932860d7b3426d6c0b2a7c1641ead75a.ppt

- Количество слайдов: 95

INCOME AND WITHHOLDING TAXES Atty. Vic C. Mamalateo July, 2011 Ateneo Law School

INCOME AND WITHHOLDING TAXES Atty. Vic C. Mamalateo July, 2011 Ateneo Law School

• INCOME TAX (TITLE II, NIRC)

• INCOME TAX (TITLE II, NIRC)

BASICTAX PRINCIPLES • LIFEBLOOD THEORY – Taxation is the rule; exemption, the exception. – In case of doubt, tax income or disallow deductions and tax credits. • Taxes are imposed by law (e. g. , NIRC), while financial accounting are based on generally accepted accounting standards. In case of conflict between tax rules and accounting rules, the former shall prevail.

BASICTAX PRINCIPLES • LIFEBLOOD THEORY – Taxation is the rule; exemption, the exception. – In case of doubt, tax income or disallow deductions and tax credits. • Taxes are imposed by law (e. g. , NIRC), while financial accounting are based on generally accepted accounting standards. In case of conflict between tax rules and accounting rules, the former shall prevail.

INCOME TAX • INCOME TAX – Tax on all yearly profits arising from property, professions, trades or offices, or as a tax on a person’s income, emoluments, profits and the like (Fisher v. Trinidad). – Income tax is a direct tax on taxable actual or presumed income (gross or net) of a taxpayer received, accrued or realized during the taxable year. • WITHHOLDING TAX – It is not an internal revenue tax but a mode of collecting income tax in advance on income of the recipient of income thru the payor of income. [NOTE: Sec. 21, NIRC enumerates various internal revenue taxes. ] – There are 2 types of withholding taxes, namely: (1) final withholding tax; and (2) creditable withholding tax, including expanded withholding tax.

INCOME TAX • INCOME TAX – Tax on all yearly profits arising from property, professions, trades or offices, or as a tax on a person’s income, emoluments, profits and the like (Fisher v. Trinidad). – Income tax is a direct tax on taxable actual or presumed income (gross or net) of a taxpayer received, accrued or realized during the taxable year. • WITHHOLDING TAX – It is not an internal revenue tax but a mode of collecting income tax in advance on income of the recipient of income thru the payor of income. [NOTE: Sec. 21, NIRC enumerates various internal revenue taxes. ] – There are 2 types of withholding taxes, namely: (1) final withholding tax; and (2) creditable withholding tax, including expanded withholding tax.

FEATURES OF INCOME TAX • It is a direct tax. • It is a progressive tax, since the tax base increases as the tax rate increases. It is founded on the ability to pay of taxpayer. • Phil adopted the most comprehensive system in imposing income tax. • Phil follows the semi-global or semi-schedular income tax system. • It is of American origin. Decisions of U. S. tax authorities have peculiar and persuasive effects for the Phil.

FEATURES OF INCOME TAX • It is a direct tax. • It is a progressive tax, since the tax base increases as the tax rate increases. It is founded on the ability to pay of taxpayer. • Phil adopted the most comprehensive system in imposing income tax. • Phil follows the semi-global or semi-schedular income tax system. • It is of American origin. Decisions of U. S. tax authorities have peculiar and persuasive effects for the Phil.

INCOME TAX SYSTEMS • GLOBAL TAX SYSTEM – – – Compensation income not subject to FWT Business and/or professional income Capital gains not subject to FWT Passive investment income not subject to FWT Other income not subject to FWT • SCHEDULAR TAX SYSTEM – – Compensation income subject to FWT Capital gains subject to FWT Passive investment income subject to FWT Other income subject to FWT • The Philippines adopted the semi-global or semi-schedular tax system. Either the global or schedular system, or both systems, may apply on income of a taxpayer. • You apply the schedular tax system only when the income, gain or profit is subject to FWT.

INCOME TAX SYSTEMS • GLOBAL TAX SYSTEM – – – Compensation income not subject to FWT Business and/or professional income Capital gains not subject to FWT Passive investment income not subject to FWT Other income not subject to FWT • SCHEDULAR TAX SYSTEM – – Compensation income subject to FWT Capital gains subject to FWT Passive investment income subject to FWT Other income subject to FWT • The Philippines adopted the semi-global or semi-schedular tax system. Either the global or schedular system, or both systems, may apply on income of a taxpayer. • You apply the schedular tax system only when the income, gain or profit is subject to FWT.

FINAL WITHHOLDING TAX • Income payment is listed in Sec 57(A), NIRC, as subject to FWT. • FWT withheld by the payor of income (e. g. , 20% FWT on interest income on bank deposits) represents FULL payment of income tax due on such income of the recipient. • Income payee (or recipient of income) does not report income subjected to FWT in his income tax return, although income is reflected in his audited financial statements for the year. However, he is not allowed to claim any tax credit on income subjected to FWT. • Withholding agent (payor of income) files the withholding tax return, which includes the FWT deducted from the income of payee, and pays the tax to the BIR. There is no Certificate of Tax Withheld issued to income payee. • No Certificate of Tax Withheld (BIR Form 2307) is attached to the income tax return of recipient of income because he does not claim any tax credit in his tax return.

FINAL WITHHOLDING TAX • Income payment is listed in Sec 57(A), NIRC, as subject to FWT. • FWT withheld by the payor of income (e. g. , 20% FWT on interest income on bank deposits) represents FULL payment of income tax due on such income of the recipient. • Income payee (or recipient of income) does not report income subjected to FWT in his income tax return, although income is reflected in his audited financial statements for the year. However, he is not allowed to claim any tax credit on income subjected to FWT. • Withholding agent (payor of income) files the withholding tax return, which includes the FWT deducted from the income of payee, and pays the tax to the BIR. There is no Certificate of Tax Withheld issued to income payee. • No Certificate of Tax Withheld (BIR Form 2307) is attached to the income tax return of recipient of income because he does not claim any tax credit in his tax return.

CRITERIA IN IMPOSING INCOME TAX • Citizenship principle – For Filipino citizens and domestic corporations, who are entitled to Philippine government protection wherever they are situated. • Residence principle – For alien individuals and foreign corporations • Source principle – For alien individuals and foreign corporations

CRITERIA IN IMPOSING INCOME TAX • Citizenship principle – For Filipino citizens and domestic corporations, who are entitled to Philippine government protection wherever they are situated. • Residence principle – For alien individuals and foreign corporations • Source principle – For alien individuals and foreign corporations

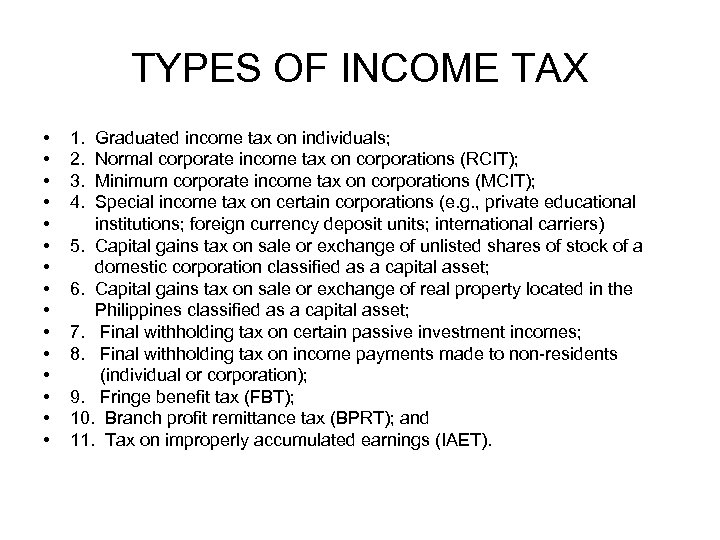

TYPES OF INCOME TAX • • • • 1. 2. 3. 4. Graduated income tax on individuals; Normal corporate income tax on corporations (RCIT); Minimum corporate income tax on corporations (MCIT); Special income tax on certain corporations (e. g. , private educational institutions; foreign currency deposit units; international carriers) 5. Capital gains tax on sale or exchange of unlisted shares of stock of a domestic corporation classified as a capital asset; 6. Capital gains tax on sale or exchange of real property located in the Philippines classified as a capital asset; 7. Final withholding tax on certain passive investment incomes; 8. Final withholding tax on income payments made to non-residents (individual or corporation); 9. Fringe benefit tax (FBT); 10. Branch profit remittance tax (BPRT); and 11. Tax on improperly accumulated earnings (IAET).

TYPES OF INCOME TAX • • • • 1. 2. 3. 4. Graduated income tax on individuals; Normal corporate income tax on corporations (RCIT); Minimum corporate income tax on corporations (MCIT); Special income tax on certain corporations (e. g. , private educational institutions; foreign currency deposit units; international carriers) 5. Capital gains tax on sale or exchange of unlisted shares of stock of a domestic corporation classified as a capital asset; 6. Capital gains tax on sale or exchange of real property located in the Philippines classified as a capital asset; 7. Final withholding tax on certain passive investment incomes; 8. Final withholding tax on income payments made to non-residents (individual or corporation); 9. Fringe benefit tax (FBT); 10. Branch profit remittance tax (BPRT); and 11. Tax on improperly accumulated earnings (IAET).

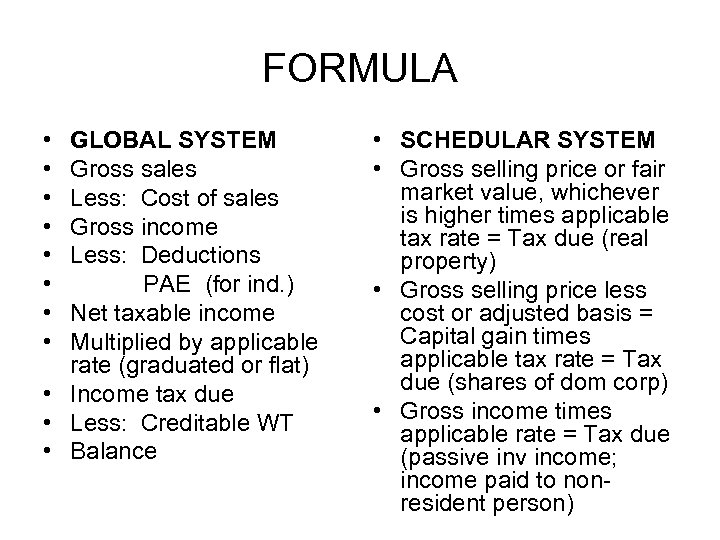

FORMULA • • GLOBAL SYSTEM Gross sales Less: Cost of sales Gross income Less: Deductions PAE (for ind. ) Net taxable income Multiplied by applicable rate (graduated or flat) • Income tax due • Less: Creditable WT • Balance • SCHEDULAR SYSTEM • Gross selling price or fair market value, whichever is higher times applicable tax rate = Tax due (real property) • Gross selling price less cost or adjusted basis = Capital gain times applicable tax rate = Tax due (shares of dom corp) • Gross income times applicable rate = Tax due (passive inv income; income paid to nonresident person)

FORMULA • • GLOBAL SYSTEM Gross sales Less: Cost of sales Gross income Less: Deductions PAE (for ind. ) Net taxable income Multiplied by applicable rate (graduated or flat) • Income tax due • Less: Creditable WT • Balance • SCHEDULAR SYSTEM • Gross selling price or fair market value, whichever is higher times applicable tax rate = Tax due (real property) • Gross selling price less cost or adjusted basis = Capital gain times applicable tax rate = Tax due (shares of dom corp) • Gross income times applicable rate = Tax due (passive inv income; income paid to nonresident person)

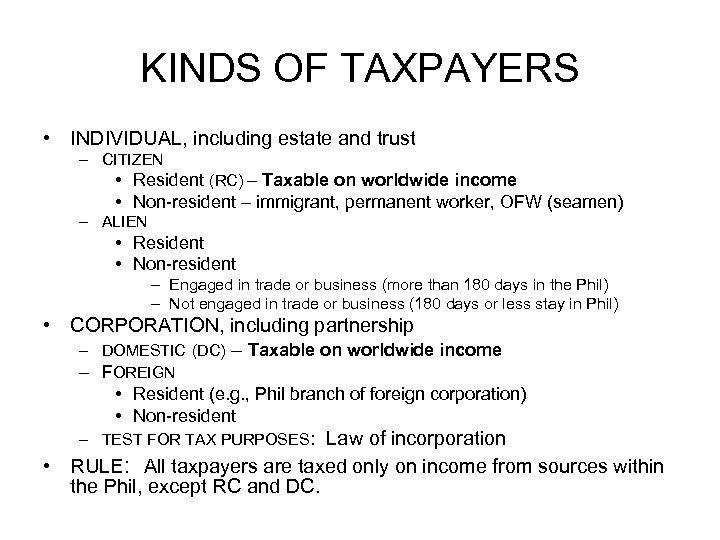

KINDS OF TAXPAYERS • INDIVIDUAL, including estate and trust – CITIZEN • Resident (RC) – Taxable on worldwide income • Non-resident – immigrant, permanent worker, OFW (seamen) – ALIEN • Resident • Non-resident – Engaged in trade or business (more than 180 days in the Phil) – Not engaged in trade or business (180 days or less stay in Phil) • CORPORATION, including partnership – DOMESTIC (DC) – Taxable on worldwide income – FOREIGN • Resident (e. g. , Phil branch of foreign corporation) • Non-resident – TEST FOR TAX PURPOSES: Law of incorporation • RULE: All taxpayers are taxed only on income from sources within the Phil, except RC and DC.

KINDS OF TAXPAYERS • INDIVIDUAL, including estate and trust – CITIZEN • Resident (RC) – Taxable on worldwide income • Non-resident – immigrant, permanent worker, OFW (seamen) – ALIEN • Resident • Non-resident – Engaged in trade or business (more than 180 days in the Phil) – Not engaged in trade or business (180 days or less stay in Phil) • CORPORATION, including partnership – DOMESTIC (DC) – Taxable on worldwide income – FOREIGN • Resident (e. g. , Phil branch of foreign corporation) • Non-resident – TEST FOR TAX PURPOSES: Law of incorporation • RULE: All taxpayers are taxed only on income from sources within the Phil, except RC and DC.

