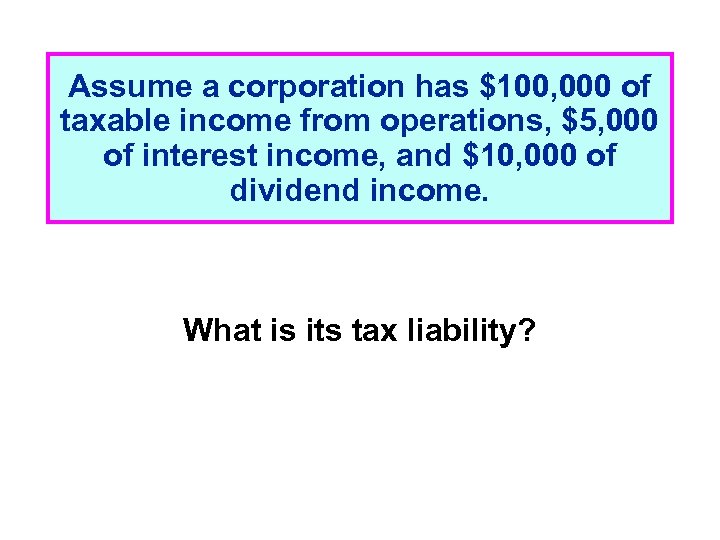

Assume a corporation has $100, 000 of taxable income from operations, $5, 000 of interest income, and $10, 000 of dividend income. What is its tax liability?

Assume a corporation has $100, 000 of taxable income from operations, $5, 000 of interest income, and $10, 000 of dividend income. What is its tax liability?

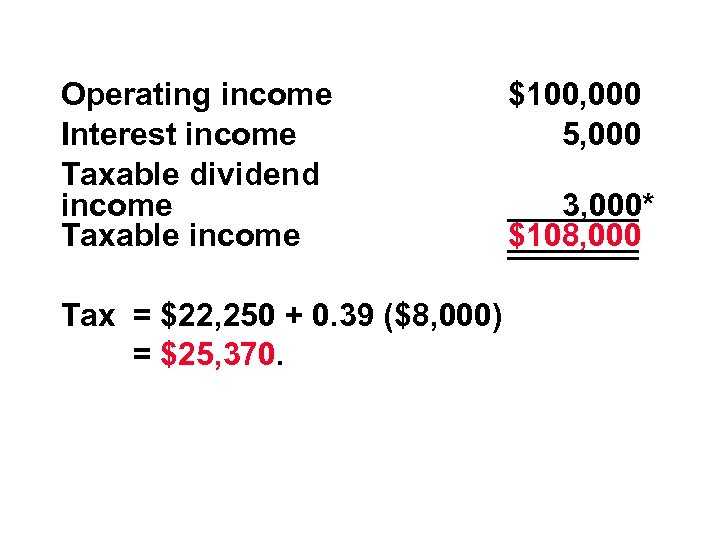

Operating income Interest income Taxable dividend income Taxable income Tax = $22, 250 + 0. 39 ($8, 000) = $25, 370. $100, 000 5, 000 3, 000* $108, 000

Operating income Interest income Taxable dividend income Taxable income Tax = $22, 250 + 0. 39 ($8, 000) = $25, 370. $100, 000 5, 000 3, 000* $108, 000

Key Features of Individual Taxation

Key Features of Individual Taxation

Taxable versus Tax Exempt Bonds State and local government bonds (municipals, or “munis”) are generally exempt from federal taxes.

Taxable versus Tax Exempt Bonds State and local government bonds (municipals, or “munis”) are generally exempt from federal taxes.

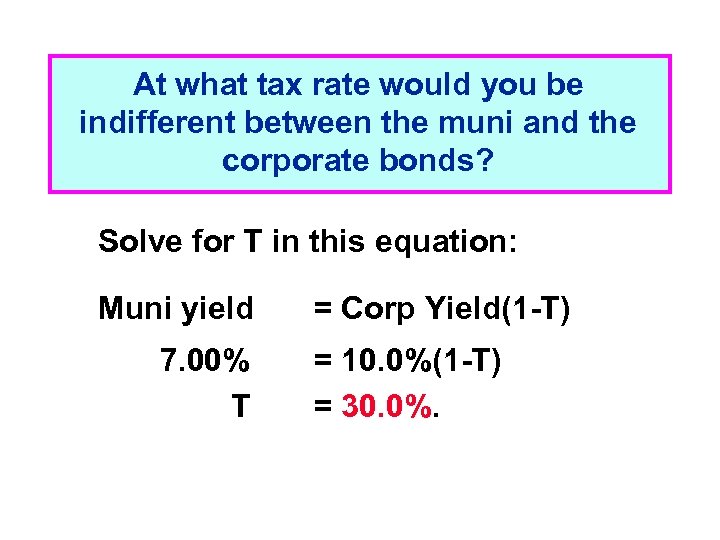

At what tax rate would you be indifferent between the muni and the corporate bonds? Solve for T in this equation: Muni yield 7. 00% T = Corp Yield(1 -T) = 10. 0%(1 -T) = 30. 0%.

At what tax rate would you be indifferent between the muni and the corporate bonds? Solve for T in this equation: Muni yield 7. 00% T = Corp Yield(1 -T) = 10. 0%(1 -T) = 30. 0%.

Implications

Implications