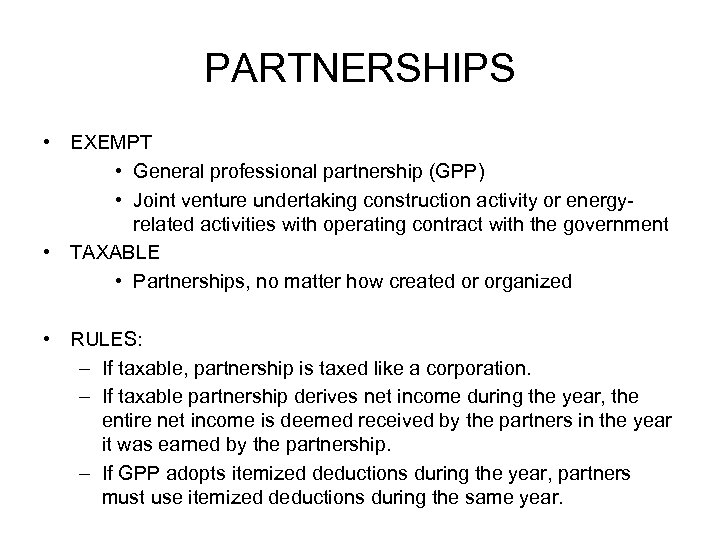

PARTNERSHIPS • EXEMPT • General professional partnership (GPP) • Joint venture undertaking construction activity or energyrelated activities with operating contract with the government • TAXABLE • Partnerships, no matter how created or organized • RULES: – If taxable, partnership is taxed like a corporation. – If taxable partnership derives net income during the year, the entire net income is deemed received by the partners in the year it was earned by the partnership. – If GPP adopts itemized deductions during the year, partners must use itemized deductions during the same year.

PARTNERSHIPS • EXEMPT • General professional partnership (GPP) • Joint venture undertaking construction activity or energyrelated activities with operating contract with the government • TAXABLE • Partnerships, no matter how created or organized • RULES: – If taxable, partnership is taxed like a corporation. – If taxable partnership derives net income during the year, the entire net income is deemed received by the partners in the year it was earned by the partnership. – If GPP adopts itemized deductions during the year, partners must use itemized deductions during the same year.

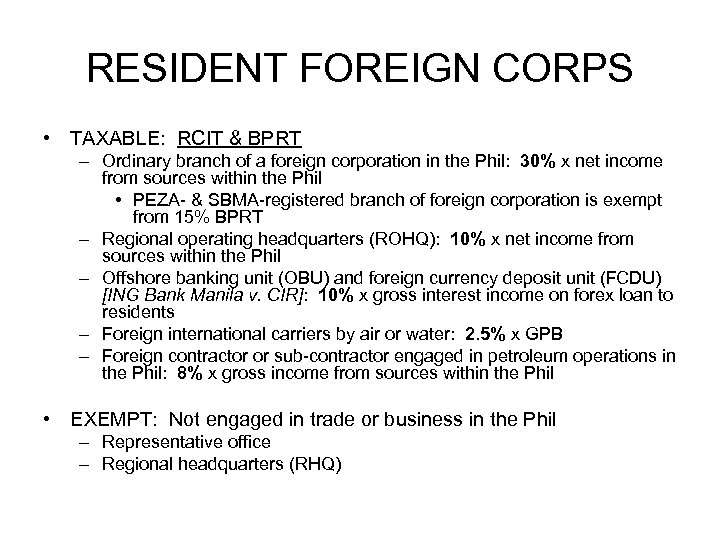

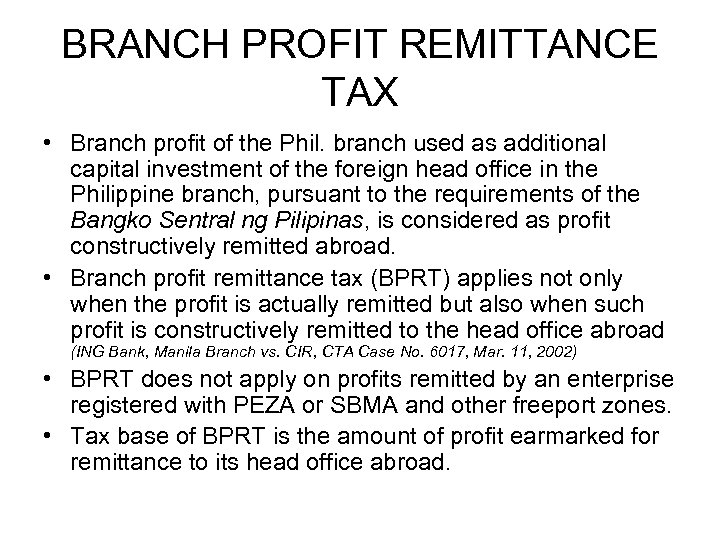

RESIDENT FOREIGN CORPS • TAXABLE: RCIT & BPRT – Ordinary branch of a foreign corporation in the Phil: 30% x net income from sources within the Phil • PEZA- & SBMA-registered branch of foreign corporation is exempt from 15% BPRT – Regional operating headquarters (ROHQ): 10% x net income from sources within the Phil – Offshore banking unit (OBU) and foreign currency deposit unit (FCDU) [ING Bank Manila v. CIR]: 10% x gross interest income on forex loan to residents – Foreign international carriers by air or water: 2. 5% x GPB – Foreign contractor or sub-contractor engaged in petroleum operations in the Phil: 8% x gross income from sources within the Phil • EXEMPT: Not engaged in trade or business in the Phil – Representative office – Regional headquarters (RHQ)

RESIDENT FOREIGN CORPS • TAXABLE: RCIT & BPRT – Ordinary branch of a foreign corporation in the Phil: 30% x net income from sources within the Phil • PEZA- & SBMA-registered branch of foreign corporation is exempt from 15% BPRT – Regional operating headquarters (ROHQ): 10% x net income from sources within the Phil – Offshore banking unit (OBU) and foreign currency deposit unit (FCDU) [ING Bank Manila v. CIR]: 10% x gross interest income on forex loan to residents – Foreign international carriers by air or water: 2. 5% x GPB – Foreign contractor or sub-contractor engaged in petroleum operations in the Phil: 8% x gross income from sources within the Phil • EXEMPT: Not engaged in trade or business in the Phil – Representative office – Regional headquarters (RHQ)

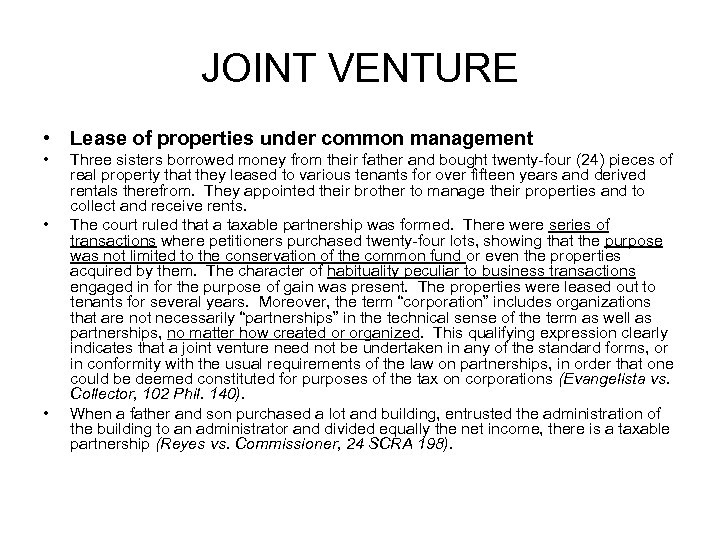

JOINT VENTURE • Lease of properties under common management • • • Three sisters borrowed money from their father and bought twenty-four (24) pieces of real property that they leased to various tenants for over fifteen years and derived rentals therefrom. They appointed their brother to manage their properties and to collect and receive rents. The court ruled that a taxable partnership was formed. There were series of transactions where petitioners purchased twenty-four lots, showing that the purpose was not limited to the conservation of the common fund or even the properties acquired by them. The character of habituality peculiar to business transactions engaged in for the purpose of gain was present. The properties were leased out to tenants for several years. Moreover, the term “corporation” includes organizations that are not necessarily “partnerships” in the technical sense of the term as well as partnerships, no matter how created or organized. This qualifying expression clearly indicates that a joint venture need not be undertaken in any of the standard forms, or in conformity with the usual requirements of the law on partnerships, in order that one could be deemed constituted for purposes of the tax on corporations (Evangelista vs. Collector, 102 Phil. 140). When a father and son purchased a lot and building, entrusted the administration of the building to an administrator and divided equally the net income, there is a taxable partnership (Reyes vs. Commissioner, 24 SCRA 198).

JOINT VENTURE • Lease of properties under common management • • • Three sisters borrowed money from their father and bought twenty-four (24) pieces of real property that they leased to various tenants for over fifteen years and derived rentals therefrom. They appointed their brother to manage their properties and to collect and receive rents. The court ruled that a taxable partnership was formed. There were series of transactions where petitioners purchased twenty-four lots, showing that the purpose was not limited to the conservation of the common fund or even the properties acquired by them. The character of habituality peculiar to business transactions engaged in for the purpose of gain was present. The properties were leased out to tenants for several years. Moreover, the term “corporation” includes organizations that are not necessarily “partnerships” in the technical sense of the term as well as partnerships, no matter how created or organized. This qualifying expression clearly indicates that a joint venture need not be undertaken in any of the standard forms, or in conformity with the usual requirements of the law on partnerships, in order that one could be deemed constituted for purposes of the tax on corporations (Evangelista vs. Collector, 102 Phil. 140). When a father and son purchased a lot and building, entrusted the administration of the building to an administrator and divided equally the net income, there is a taxable partnership (Reyes vs. Commissioner, 24 SCRA 198).

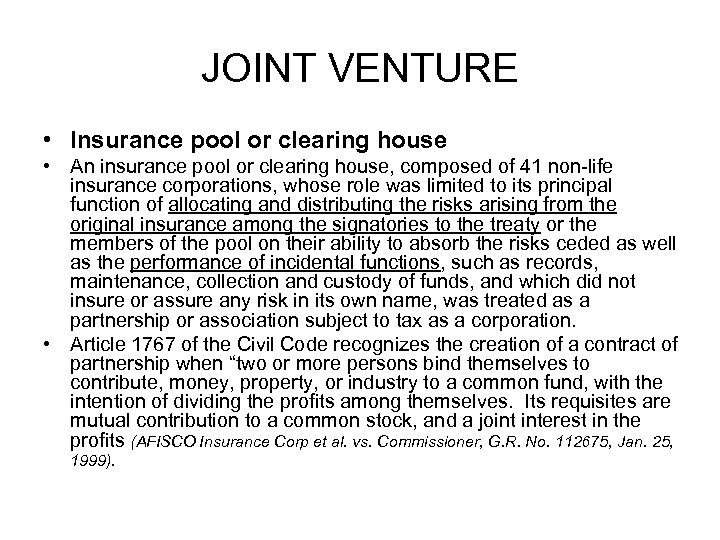

JOINT VENTURE • Insurance pool or clearing house • An insurance pool or clearing house, composed of 41 non-life insurance corporations, whose role was limited to its principal function of allocating and distributing the risks arising from the original insurance among the signatories to the treaty or the members of the pool on their ability to absorb the risks ceded as well as the performance of incidental functions, such as records, maintenance, collection and custody of funds, and which did not insure or assure any risk in its own name, was treated as a partnership or association subject to tax as a corporation. • Article 1767 of the Civil Code recognizes the creation of a contract of partnership when “two or more persons bind themselves to contribute, money, property, or industry to a common fund, with the intention of dividing the profits among themselves. Its requisites are mutual contribution to a common stock, and a joint interest in the profits (AFISCO Insurance Corp et al. vs. Commissioner, G. R. No. 112675, Jan. 25, 1999).

JOINT VENTURE • Insurance pool or clearing house • An insurance pool or clearing house, composed of 41 non-life insurance corporations, whose role was limited to its principal function of allocating and distributing the risks arising from the original insurance among the signatories to the treaty or the members of the pool on their ability to absorb the risks ceded as well as the performance of incidental functions, such as records, maintenance, collection and custody of funds, and which did not insure or assure any risk in its own name, was treated as a partnership or association subject to tax as a corporation. • Article 1767 of the Civil Code recognizes the creation of a contract of partnership when “two or more persons bind themselves to contribute, money, property, or industry to a common fund, with the intention of dividing the profits among themselves. Its requisites are mutual contribution to a common stock, and a joint interest in the profits (AFISCO Insurance Corp et al. vs. Commissioner, G. R. No. 112675, Jan. 25, 1999).

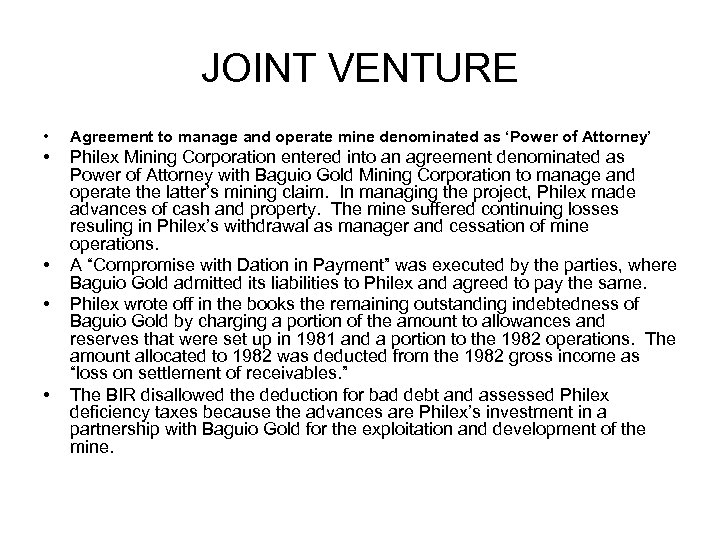

JOINT VENTURE • Agreement to manage and operate mine denominated as ‘Power of Attorney’ • Philex Mining Corporation entered into an agreement denominated as Power of Attorney with Baguio Gold Mining Corporation to manage and operate the latter’s mining claim. In managing the project, Philex made advances of cash and property. The mine suffered continuing losses resuling in Philex’s withdrawal as manager and cessation of mine operations. A “Compromise with Dation in Payment” was executed by the parties, where Baguio Gold admitted its liabilities to Philex and agreed to pay the same. Philex wrote off in the books the remaining outstanding indebtedness of Baguio Gold by charging a portion of the amount to allowances and reserves that were set up in 1981 and a portion to the 1982 operations. The amount allocated to 1982 was deducted from the 1982 gross income as “loss on settlement of receivables. ” The BIR disallowed the deduction for bad debt and assessed Philex deficiency taxes because the advances are Philex’s investment in a partnership with Baguio Gold for the exploitation and development of the mine. • • •

JOINT VENTURE • Agreement to manage and operate mine denominated as ‘Power of Attorney’ • Philex Mining Corporation entered into an agreement denominated as Power of Attorney with Baguio Gold Mining Corporation to manage and operate the latter’s mining claim. In managing the project, Philex made advances of cash and property. The mine suffered continuing losses resuling in Philex’s withdrawal as manager and cessation of mine operations. A “Compromise with Dation in Payment” was executed by the parties, where Baguio Gold admitted its liabilities to Philex and agreed to pay the same. Philex wrote off in the books the remaining outstanding indebtedness of Baguio Gold by charging a portion of the amount to allowances and reserves that were set up in 1981 and a portion to the 1982 operations. The amount allocated to 1982 was deducted from the 1982 gross income as “loss on settlement of receivables. ” The BIR disallowed the deduction for bad debt and assessed Philex deficiency taxes because the advances are Philex’s investment in a partnership with Baguio Gold for the exploitation and development of the mine. • • •

JOINT VENTURE • The totality of the circumstances and the stipulations in the parties’ agreement indubitably lead to the conclusion that a partnership was formed between the parties. • First, it does not appear that Baguio Gold was unconditionally obligated to return the advances made by Philex under the agreement. • Second, the Tax Court correctly observed that it was unlikely for a business corporation to lend hundreds of millions to another corporation with neither security nor collateral or a specific deed evidencing the terms and conditions of such loans. The parties also did not provide for a specific maturity date for the advances to become due and demandable, and the manner of payment was unclear. • Third, the strongest indication that Philex was a partner is the fact that it would receive 50% of the net profits as “compensation” under the agreement (Philex Mining Corporation vs. Commissioner, G. R. No. 148187, Apr. 16, 2008).

JOINT VENTURE • The totality of the circumstances and the stipulations in the parties’ agreement indubitably lead to the conclusion that a partnership was formed between the parties. • First, it does not appear that Baguio Gold was unconditionally obligated to return the advances made by Philex under the agreement. • Second, the Tax Court correctly observed that it was unlikely for a business corporation to lend hundreds of millions to another corporation with neither security nor collateral or a specific deed evidencing the terms and conditions of such loans. The parties also did not provide for a specific maturity date for the advances to become due and demandable, and the manner of payment was unclear. • Third, the strongest indication that Philex was a partner is the fact that it would receive 50% of the net profits as “compensation” under the agreement (Philex Mining Corporation vs. Commissioner, G. R. No. 148187, Apr. 16, 2008).

SOURCES OF INCOME • • Interest – Interest from sources within Phil and interest on bonds and obligations of residents, corporate or otherwise Dividend – From domestic corporation and from foreign corporation, unless than 50% of gross income of foreign corporation for 3 years prior to declaration of dividends was derived from sources within the Phil, in which case, apply only ratio of Phil-source income to gross income from all sources Services – Place where services are performed, except in case of international air carrier and shipping lines which are taxed at 2. 5% on their Gross Phil Billings. Revenues from trips originating from the Phil are considered as income from sources within the Philippines, while revenues from inbound trips are treated as income from sources outside the Philippines. Rentals and royalties – Location or use of property or property right in Phil Sale of real property – Located in the Philippines Sale of personal property – Located in the Philippines Gain from sale of shares of stocks of a domestic corporation is ALWAYS treated as income from sources within the Philippines. Other intangible property – Mobilia sequuntur personam (e. g. , gain from sale of shares of stocks of a foreign corporation)

SOURCES OF INCOME • • Interest – Interest from sources within Phil and interest on bonds and obligations of residents, corporate or otherwise Dividend – From domestic corporation and from foreign corporation, unless than 50% of gross income of foreign corporation for 3 years prior to declaration of dividends was derived from sources within the Phil, in which case, apply only ratio of Phil-source income to gross income from all sources Services – Place where services are performed, except in case of international air carrier and shipping lines which are taxed at 2. 5% on their Gross Phil Billings. Revenues from trips originating from the Phil are considered as income from sources within the Philippines, while revenues from inbound trips are treated as income from sources outside the Philippines. Rentals and royalties – Location or use of property or property right in Phil Sale of real property – Located in the Philippines Sale of personal property – Located in the Philippines Gain from sale of shares of stocks of a domestic corporation is ALWAYS treated as income from sources within the Philippines. Other intangible property – Mobilia sequuntur personam (e. g. , gain from sale of shares of stocks of a foreign corporation)

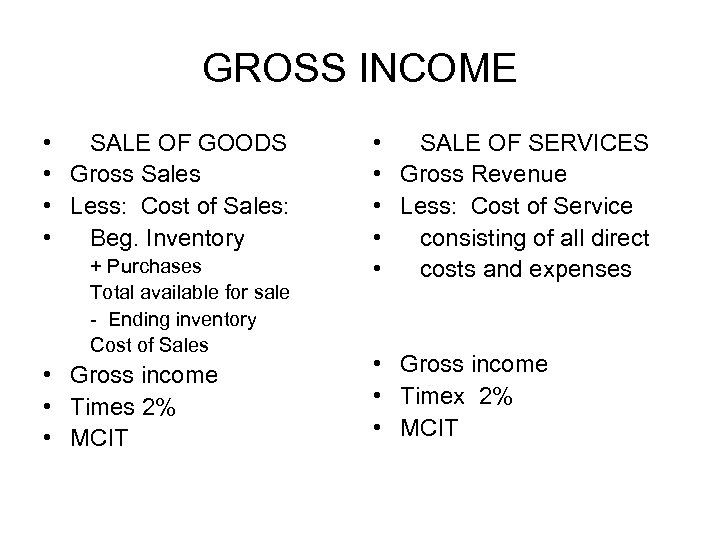

GROSS INCOME • SALE OF GOODS • Gross Sales • Less: Cost of Sales: • Beg. Inventory + Purchases Total available for sale - Ending inventory Cost of Sales • Gross income • Times 2% • MCIT • SALE OF SERVICES • Gross Revenue • Less: Cost of Service • consisting of all direct • costs and expenses • Gross income • Timex 2% • MCIT

GROSS INCOME • SALE OF GOODS • Gross Sales • Less: Cost of Sales: • Beg. Inventory + Purchases Total available for sale - Ending inventory Cost of Sales • Gross income • Times 2% • MCIT • SALE OF SERVICES • Gross Revenue • Less: Cost of Service • consisting of all direct • costs and expenses • Gross income • Timex 2% • MCIT

INCOME • INCOME means cash or its equivalent coming to a person within a specified period, whether as payment for services, interest or profit from investment. It covers gain derived from capital, from labor, or from both combined, including gain from sale or conversion of capital assets. • Return of capital is exempt from income tax. Capital, labor, or property is the tree; income is the fruit. Capital is the fund, income is the flow of fund. • To be taxable, there must be income, gain or profit; gain is received, accrued or realized during the year; and it is not exempt from income tax under the Constitution, treaty or law. – Mere increase in the value of property does not constitute taxable income. It is not yet realized during the year. – Transfer of appreciated property to the employee for services rendered is taxable income.

INCOME • INCOME means cash or its equivalent coming to a person within a specified period, whether as payment for services, interest or profit from investment. It covers gain derived from capital, from labor, or from both combined, including gain from sale or conversion of capital assets. • Return of capital is exempt from income tax. Capital, labor, or property is the tree; income is the fruit. Capital is the fund, income is the flow of fund. • To be taxable, there must be income, gain or profit; gain is received, accrued or realized during the year; and it is not exempt from income tax under the Constitution, treaty or law. – Mere increase in the value of property does not constitute taxable income. It is not yet realized during the year. – Transfer of appreciated property to the employee for services rendered is taxable income.

TEST IN DETERMINING INCOME • Realization test – There must be separation from capital of something of exchangeable value (e. g. , sale of asset) • Claim of right doctrine – CIR v. Javier, 199 SCRA 824 (bank erroneously paid $1 M, instead of $1, 000) • Economic benefit test – Stock option given to the employee • Income from whatever source – All income not expressly exempted from income, irrespective of voluntary or involuntary action of taxpayer in producing income

TEST IN DETERMINING INCOME • Realization test – There must be separation from capital of something of exchangeable value (e. g. , sale of asset) • Claim of right doctrine – CIR v. Javier, 199 SCRA 824 (bank erroneously paid $1 M, instead of $1, 000) • Economic benefit test – Stock option given to the employee • Income from whatever source – All income not expressly exempted from income, irrespective of voluntary or involuntary action of taxpayer in producing income

NATURE OF INCOME • COMPENSATION INCOME – Existence of employer-employee relationship • BUSINESS AND/OR PROFESSIONAL INCOME – NO employer-employee relationship • CAPITAL GAIN – Real property in the Phil and shares of stock of domestic corporation – Other sources of capital gain • PASSIVE INVESTMENT INCOME – Interest, dividend, and royalty income • OTHER INCOME – Prizes and winnings – All other income, gain or profit not covered by the above classes

NATURE OF INCOME • COMPENSATION INCOME – Existence of employer-employee relationship • BUSINESS AND/OR PROFESSIONAL INCOME – NO employer-employee relationship • CAPITAL GAIN – Real property in the Phil and shares of stock of domestic corporation – Other sources of capital gain • PASSIVE INVESTMENT INCOME – Interest, dividend, and royalty income • OTHER INCOME – Prizes and winnings – All other income, gain or profit not covered by the above classes

COMPENSATION INCOME • Compensation income falling within the meaning of “statutory minimum wage”(SMW) under R. A. 9504, effective July 6, 2008, as implemented by Revenue Regulations No. 10 -2008 dated July 8, 2008, shall be exempt from income tax and withholding tax. • Holiday pay, overtime pay, night shift differential pay, and hazard pay earned by Minimum Wage Earner (MWE) shall likewise be covered by the above exemption, provided that an employee who receives/earns additional compensation such as commissions, honoraria, fringe benefits, benefits in excess of the allowable statutory amount of P 30, 000, taxable allowances and other taxable income other than the SMW, holiday pay, overtime pay, hazard pay and night shift differential pay shall not enjoy the privilege of being a MWE and, therefore, his/her entire earnings are not exempt from income tax and withholding tax. •

COMPENSATION INCOME • Compensation income falling within the meaning of “statutory minimum wage”(SMW) under R. A. 9504, effective July 6, 2008, as implemented by Revenue Regulations No. 10 -2008 dated July 8, 2008, shall be exempt from income tax and withholding tax. • Holiday pay, overtime pay, night shift differential pay, and hazard pay earned by Minimum Wage Earner (MWE) shall likewise be covered by the above exemption, provided that an employee who receives/earns additional compensation such as commissions, honoraria, fringe benefits, benefits in excess of the allowable statutory amount of P 30, 000, taxable allowances and other taxable income other than the SMW, holiday pay, overtime pay, hazard pay and night shift differential pay shall not enjoy the privilege of being a MWE and, therefore, his/her entire earnings are not exempt from income tax and withholding tax. •

COMMISSION INCOME • • Commissions paid for marketing services rendered abroad for a Philippine company is considered foreign-source income. The source of the income is the property, activity or service that produced the income. Place where services are rendered determine taxation. The fact that recipient of commission income is President and majority stockholder of the Philippine company does not alter the source of income. There are only two ways by which the President and other members of the Board can be granted compensation apart from reasonable per diems: (1) when there is a provision in the by-laws fixing their compensation; and (2) when the stockholders agree to give it to them. If none of these conditions are present, commission income cannot be automatically attributed to petitioner’s position in the company (Juliane Baier-Nickel vs. CIR, GR No. 156305, Feb. 17, 2003) • Documents faxed to Philippine company bearing instructions as to sizes, designs and fabrics to be used in finished products and sample sales orders relayed to clients abroad are not enough to show services were performed abroad. Said documents must show that instructions or orders ripened into concluded or collected sales in Germany (CIR v. Baier-Nickel, GR No. 153793, Aug 29, 2006).

COMMISSION INCOME • • Commissions paid for marketing services rendered abroad for a Philippine company is considered foreign-source income. The source of the income is the property, activity or service that produced the income. Place where services are rendered determine taxation. The fact that recipient of commission income is President and majority stockholder of the Philippine company does not alter the source of income. There are only two ways by which the President and other members of the Board can be granted compensation apart from reasonable per diems: (1) when there is a provision in the by-laws fixing their compensation; and (2) when the stockholders agree to give it to them. If none of these conditions are present, commission income cannot be automatically attributed to petitioner’s position in the company (Juliane Baier-Nickel vs. CIR, GR No. 156305, Feb. 17, 2003) • Documents faxed to Philippine company bearing instructions as to sizes, designs and fabrics to be used in finished products and sample sales orders relayed to clients abroad are not enough to show services were performed abroad. Said documents must show that instructions or orders ripened into concluded or collected sales in Germany (CIR v. Baier-Nickel, GR No. 153793, Aug 29, 2006).

ONSHORE AND OFFSHORE INCOME • Construction and installation works were subcontracted and done in the Philippines by a Phil corporation; hence, income is from sources within the Philippines. • However, some pieces of equipment and supplies for NDC project and ammonia storage tanks and refrigeration units were completely designed and engineered in Japan. All services for the design, fabrication, engineering and manufacture of materials and equipment under Japanese Yen portion were made and completed in Japan; hence, exempt from Phil income tax. • Service income from turn-key contract on a project in the Phil is divisible (CIR v. Marubeni Corp, GR No. 137377, Dec 18, 2001).

ONSHORE AND OFFSHORE INCOME • Construction and installation works were subcontracted and done in the Philippines by a Phil corporation; hence, income is from sources within the Philippines. • However, some pieces of equipment and supplies for NDC project and ammonia storage tanks and refrigeration units were completely designed and engineered in Japan. All services for the design, fabrication, engineering and manufacture of materials and equipment under Japanese Yen portion were made and completed in Japan; hence, exempt from Phil income tax. • Service income from turn-key contract on a project in the Phil is divisible (CIR v. Marubeni Corp, GR No. 137377, Dec 18, 2001).

GROSS PHIL BILLINGS • INTERNATIONAL AIR CARRIER • On outbound trip: Flight from Phil to foreign destination, income is treated as from Philippine sources; hence, subject to 2. 5% on GPB – Continuous and uninterrupted flight – If transhipment of passenger in another country on another foreign airline takes place: GPB tax applies only on aliquot portion of revenue on Philippine leg (Phil to foreign country) • On inbound trip: Flight from foreign country to the Phil, income is treated as from foreign sources; hence, exempt from Phil income tax • INTERNATIONAL SHIPPING LINE • From Phil to final foreign destination: entire income is taxable, even if transhipment of cargoes took place in another country • From foreign country to Phil: exempt

GROSS PHIL BILLINGS • INTERNATIONAL AIR CARRIER • On outbound trip: Flight from Phil to foreign destination, income is treated as from Philippine sources; hence, subject to 2. 5% on GPB – Continuous and uninterrupted flight – If transhipment of passenger in another country on another foreign airline takes place: GPB tax applies only on aliquot portion of revenue on Philippine leg (Phil to foreign country) • On inbound trip: Flight from foreign country to the Phil, income is treated as from foreign sources; hence, exempt from Phil income tax • INTERNATIONAL SHIPPING LINE • From Phil to final foreign destination: entire income is taxable, even if transhipment of cargoes took place in another country • From foreign country to Phil: exempt

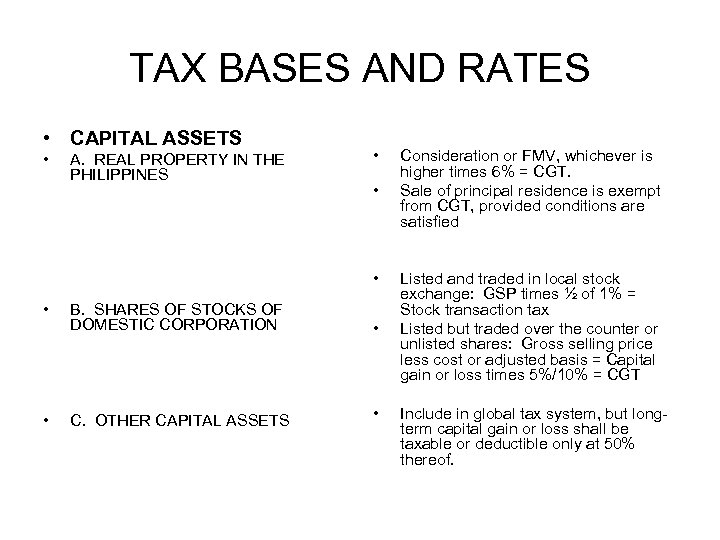

CAPITAL GAINS • 3 TYPES OF CAPITAL GAINS – Capital gain from sale of real property located in the Phil – Capital gain from sale of shares of stocks of a domestic corporation – Other types of capital gains • Sale of real property located in the Phil – Seller is not engaged in real estate business • The law presumes that the seller realizes a profit from sale of capital asset; hence, despite the loss from sale, seller has to pay the 6% CGT.

CAPITAL GAINS • 3 TYPES OF CAPITAL GAINS – Capital gain from sale of real property located in the Phil – Capital gain from sale of shares of stocks of a domestic corporation – Other types of capital gains • Sale of real property located in the Phil – Seller is not engaged in real estate business • The law presumes that the seller realizes a profit from sale of capital asset; hence, despite the loss from sale, seller has to pay the 6% CGT.

SALE OF REAL PROPERTY • The tax base is gross selling price or fair market value, whichever is higher • Apply the 6% capital gains tax, if the seller is a resident citizen, an alien individual (resident or non-resident), or a domestic corporation. • If the seller is a foreign corporation (resident or non-resident), the asset in the Phil is a capital asset, but the gain from sale is subject to the global tax system of taxation. • If the real property is located abroad, the gain from sale is exempt from Phil income tax, unless the seller is a resident citizen or a domestic corporation. • If the seller is a resident citizen and capital asset is the principal residence of the seller, the sale may be exempt from the 6% CGT, provided that the conditions provided for in the law are complied with by the seller.

SALE OF REAL PROPERTY • The tax base is gross selling price or fair market value, whichever is higher • Apply the 6% capital gains tax, if the seller is a resident citizen, an alien individual (resident or non-resident), or a domestic corporation. • If the seller is a foreign corporation (resident or non-resident), the asset in the Phil is a capital asset, but the gain from sale is subject to the global tax system of taxation. • If the real property is located abroad, the gain from sale is exempt from Phil income tax, unless the seller is a resident citizen or a domestic corporation. • If the seller is a resident citizen and capital asset is the principal residence of the seller, the sale may be exempt from the 6% CGT, provided that the conditions provided for in the law are complied with by the seller.

SALE OF REAL PROPERTY • Seller is a person engaged in real estate business – Real property is an ordinary asset; hence, any gain (selling price less cost or adjusted basis) from sale is taxed under the global tax system. – The transaction is subject to the expanded withholding tax, such tax to be withheld by the buyer of the property and remitted to BIR. The withholding tax is creditable against the income tax of the seller. – The 6% capital gains tax on the transaction is not applicable thereon.

SALE OF REAL PROPERTY • Seller is a person engaged in real estate business – Real property is an ordinary asset; hence, any gain (selling price less cost or adjusted basis) from sale is taxed under the global tax system. – The transaction is subject to the expanded withholding tax, such tax to be withheld by the buyer of the property and remitted to BIR. The withholding tax is creditable against the income tax of the seller. – The 6% capital gains tax on the transaction is not applicable thereon.

SALE OF SHARES OF DOMESTIC CORPORATION • Seller is a dealer in securities – Dealer in securities is a person regularly engaged in the buy and sale of securities for his own account. He sells property and looks at profits from sale of shares or securities. A stockbroker is a middleman between the seller and buyer of stocks or securities. He is a seller of services and his income is commission. – Shares are ordinary assets of seller; selling price less cost or adjusted basis equals gain; gain from sale is subject to global tax system of income taxation. – Transaction involving listed shares traded in local stock exchange is not covered by Sec 127(A), NIRC (stock transaction tax), by express provision of law.

SALE OF SHARES OF DOMESTIC CORPORATION • Seller is a dealer in securities – Dealer in securities is a person regularly engaged in the buy and sale of securities for his own account. He sells property and looks at profits from sale of shares or securities. A stockbroker is a middleman between the seller and buyer of stocks or securities. He is a seller of services and his income is commission. – Shares are ordinary assets of seller; selling price less cost or adjusted basis equals gain; gain from sale is subject to global tax system of income taxation. – Transaction involving listed shares traded in local stock exchange is not covered by Sec 127(A), NIRC (stock transaction tax), by express provision of law.

SHARES OF DOMESTIC CORPORATION • Seller is an investor who is not a dealer in securities – If shares are listed and traded in a local stock exchange, apply ½ of 1% stock transaction tax on gross selling price or gross value in money. Sale is exempt from income tax. – If shares are listed but not traded in a local stock exchange (or over-the-counter), or the shares are unlisted, the net capital gain (selling price less cost or adjusted basis), if any, is subject to the capital gains tax computed as follows: • 5% on first P 100, 000 net capital gain; and • 10% on any amount in excess of P 100, 000

SHARES OF DOMESTIC CORPORATION • Seller is an investor who is not a dealer in securities – If shares are listed and traded in a local stock exchange, apply ½ of 1% stock transaction tax on gross selling price or gross value in money. Sale is exempt from income tax. – If shares are listed but not traded in a local stock exchange (or over-the-counter), or the shares are unlisted, the net capital gain (selling price less cost or adjusted basis), if any, is subject to the capital gains tax computed as follows: • 5% on first P 100, 000 net capital gain; and • 10% on any amount in excess of P 100, 000

SHARES OF DOMESTIC CORPORATION – CGT return is filed within 30 days from date of sale. Every sale must be covered by a separate CGT return and the tax paid upon filing of the return. – All transactions during the year are consolidated and the annual return shall be filed not later than April 15 of the following year, but only one P 100, 000 is subject to 5% and the balance of net capital gain for the year is subject to 10%. – Net capital gain = Total capital gains from sales of shares of domestic corporation during the year less total capital losses during the same year.

SHARES OF DOMESTIC CORPORATION – CGT return is filed within 30 days from date of sale. Every sale must be covered by a separate CGT return and the tax paid upon filing of the return. – All transactions during the year are consolidated and the annual return shall be filed not later than April 15 of the following year, but only one P 100, 000 is subject to 5% and the balance of net capital gain for the year is subject to 10%. – Net capital gain = Total capital gains from sales of shares of domestic corporation during the year less total capital losses during the same year.

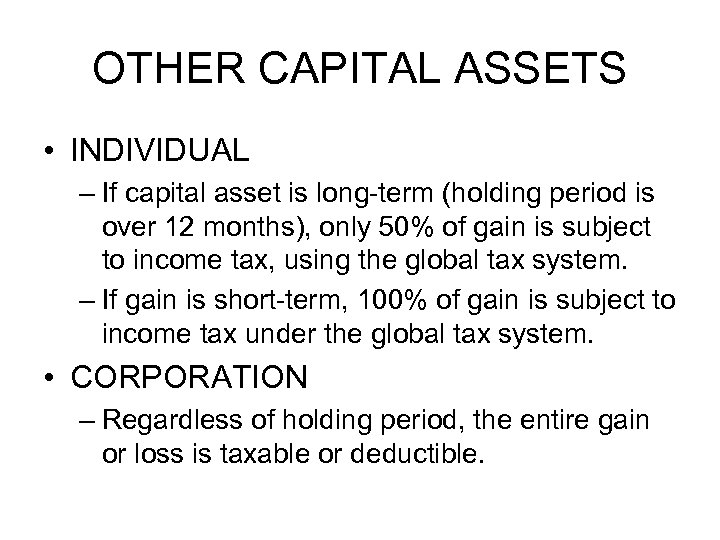

OTHER CAPITAL ASSETS • INDIVIDUAL – If capital asset is long-term (holding period is over 12 months), only 50% of gain is subject to income tax, using the global tax system. – If gain is short-term, 100% of gain is subject to income tax under the global tax system. • CORPORATION – Regardless of holding period, the entire gain or loss is taxable or deductible.

OTHER CAPITAL ASSETS • INDIVIDUAL – If capital asset is long-term (holding period is over 12 months), only 50% of gain is subject to income tax, using the global tax system. – If gain is short-term, 100% of gain is subject to income tax under the global tax system. • CORPORATION – Regardless of holding period, the entire gain or loss is taxable or deductible.

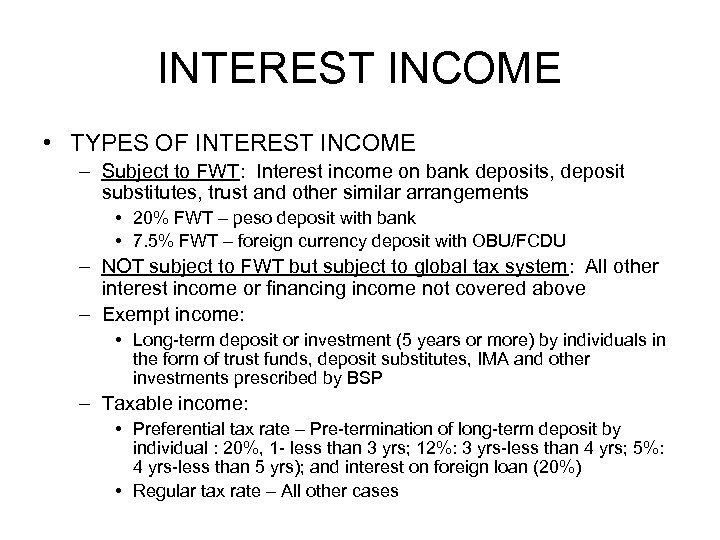

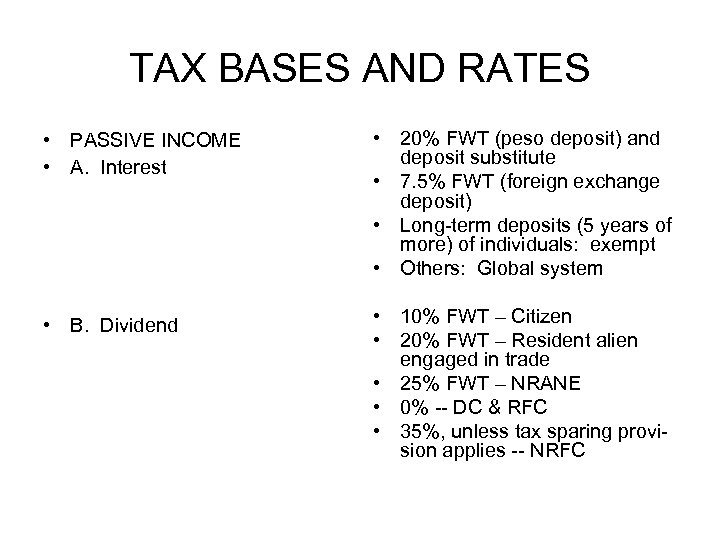

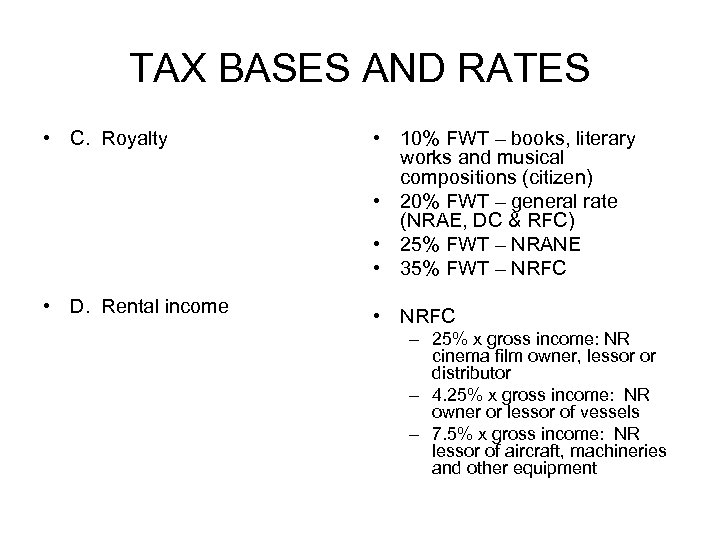

INTEREST INCOME • TYPES OF INTEREST INCOME – Subject to FWT: Interest income on bank deposits, deposit substitutes, trust and other similar arrangements • 20% FWT – peso deposit with bank • 7. 5% FWT – foreign currency deposit with OBU/FCDU – NOT subject to FWT but subject to global tax system: All other interest income or financing income not covered above – Exempt income: • Long-term deposit or investment (5 years or more) by individuals in the form of trust funds, deposit substitutes, IMA and other investments prescribed by BSP – Taxable income: • Preferential tax rate – Pre-termination of long-term deposit by individual : 20%, 1 - less than 3 yrs; 12%: 3 yrs-less than 4 yrs; 5%: 4 yrs-less than 5 yrs); and interest on foreign loan (20%) • Regular tax rate – All other cases

INTEREST INCOME • TYPES OF INTEREST INCOME – Subject to FWT: Interest income on bank deposits, deposit substitutes, trust and other similar arrangements • 20% FWT – peso deposit with bank • 7. 5% FWT – foreign currency deposit with OBU/FCDU – NOT subject to FWT but subject to global tax system: All other interest income or financing income not covered above – Exempt income: • Long-term deposit or investment (5 years or more) by individuals in the form of trust funds, deposit substitutes, IMA and other investments prescribed by BSP – Taxable income: • Preferential tax rate – Pre-termination of long-term deposit by individual : 20%, 1 - less than 3 yrs; 12%: 3 yrs-less than 4 yrs; 5%: 4 yrs-less than 5 yrs); and interest on foreign loan (20%) • Regular tax rate – All other cases

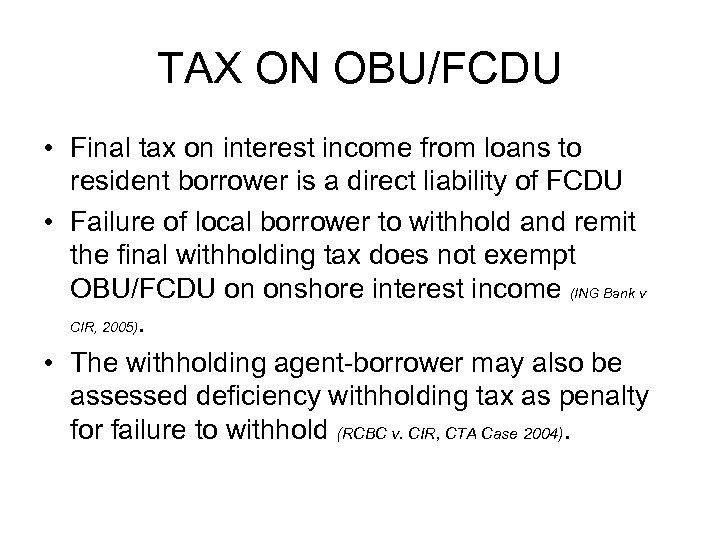

TAX ON OBU/FCDU • Final tax on interest income from loans to resident borrower is a direct liability of FCDU • Failure of local borrower to withhold and remit the final withholding tax does not exempt OBU/FCDU on onshore interest income (ING Bank v CIR, 2005). • The withholding agent-borrower may also be assessed deficiency withholding tax as penalty for failure to withhold (RCBC v. CIR, CTA Case 2004).

TAX ON OBU/FCDU • Final tax on interest income from loans to resident borrower is a direct liability of FCDU • Failure of local borrower to withhold and remit the final withholding tax does not exempt OBU/FCDU on onshore interest income (ING Bank v CIR, 2005). • The withholding agent-borrower may also be assessed deficiency withholding tax as penalty for failure to withhold (RCBC v. CIR, CTA Case 2004).

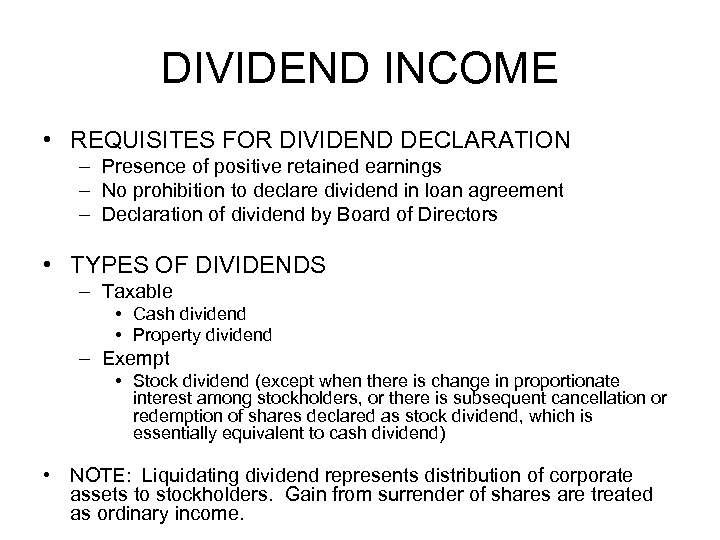

DIVIDEND INCOME • REQUISITES FOR DIVIDEND DECLARATION – Presence of positive retained earnings – No prohibition to declare dividend in loan agreement – Declaration of dividend by Board of Directors • TYPES OF DIVIDENDS – Taxable • Cash dividend • Property dividend – Exempt • Stock dividend (except when there is change in proportionate interest among stockholders, or there is subsequent cancellation or redemption of shares declared as stock dividend, which is essentially equivalent to cash dividend) • NOTE: Liquidating dividend represents distribution of corporate assets to stockholders. Gain from surrender of shares are treated as ordinary income.

DIVIDEND INCOME • REQUISITES FOR DIVIDEND DECLARATION – Presence of positive retained earnings – No prohibition to declare dividend in loan agreement – Declaration of dividend by Board of Directors • TYPES OF DIVIDENDS – Taxable • Cash dividend • Property dividend – Exempt • Stock dividend (except when there is change in proportionate interest among stockholders, or there is subsequent cancellation or redemption of shares declared as stock dividend, which is essentially equivalent to cash dividend) • NOTE: Liquidating dividend represents distribution of corporate assets to stockholders. Gain from surrender of shares are treated as ordinary income.

DIVIDEND INCOME • Intra-corporate dividend: Exempt from tax – Corporation paying dividend: Domestic corporation – Recipient of dividend: Another domestic corporation or resident foreign corporation • Dividend paid to non-resident foreign corporation – Corporation paying dividend: Domestic corporation – Recipient of dividend • Foreign head office makes direct investment in Phil company: 15% FWT on gross dividend income • Phil branch of foreign corporation makes investment in Phil company: Exempt from income tax – Tax-sparing provision • If country of residence of the foreign corporation does not impose income tax on dividend paid by a domestic corporation, impose 15% FWT only

DIVIDEND INCOME • Intra-corporate dividend: Exempt from tax – Corporation paying dividend: Domestic corporation – Recipient of dividend: Another domestic corporation or resident foreign corporation • Dividend paid to non-resident foreign corporation – Corporation paying dividend: Domestic corporation – Recipient of dividend • Foreign head office makes direct investment in Phil company: 15% FWT on gross dividend income • Phil branch of foreign corporation makes investment in Phil company: Exempt from income tax – Tax-sparing provision • If country of residence of the foreign corporation does not impose income tax on dividend paid by a domestic corporation, impose 15% FWT only

DIVIDEND INCOME • • While there is transfer of the shares of stock/securities to the Borrower pursuant to the Securities Borrowing and Lending (SBL) Agreement, the Lender retains certain rights accruing to the shares of stock/securities lent, such as the right to receive cash, stock dividends or interest which the Borrower is obliged to manufacture or reimburse to the Lender during the borrowing period. These cash, stock dividends or interest which the Borrower is required to manufacture or reimburse to the Lender are otherwise referred to as "Manufactured Dividends or Benefits". The Lender may likewise retain voting rights over the loaned shares of stock/securities while in the possession of the Borrower, if mutually agreed upon by the parties. Receipt of the “Manufactured Dividends or Benefits” shall not be a taxable income of the Lender since it just represents dividends/other benefits that the lender would have received had the share not been loaned pursuant to SBL agreement. However, the payment of such amount by the Borrower shall not be a tax deductible expense. On the other hand, the receipt of cash dividend from the issuing company by the Borrower or Buyer shall be subject to the provisions of existing laws (e. g. , final withholding tax of 10% on gross dividend paid to a citizen).

DIVIDEND INCOME • • While there is transfer of the shares of stock/securities to the Borrower pursuant to the Securities Borrowing and Lending (SBL) Agreement, the Lender retains certain rights accruing to the shares of stock/securities lent, such as the right to receive cash, stock dividends or interest which the Borrower is obliged to manufacture or reimburse to the Lender during the borrowing period. These cash, stock dividends or interest which the Borrower is required to manufacture or reimburse to the Lender are otherwise referred to as "Manufactured Dividends or Benefits". The Lender may likewise retain voting rights over the loaned shares of stock/securities while in the possession of the Borrower, if mutually agreed upon by the parties. Receipt of the “Manufactured Dividends or Benefits” shall not be a taxable income of the Lender since it just represents dividends/other benefits that the lender would have received had the share not been loaned pursuant to SBL agreement. However, the payment of such amount by the Borrower shall not be a tax deductible expense. On the other hand, the receipt of cash dividend from the issuing company by the Borrower or Buyer shall be subject to the provisions of existing laws (e. g. , final withholding tax of 10% on gross dividend paid to a citizen).

OTHER INCOME • Income from any source whatever • The words “income from any source whatever” discloses a legislative policy to include all income not expressly exempted from the class of taxable income under our laws (Madrigal vs. Rafferty, supra; Commissioner vs. BOAC). The words “income from any source whatever” is broad enough to cover gains contemplated here. These words disclose a legislative policy to include all income not expressly exempted within the class of taxable income under our laws, irrespective of the voluntary or involuntary action of the taxpayer in producing the gains (Gutierrez vs. Collector, CTA Case 65, Aug. 31, 1955). • Any economic benefit to the employee whatever may have been the mode by which it is effected is taxable. Thus, in stock options, the difference between the fair market value of the shares at the time the option is exercised and the option price constitutes additional compensation income to the employee (Commissioner vs. Smith, 324 U. S. 177).

OTHER INCOME • Income from any source whatever • The words “income from any source whatever” discloses a legislative policy to include all income not expressly exempted from the class of taxable income under our laws (Madrigal vs. Rafferty, supra; Commissioner vs. BOAC). The words “income from any source whatever” is broad enough to cover gains contemplated here. These words disclose a legislative policy to include all income not expressly exempted within the class of taxable income under our laws, irrespective of the voluntary or involuntary action of the taxpayer in producing the gains (Gutierrez vs. Collector, CTA Case 65, Aug. 31, 1955). • Any economic benefit to the employee whatever may have been the mode by which it is effected is taxable. Thus, in stock options, the difference between the fair market value of the shares at the time the option is exercised and the option price constitutes additional compensation income to the employee (Commissioner vs. Smith, 324 U. S. 177).

EXCLUSIONS • • • Life insurance proceeds Amount received by insured as return of premium Gifts, bequests and devises Compensation for injuries or sickness Income exempt under treaty Retirement benefits, pensions, gratuities – R. A. 7641 (5 yrs & 60 yrs) and R. A. 4917 (10 yrs & 50 yrs) • Interest income of employee trust fund or accredited retirement plan is exempt from FWT (CIR v. GCL Retirement Plan, 207 SCRA 487) – Amount received as a consequence of separation because of death, sickness or other physical disability or for any cause beyond the control of employee • Miscellaneous items – Income of foreign government – Income of government or its political subdivisions from any public utility or exercise of governmental function

EXCLUSIONS • • • Life insurance proceeds Amount received by insured as return of premium Gifts, bequests and devises Compensation for injuries or sickness Income exempt under treaty Retirement benefits, pensions, gratuities – R. A. 7641 (5 yrs & 60 yrs) and R. A. 4917 (10 yrs & 50 yrs) • Interest income of employee trust fund or accredited retirement plan is exempt from FWT (CIR v. GCL Retirement Plan, 207 SCRA 487) – Amount received as a consequence of separation because of death, sickness or other physical disability or for any cause beyond the control of employee • Miscellaneous items – Income of foreign government – Income of government or its political subdivisions from any public utility or exercise of governmental function

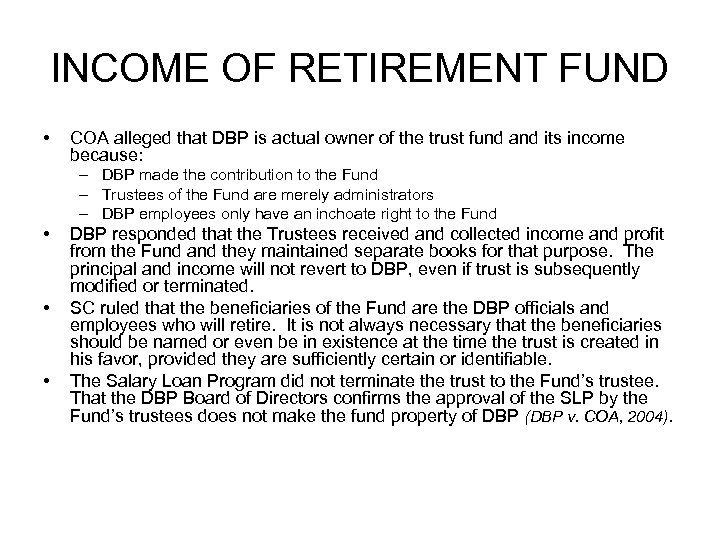

INCOME OF RETIREMENT FUND • COA alleged that DBP is actual owner of the trust fund and its income because: – DBP made the contribution to the Fund – Trustees of the Fund are merely administrators – DBP employees only have an inchoate right to the Fund • • • DBP responded that the Trustees received and collected income and profit from the Fund and they maintained separate books for that purpose. The principal and income will not revert to DBP, even if trust is subsequently modified or terminated. SC ruled that the beneficiaries of the Fund are the DBP officials and employees who will retire. It is not always necessary that the beneficiaries should be named or even be in existence at the time the trust is created in his favor, provided they are sufficiently certain or identifiable. The Salary Loan Program did not terminate the trust to the Fund’s trustee. That the DBP Board of Directors confirms the approval of the SLP by the Fund’s trustees does not make the fund property of DBP (DBP v. COA, 2004).

INCOME OF RETIREMENT FUND • COA alleged that DBP is actual owner of the trust fund and its income because: – DBP made the contribution to the Fund – Trustees of the Fund are merely administrators – DBP employees only have an inchoate right to the Fund • • • DBP responded that the Trustees received and collected income and profit from the Fund and they maintained separate books for that purpose. The principal and income will not revert to DBP, even if trust is subsequently modified or terminated. SC ruled that the beneficiaries of the Fund are the DBP officials and employees who will retire. It is not always necessary that the beneficiaries should be named or even be in existence at the time the trust is created in his favor, provided they are sufficiently certain or identifiable. The Salary Loan Program did not terminate the trust to the Fund’s trustee. That the DBP Board of Directors confirms the approval of the SLP by the Fund’s trustees does not make the fund property of DBP (DBP v. COA, 2004).

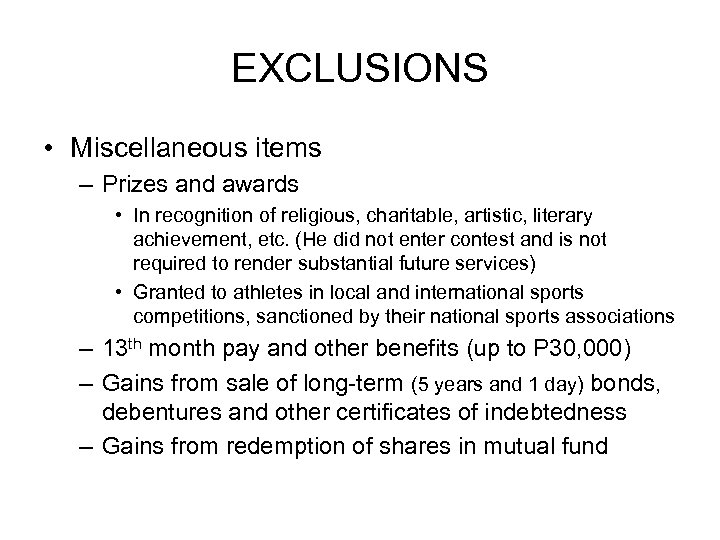

EXCLUSIONS • Miscellaneous items – Prizes and awards • In recognition of religious, charitable, artistic, literary achievement, etc. (He did not enter contest and is not required to render substantial future services) • Granted to athletes in local and international sports competitions, sanctioned by their national sports associations – 13 th month pay and other benefits (up to P 30, 000) – Gains from sale of long-term (5 years and 1 day) bonds, debentures and other certificates of indebtedness – Gains from redemption of shares in mutual fund

EXCLUSIONS • Miscellaneous items – Prizes and awards • In recognition of religious, charitable, artistic, literary achievement, etc. (He did not enter contest and is not required to render substantial future services) • Granted to athletes in local and international sports competitions, sanctioned by their national sports associations – 13 th month pay and other benefits (up to P 30, 000) – Gains from sale of long-term (5 years and 1 day) bonds, debentures and other certificates of indebtedness – Gains from redemption of shares in mutual fund

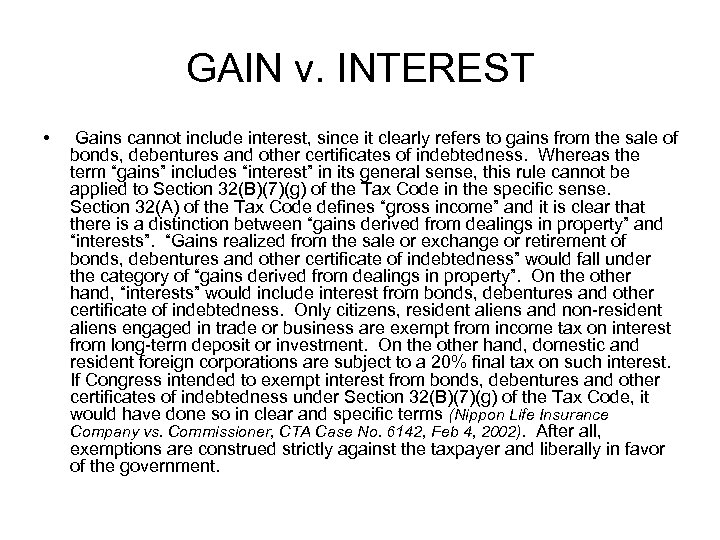

GAIN v. INTEREST • Gains cannot include interest, since it clearly refers to gains from the sale of bonds, debentures and other certificates of indebtedness. Whereas the term “gains” includes “interest” in its general sense, this rule cannot be applied to Section 32(B)(7)(g) of the Tax Code in the specific sense. Section 32(A) of the Tax Code defines “gross income” and it is clear that there is a distinction between “gains derived from dealings in property” and “interests”. “Gains realized from the sale or exchange or retirement of bonds, debentures and other certificate of indebtedness” would fall under the category of “gains derived from dealings in property”. On the other hand, “interests” would include interest from bonds, debentures and other certificate of indebtedness. Only citizens, resident aliens and non-resident aliens engaged in trade or business are exempt from income tax on interest from long-term deposit or investment. On the other hand, domestic and resident foreign corporations are subject to a 20% final tax on such interest. If Congress intended to exempt interest from bonds, debentures and other certificates of indebtedness under Section 32(B)(7)(g) of the Tax Code, it would have done so in clear and specific terms (Nippon Life Insurance Company vs. Commissioner, CTA Case No. 6142, Feb 4, 2002). After all, exemptions are construed strictly against the taxpayer and liberally in favor of the government.

GAIN v. INTEREST • Gains cannot include interest, since it clearly refers to gains from the sale of bonds, debentures and other certificates of indebtedness. Whereas the term “gains” includes “interest” in its general sense, this rule cannot be applied to Section 32(B)(7)(g) of the Tax Code in the specific sense. Section 32(A) of the Tax Code defines “gross income” and it is clear that there is a distinction between “gains derived from dealings in property” and “interests”. “Gains realized from the sale or exchange or retirement of bonds, debentures and other certificate of indebtedness” would fall under the category of “gains derived from dealings in property”. On the other hand, “interests” would include interest from bonds, debentures and other certificate of indebtedness. Only citizens, resident aliens and non-resident aliens engaged in trade or business are exempt from income tax on interest from long-term deposit or investment. On the other hand, domestic and resident foreign corporations are subject to a 20% final tax on such interest. If Congress intended to exempt interest from bonds, debentures and other certificates of indebtedness under Section 32(B)(7)(g) of the Tax Code, it would have done so in clear and specific terms (Nippon Life Insurance Company vs. Commissioner, CTA Case No. 6142, Feb 4, 2002). After all, exemptions are construed strictly against the taxpayer and liberally in favor of the government.

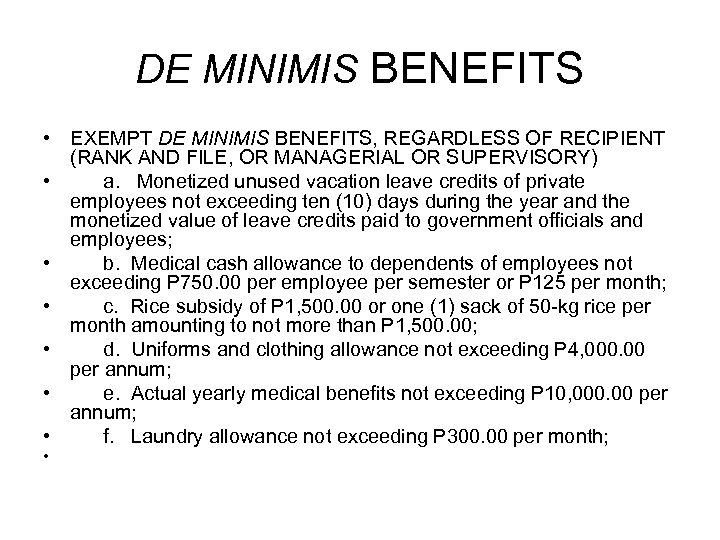

DE MINIMIS BENEFITS • EXEMPT DE MINIMIS BENEFITS, REGARDLESS OF RECIPIENT (RANK AND FILE, OR MANAGERIAL OR SUPERVISORY) • a. Monetized unused vacation leave credits of private employees not exceeding ten (10) days during the year and the monetized value of leave credits paid to government officials and employees; • b. Medical cash allowance to dependents of employees not exceeding P 750. 00 per employee per semester or P 125 per month; • c. Rice subsidy of P 1, 500. 00 or one (1) sack of 50 -kg rice per month amounting to not more than P 1, 500. 00; • d. Uniforms and clothing allowance not exceeding P 4, 000. 00 per annum; • e. Actual yearly medical benefits not exceeding P 10, 000. 00 per annum; • f. Laundry allowance not exceeding P 300. 00 per month; •

DE MINIMIS BENEFITS • EXEMPT DE MINIMIS BENEFITS, REGARDLESS OF RECIPIENT (RANK AND FILE, OR MANAGERIAL OR SUPERVISORY) • a. Monetized unused vacation leave credits of private employees not exceeding ten (10) days during the year and the monetized value of leave credits paid to government officials and employees; • b. Medical cash allowance to dependents of employees not exceeding P 750. 00 per employee per semester or P 125 per month; • c. Rice subsidy of P 1, 500. 00 or one (1) sack of 50 -kg rice per month amounting to not more than P 1, 500. 00; • d. Uniforms and clothing allowance not exceeding P 4, 000. 00 per annum; • e. Actual yearly medical benefits not exceeding P 10, 000. 00 per annum; • f. Laundry allowance not exceeding P 300. 00 per month; •

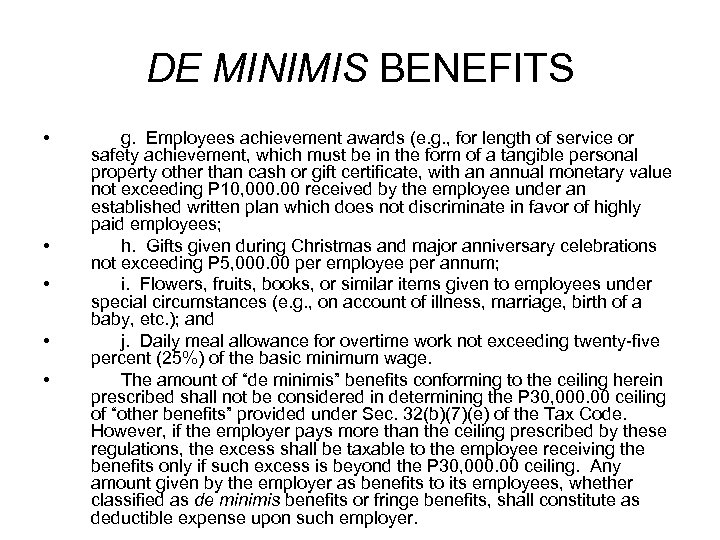

DE MINIMIS BENEFITS • • • g. Employees achievement awards (e. g. , for length of service or safety achievement, which must be in the form of a tangible personal property other than cash or gift certificate, with an annual monetary value not exceeding P 10, 000. 00 received by the employee under an established written plan which does not discriminate in favor of highly paid employees; h. Gifts given during Christmas and major anniversary celebrations not exceeding P 5, 000. 00 per employee per annum; i. Flowers, fruits, books, or similar items given to employees under special circumstances (e. g. , on account of illness, marriage, birth of a baby, etc. ); and j. Daily meal allowance for overtime work not exceeding twenty-five percent (25%) of the basic minimum wage. The amount of “de minimis” benefits conforming to the ceiling herein prescribed shall not be considered in determining the P 30, 000. 00 ceiling of “other benefits” provided under Sec. 32(b)(7)(e) of the Tax Code. However, if the employer pays more than the ceiling prescribed by these regulations, the excess shall be taxable to the employee receiving the benefits only if such excess is beyond the P 30, 000. 00 ceiling. Any amount given by the employer as benefits to its employees, whether classified as de minimis benefits or fringe benefits, shall constitute as deductible expense upon such employer.

DE MINIMIS BENEFITS • • • g. Employees achievement awards (e. g. , for length of service or safety achievement, which must be in the form of a tangible personal property other than cash or gift certificate, with an annual monetary value not exceeding P 10, 000. 00 received by the employee under an established written plan which does not discriminate in favor of highly paid employees; h. Gifts given during Christmas and major anniversary celebrations not exceeding P 5, 000. 00 per employee per annum; i. Flowers, fruits, books, or similar items given to employees under special circumstances (e. g. , on account of illness, marriage, birth of a baby, etc. ); and j. Daily meal allowance for overtime work not exceeding twenty-five percent (25%) of the basic minimum wage. The amount of “de minimis” benefits conforming to the ceiling herein prescribed shall not be considered in determining the P 30, 000. 00 ceiling of “other benefits” provided under Sec. 32(b)(7)(e) of the Tax Code. However, if the employer pays more than the ceiling prescribed by these regulations, the excess shall be taxable to the employee receiving the benefits only if such excess is beyond the P 30, 000. 00 ceiling. Any amount given by the employer as benefits to its employees, whether classified as de minimis benefits or fringe benefits, shall constitute as deductible expense upon such employer.

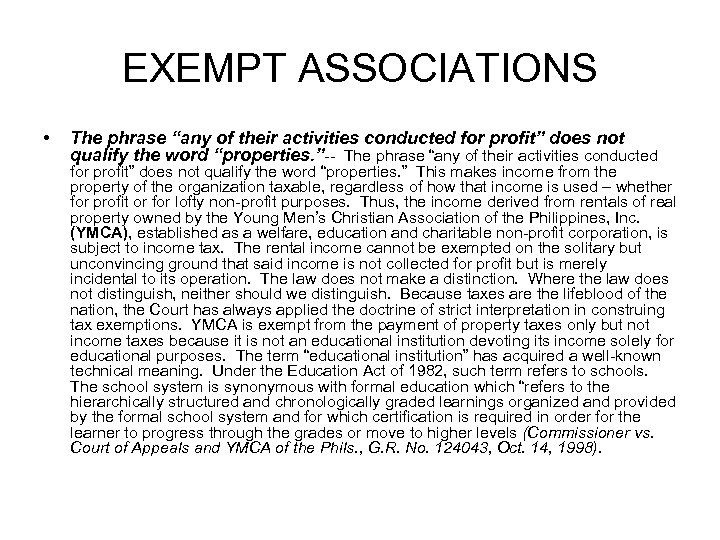

EXEMPT ASSOCIATIONS • The phrase “any of their activities conducted for profit” does not qualify the word “properties. ”-- The phrase “any of their activities conducted for profit” does not qualify the word “properties. ” This makes income from the property of the organization taxable, regardless of how that income is used – whether for profit or for lofty non-profit purposes. Thus, the income derived from rentals of real property owned by the Young Men’s Christian Association of the Philippines, Inc. (YMCA), established as a welfare, education and charitable non-profit corporation, is subject to income tax. The rental income cannot be exempted on the solitary but unconvincing ground that said income is not collected for profit but is merely incidental to its operation. The law does not make a distinction. Where the law does not distinguish, neither should we distinguish. Because taxes are the lifeblood of the nation, the Court has always applied the doctrine of strict interpretation in construing tax exemptions. YMCA is exempt from the payment of property taxes only but not income taxes because it is not an educational institution devoting its income solely for educational purposes. The term “educational institution” has acquired a well-known technical meaning. Under the Education Act of 1982, such term refers to schools. The school system is synonymous with formal education which “refers to the hierarchically structured and chronologically graded learnings organized and provided by the formal school system and for which certification is required in order for the learner to progress through the grades or move to higher levels (Commissioner vs. Court of Appeals and YMCA of the Phils. , G. R. No. 124043, Oct. 14, 1998).

EXEMPT ASSOCIATIONS • The phrase “any of their activities conducted for profit” does not qualify the word “properties. ”-- The phrase “any of their activities conducted for profit” does not qualify the word “properties. ” This makes income from the property of the organization taxable, regardless of how that income is used – whether for profit or for lofty non-profit purposes. Thus, the income derived from rentals of real property owned by the Young Men’s Christian Association of the Philippines, Inc. (YMCA), established as a welfare, education and charitable non-profit corporation, is subject to income tax. The rental income cannot be exempted on the solitary but unconvincing ground that said income is not collected for profit but is merely incidental to its operation. The law does not make a distinction. Where the law does not distinguish, neither should we distinguish. Because taxes are the lifeblood of the nation, the Court has always applied the doctrine of strict interpretation in construing tax exemptions. YMCA is exempt from the payment of property taxes only but not income taxes because it is not an educational institution devoting its income solely for educational purposes. The term “educational institution” has acquired a well-known technical meaning. Under the Education Act of 1982, such term refers to schools. The school system is synonymous with formal education which “refers to the hierarchically structured and chronologically graded learnings organized and provided by the formal school system and for which certification is required in order for the learner to progress through the grades or move to higher levels (Commissioner vs. Court of Appeals and YMCA of the Phils. , G. R. No. 124043, Oct. 14, 1998).

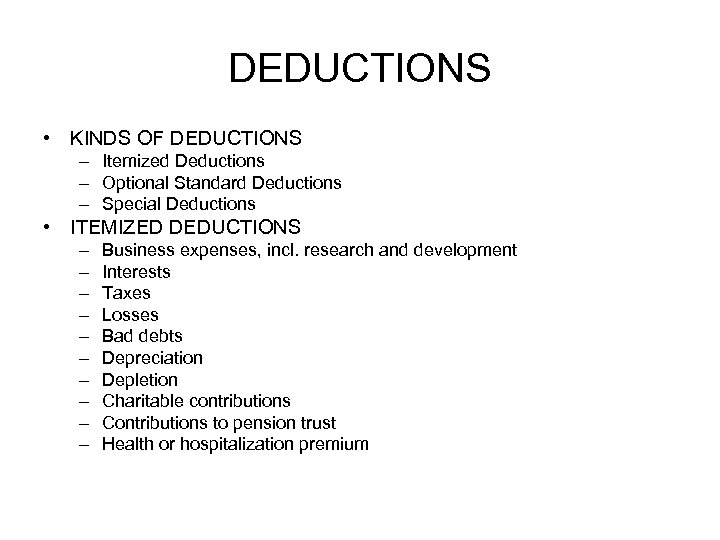

DEDUCTIONS • KINDS OF DEDUCTIONS – Itemized Deductions – Optional Standard Deductions – Special Deductions • ITEMIZED DEDUCTIONS – – – – – Business expenses, incl. research and development Interests Taxes Losses Bad debts Depreciation Depletion Charitable contributions Contributions to pension trust Health or hospitalization premium

DEDUCTIONS • KINDS OF DEDUCTIONS – Itemized Deductions – Optional Standard Deductions – Special Deductions • ITEMIZED DEDUCTIONS – – – – – Business expenses, incl. research and development Interests Taxes Losses Bad debts Depreciation Depletion Charitable contributions Contributions to pension trust Health or hospitalization premium

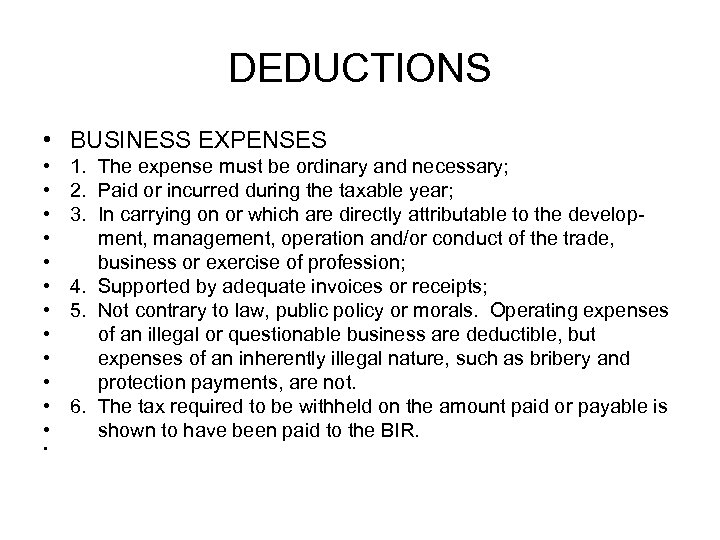

DEDUCTIONS • BUSINESS EXPENSES • • • • 1. The expense must be ordinary and necessary; 2. Paid or incurred during the taxable year; 3. In carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of profession; 4. Supported by adequate invoices or receipts; 5. Not contrary to law, public policy or morals. Operating expenses of an illegal or questionable business are deductible, but expenses of an inherently illegal nature, such as bribery and protection payments, are not. 6. The tax required to be withheld on the amount paid or payable is shown to have been paid to the BIR.

DEDUCTIONS • BUSINESS EXPENSES • • • • 1. The expense must be ordinary and necessary; 2. Paid or incurred during the taxable year; 3. In carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of profession; 4. Supported by adequate invoices or receipts; 5. Not contrary to law, public policy or morals. Operating expenses of an illegal or questionable business are deductible, but expenses of an inherently illegal nature, such as bribery and protection payments, are not. 6. The tax required to be withheld on the amount paid or payable is shown to have been paid to the BIR.

DEDUCTIONS • An expense is “ordinary” when it connotes a payment, which is normal in relation to the business of the taxpayer and the surrounding circumstances. • An expense is “necessary” where the expenditure is appropriate or helpful in the development of taxpayer’s business or that the same is proper for the purpose of realizing a profit or minimizing a loss. • P 9. 4 M paid in 1985 for advertising a product was staggering incurred to “create or maintain some form of goodwill for the taxpayer’s trade or business or for the industry or profession of which the taxpayer is a member. ” • “Goodwill” generally denotes the benefit arising from connection and reputation, and efforts to establish reputation are akin to acquisition of capital assets. Therefore, expenses related thereto are not business expenses but capital expenditures (CIR vs. General Foods Phi. , GR No. 143672, Apr. 24, 2003).

DEDUCTIONS • An expense is “ordinary” when it connotes a payment, which is normal in relation to the business of the taxpayer and the surrounding circumstances. • An expense is “necessary” where the expenditure is appropriate or helpful in the development of taxpayer’s business or that the same is proper for the purpose of realizing a profit or minimizing a loss. • P 9. 4 M paid in 1985 for advertising a product was staggering incurred to “create or maintain some form of goodwill for the taxpayer’s trade or business or for the industry or profession of which the taxpayer is a member. ” • “Goodwill” generally denotes the benefit arising from connection and reputation, and efforts to establish reputation are akin to acquisition of capital assets. Therefore, expenses related thereto are not business expenses but capital expenditures (CIR vs. General Foods Phi. , GR No. 143672, Apr. 24, 2003).

DEDUCTIONS • TEST OF REASONABLENESS OF BONUS • There is no fixed test for determining the reasonableness of a given bonus as compensation. This depends upon many factors, one of them being the amount and quality of the services performed with relation to the business. • Other tests suggested are payment must be made in good faith, the character of the taxpayer’s business, the volume and amount of its net earnings, its locality, the type and extent of the services rendered, the salary policy of the corporation, the size of the particular business, the employee’s qualifications and contributions to the business venture, and general economic conditions. • However, in determining whether the particular salary or compensation payment is reasonable, the situation must be considered as a whole. Ordinarily, no single factor is decisive (C. M. Hoskins & Co. , Inc. vs. Commissioner, L-24059, Nov. 28, 1969; Pacific Banking Corp. vs. Commissioner, CTA Case 1667, Oct 29, 1970). • Bonuses that are “out-and-out gifts, ” are gratitude and are not deductible.

DEDUCTIONS • TEST OF REASONABLENESS OF BONUS • There is no fixed test for determining the reasonableness of a given bonus as compensation. This depends upon many factors, one of them being the amount and quality of the services performed with relation to the business. • Other tests suggested are payment must be made in good faith, the character of the taxpayer’s business, the volume and amount of its net earnings, its locality, the type and extent of the services rendered, the salary policy of the corporation, the size of the particular business, the employee’s qualifications and contributions to the business venture, and general economic conditions. • However, in determining whether the particular salary or compensation payment is reasonable, the situation must be considered as a whole. Ordinarily, no single factor is decisive (C. M. Hoskins & Co. , Inc. vs. Commissioner, L-24059, Nov. 28, 1969; Pacific Banking Corp. vs. Commissioner, CTA Case 1667, Oct 29, 1970). • Bonuses that are “out-and-out gifts, ” are gratitude and are not deductible.

DEDUCTIONS • Legal and accountant’s fees for prior years were not billed in corresponding years (1984 -1985). It was paid by taxpayer in succeeding year (1986) when it was billed by the lawyer and accountant. Taxpayers uses accrual method of accounting. • Accrual of income and expense is permitted when the “all events test” has been met. This test requires (1) fixing a right to income or liability to pay, and (2) the availability of reasonably accurate determination of such income or liability. It does not, however, demand that the amount of income or liability be known absolutely; it only requires that a taxpayer has at its disposal the information necessary to compute the amount with reasonable accuracy, which implies something less than an exact or completely accurate amount. • Moreover, deduction takes the nature of tax exemption; it must be construed strictly against the taxpayer (Commissioner vs. Isabela Cultural Corporation, G. R. No. 172231, Feb. 12, 2007).

DEDUCTIONS • Legal and accountant’s fees for prior years were not billed in corresponding years (1984 -1985). It was paid by taxpayer in succeeding year (1986) when it was billed by the lawyer and accountant. Taxpayers uses accrual method of accounting. • Accrual of income and expense is permitted when the “all events test” has been met. This test requires (1) fixing a right to income or liability to pay, and (2) the availability of reasonably accurate determination of such income or liability. It does not, however, demand that the amount of income or liability be known absolutely; it only requires that a taxpayer has at its disposal the information necessary to compute the amount with reasonable accuracy, which implies something less than an exact or completely accurate amount. • Moreover, deduction takes the nature of tax exemption; it must be construed strictly against the taxpayer (Commissioner vs. Isabela Cultural Corporation, G. R. No. 172231, Feb. 12, 2007).

DEDUCTIONS • Entertainment, amusement and recreation expenses are subject to limitation – ½% of net sales for sellers of goods – 1% of net sales for sellers of services • Club dues for membership in social or athletic clubs to promote business of corporation paid by the corporation are deductible from gross income. However, they will be treated as fringe benefits subject to FBT on the part of the employer. FBT paid by employer is deductible as business expense of the corporation. • Rental expenses include leasehold acquired for business purposes and cost of improvements introduced by lessee to be allocated over the term of the lease. Realty taxes paid by lessee for business property is part of rental expenses.

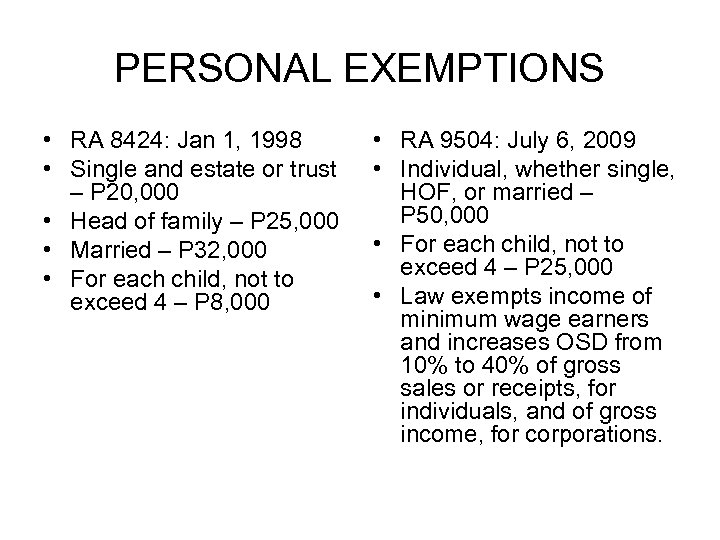

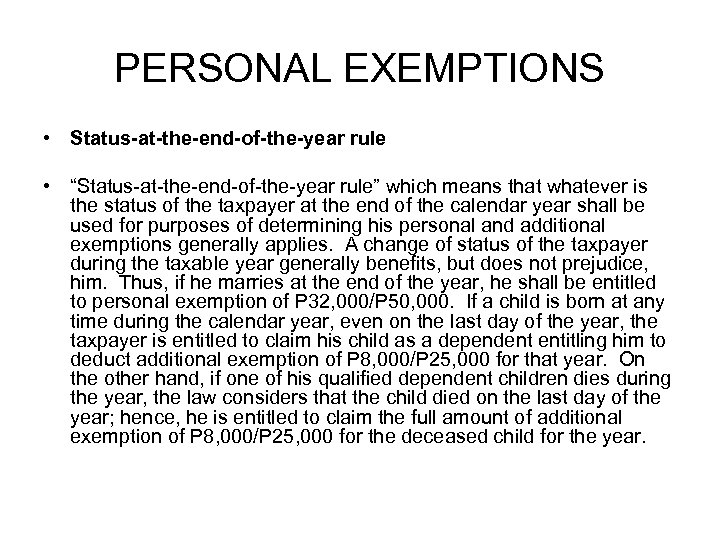

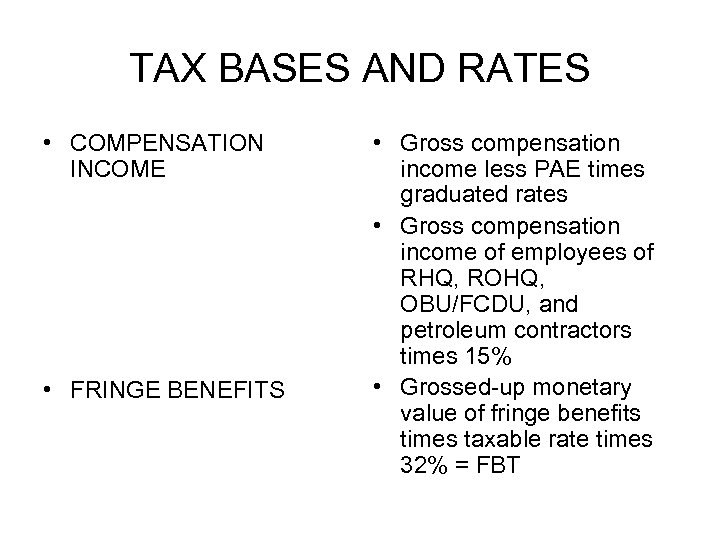

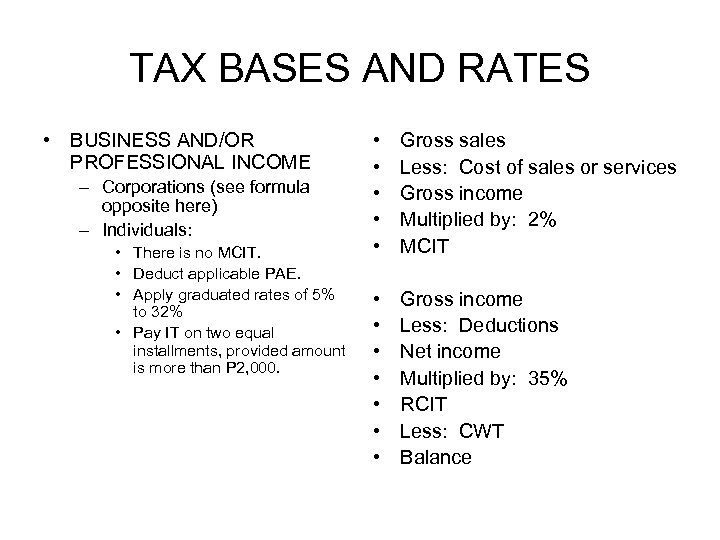

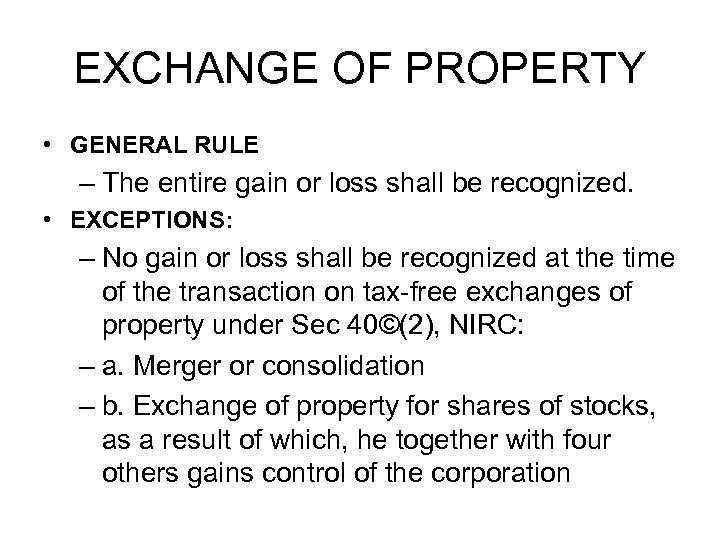

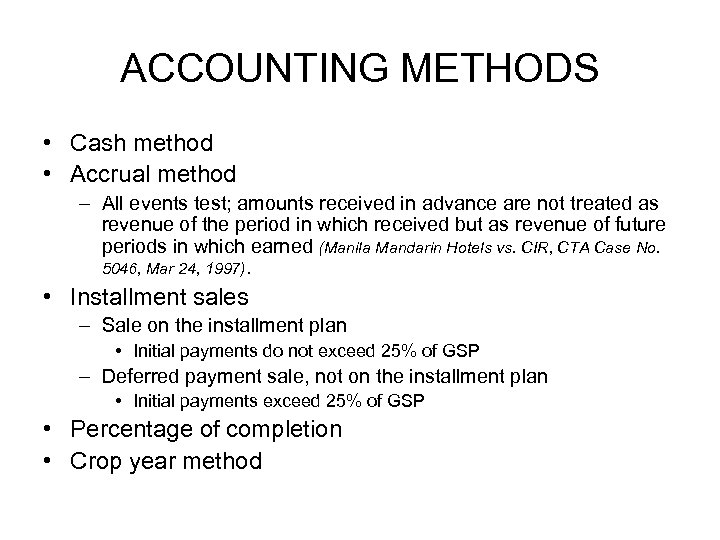

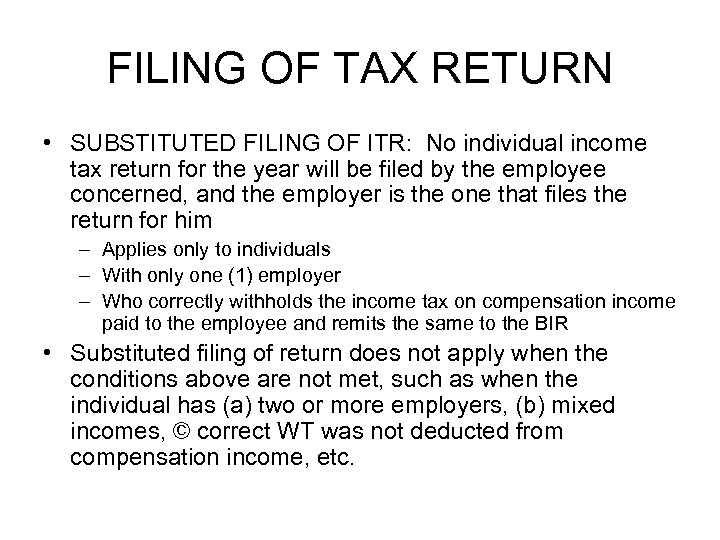

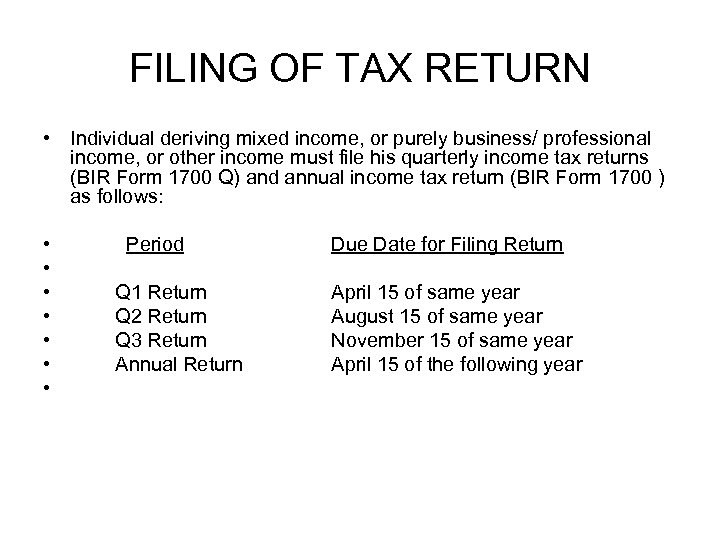

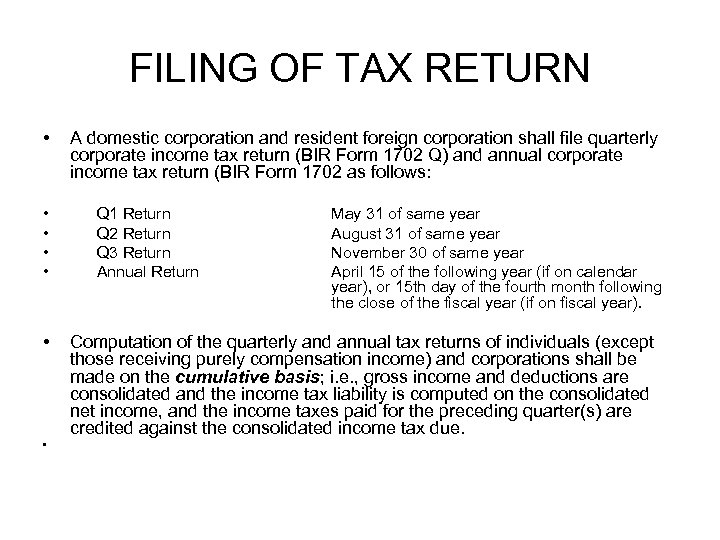

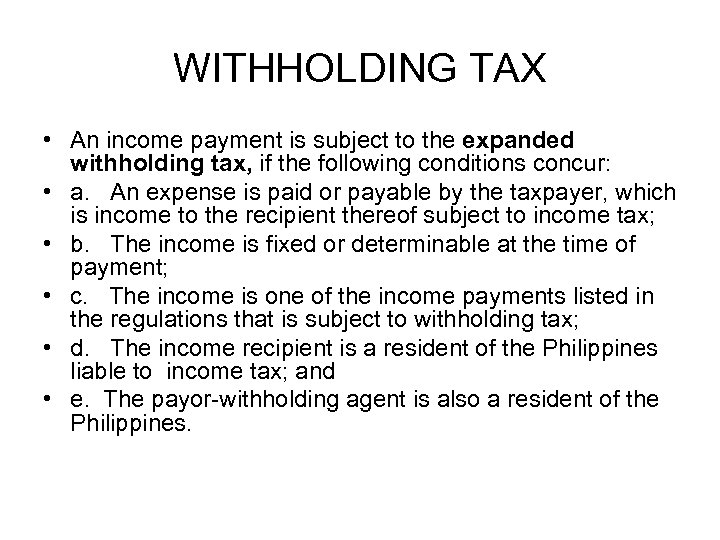

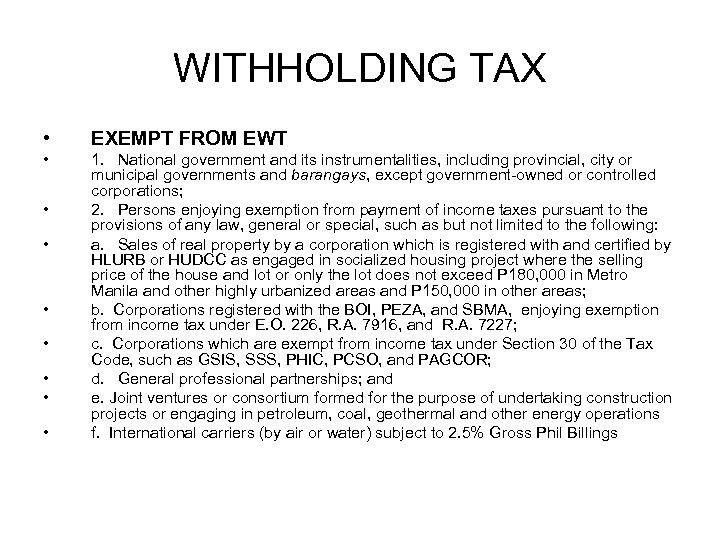

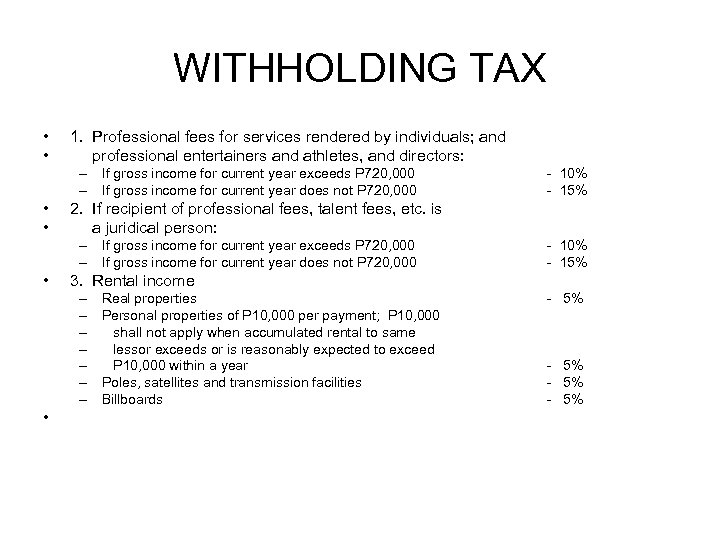

DEDUCTIONS • Entertainment, amusement and recreation expenses are subject to limitation – ½% of net sales for sellers of goods – 1% of net sales for sellers of services • Club dues for membership in social or athletic clubs to promote business of corporation paid by the corporation are deductible from gross income. However, they will be treated as fringe benefits subject to FBT on the part of the employer. FBT paid by employer is deductible as business expense of the corporation. • Rental expenses include leasehold acquired for business purposes and cost of improvements introduced by lessee to be allocated over the term of the lease. Realty taxes paid by lessee for business property is part of rental expenses.